The Systematic Trader: a systematic approach to better trading

Some of you might wish to incorporate technical analysis as part of your stock trading/investing arsenal but to find a qualified chartered portfolio manager or even a certified financial technician to justify and improve your investment strategies is outright tough.

This is where the systematic trader system shines. As opposed to discretionary trading, the system deploys various “rules” to simplify your trading process and investment strategies. It is a systematic, step-by-step process to detect market trends in its infancy stage and allow one to get vested in stocks that have a higher probability of success rate in the stock markets.

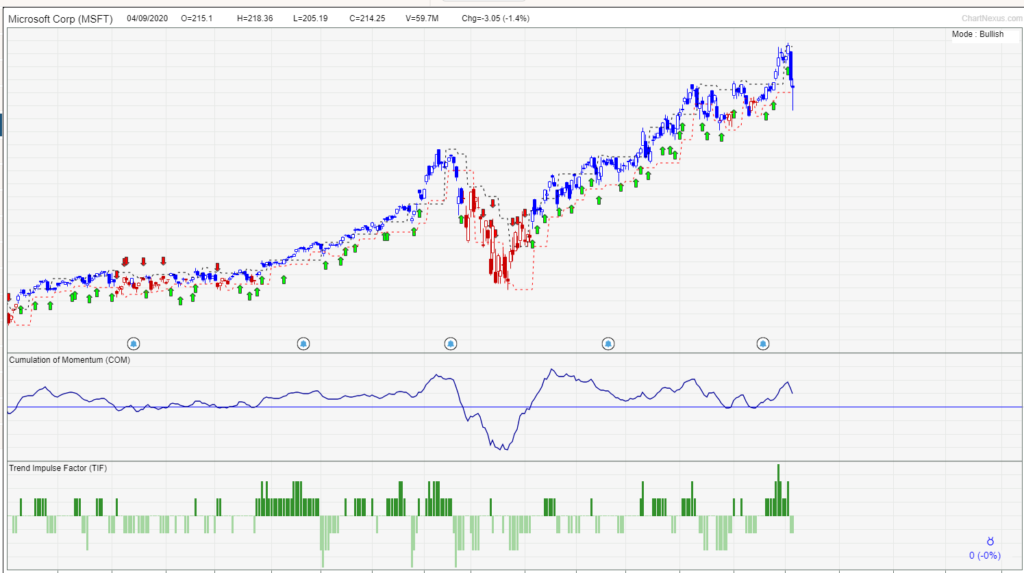

The below diagrams illustrate one of the four key trading strategies taught in The Systematic Trader. Notice the green and red arrows? These are the proprietary indicators used by the system to indicate strengths and weaknesses. By following a set of rules (not complicated) which I will further elaborate later, a trader will be able to achieve these 3 key objectives:

- Knowing which are the best stocks to buy and sell, essentially those that have the highest potential returns

- When exactly to buy these stocks with remorseless precision even during the ups and down of the stock markets

- How much to buy and sell, finding the right position sizing that keeps your losses small while maximizing your gains tremendously.

The following content contains a non-sponsored review but may contain affiliate links

The man behind the system

The Systematic Trader is a trading program anchored by Collin Seow. Collin Seow is a qualified Chartered Portfolio Manager (CPM) who holds a Certified Financial Technician (CFTe) qualification.

He has been awarded the Top 10 Achievers in PhillipCFD for many consecutive years and he is also a reputable trainer with a decade long standing-record.

Collin is the proud inventor of a stock trading algorithm/software known as “TradersGPS”. Given his vast experience in trading, he is often sought after to speak at numerous prestigious conferences such as Shares Investment Conference, Shareinvestor Carnival, Phillip IFest, Investor Wealth Summit, and the MetaStock Conference.

Collin authored his book titled “The Systematic Trader”, which details his journey and methods on turning a $250,000 debt into profits through profitable trades.

Collin has also been featured by many media outlets such as 938 Live, Shareinvestor, SGX, etc

Raving reviews all around

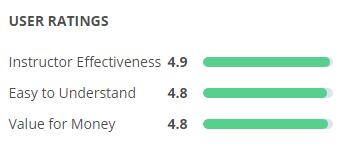

Before I talk about my own experience using the systematic trading system, hear it from the masses who have given The Systematic Trader the “Thumbs Up” on Seedly Reviews. There are currently 826 reviews and counting (the most number of reviews on the Seedly Recommended Investment Course platform) with a STAR rating of 4.9 out of a possible 5, again the highest among all the investment courses being featured.

Some of the most common comments are that the instructors (Collin and Marc) can bring across key trading concepts of the system in an easy-to-understand manner, with many impressed by their level of patience, with the true intent of helping every student (doesn’t matter if you are a total noob when it comes to trading) master the trait.

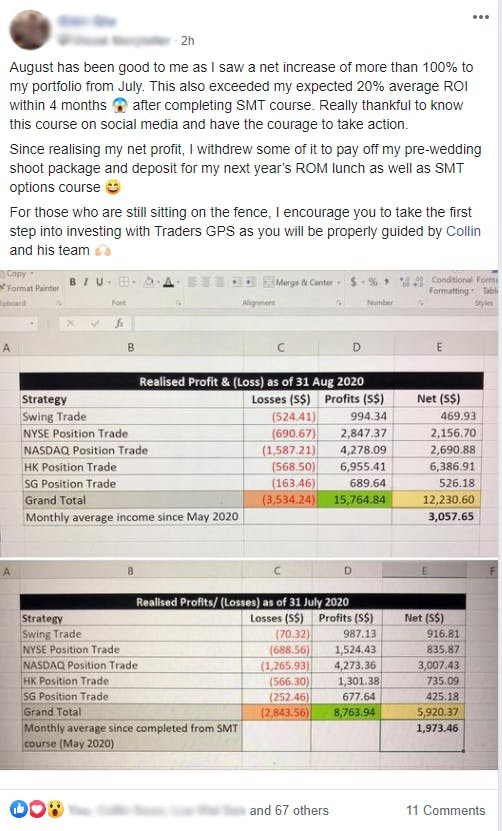

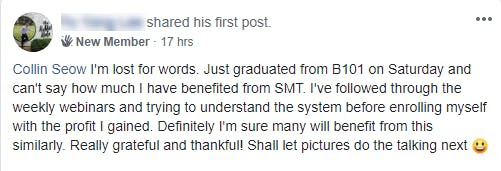

Having a good instructor who can bring across key concepts is already half the battle won, the next half will be on the effectiveness of the system itself which according to some graduate students who posted on the community Facebook Group, they are seeing positive results in their trading almost immediately. I shall elaborate further on my own experience in the later segments.

Here is another one from a new member who made over US$14k of profits in a short period.

Besides the man in the street, Collin has also gotten strong reviews from Celebrity Emcee such as Joe Augustin and Jessica Seet.

Ok enough about reviews…. Let me give you a real preview of what their proprietary trading system looks like as well as a brief commentary of the 4 key Trading Methodologies deployed by The Systematic Trader.

The Traders GPS System – the platform for your next big trading idea

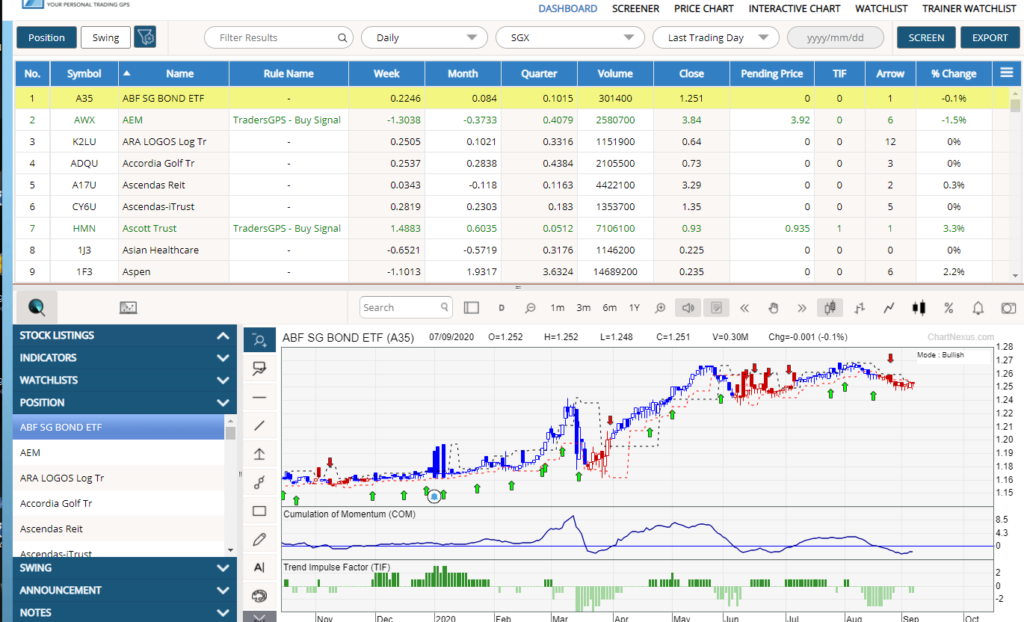

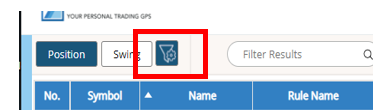

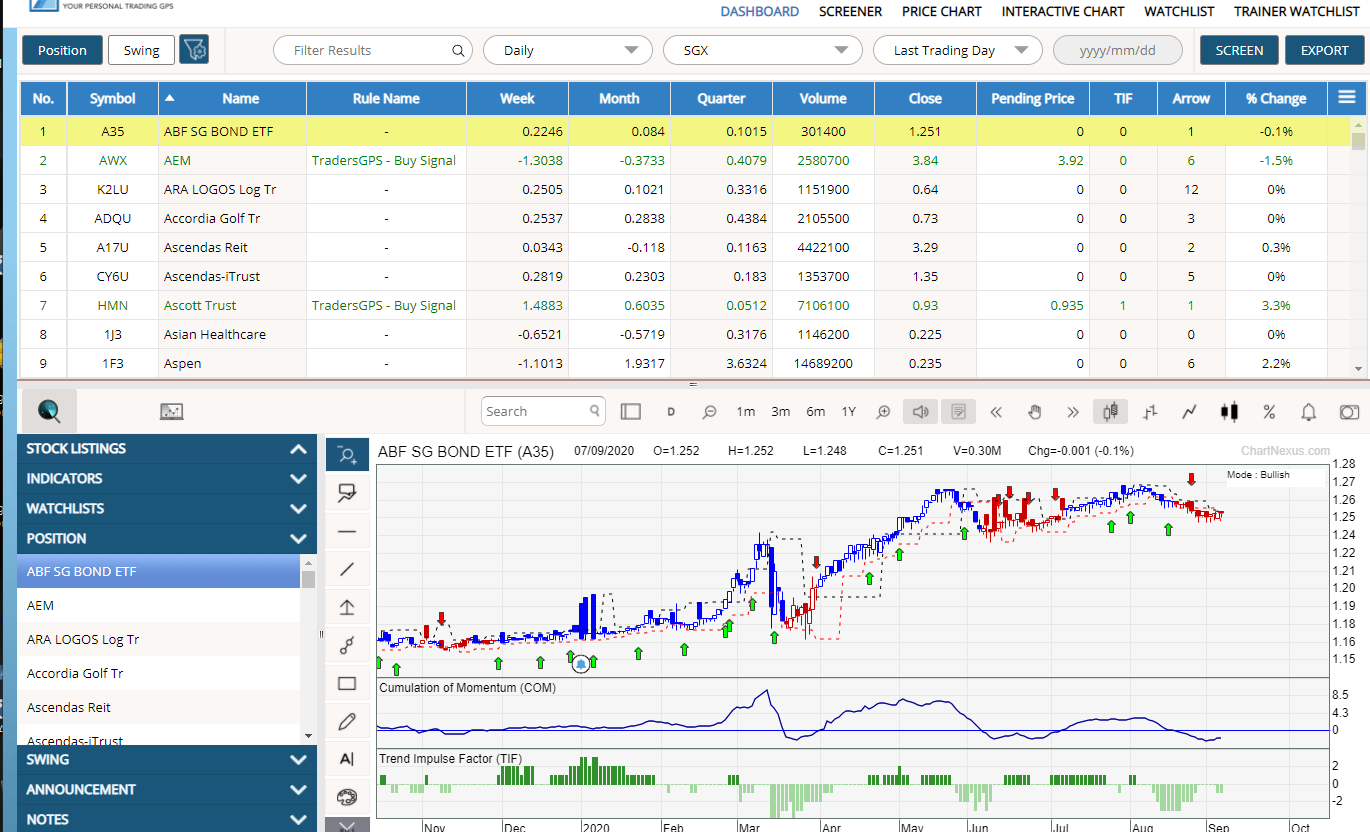

This is the dashboard of their proprietary Traders GPS platform when you log into the system. Let me walk you through step-by-step. I break it up into 4 Levels

Level 1

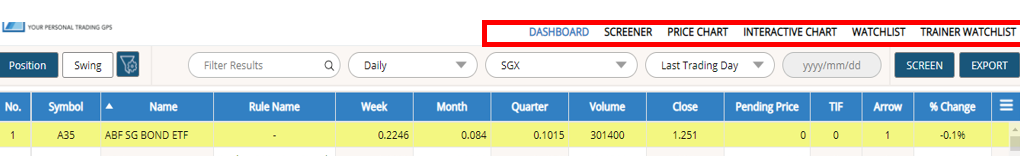

At the top, you will find items such as dashboard, screener, price chart, watchlist, etc. This is where you can toggle between looking at a summary of the screening results as well as the price charts of the stock in question. Hitting the “screener” button will pull out the screen function as per the diagram below.

While if you prefer to analyze the individual charts of the stock in question on the “big screen”, you can hit the “Price Chart” or “Interactive Chart” tabs where one can then incorporate additional technical indicators if so required. That is just an additional function for more seasoned traders who know what they are doing.

Typically, the SMT strategies do not need these additional technical indicators.

You can also hit the “Watch list” tab to create your watchlist of stocks to monitor.

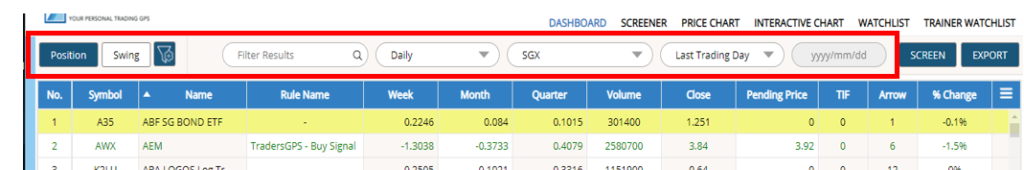

Level 2

This is where you can filter to the stock market which you like to focus on. The main ones are Singapore, Hong Kong, and the US.

You can also select the key trading strategies: Position/Swing, Daily/Weekly (more on that later).

Lastly, you can set various parameters to screen for stocks that fulfill certain criteria such as 1. minimum price, 2. Volume etc

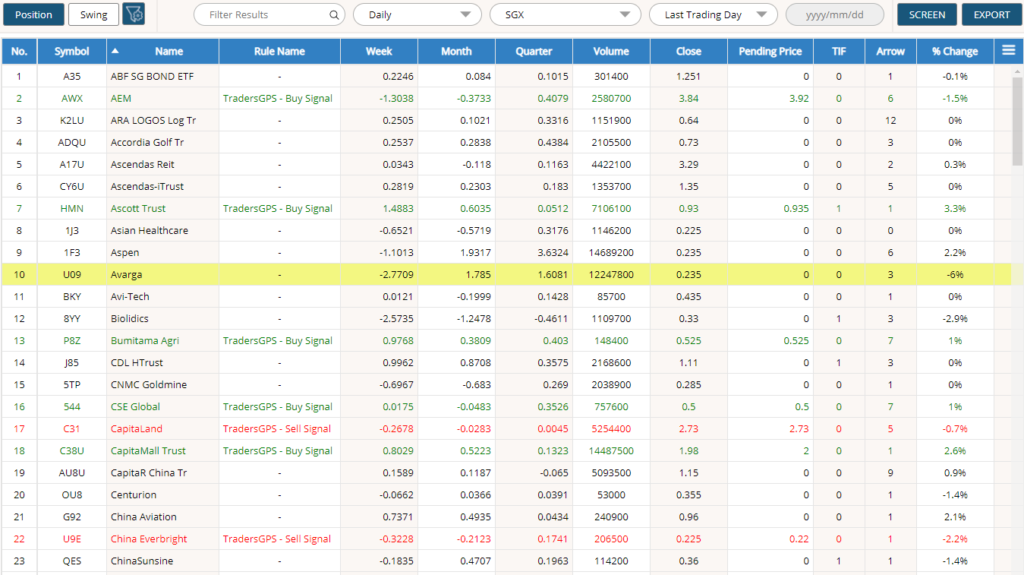

Level 3

This is where you have the screening function in place. The system will automatically highlight to you which are the stocks that are currently displaying a “BUY SIGNAL” based on one of the more popular trading strategies which is the “Daily Position” strategy.

Users can screen for stock displaying the greatest “momentum” and only purchase or short sell a particular stock in question based on a “clearly defined set of rules” as will be explained during the course.

Notice above there is a “pending price” column. This is the “trigger” price where you can potentially go long or short sell a stock. Hence it takes a lot of “guesswork” out of the equation.

Other important components would include the “TIF” and the “Arrow”, all of which are used in combination with its proprietary momentum indicators to find the ideal trade/s to execute on a daily or weekly basis.

Level 4

This is where one will “evaluate” the attractiveness of the counter after the screening process by looking at various components such as if the stock is “trending” etc and how “noisy” the stock chart might be. These are some of the concepts that will be taught by Collin and Marc.

I have provided a brief overview of the TradersGPS platform. Now let’s move on to the key trading strategies which will be taught in the course.

4 Key Trading Strategies

Over the 3 days course, students will be taught on the 4 Key SMT Strategies.

- Weekly Position

- Daily Position

- Weekly Swing

- Daily Swing

Let me further elaborate on them.

Weekly Position

This is a longer trading strategy where the investment horizon is about 1-1.5 years. The idea is to find stocks that are in the very early stages of a potential long trending move up or down and ride the stock over a long enough horizon of 1-1.5 years until the macro trend changes.

For example in the case of Microsoft (MSFT) as illustrated below, the Weekly Position signal an entry in early 2019, and if one is to “follow the system” and not be affected by sentiments, the total gains over this period will be approx. 104%.

Notice that even during the highly volatile period during COVID, the trade was not “exited” (no change in candlestick color) as the momentum for MSFT is still viewed as strong despite the huge weekly volatility. The subsequent rebound in MSFT stock price proves that the system was right.

Notice that for this strategy, there is no presence of “arrows”. It is based on changes in candlestick colors which are certainly infleunced by market trends. The exact details to implement this strategy will be taught in the systematic trader course.

This is an ideal strategy for those who have got no time to trade daily but will prefer to just let the stock ride the macro trend and only exit when the momentum is no longer in his/her favor.

Daily Position

The trading horizon for this strategy is around 6-9 months and it is one of the most popular investment strategies used by students in the systematic trader course Simply because it is easy to understand using “arrows” as guidance and the frequency of “positive” indicators to trigger entry is much higher than that of Weekly Position.

The above diagram shows the chart of Frasers Centrepoint Trust which shows a “positive” stock entry confirmation back on 24 August. The price has since rallied by 11% over the past 2 weeks.

Weekly Swing

The Swing strategies are more “short-term” in nature, with a typical weekly swing strategy lasting for about 3-6 months.

Instead of identifying the early stage of a longer-term trend in play and being “positioned” to ride it without multiple entries and exits, the weekly swing strategy looks to trade that that up or downtrend.

The Swing strategies premised on the moving average as well as the CCI indicators. There is a strict pre-defined rule as to how one should enter or exit that trade. Also, there is a proprietary Traders GPS Stop Loss mechanism (grey color channel lines) that indicates that the trade should be exited for a loss if it breaches that level.

Right from the start, highly profitable traders using the Weekly Swing strategy will be able to set his stop loss and take profit level (risk-reward of 1:2) without too concern about monitoring the trade daily.

Daily Swing

Among the 4 trading strategies, this is the one with the shortest trading horizon, typically lasting only about 1 week, with some fast-moving trades exited possibly in a day.

Similar to the Weekly Swing strategy, it is based on the moving average and CCI indicators but on a much shorter time frame.

It is also a very popular trading strategy with students due to its fast-moving nature (being able to take profit or exit for a loss in a few days) although it is not a strategy that is highly recommended by the trainers due to its relatively higher volatility.

These are the 4 key strategies that will be taught in-depth over the 3 days course, in addition to other tutorials such as risk management, etc and how to position size your trades accordingly to partake in a strong trending stock, especially in the early stage of the trend and how to avoid entering stocks that have already trended too high and thus make for a lower probability trade.

Robust Facebook Group Community

I feel that the system, no matter how fantastic it might be, will be incomplete without the presence of a strong community where members support each other in their trading journey.

The Systematic Traders FB Group is one where there are close to 3k active members that are contributing trade ideas daily.

If you are a newbie trader who has got no clue if you might be executing your trades according to the system, just take a screenshot of the chart and post it in the FB group and there will be assistance provided by more senior members who will provide their take on whether the trade is a “go” or “no-go”.

Collin himself is also extremely active in the FB group and he will be there to provide guidance for you in terms of your trading journey as well as provide some “philosophical” quotes from time to time such as the one below.

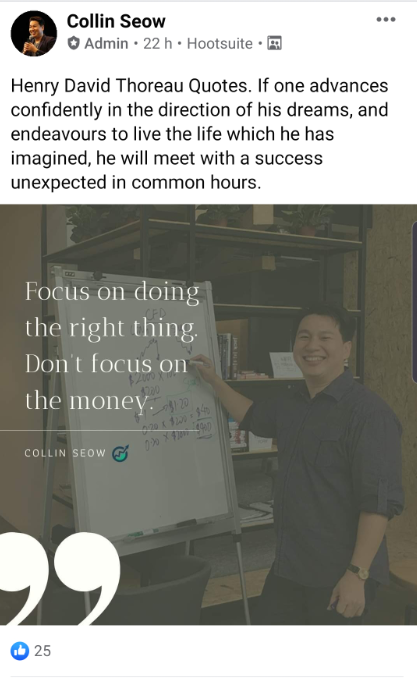

Not just about trading but giving back to the less fortunate

What I like about this FB group is that there is no “hate”. You won’t find anyone making personal attacks etc. It is all about supporting one another to become better traders. And again, at the end of the day, the FB group is not purely focused on trading but also on “doing good”, helping other community members as well as the less fortunate.

There are “charity drives” initiated either by Collin or members of the community to use part of the profits derived from successful trades to give back to society and the less fortunate. It is not “mandatory” but always a kind gesture to help the less fortunate.

Weekly webinars a godsend

It is helpful to know that the journey and guidance do not end with the completion of the 3 days course.

Collin provides a weekly webinar to all graduates of the SMT program and this weekly webinar is currently running indefinitely. Yes, meaning it is FOR LIFE at this very moment.

In these webinars, Collin will provide some trade ideas for execution as well as answer any of the queries which students might have.

For example, Collin highlighted the stock ETSY to get into back on 11 May when the price was US$80/share. The current price is still trading at approx. 40% higher even after the recent correction.

Other recommendations made back in May and June include stocks like NVDA and HZNP which remain strong trending counters even after their latest price correction.

In the current context where the Nasdaq has undergone a 10% correction from its peak, Collin believes that this correction is a healthy one and remains a “correction” as of now and NOT a change in trend.

The trade idea contribution is not going to be indefinite as Collin’s motto is that it is better to teach you to become a better fisherman than to provide you with fishes for life.

The trade ideas are to demonstrate that the “system works” and not inculcate a “laisser-faire” attitude where one becomes complacent and becomes a “free-rider”.

The weekly webinars are often well-attended by hundreds of students every week who will pose their questions to Collin. It is one of the best “after-course” services, in addition to its FB Group, which Systematic Traders graduates are entitled to.

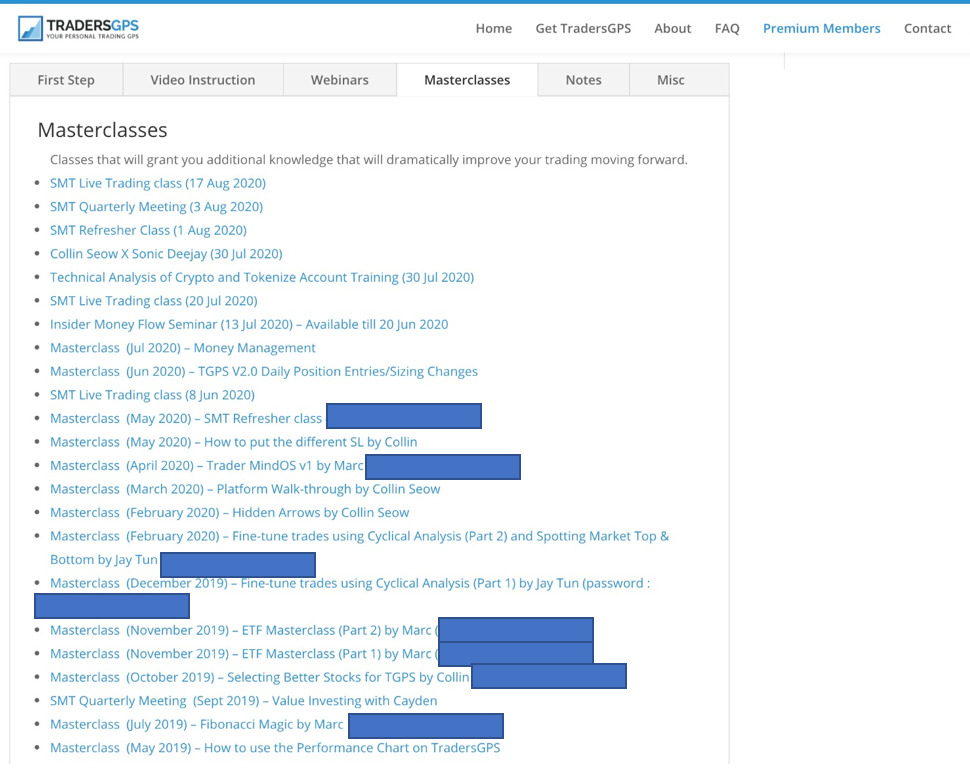

Additional Masterclass Programs & Resources

Beyond the core teachings of the SMT program (which students can refer back to the video tutorials with access for life), there are also additional resources that graduates are entitled to such as masterclass tutorials on ETF selections, additional key technical analysis indicators, cryptocurrencies selection, and value investing, etc.

For those who wish to take their trading “prowess” one step further, there are also classes which blend the usage of options alongside SMT strategies to achieve that additional leverage effect as well as evaluating a stock from a fundamental standpoint using unique indicators which identify stocks to purchase based on seasonality, market direction, and more.

Additional masterclass programs and resources are being constantly added to give a boost to the students’ “trading arsenal”. For example, a brand new “options income strategy” will be added into the Masterclass Program shortly.

Who is The Systematic Trader program suitable for?

I would say both newbies as well as seasoned traders.

The Systematic Trader’s specialty is in bringing beginners to become highly profitable traders in record time. It is usually better that you have an open mind and clean slate (no experience) so that one is “programmed” with the right principles from the start.

For more seasoned traders who have some trading background, this workshop will reveal what you should do exactly to bring your trading to the next level, and the principles that are a MUST know to succeed and build your trading account consistently. However, you must keep an open mind when you go for the program. There will be technical analysis “best practices” but the tools used and system taught by Collin and his team is radically different from what is commonly practiced out there.

How I benefited from The Systematic Trader course and use of the TradersGPS system

I am more of a fundamental guy by nature rather than a technical one. However, after going through the 3-days course, I have learned how “simple” it is for someone like myself without much of a technical background to grasp the key concepts of the system.

As I always say, investing for the layman does not have to be complicated. In this case, trading using technical analysis does not need to look like this:

It should be as simple as this:

Following a systematic way of identifying good stocks to buy/short sell using a predefined set of rules that are not overly complicated and having a clear “indication” for entry/exit.

The 3 days course, while chock full with content on how to best use the TradersGPS system, is not overly heavy when it comes to information absorption, with the trainers such as Collin and Marc being extremely patient with newbies like myself who are not familiar with technical analysis in the first place, not to mention using the system.

Nonetheless, the course is run in a step-by-step manner that even a newbie trader should not have a problem comprehending the course materials being taught. In between lessons, there will also be quizzes being thrown to ensure that your understanding of the concepts is on a firm footing.

It is now my daily routine to boot up the TradersGPS system to look at my Watchlist of stocks that fit the Weekly/Daily Positions as well as Weekly Swing Trades. These are stocks that I am comfortable to own on a fundamental standpoint but will like to get that additional technical edge when it comes to establishing a new position or to add on to my existing position.

I have written about how I have used the Traders GPS system for entry into stocks like Wilmar in this article: Wilmar China IPO. Listing imminent? as well as some of the popular HK tech stocks that form part of the recently established Hang Seng Tech Index where I combine some basic fundamental ratios alongside the TradersGPS system for a better entry into some of these popular tech names.

Final thoughts on The Systematic Trader review

The Systematic Trader course as well as its TradersGPS platform should not be viewed as the Holy Grail of trading in stock markets. It is not going to be 100% accurate, possibly not even 60-70%. As long as it is better than flipping a coin (meaning 50:50 chance) coupled with an easily understandable trading mechanism that can be effortlessly executed, one which cuts your losses quickly while letting your winners ride the long-term market trends, it is a trading tool worthy to be part of your trading arsenal.

Just to recap, by following the set of rules, a trader will be able to achieve these 3 key objectives:

- Knowing which are the best stocks to buy and sell, essentially those that have the highest potential returns

- When exactly to buy these stocks with remorseless precision even during ups and down of stock markets

- How much to buy and sell, finding the right position sizing that keeps your losses small while maximizing your gains tremendously.

For myself, I will continue to execute trades using the signals from the TradersGPS platform on fundamentally strong stocks in my watchlist.

After all that is being said, it is still critical that one adopts a “Trading Plan”. You might have the best system or program in the world which raises your probability of trading success significantly but without a proper trading plan in place, you are likely still going to fail.

For those who are interested in finding out more about The Systematic Trader course, you can join in their SMT Masterclass live webclass (attend online) workshop where Collin will demonstrate to you first hand how his system works and how easy it is for you to “Follow the System” (FTS) to find good trending stock candidates to buy into before they start running higher.

For a limited period of time, this online admission will be made FREE (typically it cost S$68 just to join in the session to hear Collin talk about some of the latest trending stocks). If you sign up today, you will still be in time to attend the latest Webclass held on 15 September 2020 ( the web class was attended by approx 500 pax and the 2 course dates were fully sold) If not, the next upcoming web class will be on 29 September.

If you think the Systematic Trader Course is the right one for you and you will like Collin to help set your trading foundation right, then join in the Webclass to find out more.

For NAOF readers, I will provide you with an additional rebate when you signed up for Collin’s course through the above link. Just send me an email at newacademyoffinance@gmail.com with the confirmation email of the purchase and I will rebate you $X amount once the 30-days Money-Back Guaranteed period is over. Yes there is a money-back guaranteed offer where Collin will allow students to attend the 1st day of training and if for whatever reason he/she finds that the course is not suitable, there will be a full refund (administration fees absorbed), no questions asked.

Final words: Don’t expect to become a MASTER of trading after attending the 3 days course. Collin himself took more than 7 years of practice to master that trade himself. While he often says that he is not the most intelligent person out there and one can definitely achieve trading success in a much shorter period of time using his system combine with his knowledge (which he is more than willing to share), don’t expect a “miracle” to happen overnight, one where you stumble upon a system that works 100% of the time, just like a crystal ball. The Systematic Trader course is not meant to be the holy grail of trading as I have mentioned but one which simplifies a complicated process to allow users to FTS and trade without too much emotions in place.

Click on the link to find out more.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- 8Best Stock Brokerage in Singapore [Update July 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

4 thoughts on “The Systematic Trader Review: Is this the BEST Stock Trading System out there?”