Motley Fool is a company founded in 1993 by David Gardner and Tom Gardner who still run the company today. This company aims to help the man-in-the-street achieve their dream of attaining financial freedom through investing.

The company provides free investing-related articles, such as those that you find on their site as well as premium financial advice and research where they dish out some of their best well-timed investing ideas to their subscribers.

This article serves to act as a comprehensive Motley Fool Review on their Stock Advisor premium subscription. I will walk readers through the key features of this premium newsletter service followed by a thorough review of their historical stock-picking track record and end the article with my personal view on the legitimacy of this premium subscription as well as who this stock-picking newsletter might be ideal for.

The following content contains a non-sponsored review, but may contain affiliate links. For more information, please read them here.

Motley Fool Review: Selecting multi-bagger stocks

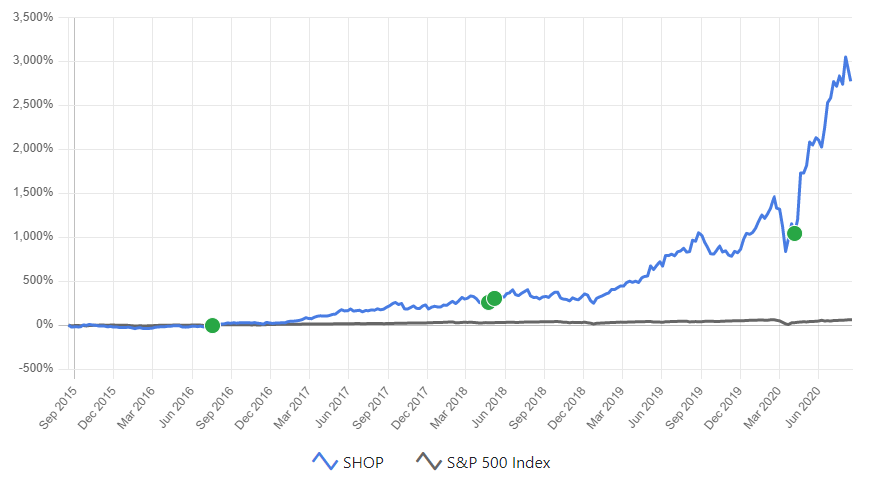

I have personally been a Motley Fool subscriber for more than 4 years and during this period of time, I have been introduced to winners such as Shopify which I got in at approx. US$122/share, an almost 10-bagger at the current price slightly north of US$1,000/share. That was back in April 2018. I am currently still holding on to Shopify and have no intention to sell, with the proliferation of e-commerce just getting started.

Do you know that Shopify stands to benefit from the Cannabis Boom in North America? How is this e-commerce company even remotely-linked to Cannabis? The folks at Motley Fools have done their research and explain in a simple but yet well-crafted report as part of a continuous education process for their subscribers to learn more about their recommendations, in this case, on Shopify.

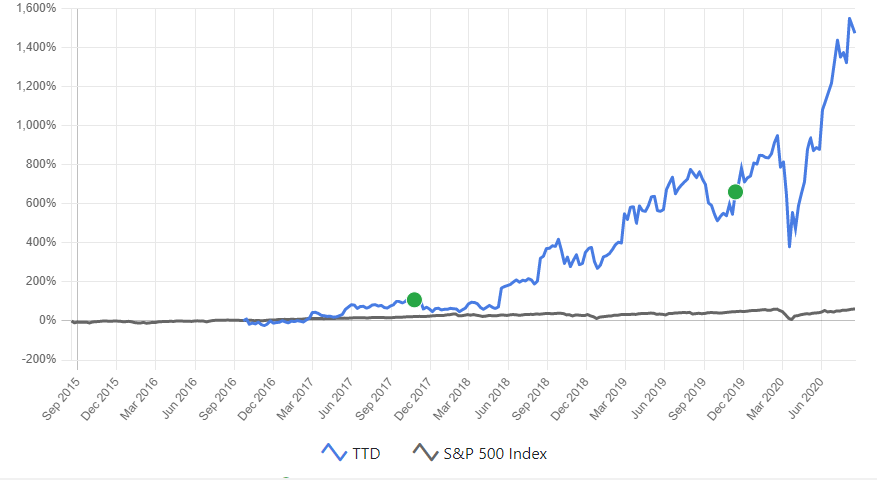

These Research Reports are all available as part of their premium subscription service. Another company that I have never heard about until I hear it from the folks over at Motley Fools is The Trade Desk, a company that operates a cloud-based technology platform that lets ad buyers optimize their spending, getting the right ads in front of the right shoppers at the right time.

They made their first recommendation on this stock back in October 2017 when it was at approx. USD$63/share. The counter last traded at USD$470+ and I believe there is going to be more upside for this counter as video streaming services or connected TV (CTV) services take center-stage. CTV is expected to reach well over 80m households in the US this year, with The Trade Desk likely surpassing traditional TV in reach capabilities for the first time in its history.

If that is the case, there is a long runway for growth for this counter, one which I am planning to hold for the long run to capitalize on this long-term macro-trend.

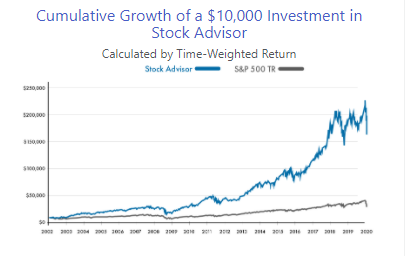

I have given a few examples of stock recommendations by the Motley Fools that have done fantastically well for me over the past few years. According to the company, their flagship Stock Advisor service has generated a total return of 490% from its inception in Feb 2002 to the current date of 19 August 2020 vs. the 102% appreciation of the S&P 500.

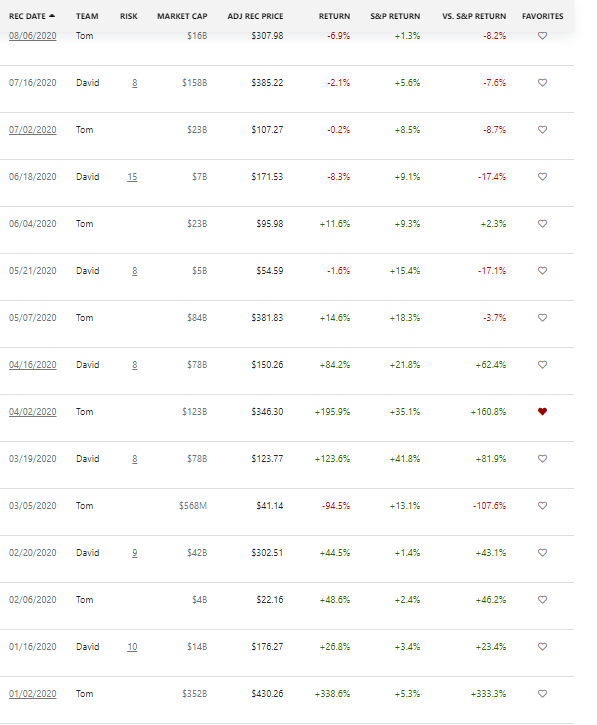

This year alone, they have identified a total of 9 winners out of 15. Not fantastic in terms of hit rate. But the average return of these 9 winners is 99%! One of their key recommendations made in the early part of this year is up a staggering 339% (hint: it’s a controversial stock) while 2 other major recommendations made in March/April 2020 are already up between 124% -196% YTD.

Note that not all stocks will do well. Motley Fool’s recommendation should not be taken as the holy grail of stock investing. They do not have all the answers and are equally susceptible to making mistakes, such as their recommendation of Luckin Coffee recommended back in March 2020 at US$41.14/share. That recommendation is now down 95%.

Thus far in YTD 2020, they made 15 stock recommendations with 6 in the red and 9 in the black as previously mentioned. Note that however, the simple average return for those 9 stocks that are in the black is 99% vs. the -19% simple average drawdown for the 6 stocks in the red. Note again that the -19% drawdown was due to Luckin’s share price collapsing by 95%. Excluding this “outlier” and the average drawdown for the 4 other stocks in the red is 6%. (More on this outperformance in the later segment)

99% appreciation vs. 6% drawdown. I will take that any day. Note that this outperformance is happening amid all of this COVID mess that has wreaked havoc on most stocks. However, the team at Motley Fool has been quick to identify stocks that will do well both in a COVID and the post-COVID world, capitalizing on price weakness to enter a good business at an attractive price.

That is how they consistently outperform the competition.

Both Tom and David Gardner, co-founders of the company, have decades of experience researching stocks and investing in them. Their newsletter’s stock picks are time tested and proven to outperform (more on this later)

Motley Fool Review: Investing the Stock Advisor Way

There are 7 key principles as to how the Motley Fool folks run this premium subscription.

Principle No. 1: Buy Businesses, Not Tickers

Principle No. 2: Be a Lifetime Investor

Principle No. 3: Diversify

Principle No. 4: Fish Where Others Aren’t

Principle No. 5: Check Emotions at the Door

Principle No. 6: Keep Score

Principle No. 7: Be Foolish and Have Fun

These are the 7 tenets of investing the Stock Advisor way. Motley Fool takes a well-rounded approach to their investment research. They account for broader market factors, sector trends, and overall financial health of the companies they recommend.

Essentially, they seek to identify growth companies with strong positive catalysts on the horizon, thus making them “undervalued” in a non-typical sense.

Motley Fool review: An easy to read newsletter for the man-in-the-street

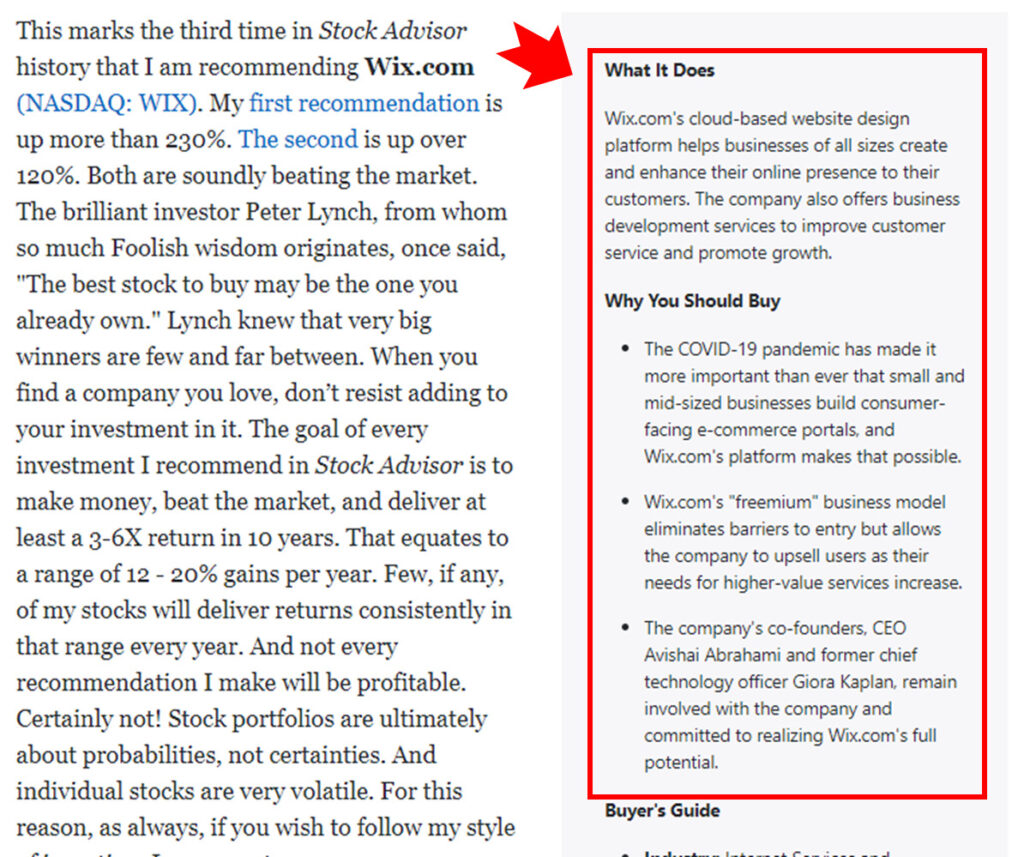

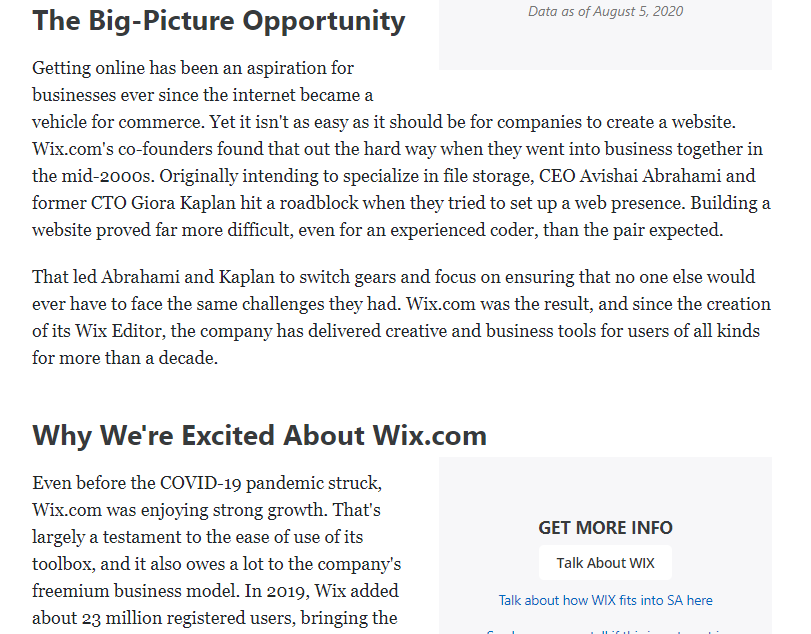

Another key “characteristic” which I like about Motley Fool articles and recommendations is that they are presented in an easy to read format, giving a top-down overview of the company’s business model and value proposition without dwelling too much into the nitty-gritty financial details which often is “too boring” for the man-in-the-street to comprehend.

While some people just want to get the stock ideas and start “investing”, others might prefer to have some basic understanding of the stocks that they are being recommended. It can add some peace of mind to the investor while yet not bore it’s readers with “too much” details.

I believe in this sense, Motley Fool has done a good job balancing this mix.

They first look to summarise the business of the company in a short 1 para summary before proceeding to list down the few key points as to why you should be buying this stock at the current moment. This information is usually found on the right-side panel of the recommendation article.

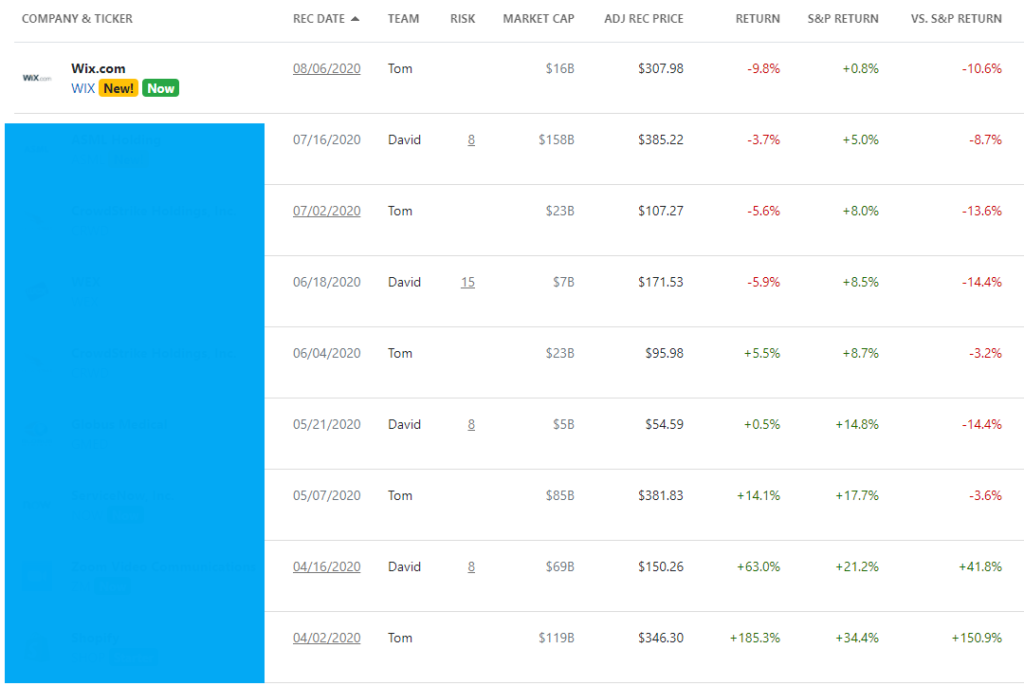

Using, for example, one of their latest recommendations, WIX made on 6 August 2020, they provide a quick summary as to why this stock should be of interest to you in the right-hand “1 Minute” column before proceeding to explain in more detail about the company.

The company is very transparent as to the performance of their recommendation and you can see that this latest recommendation has not performed well vs. the S&P500. Not every stock is going to be a winner at the very first recommendation. Subscribers will need to “fine-tune” their expectations if they believe that the folks at Motley Fools are the “God of Investing” and can do no wrong. Even legendary investment guru, Warren Buffett has his “off days”.

To be fair to paying subscribers, I am going to disclose the rest of the recommendations in this list. Note that buyers of these latest recommendations are potentially getting in at a better entry price NOW vs. when the recommendations were first made.

In the case of WIX, one also has to take into consideration that this is the 3rd time that the Motley Fool is recommending the purchase. Their first recommendation of the counter back in June 2018 at a price of USD$98/share has generated a return of 230% and the second recommendation in May 2019 at a price of USD$142/share has generated a return of 120%. This is the 3rd time they are recommending the counter and while this recommendation is off to a “shaky” start, let’s give it some time to prove its worth.

WIX, to me is like the alternative to Shopify, or the cheaper version, considering that the counter is “just” trading at a Price/Sale of 16x compared to Shopify “jaw-dropping” 75x Price/Sale, the latter probably the most expensive SaaS-type company at present based on this financial metric.

I have digressed.

Back to the key content write-up. Motley Fool will look to summarise the purchase thesis in a few simple paragraphs, usually highlighting the big-picture long-term opportunity in the counter and the key reason/s why they are particularly excited about the stock.

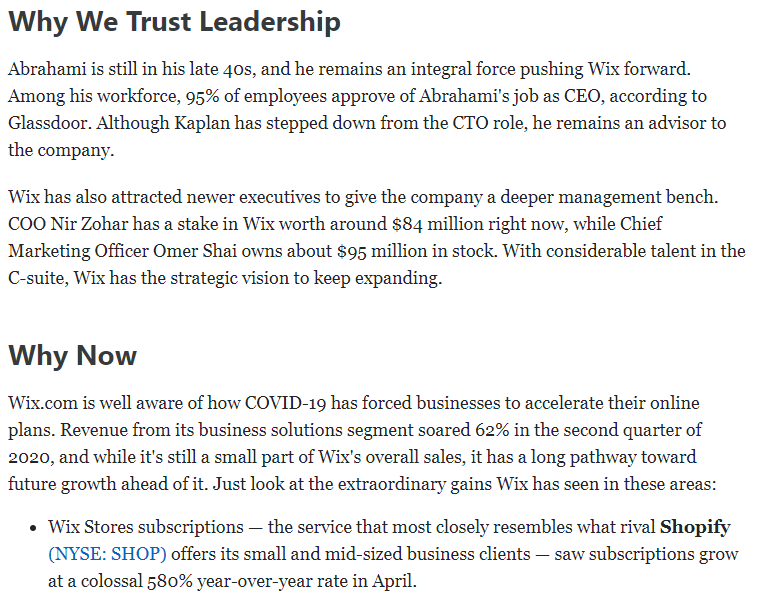

Most of the time there will be a paragraph or two dedicated to talking about management and if they are considerably owners in the company.

They will tend to end off the 1-pager write-up as to why the stock is a buy NOW and what might the risk/s of investing in this company entail.

There is usually very little emphasis on the financials of the company and Motley Fools will also not provide a “fair value” of the counter over a specific time horizon. Most of their stock picks are meant to be held for at least 3-5 years as the recommended holding period.

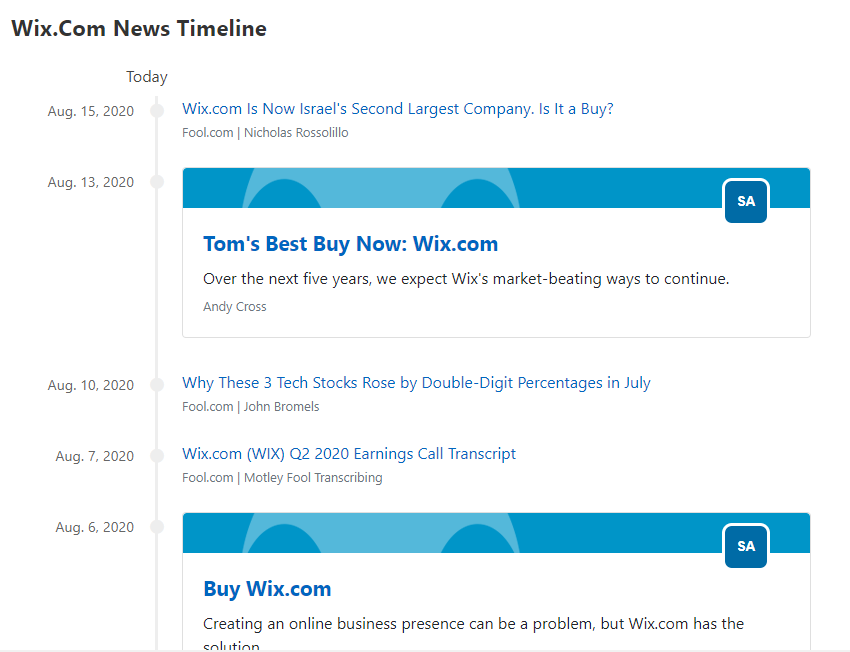

After the recommendation is made, you can then follow up with the company News Timeline where Motley Fools’ articles written about the company as well as the company’s earnings call transcript will be made available in this segment.

As mentioned, what is lacking is probably the ability to access the financials of the recommendations. Motley Fools’ key strength isn’t the detailed analysis of the company’s quarter to quarter numbers but to identify stocks that have the potential to appreciate significantly based on their long-term business prospect, most of the time riding on favorable macro-trend/s.

For “serious” investors who need to “review” the company’s financial performance and valuation before making a purchase decision, like yours truly, I tend to follow up with a review of the company’s financial using a 3rd party site as well as get the “thoughts” of the investment community (on the counter) through SeekingAlpha.

Such a combination has served me well thus far, with Motley Fool being the source of idea generation and the other websites “affirming” the buy decision based on financial justification and “crowd-thoughts”.

Note that many of their recommendations are growth counters and the traditional valuation metrics to justify undervaluation such as P/E, P/B, etc might not be truly relevant in most instances.

Motley Fool Review: Additional Education

Premium Research Reports

I previously highlighted that premium subscribers can get access to their Research Reports on a particular stock counter or an industry in general.

These reports are not as frequently dished out compared to their stock selections, the latter being the gem and focus of this subscription service, but when they do issue a research report, it is definitely worth your while to spend 5-10 minutes reading these reports which very often include identifying a macro-trends that will take shape over the coming decade and the relevant stocks to ride on the tailwind of these trends.

There are also evergreen articles such as their “Essential Guide to Dividend Investing” written back in 2016 which remain a good investing resource for a newbie to understand more about the world of dividend investing.

News and updates

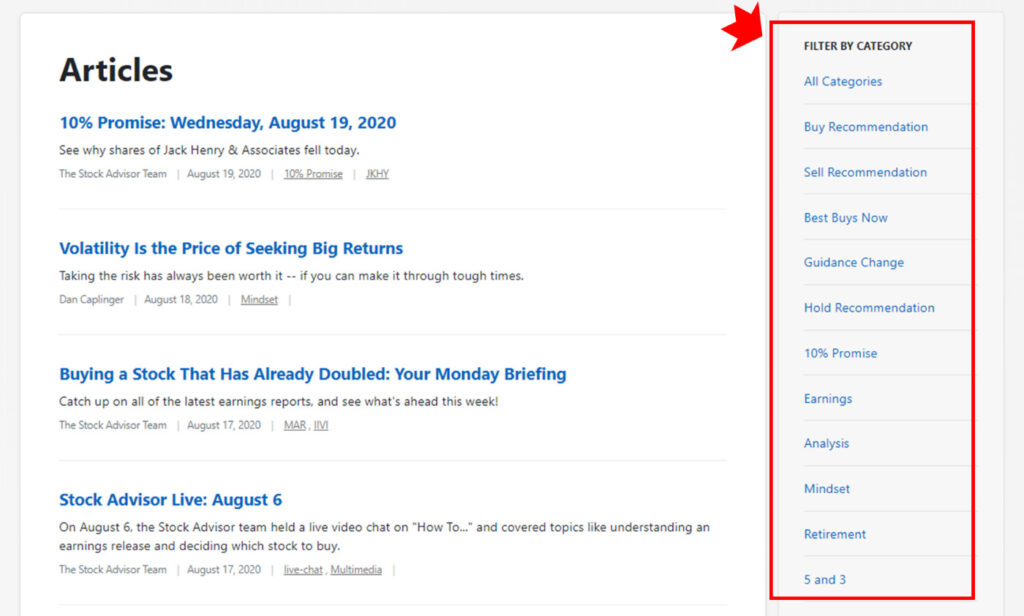

This is where you can find all the news information on stocks that were previously recommended by Motley Fools. You can filter them by the different categories as seen from the diagram below:

Some of these categories are pretty straight forward but let me highlight several more unique ones.

Best Buys Now – This is where the team at Motley Fools believe is the right time to be getting into some of their previously recommended stocks. There are usually 5 stocks that will be on the “Best Buy Now” list. If you are looking for investing ideas today, consider these stocks as worthy additions to a well-balanced portfolio of at least 15 stocks.

10% promise – This is when a previously recommended stock moves up or down by 10% which is a significant movement. Motley Fools promise to deliver the relevant content on why the stock price is moving so drastically as well as their thoughts on the price movement.

Mindset – This segment is more on articles on the psychological side of investing. For example, how do you view volatility? What moves the market? 5 simple rules for investing success etc.

5 and 3 – This is where Motley Fool talks about what could go right or wrong in their recommendations. For every new recommendation, there will be a particular on 5 and 3. 5 Green Flags that they see as positives for the company as well as 3 Red Flags which are potentially concerning areas that one will need to keep a watchful eye on.

So again, a treasure chest of educational information which one can benefit from this premium recommendation, not just from the perspective of identifying a winner.

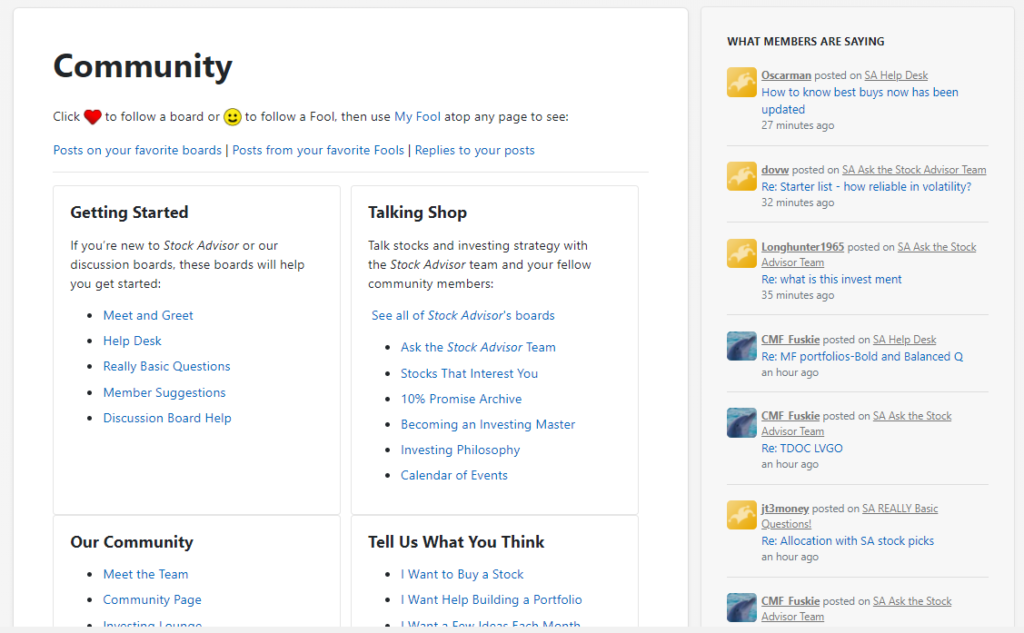

A community of Fool members

Just to add, Motley Fools Stock Advisor is not just a premium newsletter where you just absorb Tom and David dishing out their favorite stock of the month and that’s it. There is a community segment where premium members can interact with other members to find new ideas as well as discuss Motley Fool’s recommended stocks.

Motley Fool Podcast

You don’t have to be a paying member to get access to their Motley Fool Podcast. However, just like to briefly highlight that this is a great educational tool to get up to date with the latest happenings, be it “Target’s record-shattering quarter” or news on Chinese tech, with stock discussion on Alibaba, Tencent, PDD, etc.

Motley Fool review: How did Motley Fools Stock Advisor perform?

I briefly highlighted that Motley Fools Stock Advisor service returns have crushed the S&P500 returns since its inception back in 2002.

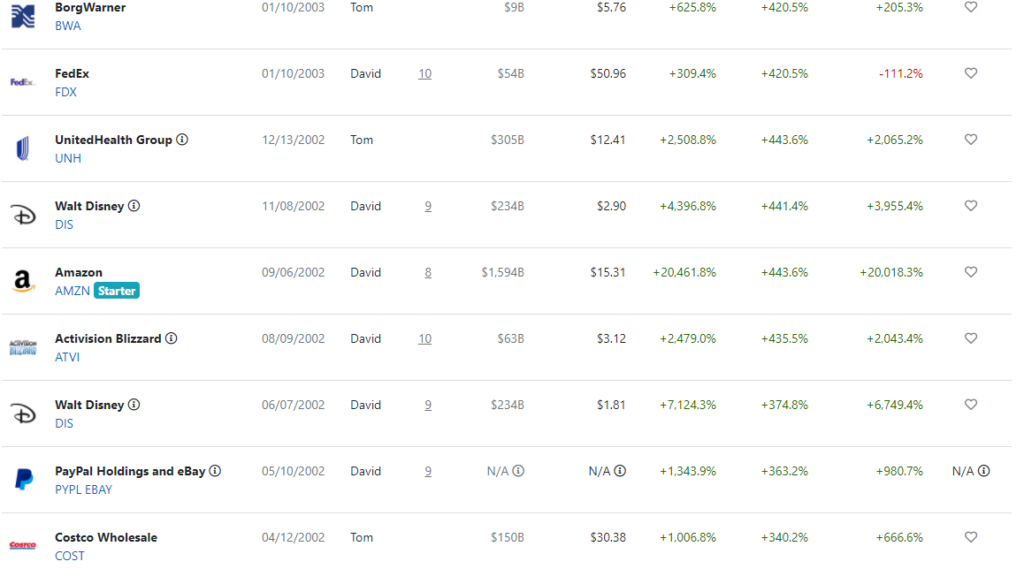

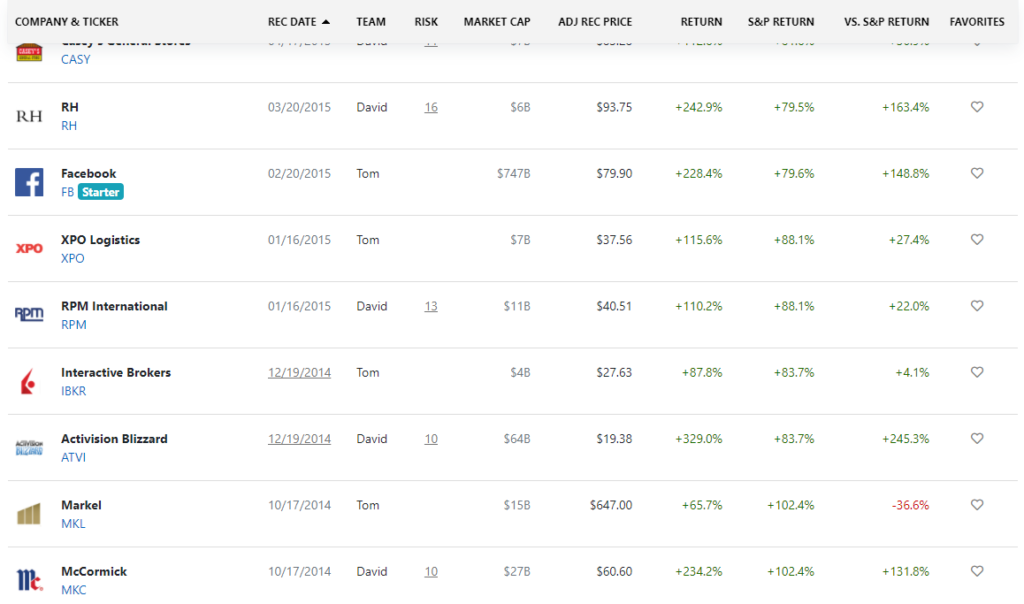

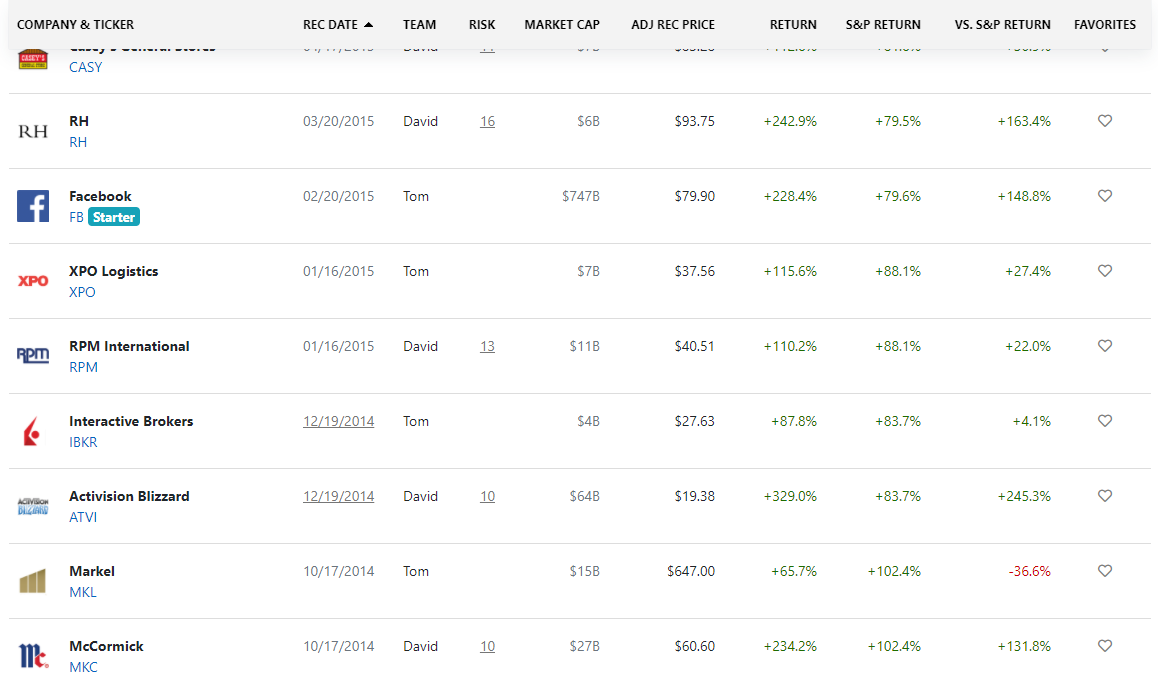

Motley Fools also gave a breakdown of the performance of Tom Garner and David Gardner in the table below:

However, I note that some of this huge outperformance might be skewed towards 1-2-star performers such as Amazon that was first recommended back in September 2002 and generated total returns of 20,000+% YTD.

What will Motley Fool’s performance look like without the benefit of these “legacy” stocks that were purchased many years ago? Is its recent performance still as outstanding?

Using its performance table as shown on its website, one can calculate the individual returns of the stocks since the recommendations were made. (I am not disclosing the company names)

- In 2020 YTD, 15 recommendations were being made

- There were 9 winners and 6 losers as of 19 August 2020

- The average return of a winning stock is +99%

- The average return of a losing stock is – 18.9%

- The average return generated from these 15 recommendations is currently +52%.

- The average return of the S&P 500 is 12.8% (using the same “buy” dates as the stock picks)

What does this mean for an investor?

- If one invested $1000 in each of these 15 stocks, ignoring comms and other costs, the total cost outlay would be $15,000.

- The value of these stocks as of 19 August will equate to $22,750, generating a YTD return of c.52%.

- Profit will be $7,750

- If one invested $15,000 into the S&P500 index, the final value will be $16,920 or a profit of $1,920

- Your Motley Fool stocks will have generated excess profits of $5,830 during this period.

Similarly, in 2019, 24 recommendations were made. If those recommendations were purchased at the recommended price, based on the cost of $1,000/recommendation (total cost of $24,000), the current value of those recommendations made in 2019 will return $39,720 at present.

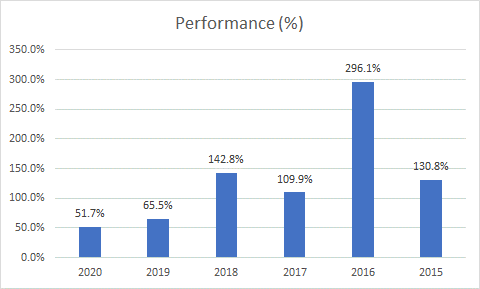

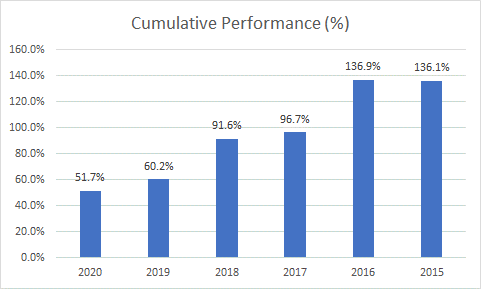

I did the same analysis for the stock recommendations from 2015 to YTD 2020. The performance is shown below. Each of those returns represents the stocks that were purchased solely in that year and held to today.

For example, in 2016, 22 recommendations were made and if an investor was to purchase just those 22 stocks at Motley Fools recommended price, those 22 stocks would have generated a return of close to 300% YTD.

We can go one step further and find the cumulative returns of recommendations made since 2015. There were 127 stock recommendations (there could be duplicated recommendations) made since 2015 and if an investor partakes in every single one of them for a total cost outlay of $127,000 ($1,000/recommendation), the value of his/her portfolio will now be $300,000. That will equate to a total cumulative return of 136% from 2015 to YTD.

So if an investor was to start investing on the back of Motley Fools recommendations from 2015 till date, he would have more than doubled his investment outlay (cost: $127,000 vs. value $300,000). Again, assuming that the outlay of $127,000 was all made right at the beginning of 2015, that will translate to a compound annual growth rate (CAGR) of 16.3%. The actual CAGR, in this case, will be much higher than the 16.3% figure as funds were deployed periodically between 2015 to YTD.

This simple performance illustration looks to emphasize on Motley Fools’ recent stock pick performance (past 5 years) vs. its legacy stocks, the latter skewing its long-term performance significantly to the upside.

Even removing the impact of its legacy stocks first recommended at “rock-bottom” prices, the recent performance of Motley Fools is still very much commendable.

If you came here just to get that Quick Summary of the Motley Fool’s stock picks’ performance over the last 5 years and you are already convinced and you don’t want to miss their next pick, then CLICK HERE to get their next picks for just $19 a month or $99 a year.

Motley Fools Stock Advisor stock picks focus mainly on large-cap companies that have a lower risk compared to small caps and micro caps. One can find the performance of all its historical stock picks in the “performance” segment with data on:

- Stock recommendation date

- Company

- Company ticker

- Market Cap

- Team (who made the recommendation, Tom or David)

- Risk Level

- Recommended Price

- Current Price

- Return (from recommended price to YTD)

- S&P 500 return during the same period

- Outperformance/underperformance vs. S&P500

To be fair, I am showing some of their historical stock picks vs. disclosing the latest ones (did I mention that WIX was its latest recommendation?)

While you can find big-cap names like FB etc which is currently recommended as a “starter” stock (meaning this is a relatively safe and robust stock recommended for a new investor), there are also other hidden gems that are not often talked about in the mainstream media, stocks like WIX which have appreciated more than 230% since their first recommendation.

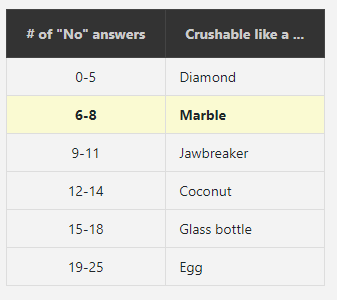

The risk level measures the riskiness of the stock based on its own “crushability” index. What is crushability? David and Tom have a set of 25 questions. When evaluating a company’s risk profile, every “No” answer point to one of its risk questions is a point. The fewer “No” or points a company accumulates, the harder they believe it will be to crush under the pressures of doing business in an unpredictable world.

So for a stock which has a risk rating of 6-8, it is solid as a “marble”, meaning that its risk profile is relatively low. You won’t want to be investing in a stock with “egg-like” crushability if you do not have an appetite for risk-taking.

Other Key Premium Tools

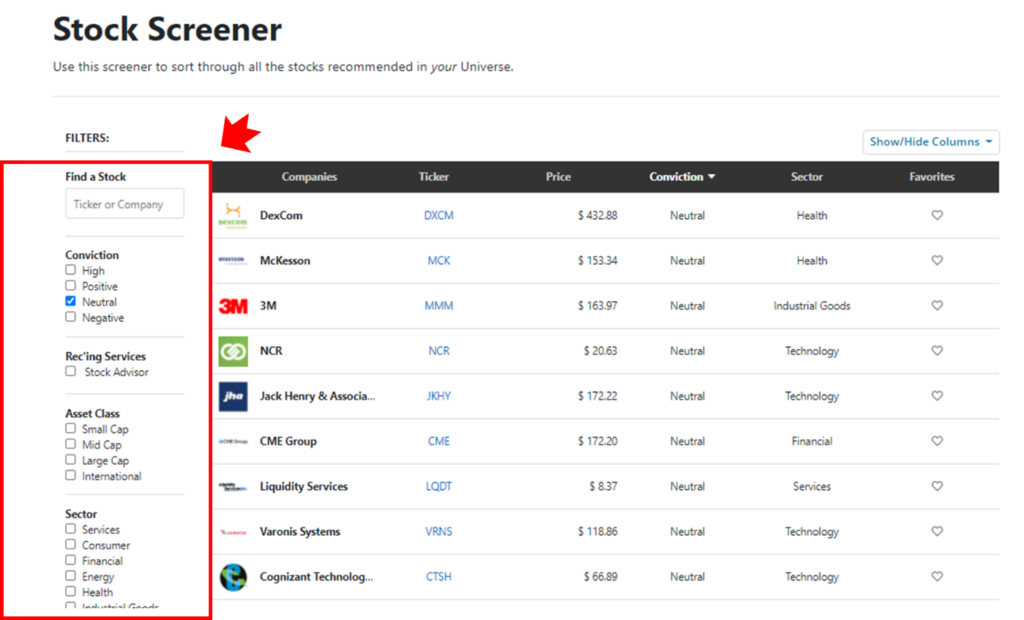

Stock Screener

To be honest, Motley Fools’ stock screener is pretty basic and not their strongest selling feature.

It just allows users to screen based on their conviction level as well as other broad categories such as 1. Asset Class, 2. The sector, 3. Volatility, 4. Dividend Yield and 5. Glassdoor 4 or 5 level.

Disclosing some of their Neutral Calls over here.

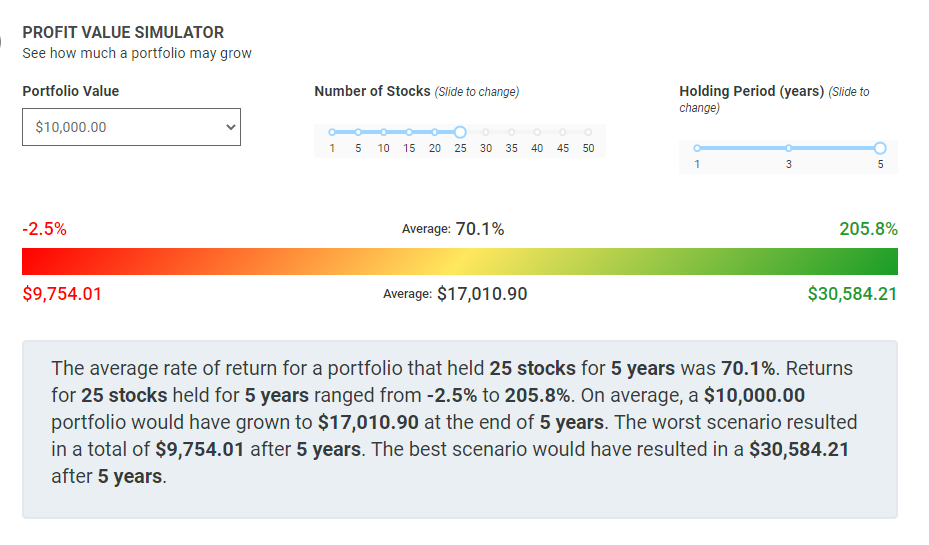

Simulations

Another premium tool that ain’t too useful. It shows the probability of positive returns by holding a portfolio of recommended Motley Fools stocks over several time horizons.

For example, in their simulation, if you hold a portfolio of 25 Motley Fool recommended stocks over a horizon of 5 years, your probability of making money is calculated to be 97% with an average return of 70%. That translates to a simple average return of c.14% a year which is slightly lower than what we have previously calculated of Motley Fools calls having a CAGR of c.17% (likely higher) over a holding horizon of 5.7 years.

At the end of the day, it is just a simple simulation tool which gives a new investor a macro overview of what to expect if he/she invests a lump sum in a Motley Fool recommended portfolio of stocks.

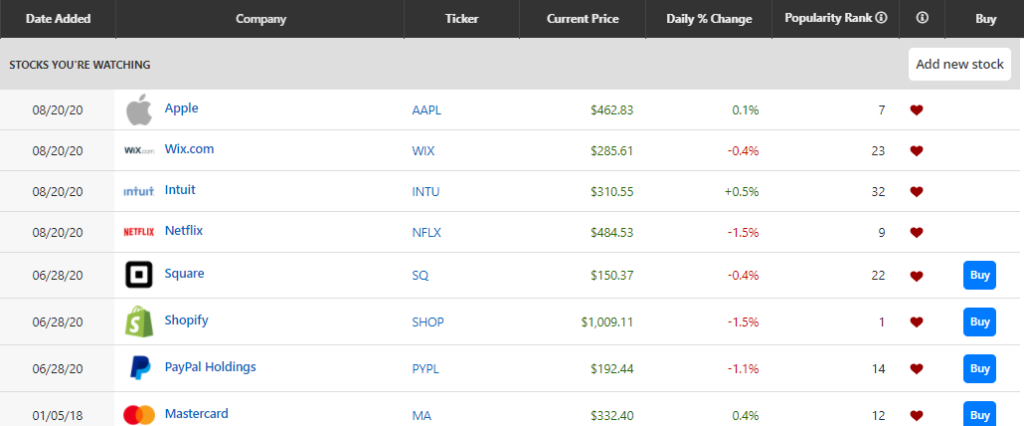

Favorites

You will also get access to the “Favorites” page which allows you to customize a list of stocks that you are interested in following.

It shows you the daily price change as well as their “Popularity Rank” based on Fool’s most popular stock. At present, the #1 accolade belongs to Shopify.

You will get “Instant Alerts” send to you as soon as one of these events occur to stock in your list:

- New Buy Alerts

- Time To Sell Alerts

- Large Price Change Alerts

Motley Fool Review: What to expect out of this premium subscription

This is what you should be expecting out of this premium subscription.

- Two brand new stock recommendations and analysis per month delivered to your email

- On the first Thursday of the month, there will be a new stock recommendation from Tom Gardner

- On the third Thursday of the month, there will be a new stock recommendation from David Gardner

- Access to all of the Motley Fool’s Stock Advisor recommendations ever made. Why were they first recommended in the first place and has that thesis change?

- The Motley Fool’s Top 10 Best Stocks to Buy Now which feature Motley Fools recommended stocks that are ideal BUY candidates at the moment.

- On the second Thursday of the month, Tom Gardner will release his 5 New Best Stocks to Buy Now. 2 Stocks that are in Tom’s latest Best Buy Now list is WIX and ZM.

- On the fourth Thursday of the month, David Gardner will release his 5 New Best Stocks to buy now. 2 Stocks that are in David’s latest Best Buy Now list is NFLX and ZM (seems like a pretty hot stock)

- The Motley Fool’s Top 10 Starter Stocks report features the ideal stocks that should be the foundation of a new investor’s portfolio. As a preview, 3 stocks that are currently featured as Starter Stocks are SHOP, NFLX, and TTD. Despite their huge price outperformance vs. index over the past year, the team at Motley Fool believes they are still one of the best stocks for a new investor to own as the foundation of their portfolio.

- Advice on when to sell a stock when it is no longer fits their thesis. Their current “Sell” list, however, only encompasses Ford and Luckin.

Motley Fool review: Is Motley Fool a Scam?

These guys have been around for a long time. While one can also argue that a scam can be rather “long-lasting”, I would say that Motley Fool has presented themselves and their stock calls in a rather transparent manner that it is hard to argue against their track record.

As I mention, you should not expect every single one of their calls to be winners. They are not the holy grail of investing but so far, their track record has proven that they can outperform the market and they have done so pretty handily since the establishment of Stock Advisor since 2002.

Nonetheless, historical performance is never representative of future performance. As an investor, you should also feel free to do your due diligence and see if Motley Fool is indeed a trust-worthy investment newsletter service company.

Like many other financial and investment research firm, you can try out their service and cancel at any time if you feel that their stock calls are not worthy of the money that you are paying. They have a 30-day money-back guarantee, so you can give it a try without any risk.

With over 600,000 subscribers across all their premium services, it is hard to argue that Motley Fool is a scam. You might not like their investment calls or you have a bad experience with 1 or 2 of their picks (think Luckin) but that is likely not a good enough reason to label them as a scam.

Aggressive advertising

With a total of 24 premium services on the last count (not all of them are open to new members only 4 out of the 24 premium services are available at the moment), they are guilty of trying to “upsell” you a premium service through marketing emails and promotions.

While you are welcome to explore these options, I recommend sticking with the basic Stock Advisor program. It is affordable, simple, and most importantly effective.

You don’t need that many premium services to find stock winners. As an investor, you just need to set the foundations of your portfolio right by picking a few good stocks and you are effectively good to go.

Motley Fool review: How much does the Motley Fool Stock Advisor cost and is it worth the money?

The Motley Fool Stock Advisor subscription is one of the most affordable “premium” subscriptions out there.

After demonstrating how they have “drastically” outperform the market and their competition over the past decade, you would think that this is a service that is going to cost you and “an arm and a leg”, a service that is priced in the 4-digits/annum range at least.

Well, guess what, it is far from that. This subscription is not even in the 3-digits/annum range!

For new subscribers, you can now get access to the subscription at an extremely affordable sum of $99/year or $19/month. Both plans renew automatically unless canceled.

It is really hard to make an argument that this subscription is pricey and not worth your investment. If you have invested just $100/share into the 15 recommendations this year, you would have generated a total profit of $780, making back your cost of the subscription by almost 8-fold. And that is on a TINY investment outlay of $100/stock.

The availability of the monthly option will allow a user to test it out before committing to a year. But note that there is always still the 30-days money-back guarantee option.

Motley Fool Review: Who is the Motley Fool suitable for?

This is a subscription service for an investor who wishes to engage in more hands-on stock picking to try and “outperform” the market. Note that there is always unsystematic risk involve when picking a stock, just like what happen to Luckin Coffee (not so lucky after all). A new investor can choose to have his/her core portfolio vested in Index ETFs which are diversified in nature and use this subscription to select Alpha plays.

I would say that the folks at Motley Fools are “businessman” at heart and subscribe to the Peter Lynch investing philosophy of buying into good businesses run by good managers. They are not “core” fundamentalists so to speak, that scrutinizes the financials of the company down to the last figure. They leave that hard job to the analysts.

Instead, they look out for strong businesses that have strong structural tailwinds/catalyst behind them and look to ride the wave up over the next 3-5 years. Hence their recommendations are mostly long term in nature.

It is thus not suitable for day traders or someone who relies solely on technical analysis to make buy or sell decisions. One can of course use technical analysis to “time” a better entry into these Fool’s recommendations which already covers the business fundamentals.

Whether it is for general knowledge of the market, stock or for investment purpose, I believe the Stock Advisor subscription is an affordable tool for the man-in-the-street to have in their trading/investing arsenal.

Motley Fool Review: Final Thoughts on Motley Fool Stock Advisor Subscription

- Motley Fool, at $99/annum for a new subscriber (usually priced at $199/year) with a 30-day 100% money-back guarantee, is one if not the most affordable investing subscription service out there.

- The articles and recommendations are structured and written in such a way that it is easily absorbed and understood by the laymen.

- This is not a stock screening service that focuses on all the financial numbers. If you wish to dig deeper “financially” into a stock, you will need to use other 3rd party resources such as SeekingAlpha (for community mindshare) or Stock Rovers (screening) to do the job.

- With over 600,000 subscribers across all their premium services, Motley Fool is not a SCAM. However, don’t treat all their recommendations as the holy grail of stock investment advice. Follow up with your due diligence. There will be Hits and Misses but so far, their track record is skewing heavily to the former.

- Ultimately, the Motley Fool Stock Advisor subscription is ideal for longer-term investors with an investment horizon of 3-5 years. Over time, their recommendations have proven to work and significantly outperform the market. That said, investors should have realistic expectations and not expect every pick to be a winner.

Conclusion

I look to present an unbiased review of Motley Fool’s flagship subscription as much as possible. It is not going to tick all the boxes for the IDEAL newsletter subscription service but for the money that you are paying, it is well-worth every single penny.

Since I subscribe to their service back in 2016, I bought several stocks that are multi-baggers already and have made back my subscription fees many times over the past 4 years.

- SHOP – 744% return

- TTD – 623% return

- OKTA – 597% return

- SQ – 58% return

- ZS – 226% return

- TWLO – 206% return

- ZM – 120% return

The key loser which I bought through their recommendation was Stitch Fix (SFIX) which I purchased at $28/share and it is currently languishing at around $25/share. I am not losing sleep over it.

For those who are looking for an affordable newsletter subscription, look no further than the Motley Fool Stock Advisor subscription. If you invest today, you will be in time to get David’s New Best Buys Now on 27 August, Tom’s New Stock Recommendation on 3 Sep, and Tom’s New Best Buy Now on 10 Sep.

Get 50% off your Motley Fool Stock Advisor!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 17 US COMPANIES MOST AT RISK FROM ESCALATING US-CHINA TENSIONS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Motley Fool review: Getting multi-bagger ideas the easy way”

Hi. Will they advise you to sell the stock once they think it’s not a viable investment anymore? Or is that up to individual investors? Thanks.