The Hong Kong Stock Exchange is getting an index to track the performance of some of the biggest technology companies in the world.

The gauge, known as Hang Seng Tech Index, will include the largest 30 of 163 entities which command a combined market cap of c.USD$1.58trn. This is relatively similar to the Nasdaq Composite Index.

The index, which debuts today, will likely trigger fund managers to introduce ETFs as a short cut for investors to buy into these tech stocks. As tech stocks were performing strongly this year, it provides the perfect window of opportunity for asset managers to launch tech-focused ETFs, which will likely be popular among investors.

The top 5 constituents of the index are Alibaba Group, Tencent Holdings, Meituan Dianping, Xiaomi, and Sunny Optical.

This new index comes at a time when many US-listed mainland tech companies are “returning home” with a secondary listing in HK, with more expected to come, thus boosting the appeal of Hong Kong Exchange stock. Ant Group, the financial arm of Alibaba, recently unveiled its intention to list in Hong Kong and Shanghai, bypassing the US.

This article aims to provide a comprehensive business summary of the 30 tech companies behind the index. I will also provide a valuation summary, identifying the companies with the fastest forward 1-year revenue and earnings growth towards the latter part of the article. Are their current valuations justified?

This list will start with the largest index component to the smallest.

The following content contains a non-sponsored review but may contain affiliate links.

Hang Seng Tech Index Stock #1: Alibaba Group Holdings (SEHK:9988)

Alibaba Group Holding Limited, through its subsidiaries, provides online and mobile commerce businesses in the People’s Republic of China and internationally. It operates through four segments: Core Commerce, Cloud Computing, Digital Media and Entertainment, and Innovation Initiatives and Others.

The company operates Taobao Marketplace, a mobile commerce destination; Tmall, a third-party online and mobile commerce platform for brands and retailers; Alibaba Health Internet platforms for pharmaceutical and healthcare products; Alimama, a monetization platform; 1688.com and Alibaba.com, which are online wholesale marketplaces; AliExpress, a retail marketplace; Lazada, an e-commerce platform; and Tmall Global, an import e-commerce platform.

It also operates Lingshoutong, a digital sourcing platform; Cainiao Network logistic services platform; Ele.me, a delivery and local services platform; Koubei, a restaurant, and local services guide platform; and Fliggy, an online travel platform. Also, the company offers pay-for-performance and display marketing services; and Taobao Ad Network and Exchange, a real-time bidding online marketing exchange.

Further, it provides elastic computing, database, storage, virtualization network, large-scale computing, security, management and application, big data analytics, and Internet of Things and other services for enterprises; payment and escrow services; and movies, television series,

variety shows, animations, and other video content.

Additionally, the company operates Youku, an online video platform; Alibaba Pictures and other content platforms that provide online videos, films, live events, news feeds, literature, music, and others.

Amap, a mobile digital map, navigation, and real-time traffic information app; DingTalk, a business efficiency app; and Tmall Genie, an AI-powered smart speaker.

Hang Seng Tech Index Stock #2: Tencent Holdings (SEHK:700)

Tencent Holdings Limited, an investment holding company, provides value-added services (VAS) and Internet advertising services in Mainland China, the United States, Europe, and internationally. The company operates through VAS, FinTech and Business Services, Online Advertising, and Other segments.

It offers online games and social network services; FinTech and cloud services; and online advertising services, such as media, social, and other advertisement services. The company is also involved in the production, investment, and distribution of films and television programs for third parties, as well as copyrights, licensing, merchandise sales, and other activities.

Also, it develops software; develops and operates online games; and provides information

technology, information system integration, asset management, online literature, and online music entertainment services. The company is the owner of the popular WeChat app.

Hang Seng Tech Index Stock #3: Meituan Dianping (SEHK:3690)

Meituan Dianping, an investment holding company, provides an e-commerce platform that uses technology to connect consumers and merchants. It operates through Food Delivery; In-store, Hotel & Travel; and New Initiatives and Other segments.

The Food Delivery segment offers food ordering and delivery service through its platform. The In-Store, Hotel & Travel segment enables merchants to sell vouchers, coupons, tickets, and reservations through the company’s platform. The New Initiatives and Other segments offer restaurant management systems, supply chain, Meituan Instashopping, integrated payment, microloan, local transportation, non-food delivery, and other products and services, as well as pilot car-hailing and bike-sharing services.

The company also offers multimedia information technology, cloud computing, merchant information advisory, online payment, and marketing services. The company was formerly known

as Internet Plus Holdings Ltd. and changed its name to Meituan Dianping in June 2018.

Hang Seng Tech Index Stock #4: Xiaomi Corp (SEHK:1810)

Xiaomi Corporation, an Internet company, provides hardware, software, and Internet services in Mainland China and internationally. It operates through Smartphones, IoT and Lifestyle Products, Internet Services, and Others segments. The Smartphone segment sells smartphones.

The IoT and Lifestyle Products segment offers smart TVs, laptops, AI speakers, and smart routers; various IoT and other smart hardware products; and lifestyle products. The Internet Services segment provides advertising services and Internet value-added services. The Others

segment offers hardware repair services for its products. The company also engages in the wholesale and retail of smartphones and ecosystem partners’ products; investment activities; development of software and hardware; procurement and sale of smartphones, ecosystem partners’ products, and spare parts; procurement of raw materials; and operation of retail stores.

It is also involved in the research and development of computer software and information technology; property management and commercial factoring activities; e-commerce and market

research businesses; sale of e-books; asset management, project investment, and investment consulting activities; and provision of Internet finance, consumer loan, software-related, information technology, electronic payment, and Internet services.

Hang Seng Tech Index Stock #5: Sunny Optical (SEHK:2382)

Sunny Optical Technology (Group) Company Limited, an investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

It operates through three segments: Optical Components, Optoelectronic Products, and Optical Instruments. The company’s products include optical components, such as glass spherical and aspherical lenses, plane products, handset lens sets, vehicle lens sets, security surveillance lens sets, and other lens sets; optoelectronic products, such as handset camera modules, three dimensional

optoelectronic products, vehicle modules, and other optoelectronic modules; and optical instruments comprising microscopes and intelligent equipment for testing.

Its optoelectronic-related products are used in handsets, digital cameras, vehicle imaging and sensing systems, security surveillance systems, virtual reality/augmented reality, and automated factories, which are combined with optical, electronic, software, and mechanical technologies.

In addition, the company engages in the research and development of infrared technologies; trading of optical instruments and optoelectronics products; property leasing activities; manufacture and sale of optical automotive components; and development, service, and consultation of technology, as well as provision of financing services.

Hang Seng Tech Index Stock #6: SMIC (SEHK:981)

Semiconductor Manufacturing International Corporation, an investment holding company, engages in the computer-aided design, manufacture, testing, packaging, and trading of integrated circuits (IC) and other semiconductor services.

It is also involved in wafer manufacturing, wafer probing and bumping, technology development,

design service, mask manufacturing, and assembly and final testing of integrated circuits; and sale of self-manufactured products.

In addition, the company designs and manufactures semiconductor masks; and offers marketing related services. It operates in North America, China, Hong Kong, and Eurasia. The company serves integrated device manufacturers, fabless semiconductor companies, and system companies.

Hang Seng Tech Index Stock #7: Alibaba Health (SEHK:241)

Alibaba Health Information Technology Limited, an investment holding company, engages in pharmaceutical e-commerce, intelligent medicine, and product tracking platform businesses in the People’s Republic of China.

It engages in business-to-customer (B2C) retail activities; advertisement business; and business-to-business (B2B) centralized procurement distribution business. The company also provides pharmaceutical and healthcare products through its online stores on Tmall.com and offline pharmacy outlets to B2C and B2B customers; marketing services; health consultation services; outsourced and value-added services to the Tmall entities; and telemedicine services. Besides, it trades in pharmaceutical products; and provides network hospital services.

Hang Seng Tech Index Stock #8: JD.com (SEHK:9618)

JD.com, Inc., through its subsidiaries, operates as an e-commerce company and retail infrastructure service provider in the People’s Republic of China. It operates in two segments, JD Retail, and New Businesses.

The company offers home appliances; mobile handsets and other digital products; desktop, laptop, and other computers, as well as printers and other office equipment; furniture and household goods; apparel; cosmetics, personal care items, and pet products; women’s shoes, bags, jewelry, and luxury goods; men’s shoes, sports gears, and fitness equipment; automobiles and accessories; maternal and childcare products, toys, and musical instruments; and food, beverage, and fresh produce.

It also provides gifts, flowers, and plants; nutritional supplements, healthcare services, and other healthcare equipment; books, e-books, music, movie, and other media products; and virtual goods, such as online travel agency, attraction tickets, and prepaid phone and game cards, as well as industrial products and installation and maintenance services.

In addition, the company offers an online marketplace for third-party merchants to sell products to customers; and transaction processing and billing and other services. Further, it provides online marketing services for suppliers, third-party merchants, and other business partners; supply chain and logistics services for various industries; and consumer financing services to individual customers, as well as online-to-offline solutions.

JD.com, Inc. offers its products through its website jd.com and mobile apps, as well as directly to customers. As of December 31, 2019, JD.com, Inc. operated fulfillment centers in seven cities; and 700 warehouses in 89 cities covering various counties and districts. The company has a strategic cooperation agreement with Tencent Holdings Limited.

Hang Seng Tech Index Stock #9: Kingdee (SEHK:268)

Kingdee International Software Group Company Limited, an investment holding company, engages in enterprise resource planning business. The company operates through ERP Business, Cloud Services Business, and Investment Properties Operating Business segments.

The ERP Business segment sells software and hardware products; and provides software solution consulting, maintenance, upgrade, and other supporting services, as well as software implementation services.

The Cloud Services Business segment provides enterprise, finance, industry, and other cloud services.

The Investment Properties Operating Business segment invests in properties.

The company also develops, designs, manufactures, and sells hardware products; provides software-related and online financial services; and develops Internet and online pay technologies. It serves enterprises, government agencies, and other organizations worldwide.

Hang Seng Tech Index Stock #10: Ping An Good Doctor (SEHK:1833)

Ping An Healthcare and Technology Company Limited operates an Internet healthcare platform in the People’s Republic of China.

It offers online medical services, such as online consultation, hospital referral, and appointment,

inpatient arrangement, and second opinion services; and consumer healthcare services, including various standardized service packages that integrate services at healthcare institutions.

The company also provides healthcare products comprising medicines, health supplements,

and medical devices; wellness products consisting of fitness equipment and accessories, and personal care products; and other products.

In addition, it offers health management and wellness interaction services, such as wellness programs, tools and activities, and personalized content. Further, the company provides

medicine marketing services; technology services; application development and operation services; and hospital and clinic services, as well as operates an insurance agency.

Hang Seng Tech Index Stock #11: AAC Tech (SEHK:2018)

AAC Technologies Holdings Inc., an investment holding company, provides solutions to enhance the user experience of smart mobile devices in China and internationally.

The company operates through Dynamic Components, Electromagnetic Drives and Precision Mechanics, Micro Electro-Mechanical System Components, and Other Products segments.

It researches, develops, manufactures, and sells acoustic products, electronic components, tooling and precision components, and electronics-related accessories and components; and offers electroplating services.

The company’s products include miniature speaker modules, receivers, and speakers; and optics, RF antennas traditional microphones, and headsets.

Hang Seng Tech Index Stock #12: Lenovo (SEHK:992)

Lenovo Group Limited, an investment holding company, develops, manufactures, and markets technology products and services. It offers commercial and consumer personal computers, as well as servers and workstations; and a family of mobile Internet devices, including tablets

and smartphones.

The company also provides laptops, desktops, phones, accessories, monitors, ultrabooks, data center solutions, systems, software, server and storage products, networking products, and replacement parts. In addition, it manufactures and distributes IT products, computers, computer hardware, and peripheral equipment; and offers IT, business planning, management, supply chain, finance, administration support, procurement agency, data management solution, intellectual property, investment management, and computer hardware and software systems repair services.

Further, the company is involved in the retail and service business for consumer electronic products and related digital services; and development, ownership, licensing, and sale of communications hardware and software.

It operates in China, the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Hang Seng Tech Index Stock #13: Kingsoft (SEHK:3888)

Kingsoft Corporation Limited, an investment holding company, operates as a software and Internet service company in Mainland China, Hong Kong, and internationally.

It operates through three segments: Entertainment Software; Cloud Services; and Office Software and Services and Others.

The Entertainment Software segment engages in the research and development of games; and the provision of online games, mobile games, and casual game services. The Cloud Services segment provides cloud computing, storage and delivery, and comprehensive cloud-based solutions. The Office Software and Services and Others segment designs, researches, and develops, sells, and markets office software products and services of WPS Office.

It also engages in the operation and distribution of games; marketing and operation of SMS, and wireless service of online games and application software; sale and operation of office application

software; marketing and operation of entertainment software products; and research, development, and distribution of consumer application software.

Hang Seng Tech Index Stock #14: ASM Pacific (SEHK:522)

ASM Pacific Technology Limited, an investment holding company, engages in the design, manufacture, and marketing of machines, tools, and materials used in the semiconductor and electronics assembly industries worldwide.

It operates through three segments: Semiconductor Solutions, Surface Mount Technology Solutions, and Materials.

The company provides deposition process equipment, wafer separation equipment, AOI/FOL equipment, die-attach equipment, wire bonding equipment, dispensing equipment, encapsulation solutions equipment, and CIS equipment. It also offers singulation, trim, and form systems; LED testing, sorting, and taping systems; and test and finish handling systems.

In addition, it offers advanced fine pitch solutions; advanced packaging solutions; copper bonding solutions; Leadframe solutions; LED/Opto solutions; photonics, display, and COB solutions; stacked die solutions; and smart SMT factory solutions. Further, the company provides agency and logistics services.

Hang Seng Tech Index Stock #15: China Literature (SEHK:772)

China Literature Limited, an investment holding company, operates an online literature platform in the People’s Republic of China.

The company’s flagship product is QQ Reading, unified mobile content aggregation , and distribution platform. As of December 31, 2019, its library featured 8.1 million writers and 12.2 million works of literature, including 11.5 million original literary works created by writers on its platform, 400 thousand works that are sourced from third-party platforms, and 280 thousand e-books.

It is also involved in the self-operated channels business on partner distribution platforms. In addition, the company licenses the content to third-party partners, such as Baidu, Sogou, JD.com, and Xiaomi Duokan for distribution, as well as offers online paid reading and content adaptations into various entertainment formats.

Further, it provides reading, copyright commercialization, and writer cultivation and brokerage services; and operates text work reading and related open platform through technology methods and digital media, including personal computers, Internet, and mobile network.

Additionally, the company engages in the production and distribution of television series, web series, and films; licensing and distribution of film and television properties; licensing copyrights; sale of physical books; and operation of in-house online games, etc

Hang Seng Tech Index Stock #16: Netease (SEHK:9999)

NetEase, Inc., an Internet technology company, provides online services focusing on content, community, communication, and commerce in the Peoples’ Republic of China and internationally.

The company operates in three segments: Online Games Services, Youdao, and Innovative Businesses and Others.

It develops and operates PC-client and mobile games, as well as offers games licensed from other game developers.

The company’s products and services include Youdao Dictionary, an online knowledge tool; Youdao Cloudnote, a notetaking tool; smart devices, such as Youdao Smart Pen, Youdao Dictionary Pen, and Youdao Pocket Translator; online courses; interactive learning apps; and enterprise services, such as Youdao Smart Cloud, a cloud-based platform that helps third-party app developers, smart device brands, and manufacturers to access its advanced optical character recognition capability and neural machine translation engine.

Its products and services also include NetEase Cloud Music, a music streaming platform; Yanxuan, an e-commerce platform, which sells private label products, including consumer electronics, food, apparel, homeware, kitchenware, and other general merchandise; NetEase Media, an Internet

media service; NetEase Mail, an email service; CC Live streaming, a live streaming platform with a focus on game broadcasting; and NetEase Pay, a payment platform.

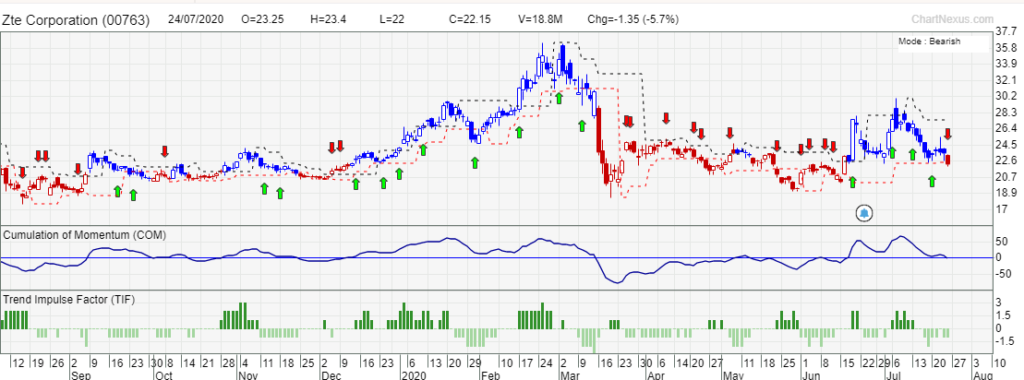

Hang Seng Tech Index Stock #17: ZTE (SEHK:763)

ZTE Corporation provides integrated telecommunications and information technology (IT) solutions worldwide.

It operates through three segments: Carriers’ Networks, Consumer Business, and Government and Corporate Business.

The company offers wireless products, such as baseband units, AAU series, ultra-broadband radio series, indoor coverage, small cell base station series, and microwave products. It also provides cloud core network products that comprise hardware devices, cloud platform systems, and SDN controllers; HD voice and video, intelligent pipeline, and user data convergence; CloudStudio GSO,

NFVO, and VNFM; and cloud integration products.

In addition, the company offers fixed network services, including optical and copper access, and smart home products; transport networks, such as optical network, mobile backhaul, router, Ethernet switch, and network control and management systems; multi-media solutions; energy solutions comprise telecom power and data center; and data management solutions.

Further, it provides cloud computing products that include cloud platform, storage, and desktop products; cloud video products, such as video conferencing and IoT platform, contact center, coalition emergency response systems, and meeting infrastructure; and smartphone and mobile

internet products, as well as 5G, consulting and integration, technical, digital operation, intelligent O&M customer support, and learning services.

Additionally, the company offers wireless access, cloud core and transport network, fixed access, and AI and big data solutions.

Hang Seng Tech Index Stock #18: ZhongAn Online (SEHK:606)

ZhongAn Online P & C Insurance Co., Ltd., an online insuretech company, provides internet insurance and information technology services in the People’s Republic

of China.

The company operates through Insurance, Technology, and Others segments. It offers property

and casualty insurance products covering accident, bond and credit, health, liability, cargo, household property, and motor insurance, as well as shipping return policy insurance.

The company also provides technology development and consulting, asset management,

IT consulting, telemedicine, biotechnology, online medical, life insurance, micro, and virtual financing, and insurance broking services.

Hang Seng Tech Index Stock #19: Weimob (SEHK:2013)

Weimob Inc., an investment holding company, provides cloud-based commerce and marketing solutions in the People’s Republic of China. The company operates in two segments, SaaS Products, and Targeted Marketing Service.

It offers software as a service product, such as commercial cloud products, which include Wei

Mall, an integrated e-commerce solution; Smart Retail, a solution for offline retail merchants; Ke Lai Dian, a WeChat-based solution for merchants; Smart Restaurant that targets merchants in the restaurant and catering industry; Cloud Store, a vertical solution for the food delivery industry, featuring mobile ordering, online payment, receipt issuing, physical delivery, mobile social networking marketing, sales promotion, and customer membership management services; Smart

Hotel for merchants in the hospitality industry; Smart Beauty, which provides a solution for the beauty industry merchants; Smart Meeting, a digital conference solution; and Smart Traveling, a solution for travel agencies.

The company also provides Marketing Cloud, including Wei Station that enables enterprises and brands to establish their own official WeChat Mini Program-based website; Smart Marketing, a marketing platform for enterprises; and Wei Form, a general solution for merchants with various information collection, as well as Sales Pusher, an intelligent solution for enterprises to enhance the customer acquisition capability of their sales force.

In addition, it offers Targeted Marketing, a platform for mobile advertising.

Hang Seng Tech Index Stock #20: BYD Electronics (SEHK:285)

BYD Electronic (International) Company Limited, an investment holding company, designs, manufactures, assembles, and sells mobile handset components and

modules in the People’s Republic of China, the Asia Pacific, the United States, and internationally.

The company also provides high-level assembly services; and manufactures and sells batteries, chargers, and iron phosphate batteries for use in electric buses, trucks, cars, and forklifts, as well as its components and spare parts.

In addition, it builds and maintains monorail projects.

Hang Seng Tech Index Stock #21: Tongcheng elong (SEHK:285)

Tongcheng-Elong Holdings Limited, an investment holding company, provides travel-related services in the People’s Republic of China.

It offers various products and services covering a range of aspects of travel, including transportation ticketing, accommodation reservation, and various ancillary value-added products and services.

The company also provides online advertising services, technology consulting and services, and insurance agency services. It provides its travel products and services through its Tencent-based online platforms, mobile apps, and websites.

Hang Seng Tech Index Stock #22: Koolearn (SEHK:1797)

Koolearn Technology Holding Limited provides online extracurricular education services under the Koolear brand in China.

The company operates through three segments: College Education, K12 Education, and Pre-school

Education. It offers live and pre-recorded courses for pre-school, K-12, and college segments.

The company offers test preparation, overseas test preparation, and English language services to college students and working professionals; and after-school tutoring courses. It also provides educational content and service packages to institutional customers, such as universities,

public libraries, telecom operators, and online video streaming service providers.

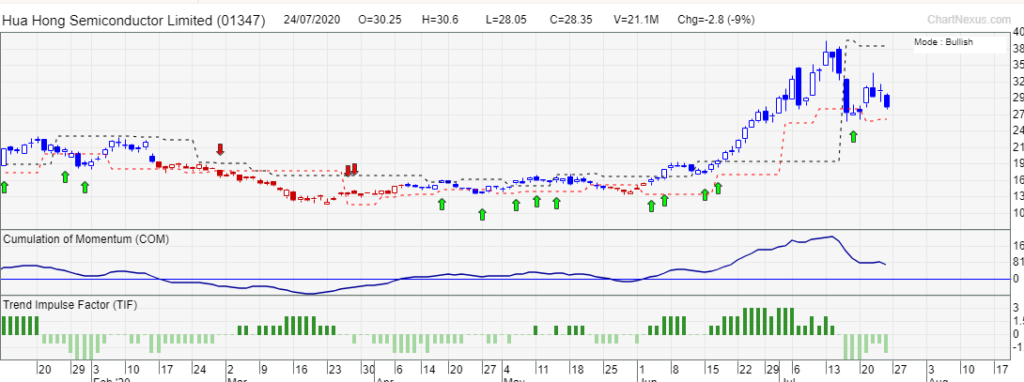

Hang Seng Tech Index Stock #23: Hua Hong Semiconductor (SEHK:1347)

Hua Hong Semiconductor Limited, an investment holding company, manufactures and sells semiconductor products.

It primarily focuses on the research and manufacturing of semiconductors on 200mm wafers for applications, including embedded non-volatile memory (eNVM) and power discrete. The company offers eNVM, power management integrated circuits, power discrete, radiofrequency, standard logic and mixed-signal, and automotive solutions; and process technologies, such as RFCMOS, analog, and mixed-signal, PMIC, and MEMS.

It also offers foundry services; and design services comprising standard and customized IP development, full-custom layout design, and customer-specific integrated solutions, as well as design support and tape out services.

In addition, the company provides multi-project wafer services; mask making services; and backend services, such as in-house testing, backside processing, and dicing, and backend turnkey services, as well as wafer probing, assembly, and testing.

Its products are used in consumer electronics, communications, computing, industrial, and automotive markets in the People’s Republic of China, the United States, Europe, Japan, and other Asian countries.

Hang Seng Tech Index Stock #24: Maoyan Entertainment (SEHK:1896)

Maoyan Entertainment operates a platform that provides Internet-empowered entertainment services in the People’s Republic of China.

The company offers online entertainment ticketing, entertainment content, e-commerce, advertising, and other services. It provides online movie and entertainment event ticketing services; Internet-based promotion and distribution services for movies, as well as a range of entertainment content; and computer technology research, film project technology advisory, and e-business

services.

The company’s customers primarily include cinemas, entertainment content producers and distributors, and advertisers. The company has a strategic alliance with Tencent Video to develop an entertainment consumption platform.

Hang Seng Tech Index Stock #25: FIT Hon Teng (SEHK:6088)

FIT Hon Teng Limited engages in the design, development, production, and sale of interconnect solutions and related products in Taiwan, Mainland China, the United States, Hong Kong, Singapore, and internationally.

The company offers cable components, including an array of input/output (I/O) cable assemblies, as well as wire harness and power cords. It also provides connector components comprising I/O connectors, sockets, SAS connectors, power and backplane connectors, memory/edge cards, terminal blocks, and wire to board/board to board connectors. In addition, the company offers optical modules, such as active optical cables, an optical transceiver, and embedded optical modules.

Further, it provides radio frequency antenna cable and module assemblies; wireless charging products and components; and accessories, such as headsets, speaker systems, and power and cable accessories.

The company’s interconnect solutions provide the functionality to a computer and consumer electronics, mobile and wireless devices, and communications infrastructure, including cloud computing, as well as other end markets, such as automotive, industrial, and medical.

It also engages in the structured cabling, installation, and maintenance of intelligent control

system, as well as research, development, and manufacture of batteries.

Hang Seng Tech Index Stock #26: XD Inc (SEHK:2400)

XD Inc., an investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

It also operates TapTap, a game community, and platform, as well as provides information services.

Hang Seng Tech Index Stock #27: HengTen Networks (SEHK:136)

HengTen Networks Group Limited, an investment holding company, engages in the internet community and related businesses in the People’s Republic of China, Hong Kong, Europe, and internationally.

It operates HengTen Mimi, a smart community services platform to support communities through its property services platform by providing support to property fee payment, event reporting, repair reporting, and community intelligent station.

The company is also involved in internet home furnishing business; and internet materials logistics business that covers building materials, furniture, customization, home appliances, and various soft decorations for consumers, small and medium-sized properties, and decoration companies.

In addition, it invests and trades in securities; provides loan financing services; and manufactures, sells, and trades in accessories for photographic, electrical, and multimedia products.

Hang Seng Tech Index Stock #28: Q Tech (SEHK:1478)

Q Technology (Group) Company Limited engages in the research and development, design, manufacture, and sale of camera and fingerprint recognition modules in the People’s Republic of China and internationally.

The company offers high- and middle-range, dual camera, and 3D modules, as well as front-facing and rear fingerprint recognition modules for the branded smartphone and tablet market. It also trades in camera modules.

Hang Seng Tech Index Stock #29: NetDragon (SEHK:777)

NetDragon Websoft Holdings Limited, an investment holding company, develops online and mobile games in the People’s Republic of China, the United States, the United Kingdom,

and internationally.

It engages in the games design, programming, and graphics, and online and mobile games operation; online education and related application business; and mobile solution, products, and marketing

businesses. The company’s games for kids include JumpStart, School of Dragons, Neopets, World of Madagascar, and Math Blaster; and other games comprise Eudemons Online, Conquer Online, Way of the Five, and Adventure Navigation.

It also licenses and services developed games; develops and provides products in augmented reality and computer vision with machine learning technology; sells education hardware and software products; and develops properties.

Hang Seng Tech Index Stock #30: Yixin (SEHK:2858)

Yixin Group Limited, an investment holding company, operates as an online financed automobile transaction platform in the People’s Republic of China.

The company operates in two segments, Transaction Platform Business , and Self-Operated Financing Business.

The Transaction Platform Business segment offers auto loans to consumers by its auto finance partners; advertising and subscription services for automakers, auto dealers, auto finance

partners, and insurance companies; and used automobile transaction facilitation services.

The Self-Operated Financing Business segment provides consumers with auto finance solutions through financing leases.

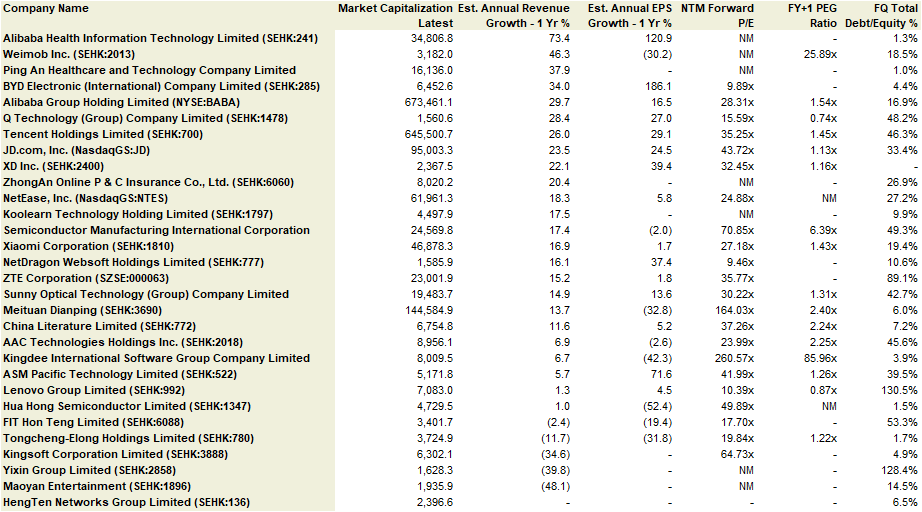

Fastest growing tech companies

The list above is sorted based on the fastest growing index component tech company to the slowest based on the revenue forecast by the street.

Sitting atop is Alibaba health which is forecasted to its revenue by 73% in the coming year. The company will be the 7th largest index component stock with a market cap of US$34bn.

Many of the fastest revenue growers are currently loss-making such as Alibaba Health and Ping An Healthcare. However, Alibaba Health is forecasted to turn in a sizable profit of HKD$530m in its next financial year-end March 2021. Ping An Healthcare on the other hand is forecasted to turn profitable only in 2022.

BYD Electronics looks like an interesting company that is expected to grow its revenue by 34% and EPS by a massive 186%. In the coming year. Assuming it can achieve that feat, it is trading at just a shade below 10x forward PER, a massive bargain for a tech company with such growth. The company also has a strong balance sheet which is not at all levered.

Another interesting company that seems like a “value” buy is Q Technology, one of the smallest market cap component stock in the index. The company is forecasted to grow at c.27-28% for both its top and bottom-line. With a forward PER of just 15x, its PEG ratio is a relatively low 0.74x.

Some of the biggest component stocks such as Alibaba, Tencent, JD, Netease, etc are all looking to grow their top-line by double-digit. Among the heavyweights, Alibaba Group’s forecasted growth in terms of revenue is the strongest but trails Tencent when it comes to earnings. However, in terms of “cheapness”, Alibaba is the cheapest among the lot with a forward PER of JUST 28x vs. Tencent at 35x and JD at 44x.

Another company that caught my eye is NetDragon which has forward revenue growth of 16% while earnings are expected to increase by 37%. With a market cap of USD$1.6bn, the company is expected to generate a profit of HKD$1.26bn (USD0.16bn) which translates to just a 10x forward PER multiple. Seems like another “value” tech counter, one which has turned profitable since 2017 and is forecasted to grow EPS by double-digit over the coming years.

Lenovo Group looks like another “value” tech buy based on PEG. However, revenue growth is weak and the company is highly levered.

Conclusion

This article provides a comprehensive write-up of the companies behind the latest Hang Seng Tech Index.

I have provided a technical perspective of these stocks using the proprietary software called Traders GPS. Some of the stocks which are looking good from the technical standpoint using this software are BYD Electronics and XD, both companies that scored fairly well in terms of forward growth as well. I will be interested in taking a closer look at BYD Electronics.

As highlighted, fund managers will be rushing to create ETFs which mimic the performance of this tech index ahead. This will allow both retail and professional investors a quick and easy way to buy into a basket of the hottest technological counters on the Hong Kong Stock Exchange.

With an increasing number of US-listed China-domiciled stocks coming home, we should expect changes in the index component stocks on a fairly frequent basis. The listing of Ant Financial, for example, will be a closely watched affair.

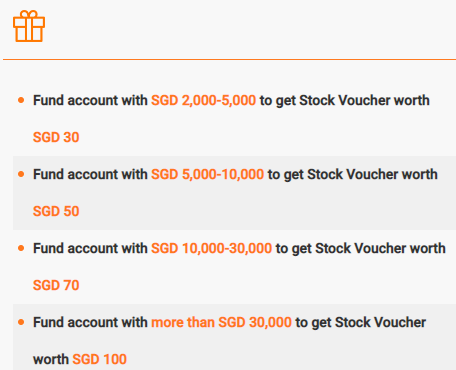

Unfortunately, trading in HK stocks is often more expensive than SG stocks or US stocks for Singaporean investors. The introduction of Tiger Brokers has dramatically changed the brokerage landscape and this platform now allows retail investors to save big time in commission fees when trading in HK stocks.

I have written a comprehensive July 2020 update on the various Brokerages in Singapore and their respective associated fees when trading in SG, HK, and US stocks.

One of the recommended Platform is Tiger Brokers which allows me to now trade in HK stocks (likely to be an increasingly popular market) cheaply, their brokerage cost often a fraction of what the other brokerages are charging and even more affordable than the market leader of cheap online brokerage, Interactive Brokers.

You can read my comprehensive review of Tiger Brokers in this article here: TIGER BROKERS REVIEW: POSSIBLY THE CHEAPEST BROKERAGE IN TOWN. IS IT RIGHT FOR YOU?

Tiger Brokers is currently offering a promotion where you will be entitled to stock voucher rewards up to S$100 simply by opening an account with them and funding it.

If you think that Tiger Brokers might be a suitable online brokerage for you, simply:

Register for Tiger Brokers here and get your rewards today!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- FSMONE SINGAPORE: STEP-BY-STEP GUIDE TO OPEN YOUR FSMONE ACCOUNT AND START TRADING

- BEST STOCK BROKERAGE IN SINGAPORE [UPDATE MAY 2020]

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- FSMONE FEES: THE CHEAPEST REGULAR SAVINGS PLAN (RSP) FOR ETF (2020)

- TOP 5 BEST STOCK MARKET MOVIES AND HOW TO WATCH THEM FREE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.