Dividend Growth Stocks

I came across this interesting US Dividend Stock Watchlist that was compiled by Tom Stevenson who had a Dividend Growth Investing Facebook Group and I thought I customize it and share it with readers of NAOF.

The idea is to find the “Best” Dividend Growth Stocks based on 3 criteria:

- Fidelity Equity Summary Score (Quality Score)

- Dividend Safety Score by Simply Safe Dividends (Quality Score)

- Value Score by Morningstar (Value Score)

The “Quality Score” is calculated by using Fidelity’s “Equity Summary Score” x 10 to put it on a scale of 1-100, adding that to the “Dividend Safety Score” at Simply Safe Dividends, and dividing the sum by 2 to get an average, which is the Quality Score.

The “Value Score” is based on Morningstar’s “Fair Value Estimate” as of the document date. It is calculated as a percentage of the Price. If the fair value estimate is 25% higher than the price, it will show as 125% for the Value Score. Conversely, If the price is 25% below the fair value estimate, it will show as a 75% Value Score. The higher the score, the more undervalued the current stock price is and therefore the better value, according to Morningstar’s FV estimate.

The “Total Score” is calculated by multiplying the Value Score times the Quality Score. A stock with a 125% Value Score will get 125% of its Quality Score points in the Total Score. A stock with a 75% Value Score will have its Quality Score reduced by 25% in the Total Score.

The Total Score, therefore, gives equal weight to three things Tom looks at when deciding whether to do more research on a stock: Analyst buy/sell/hold recommendations as shown in the Fidelity Equity Summary Score, the safety of the dividend as calculated by Simply Safe Dividends, and its current value (cheap or expensive) based on Morningstar’s opinion of fair value. These data sources were chosen to give a consistent standard expressed in one number for each of the factors.

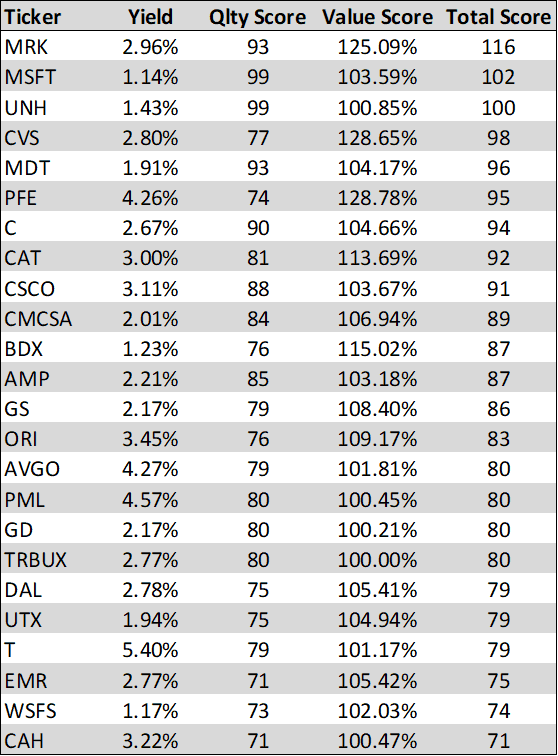

I customized it by further filtration, including only stocks with 1) at least 70 points in its Total Score, 2) a Quality Score that is 70 or higher and 3) a Value Score that is greater than 100%.

Essentially, I am only focusing on the best dividend growth stocks (greatest analyst Buy calls and high dividend safety) with the potential for more price upside, according to Morningstar fair value criteria.

Nothing here should be taken as an investment recommendation. Always perform your own due diligence and create an investment strategy based on your risk tolerance, age, time horizon, ability to research, total wealth accumulation, budget, other income sources, etc.

NAOF-Customized dividend growth stock list

With that, here is the final list of US dividend growth stocks that met these rather stringent criteria:

I see some familiar names in the list, of particular interest, is CMCSA, the ticker for Comcast. We have written about this stock previously as one of only a handful of 5 recession-proof stocks that demonstrated 14 years of consecutive earnings growth.

MRK

The stock with the highest Total Score in this list is Merck & Co (MRK), one of the largest pharmaceutical companies in the world. The counter spots a decent yield of close to 3%, scoring well in the Quality Score, with Morningstar’s Fair Value of the counter at least 25% higher than where the stock is currently trading at.

The company announced on Feb. 5 this year that it will be spinning off its women’s health business along with legacy brands and biosimilars into a new company as it attempts to focus on “key growth pillars:” oncology, vaccines, animal health, and hospital.

The company is heavily dependent on its key drug, Keytruda, which treats multiple cancers, and which made up more than $11 billion in revenue all on its own in 2019, up 55% year over year.

In some ways, MRK can be seen as a recession-proof counter, with patients needing their drugs and treatment regardless of the state of the current economy. While pharmaceutical companies stock prices have lagged the S&P500 index over the past 5 years, they tend to be outperformers over a long horizon.

XPH, the SPDR S&P Pharmaceuticals ETF, generated a CAGR of 9.8% vs. SPY (the ETF that tracks S&P500 index) 8.7% since Year 2000.

MRK stock is down roughly 10% YTD, with the sharp fall in its price due to a “fair” 4Q19 results that was accompanied by its spinoff announcement that will likely hurt its short term earnings performance.

While I don’t follow MRK close enough to be confident of making a direct investment in the counter at the moment, I can incorporate a Put Option Selling Strategy to generate some income while I investigate the counter further.

A Put Option Selling strategy is rather attractive at the moment for MRK, given that the stock is at a strong support level of US$80/share. Such a strategy could generate a cash-secured annualized return of 15% over a 40 -days horizon, with the entry cost at US$80/share.

Conclusion

Dividend Growth stocks have shown to be strong outperformers over a long horizon. I have written about their performance in this article: 7 Golden Rules of Dividend Investing.

This article presents some of the “best” dividend growth stocks, from 1) bullish market consensus, 2) dividend stability and 3) cheapness.

There are quite a number of healthcare stocks in this list, of particular interest is MRK which sits atop the list. A strategy that I often embark to generate income while I investigate the counter further to see if they warrant a serious investment is to execute an Option Selling Strategy.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- SEMBCORP MARINE 4Q19 LOSSES EXCEEDED EXPECTATIONS. WHAT YOU SHOULD KNOW

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.