Singapore Growth Stocks

In the last article, I highlighted 5 Singapore growth stocks that the street believes will see earnings growth continuing in 2020 despite the current COVID-19 health pandemic that will undoubtedly result in many more business closures in the months ahead.

Out of the 5 stocks, we have 3 from the tech sector, 1 from the industrial sector, and 1 from the healthcare sector.

Do check out the article: Top 10 Singapore Growth Stocks for 2020 [Part 1] if you have not already done so.

I will be following up with the next 5 Singapore Growth Stocks in this article. These 5 stocks are expected to generate YoY earnings growth of between 29% and 86% in 2020. Surprisingly, there is only 1 tech-related company on this list. So stay tuned for it.

Without further ado, let’s take a closer look at these Singapore growth stocks and determine if they are worthy of an investment.

Singapore Growth Stocks #5: iFast Corporation

iFast corporation sits at number 5 in this list with the street expecting 2020 EPS growth to be 29%. The company is a leading wealth management fintech platform, with assets under administration of approximately S$9.54 billion as of 31 March 2020.

Incorporated in the year 2000 in Singapore, iFAST Corp provides a comprehensive range of investment products and services to financial advisory firms, financial institutions, banks, multinational companies, as well as retail and high net worth investors in Asia.

The Group offers access to over 10,000 investment products including unit trusts, bonds, and Singapore Government Securities, stocks and exchange-traded funds, and insurance products; while services offered include online discretionary portfolio management services, research, and investment seminars, IT solutions, and investment administration and transaction services. The company is also present in Hong Kong, Malaysia, China, and India.

For those who are not aware, iFast Corporation is the parent company behind Fundsupermart and FSMOne. These are online platforms that allow a DIY investor to trade/invest in both bonds and stocks without the need for an intermediary broker.

![Top 10 Singapore Growth Stocks for 2020 [Part 2] 1](https://newacademyoffinance.com/wp-content/uploads/2020/11/FSMOne.jpg)

FSMOne

The cheapest Regular Savings Plan account in Singapore. This is the account I use to engage in recurring investment through Dollar Cost Averaging approach into low-cost ETFs.

FSMOne is the ideal brokerage for new investors looking to DCA every month into their investing account

I have identified FSMOne as one of the cheapest online brokerage firms that you can use to purchase your stocks/ETFs, either on a lump sum basis or on an RSP basis.

For more information on commission costs in Singapore, do refer to the following articles:

Best Brokerage in Singapore [Update May 2020]

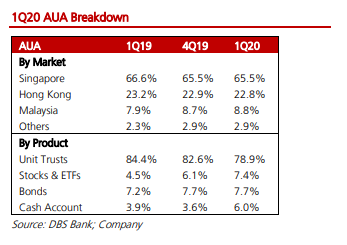

DBS is the only brokerage that is actively covering iFast Corporation. Following a rather dismal 2019 performance where the company’s net profit declined from S$10.7m to S$9.3m, DBS expects earnings to rebound rather strongly to S$12m in 2020, both from a combination of moderation in operating expense increment as well as higher Assets under Administration (AUA).

The company achieved a record-high net profit of S$3.64m in 1Q20 despite a major sell-off in financial markets during the quarter. In the medium to long term, DBS expects the COVID-19 crisis to lead to an acceleration in the pace of digitalization of financial services and the pace of adoption of Fintech services by consumers.

In terms of AUA, the Group regained back the S$10bn AUA level as at 22 April, last seen during the end-2019. The larger the AUA, the higher will be its recurring revenue. DBS expects its AUA to grow by 8%/annum for 2020 and 2021.

The company generates the bulk of its revenue from recurring fees derived from its AUA, mainly trailer fees which funds pay iFast for having their products being marketed on the iFast site. At present (1Q20), recurring revenue represents approximately 75% of iFast total revenue, a slight decline from the historical level of about 80%.

This is likely due to some weakness in 1Q20 as AUA decline from the COVID-19 situation. Nonetheless, non-recurring revenue has shown strong growth and should significantly outperform in 2020. Non-recurring revenue covers transaction fees from various products, forex conversion fees, and insurance commission.

![Top 10 Singapore Growth Stocks for 2020 [Part 2] 2](https://newacademyoffinance.com/wp-content/uploads/2020/06/Singapore-Growth-Stocks-ifast-financials.png)

With a substantial amount of recurring revenue that has not declined since the GFC period, I believe that iFast can continue to grow its earnings in 2020 and beyond, as investors increasingly transition towards their low-cost platform.

However, as a user of their FSMOne platform, I feel that it is not entirely intuitive to use and they lack various products such as a good stock screener that will make their platform an All-in-one powerhouse.

This is why the company continues to invest in its R&D to improve the user experience of its various platforms.

Lastly, its foray into China has not yielded results yet. A successful penetration hitting economies of scale could see a huge jump in the company’s profitability ahead (China is currently loss-making).

Singapore Growth Stocks #4: Sheng Siong

This is a company that needs no introduction. Sheng Siong currently sits at number 4 in this list with an expected 2020 EPS growth rate of 31%, according to the street.

The company operates supermarket retail stores in Singapore. Sheng Siong’s stores offer an assortment of live, fresh, and chilled produce, such as seafood, meat, and vegetables; and packaged, processed, frozen, and/or preserved food products, as well as general merchandise, including toiletries and essential household products.

It is also involved in general trading, and wholesale import and export businesses. Also, the company operates allforyou.sg, an online shopping platform for groceries. It operates 64 stores in Singapore; and two stores in Kunming, China under the Sheng Siong brand name.

I have written about Sheng Siong on numerous occasions. The company has been a huge beneficiary of the COVID-19 pandemic where Singaporeans only pastime during the “Circuit Breaker” is to go grocery shopping at Sheng Siong.

I have highlighted previously in this article: Top 5 Singapore Stocks to Buy amid COVID-19 uncertainty that Sheng Siong is one of the most defensive plays on the Singapore bourse.

The company will likely see a strong operational performance in 2Q20, benefitting from the full effect of the CB lockdown.

The stock is well covered by 9 analysts in the street with the majority having a buy call on the stock. RHB is the most bullish in the street with a TP of S$1.72, indicating a potential upside of 10% from the current level.

The street has undoubtedly rushed to upgrade their earnings forecast for Sheng Siong as a result of the COVID-19 driven sales increment. However, the bigger question that one should be asking is whether such sales and earnings are sustainable as we exit from the lockdowns and return to normal life.

I will be extremely surprised to see snaking queues at their stores once we fully exit from the lockdown. This will imply that while we are going to see the company generating supernormal profits in 2020, there will likely be a significant decline in EPS come 2021.

Currently, the street is estimating earnings growth of c.30% in 2020. That will mean earnings increasing from S$76m in 2019 to S$99m in 2020. Assuming the company has a normalized earnings growth of S$6-7m/annum, we should see 2021 earnings normalizing to c.S$90m in 2021.

![Top 10 Singapore Growth Stocks for 2020 [Part 2] 3](https://newacademyoffinance.com/wp-content/uploads/2020/06/Singapore-Growth-Stocks-Sheng-Siong-PER-1.png)

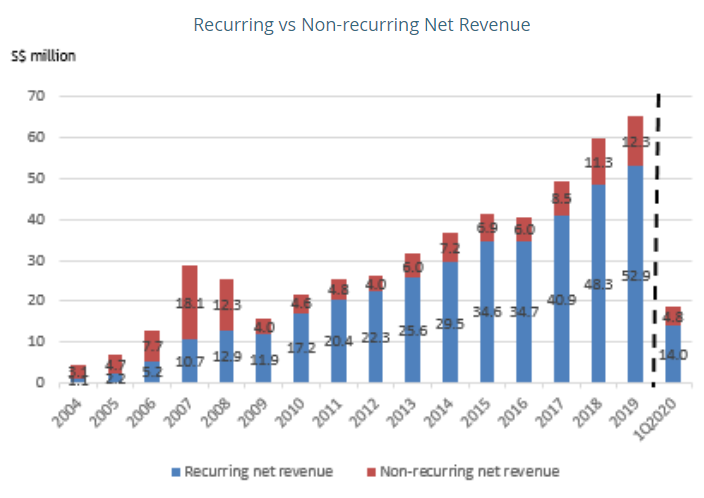

With a current market cap of S$2.36bn, the company is trading at a forward 2021 PER multiple of 26x which is above its 5 years average PER multiple ranges of 21x. Assuming again that the market now rewards Sheng Siong with a higher valuation multiple of 24x, a longer-term fair value for the stock could potentially be at S$1.45.

Sheng Siong is undoubtedly one of the best-run supermarket company in Singapore. However, I don’t think it is reasonable to expect 2021 earnings to be similar or better than 2020 (which DBS believes to be the case) unless we are permanently in a “semi-lockdown” scenario where the only pastime as I mention is to go grocery shopping.

While the company has grown its Singapore operations steadily through the years, it has yet to demonstrate that it can expand profitably in China which remains a huge but highly competitive market.

Singapore Growth Stocks #3: Bumitama Agri

Bumitama Agri, a palm oil player, sits at no. 3 in this list with an expected 2020 earnings growth of 36%. The company produces and trades in crude palm oil (CPO), palm kernel (PK), and related products for refineries in Indonesia. Bumitama Agri operates through two segments; Plantations and Palm Oil Mills and Downstream Biodiesel Refinery.

It is involved in the cultivation and maintenance of oil palm plantations and operation of palm oil mills; and processing biodiesel plant and sells biodiesel products from the refinery. The company also engages in harvesting and processing fresh palm fruit bunches (FFB) into CPO and PK, and business and management consultancy services.

It manages a total land area of approximately 187,567 hectares in Central Kalimantan, West Kalimantan, and Riau provinces.

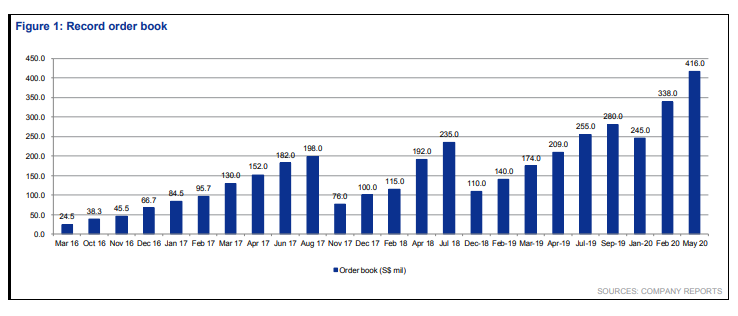

The stock is covered by 5 analysts (AmBank, DBS, Maybank, RHB, and UOB) where views are mixed, with Maybank being the most bullish on the counter. The brokerage house expects core EPS growth to increase by 66% YoY to hit IDR915bn in 2020.

DBS on the other hand is not that positive, with a forecasted net profit of IDR730bn or a 6% YoY growth rate.

The key thesis for growth remains higher CPO prices and FFB growth according to Maybank and DBS.

In terms of valuation, the counter is also cheap, trading at a forward PER of close to -2SD

While palm oil players are extremely cyclical plays and we cannot be sure if CPO prices will remain strong in 2021 to support earnings growth, the counter’s low valuation does provide a certain level of margin of safety in today’s context.

The chart above shows the price performance between Bumitama Agri and First Resources over a 2-years horizon. Notice that they to trend very much in line but there has been a price disparity of late where the price increment of First Resources is much stronger than that of Bumitama Agri.

A hedging strategy could be to go long Bumitama and short First Resources on the assumption that the price gap will narrow.

Singapore Growth Stocks #2: AEM Holdings

AEM Holdings, an extremely popular tech counter, sits at number 2 in the list with an expected 2020 earnings growth of 56%. AEM Holdings provides intelligent system testing and handling solutions for semiconductor and electronics companies Asia, North America, Europe, the Middle East, and Central America.

It operates through Equipment Systems Solutions, System Level Test & Inspection, Micro-Electro-Mechanical Systems, and Test and Measurement Solutions segments. The company offers handling and test equipment; engineering and design services; field support services; and supplies, consumables, maintenance services, upgrade kits, and upgrade engineering for handlers.

It also provides automatic measurement and test solutions for communications; and specialized wafer probers that enable the testing for sensors and semiconductors for the automotive, industrial, and consumer sectors.

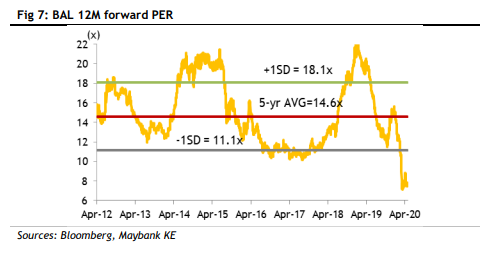

AEM has seen its share price appreciating from a March low of S$1.30+ to the current level of S$3.09, more than double its share price. This came at the back of a strong set of 1Q20 performance where the company raised its FY2020 revenue guidance to S$430-445m from S$360-380m given back in February.

The order book is now at a record high and should continue to trend higher for the coming 2 quarters, based on the historical trend. A decline in its order backlog in the next update will be seen as a negative surprise.

The key issue I see with AEM is that it remains highly dependant on Intel (key customer) which is essentially almost 100% of its revenue. The outlook for intel remains decent at present and the company continues to increase its capital expenditure spending target for 2020 at US$17bn, up from 2019 reported CAPEX of US$16.2bn. This should continue to bode well for AEM.

There is a possibility that AEM can continue to grow its earnings. However, the cyclical nature of the semiconductor industry and the high concentration risk is something that one should be mindful of when chasing a high momentum stock like AEM.

![Top 10 Singapore Growth Stocks for 2020 [Part 2] 6](https://newacademyoffinance.com/wp-content/uploads/2020/11/tiger-brokers-3.jpg)

Tiger Brokers

With ZERO min/0.08% variable commission charges, Tiger Brokers is the cheapest brokerage account to purchase your SG stocks.

Use their mobile platform to find the hottest trending stocks in SG, HK, China and US.

Singapore Growth Stocks #1: Riverstone Holdings

Riverstone holdings sit at number 1 in the list with an expected earnings growth of 63%. The company manufactures and distributes cleanroom and healthcare gloves in Malaysia. Riverstone offers cleanroom finger cots, static shielding, and packaging bags, face masks, and wipers; and other consumables, such as hairnets, antistatic gloves, conductive latex finger cots, static dissipative shoes, safety booties, shoe covers, cleanroom coveralls, ESD rubber bands, sticky mats and rollers, swab-polyester and microfibers, and cleanroom papers.

It also provides healthcare products, including blue, white, black, and accelerator free nitrile exam gloves. Besides, the company trades in latex products; and distributes cleanroom products. It sells its products under the RS brand for use in the hard disk drive, semiconductor, and healthcare industries. The company also exports its products to Asia, Europe, and the Americas.

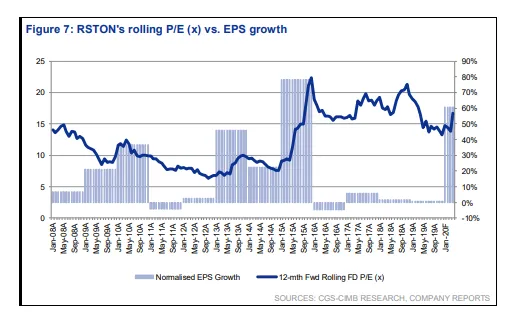

I recently wrote about Riverstone in this article: Riverstone. Can the share Outperformance continue?

In that article, I shared that Riverstone will be a key beneficiary of COVID-19 and a strong catalyst will an improvement in its gross profit margin, driven by ASP increment in its healthcare glove products while concurrently benefitting from a low-cost environment due to the reduction in oil prices.

I forecast that its GPM level could hit 29% in 2020 which is a huge improvement from the 20% seen in 2019 and that will propel its earnings up to RM253m which is almost double the 2019 level of RM130m.

Assuming a re-rating of its multiples to 22x, that will imply a fair value of S$2.44/share for Riverstone. The counter traded to as high as S$2.46 in recent days and has currently retreated to the S$2.20 level.

However, note that Riverstone is operating in a rather commoditized environment wherein normal times, the company will have to pass through the bulk of its cost savings to customers. It is only in the current extraordinary times where due to a huge supply-demand mismatch can the company command such strong margins, similar to the period back in 2015.

However, note that since 2015, gross margins have been progressively trending lower.

At the current price level, despite its strong earnings growth potential, I sense that the counter might already have been fairly valued and it will be prudent not to chase the stock.

I will be waiting for a pullback for entry into the counter. Despite its commoditized nature, management has done a good job running the company in my view and there remain structural tailwinds for this industry which should continue to see product demand improving.

UOB has recently upgraded Riverstone’s 2020 earnings forecast to RM250m as well as expecting earnings growth to continue in 2021-22. That will largely depend if the demand-supply metric can continue to skew in favor of glove manufacturers that will result in higher product gross margins, in my view.

Conclusion

In this article, we showcase the Top 5 Singapore growth stocks based on a 1-year forward earnings growth estimate by the street. Many of these counters such as Riverstone (Rank 1), AEM (Rank 2), and Sheng Siong (Rank 4) has seen significant price appreciation since the March sell-off.

I will be hesitant to chase these stocks at the current level and will look for pullbacks for a better entry point. iFast looks like a decent company to ride the trend of digitalization and the increased usage of low-cost online platforms which mainly appeal to price-savvy millennials who wish to engage in DIY investing.

In Part 1 of this article, I have also showcased 5 Singapore growth stocks which are 1) Tianjin Zhongxin pharmaceutical, 2) Fu Yu Corporation, 3) Avi-Tech, 4) Penguin International and 5) UMS Holdings.

Top 10 Singapore Growth Stocks for 2020 [Part 1]

Combined, these are the Top 10 Singapore growth stocks which the street is still relatively positive on their 1-year forward earnings outlook.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- VALUE INVESTING IN SINGAPORE: 10 SG VALUE STOCKS THAT MIGHT MAKE SENSE

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

- 10 SINGAPORE BLUE-CHIP STOCKS YIELDING MORE THAN 5% (2020)

- BEST STOCK BROKERAGE IN SINGAPORE [UPDATE MAY 2020]

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

![Top 10 Singapore Growth Stocks for 2020 [Part 2] 4](https://newacademyoffinance.com/wp-content/uploads/2020/06/Singapore-Growth-Stocks-bumitama-CPO-price.png)

![Top 10 Singapore Growth Stocks for 2020 [Part 2] 5](https://newacademyoffinance.com/wp-content/uploads/2020/06/Singapore-Growth-Stocks-bumitama-FFO-growth.png)

1 thought on “Top 10 Singapore Growth Stocks for 2020 [Part 2]”