FSMOne Singapore: Cheap but is it suitable for you?

While FSMOne Singapore is one of the cheapest online brokerage platforms out there for Singapore retail investors, the FSMOne platform usage is not exactly intuitive, particularly when it comes to funding your account for regular savings plan (RSP) into ETFs, which I feel is one of the platform key selling points.

I will break down the step-by-step manner to get you started and funded on the FSMOne Singapore platform. Throughout the article, I will also provide links of FSMOne review which I have previously written, particularly on items such as their commission costs and their RSP offerings.

However, before I embark on that, let’s take a quick minute or two to decide if using the FSMOne Singapore brokerage platform or DIY investing, in general, is suitable for you.

When should you start investing?

Some of you might be wondering if now is a good time to start your investing journey? Well many would say that the “best time to invest was YESTERDAY, the second-best time to invest is TODAY and the worst time to invest is TOMORROW”.

As cliché as it sounds, I would say that the best time to invest is when you are ready. Here are some questions to ask yourself to decide if you are ready to invest:

- Have you understood the basic concepts of investing and why you need or should be investing?

- Do you have enough savings and emergency fund to last you for at least 3 months in case you experience a financial dilemma?

- All investments come with a certain level of risk. Are you willing to take some risk?

- Lastly, have you thought of DIYing your investments or would prefer to leave the investment decision to a Robo advisor?

Some new investors might have no clue how to get started on investing. Besides having the capital to do so, what else do you need?

Step 1: Decide if you wish to partake in DIY investing or Robo Investing

The very first step a new investor should be asking is whether you are capable to make your stock purchases or should you leave that decision to a Robo advisor?

DIY investing is generally a cheaper way to invest, as you save on the platform costs (typically around 0.6-1.0%/annum) that you would have to pay when using a Robo advisor.

However, a Robo-advisor is seen as an All-in-one platform. Once you set up your Robo-advisor account (the online setup process is typically very fast), you can just “leave and forget” about it. You don’t have to worry about what brokerage to choose, what stocks to choose etc. Just leave it to the Robo advisors to decide (base on your risk preference).

If you decide to go with Robo investing, then this article might not be suitable for you. Instead refer to my Ultimate Robo Advisors Guide which is a pretty comprehensive guide, detailing all the Robo-advisors in Singapore and their investment methodology.

However, if you decide that DIY investing is for you, then move on to Step 2.

Step 2: Decide what kind of brokerage account you will like to have

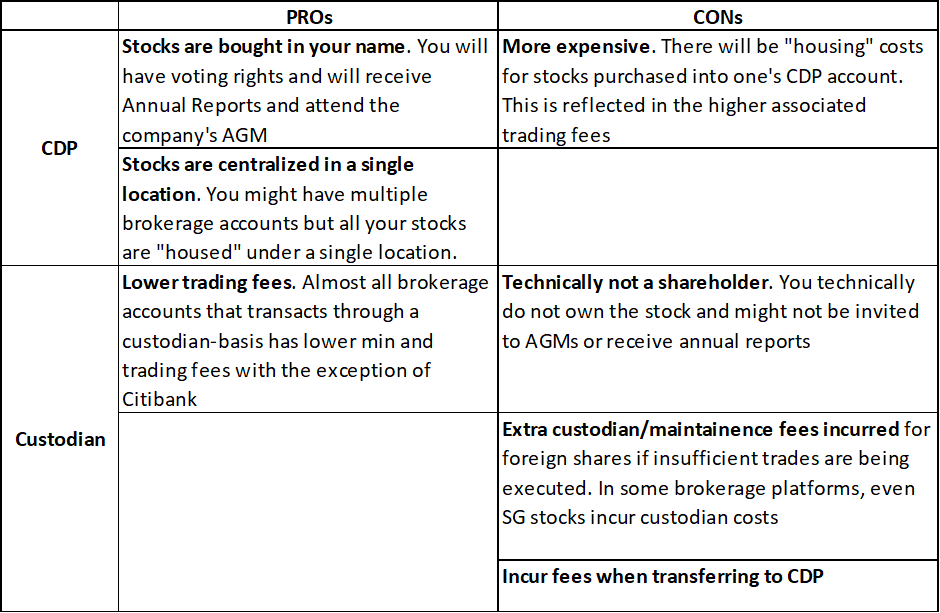

For all DIY investors, you will need to have a brokerage account. Here you need to decide if you would like to have a CDP account or custodian account.

CDP VS. CUSTODIAN ACCOUNTS

A CDP securities account is one where all the stocks you have purchased are “stored”. You can be using DBS Vickers to buy Stock A and Maybank Kim Eng to buy Stock B. Ultimately, these stocks will be deposited in a single location which is your CDP account.

Stocks you purchased and subsequently deposited in your CDP account outright belong to you and there will not be any legality issue.

Stocks you purchased and deposited in a custodial account (for example, a pre-funded account such as FSMOne Singapore) belong under the name of the brokerage firm. You are technically not a shareholder and in the “extremely unlikely” event that the brokerage firm goes belly-up, you might have trouble claiming ownership of the shares you purchase. Most brokerage houses however assure their clients that custodian accounts are kept separate from the house account and will not be affected should the company goes into insolvency or liquidation.

If you decide that CDP account is your preferred choice, then you will probably need to approach your traditional brokerage house likes DBS Vickers, Maybank Kim Eng, UOB Kay Hian, etc. (Note that these brokerage accounts can assist you to open your CDP account, so you do not have to go down personally to CDP to do that). Hence again, this article might not be suitable for you as FSMOne is a custodian account.

Again I have written a Stock Brokerage Guide in Singapore which one might like to refer to when deciding which Stock Brokerage to use to reduce commission costs as well as detailing a strategy to purchase foreign stocks using key brokerages for a Singaporean Investor.

However, if you decide that a custodian account is a better fit as you don’t mind not having the “benefits” of using a CDP account and will prefer to focus on lowering your commission costs, then proceed to Step 3.

(Note that for a custodian account and pre-funded accounts, you need to have cash in your account before you can purchase the stocks. This is unlike margin accounts that are offered by traditional brokerage houses like DBS Vickers etc where you can make your stock purchases first and fund the amount later).

Step 3: Deciding on a custodian brokerage to open (FSMOne Singapore)

Since this article is about FSMOne Singapore, the focus will be centered on using this low-cost online brokerage account.

Two key benefits of using the FSMOne Singapore account is that the platform is a 1) low-cost online platform and 2) provides a means to dollar cost average into ETFs.

Do again refer to Stock Brokerage Guide in Singapore where I review the commission costs of FSMOne and the other brokerage companies (traditional and online) here in Singapore.

For a new investor, a disciplined dollar-cost-average approach might be a good way to start your investing journey. In this sense, FSMone Singapore is one of the best and cheapest platforms to engage in dollar-cost averaging through a Regular Savings Plan into ETFs.

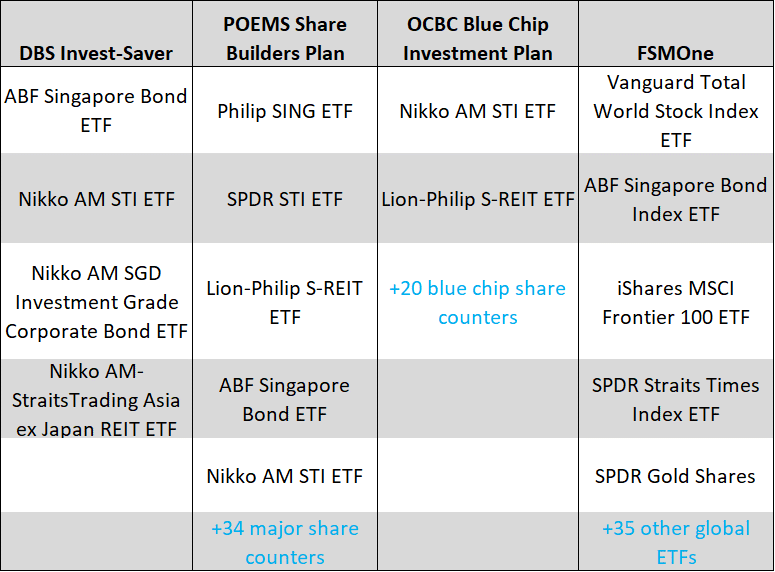

Compared to other brokerage platforms such as DBS Invest-Saver, POEMS Share Builders Plan, and OCBC Blue Chip Investment Plan, FSMOne Singapore provides the greatest variety of available low-cost ETFs to invest into.

I have written a review about why FSMOne Singapore is the cheapest brokerage account for a dollar-cost average approach into ETFs.

The downside is that the FSMOne platform is only limited to 3 markets: SG, HK, and the US. If that is not a major consideration, then do consider opening an FSMOne Singapore account.

So how do you open an FSMOne Singapore account and start investing immediately?

Step 3b: Opening an FSMOne Singapore account through MyInfo

The account opening process is now made quite seamless using MyInfo which is for Singaporeans and PRs with SingPass login access. The account opening form will be filled with your personal data from MyInfo automatically, making your application process fast and convenient.

You will be eligible for instant account approval if all your details are declared accurately and completed by MyInfo. You can theoretically start investing within minutes once your account is completed using MyInfo.

Step 4: Setting up your cash account in FSMOne Singapore.

Once you have successfully opened an account with FSMOne Singapore, the next step will be to fund your SGD Cash account. You can fund your FSMOne Singapore cash account through various means such as FAST Transfer, PayNow, Internet Bill Payment, Cheque, Telegraphic Transfer (for USD, and other foreign currencies) and Bank Drafts.

For most of us to fund a one-time payment, the easiest would be to use either a FAST transfer or PayNow. You can refer to this FSMOne Singapore site for a detailed step by step approach to fund your account. Do remember to state your FSMOne Singapore account number when you process the fund transfer from your bank.

With your SGD cash account funded, you can immediately get started on purchasing SGD-denominated stocks by clicking the Live Trading tab.

However, what if you wish to purchase HK or US-denominated stocks? You will need to do a currency conversion.

Step 5: Convert your SGD into HKD/USD to make stock purchases denominated in HKD or USD

Head over to the Cash Solutions tab and click on foreign currency exchange. Over there you will be given the different conversion rates. The spread is generally about 0.5%.

Convert your SGD to USD/HKD. You will essentially have created a separate USD or HKD Cash account which you can then use to purchase your USD/HKD denominated stocks.

If you wish to park your cash in other currencies such as AUD, EUR, CHF, GBP, etc, you can also do so using this site. However, the rates might not be competitive.

Step 5b: Cash park in Auto Sweep account

Alternatively, if you think its too much of a hassle to always convert your SGD cash manually into USD or HKD to buy stocks denominated in those currencies, you can choose to park your SGD cash into your FSMOne’s Auto Sweep account.

This is a cash management account that FSMOne Singapore manages on a discretionary basis. The account invests in various money market funds and cash to provide investors seamless liquidity and higher yield at the same time.

According to FSMOne as of 2 June 2020, the latest net yield is 1.066%. Not very attractive but at least the platform is very transparent in disclosing the latest yield figure which I appreciate.

You can choose to opt into the auto sweep account where FSMOne will automatically transfer and sweep all your excess cash such as sales proceeds, bonds maturities, dividends, coupons into this account vs. your standard SGD/USD/HKD Cash account where the interest is almost negligible. The likelihood of you losing money in a money market fund is extremely low as the fund is mostly vested in high-quality SG government bonds.

Funds in your Auto Sweep account can be used to directly purchase stocks denominated in any currencies, so there is no hassle of having to convert every time you wish to purchase a foreign-currency stock.

So you can repeat Step 4 and 5 every time you wish to fund your account and purchase a stock.

Do note that if you wish to purchase US Stocks, there is a W-8BEN form that you need to complete which is standard across all brokerage houses in Singapore.

Step 6: Making recurring (RSP) ETF purchases

Recall earlier that one of the key benefits of FSMOne Singapore which I stated was the option of purchasing low-cost ETFs through a regular savings plan (RSP) approach.

This is ideal for a new investor who does not have much capital, to begin with. Essentially you can commit just SGD$50/month to start an RSP plan with FSMOne Singapore to invest in these low-cost ETFs.

Head over to My Account and click on Regular Savings Plan and then click on Apply RSP for Exchange Traded Funds.

You can then select which ETFs you will like to invest in from the list of 38 ETFs that are available on the FSMOne platform. Some of the more popular ones are SPDR Straits Times Index ETF, iShares Core S&P500 ETF, etc. Again, if you are purchasing US-based ETFs, you will need to have completed the W-8BEN form (Do also note that US-domiciled stocks/ETFs incur 30% dividend withholding taxes and estate taxes)

Click on Add RSP and you can add the recurring amount you wish to purchase each month.

You would be brought to the checkout page where you will have the option of applying for a recurring cash top-up. You can click on that and put in a figure you wish to transfer from your specific bank account to your FSMOne specific cash account (SGD/HKD/USD etc) every month. However, you will still need to send in a DDA form which I will explain in the next step.

You can then stroll down to the end, enter your password, and submit the order. Click onto the “My Account” tab and Regular Savings Plan and you can see your active ETFs and various cash accounts.

Step 7: Funding your recurring FSMOne Singapore RSP ETF purchases

This is where things can get a little more complicated.

There are essentially two ways to fund your recurring monthly FSMOne Singapore RSP ETFs.

First Method

You can choose to download the DDA form as seen in the figure above right at the end. Sign the copy for each cash account and mail it back to FSMOne Singapore. This DDA aka GIRO form gives FSMOne Singapore the authority to deduct x amount of money each month to credit into your respective cash accounts.

Upon receipt and confirmation of the DDA on the part of FSMOne Singapore (the whole process could take approx. 2 months for approval from both sides), they will purchase the ETFs for you on the 8th of every month. For SGD-denominated ETF, it is straight-forward.

For USD or HKD-denominated ETF, FSMOne Singapore will automatically convert the SGD funds to your USD or HKD equivalent amount and park them in your respective cash account to purchase your USD/HKD-denominated ETFs.

There will however be a one-month lag for the very first month because the GIRO (using DDA) is done on the 8th of each month which coincides with the purchase of the RSP ETF. This will also mean that there will always be an excess of one-month worth of cash park in your respective cash account at all times.

Do note that as the foreign currencies fluctuate, your stated FIXED monthly amount to transfer in SGD into your HKD/USD Cash accounts might fall short of the required USD or HKD which you stated in Step 6. Hence, it is better to provide an additional buffer. Alternatively, your first-month worth of cash can also act as a buffer. (The amount you state to be transferred from your bank to your FSMOne account is in SGD while the amount you wish to purchase for a foreign currency-denominated ETF is in that foreign currency, hence the potential discrepancy)

Second Method

You can choose to provide a standing instruction with your bank and transfer a fixed amount of SGD into your SGD cash account every month before the 8th. Using this method, if you purchase an HKD/USD ETF on an RSP basis, you will also need to MANUALLY log in every month before the 8th and convert your SGD cash into either USD/HKD foreign currencies which will then be park in the respective cash accounts to purchase USD/HKD denominated ETFs.

That is quite a hassle and defeats the purpose of making your monthly RSP purchases automatic.

Unfortunately, unlike the lump-sum approach, RSP ETF cannot be purchased from the Auto Sweep account and can only be deducted from the respective currencies’ cash accounts.

Potential Solution

Investing in SGD-denominated RSP ETF is simple and immediate as you can just use method 2 and set up a standing instruction with your bank to credit x amount before the 8th of each month into your FSMOne SGD cash account, regularly.

However, investing in a foreign currency-denominated RSP ETF will be more tedious and not immediate. To fully automate the process, you will need to complete the DDA form and wait for approval which will take approx. 2 months. In the first 2 months, you will need to manually transfer SGD funds into your FSMOne SGD cash account and convert them into the respective foreign currencies before the 8th.

Conclusion

FSMOne Singapore is a low-cost online brokerage platform suitable for a DIY investor who wishes to reduce their commission charges when purchasing stocks or ETFs. Note that your FSMOne Singapore account is a custodian account. However, you can still link your existing CDP account with FSMone Singapore as a means to reduce your commission cost when SELLING stocks in your CDP account.

I believe the value proposition of FSMOne Singapore lies in its low-cost RSP ETF which minimizes the commissions paid for new investors starting with a low recurring monthly RSP. One should use FSMOne Singapore to purchase SG-ETFs on a dollar-cost averaging basis.

You can decide to transfer funds using their 1. GIRO (DDA) or 2. Through Bank standing instruction format. Option 2 will be the easier option for SG-denominated ETFs while Option 1 will be the better option if you decide to purchase HK/US-denominated ETFs.

I hope I have presented a clear and thorough guide/review to setting up your FSMOne Singapore account and funding your account for the purchase of stocks both on a lump sum basis or through a recurring RSP basis.

For those who are interested to open an account with FSMOne, I will be grateful if you can use my referral code:P0375988 when signing up for your account which will entitle me to some points.

Once again, all the best in your investing journey.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- FSMONE FEES: THE CHEAPEST REGULAR SAVINGS PLAN (RSP) FOR ETF (2020)

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 2]

- BEST STOCK BROKERAGE IN SINGAPORE [UPDATE MAY 2020]

- STASHAWAY SIMPLE REVIEW + OTHER NO FRILLS CASH SAVINGS [UPDATE MAY 2020]

- ULTIMATE GUIDE TO REITS IN SINGAPORE (2020)

- VENTURE 6% PRICE DECLINE POST-RESULTS; SATS’ 2QFY20 COULD REMAIN WEAK

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.