Concerns about the developing global COVID-19 pandemic have sent the equity market in a tailspin. However, there will always be stocks that are better positioned to ride out the current market volatility.

Here we introduced 4 stocks with more than 80% recurring revenue owned by Gurus

All 4 stocks have outperformed the S&P500 in terms of YTD returns, with the average YTD return for an equal combination of these 4 stocks at -4% compared to the S&P500 YTD returns of -18%

Investment Gurus such as Bill Miller, David Tepper, Stephen Mandel, etc are owners of these stocks.

Without further ado, let’s dive into these 4 stock counters.

High Recurring Revenue Stock #1: ADBE

I am sure that most of you would be familiar with the stock Adobe. But do you know that 90% of their revenue is recurring in nature?

It was not too long ago in 2013 when Adobe had about $200m in annual recurring revenue. In its last fiscal Year 2019, the company generated $10bn in recurring subscription revenue.

So, what did the company learn during their transition phase from selling a product to a service?

According to management, when you sell a product, the journey ends when it reaches into the hands of the customers. You don’t exactly know the challenges your customers might face when using the product and how much value they are getting. You miss the full customer experience because the biggest part and often the most hidden part is their usage.

By moving towards a subscription company, Adobe went from having an arms-length relationship with its customers to a 24/7 interaction.

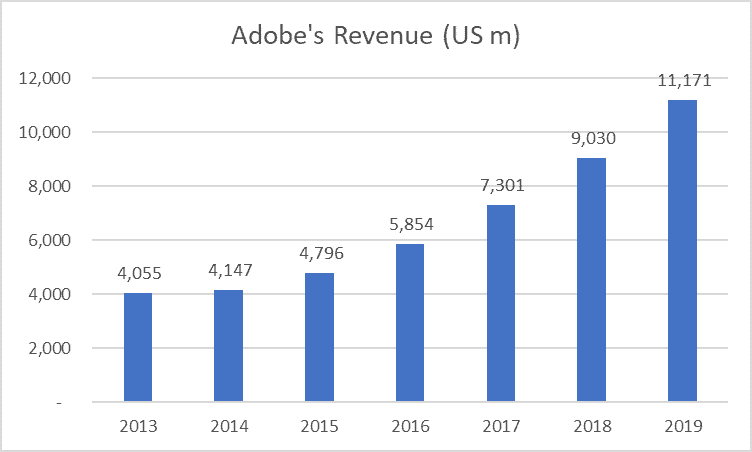

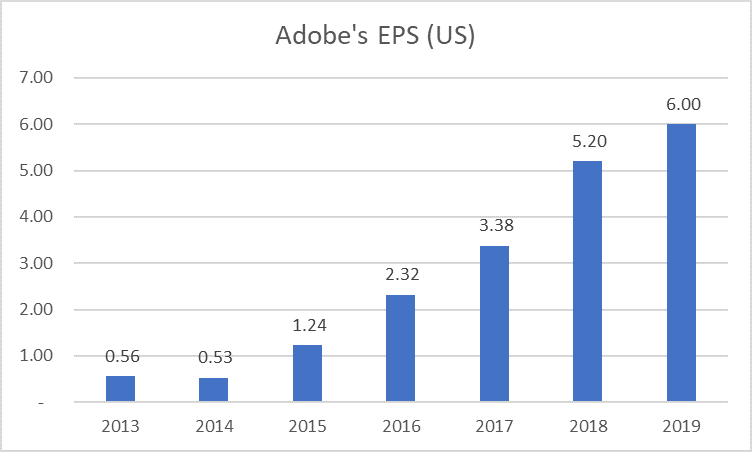

Adobe’s revenue growth has been impressive, growing from $4bn in 2013 to S$11.2bn in 2019, or a CAGR of 18.7%. Its EPS growth has been even more impressive, increasing from $0.53 in 2013 to $6 in 2019, or a CAGR of 50%.

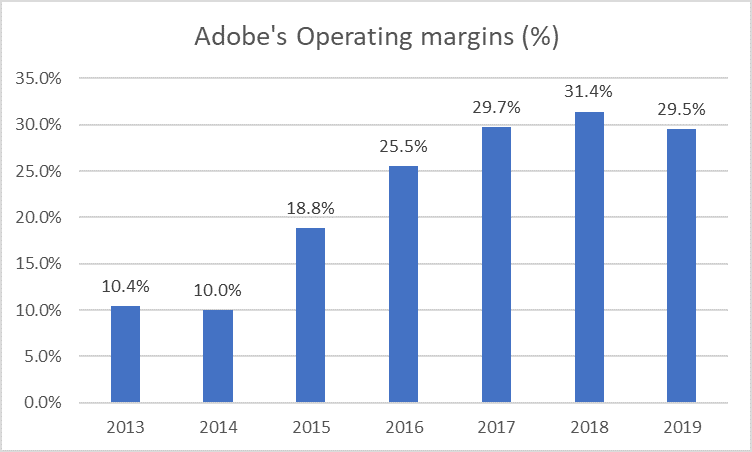

This is mainly due to its transition from a product company to that of a service company, resulting in an elevation of its operating margins.

Don’t get me wrong. Adobe has been a fantastic product company, generating operating margins of approx. 10%. However, when it transitioned into a service company, operating margins ballooned to c.30%.

The potent combination of high teens revenue growth, increasing operating margins, and a consistent share buy-back mandate resulted in the huge jump in the company’s EPS.

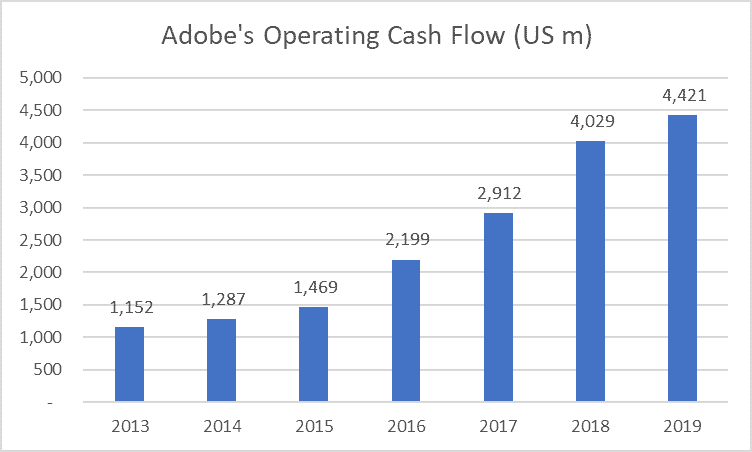

A quick look at its cash flow and balance sheet statement shows that this company is ticking all the right boxes.

Its operating cash flow has been increasing in-line with earnings which is a fantastic sign.

While the company has geared up in 2018, the company’s debt to equity ratio remains comfortably below 0.4x. With close to $4.2bn in cash and short-term investments, Adobe is likely in a neutral net cash position which puts the company in an ideal situation to ride out the current stock market volatility.

All-in-all, a fantastic company to own with a high level of revenue visibility, even in today’s climate of elevated business uncertainty. However, that is assuming you find its elevated PER of 48x palatable.

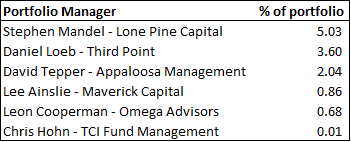

Adobe is owned by 6 investment gurus which include Stephan Mandel from Lone Pine Capital, Daniel Loeb from Third Point and David Tepper from Appaloosa management.

High Recurring Revenue Stock #2: Ecolab

Ecolab is a stock which most are likely not familiar with but owned by Bill & Melinda Gates Foundation Trust.

Ecolab is the global leader in water, hygiene and energy technologies and services that protect people and vital resources. Millions of customers use their products daily to promote safe food, maintain clean environments, optimize water and energy use, and improve operational efficiencies.

During 2019, the company helped customers wash more than 40bn hands, process 42% of the world’s total milk and reduce 1.4bn pounds of greenhouse gas emissions.

With the COVID-19 pandemic issue, I will not be too surprising that Ecolab’s products are even in greater demand, particularly its hygiene, sanitizing and water treatment solution.

The company is well diversified by product, geography, customer and technology and about 90% of its sales are also recurring revenue streams in the form of consumable products such as soaps and detergents, etc.

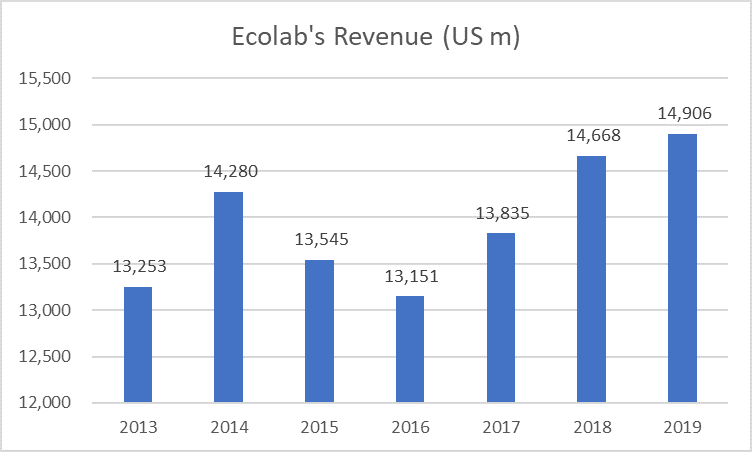

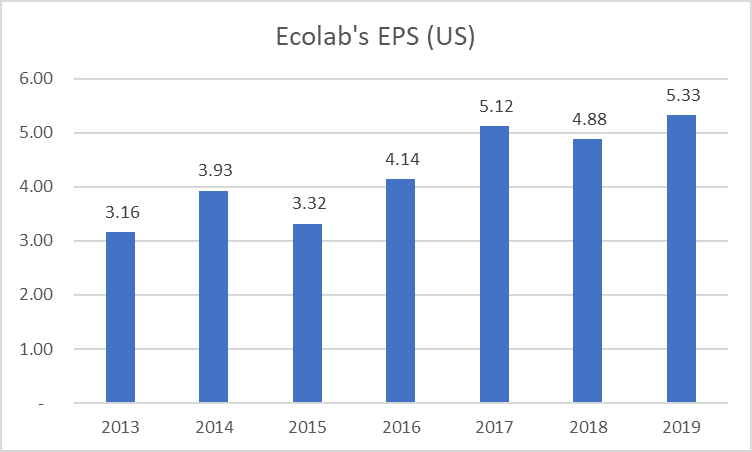

The company’s financials have not been as outstanding as that of Adobe, with revenue rising from $13.2bn in 2013 to 14.9bn in 2019 or a CAGR of just 2%. On an EPS basis, it grew from $3.16 to $5.33 or a CAGR of 9.1%.

With an EPS of $5.33, Ecolab trades at a trailing multiple of 29x vs. Adobe’s multiple of 48x.

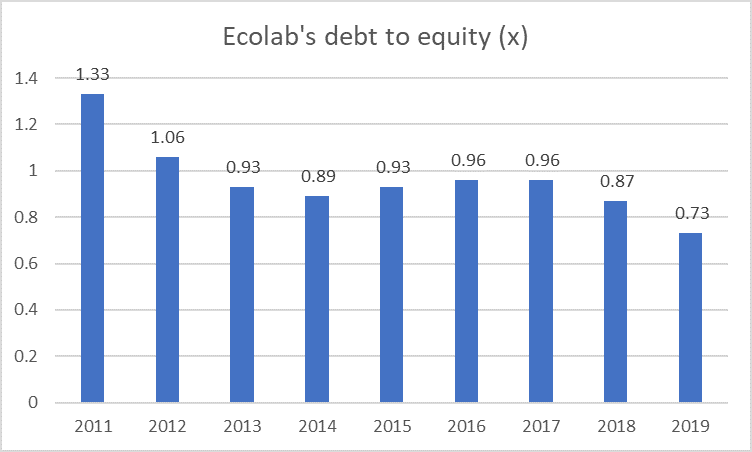

While there is quite a fair amount of long-term debt on its balance sheet amounting to nearly $6bn as of end-2019, this is well supported by consistent operating cash flow generation of about 2.4bn per annum. Debt to equity stood at about 0.7x, a multiple that has been on a downward trend.

In summary, Ecolab appears to be a wonderful business with a sustainable future, potentially even doing well in the current COVID-19 pandemic. Its large recurring revenue base and long-lasting customer relationships will serve the company well for many years to come.

Some of the high-profile investment gurus which own the stock include William Von Mueffling from Cantillon Capital Management and of course, Bill & Melinda Gates Foundation Trust where Ecolab alone consists of close to 4% of the latter’s portfolio AUM.

High Recurring Revenue Stock #3: Netflix

This counter requires no introduction and most of us probably already have a subscription with the company. Netflix is the No. 1 stock in terms of share price performance over the last decade. Climbing at an annualized rate of 45% over the past 10 years, Netflix has returned a whopping 3,726% in total since 2010.

While most stocks have cratered to the tune of approx. 20% YTD, Netflix stock is up 15% YTD, a credible performance but not surprising. This is one stock that the market believes will be a big winner in the current global COVID-19 driven lockdown that has seen half the globe’s population under some form of stay-home mandate.

So what do you do at home besides “pretending” to stay hardworking? Watch streaming programs, right?

I do not doubt that Netflix will be a beneficiary of this current health pandemic with strong growth in international subscribers, despite increasing competition from the likes of Disney+ and Apple TV, etc.

With a revenue model that is almost 100% recurring in nature, Netflix seems like the ideal company to own in one’s portfolio.

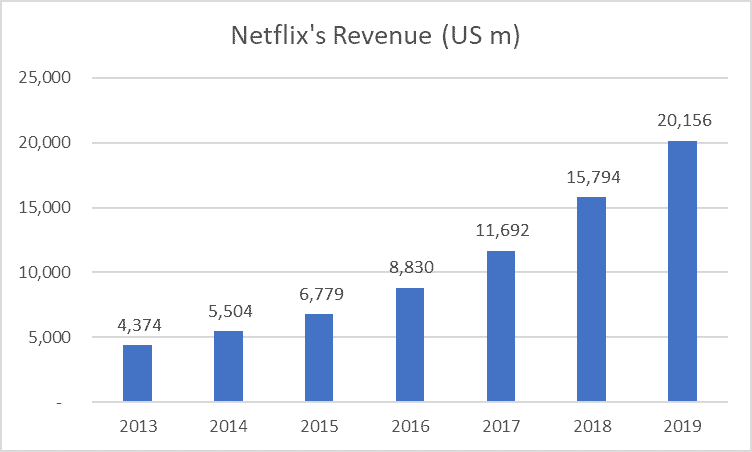

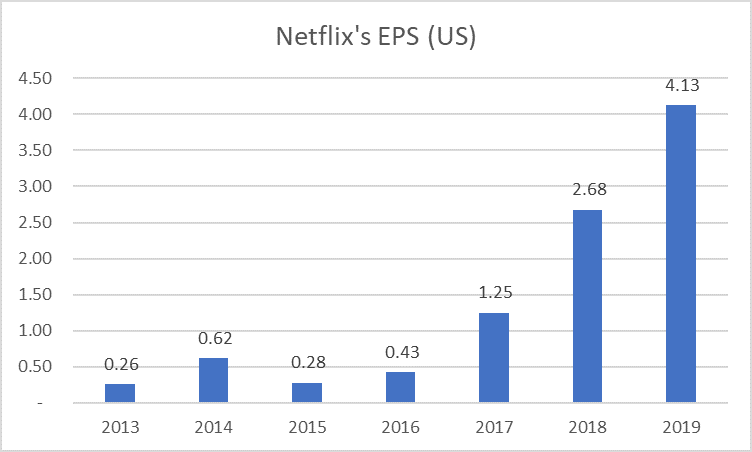

The company grew its revenue from $4bn in 2013 to $20bn in 2019. During this period, EPS grew from $0.26 to $4.13 or a CAGR of 58%. This is an even better performance than Adobe. At an EPS of $4.13, the counter trades at close to 100x trailing PER.

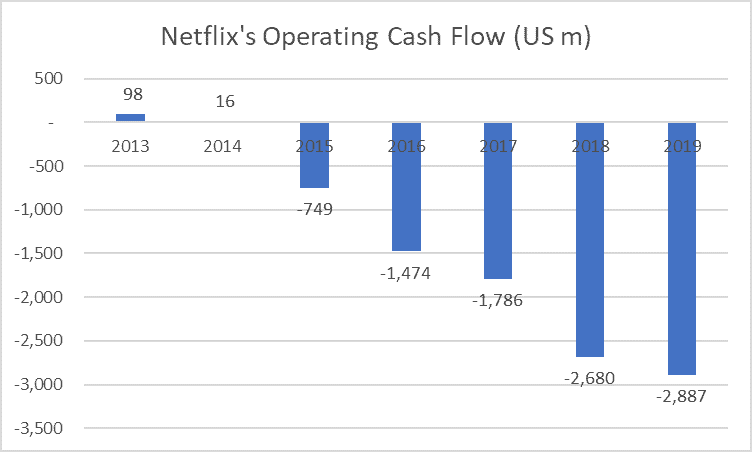

The main grouse for me is that Netflix operating cash flow has been negative these past few years despite a strong rising revenue trend.

This is due to a need to constantly invest in TV and movie production or what is often being termed as Netflix originals to stay ahead of the competition. Such productions are not cheap.

Netflix turns to debt to fund the cash-flow deficit. Its debt to equity ratio is now close to 2x. For any other company, this would have been a major red flag. However, Netflix is likely a company that can continue to gain access to cheap funding due to its growing business model.

In summary, Netflix is likely banking on its original content and excellent user-experience, one which is not driven by ads, to stay ahead of the competition. It is also probably the cheapest form of go-to entertainment for most people after a long day at work.

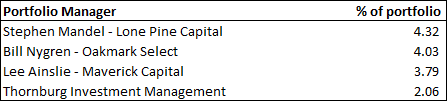

Surprisingly, Netflix is only owned by 4 investment Gurus, with Stephen Mandel and Bill Nygren being the top Gurus with the highest stake of Netflix in their portfolio.

High Recurring Revenue Stock # 4: Chegg

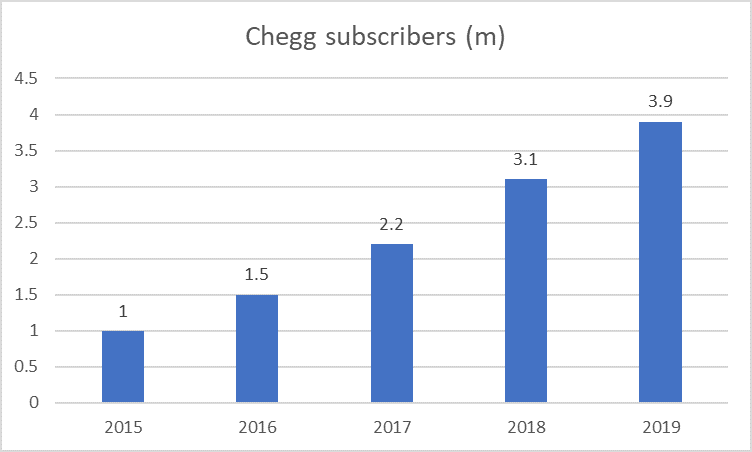

This stock is probably one that you would not have heard of. Chegg is an American Education technology based in California with approx. 3.9m subscribers. Simply put, Chegg is a digital education platform that gives high school and college students across America the digital education companion they have needed for the past several years.

Chegg has grown subscribers at a near 40% compounded annual growth rate since 2012. For the first time in 2019, the company recorded an operating profit of $17.8m. Looking ahead, management expects to grow its recurring service revenue by 31% in 2020. Its service revenue currently encompasses 81% of total net revenues which means that more than 80% of Group’s revenue is recurring in nature.

Chegg, operating in the education sector, has historically been resilient to recessions and can provide some downside protection. In the current COVID-19 context, the stay-at-home orders across the US might also catalyze net new subscribers away from in-person tutoring and other similar services.

The company could ultimately be recognized as a leader in online education during the crisis, much as Teladoc has been in the healthcare space.

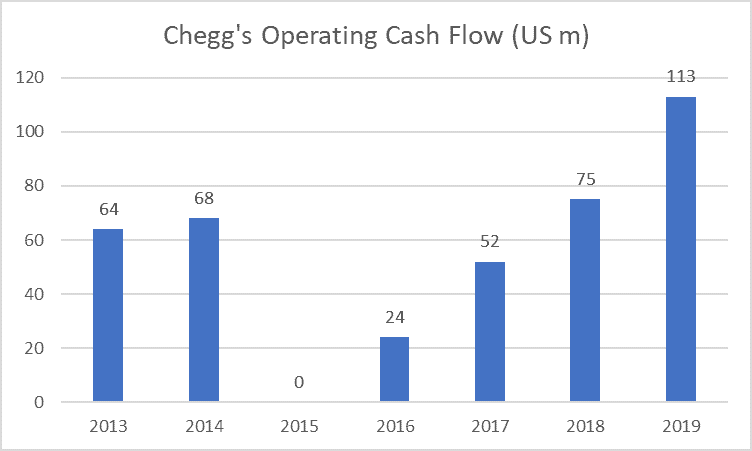

Despite generating net losses in 2019 to the tune of $9.6m, the company generated $113m in operating cash flow.

No doubt that among the 4 stocks in this list, Chegg is the riskiest due to its loss-making nature, but could also provide the strongest share price growth potential among the 4 stocks if the number of subscribers accelerates significantly due to the COVID-19 issue.

Chegg being a relatively small company with a market cap of only $4.3bn is owned by 2 investment gurus, Bill Miller from Miller Value Partners and Lee Ainslie from Maverick Capital.

Conclusion

These 4 stocks with more than 80% of recurring revenues are good candidates for consideration in one’s portfolio.

Not only are their revenues highly recurring in nature, but these stocks could also potentially benefit in a scenario where the current health pandemic sees no improvement.

Adobe, with its suite of digital media products, could see an increase subscription base for its distance-learning initiatives. For example, students and teachers of the company’s higher education and K-12 institutional customers across the world are now getting the at-home access to Adobe Creative Cloud desktop apps.

For Ecolab, its portfolio of hygiene and sanitizing products will be in strong demand during this health crisis. However, given that many of its clients are restaurants and lodging customers, the closures of their business during this period could negatively affect the demand for its products. Ecolab provided a 1Q20 guidance on 18th March, with only a slight reduction of $0.05 per share impact from the effects of the COVID-19 pandemic.

Netflix will likely remain as a key beneficiary of the stay-home trend, particularly from an increase in international subscriber base.

Last but not least, Chegg, with its focus on digital learning, could witness a substantial spike in its subscriber base as students transition from offline learning towards taking classes online.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- HOW TO BUY REITS IN SINGAPORE. 10-KEY S-REIT QUANTITATIVE FILTER (PART 1)

- WHICH ARE THE BEST TAX-EFFICIENT ETFS TO INVEST IN?

- ARE YOU OVERPAYING YOUR REIT MANAGER? WHICH S-REITS HAVE THE “HIGHEST” MANAGEMENT FEES?

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “4 stocks with more than 80% recurring revenue owned by Gurus”

Best view i have ever seen !