In this article, I will introduce 4 recession-resistant stocks with a fortress balance sheet. Not only are they COVID-19 resilient, meaning that the negative impact of the coronavirus outbreak to their income is marginal or might even be positive, but they will also continue to strive after this whole health pandemic issue is over by gaining market share from their cash-strapped peers.

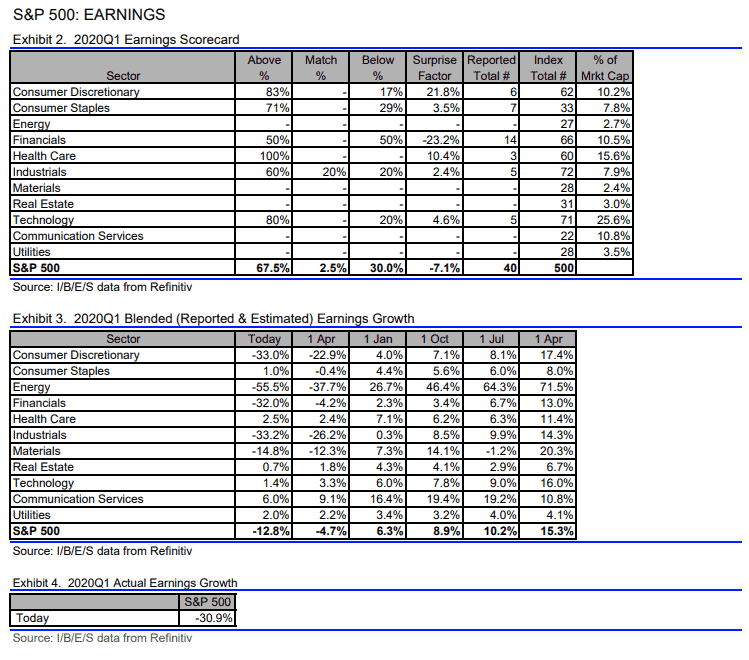

With a recession being imminent or perhaps we are already in one, many companies will be in a challenging position in 2020. According to the data from Refinitiv, 40 S&P500 companies have already reported their 1Q20 results as of 16 April. The actual YoY (1Q20 vs. 1Q19) earnings growth thus far was -30.9%.

On a full year 2020 basis, the current street forecast is for YoY earnings to decline by -12.8%, as of now. I expect changes to be pretty fluid (one week ago it was at -8%), with a downside biased. Take a look at Johnson & Johnson (JNJ). The company slashed full-year earnings by 14% due to coronavirus.

Note that JNJ is supposed to be a defensive pharmaceutical company. If such a defensive company is to see its full-year earnings slashed by 14%, I can’t imagine other companies doing significantly better than JNJ in the current recessionary climate.

There is a significant downside risk to the current -12.8% full-year earnings decline.

During an economic downturn that could potentially rival the Great Depression of the 1930s, investors should look to blue-chip stocks to weather the stock. However, not all blue-chips will excel in the current climate.

What you should be on the lookout for is companies with 1. A strong business model that is enduring, 2. Healthy cash flow generation and 3. A rock-solid balance sheet that often has more cash than debt.

Let’s take a look at these well-fortified blue-chips that should be in the current watch-list of all investors.

Recession-resistant stocks with a fortress balance sheet #1 – Amazon

No prices for guessing that Amazon sits right at the top of our list. The company is the go-to resource for a huge proportion of the world population currently under varying degrees of lockdown.

While many brick-and-mortar retailers are shuttered – retailers such as JC Penney misses its bond interest payment, Macy will Furlough the majority of its 125,000 employees, Best Buy to furlough about 51,000 employees, etc, Amazon hired 100,000 workers in March and looks to hire an additional 75,000 more workers to cope with brisker business.

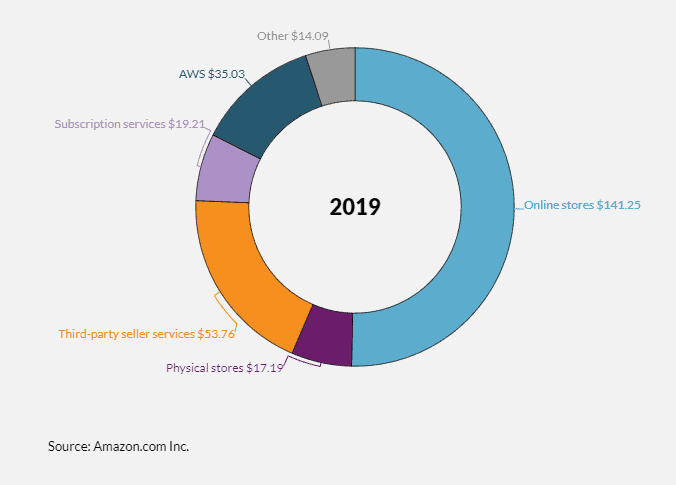

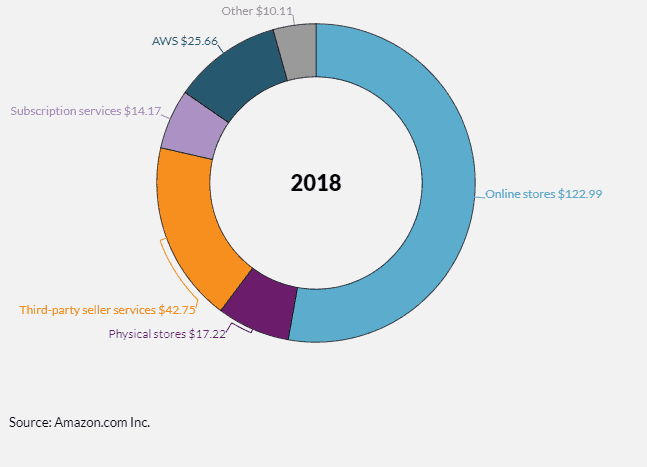

The durability of Amazon’s business model is no longer in question. The company has very interesting dynamics that in the near term will dramatically change how investors perceive the company. Amazon breaks down its business into three segments: North America, International and Amazon Web Services (AWS). The first two of these segments, North America and International, refer to geographical breakdowns of Amazon’s retail business. Retail can be further broken down into online stores and physical stores.

Despite the strong growth in retail sales, it is not where the company historically generates the bulk of its operating income. That honor belongs to AWS. AWS provides the company with more than $9.2bn in operating profits for 2019. Comparatively, retail generates “only” $5.4bn.

The tide might have shifted in the current context, with Amazon benefitting strongly from the elevated volume in its online retail business and the progressive shift towards digital retail. As the health pandemic issue recedes over the coming months, Amazon might find itself as the prime beneficiary of a world population that is so much more accustomed to digital shopping.

Who knows how many physical retail malls will be left standing after this crisis.

The company is probably the dream of every investor right now, one that generates enormous profits in a bull market and in times of crisis ensures that these profits do not fade away as the rest of the market crumbles.

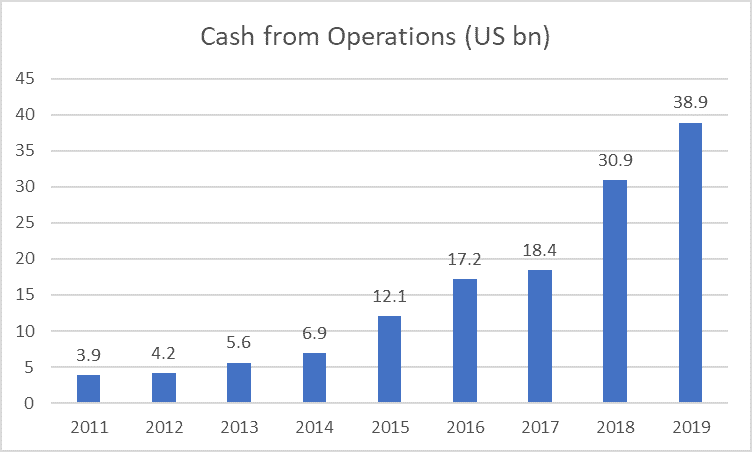

Amazon generates tons of cash and that is the company key selling point. Net cash from operations increased from $3.9bn in 2011 to $38.9bn in 2019 or a CAGR of 33%. During this period, Amazon’s market cap increased at a rate of approx. 30% CAGR from $112bn to S$920bn.

At $112bn market cap generating $3.9bn in operating cash, Amazon is valued at approx. 29x Price/Operating cash flow. At $920bn market cap generating $38.5bn in operating cash, Amazon is valued at approx. 24x Price/Operating cash flow.

With the recent rise in share price, Amazon is now valued at $1.15trn. If I am to assume that operating cash flow can grow at a rate of 30% in 2020 (2019 growth rate was 25%), that will translate to full-year operating cash of $50bn.

At an average multiple of 26.5x, that could imply a fair value of at least $1.3trn for Amazon.

Not only is the company highly cash flow generative, but it is also in an enviable position where the company is only marginally in a net debt position (assume lease liabilities as part of the debt and marketable securities as part of cash) of -$8bn. With an equity of $62bn, net debt to equity is a very manageable 13%.

All in all, a fantastic company to own, one that is highly COVID resilient. An investor might want to keep the counter in your radar and purchase the stock on dips.

Recession-resistant stocks with a fortress balance sheet #2 – Electronic Arts

Electronic Arts is the software publisher behind blockbuster franchises such as Fifa and Star Wars. As a “Gaming” company, this is another stock that will benefit from the current COVID-driven stay home trend. As the government begins to encourage social distancing to slow the spread of the coronavirus, the videogame industry could see some near term benefits.

The video game industry is rather uniquely positioned to see very little disruption over the next 12 months. Video games could see increased engagement as folks fight off cabin fever. Online gaming often includes voice chat, away friends can keep in touch and hang out virtually amid self-quarantines.

Both Microsoft and Sony have announced their next-generation consoles which are still scheduled to be launched in late 2020. Historically, the start of videogame console cycles, which occur every five to eight years, are positive for game publisher stock returns.

There is however the risk of game schedules being delayed and the new consoles from Microsoft and Sony may likewise suffer supply issues from a prolonged disruption. Already, Sony just announced that it plans to produce far fewer units of its upcoming PlayStation 5 in its first year.

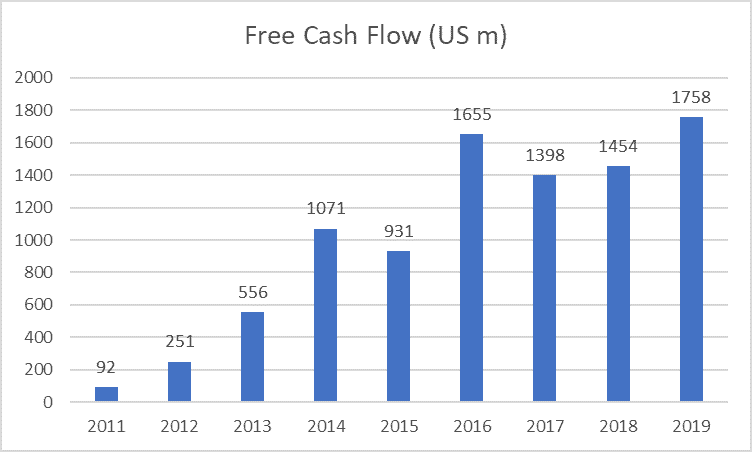

To be honest, all three video games software publisher Electronic Arts, Activision Blizzard, and Take-Two Interactive are strong cash-generating entities. For Electronic Arts, cash generation has been extremely strong, with its free cash flow increasing from a mere $92m in 2011 to $1,758m in 2019.

With a market cap of $32bn, the company is trading at an attractive trailing Price/Free Cash Flow multiple of 18.2x. This is at the lower range of its 5-years Price/Free cash flow trading band of between 15x and 38x.

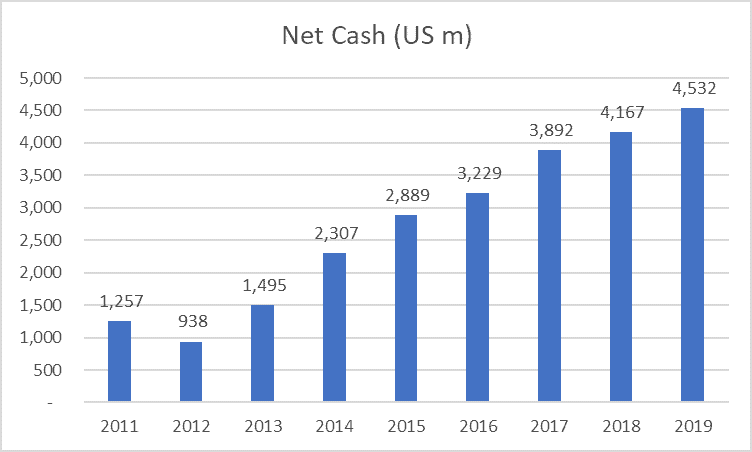

Meanwhile, Electronic Arts’ strong balance sheet, which includes $5.6bn in cash and only $1.1bn in total debt, places the company in a strong net cash position of $4.5bn which is approx. 14% of its total market cap. This is almost as good as it gets.

Even if there might be a delay in the launch of the new consoles from Microsoft and Sony slated for the end of the year, Electronic Arts, as a cash-generating machine, is well-positioned to manage any troubles that come its way.

Recession-resistant stocks with a fortress balance sheet #3 – Costco

During the coronavirus pandemic, it has become clear that a few companies remain essential no matter what is happening in the world. One of them has got to be Costco, the warehouse winner that sells products in bulk.

It’s obvious why people flock to the BULK DISCOUNT chain in a pandemic. People want to buy everything in BULK and everything at a DISCOUNT. These products are sold at everyday low prices in very large stores that lend themselves to social distancing.

The company reported EPS of $2.10 for its fiscal second quarter ended Feb with a beat fuelled by panic buying due to COVID fears.

The company also recently announced a spike in March sales to $15.5bn, up 11.7% from the year-ago period. Its e-commerce sales climbed 48.3% as more people around the world turned to online shopping.

There are concerns that sales will taper off after the crisis. No doubt, the current bump in sales might be a 1-2 quarters event. However, even after the coronavirus passes, Costco’s low prices will remain extremely appealing, especially in an economy where the unemployment rates could be driven up as high as 20-30% in a worst-case scenario.

People will be clamoring for discount items and that what makes discount stores such as Costco so much more appealing even after this health crisis wanes.

Costco generates plenty of free cash flow, to the tune of $3.3bn in fiscal year 2019. While not exactly as attractive as EA when we view it in terms of Price / free cash flow, the counter’s Price / free cash flow multiple of 33x is still at the lower range of its 5-year band of 19-100+ x.

The counter also has a pristine balance sheet where it is in a slight net cash position which is why I favor it over retail heavyweight Walmart that has a net debt position of over $61bn.

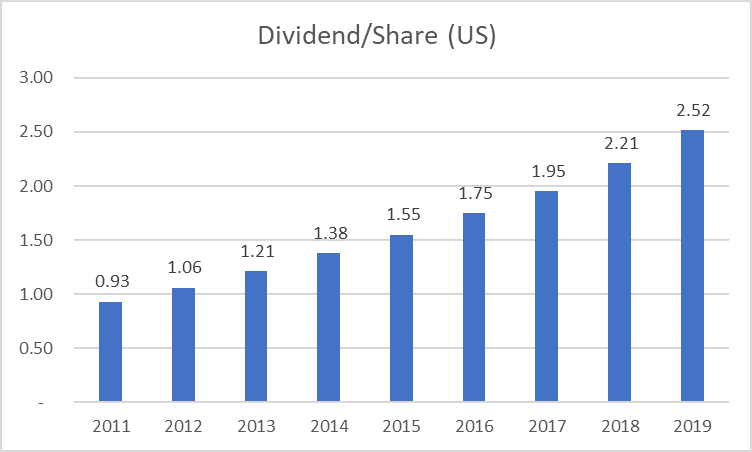

This allows Costco to maintain its track record of dividend hike since 2005. The company on Wednesday declared a hike of almost 8% in its quarterly dividend. The new amount, $0.70/share will be handed out on May 15 to investors of record as of 1 May.

While not exactly a high yielding counter (still less than 1% yield after the hike), this is one dividend growth stock that investors should keep an eye out for during this recessionary period, one which is likely to outperform the general market, both in terms of share price performance and earnings expectation.

Recession-resistant stocks with a fortress balance sheet #4 – Vertex Pharmaceutical

Vertex Pharmaceutical is a stock that is largely immune to the ravages of the coronavirus because the company is focused solely on the development of pharmaceuticals to treat serious diseases such as cystic fibrosis. It also has pipeline products for kidney diseases, sickle cell anemia, and other ailments.

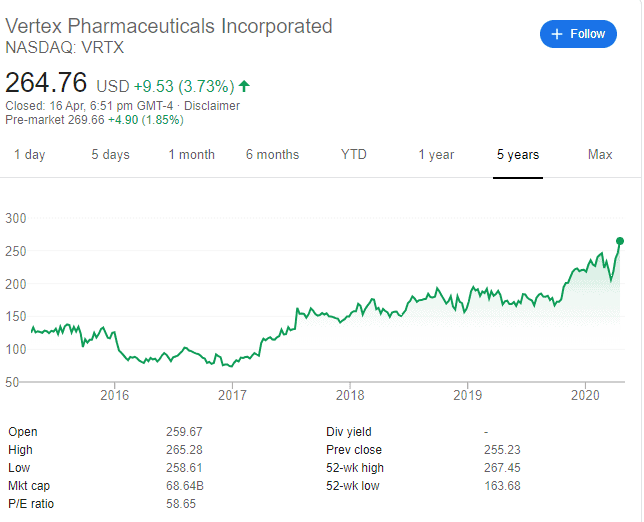

The company is currently enjoying a trifecta of 1. High growth, 2. Long patent life and 3. A major pipeline of catalysts in 2020. Shares of the company jumped in January when the company reported sales of its new cystic fibrosis therapy that vastly outpaced analyst expectations.

Cystic Fibrosis is a progressive genetic disease that affects various organs, but it’s most known for its effect on the lungs.

Morningstar predicts sales of its cystic fibrosis drugs will hit $5.3bn this year and may contribute more than $10bn to revenue in 2028. At $5.3bn in sales for 2020, that represents a YoY growth rate of 26%.

Some people might be concern about Vertex’s supply chain disruption. However, the company recently said that the pandemic hasn’t impacted its supply chain or its business outlook for the year. Nonetheless, new clinical studies might be delayed as many hospitals that serve as trial sites, are currently overwhelmed with coronavirus patients.

The company is one of the few pharmaceutical companies that generate a ton of free cash flow, $1.5bn to be exact in 2019. Consequently, it has also built up a strong balance sheet, with a net cash position of $3.3bn, or 5% of its market cap.

Shares are trading at a near-record high after gaining 16% YTD. Over the short term, this counter will likely be seen as a safe-haven and highly recessionary proof. In the long term, its new family of cystic fibrosis drugs, some in their early days such as Trikafta, will ensure that Vertex’s revenue and earnings continue to climb.

This is one pharmaceutical stock that could join the $100bn market cap club category sooner rather than later.

Conclusion

These stocks are mostly trading at 52-weeks high, even in today’s context which is pretty commendable. Out of the 4 stocks, Costco might potentially see some short-term pull-back when the virus ebbs, as the market views the spike in near-term buying is over. Nonetheless, Costco is one of the very few stocks that has done extremely well, both during good and bad times due to its unique positioning as a bulk purchase discount store with an extremely high level of membership renewal rate.

Do take a look at these stocks and do your due diligence if they are potential candidates for your portfolio. These 4 recession-resistant stocks with fortress balance sheets are part of my shopping list of “blue-chip” stocks.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- HOW TO BUY REITS IN SINGAPORE. 10-KEY S-REIT QUANTITATIVE FILTER (PART 1)

- 3 REASONS TO KEEP INVESTING EVEN IN A DOWNTURN

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- WHEN TO BUY STOCKS IN A RECESSION? THE IDEAL TIME TO PICK A BOTTOM

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “4 Recession-Resistant Stocks with a Fortress Balance Sheet”