The war of words between the US and China is heating up. Shortly after signing executive orders to ban TikTok and WeChat which could take effect in September 2020, Trump says that he is now considering a ban on other Chinese-owned companies including Alibaba.

If this war of words escalates into concrete actions being taken, we could see widespread repercussions for many US companies. In this article, we explore the 17 US companies most at risk, based on their revenue exposure to China.

De-listing risk still on the table

The escalating US-China trade row could affect several companies listed in the US. The obvious negative blowback on Chinese companies listed in the US is the delisting risk. Amid a tide of anti-China sentiment stateside, the US Senate passed a bill in May that could essentially ban many Chinese companies from listing their shares on US exchanges.

It will require these Chinese companies to certify that they are not owned or controlled by a foreign government but more critically, be subjected to audits by US regulators for three consecutive years. It is highly unlikely that China is going to allow inspections of audits done in mainland China, in my view, which will mean that high profile Chinese companies such as Alibaba, JD, etc will stop trading on the US exchange if the bill becomes law.

For that to happen, the bill will still need to pass the Democrat-controlled House.

These US-listed Chinese companies, in the meanwhile, are looking at alternatives, with many seeking a secondary listing on the Hong Kong Stock Exchange as a potential “hedge” against a delisting in the US while still tapping global liquidity.

If delisting comes to fruition, these ADRs could be at risk for volatility, at least in the near term. However, some fund managers reckon that big Chinese stocks such as Alibaba, JD, Baidu, etc with secondary listings in Hong Kong will be a buying opportunity while those without a secondary listing could face more challenges.

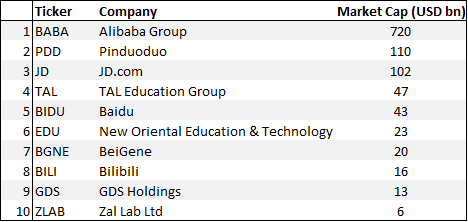

Key China ADRs

The table below shows some of the largest ADRs that could be at risk of some near-term volatility if the bill ultimately becomes law.

US Companies could also suffer

However, the Chinese companies are not the only ones that will be negatively impacted by the backlash seen from the escalating US-China war that has escalated beyond just a focus on trade.

US companies with significant revenue exposure to China could also bear the brunt as a result of worsening tension between the two superpowers.

Firms in the technology sector alone risk a US$3.5trn cost over the next five years in lost revenue in China, not to mention moving factories and dealing with new regulations. The fallout would be significant, the question is how bad can things get?

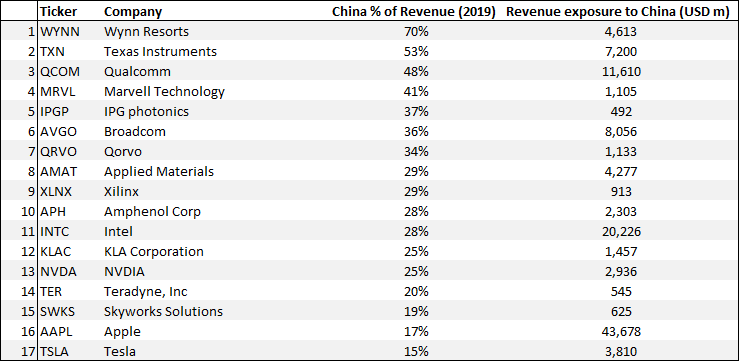

US Companies with largest revenue exposure to China

The table below shows the largest companies in the US and their revenue exposure to China. Most of these are tech companies. The US-listed company with the single largest exposure to China in % terms is Wynn, which has approx. 70% of its revenue tied to China alone and that heavy reliance could hit the company badly if the situation worsens.

According to media reports, Apple, got US$43bn in revenue from Greater China (including Taiwan and HK) last year. That’s more than any other S&P500 company although it just encompasses approx. 17% of Apple’s revenue. Nonetheless still a very significant number.

This could be a reason why Warren Buffett is buying into the materials sector through the purchase of Barrick Gold, potentially to hedge Berkshire Hathaway’s massive Apple position. In this scenario, Apple might no longer be the safe haven that most investors will associate the stock with.

Conclusion

This is a short article, highlighting the companies most at risk if the relationship between the US and China continues to sour.

For US-listed Chinese stocks, the greatest risks remain de-listing which might introduce a certain level of uncertainty into the equation. However, that could be a buying opportunity for some of these fundamentally strong Chinese companies such as Alibaba whose price might become “artificially” depressed.

For US stocks with a sizable exposure of their revenue tied to China, there could significant implications if there is an outright trade war with China taking retaliatory actions and banning US companies from marketing their products/services in China.

Apple, for example, will see a huge amount of iPhone demand “disappear” if that is to happen.

The new ban on Huawei (chips supplied to Huawei by a non-American company using American technology will also require licenses) is just one prime example of how the trade war situation can further escalate.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 1Q 2020 TOP HEDGE FUND LETTERS TO SHAREHOLDERS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “17 US Companies most at risk from escalating US-China tensions”