Tiger Brokers Review

Most of you might not have heard of Tiger Brokers, the new kid on the block when it comes to providing brokerage services here in Singapore. Tiger Brokers which usually lets you trade on the New York stock exchange has recently added SGX trading to its platform, finally allowing Singaporean investors access to their home market, in addition to popular global markets such as the US, HK, China, etc, with possibly more additions in the year ahead.

In all honesty, I was skeptical when I first heard of this new fintech brokerage firm looking to enter the already hyper-competitive brokerage scene here in Singapore by being a low-cost service provider. Hence, I decided to do a little sleuthing on the background of the company and the quality of its product offerings. I came away pleasantly surprised.

Before I even embark on its low-cost service offerings and why I believe the tiger trade app is possibly one of the best, if not the best here in Singapore (Yes their mobile platform standard is comparable to some of the most established US brokerages), I believe it is important to provide a little background on Tiger Brokers Singapore as well as its parent, UP Fintech Holding Limited.

Tiger Brokers Singapore: A MAS-approved broker

Tiger Brokers Singapore is a licensed broker under the Monetary Authority of Singapore (MAS). It has gotten the Capital Markets Services License which allows the brokerage to deal in various capital markets products such as securities, collective investment schemes, and exchange-traded derivatives contracts as well as providing financing and custodial services.

The company has got a physical presence here in Singapore, with its office based in Singapore Land Tower (50 Raffles Place #29-04). Tiger Brokers Singapore is headed by its CEO, Mr. Eng Thiam Choon who has 14 years’ experience in the futures industry and spent 8 years at Phillip Futures where he represented the Singapore office in expanding and exploring the Greater China Market.

UP Fintech Holdings Limited

UP Fintech Holdings Limited (UP Fintech), or more commonly known as Tiger Brokers here in Asia, is the parent of Tiger Brokers Singapore. Founded in 2014 by Mr. Wu Tianhua, CEO of Tiger Brokers, the company is an online stock brokerage start-up in China backed by the likes of Interactive Brokers, Xiaomi Inc, ZhenFund and Wall Street investment guru Jim Rogers.

Mr Wu created Tiger Brokers back in 2014 to provide Chinese millennials with a solution to invest in companies listed in the US. The company has since won several accolades such as being awarded “2017 Fintech 250” by CB Insights and shortlisted for “China Leading Fintech 50” for two years in a row by KPMG China.

UP Fintech was listed on the Nasdaq stock market under the ticker: TIGR and while its share price has taken a beating alongside most small-cap start-ups, the counter has since rebounded strongly (now at c.US$4) off its low of US$2 back in March 2020.

In UP Fintech’s latest 1Q20 quarterly results, the company recorded a 137% YoY increase in total revenues and for the very first time, the company generated net income of US$3m in the quarter after reaching sufficient scale where its strong revenue growth of 137% YoY more than offset its operating cost, which grew by only 45% YoY.

It is comforting to know that UP Fintech has finally turned profitable and is looking to add more investment products and proprietary analytical tools to assist its global users in efficiently managing their wealth.

Using custody services here in Singapore

Since the MF Global blow-up back in 2011, there are always concerns over how secure our investments and funds that we park with brokerage firms are, particularly foreign ones. For new fintech start-ups, such as Robo-advisors, many of which have started to gain traction here in Singapore, they work with reputable and established custodian service providers to help clients “safe-keep” their funds and investments.

If these fintech firms go bankrupt or close shop, it is comforting to know that our funds/investments are kept safe with these established custodians such as UOB Kayhian, DBS, Saxo Capital, etc.

I am not going to sugar-coat and claim that Tiger Brokers Singapore is financially sound and here to stay for the long-run with the potential to become one of the best fintech brokerage firms in Singapore. I do not know enough to make that claim.

Having its “roots” from China might be seen as a risk as the Chinese government could just close down its parent, UP Fintech tomorrow. One cannot disregard such a political and industry-specific risk, particularly so in China where strict capital controls remain in place.

Nonetheless, Singaporean investors do not have to worry about their deposited funds and investments with Tiger Brokers Singapore because, just like the Robo Advisors, the company engages a custodian to manage Clients’ funds and investments.

Base on my understanding, Tiger Brokers account Singapore uses DBS as their key custodian service provider here in Singapore and Interactive Brokers for other markets. Interactive Brokers, if you have not already heard of the firm, is one of the largest brokerage companies in the US. It operates the largest electronic trading platform in the US by the number of daily average revenue trades.

Hence, I don’t see the permanent loss of funds stemming from the liquidation of Tiger Brokers Singapore (if it happens) as a key risk in this context.

Key Product Offerings

Competitive rates

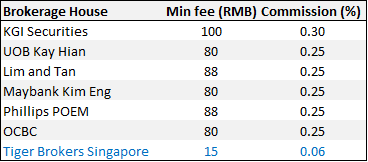

When it comes to commission charges, there is no doubt that Tiger Brokers Singapore is among the most competitive here in Singapore.

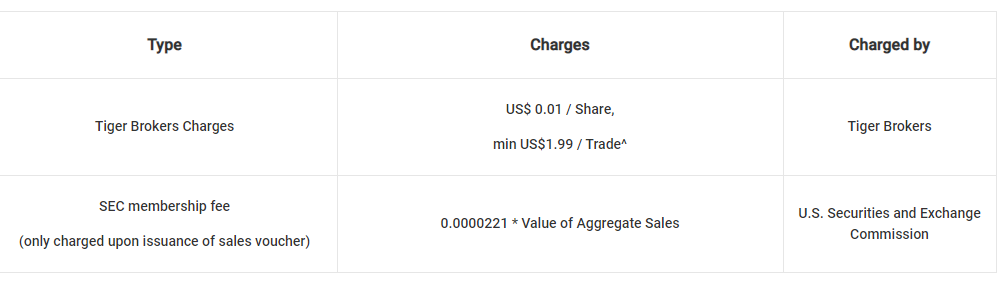

US Stocks

For US stocks, the broker charges a minimum amount of US$1.99 (commission + platform fee) which is only rivaled currently by Interactive Brokers which charge US$1. However, unlike Interactive Brokers which charges a custodian fee of US$10/month for account size less than US$100k, Tiger Brokers Singapore DO NOT charge clients a custody fee, base on my understanding.

Hence, they are actually the lowest cost brokerage to partake in buying US stocks for the man-in-the-street. Actually for SGX, using the tiger trade app you get unlimited commission free trades.

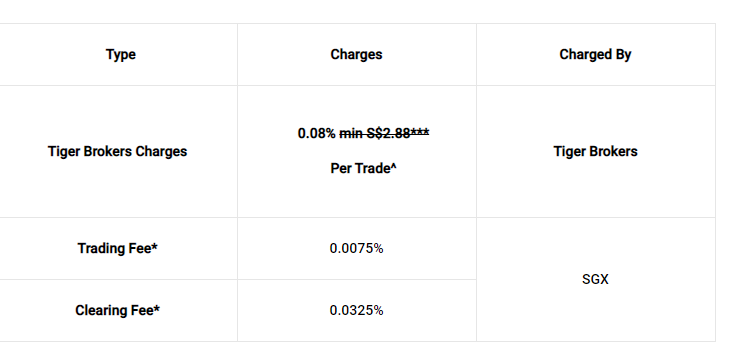

SG Stocks

For SG stocks, there are currently no minimum fees which are quite unheard of. Most of the brokers here in Singapore charge a min fee of at least $9-10 for trading in SGX, including FSMOne which charges min $10 and a comparable comms of 0.08%.

HK Stocks

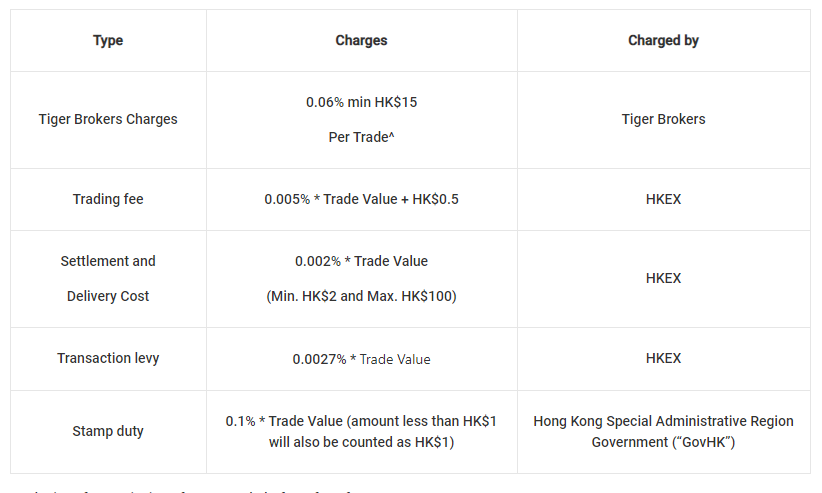

For HK stocks, Tiger Brokers Singapore min fee of HK$15 per trade with 0.06% comms is also the lowest with the next best alternative being Interactive Brokers at HK$18 min with 0.08% comms.

For the full list of brokerage charges, you can refer to this article I have written, comparing the brokerage charges for Singaporeans trading in SG, HK and US markets. Also considering the currency exchange fees.

FX-related charges

A hidden charge that is associated with buying foreign shares is FX conversion fees which might increase the All-in costs of purchasing foreign shares beyond just the commission charges and custodian fees.

Tiger Brokers Singapore used to charge USD$2 for each FX conversion on-top of the spread which is approx. 0.3-0.5% (not fantastic but competitive) for USD/SGD and SGD/HKD. However, according to my understanding, Tiger Brokers Singapore has since waived that USD$2 charges.

Do note that when trading in the US, HK, or RMB stocks with Tiger Brokers account, one will need to convert your SGD cash holdings into the respective currencies if not the brokerage will count that foreign currency transaction as a borrowing which will incur interest charges. This is similar to the structure that Interactive Brokers adopts.

Other market and product offerings

Cheap access to China shares

Beyond being the most competitive in terms of commission charges, investors who wish to access China stocks through the Shanghai/Shenzhen-Hong Kong Connect can do so through the Tiger Brokers Singapore platform. This is a market where not all brokerage houses currently allow clients access to and even if they do so, the charges are comparatively much high.

Potential access to the UK market in the future

While currently not a market which clients can access, its mobile platform caters access to UK stock information. I am personally looking forward to Tiger Brokers Singapore launching this market as it will give me access to the various UCITs ETFs (tax-efficient ETFs for Singaporeans) which are traded on the London Stock Exchange.

While existing brokerages such as Saxo, IG, and Stanchart do provide Singaporeans access to stocks traded on the London Stock Exchange, their min fees are generally pretty high (from US$5-US20) and it will be excellent if Tiger Brokers Singapore can provide a low-cost alternative to this market.

Trade US options

Another great feature is the availability of US options trading which is increasingly gaining traction with Singaporean investors. At a low fee of $0.95/contract or min $2.99 per order, clients can now trade US options in conjunction with purchasing US stocks direct, deploying option strategies which generate income such as covered call selling or cash-secured puts selling etc.

Fantastic mobile platform

What got me intrigued, beyond Tiger Brokers Singapore’s low-cost commission structure is its own tiger trade app.

Tiger Brokers Singapore mobile platform is possible one of the best if not the best mobile platform here in Singapore for the generic investor (not necessarily for day traders which requires sophisticated technical charts). Let me show you why.

Tiger Brokers currently provide access to 4 key markets (SGX, HK, US, China) as well as futures trading. While it provides information about the LON market, currently that market is not tradable but users can still glean useful London-listed stock information on the platform.

For some of these markets, you can have a birds-eye view of the performances of the various industries through their Heat Map feature.

For those who are interested in the latest news, their platform pulls the latest Top news information from various sources such as Yahoo Finance, Benzinga, Dow Jones, Straits Times, Channel News Asia, etc. Not the most comprehensive but very decent for a brokerage platform. You can also pull news about stocks in your watchlist.

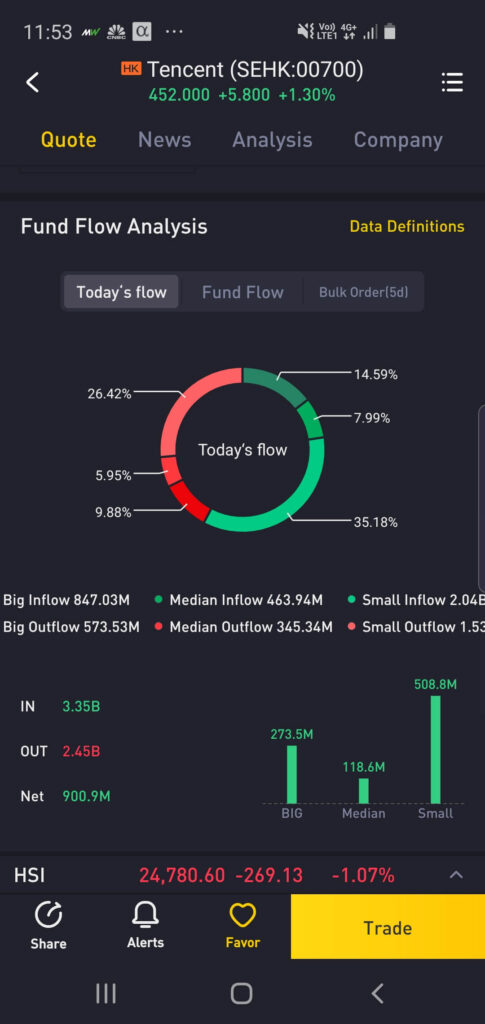

If you are interested to know more about the fund flow situation in HK for example, the platform also provides that feature, both for the overall market as well as an individual stock counter. You can also have access to the various short statistics which are not often given free to retail investors.

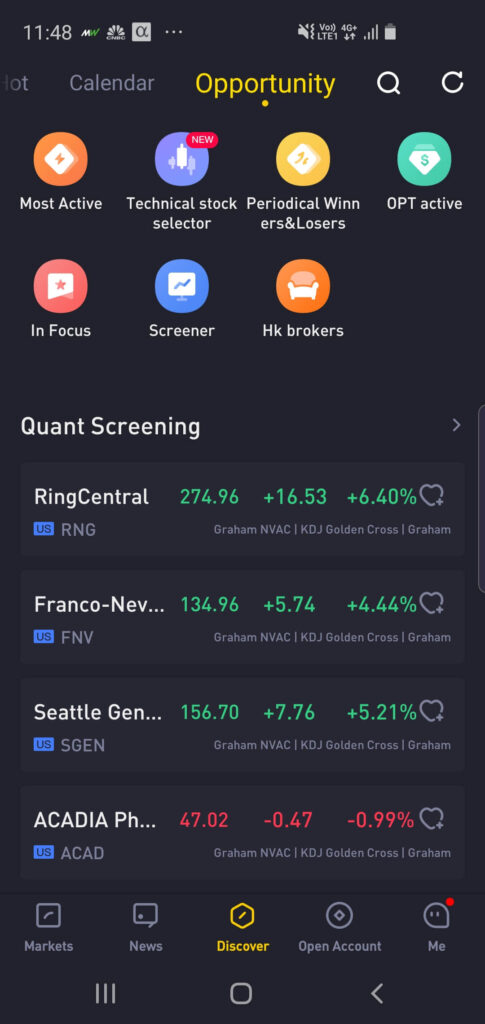

There is also a Discover function where you can find interesting stock ideas based on certain themes such as Big Data, Social Media, Smart Beta ETFs, etc

You can screen for your stocks using their fundamental screener. Again, not the most comprehensive but it beats some of the very basic screeners that most brokerage provides as well as what you can find on SGX.

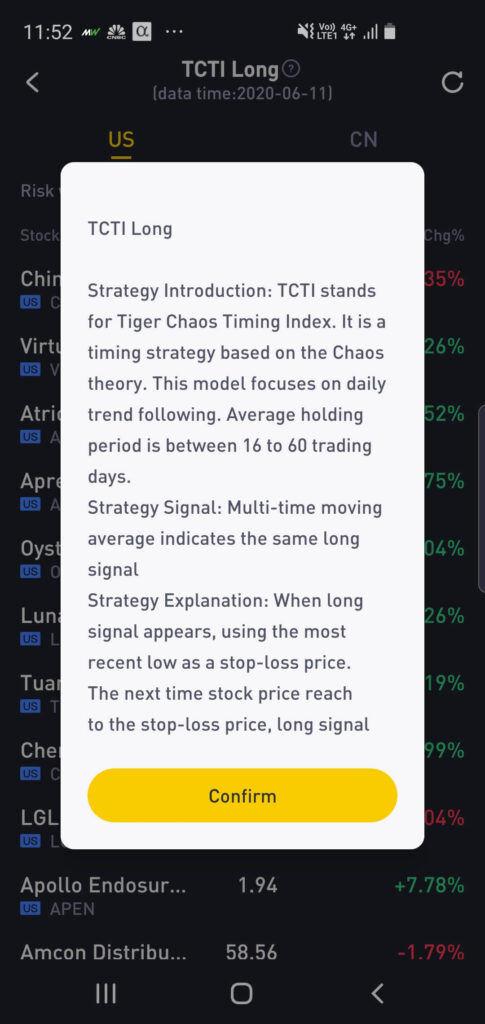

Alternatively, you can look at their quant screening which is based on a few unique criteria such as Benjamin Graham NVAC, KDJ Golden Cross, etc, TCTI long.

Quite a fair bit of interactive features that you can explore on a big picture basis and we have yet to touch on the functionality that the platform provides for individual counters.

Clicking into each stock, you can have access to not just the basic quotes and charting of the company but also access to data such as short interest in the counter as well as fund flow of the counter.

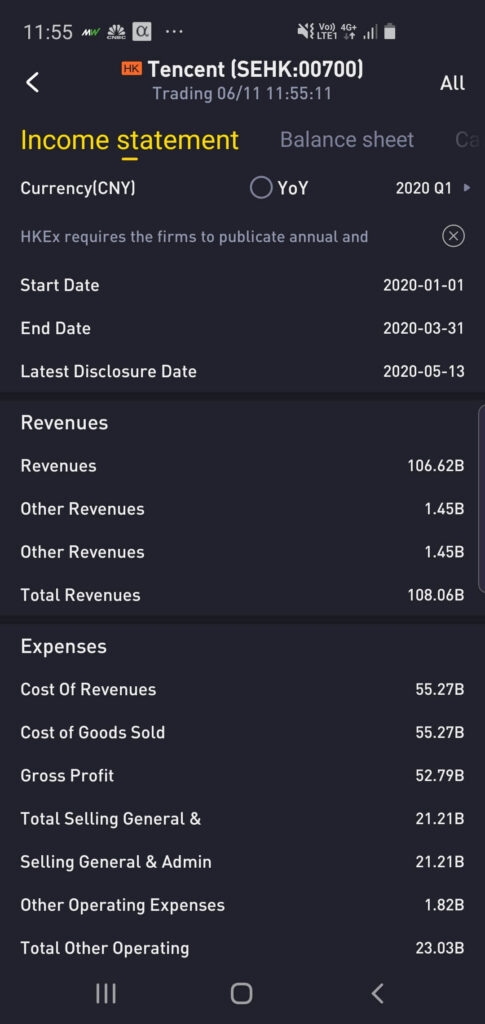

For those who are interested to dive into the details of the company’s fundamentals and financials, you can do so on Tiger Brokers Platform where it provides you with both a snapshot of the company financials, as well as the individual components of their financial statements all with just a click of the button.

An area of possible improvement is if the platform can benchmark a company’s key financial metrics and ratios with that of their closest 2-3 competitors to provide users with a quick overview of the relative financials of these companies.

There is quite a fair bit of other features on their mobile platform which I did not touch. I would recommend users to sign up for an account and download their mobile app to just play around with the features that Tiger Brokers Singapore offer. The whole signing up process takes less than 10 mins which I will detail in the next segment.

Step-by-step of opening your Tiger Brokers Singapore account

The whole client onboarding process is quick and simple.

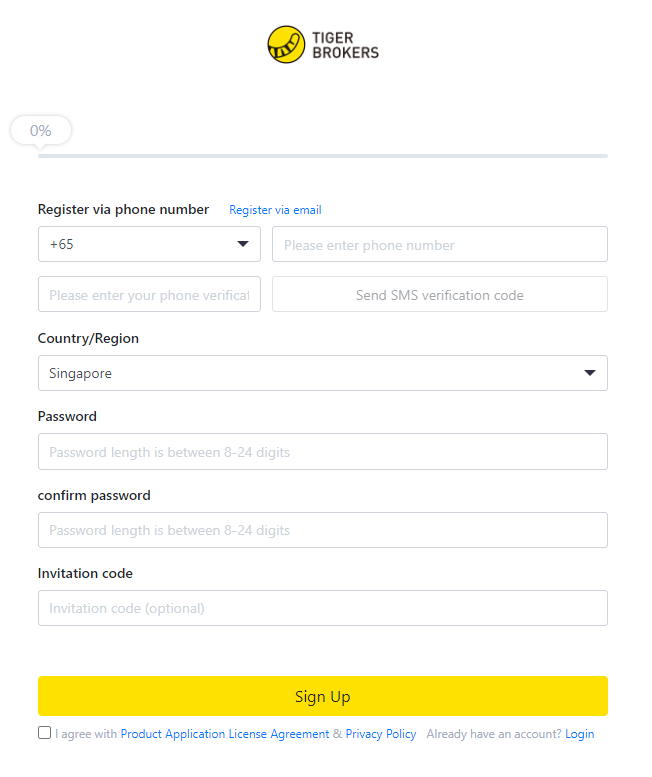

Step 1: Registering your phone number and password (30 sec)

For those who are looking for an invitation code to sign up, I will appreciate if you can enter my invitation code LXMV9I where you will get to enjoy Free Level 2 Data for US stocks for 30 days + Commission Free for 1US&HK stocks in 30 days as well as up to S$100 when you deposit funds in the account.

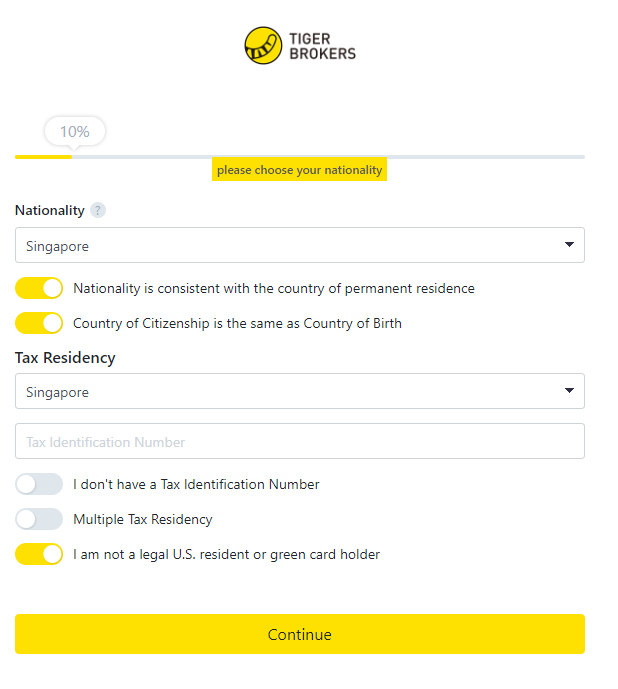

Step 2: Enter your nationality and Tax Residency (30 sec)

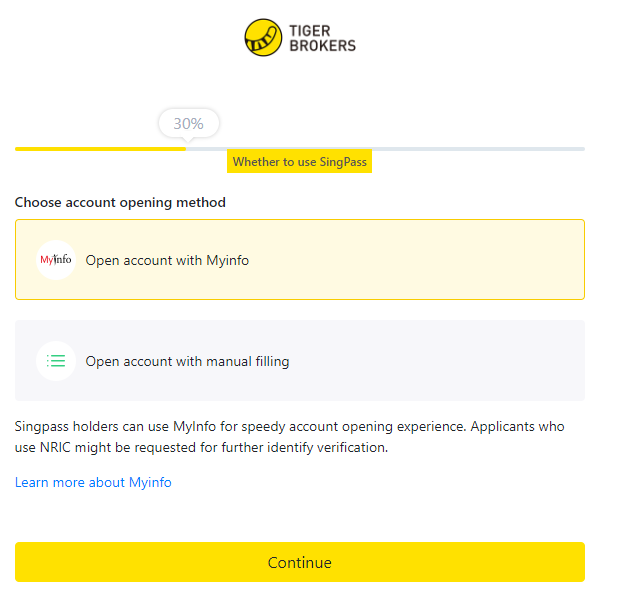

Step 3: Open the account with Myinfo (30 sec)

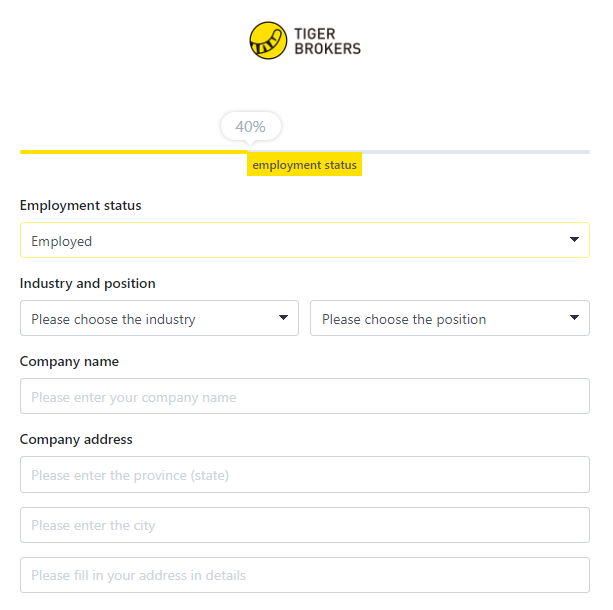

Step 4: Enter your employment status and company details (2 min)

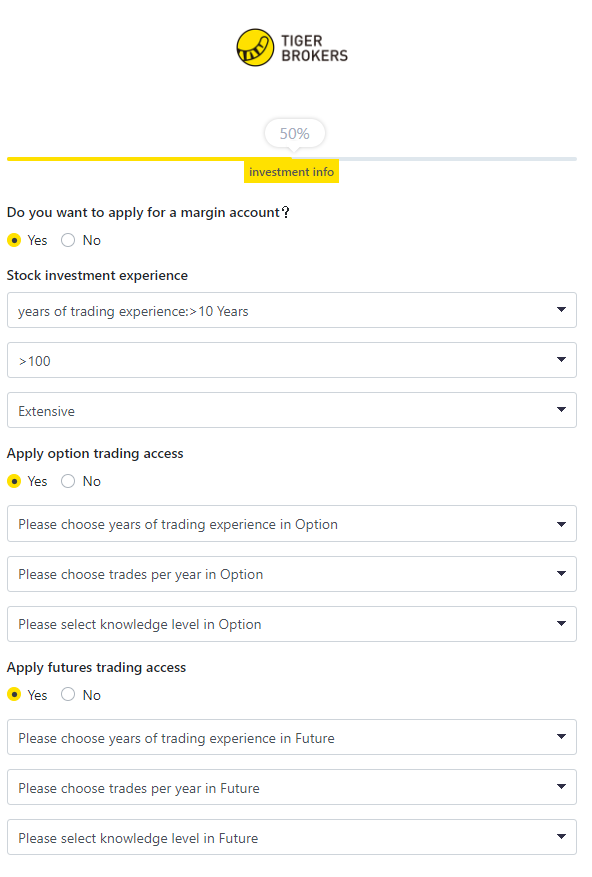

Step 5: Select your investment info (30 sec)

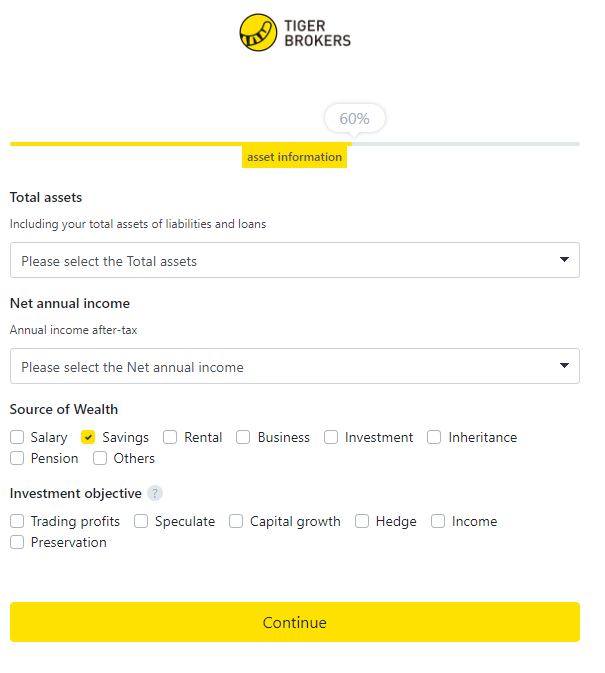

Step 6: Enter your asset information (30 sec)

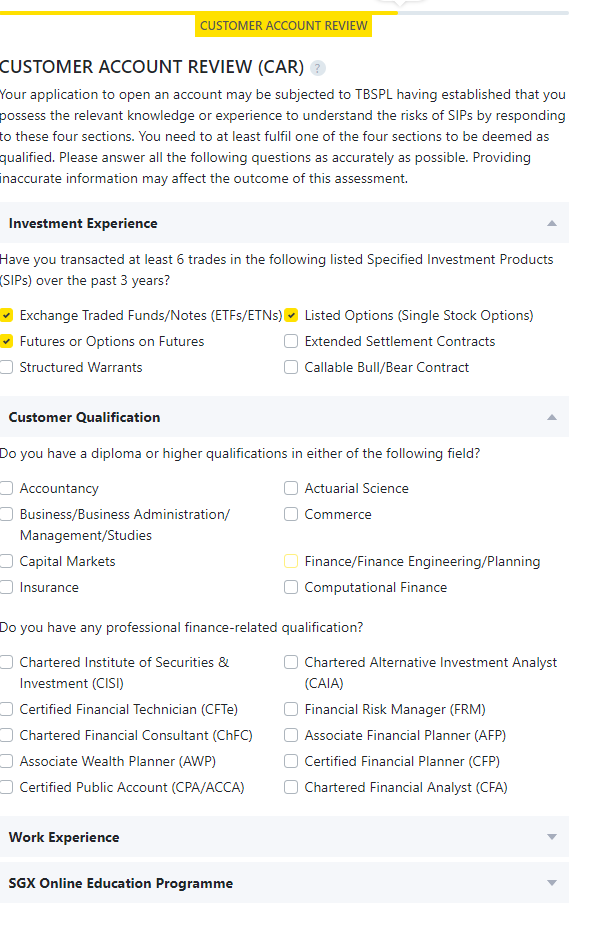

Step 7: Complete the Customer Account Review (1 min)

For this step, you need to at least fulfill one of the four sections to be deemed as qualified.

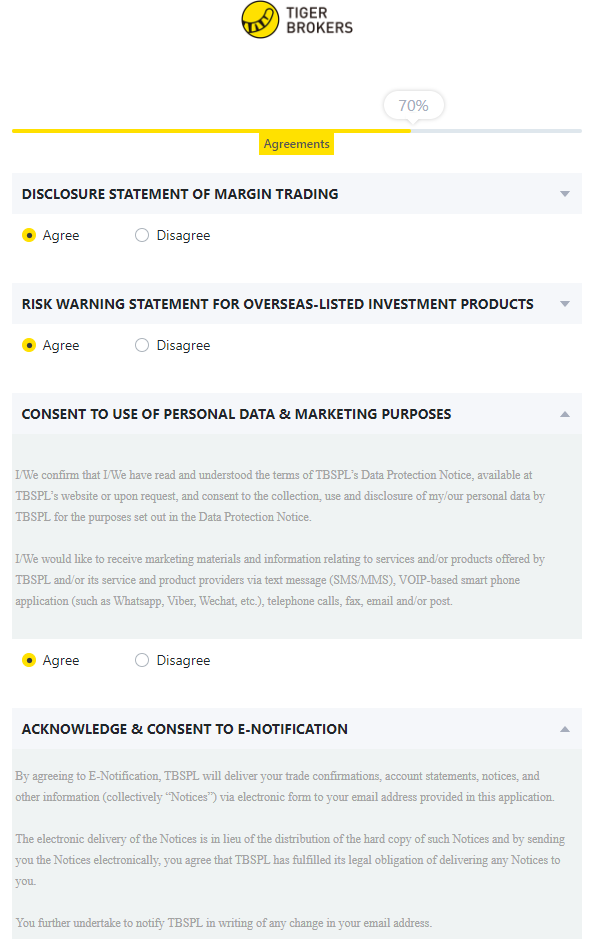

Step 8: Sign the Acknowledgment and Agreement letter (1 min)

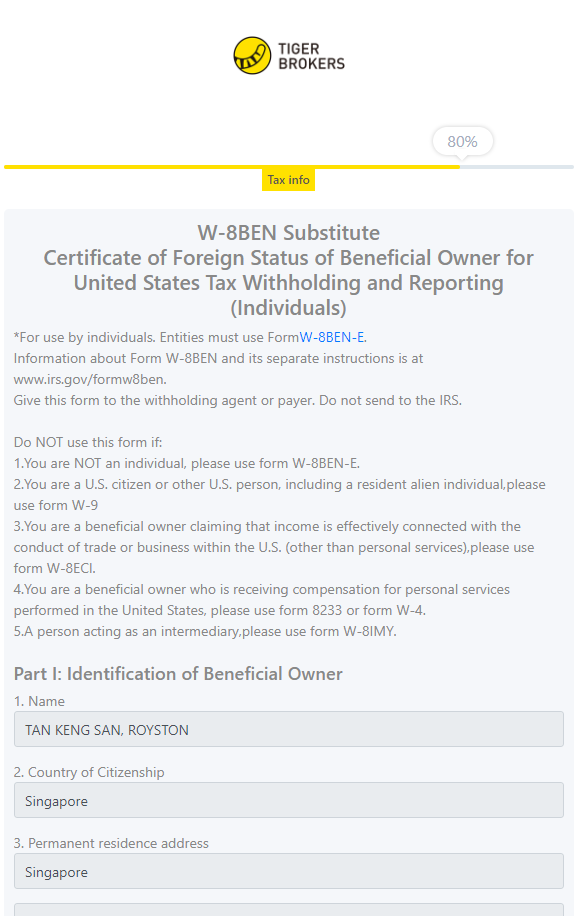

Step 9: Complete the W-8BEN form (30 sec)

This is mostly pre-filled for you.

There you go, just approx. 7 minutes to fill in all the details necessary for Step 1-9. Thereafter, you will need to wait briefly for account verification.

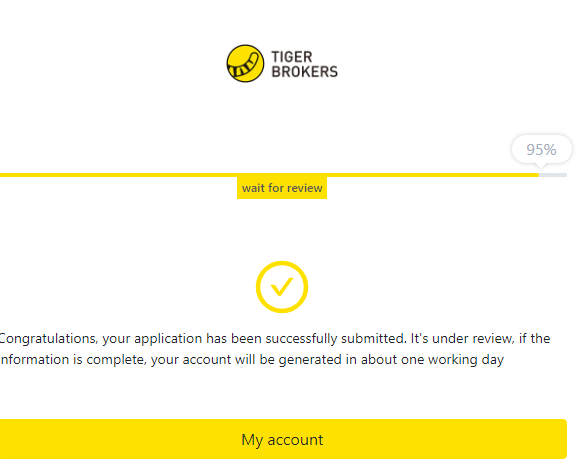

Step 10: Wait for account verification

This will be quite quick. Its stated one working day but I got mine approved within a matter of 10-15 minutes.

At this stage, you can download their Tiger Trade software to be used on your desktop and/or their Tiger trade mobile app. I highly recommend their mobile app as a key source of getting new investing ideas, an area which I have already highlighted above.

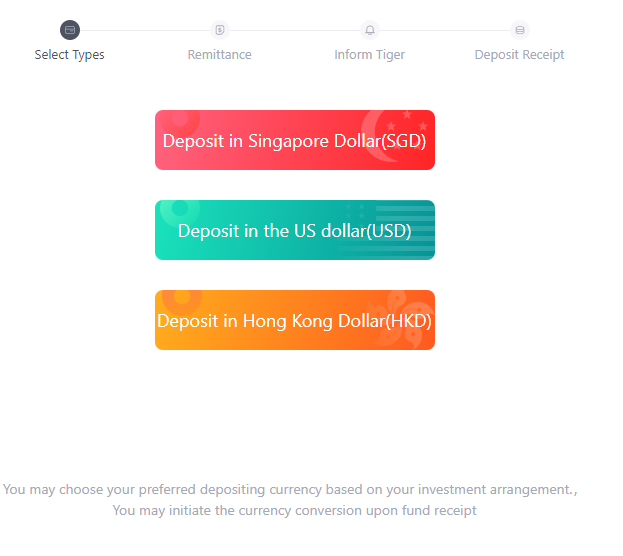

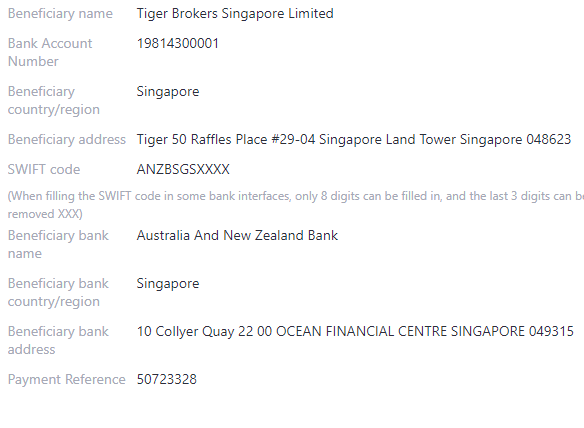

Step 11: Fund your account

Once approved, you can fund your account using the details stated by Tiger brokers. Again, the funding is pretty fast and I got my account funded in less than an hour.

There you go, the whole onboarding process is pretty painless and you can have your account set-up and funded all within the very same day.

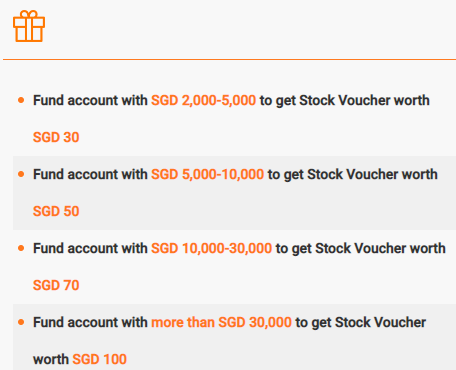

I hope I have provided you with an independent and non-biased review of the Tiger Brokers Singapore brokerage platform. If you find this Tiger Brokers review and a step-by-step guide to opening your account useful, do use my affiliate link to sign up for your account and you will be entitled to the following stock voucher rewards.

Stock Vouchers are money that you can use to offset your stock cost.

Conclusion

Even if you decide not to fund the account at the end of the day (or at least not yet), I will highly recommend you download their tiger trade app and use the features in there. There are lots of features and a potential source of investing ideas provided by the platform which I believe is unrivaled at the moment within the Singapore context.

I do look forward to seeing increasing product offerings such as RSP features, CFDs, cash management, etc on their platform which I believe are all work-in-progress at the moment.

While Tiger Brokers Singapore is the new kid on the block, they have entered this market with a bang with their excellent mobile platform offering. While only time can tell if their presence has lasting power, I believe they will be one of the first movers to bring low-cost (and hopefully in the future, no cost) commission trading to the Asia market.

Once again, thanks for taking the time to read this Tiger Brokers review and I will appreciate if you can use this affiliate link to sign up for your Tiger Brokers account today where you can potentially get up to S$100 in stock rebates.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- FSMONE SINGAPORE: STEP-BY-STEP GUIDE TO OPEN YOUR FSMONE ACCOUNT AND START TRADING

- BEST STOCK BROKERAGE IN SINGAPORE [UPDATE MAY 2020]

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- FSMONE FEES: THE CHEAPEST REGULAR SAVINGS PLAN (RSP) FOR ETF (2020)

- TOP 5 BEST STOCK MARKET MOVIES AND HOW TO WATCH THEM FREE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

5 thoughts on “Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?”