Introduction to thematic ETFs

In a previous article, I wrote about the best performing ETFs which consistently outperform the S&P500 over the past decade. Not surprisingly, most of them are skewed towards technological plays with substantial exposure in tech heavyweights such as Apple, Microsoft, Facebook, Google, etc.

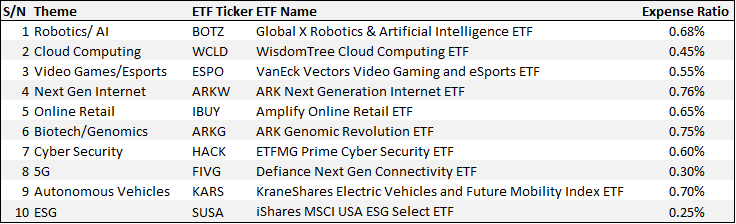

In this article, we will be exploring some of the best thematic ETFs to buy. The concept of thematic ETFs is not new and they have been growing in popularity for years. Lately, the focus has shifted to new-age technologies such as Robotics, AI, cloud computing as well as social causes including environmental protection.

I believe that thematic ETFs are here to stay and they will be increasingly sought after. These ETFs offer the benefits of diversification in a relatively low-cost structure. Unlike an index ETF which typically consists of 1000s of companies, thematic ETFs select roughly 30-50 names to partake in. That gives sizable exposure to each company. Sometimes, it pays to make a targeted bet. That has been the driving force behind thematic ETFs: they have been growing 3x as fast as the rest of the ETF industry in 2Q20.

COVID-19 for example has disrupted how people live and how companies are run, possibly forever. Investors have become aware that the future might look from different from today and they are interested in the companies that could be the biggest beneficiaries. Investing in thematic ETFs is thus a useful way to get exposure to these beneficiaries while yet maintaining a decent level of diversification and thus mitigating unsystematic risk to a certain level.

However, a note of caution. Most of these ETFs are quite small and they lack the track record. As they are more complicated to build compared to pure passive index funds (they are either actively managed or track a customized index), that is going to increase their expense ratio which could be easily above 1% compared to some of the largest passive index ETFs whose expense ratio is less than 0.10%.

Most thematic ETFs also have very little overlap with traditional sector funds. They usually have fewer stocks and tend to own more small and international stocks, at times across multiple sectors. The weightings of individual stocks depend on either the active managers’ conviction or how well the stocks have already been performing. Some believe that thematic investing if done right, should be more concentrated. You want to own the companies that are best positioned to benefit from the materialization of a trend.

Investors who still want some diversification but not overly exposed to one particular stock might be better served with equal-weighted funds. For example, the RYH ETF, which is an equal-weighted index of US health care companies taken from the S&P500 Index has outperformed its benchmark, the Health Care Select Sector SPDR ETF (XLV) by almost 2ppt YTD.

By investing in equal-weighted thematic ETFs, it is really about delivering thematic beta and not about having a view that one particular company will be the winner of the theme. It is hence more about getting exposure to a range of firms.

I have given a brief introduction to thematic ETFs. Let’s get down to which are the best thematic ETFs to buy now. These are ETFs which will likely benefit from structural macro tailwinds over the coming decade.

Best Robotics/Artificial Intelligence ETF: BOTZ

Robotics is one of the fastest-growing segments within the technology sector today and this refers to the development, manufacture, and application of robots across various types of industries. Growth in robotics has been fuelled by advances in machine learning, sensor technologies, cloud connectivity, and declining costs for electrical components like CPUs and GPUs.

As such, the number and types of robotics applications have expanded well beyond the traditional factory and warehouse settings to the home, office work, and beyond.

The robotics industry has permeated the following spaces in one way or another:

- Defense – this includes drones as well as sophisticated unmanned machines used by the military

- Industrial – in addition to modernizing the assembly line, robots are starting to take on more advanced automation tasks requiring greater dexterity and familiarity with their environment

- Healthcare – nanorobots are a budding field at the intersection of biotechnology and engineering

- Consumer – robot vacuum cleaners and kitchen appliances that talk to one another are just the starts as we begin to embrace entirely new ways of integrating robots in our day to day lives.

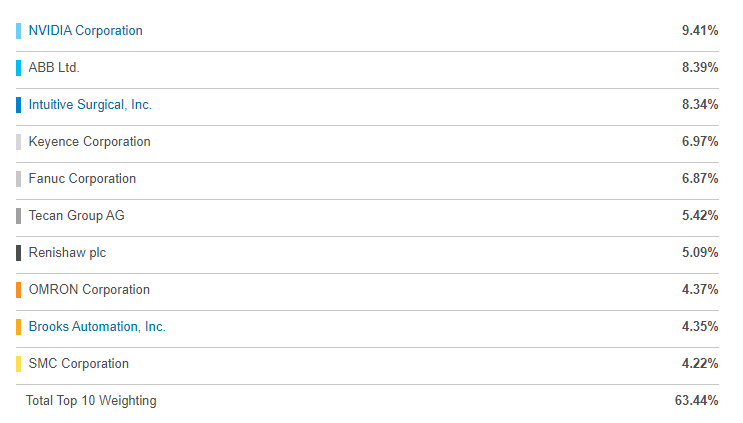

The Global X Robotics & Artificial Intelligence ETF (BOTZ) is one way to play the robotic theme. The ETF has an expense ratio of 0.68%. The ETF focuses on companies from developed markets involved in the production and development of robotics and AI and is based on an index that uses a market cap approach to select and weight its components. The company must derive a significant amount of its activities related to robotics and AI.

This ETF has good geographical diversification, with Japan having the largest exposure at c.45% followed by the US at 32.5%. The top 10 holdings of the company are seen below which encompass 63% of the fund holdings. It is hence a rather concentrated ETF.

The ETF has vastly outperformed the S&P500 index (represented by SPY ETF) over a 1-year horizon.

Best Cloud Computing ETF: WCLD

The Covid-19 pandemic has accelerated the rise of cloud computing. With social distancing measures in place, a lot of businesses have deployed cloud computing as a primary means to run their core businesses.

Cloud computing is disrupting both the technology sector as well as the investing community. It has become part of our lives by fundamentally altering how we consume, process, and share information in the digital age. The trend toward cloud-based solutions hence offers a compelling, long-term opportunity for investors looking to gain exposure to a rapidly developing segment of the technology sector.

Cloud companies tend to be vertically integrated. They create software for one specific industry. Each vertical has its own unique set of needs. In a vertical market, a company like Veeva, which goes deep in health care and provides CRM (customer relationship management) for life sciences, has an 80% market share. Vertical software has more chances to be a ‘winner-take-all’ market, and once you are a market leader, you can cross-sell products.

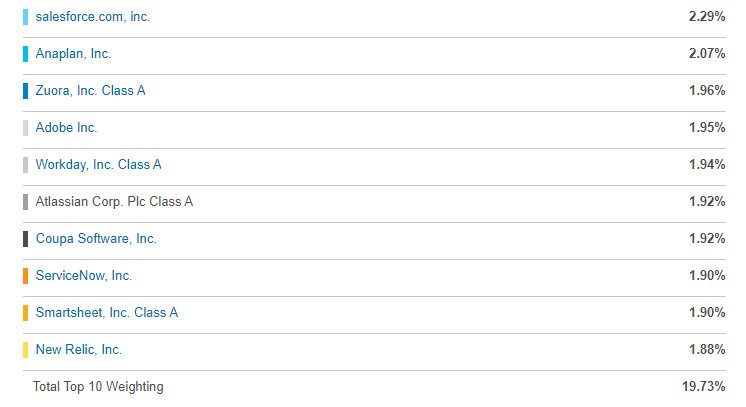

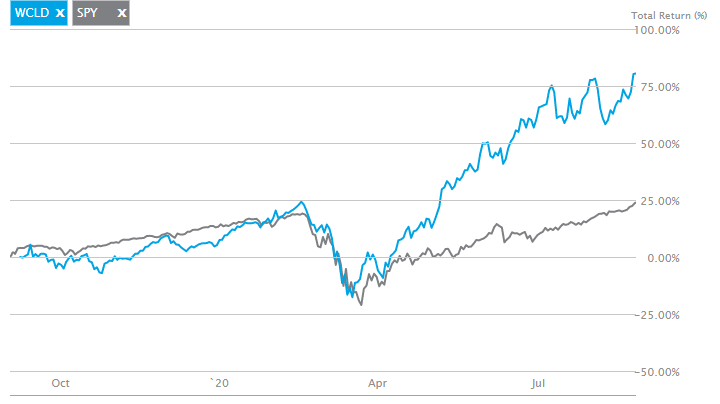

Up more than 60% this year, the WisdomTree Cloud Computing ETF (WCLD) is proving the cloud computing theme is here to stay and that there’s plenty of room for competition and innovation among cloud ETF

The WisdomTree Cloud Computing Fund seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers.

To be included in the index, a company must: have a revenue growth rate of at least 15% for each of the last two full fiscal years for new Index constituents or a revenue growth rate of at least 7% in at least one of the last two fiscal years for existing constituents, the company’s stock must be listed for trading on a US stock exchange and meet minimum liquidity requirements.

The Top 10 holdings of this ETF only account for roughly 20% of the portfolio, with household names such as Salesforce, Adobe, etc in the top 10 list. However, there are also unique names such as Anaplan, Zuora, Smartsheet, etc which most investors would not have heard of.

One of the best performing thematic ETFs in 2020, it is not surprising that it has significantly outperformed the S&P500 index

Best Video Games ETF: ESPO

The video game industry has capitalized on broad trends, including a rise in consumer demand for interactive entertainment, a move away from more expensive traditional media to cheaper alternatives, and the clout of younger consumers who are more enthusiastic about video games.

It’s no secret anymore that gaming, or esports, is big business and that trend should continue in 2020 and beyond. Importantly, video game equities have a reputation for performing well after the past instances of virus situations comparable to COVID-19. For example, in 2008 and 2009, gaming companies saw steady or growing cash flow while the recession took down other sectors and the broader economy.

A way to play it would be through the VanEck Vectors Video Gaming and eSports ETF (ESPO). ESPO seeks to track the performance of the MVIS Global Video Gaming and eSports Index (MVESPO). The index is a rules-based, modified capitalization-weighted, float-adjusted index intended to give investors a means of tracking the overall performance of companies involved in video gaming and eSports.

The fund is primarily focused on big-name game developers and hardware companies from the US, Japan, China, and Korea.

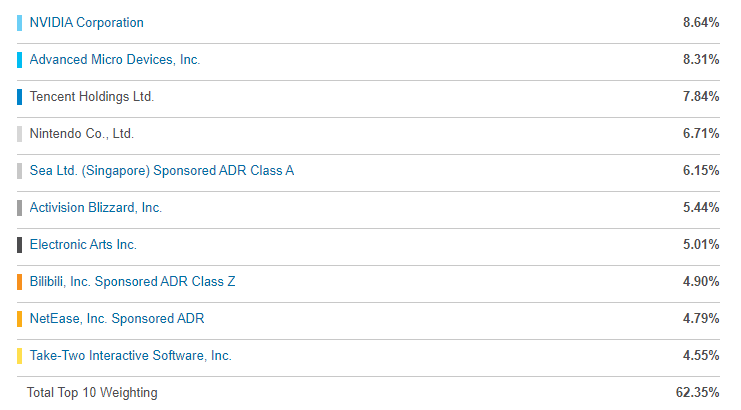

The top holding of the fund is Nvidia with encompasses 8.64% of the portfolio followed by AMD at 8.31%. These are the two hottest stocks currently in the semi-conductor space. It might seem weird that Nvidia is the top holding for ESO but note that the former is a major global supplier of computer game graphics chips which is a key component for all gaming hardware.

Other top holdings include well-known gaming companies such as Tencent, Nintendo, Sea Ltd, ATVI, EA, etc.

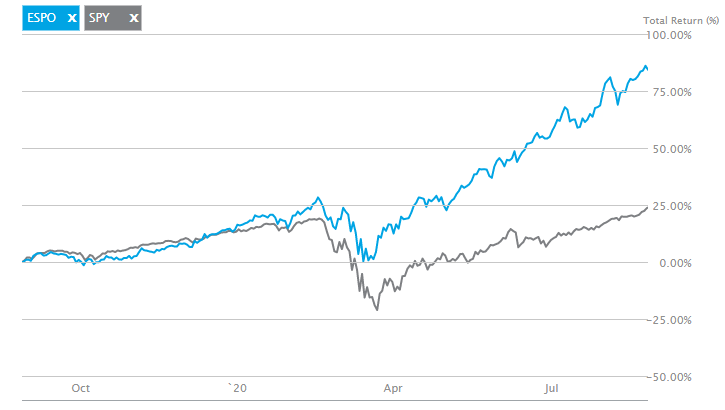

This is clearly another ETF that has vastly outperform the S&P500 index over the past 1 year.

Best Next Generation Internet ETF: ARKW

A more “broad base” ETF that will invest in stocks that are the future of the internet. These stocks can be in the cloud sector, or Big Data sector or IoT sector, etc.

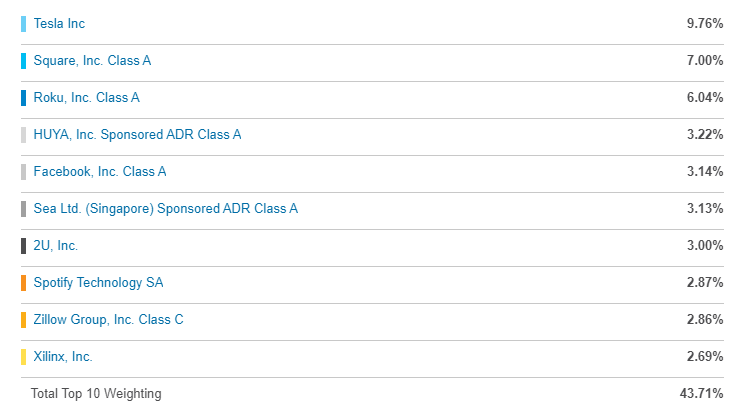

While standard internet ETFs rely on Amazon (NASDAQ: AMZN) and Facebook (NASDAQ: FB), among others to drive returns, the ARK Next Generation Internet ETF (ARKW) allocates almost 18% of its combined weight to Tesla (NASDAQ: TSLA) and Square (NYSE: SQ), two of this year’s best-performing names regardless of sector or industry.

ARKW centers its investments on the long-term growth of capital where 80 percent of its assets in domestic and foreign equity securities of companies coincide with the ETF’s investment theme of Web x.0. This includes companies in the forefront of web technology, such as cloud computing, cybersecurity, big data, and machine learning. The fund also features blockchain, bitcoin, and e-commerce exposure, among other allocations to hyper-growth segments.

For those who are interested to find out the rationale behind how its star portfolio manager, Cathie Wood selects the stocks that go into ARKW, she has a youtube channel that she talks about it as well as her thoughts on macro factors driving the economy and market today.

The fund’s top holding is in Tesla which encompasses 9.8% of the portfolio followed by Square and Roku with 7% and 6% respectively.

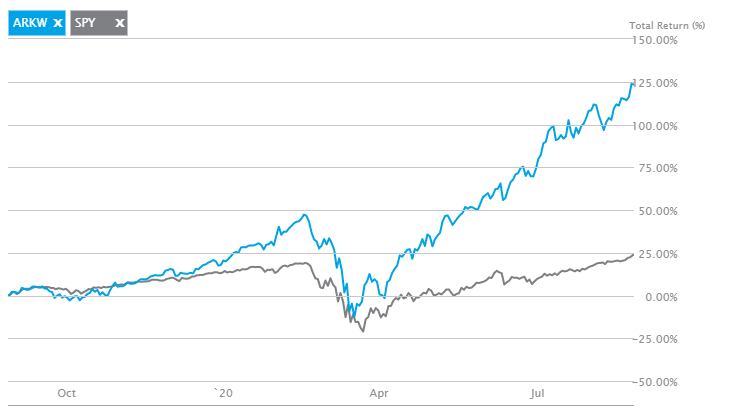

On a YTD basis, this ETF has generated 90% in returns, possibly the best performing unlevered ETF out there. Recall that in our previous article highlighting the best large-cap ETFs with the most consistent performance over the past decade, none of them have generated more than 25% return on a YTD basis.

Can ARKW continue to show that outperformance beyond 2020? Well, it does hold some of my favorite stocks such as Square, Roku, and FB as its top holdings.

Best Online Retail ETF: IBUY

The way we shop is changing. Today, the biggest shopping malls and stores fit right into our desktop and mobile screens. This shift has disrupted the retail landscape and has put brick and mortar stores under tremendous pressure. The emergence of online platforms, busy lifestyles, better incomes, penetration of mobile devices and access to the internet have altogether been instrumental in bringing a shift in the retail consumer mindset and mode of purchase.

The COVID-19 pandemic is speeding along with the move to e-commerce as malls and non-essential retailers across the U.S. are temporarily shuttered. This respiratory illness could have long-ranging implications for retailers.

According to GlobalData, when stores re-open many consumers will be reluctant to visit busy locations due to lingering concerns around their health. Consumers may switch to third-party pickup options instead, especially lockers, as this fulfillment method has no contact with others, as long as shoppers are reassured about the cleanliness of the facilities.

My favorite ETF to play the shift towards online retailing is through the Amplify Online Retail ETF (IBUY) which is the original online retail ETF, debuting more than 4 years ago. The fund tracks the EQM Online Retail Index which requires member firms to derive at least 70% of sales from online or virtual venues.

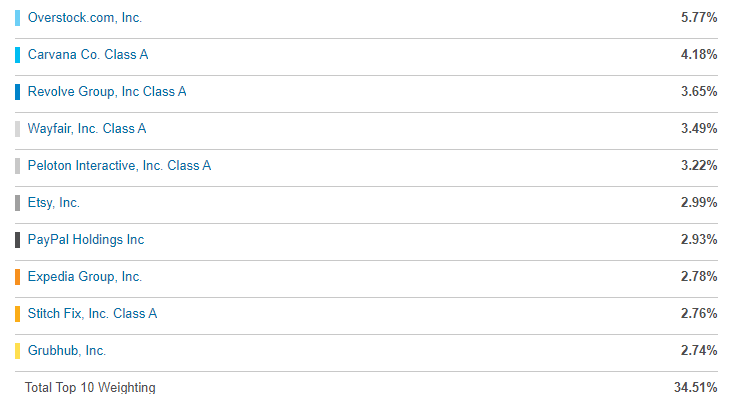

The table below shows its Top 10 holdings. What is amazing is that IBUY is one of the best performing unlevered ETF in 2020 (slightly behind ARKW) and this was achieved without being overweight on Amazon (which only accounts for 2.74% of the portfolio)

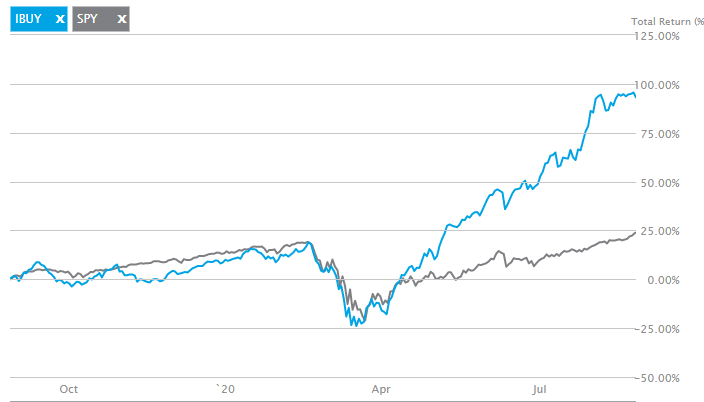

On a 1-year basis, the counter generated returns of 94% with a 3-years annualized performance of 38.5%. This hugely outperforms that of the SPY index.

Best Biotech Retail ETF: ARKG

Biotech is an exciting area to invest in. It is a recession-proof industry, one which is focused on developing cures for diseases and medical conditions. You need these companies and you need to spend on their products, in the unfortunate scenario that you have a disease/virus beyond the mild flu (think COVID), recession or no recession.

Biotech has a unique business model, one which requires heavy investment in R&D that may never yield a profit for years. Even when a project is successful, the path to profitability can be a long and grueling one, requiring multiple product testing before it finally gets approved by the relevant authority.

But once it does so with a long-lasting patent to it, the rewards are sweet. Finding the right Biotech company to invest in is often the key. Most will stick with large-cap names such as Gilead, Amgen, etc. Nothing wrong with this strategy.

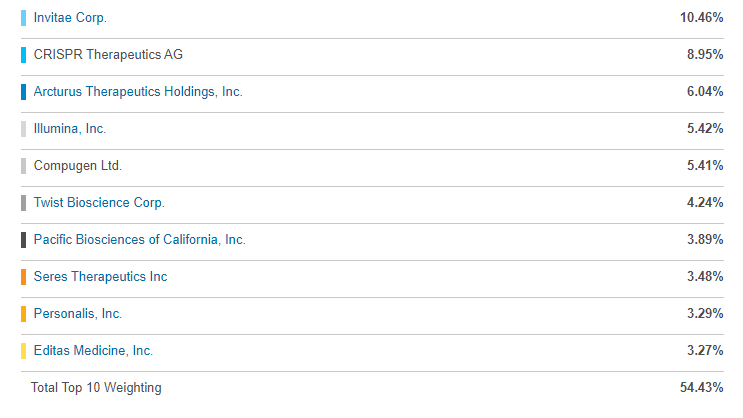

However, for those who are slightly more risk-averse, you can consider the ARK Genomic Revolution ETF (ARKG), again managed by Catherine Wood which invests in smaller cap biotech names such as Invitae, CRISPR therapeutics, Illumina, etc as its top holdings.

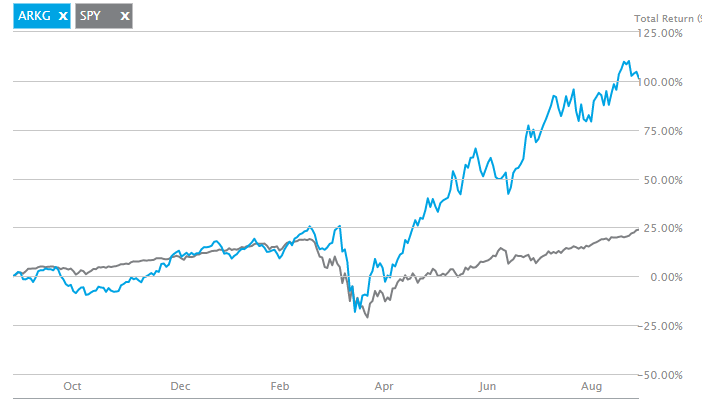

Again, this is likely considered as a “higher risk” biotech play, nonetheless a very attractive one based on its share price performance over the past 1-year.

Compared to its closest peer, the iShares genomics Immunology Healthcare ETF (IDNA), ARKW has outperformed IDNA by a massive 55ppt on a YTD basis (ARKW: 80% return vs. IDNA: 25% return)

Best Cyber Security ETF: HACK

As more and more businesses turn to cloud technology, cybersecurity will continue to gain traction as a viable investment opportunity. The industry is expected to capitalize on the increased spending for cybersecurity as more companies adjust to working remotely. According to a LearnBonds.com report, 70% of organizations see the value of raising investments in cybersecurity solutions, and around 55% of major organizations will bolster their investments in automation solutions, Security Magazine reports.

For most investors who want to take advantage of this growing market, it makes sense to invest in a wide spectrum of cybersecurity stocks through exchange-traded funds (ETFs), versus just betting on one or two stocks.

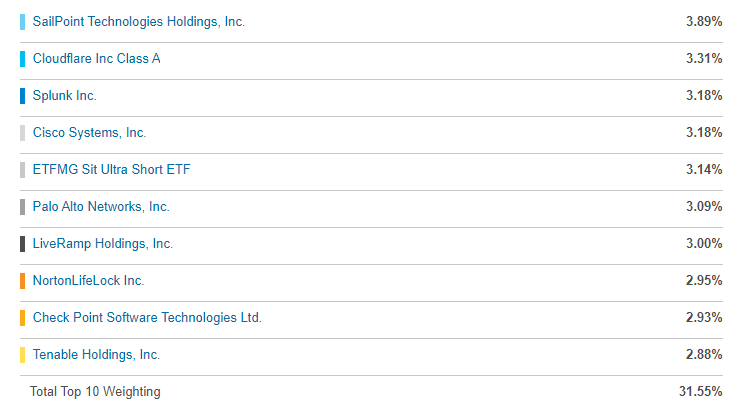

My favorite play here is through the ETFMG Prime Cyber Security ETF (HACK). Hack was launched in Nov 2014 to trach the ISE Cyber Security index which focuses on companies developing hardware and software to protect data and those providing cybersecurity as a service.

It has a unique, cybersecurity-focused take on the technology segment that gives it a small-cap tilt, with concentrations in software and IT services that you won’t find in a plain-vanilla fund

The top 10 holdings include names such as SailPoint, Cloudflare, and Splunk which on the surface looks to be big data companies or CDN companies but are key players in terms of providing security solutions to corporations.

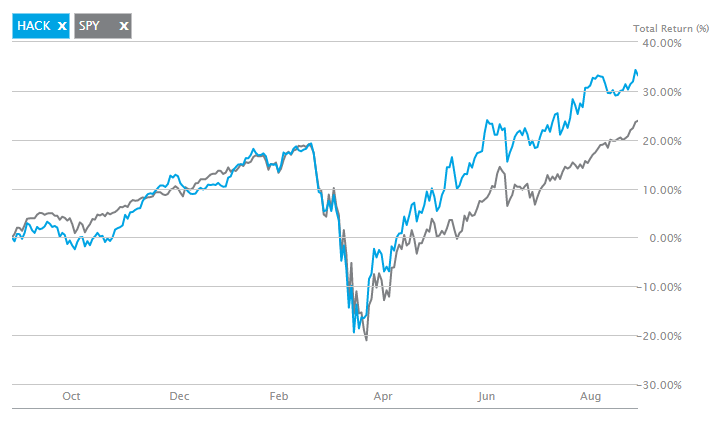

While its 1-year performance has not been as outstanding as some of the thematic ETFs in this list, it has still soundly beaten the S&P500 index over this horizon.

Best 5G ETF: FIVG

I have written about investing in the 5G themes in several articles. In this article: 4 blue-Chip stocks to play the 5G Evolution, I highlighted 4 starter stocks that one can partake in to gain exposure in the coming 5G evolution.

In these articles: 6 Top Investment Trends and Top 8 Technology Trends I highlighted names that will benefit from 5G development, stocks such as American Tower, Crown Castle International that provide communications infrastructure as well as chip names such as Intel and KLAC.

Just as the transition to cars and airplanes opened up a world of infinite possibilities in the world of travel, so will the transition to 5G that will make self-driving cars, Virtual Reality, edge computing, advanced robotics, etc a not too distant reality. Qualcomm sees 5G unlocking $13.2trn in global economic output by 2035.

Therefore, jumping on the 5G bandwagon might be the once in a lifetime opportunity that you don’t want to miss.

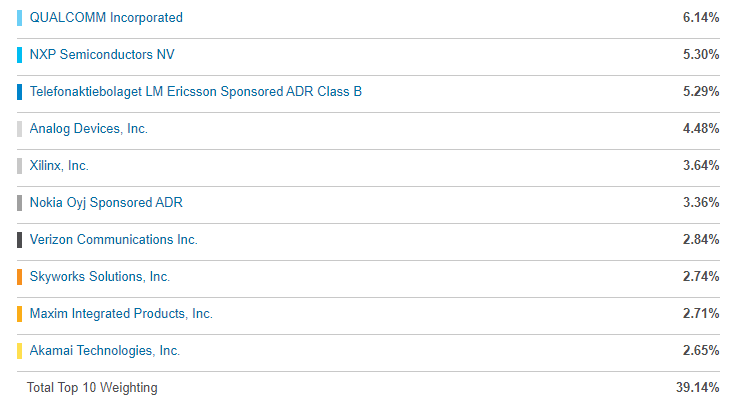

My favorite way to play this trend is through the Defiance Next Gen Connectivity ETF (FIVG). FIVG offers investors a highly concentrated pure-play investment into the leaders of the 5G revolution at a very low cost, with an expense ratio of only 0.3%.

FIVG is weighted in four tiers. The first tier, weighted at 50%, is comprised of companies predominantly associated with core cellular networking and satellites operating in the C-band wireless spectrum.

The second tier, weighted at 25%, consists of cellphone tower/center data REITs, service providers as mobile network operators, or companies supporting the infrastructure of these organizations.

The third tier, weighted at 15%, focuses on hardware and software improving the quality of service, and network testing and bandwidth optimization equipment.

The last tier, weighted at 10%, is tied to enhanced mobile broadband modems, new radio technology for connected devices, or optical fiber cables.

The ETF top holding is in Qualcomm which encompasses 6.14% of its portfolio.

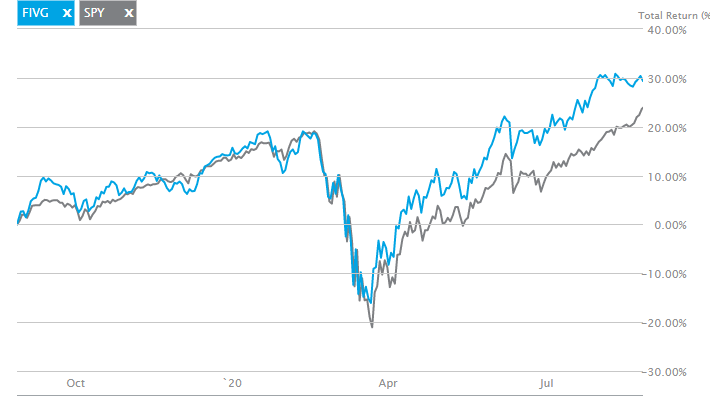

In terms of performance, similar to HACK, it has not been as outstanding as the other ETF in this list but still manages to eke out a slight outperformance vs. the S&P500 index over a 1-year horizon.

Best Autonomous Vehicle ETF: KARS

Autonomous vehicles, popularly known as self-driving vehicles, are attracting a great deal of attention from the media and investors. That attention is warranted because autonomous vehicles are already on our streets.

However, far-far away from ordinary man’s thoughts, in the land of innovative technologies and amid top-notch leaders of the race of innovation, self-driving cars are no more a far-off star.

The involvement of big techs including Google, Microsoft, Amazon, and others has stamped the progressive prospects of autonomous technology. This has subsequently created a positive image of self-driving cars among most of the population.

Moreover, according to Bloomberg, here the top 5 leaders of autonomous vehicles landscape in 2020.

- Waymo

- Cruise

- Argo AI

- Aurora

- Aptiv

A good way to play this trend is through the KraneShares Electric Vehicles and Future Mobility Index ETF (KARS). KARS focuses on companies engaged in one or more of the following sub-industries: electric vehicle production, autonomous driving, shared mobility, lithium and/or copper production, lithium-ion/lead-acid batteries, hydrogen fuel cell manufacturing, or electric infrastructure. Selected stocks are sorted into tiers by market capitalization; the largest tiers get the most weight, but holdings are equal-weighted within the tiers. In terms of sector exposure, the portfolio is heavily weighted toward consumer discretionary and information technology names.

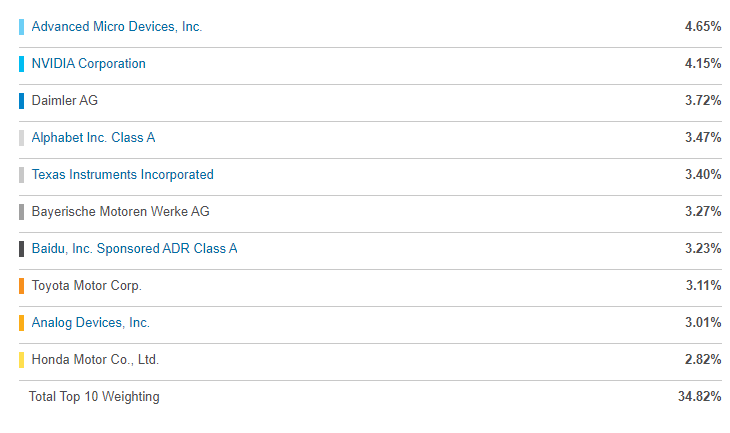

Top 10 holdings of the stocks include AMD, Nvidia, Daimler, Alphabet, Baidu, etc.

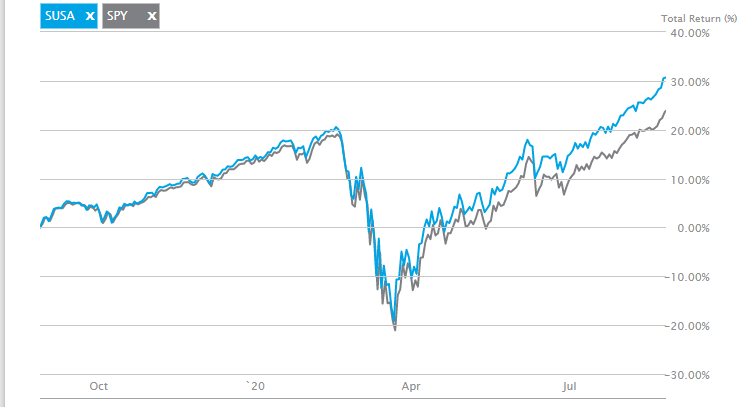

In terms of performance, the ETF has generated pretty decent outperformance over the S&P500 index. This is particularly so considering that there is no/minimal Tesla exposure in the fund.

Best ESG ETF: SUSA

ESG (Environmental, Social, and Governance) investing refers to a class of investing that is also known as “sustainable investing.” This is an umbrella term for investments that seek positive returns and long-term impacts on society, the environment, and the performance of the business.

Companies across sectors are increasing emphasis on ESG. A 2020 Fidelity survey pointed out that over 90% of its analysts report that “some or all of the companies they cover are focusing more on ESG, following a pronounced increase in climate change awareness and corporate reforms.”

According to a Morgan Stanley survey, 84% of millennials give importance to the ESG impact. Millennials are poised to inherit over $68 trillion from their predecessors by 2030, which is five times the wealth they have today. Thus, the millennial ‘approach to investing’ will be an important determinant in the demand for ESG investments going forward.

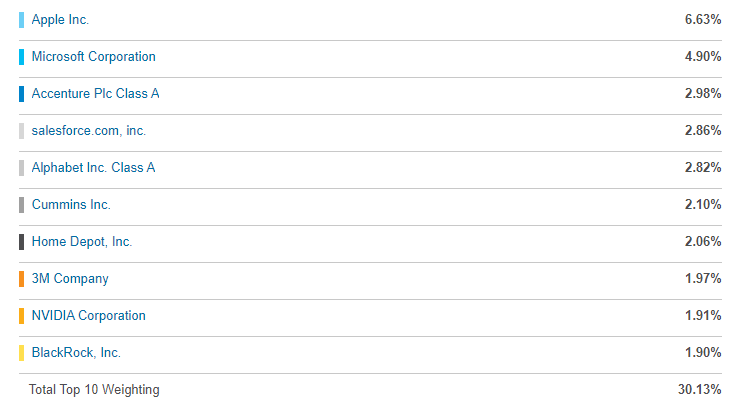

The iShares MSCI USA ESG Select ETF (SUSA) tracks an index of 250 companies with high environmental, social, and governance factor scores as calculated by MSCI. It holds about 100 MSCI USA companies with the highest ESG ratings, determined by the degree to which they reflect socially conscious values concerning the environment, society, and corporate governance. It then weights holdings in proportion to their scores. At the same time, the fund caps security weights at 5% and limits sector deviation from the broader MSCI USA index to 3%, ensuring that the fund doesn’t deviate wildly from the broader equity market.

Conclusion

The above list shows my favorite thematic ETFs which are ideal plays to partake in some of the hottest structural trends in the coming decade. These ETFs, unlike your passive index ETFs, are actively managed where the fund managers select a basket of 30-80 stocks that are best exposed to the theme in focus.

Do however note that many of these ETFs 1) do not have long term track record, 2) are relatively small in AUM and thus liquidity and 3) will have higher expense ratio compared to passive index ETFs.

Nonetheless, they have demonstrated their ability to significantly outperform the S&P500 index YTD and I believe these structural trends will remain in vogue in the coming decade.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- Top 20 Best Growth Stocks to buy [2020]

- 17 US Companies most at risk from escalating US-China tensions

- 6 Top Investment trends (2020): Finding safe havens in a pandemic-driven market

- Top 8 technology trends accelerating due to COVID and the stocks to benefit from it

- 5 outperforming stocks that crush the S&P500 in 1Q20

- Best performing ETFs which consistently outperform the S&P500 over the past decade

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Thematic ETFs partaking in the hottest trends”

There are some attention-grabbing points in time in this article but I don’t know if I see all of them heart to heart. There may be some validity however I’ll take maintain opinion until I look into it further. Good article , thanks and we would like extra! Added to FeedBurner as effectively