I have written about UCITS ETFs taxation in the past but will just like to elaborate on this topic from the angle of a retail investor looking to invest in these ETFs. Are they worth the hassle and are they that cost-efficient after all? The conclusion might surprise you.

Before I embark on this topic, let me briefly talk about the difference between US ETFs and UCITS ETFs.

US ETFs

US ETFs are among the most popular investment asset for both new as well as seasoned investors. ETFs essentially provides an easy solution for an investor to purchase a basket of assets, hence achieving the purpose of diversification and removing the problem of unsystematic risk (risk associated with the exposure to any single stock).

The US is home to the largest and most popular ETFs of them all. You can find almost any type of ETFs which are domiciled (aka registered) in the US.

However, the problem for most foreign investors, including Singaporean investors is that they are not tax-efficient. What do I mean by that?

Foreign investors of US-domiciled ETFs will typically incur 2-types of taxes. The first is Dividend Withholding Tax and the second is Estate Taxes.

Dividend Withholding Tax

I wrote about the issue of US dividend withholding tax previously in this article.

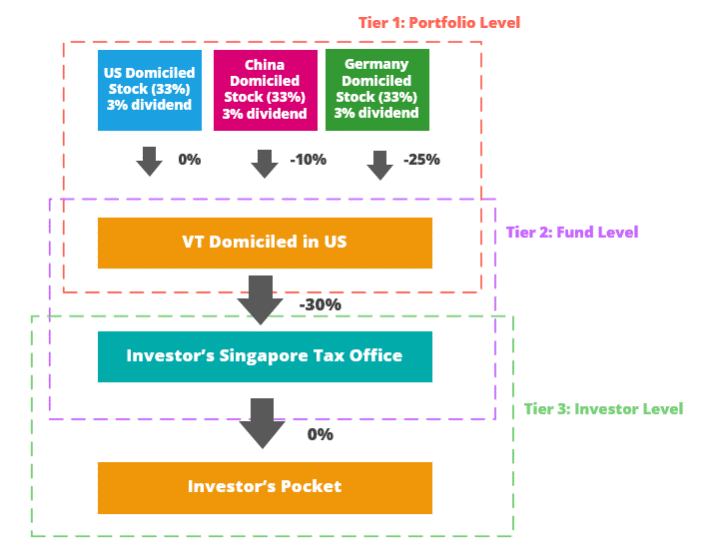

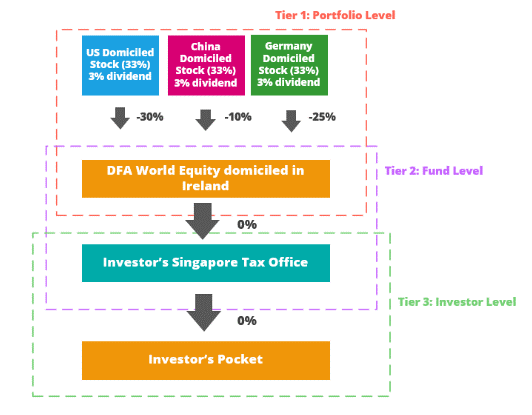

There are typically 3 Levels of taxes pertaining to dividends.

The first Level is the Portfolio level. This is when the individual stock declares a dividend to the ETF which holds the stock.

The second level is the Fund Level. This is where the fund withholds a certain tax amount to the country where the investor is based.

The third level is the Investor level. This is where the country of the investor further places a tax on the dividend received before transferring the remaining amount ultimately to the investor.

For a US-domiciled ETF like VT, there are essentially 2 layers of taxes for a foreign investor, first on the Portfolio level followed by the Fund Level.

You can see from the above diagram that US stocks do not incur a tax on the Portfolio level. However, if the fund holds other country stocks, there will be a tax rate on the portfolio level.

Subsequently, on the fund level, there is a second level of tax which is the typical 30% dividend withholding tax that we are accustomed with.

There is usually no “Investor level” tax for a Singaporean investor.

So take for example a US-domiciled ETF like VT (Vanguard Total World Stock ETF) which has a low expense ratio of 0.09%. However, assuming that VT pays a dividend yield of 3%, the “indirect cost” stemming from the withholding tax could be approx. 1.16%.

Add both together and your ALL-IN recurring annual cost becomes 1.25%, no longer just the low 0.09% Expense Ratio of the fund.

I will talk about how UCITS ETFs lower that cost in a moment. For now, let’s talk about the second issue with US ETF which is the estate taxes.

Estate taxes

There are often contradicting statements on US estate taxes. The usual understanding is that for a non-residential alien (aka foreign investor), there are going to be US estate taxes charged when you as the beneficial owner of US stocks pass away.

There is typically an exemption amount of US$60k but beyond that, there could be estate charges as high as 40% incurred on the remaining amount.

This is a guideline from TD Ameritrade Singapore which does state that a tax liability might arise in the event the beneficiary passes away and the account is not under a “Joint Account” structure. If it is under a Joint Account, the assets will typically be transferred to the remaining account owner.

The Bogleheads Wiki website also stated that estate tax is a major US tax trap and one that you should try to avoid at almost any cost.

However, there are also other statements by brokerages based here in Singapore that US Estate taxes are not an issue for Singaporean investors and they will make the necessary arrangements to transfer ownership of the assets to the deceased next-of-kin without having to incur that hefty estate tax duties. How true is this I am NOT certain.

So what is the solution around potentially reducing the dividend withholding tax amount associated with US-domiciled ETFs as well as the issue of estate taxes? That is where UCITS ETFs come in.

UCITS ETFs

UCITS ETFs are ETFs domiciled in Europe and subject to European Union regulation. They are increasingly popular among investors in Latin America, Asia, and other markets due to tax advantages.

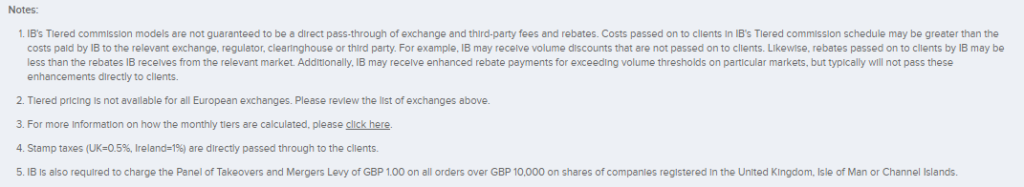

Many UCITS ETFs are domiciled in Ireland and can be purchased on the London Stock Exchange and Euronext exchange, so you will need to find a broker that offers these exchanges to trade on. A popular brokerage option is Interactive Brokers (IB). (do note that because IB is US-based, this means that if you hold more than $60k in CASH, there might also be an issue with estate taxes)

Dividend Withholding Tax

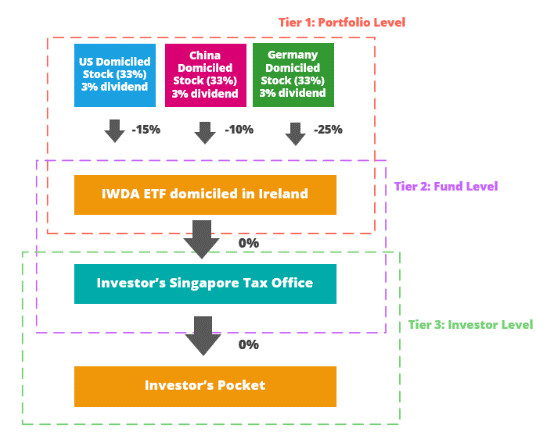

When it comes to dividend holding tax, UCITS ETFs have a more tax-efficient structure as compared to US ETFs for a Singaporean investor. Let’s take the example of the IWDA ETF which is domiciled in Ireland.

Due to the special tax arrangement between the US and Ireland, US-domiciled stocks, when they declare a dividend, are only taxed at a 15% rate on the portfolio level.

Compare this to VT which is at 0% on the portfolio level and the UCITS ETF might not seem so tax-efficient at first glance. However, it is the fund level tax which plays a huge difference.

Instead of the 30% rate withheld when the dividend passes to the investor’s Singapore tax office in the case of a US-domiciled ETF like VT, UCITS ETFs like IWDA does not pay any fund-level withholding tax.

Using the same 3% yield example, the withholding tax cost for VT is at 1.16%. The withholding tax cost for IWDA on the other hand is only 0.525%. Despite the higher expense ratio of 0.20% incurred by IWDA, the total ALL-IN cost for IWDA is at 0.725% vs. VT at 1.25%, or a good 0.525% savings each year.

Estate taxes

For UCITS ETFs, there are no concerns over estate taxes. When you hold a UCITS ETF, you DO NOT directly hold any US assets. This means that you are now entirely protected from unpleasant US estate tax surprises. The US estate tax cannot ‘look through’ a fund or ETF to the ultimate individual owner of shares in that fund or ETF.

Interim conclusion

Based on the above, the conclusion seems to rule in favor of UCITS ETFs as the more tax-efficient investment asset to own for a Singaporean investor. I believe the tax savings effect from dividend withholding is pretty well-known, however, there are other concerns over liquidity and bid-ask spread of these ETFs which are not as liquid as US-domiciled ETFs. The variety and offerings of UCITS ETFs are also vastly lower compared to that of US ETFs.

The issue pertaining to US Estate taxes remains a grey area. Are US brokerages based here in Singapore able to help address or solve this problem effectively for local investors?

Transaction costs associated with UCITS ETFs

I currently purchase US ETFs using the TD Ameritrade platform which charges a commission rate of ZERO on stocks/ETFs purchased and sold. You can’t go any lower than that.

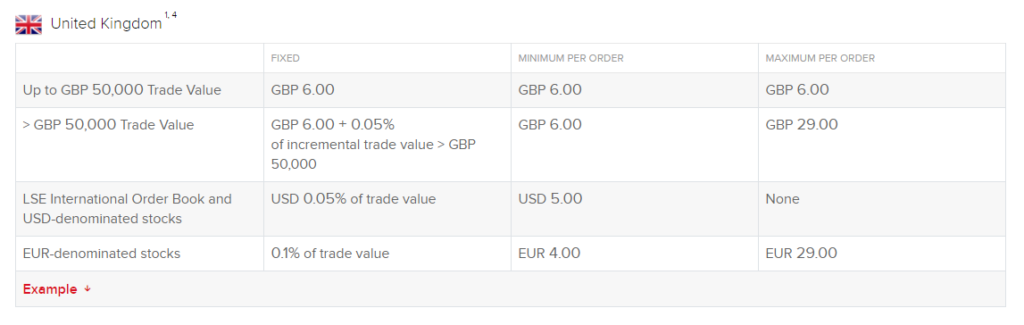

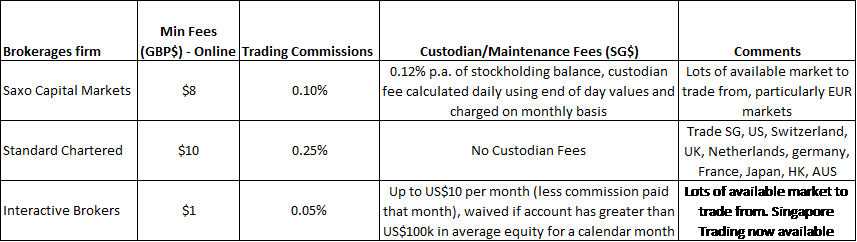

On the other hand, if I were to purchase UCITS ETFs directly through a platform such as Interactive Brokers which is among the lowest cost brokerage platform available for a Singaporean investor, the min commission amount on the fixed comms structure charges a rate of USD5. [Update]: A reader highlighted that for a small investment amount, one should select the Tiered pricing which is at GBP1. I do concur with that and apologize for the confusion. Only if your investment amount is rather significant (>GBP15k), ie using lump-sum investing, should you select the Fixed pricing option.

For Stanchart, unless you are a priority client (which will not incur min fees), the min fee is GBP10. For Saxo, that amount is GBP8.

Do note that there will be a stamp tax of 1% for Ireland-domiciled stocks. For Ireland-domiciled ETFs, there is NO 1% stamp duty charge according to this document.

For US ETFs through TD, while I will not be able to set up a standing instruction with my bank for a recurring purchase of a particular ETF based on a Dollar Cost Averaging (DCA) approach, I can do that manually and for a low capital injection, without incurring ANY commission cost.

For UCITS ETFs, it is just not possible to engage a DCA approach AFFORDABLY for the typical retail investor on most trading platform that provides UK markets.

Let say for example I wish to purchase S$500 (an affordable amount for a new investor to start investing every month) worth of IWDA every month using a DCA approach. That equates to GBP281 (based on the current exchange rate).

With a commission rate of GBP1, that will equate to a 0.35% transaction cost, and because I am doing it repeatedly every single month, I will be paying a total of GBP12 in commission cost for an annual capital outlay of (281*12) = GBP3372 (assuming same exchange rate).

Commission cost = 0.35%

Expense ratio = 0.2%

Dividend Withholding Tax = 0.525% (assume 3% yield)

Total ALL-IN Recurring annual cost = 1.075%

Compare this to buying a US-domiciled ETF such as VT which has ZERO transaction cost on a recurring monthly basis.

Expense Ratio = 0.09%

Dividend Withholding Tax = 1.16% (assume 3% yield)

Total ALL-IN Recurring annual cost = 1.25%

The cost is rather comparable assuming you use the IB platform which is extremely competitive when it comes to commission. If you use Saxo or Stanchart, that will definitely not be the case. Do however note that there could be custody charges for using the IB platform if your AUM is less than $100k and you do not transact frequently. That might potentially offset any commission savings for the small-time retail investors.

How about if one engages a lump-sum investing approach?

Assuming a lump sum investment of GBP10k, the commission cost will thus be approx.

Variable commission cost = 0.05% * 10,000 = GBP5

Total ALL-IN Cost (including expense ratio and withholding tax) = 0.05% (commission) + 0.20% expense ratio + 0.525% = 0.775%

So matter how you slice and dice it, because of the additional 1% stamp charges for Ireland counters, the overall recurring charges (assuming you invest lump sum once every year instead of every month) will still be higher than that of investing in US-domiciled ETFs, even after taking into consideration its tax-efficiency.

Only when the amount is substantial, will there be more savings on the commission side. Again this is based on the IB rate which is very competitive.

Another alternative of UCITS investment

While UCITS ETFs are typically a tax-efficient asset class to invest in rather than US ETFs, after taking into consideration the sizable commission costs involve in purchasing these UCITS ETFs for the typical retail investor wishing to engage in DCA approach, the overall cost-benefit for buying into UCITS ETFs is greatly reduced.

The alternative will be to select Robo advisors which partake in these UCITS ETFs, for example, Endowus which invest in Dimensional Funds which are domiciled in Ireland. Although the underlying asset class is unit trusts instead of ETFs (unit trusts typically have higher expense ratios), this might be a way to avoid the hefty commission fees paid for the direct purchase of UCITS ETFs. Concurrently, such a structure will allow for a DCA investment approach to be executed.

Unlike UCITS ETFs, a unit trust such as Dimensional domiciled in Ireland will incur a dividend tax rate of 30% (vs. 15% for UCITS ETFs) for dividends declared by the US companies. The key similarity is on the fund level where there is a 0% tax rate.

So such a structure will have an overall cost (expense ratio + Dividend Withholding tax) that is slightly higher than UCITS ETF but lower than US-domiciled ETFs.

US-domiciled ETFs cost = 1.25%

DFA fund cost = 1.1%

UCITS ETF cost = 0.725%

However, after taking into consideration platform costs as well as commission costs, this might be how the ALL-IN recurring cost will look like for an investor with a typical investment amount of S$500/month

US-domiciled ETF (VT) = Expense Ratio (0.09%) + Dividend Withholding tax (1.16%) = 1.25%

DFA fund = Expense ratio (0.43%) + Dividend Withholding tax (0.67%) + Endowus platform fees (0.60%) = 1.7%

UCITS ETF (IWDA) = Expense ratio (0.20%) + Dividend Withholding tax (0.525%) + commission costs (1.35%) = 2.075%

Conclusion

We seem to derive the surprising conclusion that investing in UCITS ETF is not so cost-efficient after all, especially when we account for commission costs for a small investment amount, which at the moment encompass the largest bulk of the total fee structure. This is especially the case for brokerage platforms such as Saxo and SC (not so much for IB, where the Tiered pricing is very competitive)

The advantage that US ETFs have over UCITS ETFs is that many brokerages have eliminated commission costs for the purchase of US stocks/ETFs. This makes it very easy and affordable for a typical retail investor to purchase US stocks with a small capital outlay and repeatedly.

However, the key benefit of UCITS ETFs remains the point on estate taxes. Are investors who purchased US ETFs really liable to estate taxes here in Singapore or do the online brokerages (TD, IB, Saxo, etc) already have an existing structure/solution in place to help Singaporean investors go round the key problem of estate taxes?

For those who have more insights on this matter, do feel free to comment in the comment section.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY T10 GREAT REASONS TO BUY REITS AND 3 REASONS TO BE CAUTIOUS [UPDATE 2020]

- HOW TO BUY REITS IN SINGAPORE. 10-KEY S-REIT QUANTITATIVE FILTER (PART 1)

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- HOW TO BUY REITS IN SINGAPORE. 8 ADDITIONAL FACTORS TO CONSIDER (PART 2)

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- BEST PERFORMING SINGAPORE REITS AMID CURRENT MARKET VOLATILITY

16 thoughts on “UCITS ETFs taxation: Are they that cost-efficient after all?”

By the letter of US law, all non-US residents are subject to estate tax above US$60K (US residents have a much higher threshold).

It is bad business for any broker to say this explicitly, so they either keep quiet or demur with a maybe/maybe-not non-answer.

The only way for direct US assets (like stocks, ETFs, bonds, cash, properties etc) not to be subject to estate tax is through trusts or companies domiciled in tax havens which have tax treaties with the US for this.

However, unless you’re a rich man or family office, the costs of personal trusts or companies is not worthwhile. The closest for a normal person is buying through UCITS, which is basically a company.

Hi Sinkie,

Thanks for dropping by. Your thoughts on setting up a Joint Account with your partner?

Hi RT,

In the paragraph just above your conclusion, you have commission costs for UCITS ETF as 1.35%, but in the “Transaction costs associated with UCITS ETFs” section you worked it out to be 0.35% so I’m not sure if I missed something here.

Hope you can clarify.

Thanks!

Hi Richard,

The 1.35% is based on using a brokerage platform other than Interactive Broker (IB). If you use IB it will be at 0.35% assuming you select the Tiered pricing structure.

Great article.

Potentially dumb question, but appreciate if you can help clarify.

If I were to hold some assets in UCITS ETF and some in US ETF, am i correct to say the estate tax wil only be applicable to my US ETF only not including the ucits one.

Thanks

Yes correct

Hi! I’m a beginner investor and chanced upon your website which is super helpful! Potentially a dumb and basic question, how did you calculate 1.16% withholding tax cost on VT’s dividend yield of 3%? I’m also trying to reconcile where does the 30% withholding tax fits into all of this calculation. Thanks to advice!

The calculation is slightly more complicated as compared to just using 30% * 3% yield, because we need to take into account the dividend withholding tax for foreign stocks in the portfolio on a portfolio level followed by the dividend withholding tax on the ETF as a whole because it is US domiciled (on a fund level)….

I believe the total expense % might need some fine-tuning, e.g.

“UCITS ETF (IWDA) = Expense ratio (0.20%) + Dividend Withholding tax (0.525%) + commission costs (1.35%) = 2.075%”

Here, for lump sum, the commission costs are one-time, whereas the expense ratio and with-holding tax are recurring annually.

And for DCA, the commissions might be recurring for the additional investments, but the expense ratio and with-holding tax would be increasing more, as the base gets larger each year.

Hence the significance of expense ratio and with-holding tax since both are % of the total cumulative investment on annual basis, whereas commission is a one-off at purchase and sale.

Thanks

Hi CK, thanks for dropping by and highlighting that. Duly noted

Hi RT,

Most welcome

Great article and well researched!

I am starting to switch some SGX and US stocks to UCIT ETS’s.

Thanks