Table of Contents

In part 1 of this 2-part series, I highlighted 10 ETF Investment Strategies which an investor can seek to replicate easily.

In this follow-up series, I will highlight the next 9 ETF Investment Strategies and conclude with a review of which of these 19 ETF Investment Strategies have been the most consistent and best performing over a short, medium, and long-term horizon.

Do remember to bookmark this page to get the most updated price data on these ETF investment strategies.

ETF Investment Strategies #11: Real Return

This is a strategy that allows one to benefit from increases in the price of goods and services ie inflation. This is close to our hearts given that inflation has been at an elevated level since 2022, a huge detraction from the benign levels we are so used to over the past decade.

While inflation has tapered over the past 6 months, it is currently still at a level that is beyond the “comfort zone” of the Fed’s target 2% level. Consequently, short-term interest rates are expected to remain high to combat inflation.

One way to combat inflation is to invest in certain asset classes that do well in a high inflationary environment. This is what the IQ Real Return ETF (CPI) seeks to achieve by investing in 3 asset classes: 60% TIPS Bonds, 30% equities, and 10% commodities.

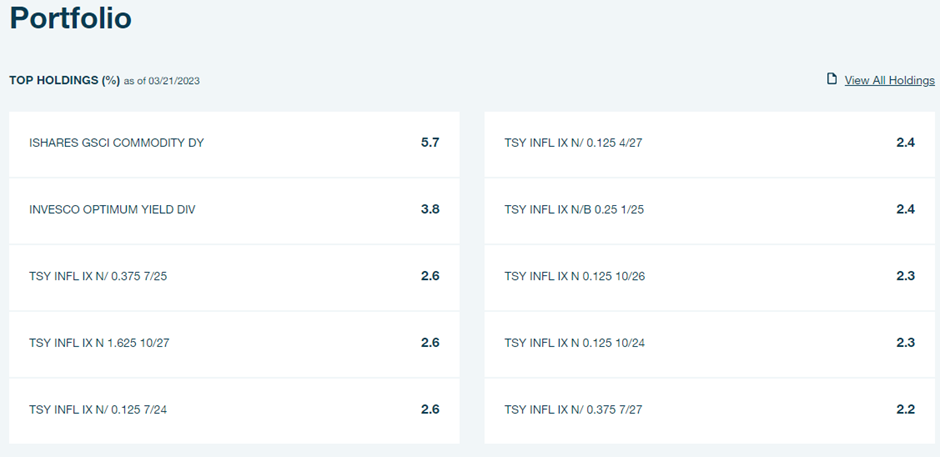

The diagram below shows the top holdings of this ETF, many of which are bond-related assets.

ETF Investment Strategies #12: Closed-End Funds

A closed-end fund is often actively managed by a fund manager and typically concentrates on a single industry, sector, or region. They are one of two major kinds of mutual funds, alongside open-end funds.

The main difference is that open-end funds can sell as many shares to investors as they want, whereas a close-end fund sells a fixed number of shares during its IPO and never reopens the fund to sell more.

One way to benefit from a strategy revolving around closed-end funds is to invest in those trading below their net asset value (NAV).

This is what the Saba Closed-end funds ETF (CEFS) seeks to do. It is an actively managed ETF that seeks to generate high income by investing in closed-end funds trading at a discount to net asset value and hedging the portfolio’s exposure to rising interest rates.

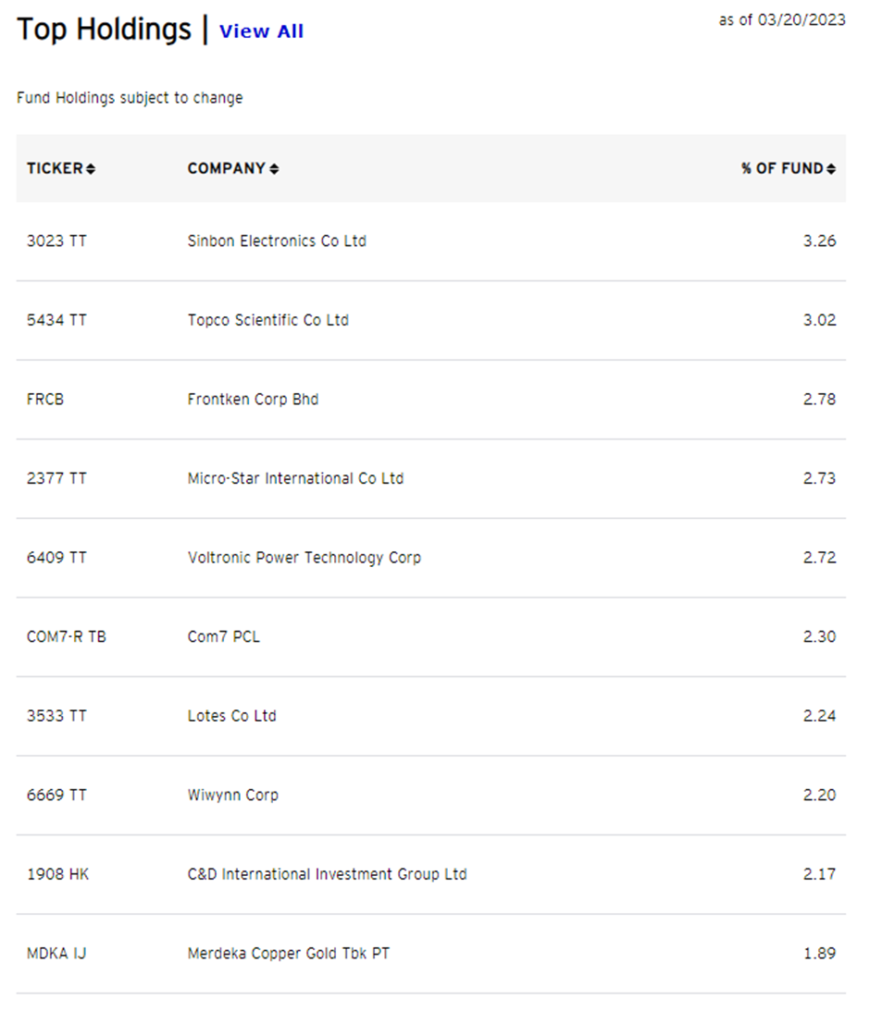

Below are the top holdings of this ETF.

Do note that this ETF pays out dividends every month. According to Saba Capital (issuer), it has an annual yield of approx. 9% which might appeal to dividend lovers.

ETF Investment Strategies #13: Emerging Markets with High Momentum

In Strategy number 2, we highlighted the ETF which gives exposure to investors seeking developed market stocks with high momentum. This is the sister ETF which focuses on emerging market stocks with high momentum.

This investment strategy can be executed through the Invesco DWA Emerging Markets Momentum ETF (PIE)

Stocks from Brazil, Chile, China, India, Indonesia, Philippines, South Africa, Thailand, Turkey, Taiwan, etc would be selected, assuming they pass certain technical characteristics.

Many of the Top 10 holdings stocks stem from Taiwan, as can be seen from the table below. These are likely stocks that most will not be familiar with.

ETF Investment Strategies #14: Guru Picks

What if there is an easy way for you to replicate the picks of the most brilliant investing minds in the world, or more fondly termed as stocks “gurus”. These are typically well-known folks in the investing world that runs their hedge fund, an arena that is out of reach for the man in the street.

The cost of investing with hedge funds can also be very high, with annual 2% management fees + profit share.

Now, one can replicate the picks of some of the top minds in the investing world cheaply through the Global X Guru Index ETF (GURU) which seeks to generate alpha over the broad market by investing in the highest conviction ideas from a select pool of hedge funds.

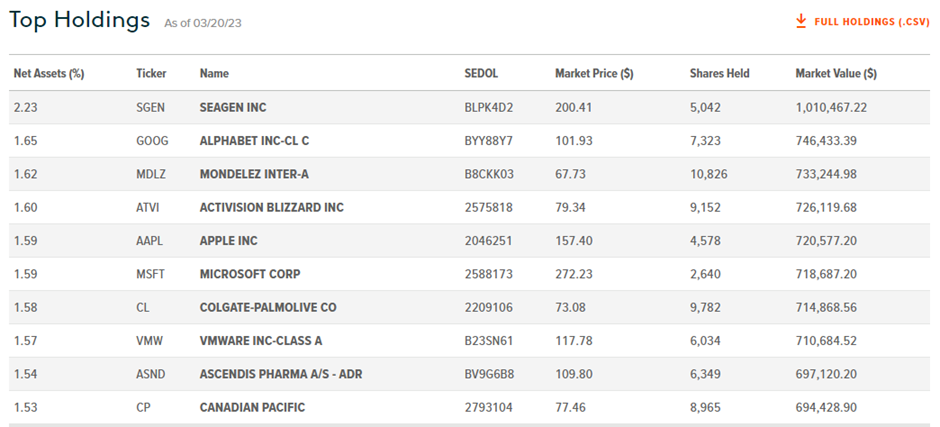

The fund’s top holding is Seagen (SGEN) a biotech company that has recently been a candidate for a takeover by Pfizer.

For those who are interested in checking out Investment Guru’s pick, do check out the dataroma website.

ETF Investment Strategies #15: Strong Buy-Rated Stocks

How about a strategy that allows you to purchase the strongest-rated stocks based on Raymond James & Associates, a mid-tier broker in the US? This can be done through the Invesco Raymond James SB-1 Equity ETF (RYJ) which seeks to purchase stocks rated as Strong Buy (1) by the broker.

While Raymond James is not exactly a top-tier broker in the US, it might be interesting to uncover some of the small-cap gems that a typical retail investor will not have the resources to uncover. Thus we leave it to the big boys.

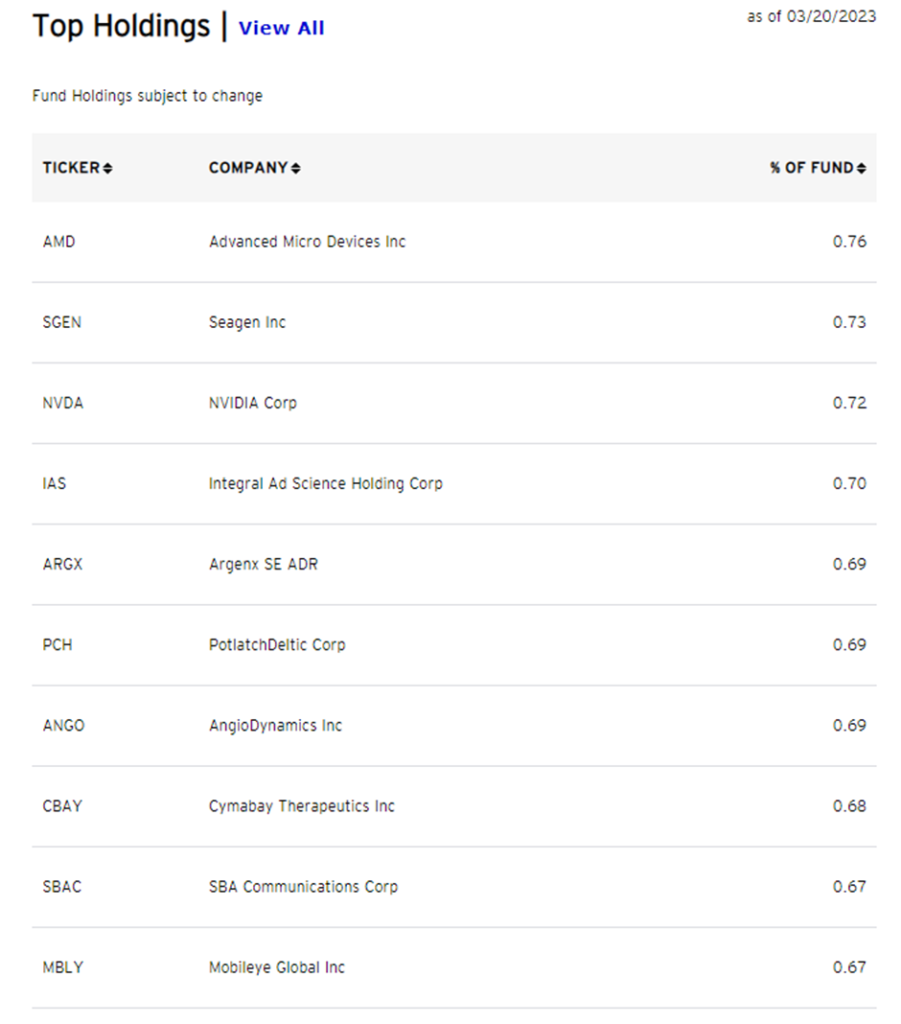

The Top holding in this ETF is Advanced Micro Devices (AMD), followed by Seagen (SGEN), familiar names which we just highlighted, and Nvidia (NVDA) rounding up the top 3. So far so good in terms of the quality of the names in my opinion.

The rest of the stocks in its Top 10 list are smaller cap names which could make for interesting research.

However, one thing to note is that the portfolio size of each counter is very small (less than 1%) which makes this ETF a rather diversified one.

ETF Investment Strategies #16: Buybacks

Buybacks are corporate actions that are similar to dividend payments. While the latter is a direct method of returning excess capital to shareholders, buybacks are more of an indirect form.

Most investors (particularly value investors) tend to focus more on dividend payments and neglect the positive price action that could accrue from share buybacks.

It is always good to look at both dividend payments and share buybacks when evaluating a company’s corporate action to return value to the shareholder. This is termed shareholder yield, a topic that I have written about previously.

An investor can look to participate in companies with a strong buyback track record through the Invesco BuyBack Achievers ETF (PKW) which seeks to select companies that have effected a net reduction in shares outstanding of 5% or more in the trailing 12 months.

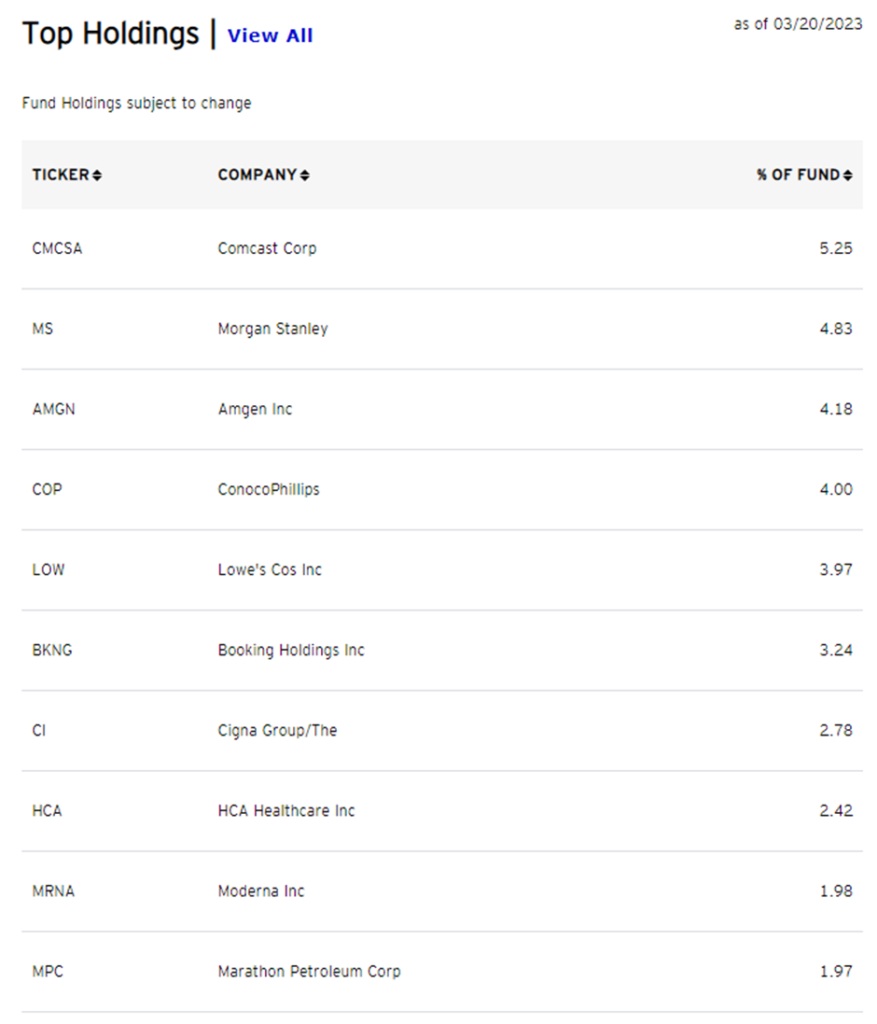

Some of the largest holdings in this ETF are Comcast Corp (CMCSA), Morgan Stanley (MS), and Amgen (AMGN) rounding up the top 3.

ETF Investment Strategies #17: International Buybacks

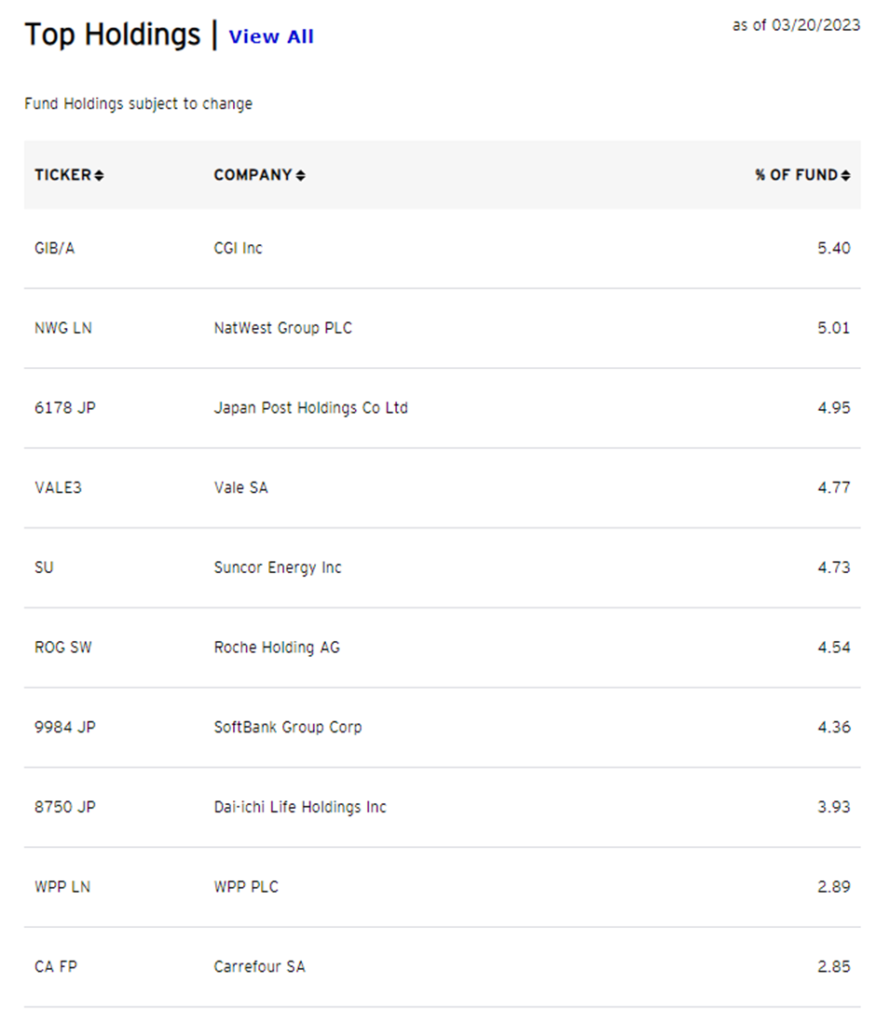

Similar to the above strategy but with a focus on international stocks instead of US stocks, one could look at the Invesco International BuyBack Achievers ETF (IPKW). Some of the best candidates doing aggressive share buybacks include the likes of CGI Inc (GIB/A), NatWest group (NWG LN), and Japan Post holdings (6178 JP)

ETF Investment Strategies #18: Merger Arbitrage

This is a strategy that Warren Buffett loves. To find arbitrage potential in M&A deals. While not exactly foolproof, how it works is that investors will typically invest in an acquiree after an announcement has been made.

Since there is no guarantee that the deal will go through, the market will not fully reflect the takeover price. By acquiring the acquiree and betting that the deal will go through, this strategy seeks to benefit from that “capital arbitrage”.

Of course, the downside risk could be that the deal doesn’t go through and the acquiree’s price falls back to the original level, which can be substantial.

For those looking for a way to partake in merger arbitrage deals, one could look at the IQ Merger Arbitrage ETF (MNA).

These are currently the top holdings of the ETF.

ETF Investment Strategies #19: Low Volatility

For investors who are more risk-averse and do not wish to have huge volatility seen in their shareholdings, one can seek a low-volatility investment strategy.

This strategy seeks to invest in stocks that exhibit low price fluctuations.

This can be done through the Invesco S&P 500 Low Volatility ETF (SPLV).

As can be seen from its top 10 holdings, many of the names here are household names that one would be familiar with, the likes of your Johnson 7 Johnson (JNJ), Pepsi Co (PEP), McDonald’s (MCD), Coca Cola (KO), etc.

Best Performing ETF Investment Strategies

So out of the 19 highlighted ETF Investment Strategies in this 2-part series article, which of them has been the most consistent in terms of price performance, over a short, medium, and long-term horizon?

One can refer to the Google Sheet table below, sorted by best-performing ETF investment strategy on a YTD basis. Do note that the information here is dynamic and will be updated daily.

That honor goes to the Invesco S&P 500 High Beta ETF (SPHB) which seeks to invest in the S&P 500 stocks with the highest beta. This is not that surprising considering that the market in YTD 2023 has been rather decent, with the SPY ETF currently up almost 5%.

The SPHB ETF, however, almost doubled those returns.

On a 1-year horizon, which was a down period for the SPY ETF, despite SPHB’s higher beta, it managed to achieve the same level of drawdown (approx -12.5%).

Last but not least, over a 10-years horizon, it is the best-performing ETF investment strategy with a total return of +180% (not adjusted for dividends) as of 24 March 2023

Second in rank is SPHQ, which focuses on selecting high-quality blue-chip names. I will be writing an article shortly on quality growth investing, which touch on the topic of finding high-quality stocks to invest in. What exactly are high-quality growth stocks? What financial characteristics do these stocks possess? Do look out for the article.

Do bookmark this page and refer back periodically to get the most up-to-date price performance of the different ETF investment strategies.

For those who are interested to learn more about ETF investing, I have a FREE Video Guide in which I highlight my favorite ETFs to invest in.