5 Outperforming Stocks to consider amid second wave outbreak

As nations begin their arduous journey of progressively opening up their economies after more than 3 months of stringent stay-home measures as a result of COVID-19, we are facing a potential “second wave” of infection that might derail our return to normalcy.

While many stocks have collapsed (and since recovered, in some cases dramatically) from the impact of COVID-19, there is a very small handful of stocks in the S&P500 that manage to generate positive stock price returns during the darkest time of 1Q20.

In fact, only 1% of the S&P500 stocks, which represents just 5 counters, were in the green from 20 February 2020 to 23 March 2020, the period where the S&P500 peak and subsequently trough, losing approx. 40% of its value during this short period of time.

These 5 outperforming stocks, on the other hand, generated positive returns of between 2-14% in the exact same period.

Which are these stocks and are they possibly defensive candidates that one can consider amid fears of a “second wave” of COVID-19 infection?

Surge in new COVID cases

In the US, about half a dozen states including Texas and Arizona are grappling with a rising number of coronavirus patients filling hospital beds, fanning concerns that the reopening of the US economy may spark a second wave of infections. Daily cases have plateaued at 20k in late May/early-June but have since risen again closer to the 30k market of late.

Dr. Anthony Fauci, the top US infectious disease official, told CBC News that more cases are inevitable as restrictions are lifted.

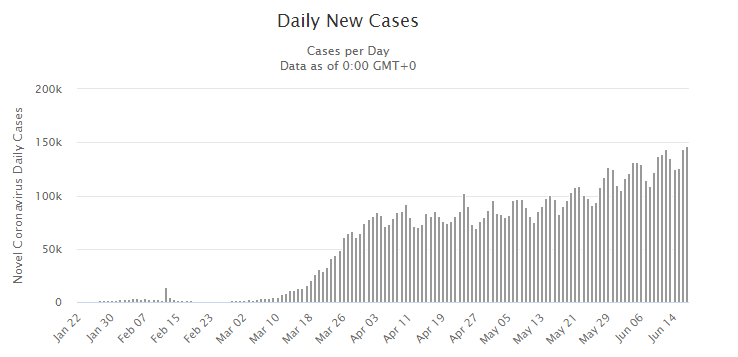

While easing of restrictions globally have hogged the headlines recently, it is sobering to note that the daily new cases around the world is at a record high level this week, according to data from worldometer.

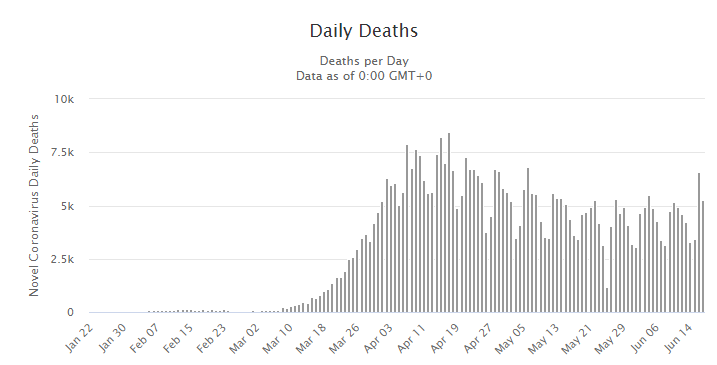

The number of fatalities has seen a spike over the last couple of days as well.

Cases in Brazil, Russia, India have seen huge spikes. The threat of a second wave hitting China, which has largely brought the virus under control, and rising tolls in Latin America and South Asia underscore the global challenge in slowing down the pandemic that has killed more than 455,000 people at the latest count.

With scientists around the globe racing to find a vaccine, the World Health Organization said it hoped that a few hundred million COVID-19 vaccine doses could be produced this year and two billion by the end of 2021.

“If we’re very lucky, there will be one or two successful candidates before the end of this year,”

WHO chief scientist Soumya Swaminathan.

The disparity between the stock market and economy

Many are still scratching their head, wondering why is there such a huge disparity between the stock market, which is just a few % points off its all-time high achieved in February 2020 (Nasdaq has recently achieved an all-time high on 10 June).

All this while the economy is still facing its worst recession since the Great Depression back in 1930s.

Many have attributed the miraculous stock market recovery to the “mountain of liquidity” that the Fed has thrown into the capital market, driving almost all assets higher, junk bonds included. Theoretically, they can and likely will continue to intervene in the capital market, with reports of the Fed purchasing up to $250bn in individual corporate bonds just a few days back, instead of just via ETFs.

The ultimate step could be the direct intervention of individual equities itself, stocks that are deemed “critical” to the economy and cannot be allowed to fail.

With access to the printing press and unlimited monetary resources, should we be fighting against the Fed? Are there however going to be major consequences from “helicopter money” on steroids? That’s probably another article for another day.

Assuming we still like to partake in the market, how does one sieve out stocks that will outperform the market in the event of a second wave of COVID infection?

While history is never truly representative of what the future might behold, we can learn from it. Stocks that outperform during the worst market drawdown in the last decade will likely have some characteristics that will buffer them against a COVID-resurgent induced market collapse, possibly in the coming months.

Without further ado, I shall disclose the S&P500 stocks that continue to generate positive returns during the darkest times in March 2020 when all other stocks crumble. There are only just 5 of them. These are the 5 largest US corporates that continue to thrive under adverse economic conditions. Are they similarly defensive in the next market selldown?

Outperforming Stock #5: Citrix System

Citrix System is an American multinational software company that provides server, application and desktop virtualization, networking, software as a service (SaaS), and cloud computing technologies. Citrix products are claimed to be in use by over 400,000 clients worldwide, including 99% of the Fortune 100 and 98% of the Fortune 500.

During the height of the recent COVID-driven crisis when the S&P500 collapse c.40% from its peak on 20 February 2020 to 23 March 2020, Citrix’s share price increase by 2% during this same period.

As the COVID crisis reached pandemic status and people were directed to stay at home, businesses adapted to remote work. Citrix, known for virtual private networking (VPN) software that lets users remotely access work computers and networks over an encrypted connection, became a go-to tool for home-based employees.

Citrix comes with established integrations with Microsoft, SAP, and Workday among others and it has connectors with cloud providers such as Google and Microsoft Azure. Established integrations mean IT administrators don’t have to configure a third-party private network each time a user needs remote access.

As employees and employers realize the benefits of securely working from home, Citrix might be the go-to company for virtualization solutions that corporates need and this will ultimately manifest itself into long-term secure demand.

Citrix has been moving up to a more profitable subscription-based model for the past year. We have seen how stocks such as Adobe has outperformed the market after converting their business model into a subscription-based one with increasing elements of “recurring revenue”, a structure that finds favor among investors.

Based on consensus estimates, the company could see EPS increasing from $5.03/share to $5.63/share in 2020 with a potential average growth rate of 15% over the coming 2 years in 2021-22.

The company’s valuation has seen a huge re-rating, with its forward PER now at 27.4x which is significantly higher than the average multiple of 21x over a 10-year horizon.

Tech investors should do well by adding Citrix to their portfolios. The health crisis has exposed many more businesses to the benefits Citrix offers and many of them will likely remain as customers after this health pandemic is all but forgotten.

Assuming the second wave of infection does occur, Citrix will likely be a continual beneficiary of this unfortunate event.

Outperforming Stock #4: The Clorox Company

The Clorox Company (Clorox) is an American global manufacturer and marketer of consumer and professional products. Clorox products are primarily sold through mass merchandisers, retail outlets, e-commerce channels, distributors, and medical supply providers.

Clorox is well-known for its bleach and disinfectant products. The company also owns numerous other consumer products such as Kingsford charcoal, Brita water filters, and Burt’s Bees personal care products.

During the height of the market sell-down, Clorox’s share price appreciated by c.4%.

This is not surprising as consumers rush to stock up on consumer staple products which benefited stocks like Clorox.

However, even if the second wave of infection appears, the demand for cleaning products may not necessarily match the levels of the first wave. Moreover, the CDC determined that COVID-19 is less likely to spread from surfaces than it had initially feared. This could dampen the demand for disinfecting wipes.

The company’s financial performance has been rather steady, growing its EPS every year from $4.92 in 2016 to $6.32 in 2019 with the street estimating that EPS in 2020 will be $6.89 in 2020, with a more gradual increase to $7.12 in 2021 and $7.76 in 2022.

Base on 2022 earnings, that is still a hefty 28x forward PER from the current price level.

As can be seen from the chart above, Clorox is currently trading at the highest forward PER multiple over the past 10-years, currently at 30x. Its 10-year average forward PER multiple is at 21x.

Based on a forward earnings growth rate of around 6%/annum, this counter is trading at a PEG ratio of 5x.

The stock has been a hot counter during the recent health pandemic, as evident from its share price. The stock appears, however, to have run out of new catalysts. Even if the second wave of COVID-19 sweeps the world, the reduced need for disinfecting wipes makes it less likely that Clorox would benefit.

Add to that its hefty valuation at the moment and additional caution might be warranted for those looking to partake in the stock at the current price.

Outperforming Stock #3: The Kroger Co.

The Kroger Company (Kroger) is the US largest supermarket by revenue and the second-largest general retailer behind Walmart. As of 2 Feb 2020, Kroger operates either directly or through its subsidiaries, 2,757 supermarkets, and multi-department stores.

Kroger stocks appreciated by 4% during the market mayhem.

Kroger attracted serious investor attention in February after Warren Buffett’s Berkshire Hathaway disclosed that it had taken a stake in the company. Not long thereafter, COVID-19 was recognized as a pandemic, and investors fled towards safe-haven stocks. As an essential-items retailer, Kroger’s business is deemed as safe as it can be.

The company just yesterday posted a blistering 19% sales spike in the three month period that ended on 23 May. This could imply some market share gain against rivals like Walmart. Kroger’s management team has seen enough data to feel confident that they will surpass their initial goal of at least 2.25% sales gains for the full fiscal year.

There has been an industry-wide increase in online grocery sales. Many shoppers who have never used these services before are trying them for the first time and may get lured by the convenience of doing so. It stands to reason that grocery chains with strong existing delivery and pickup services will benefit the most.

Kroger already excelled in this area. Digital sales grew 22% YoY in its 4QFY19 and the latest financial quarter, which grew by 92% YoY. Kroger’s share price closed 3% lower as management is not willing to reiterate its guidance, nothing that there is still a lot of uncertainty.

The company’s financial performance has not been outstanding, suffering from thin margins and hyper-competition from peers such as Walmart. The street estimates a substantial jump in EPS from $2.04 in FY2020 (ended Feb) to $2.82 in FY2021 due to the COVID impact. However, EPS is expected to decline to $2.55 in FY2022.

Nonetheless, the second wave of COVID will support supermarket stocks such as Kroger which remain an essential business and likely one of the few areas where consumers will continue to spend money on for daily necessities and food products as restaurants are shuttered.

The company is trading at a forward PER of 13x which is at the average level of its 10-year trading band.

This is not expensive although we note that forward growth beyond this year might not be exciting. However, a successful transition towards a digital model could see a more significant valuation re-rating for the counter.

While investing in Kroger is not likely going to make you a millionaire overnight, I don’t see a lot of long-term downside for the company. It is an essential business and it will be here to stay. Successful implementation of its digital strategy could propel Kroger as one of the best supermarket operators in the world.

Warren Buffett might have “seen” to have lost his golden touch of-late and there is no guarantee that Kroger will not turn out to be the next Kraft Heinz. However, at a forward PER of only 13x, I don’t think that Warren Buffett or anyone entering at the current level in this stock is overpaying for it.

Outperforming Stock #2: Gilead Sciences

Gilead Science is an American biopharmaceutical company that researches, develops, and commercializes drugs. The company focuses primarily on antiviral drugs used in the treatment of HIV, hepatitis B/C, and influenza.

The stock appreciated by 8% from 20 Feb to 23 Mar even before the announcement in April that its Remdesivir treatment is effective in combating COVID-19, based on initial trial results. The drug has been authorized for emergency use in the US, India, Singapore, and approved for use in Japan for people with severe symptoms. Gilead is giving away its total existing supply of Remdesivir to urgently treat patients with severe symptoms. The question now is how much revenue Remdesivir may generate for Gilead once commercialization begins.

Besides Remdesivir, Gilead has nearly 50 additional drug candidates in the pipeline and almost 30 commercialized products in areas including HIV, oncology, and cardiovascular disease. Its blockbuster product is still the sale of Biktarvy, the drug used to treat HIV. The global HIV drug market is expected to grow at a CAGR of 3.7% to reach $26bn by 2022.

The FDA approval for its product filgotnib used for treating rheumatoid arthritis may come as early as this month. If approved, the company is preparing for a possible launch in 2H20 and is aiming for approval in Japan and Europe later this year.

The period 2014-16 was one where Gilead generated supernormal profits from the sale of its hepatitis C drugs, with annual net profit generated of $12-18bn vs. historical level of $2-3 bn. However, the sale of that drug has since slowed tremendously due to new competing drugs that have led to price cuts as well as the strong effect of the product itself which resulted in a shrinking pool of patients.

Absence of a new blockbuster drug, net profit has slowed to $4.5-5.5bn region in the last few years.

Looking ahead, however, the street is seemingly more positive on the earnings prospect of Gilead, with net profit estimated at $8bn and rising over the next 2-3 years. This could be the result of a bottoming in its Hepatitis C product combine with still robust demand for its HIV product as well as the contribution of its Yescarta (lymphoma treatment) product and Filgotnib commercialization

With a market cap of $93bn, the counter is trading at less than 12x forward PER which is at the average of its 10-years trading band.

The market probably has not attributed any significant contribution from Remdesivir.

If the second wave of COVID is to materialize, I sense that the likely impact on its share price and earnings performance will likely be more muted this time around.

However, the downside risk is also low, with the stock likely to be seen as a defensive pharma counter where demand for its key products (HIV, Hep C, etc) are unaffected by a slowdown in the global economy. This is unless Remdesivir turns out to be a complete failure which will inadvertently result in a massive sell-down of its shares.

That could be seen as a buying opportunity as Gilead is already seen as a cheap pharma stock before the COVID-19 outbreak.

Outperforming Stock #1: Regeneron Pharmaceutical

Regeneron Pharma (Regeneron) is an American biotechnology company focused on the study of neurotrophic factors and their regenerative capabilities. It has since branched out into the study of both cytokine and tyrosine kinase receptors.

Regeneron was the strongest performer within the S&500 from 20 Feb to 23 March, appreciating by 14% as the company made a deal with the US government for the latter to fund 80% of the costs for Regeneron to develop and manufacture COVID-19 treatments while the company retains the right to set prices and control production. The share price has since appreciated more than 60% YTD.

Unlike Gilead, Regeneron has seen its revenue grown steadily over the past 10 years, from $379m in 2009 to $7.9bn in 2019. Consequently, earnings have also been growing at a double-digit rapid rate.

Based on the street’s estimate, earnings could jump from $2.1bn in 2019 to $3.2bn in 2020 and growing at an average of 15% over the next 2 years.

Beyond its COVID-19 “cocktail” treatment, sales of its biologic drug for ocular health, Eylea, and its anti-inflammatory drug, Dupixent are soaring.

Another potential blockbuster could be its Libtayo product to treat advanced cutaneous squamous cell carcinoma, a form of skin cancer.

However, unlike Gilead which has a forward PER of just 12x, Regeneron does not come cheap, trading at a more expensive forward PER of 21x which, however, is still at a discount to its 5-year average forward PER multiple of 24x.

Similar to Gilead, I believe the initial euphoria from a COVID-19 vaccine will no longer be evident in a second wave.

The share price of Regeneron might witness greater volatility compared to Gilead due to the higher growth expectations priced into the counter over the coming 2-3 years. However, the company, like many other pharma companies, will remain a defensive counter with limited downside risk amid the second wave of COVID infection.

Conclusion

These 5 Outperforming stocks that have crushed the S&P500 index during the recent bear market all have the potential to remain as defensive plays in the next wave of COVID infection.

However, the upside catalyst might not be strong for Clorox as well as the pharma plays, purely from the standpoint of a COVID-driven catalyst.

On the other hand, Citrix and Kroger will likely continue to be strong beneficiaries if a second wave outbreak is to occur as demand for their products and services will again be boosted.

Back in May, I highlighted 8 Outperforming stocks to Buy (Part 1) and (Part 2). These stocks have been consistently beating the market over the past decade.

Readers might want to check out those articles as well.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 1Q 2020 TOP HEDGE FUND LETTERS TO SHAREHOLDERS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.