Best Growth Stocks based on earnings growth expectations

For years, growth stocks have been outperforming their value peers. Despite global economies still in the early stages of an economic recession, which should favor the selection of value stocks over growth, we have yet to see the tide turn against growth stocks, with the Nasdaq breaching 52- weeks high almost every single day.

One can attribute the strong US index performance to a handful of stocks, notably the famous FAANG stocks that have accounted for a huge proportion of the index gains since its recent bottom in March.

No one knows when the music will ultimately stop but for now, the ball remains firmly in the court of growth stocks.

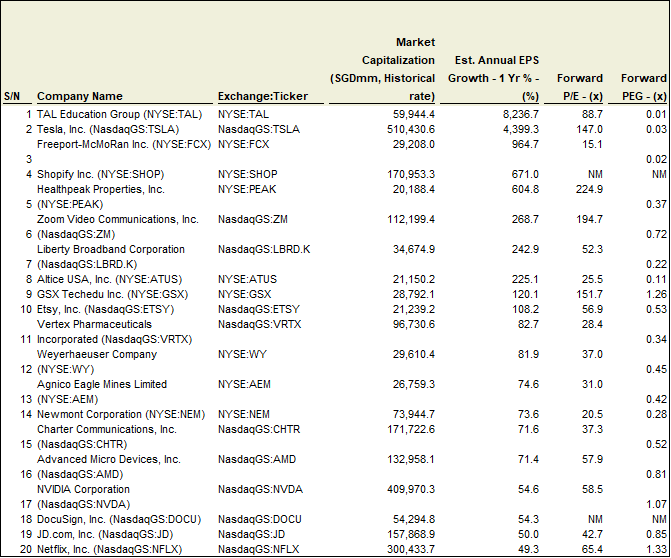

In this article, I will be exploring the Top 20 best growth stocks to buy in 2020 for some of the largest US-listed stocks (requirement of > SGD$20bn market cap). The list is tabulated based on the street’s expectations of forward earnings growth.

I will provide a table at the end of the article which will also highlight the companies (filtered by the largest to smallest market cap) which fits the below screening criteria:

- Listed on the US Stock Exchange (could be secondary listing)

- Market Cap > SGD$20bn

- Estimated 1-year forward EPS growth > 20%

Besides, the table will also show the 1-year forward estimated Price to Earnings Ratio (PER) as well as its corresponding Price Earnings Growth (PEG) ratio. This list of stocks might be more suitable for those placing a greater emphasis on market cap vs. growth rate.

In the below commentary, however, we will just be focusing on the Top 20 stocks with the fastest growth with its Primary listing on NYSE or Nasdaq.

We will start the list with the “slowest growth” and end off the list with the stock having the highest 1-year forward growth potential.

Top 20 Growth Stocks with greatest earnings growth potential

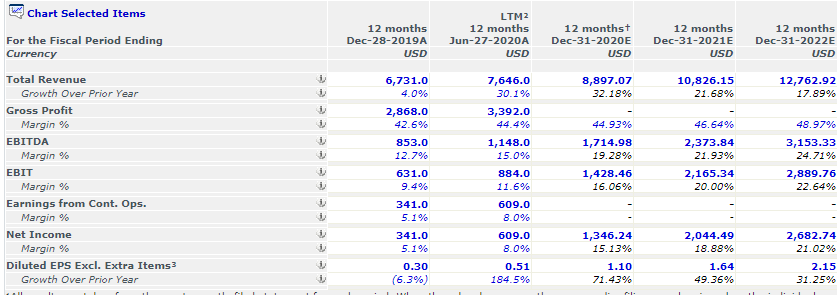

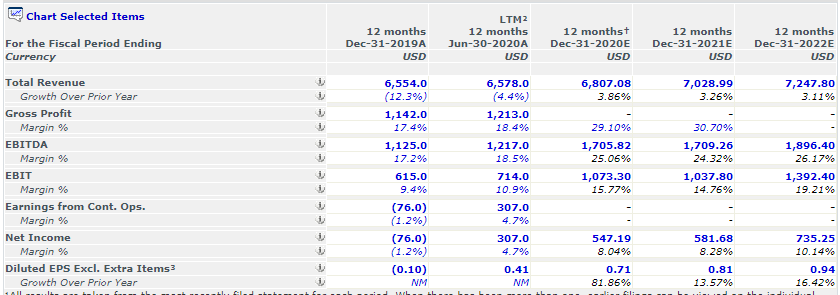

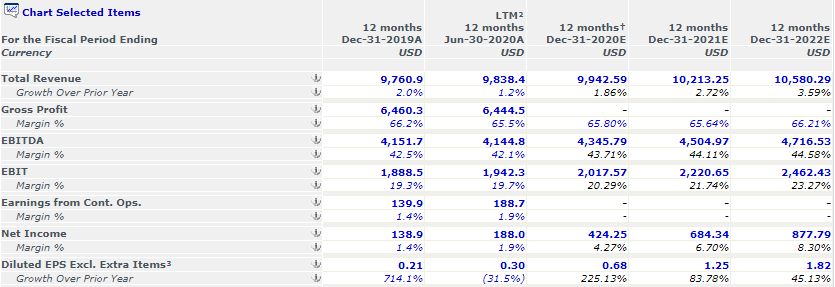

Best Growth Stocks to buy #20 – Netflix

Netflix sits at the No.20 position with an expected earnings growth rate of 49.3%. The company has a forward estimated PER of 65x which translates to a PEG ratio of 1.33x, among the highest in this list.

I have written about Netflix in numerous articles: 6 Top Investment Trends (2020) and Top 8 technology trends accelerating due to COVID which highlights the stock as a major winner as entertainment becomes Digital in nature, with streaming services becoming the mainstream form of TV entertainment over cable.

It’s hard to understate how disruptive Netflix has been in the media industry. The company went from an upstart to arguably the most powerful content producer in the industry. Netflix can acquire almost any movie or show that it wants, and it gives creators additional freedom to make content without the constraints of television schedules or the big screen economic model.

Best Growth Stocks to buy #19 – JD.com

JD.com sits at No. 19 on this list with an expected forward earnings growth rate of 49.3%. The company spots a PER multiple of roughly 43x which results in a PEG of less than 1x, 0.85x to be exact.

JD.com just released its results a couple a days ago and it was nothing short an excellent quarter, with revenue rising 34% annually to 201.1bn yuan. Its EPS surged 53% to 3.51 yuan. Those headline numbers are impressive and the market believes that this high-growth stock can continue to deliver spectacular earnings growth in the coming year.

In this Motley Fool article, they highlight 5 reasons why one should still be getting into JD despite its share price at 52-weeks high. The 5 reasons are 1. Accelerating revenue growth, 2. Accelerating customer growth, 3. Expanding margins, 4. Ecosystem expansion and 5. Robust growth with a reasonable valuation.

Reasons 1 and 3 are usually what get me excited on the financial front.

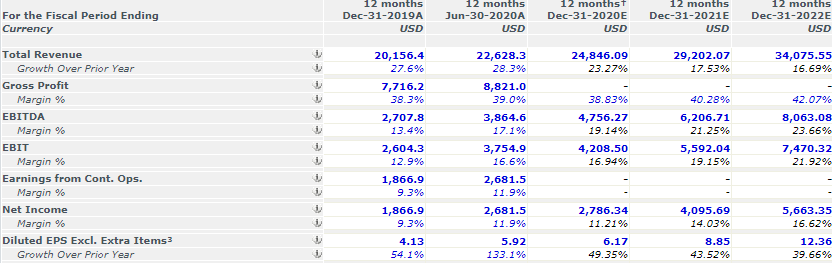

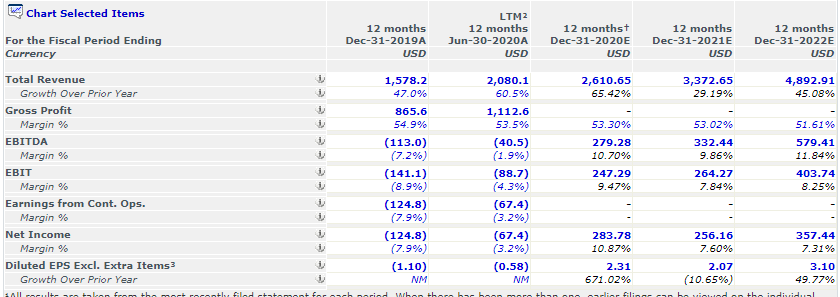

Best Growth Stocks to buy #18 – Docusign

Docusign sits at No. 18 in this list with a forward expected earnings growth rate of 54.3%.

I highlighted Docusign in this article as one of the key beneficiaries of the work from home trend. The company’s e-signature and Agreement Cloud are among the first quarter winners as companies aim to go more digital and perform more work remotely. The company’s growth strategy revolved around digitizing paper agreements and contracts into a series of processes that take an agreement and turn it into actions delivered via payment, CRM, and ERP systems.

The company is still loss-making as of its FY2020 (end-Jan) and is expected to be marginally profitable only in this fiscal financial year 2021. However, the expected earnings growth rate is somewhere in the region of 70+% over the following 2 years.

Best Growth Stocks to buy #17 – NVIDIA

NVIDIA sits at No. 17 in this list with an expected forward earnings growth rate of 54.6%. With a current forward PER multiple of 58.5X, this counter is trading at a “still reasonable” PEG of 1.07x.

NVIDIA has been a huge outperformer over the past 1-year, with its share price appreciating from US$171/share back in August 2019 to the current level of US$486/share. Some believe that NVIDIA’s massive stock gains may be over while others believe that the company could become the Apple of the data center world.

There is no doubt that the company is riding a huge macro-trend in mobile computing and the automotive market. The question is whether can such a consistent high earnings growth rate be sustained, not just in the year ahead but for the foreseeable future?

According to analyst estimates, its earnings growth rate could fall rather substantially to the high teens level in 2022/23.

Best Growth Stocks to buy #16 – Advanced Micro Devices

AMD sits at No. 16 in this list with an expected forward earnings growth rate of 71.4%. With a forward PER of 58x, this counter is “still cheap” with a forward PEG of just 0.81x.

AMD has been in the limelight of late as Intel delay of its 7-nanometer chips, which AMD already sells sent the share price of the former skyrocketing while the latter’s price collapsed.

Buying AMD today is a direct bet on the company taking full advantage of Intel’s manufacturing mishaps. AMD’s wins will have to be awesome for years to come before the company can earn its way into these roomy share prices.

Is that a bet you are willing to take?

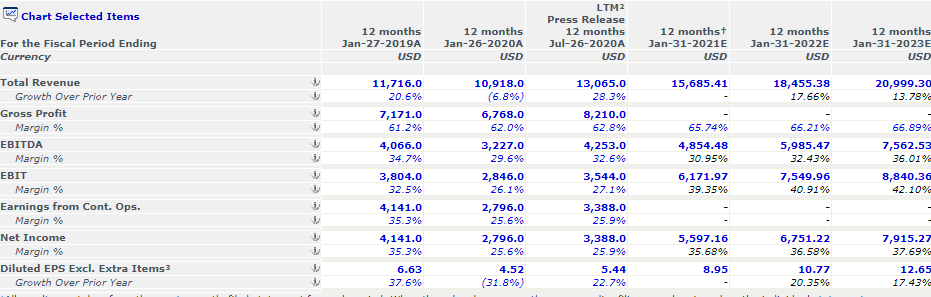

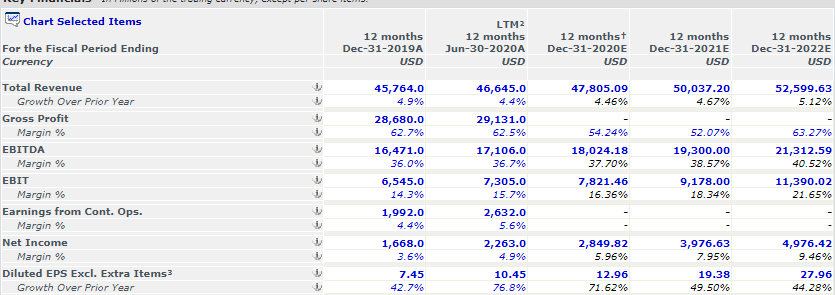

Best Growth Stocks to buy #15 – Charter Communications

Charter Communication is expected to have a forward earnings growth rate of 71.6%. With a forward PER multiple of just 37x, its PEG ratio is 0.52x.

The company is an American telecommunications and mass media company that offers its service to consumers under the branding of Spectrum.

Why is this cable and broadband giant growth expected to accelerate so significantly?

Demand for higher broadband has continued to climb and will become the soul of the new economy, both for work and play.

Hence, despite losing market share in cable TV to their streaming counterparts, cable companies are witnessing an acceleration of fixed broadband demand to cope with the increase in average broadband consumption bought on by shelter-in-place policies. Charter Communications is a prime example, one that could be a strong beneficiary of this trend towards greater fixed broadband.

Impressive results combined with Charter’s status as a safe stock amid COVID-19 has been a winning formula this year and should continue to be for the rest of 2020.

The street expects Charter’s high rate of earnings growth to continue in 2021 and 2022

Best Growth Stocks to buy #14 – Newmont Corporation

Newmont Corporation is expected to have a forward earnings growth rate of 73.6%, putting the company in 14th position. With a forward PER of just 20.5x, the company has an extremely lower PEG multiple of just 0.28x.

This could be because the company’s fortune is linked to gold prices and could be rather volatile.

However, with Gold prices expected to maintain a steady uptrend in-lieu of inflationary fears, it is reasonable to expect that Newmont’s forward earnings outlook should be relatively rosy.

In terms of market cap, Newmont is of an equivalent size compared to Barrick Gold, the company which Warren Buffett recently took a stake in. You will find that Barrick Gold will appear in the table at the end of the full article but not in the Top 20 list due to its dual listing in Toronto.

Nonetheless, an investment in a gold mining company like Newmont is often seen as a leveraged play on gold prices. For greater diversification, one can choose to invest in the GDX ETF which comprises some of the largest market cap gold miners in the world.

The street expects 2020/21 to be bumper years for Newmont, with earnings growth between 66-74% but that growth will likely turn negative in 2022.

Best Growth Stocks to buy #13 – Agnico Eagle Mines Limited

Another mining company, Agnico takes position No. 13 with an expected forward earnings growth rate of 74.6%. With a PER multiple of 31x, this company is trading at a forward PEG of 0.42x.

Agnico is another gold mining company, but one of a smaller market cap compared to both Newmont and Barrick. It has operations in Canada, Finland and Mexico and exploration and development activities extending to the US.

The company has full exposure to higher gold prices consistent with its policy of no-forward gold sales.

Compared to Newmont, the company has a higher expected earnings growth rate in 2021 as well as a lower decline in 2022, thus partially explaining its higher valuation multiples.

Best Growth Stocks to buy #12 – Weyerhaeuser Company

Weyerhaeuser Company ranks No. 12 with a forward expected growth rate of 81.9%. With a forward PER multiple of 37x, this counter has a PEG ratio of 0.45x.

Weyerhaeuser is probably a less-known company compared to all the companies on this list. The company is an American timberland company that owns nearly 12.4m acres of timberlands in the US and manages an additional 14m acres timberlands under long-term licenses in Canada.

The company operates as a REIT but suspended its dividends earlier in the year to shore up its balance sheet. However, a strong 2Q20 results with 3Q20 guidance of even stronger earnings have fuelled the rally in its share price of late. A potential reinstatement of its dividends coupled with higher lumber pricing and sales volume could be catalysts that keep the rally going.

Best Growth Stocks to buy #11 – Vertex Pharmaceutical

Vertex sits at No. 11 with an expected earnings growth rate of 82.7%. With a PER multiple of 28.4x, the company is trading at an affordable PEG of just 0.34x for a biopharmaceutical company.

I talked about Vertex previously in this article: 4 Recession-resistant stocks with a fortress balance sheet.

Vertex Pharmaceutical is a stock that is largely immune to the ravages of the coronavirus because the company is focused solely on the development of pharmaceuticals to treat serious diseases such as cystic fibrosis. It also has pipeline products for kidney diseases, sickle cell anemia, and other ailments.

The company is currently enjoying a trifecta of 1. High growth, 2. Long patent life and 3. A major pipeline of catalysts in 2020. Shares of the company jumped in January when the company reported sales of its new cystic fibrosis therapy that vastly outpaced analyst expectations.

The street expects earnings to be very strong in 2020 but that growth will likely moderate to mid-teen levels in 2021/22.

Best Growth Stocks to buy #10 – Etsy

Etsy sits at No. 10 in this list with an expected forward earnings growth of 108%. With a forward PER multiple of 56.9x, the company Is trading at a PEG of 0.53x.

Etsy is one of the key beneficiaries of the proliferation of e-commerce. The company is an American e-commerce website focused on handmade or vintage items and craft supplies. These items fall under a wide range of categories, including jewelry, bags, clothing, home décor and furniture, toys, arts as well as craft supplies and tools.

The company announced yesterday that it is ready to resume share buybacks after pausing share repurchases in the second quarter to assess the macroeconomic environment caused by COVID.

Etsy ended the second quarter with over $1 billion in cash, equivalents, and short-term investments and $803 million in long-term debt, giving it plenty of cushions to strategically buy back its stock again.

Given that the company has tripled in value in 2020 and more than quadrupled since its March lows, there are concerns that the company is overvalued. This might be true if earnings taper off from its blistering pace in 2020.

According to the street, 2021 EPS is expected to drop by $0.01 in 2021 after growing by more than 100% in 2020. Has the market already factored the potential earnings decline (albeit a very minor one)? The stock definitely will not look cheap if earnings are expected to come in flat in 2021.

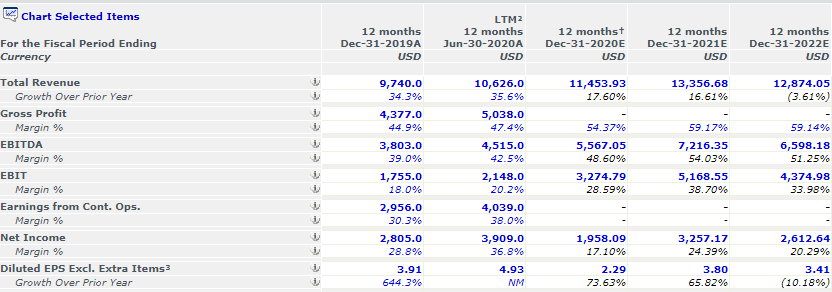

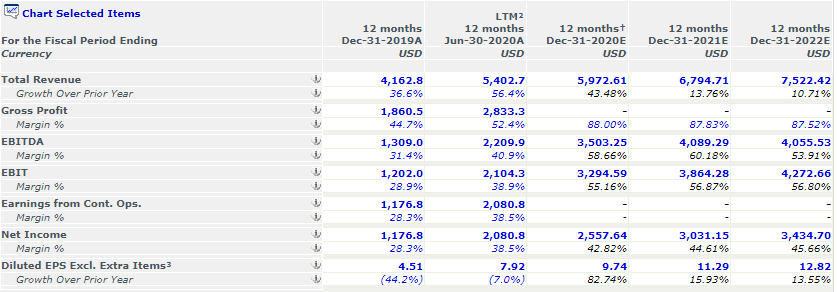

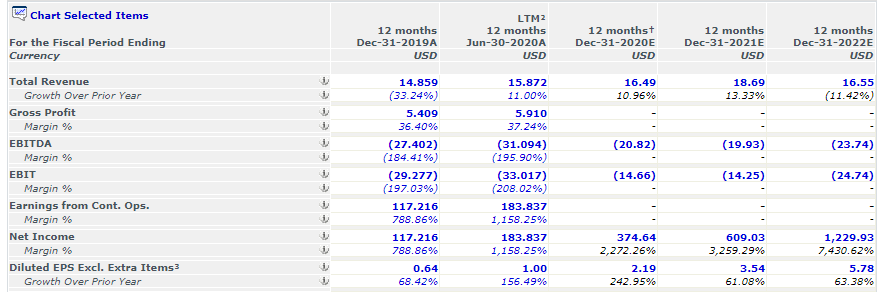

Best Growth Stocks to buy #9 – GSX Techedu

GSX ranks No. 9 in this list with an expected forward earnings growth of 120%. At a forward PER of 152x, its PEG is still at a “pricey” 1.26x.

GSX has been a controversial stock, with fame short-seller Muddy Waters saying that this China online education company is a scam, in a full report published back in May 2020. However, since that report, the share price of GSX appreciated strongly to hit a record of US$142/share in early August before retreating sharply in recent weeks.

In this Forbes report, more parties are claiming that GSX is a fraud, with Andrew Left of Citron Capital saying that “There is more evidence to GSX being a fraud than there has ever been for any Chinese company, including Luckin Coffee”.

This is not a stock for the weak hearted.

Best Growth Stocks to buy #8 – Altice USA

Altice USA sits at no. 8 in this list, with an expected forward earnings growth rate of 225%. With a PER multiple of “just” 25.5x, the company is among the cheapest in terms of PEG, at only 0.11x.

Altice is an American cable TV provider. It delivers pay television, internet access, telephone services, and original television content to approx. 4.9m residential and business customers in 21 states.

This company is an “underdog”, one that is lightly covered by the street and looks to be undervalued if earnings growth expectations are realized. According to street estimate, the company is expected to grow its earnings at a blistering pace of 225% in 2020 followed by another 84% growth in 2021.

If it is indeed so, then trading at just 25x PER, the company IS a steal. One will need to dig a little deeper as to why earnings growth might be so robust even with the cable-cutting trend accelerating.

Altice could be in a similar situation like Charter Communication, one whereby it is losing customers on the cable sit but winning big time on the broadband side.

With faster earnings growth compared to Charter while yet spotting a much lower PER, this stock might be worth a closer look, satisfying both value and growth investors at the same time.

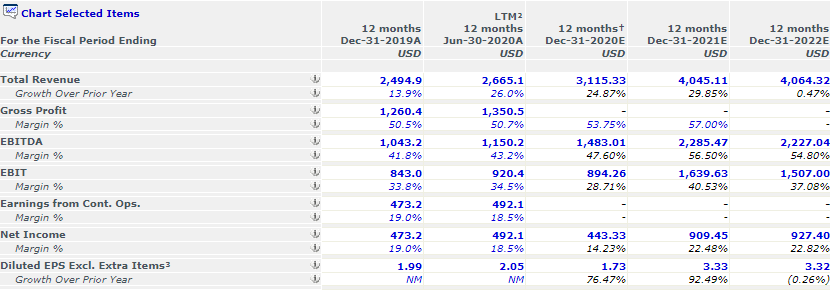

Best Growth Stocks to buy #7 – Liberty Broadband Corporation

Sitting at No. 7 is Liberty, with a forward expected earnings growth of 242.9%. It spots a forward PER of 52x, thus having a PEG of 0.22x.

Liberty is like a holding company, with a 25% stake in Charter Communication (rank 15 in this list) and a 100% stake in Skyhook, a worldwide leader in mobile positioning and contextual location intelligence solutions.

Hence Liberty Broadband acts more like a tracking stock. Since it acquired its position in Charter in 2014, the share price has increased by about 200+% vs. Charter’s rise of 240+% in the same period.

Earlier in the month, Liberty Broadband announced that it will be merging with GCI Liberty, both entities being investment vehicles of cable legend John Malone, in a deal that hopefully with unlocking value for both.

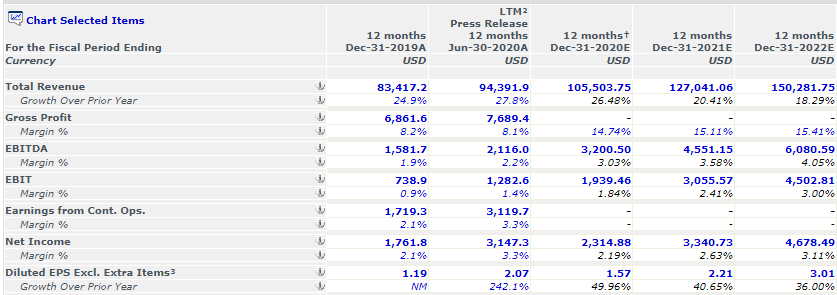

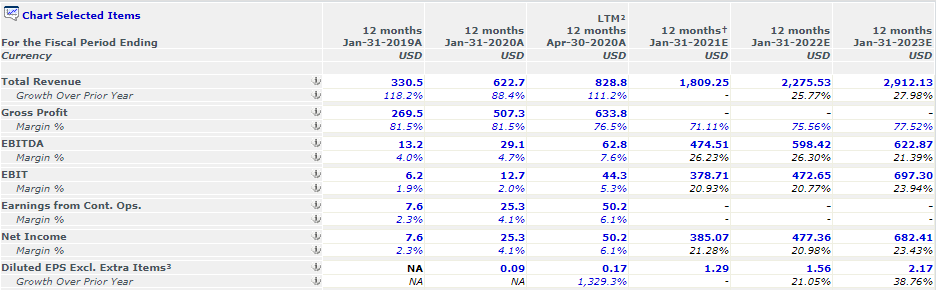

Best Growth Stocks to buy #6 – Zoom Video

Zoom sits at No. 6 in this list with a forward expected earnings growth of 268.7%. With a forward PER of a massive 195x, the counter’s PEG is 0.7x.

Zoom needs no further introduction as the company video communications services is now being used by major corporations and individuals all over the world to hold teleconferences and virtual meetings.

Earnings are expected to jump from US$50m in Jan-2020 to US$385m in Jan-2021. However, earnings growth is expected to moderate to just 21% in Jan-2022 which will put into question the huge valuation multiple that is being ascribed to the counter, trading at a potential forward PEG of almost 10x if that happens.

Nonetheless, Zoom is still everyone’s favorite work from home stock and one which could continue to gain popularity especially if the current COVID-19 situation worsens.

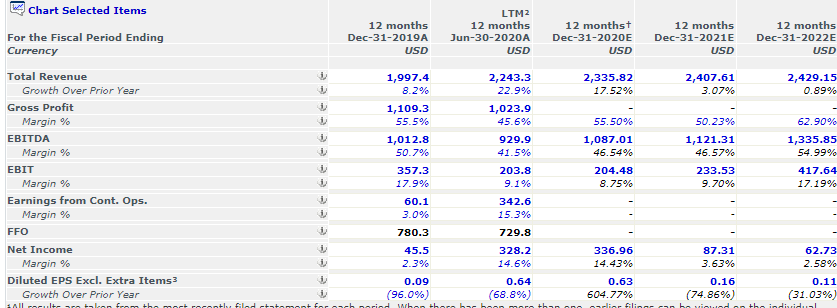

Best Growth Stocks to buy #5 – Healthpeak Properties

Healthpeak sits at No. 5 in this list with an expected forward earnings growth of 604.8%. Trading with a forward PER multiple of 225x, its PEG is 0.37x.

Healthpeak is a REIT that invests in real estate related to the healthcare industry, including senior housing, life science, and medical offices.

This Motley Fool article provides a good summary of the company as well as some of its closest peers.

Healthpeak’s portfolio is about 30% in medical office space, 30% in medical research, and the rest in a variety of senior housing assets. Medical office and medical research are two higher-growth areas of the healthcare space that have managed to weather the hit from COVID-19 fairly well — and much better than senior housing.

COVID-19 is impacting Healthpeak just like it’s impacting the REIT’s closest peers. However, with materially less exposure to senior housing, the REIT is simply in a better position to weather the hit. If you are looking at diversified healthcare landlords as a way to play the long-term demographic trends (an aging population) that remain in place despite the global pandemic, Healthpeak might just be the best-positioned option available today, even though it’s not down as much as peers, because of its well-balanced portfolio.

However, its massive 600+% growth is expected to be a one-off event, likely coming from a low base in 2019. Looking ahead, the street is expecting a huge drop in earnings over the coming 2 years.

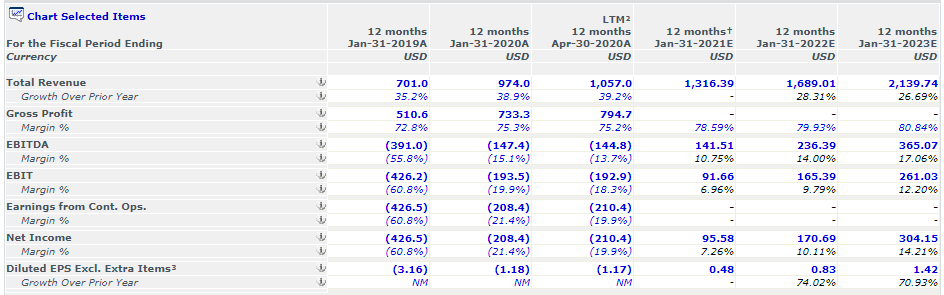

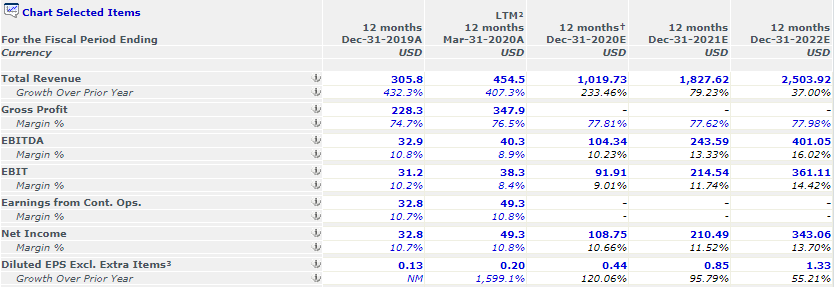

Best Growth Stocks to buy #4 – Shopify

Coming in at No. 4 is Shopify, with an expected earnings growth of 671%.

Again, another company that needs no introduction, Shopify has been a company that has benefitted significantly from the e-commerce trend.

This is a stock that has been recommended by Motley Fool’s Stock Advisor newsletter multiple times and is one of their best-performing stocks of all-time.

With a market cap that is US$170bn, the company has yet to make its first profit on a full-year basis. According to the street forecast, 2020 will be the first year that Shopify turns profitable with earnings of US$284m. Surprisingly, they expect earnings to decline by 11% in 2021 followed by a massive 50% rebound in 2022.

Shopify is one of the most expensive SaaS stocks, with its current market cap value of US$170bn implying a 2020 Price to Sales multiple of 65x. Nonetheless, this stock is likely going to remain as a “market darling” in the foreseeable future.

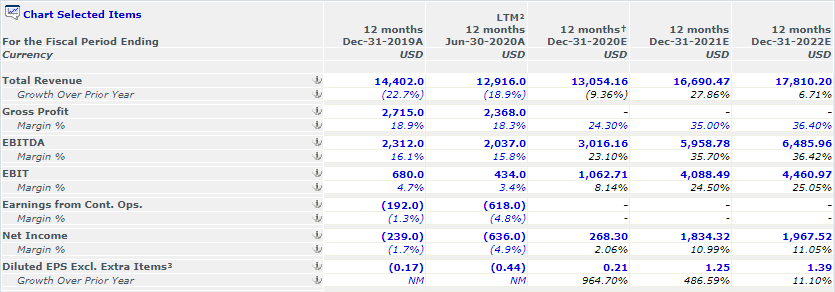

Best Growth Stocks to buy #3 – Freeport McMoRan

Rounding up the top 3 is Freeport McMoRan, which is expected to show earnings growth of 964%. With a forward PER multiple of just 15x, PEG is at 0.02x

Freeport, like Newmont, is a mining company. However, the company doesn’t just focus on gold but has a diverse asset base with significant proven and probable reserves of copper (mainly), gold, and molybdenum.

The strong earnings growth in 2020 is due to a very low base. The company incurred losses of US$239m in 2019 and is expected to rebound to a profit of US$268m in 2020, according to the street. This earnings growth is expected to remain robust in 2021, with earnings growing to US1.8bn before moderating to 11% growth in 2022.

Note that the company generated earnings over US$4bn back in 2010/11.

The thing is, at its core, Freeport-McMoRan is a miner, and its primary product is copper. Thus, in normal times, the stock tends to track along with the price of that industrial metal.

The fact that the stock tracked copper’s performance was exactly what investors would hope to see. Down just 1.5% or so through the first seven months of 2020, Freeport-McMoRan is no more out of the COVID-19 shadow than any other company. But at least for now, things appear to be more normal than they were earlier in the year.

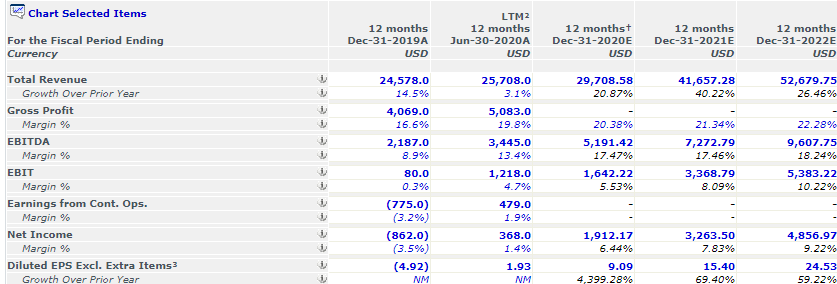

Best Growth Stocks to buy #2 – Tesla

Tesla sits at no. 2 with expected earnings growth of 4399%. The stock is trading at a forward PER multiple of 147x.

A stock that has defied all expectations, Tesla’s share price has been skyrocketing, breaking down barriers after barriers with no end to its stock appreciation in sight.

The company announced a 5 for 1 stock split which will take effect on 31 August for each shareholder of record on Aug 21.

The company’s share price soared past US$2,000/share the first time on 20 August.

Though the imminent split is probably not one of the main reasons Tesla stock is trading higher on Thursday, one headline that could have a slightly positive impact on price action today comes from the Asian news website Nikkei.

The news website reports that Panasonic plans to invest more than $100 million next year in battery-production capacity at Tesla’s factory in Nevada. In addition to boosting production capacity at the factory, the company is upgrading the storage capacity of the batteries it is making by 5% in September, according to Nikkei.

While not likely to maintain its 4000+% earnings growth in 2020, the street remains uber bullish on its growth prospect, expecting the counter to grow its earnings by 69% in 2021, followed by another massive 24% in 2022.

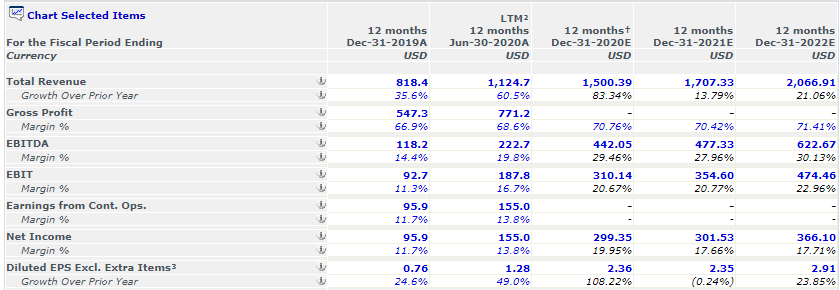

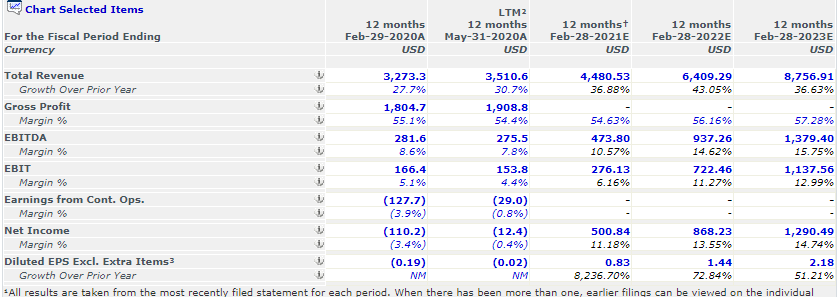

Best Growth Stocks to buy #1 – Tal Education

Sitting in pole position is TAL Education, with expected earnings growth of 8200+%. With a forward PER of 89x, the counter’s PEG is just 0.01x.

TAL Education is a Chinese holding company that offers after-school education for students in primary and secondary school.

Its share price peak recently in the early part of August and has been retreating slightly since then. Its share price trajectory of late seems to follow that of GSX Techedu.

Following the Luckin scandal, TAL Education announced in April 2020 that during its internal auditing process, it has found inflated class sales. Share price dived 20+% to hit US$43/share. Since then, its share price has almost doubled to a high of US$83/share in early August before retreating to the current level of US$73/share.

The company was loss-making in Feb-2020, which explains its massive earnings growth for Feb-2021. Nonetheless, earnings are still expected to rise by a very strong 73% in 2022 followed by another 51% in 2023, according to the street estimates.

Top 20 best growth stocks (by forward growth rate)

Conclusion

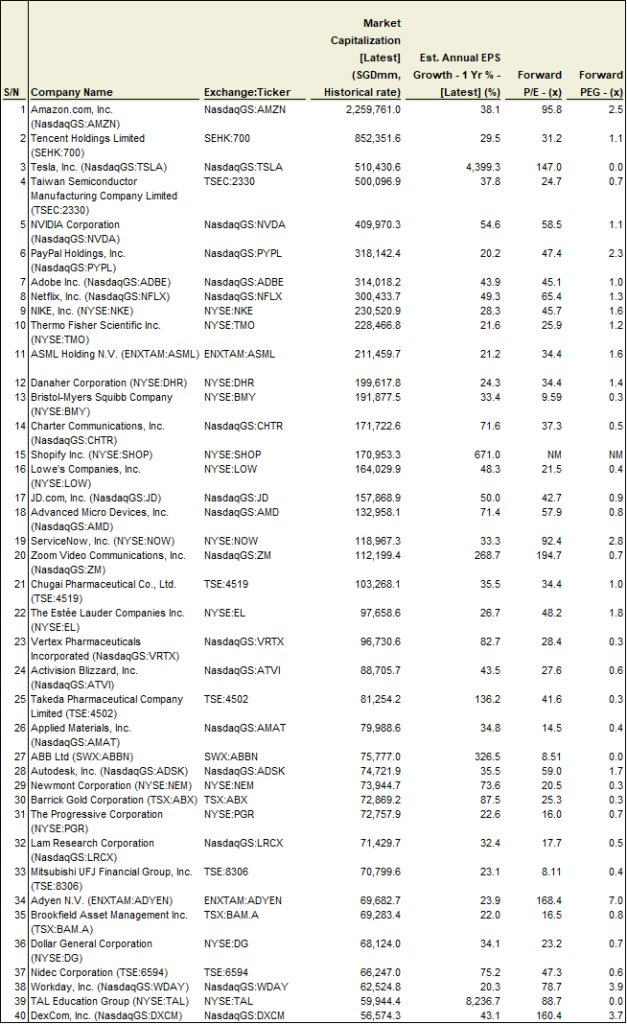

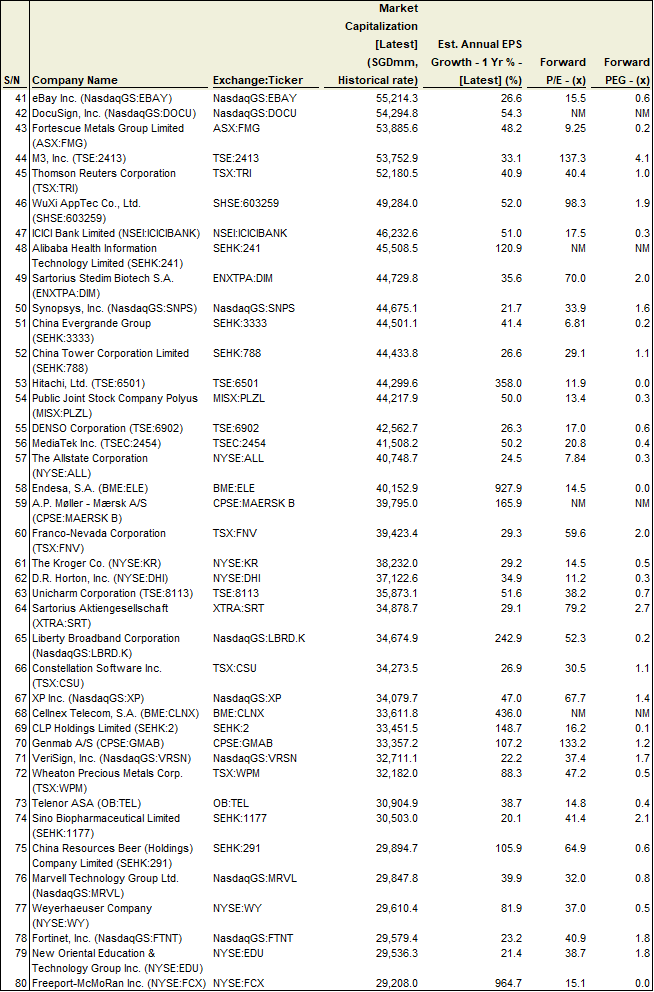

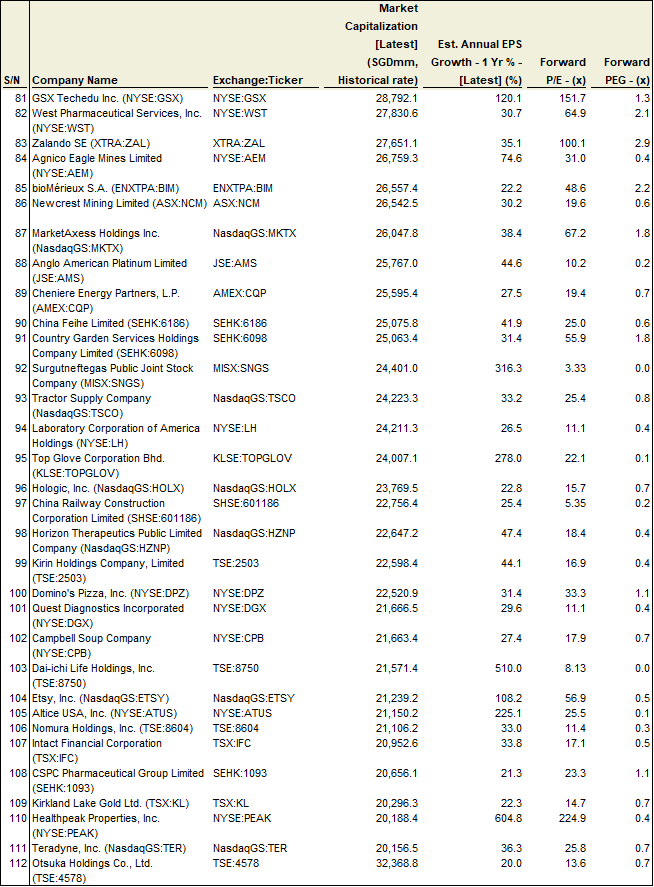

I will end of this article by also providing the high growth stocks filtered by Market Cap that fulfills the following criteria:

- Listed on the US Stock Exchange (could be secondary listing)

- Market Cap > SGD$20bn

- Estimated 1-year forward EPS growth > 20%

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 17 US COMPANIES MOST AT RISK FROM ESCALATING US-CHINA TENSIONS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Top 20 Best Growth Stocks to buy [2020]”

Best view i have ever seen !