Technology is now evolving at a rapid pace that annual predictions of technology trends can seem “out-dated” before they even go live. Covid-19 has further accelerated some of these digital trends. While most of these trends were already underway before the COVID-19 pandemic, they have grown in importance amid the pandemic and are likely to drive structurally higher investment in these technological areas.

Here are 8 technology trends that have lasting power and could dramatically transform markets in the next decade. Careful examination of these trends could point to stocks poised to benefit from these macro-trends.

Technology trends #1: Accelerating public cloud adoption

Investing in cloud computing is like a “no-brainer”. It offers enhanced security and stability, helps cut costs, and give companies greater flexibility. The latter comes in handy when you need to effectively navigate the ever-changing terrain of doing business, particularly in a post-COVID-19 era.

Leveraging the public cloud is becoming key for business survival as companies focus on improving connectivity during COVID-19. As a result, many organizations are looking to accelerate their public cloud adoption.

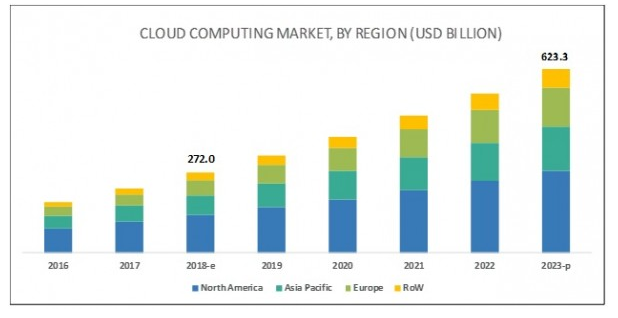

The Global Cloud Computing market size is expected to grow from USD272bn in 2018 to USD623bn by 2023, at a CAGR of 18% during the forecast period, based on market research done.

Some of the companies that look to benefit from the acceleration of public cloud adoption are Amazon Web Services (AWS), Microsoft, Google, Alibaba, IBM, and Dell/VMware. These are the big boys of cloud computing and they will continue to maintain their dominance for many years to come.

Even during the ‘old normal,’ the commercial arguments alone made it inevitable that the cloud would eventually become the dominant enterprise technology infrastructure; all organizations needed to do was to be comfortable with the idea.

However, no one could’ve predicted a universal compelling event such as COVID-19 that would come along and compress the general cloud adoption curve from years to perhaps a few months.

Now that it has, the majority of organizations have experienced the power of the cloud to make their operations more resilient and more agile. These were good strengths to have before the crisis, they certainly are during it, and they will be even more so once it has passed. By taking the lessons learned from their rapid exposure to the cloud and making them a fundamental part of their planning, businesses can come out of this stronger than when they went in.

Technology trends #2: E-Commerce

2020 is setting up to be an e-commerce inflection year as the combination of shelter-in-place, lower spend on experiences and government stimulus have driven dollars online.

Every two weeks, Salesforce Research is surveying the general population to discover how consumers and the workforce are navigating the COVID-19 pandemic. Research results and insights are publicly available via interactive Tableau dashboards. The data is updated every two weeks and can be segmented in multiple ways – geography, industry, generation, income, gender, and more.

Some of the key findings are that in 2020, there will be an accelerated adoption of e-commerce globally. In Brazil, for example, COVID-19 has driven the sharpest increase in sales and revenue in the history of Brazilian e-commerce. That is going to benefit the Amazon-equivalent in Latin America, MercadoLibre where Brazil is one of the key markets which it serves.

Other companies that look to benefit from this trend are online shopping marketplace such as Amazon, eBay, JD, Alibaba, Shopify as well as Chewy, a pet supply marketplace. As a digital-only brand, Chewy was well-positioned to absorb the surge in order volume brought on by COVID-19 which forced much of the world’s daily commerce activities online.

According to the management of Chewy, they expect the increased demand levels they are experiencing currently to be here to stay and reflect an acceleration of e-commerce adoption that is not likely to return to pre-pandemic levels.

Technology trends #3: Accelerating contactless/digital payments

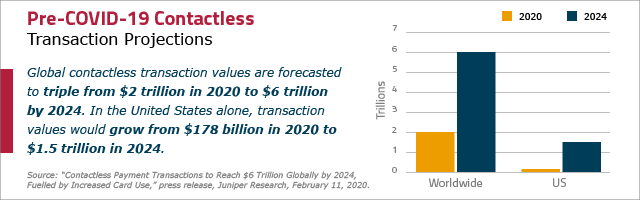

The market assumes that COVID-19 related adoption of contactless/digital payments is a near term benefit for payment providers, offsetting some of the consumers’ spending headwinds. However, contactless and digitalization of payments is part of a multi-year secular growth driver in payments, with COVID-19 as just the latest accelerator.

Here in Singapore, a recent study done by Visa showed that mobile contactless payments are on the rise, with 56% of consumers embracing this new way to pay. The increase in usage is likely due to popular mobile payment options such as Apple Pay, Samsung Pay, and Google Pay made available to Singaporeans in the past few years.

In a post-COVID-19 environment, consumers will remain very cautious of how they make payment and the notion that “cash is king” will not be applicable in this context.

While the key beneficiaries of this trend towards contactless payment are your usual card processor players like Visa/Mastercard and smartphone brands like Apple, Samsung, the combination of increased e-commerce spending (tech trend #2) and digital payments will undoubtedly benefit online payment players like Paypal which has seen its share price doubled from its March low.

Technology trends #4: Digitalization of workflow solutions

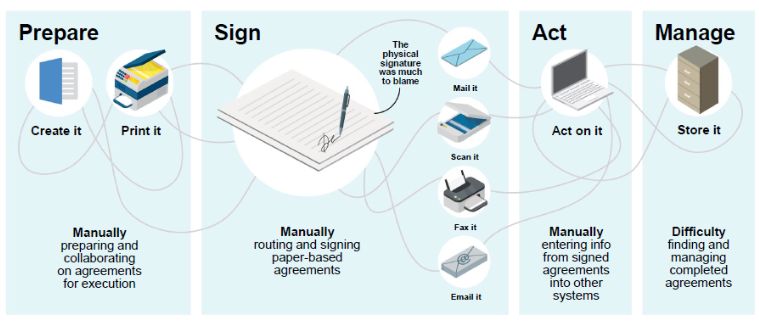

The flexibility to work from home (WFH) has the potential to accelerate declines in the commercial printing market. The digitalization of business processes is likely to compound these declines but present an opportunity for tech vendors that can offer digital experiences.

For example, DocuSign is a company that has benefitted tremendously from the rise of the WFH trend. The company’s e-signature and Agreement Cloud are among the first quarter winners as companies aim to go more digital and perform more work remotely. The company’s growth strategy revolved around digitizing paper agreements and contracts into a series of processes that take an agreement and turn it into actions delivered via payment, CRM, and ERP systems.

Another company that provides an e-signature solution is Dropbox. The company acquired HelloSign one year ago and is making it the default e-signature solution within the platform. This allows the company to provide an easy workflow to send, sign, and return documents without leaving Dropbox.

COVID-19 is also accelerating the digitalization of workflow solutions which generates faster data growth and use of analytics, allowing businesses to derive data-driven insights and improve competitive advantages and ultimately profitability.

A key company that digitalizes workflow processes is ServiceNow, a software company that develops a cloud computing platform to help companies manage digital workflows for enterprise operations.

Companies that use data analytics to transform big data into useful analytical information are Splunk, Alteryx, Salesforce, and of course Adobe, a company that I have highlighted several times as one which derives a huge amount of recurring revenue due to its recurring service offering.

Technology trends #5: Digital entertainment and network connectivity on the rise

COVID-19 and the increased demand for connectivity have amplified the importance of 5G network rollouts to support secular growth in categories including video and music streaming and online gaming.

Several trends will reshape the future of digital entertainment. The biggest one is undoubtedly the shift favoring video streaming, which will gradually become the dominant form of video entertainment. Streaming platforms have seen record increases in traffic and that has motivated Netflix and YouTube to lower bitrates to keep content rolling.

Companies that will benefit from the shift to streaming video and music services include Netflix, Spotify who are market leaders in their respective domains.

Demand for higher broadband has continued to climb and will become the soul of the new economy, both for work and play.

Hence, despite losing market share in cable TV to their streaming counterparts, cable companies are witnessing an acceleration of fixed broadband demand to cope with the increase in average broadband consumption bought on by shelter-in-place policies. Comcast and Charter Communications are two examples that could be a strong beneficiary of this trend towards greater fixed broadband.

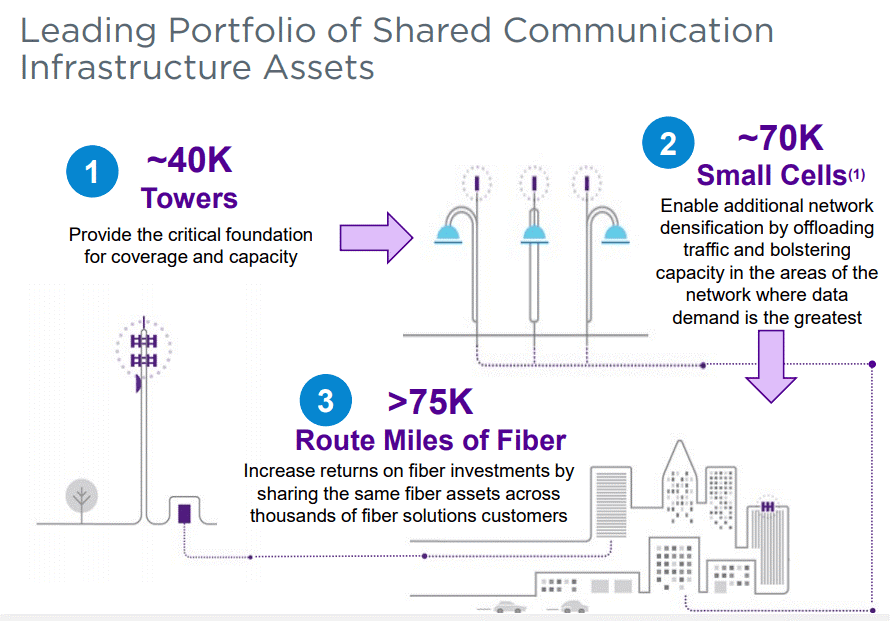

Companies providing wireless networks have also witnessed tremendous growth in their share price. Stocks such as American Tower and Crown Castle International, two extremely popular REITs that provide communications infrastructure in the US (CCI only in the US) and globally have been heavily sought after due to the rise of 5G development.

The acceleration of 5G adoption is just beginning to take shape in 2020. With 5G, adoption of AR/VR, smart cities, mobile gaming, IoT, etc will all take flight.

Technology trends #6: Ad spend shifting from offline to online

As confinement measures were introduced around the world, out-of-home and cinema advertising shrank almost instantly; print advertising also fell.

Meanwhile, in-home media usage went up. TV viewership has climbed, but digital consumption has increased even more: the use of social platforms and streaming services has risen almost everywhere; gaming has also grown dramatically.

Advertisers have adapted by following consumers, which means prioritizing digital advertising. The online environment is favorable for “direct response” campaigns – those encouraging quick purchases by consumers – an attractive proposition for brands spending cautiously and looking to drive sales.

In the first quarter, Facebook and Google saw better than anticipated first-quarter revenues despite widespread concerns over a drastic decline in their ad spending revenue. With likely greater adoption of social media platforms such as Facebook and Instagram (also owned by FB) etc, the ability for these companies to monetize their platforms through advertisement will increase significantly.

A very popular stock of late is The Trade Desk (TTD) which is a global technology company that markets a software platform used by digital ad buyers to purchase data-driven digital advertising campaigns across various ad formats and devices.

The company has become the fastest growing demand-side platform in the industry by offering agencies, aggregators, and their advertisers’ best-in-class technology to manage display, social, mobile, and video advertising campaigns.

A less well-known stock in this space is Rubicon Project. While TTD is known for its demand-side platform, Rubicon Project is the equivalent of the Sell-side platform.

Another stock that might profit from the rise in digital ad spending is Roku. While the company might continue to see earnings in the red for 2020, this stock has the potential to be an “early-stage” Netflix.

Technology trends #7: Augmented reality/Virtual Reality as a new medium for digital interactions

COVID-19 should help expand AR/VR usage because the need to interact at a distance has never been so mandatory.

AR/VR has so far been a disappointment, with promoters constantly claiming that they are the next big technology but no break-through development has happened thus far.

However, that could be finally changing with practical VR devices that are finally reaching a mass market.

For example, the Facebook subsidiary Oculus Rift is now concentrating on developing its Oculus Quest headset and will likely be made available in 2021.

Similarly, Google is making AR/VR more immersive on consumer devices, with the ability to record, reconstruct, compress and deliver high-quality immersive light field videos, lightweight enough to be streamed over regular Wi-Fi.

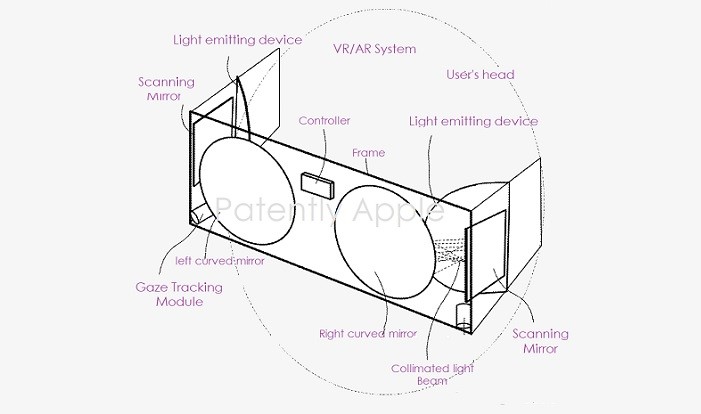

Apple is also looking to develop its own secretive AR/VR headset and recently won a patent for an AR/VR headset that uses a dynamic focus 3D Display that projects images directly unto the Retina.

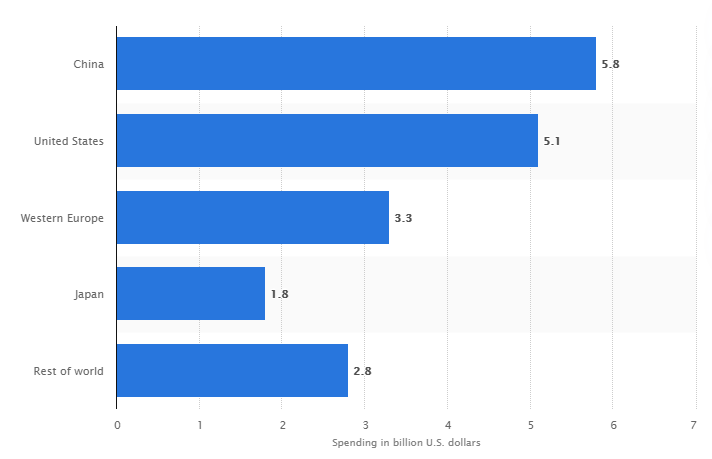

According to data from Statista, China is forecasted to spend the most on AR/VR development in 2020.

A company that is spearheading that efforts in China are Tencent holdings that have announced deals with Qualcomm and Huawei to explore AR/VR for its gaming platform.

Technology trends #8: Jump-starting the heartbeat of health tech

Investors probably do not fully appreciate the impact COVID-19 will have on accelerating big tech’s entrance into healthcare. There has been a significant shift in consumer preferences towards digital health solutions which is likely here to stay.

Digital health is the provision of healthcare through the use of technology so that it can supply cutting-edge services to improve health outcomes such as

- Remote medical consultations via video conferencing (Teledoc)

- Electronic health records (Veeva)

- Patient monitoring systems and wearable device integrations that can monitor a patient’s vital signs such as heart rate and blood pressure (Fitbit, Garmin)

- Use of mobile technologies such as smartphones for healthcare delivery (Apple’s health-kit)

Some of these companies highlighted above such as Teledoc and Veeva have seen a huge rise in their share prices as expectations grew for their product and services in a post-COVID-19 era.

On the other hand, Fitbit has continued to lag the broader market pending the approval of its acquisition by Google, while its competitor Garmin has mostly recovered its losses from the March sell-off.

Big tech such as Apple has used data collected from wearers of its iWatch for the most ambitious research study yet undertaken with “wearable” technology: tracking heart irregularities across a large population in real-time.

Google has drawn on both expert knowledge and extensive patient data to produce a specialist health search engine. And Microsoft, through its cloud computing platform Azure, has taken on expansive projects including one with pharmaceutical group Novartis that covers everything from manufacturing and finance operations to drug discovery.

Conclusion

The COVID-19 disruption has served as a wake-up call to many companies, as the pandemic is requiring a greater digital presence for businesses to succeed.

I believe the above key technology trends are here to stay for the next decade or longer and the companies mentioned above that provide these services/products will enjoy the benefits of digitalization well beyond the pandemic.

I have also previously written on 5 outperforming stocks that crush the S&P500 in 1Q20 amid the darkest period of the COVID-19 driven market crash. From 20 Feb to 23 March, while the S&P500 collapsed by c.40%, these counters appreciated by 2-14%.

In the past couple of days which saw the S&P500 index declining by c.3% due to fears of a resurgent in COVID-19 cases globally, these stocks might also be ideal candidates to find shelter amid a second-wave of COVID-19 infections.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 1Q 2020 TOP HEDGE FUND LETTERS TO SHAREHOLDERS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Top 8 technology trends accelerating due to COVID and the stocks to benefit from it”