The NAOF-DIY portfolio

I have written on numerous occasions that the New Academy of Finance (NAOF) retirement portfolio structure, one that works on the premise of the 4% withdrawal rule, is a better alternative vs. the traditional 60:40 equity bond structure.

Not only is the NAOF structure “proven” to have a much higher safe withdrawal rate vs. the traditional 60:40 equity portfolio, it is also an effective portfolio structure to withstand the negative impact of “sequence of returns risk“.

Do refer to the above links if you are not familiar with the 4% withdrawal rule as well as the scary scenario of running out of your retirement funds due to “bad luck”.

In this article, I will be showing the stocks or ETFs (to be exact) that I use to construct my own DIY low-cost portfolio structure, one that is currently up 5% YTD amid the current stock market mayhem.

The NAOF Portfolio

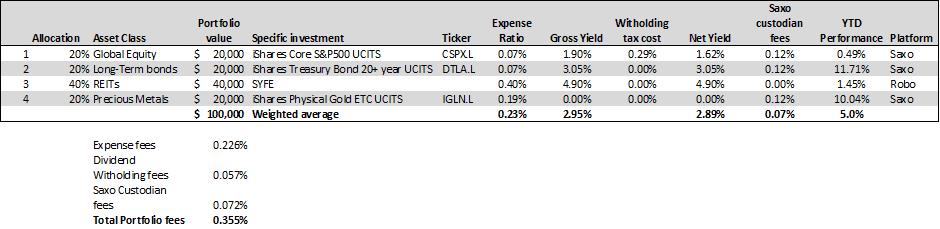

To recap, the NAOF portfolio consists of 20% equity, 20% long-term bonds, 40% REITs and 20% Gold.

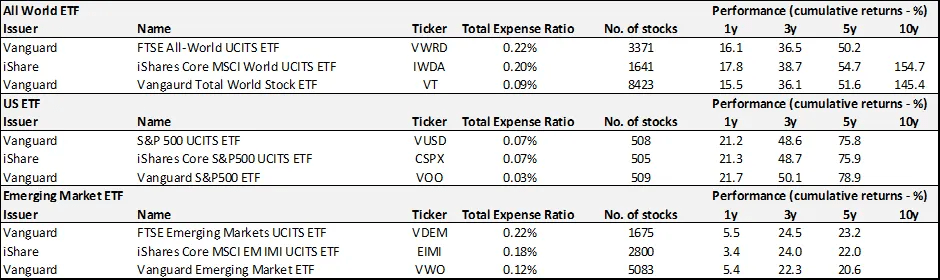

We have previously highlighted in this article: Which are the best tax-efficient ETFs to invest in, that despite the attractive nature of US-domiciled ETFs, an SG investor should not be investing in these ETFs (on a DIY basis) due to the negative impact of dividend withholding taxes as well as estate taxes.

The conclusion was simple: Go for tax-efficient UCITS ETFs which will help reduce the impact of dividend withholding taxes by 50% and incur 0% estate taxes.

I have also given a number of examples pertaining to tax-efficient UCITS ETFs to invest in, predominantly from the equity angle.

CSPX.L – 20% equity

In our NAOF portfolio, we will be using the iShares Core S&P 500 UCITS ETF (CSPX.L) to represent our 20% equity portfolio composition. This ETF, like all other major UCITS ETF, is listed on the London Stock Exchange

This ETF has a low expense ratio of 0.07%, with a gross yield of 1.9%. With an effective dividend withholding tax rate of 15%, the Total Expense for this ETF will amount to 0.36%.

DTLA.L – 20% long-term bond

We will be using the iShares Treasury Bond 20+ year UCITS ETF (DTLA.L) to represent our 20% long-term bond portfolio composition.

This ETF has a similarly low expense ratio of 0.07%, with an interest yield of 3.05% which has no dividend/interest withholding tax due to the nature of it being a government bond that is not subjected to tax. Therefore, Total Expense is only 0.07%.

We will demonstrate that this asset class contributed strongly to YTD overall portfolio performance in a later segment. However, a key risk that I am particularly concern about is inflation triggering a rapid rise in interest rate.

IGLN.L – 20% Gold

The iShares Physical Gold ETC UCITS (IGLN.L) will be used to represent our Gold portfolio composition. This ETF has an expense ratio of 0.19% which is much lower than its US-domiciled Gold ETF counterpart such as GLD which has an expense ratio of 0.40%.

Given that this ETF has no dividend, there will be absolutely no dividend withholding taxes associated with this ETF. Hence, Total Expense amounts to 0.19%.

SYFE REIT+

For our REITs composition, I have decided to go with Robo-advisor, Syfe’s latest REIT offering which is termed as SYFE REIT+. This is a portfolio structure that consists of a mixture of 15 REITs + high-quality Singapore Government Bonds.

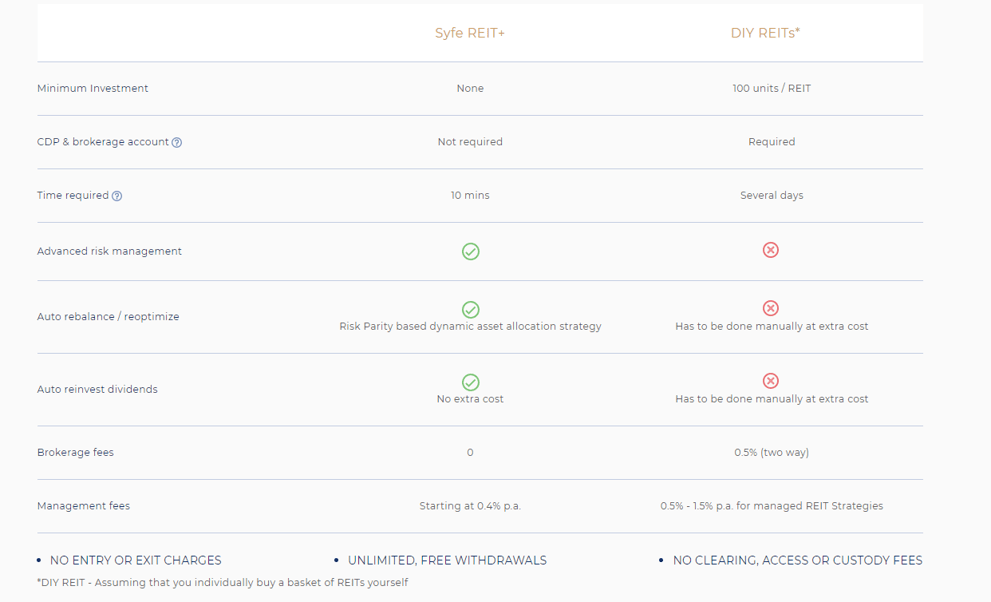

There are a number of reasons why I choose SYFE REIT+ to represent my REIT portfolio composition.

First, there are no viable REITs UCITS ETFs to select from.

Second, selecting a US-domiciled REIT ETF might provide me with the necessary REIT exposure but there will be a big issue of dividend withholding taxes as well as estate taxes. This is particularly pertinent given that REITs are high-yielding instruments.

Third, I can choose to invest in the 3 available SG-domiciled REIT ETFs here in Singapore. However, not only do they have higher recurring annual expense ratios (approx. 0.58-0.60%), there are commission fees + SGX fees (both one-off in nature) that a DIY investor will have to pay.

SYFE has done a quick comparison base on a DIY investor purchasing individual REITs vs. SYFE REIT+ option. While there are no recurring fees associated with purchasing individual REITs, the commission fees are generally pretty hefty for those with low investment capital.

For an investor that is planning to do a recurring REITs ETF RSP using FSMOne (cheapest solution previously), the total expense cost might still be higher than SYFE REIT+ which is a fixed 0.40%-0.65%.

Taking all these factors into consideration, I believe SYFE REIT+ provides a tax-efficient, low-cost, diversified manner to invest in high-yielding REIT assets.

I will not be touching on the investment methodology of SYFE in this article but nonetheless, if one is prepared to invest in a low-cost basket of REIT products, I believe that SYFE REIT+ provides the best option at the moment.

The table below provides a summarized version of our portfolio structure

Platform, one-off, and recurring fees

For the investment in these assets, I will be using Saxo as my platform for UK-listed ETFs and SYFE for REITs.

For Saxo, the commission fees are 0.10%/trade. With an expected one-time investment of US$60k (CSPX, DTLA, and IGLN), the commission fees will be US$60.

The recurring custodian fees are at 0.12%/annum. On a weighted average basis, that will amount to 0.072% or US$72/annum for a US$100k portfolio.

We have calculated that this portfolio will incur an All-In Portfolio recurring annual expense of 0.355%.

Hence for a US$100k portfolio, do expect to pay approx. US$355/annum as recurring fees. This will be more than offset by an expected dividend yield of c.3%.

YTD Performance

Amid the current stock market volatility, the NAOF portfolio has done decently well, with the portfolio up an overall 5% vs. the S&P500 which is now flat after yesterday’s massive 3.3% drawdown.

Key performing assets are the long-term bond which is up 11.7% YTD as well as Gold which is up 10% YTD.

I do not have the exact performance of SYFE REIT+ portfolio given that it was only recently created. I use the performance of Lion-Phillip S-REIT ETF (pure-play S-REIT) as a benchmark. The ETF is up 1.45% YTD.

Conclusion

In this article, I have shown the exact composition of the NAOF portfolio, one that I believe is structured in a tax-efficient manner as well as on the lowest recurring cost basis.

While a DIY investor can look to further reduce its recurring cost (the bulk is due to SYFE) by selecting a handful of REITs to invest in, they might face the issue of unsystematic risks unique to each counter.

I see such a portfolio structure as my IDEAL retirement portfolio structure, one which I believe is able to last more than 30 years based on a 4% withdrawal rule (with a c.3% yield income as a buffer) as well as withstand the negative impact of sequence of returns risk.

A potential major risk is, however, inflation rearing its ugly head, in which case long-term bond holdings might suffer. If inflation starts to show early signs of significant increment, an alternative would be to switch to long-term Treasury Inflation-Protected or TIPs bonds.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- SEMBCORP MARINE 4Q19 LOSSES EXCEEDED EXPECTATIONS. WHAT YOU SHOULD KNOW

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

10 thoughts on “The IDEAL retirement portfolio structure”

Hi,

Assume I have this portfolio live, how do I withdraw the money? Sell all the 4 components (Equity, Bond, REIT, Gold) equally and then rebalance? or there is certain ratio to withdraw?

Hi Ricky,

I will sell the asset class that has appreciated to rebalance it back to the original ratio. So if stocks now encompass 24% of the portfolio value, i will sell this asset to rebalance the portfolio accordingly.

Thats for rebalancing portfolio. What I meant is how to withdraw the money from portfolio? Like as per today, we know gold is appreciate a lot, then how many percent I need to sell to make my 4% withdrawal rate?

Hey Ricky,

So gold appreciates alot today and now encompass say 25% of your total portfolio value (instead of the original 20%), so you can have the bandwidth to sell up to 5% of it to fund your 4% retirement expense and bring that ratio back to 20%.

Say your portfolio has become v big… u only need to sell 3% of gold which more than covers your retirement expense, you can still choose to sell 5% and use the difference of 2% to rebalance into another asset class (say equities which has fallen in value) so as to maintain the same ratio.

Do i make sense?

let me illustrate with another quick example. If today a robo-advisor is able to provide such a portfolio structure for example, what it will do will be to first rebalance that portfolio ie. selling “expensive” assets to recycle into “cheap” assets and then payout your 4% from that total portfolio….

What we wish to avoid is to sell a depressed asset to fund our retirement expense. If stocks for example is down from 20% to 15% on a portfolio basis, we do not want to sell it to partially or fully fund our retirement as we will be selling at a “cheap” price.

Absolutely make sense. I was thinking to withdraw each component (1% each from equity, bond, REITs, and gold) to make 4% withdraw then rebalance. But if you mentioned the winner component takes precedence over loser then rebalanced then it makes good point.

Thanks.

Hi,

Markets are tanking nicely. Any thoughts on high beta bombed out names which could be worth picking up for the longer-term? thanks

Hi Patrick, sorry for the late reply. Well if you are looking at high beta counters then it will have been the tech shares. Personally I am looking at stocks like TTD, SPLK (counters that should not be affected by COVID) as well as some semi names such as TSMC and AVGO that are exposed to the 5G themes although that will likely be near term impact on earnings.

2nd year using Klaus Cassius and with over $460K in returns, here’s how it’s managed:

-Singapore savings bonds (3.1%pa yield)

-Fixed deposit (4.15% pa)

-Corporate Bonds (4.1% pa)

-ETFs (Stock market)

-GXS bank ( 3.48% pa up to $5K)

-Standard chartered ( 2% pa)

They help me and take time to learn about the various instruments, understand my risk appetite and goals. So far so good it’s top notch.