Thematic ETFs to buy in 2022

Thematic Investing is an approach that focuses on predicted long-term trends that could be structural, potentially resulting in the evolution of an entire industry. For investors, being able to identify some of these structural forces early would be the key catalyst to drive successful investing over the long term.

Popular themes that have gained traction over the past decade include 5G/6G, Metaverse, Fintech, Automation, sustainable/clean energy, etc, and the list goes on.

In this article, I will like to touch on 3 Thematic ETFs to buy for their long-term appreciation potential. These are not ETFs that are meant to be speculated.

Instead, invest in these ETFs with a long-term horizon in mind, if you believe in their structural growth stories. That will mean having the courage and conviction to capitalize when there is “blood on the street” through a disciplined Dollar Cost Average (DCA) approach, perhaps.

Strong outperformance track record

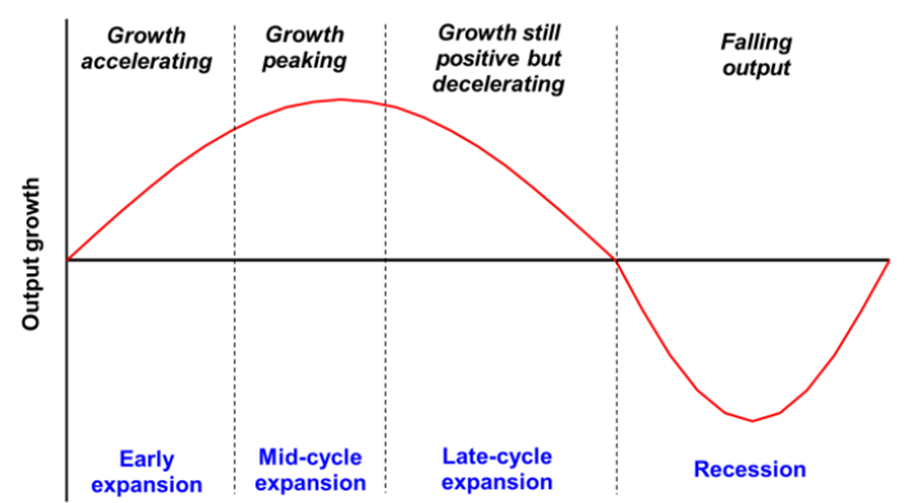

While many Thematic ETFs associated with the Technology sector have performed credibly over the past decade, many have taken a beating in 2022, notably Thematic ETFs linked to the semiconductor industry. Depending on one’s conviction level, the current price underperformance in 2022 could present an opportunity to in fact, buy more into these ETFs.

Nonetheless, I do concur that many of these Thematic ETFs that invest in “revolutionary companies that aim to change the world” can be highly risky, with their holdings in loss-making companies that might well cease to exist after the next economic downturn.

Among the 3 Thematic ETFs that I am highlighting in this article, 2 of them have a strong track record of outperforming the S&P 500 over both a short (YTD), medium (2-5 years), and long-term horizon (10 years).

This is extremely rare, with only a handful of Thematic ETFs (out of 1000s) that holds this accolade.

While this article should not be construed as a recommendation to buy these ETFs (please do your necessary due diligence), I believe it is well worth your time to further investigate these Thematic ETFs for their long-term growth/appreciation potential.

Without further ado, let us take a look at the 3 Thematic ETFs to buy today that could help super-charge your portfolio over the next decade.

Thematic ETF to buy #1: iShares U.S. Healthcare Providers ETF (IHF ETF)

Strictly speaking, this is not exactly a “thematic ETF” but I do like this ETF for its price consistency and for the fact that this is a play on an “aging population”, a phenomenon that is not unique to the US alone, but in fact, a sight increasingly prevalent across most developed nations.

This ETF seeks to track the investment results of an index composed of US equities in the healthcare provider’s sector. The Top 3 Holdings in this ETF are UnitedHealth Group (UNH), CVS Health (CVS), and Elevance Health (ELV).

This is 1 of the 2 Thematic ETFs I highlighted earlier that has demonstrated strong outperformance against the broader index over all time horizons, as can be seen from the chart below.

According to iShares, based on a hypothetical amount of $10k invested 10 years ago, this portfolio would have grown in excess of $40k to date, or an annualized return of c.15%, extremely decent considering that the long-term annualized growth potential of the broader market is at 7-8%.

Stocks in this ETF, the likes of UnitedHealth, CVS, etc, are healthcare providers/insurers that are primed to do well in the future as they welcome the retirement of the Baby Boomer Generation (those born between 1946 and 1964).

By 2050, there are likely to be 1.5bn people aged 65 or over on the planet, vs. 703m in 2019. This figure will rapidly increase to 61% of the total world population by 2100, according to data from the United Nations.

While I don’t see companies in this ETF as “revolutionary” or “life-changing” in nature (they are stable companies that have been around for a long time, providing the essential services of healthcare), demand for their services will remain extremely robust in a global aging population scenario.

What I do like is the price consistencies of the companies that consist of the IHF ETF, to do well in almost any environment.

Thematic ETF to buy #2: iShares Global Clean Energy ETF (ICLN ETF)

Clean energy is what the world has been talking about for the past couple of years and many stocks/ETFs/Unit Trusts that are linked to this theme have done very well over the past decade. The iShares Global Clean Energy ETF is one of them.

This is an ETF that seeks to track the investment results of an index composed of global equities in the clean energy sector, companies that produce energy from solar, wind, and other renewable sources.

Its largest holding is Enphase Energy, followed by Solaredge and Vestas Wind rounding up the Top 3 in this ETF.

On a YTD basis, the price performance of this ETF is in positive territory, up c.3% when the S&P 500 is down close to 17%, or an outperformance of almost 20%. The outperformance of this ETF is similar across a 2-5 years horizon as well as on a 10-years basis.

According to iShares, this is an ETF that generated an annualized 10-year return of 19%! Interestingly, if one purchased this ETF at inception back in late mid-2008 at the height of the GFC, one would still be in the red.

The ICLN ETF is undoubtedly more volatile compared to the IHF ETF. Nonetheless, if one believes in the growth story of clean energy over the coming decade, then this might be one of the largest clean energy ETFs ($5.7bn net asset) available to partake in.

The recent Inflation Reduction Act (IRA) enacted by the Biden administration, includes approx. $370bn of energy-related spending; both the clean energy theme and the electric vehicle theme are key components that could stand to benefit from this act through tax credits, grants, and favorable loans.

While I do not believe that fossil fuel is going to be replaced by clean and renewable energy any time over the coming 2 decades, there is no doubt that the use of clean energy will accelerate in the coming years, with most new power capacity consisting of renewable capacity.

Thematic ETF to buy #3: First Trust Nasdaq Cybersecurity ETF (CIBR ETF)

With more activity happening online, demand for cybersecurity services will inherently increase. In 2021, the average number of cyberattacks and data breaches increased by 15.1% from the previous year, with the education/research sector sustaining the greatest number of attacks, according to data from Checkpoint.

Like it or not, cybersecurity has become a highly sought-after service as businesses “shift online”. Unless one is prepared for a data breach which can become extremely costly, companies will pay up for cybersecurity services to prevent themselves from being a victim of cybercrimes.

This means huge business potential and opportunities for cybersecurity-related companies. Investing in the First Trust Nasdaq Cybersecurity ETF is one easy way to buy into a basket of top cybersecurity companies in their respective field.

The top 3 holdings in this ETF are Crowdstrike, Palo Alto Networks, and Cloudflare.

Do note that the risk associated with the CIBR ETF is the greatest among those mentioned in this article, as many of these fast-growing companies lack the track record of being consistent earnings generators. Nonetheless, more stable earnings generators such as Cisco and Verisign can also be found in this list.

Among the 3 Thematic ETFs highlighted in this article, CIBR has the weakest performance on a YTD 2022 basis, down by -20% vs. the S&P500 -17% decline. However, despite the slightly higher risk nature of the CIBR ETF, I do believe in its structural growth story.

Instead of buying into individual cybersecurity companies, many of which are not yet profitable, I find buying into the CIBR ETF as being a “less risky” and more diversified approach to investing in a basket of fast-growing cybersecurity plays.

How to partake in these Thematic ETFs

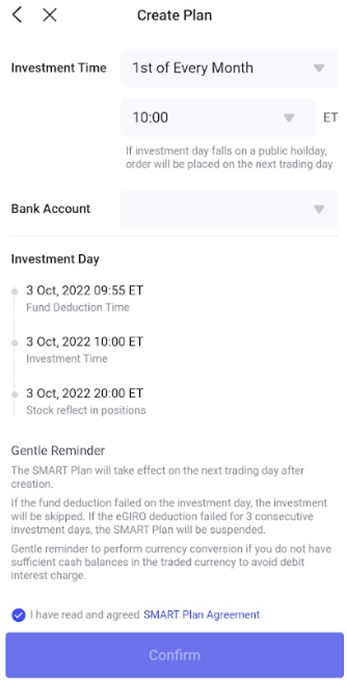

If one has got a long time horizon, I believe that these Thematic ETFs remain viable candidates to invest in for the long term. That will mean having the disciplined and conviction to be buying consistently in these ETFs in both a down and up market.

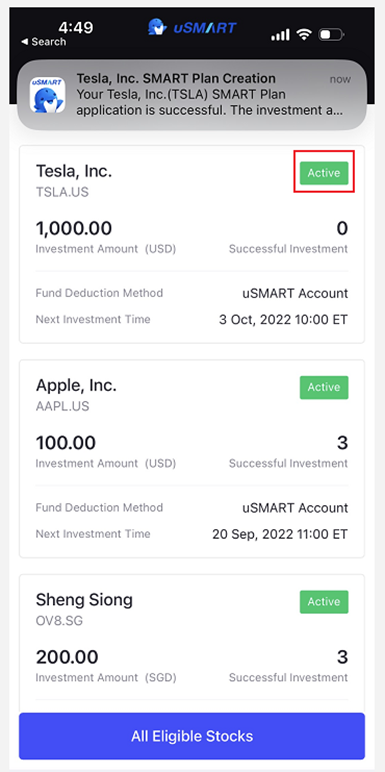

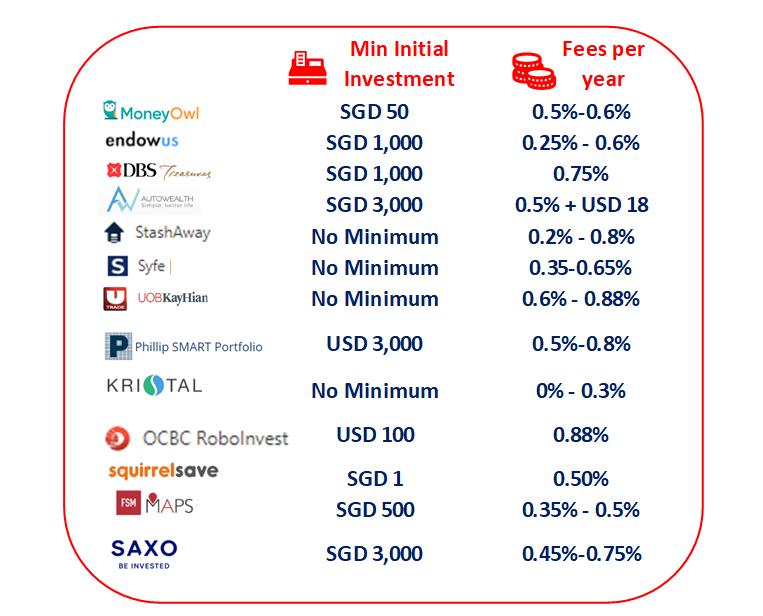

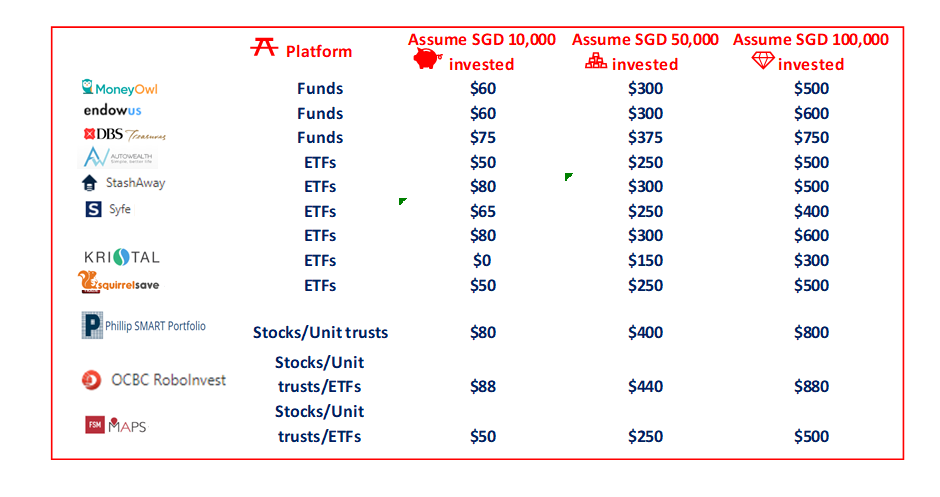

That will mean a Dollar Cost Average approach. For Singaporeans, one easy way to do that could be through the Syfe Robo Advisors.

One could create a custom portfolio consisting of these 3 Thematic ETFs: 1) IHF ETF, 2) ICLN ETF and 3) CIBR ETF and engage a simple dollar cost average strategy. This is an easy way for a beginner investor to get started.

For those who are interested, you can immediately get started on the Syfe Robo Advisor platform here.

Based on the assumption that these 3 Thematic ETFs can generate a net annualized return of 10%, a consistent DCA strategy investing an affordable $200/mth will yield a portfolio return of $42k after 10 years, $151k after 20 years, and $434k after 30 years.

If one has got the disciplined to consistently invest just $200/mth over the next 30 years, one will be surprised as to how “time in the market” can easily help you achieve a “nice-size” retirement portfolio.

Generating Alpha returns

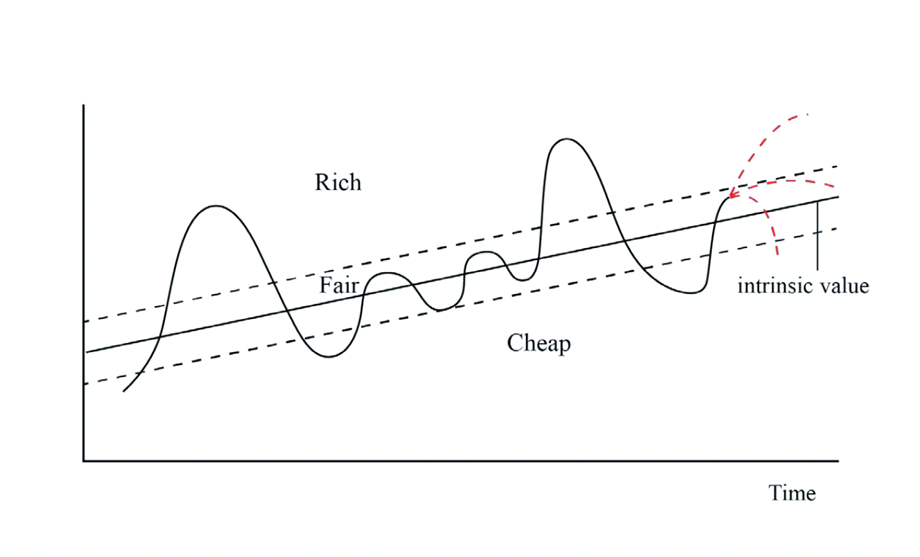

While the above strategy forms a part of my passive investing portfolio, I engage in a more active management strategy through my Alpha Blueprint Stocks. These are winning stocks that have all proven to be able to withstand the test of time.

Alpha Blueprint Stocks are your typical market leaders that possess these few characteristics: 1) highly profitable, 2) strong balance sheet, and 3) highly efficient in their operations.

These are the individual stocks that you should have the confidence to “accumulate” when they are unfairly beaten down, instead of following the masses out of the door. I will show you when is the RIGHT time to be purchasing these long-term multi-bagger winners.

For those who are interested to learn a simple strategy to screen for Alpha Blueprint Stocks that have historically shown to generate returns over 20%/annum (disclaimer: do note that historical returns should never be interpreted as a certainty nor representation of future returns), do click on the link below to find out more.

There are currently 3 blue-chip Alpha Blueprint Stocks that are in my “BUY” territory, unfairly beaten down despite maintaining their growth record as we head into the Year 2023. Critically, the street is no longer downgrading their forward earnings and hence, now might just be the time to buy into these high-quality names “on the cheap”

To know more about what makes these stocks “tick”, check out the link here.

Conclusion

The 3 Thematic ETFs to buy now, in lieu of their structural growth potential over the coming decade, should be engaged with a passive long-term approach, for the best results in my view.

The IHF ETF has the lowest risk among the 3 Thematic ETFs highlighted in this list while the CIBR ETF carries the highest risk. ICLN ETF risk profile lies somewhere in the middle.

Nonetheless, a combination of these 3 ETFs in a passive portfolio that can be DCA-ed into using the Syfe Robo Advisor platform is likely the simplest and perhaps cheapest way to get started for a newbie investor.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only