5G evolution is coming. Are you positioned to capitalize?

South Korea became the first country in Dec 2018 to offer 5G or what you might term as the fifth-generation mobile wireless standard. Most countries plan to start adopting 5G in 2020, which will be the key driver of various technological evolution such as Internet of Things (IoT), Big Data and Autonomous Vehicles etc.

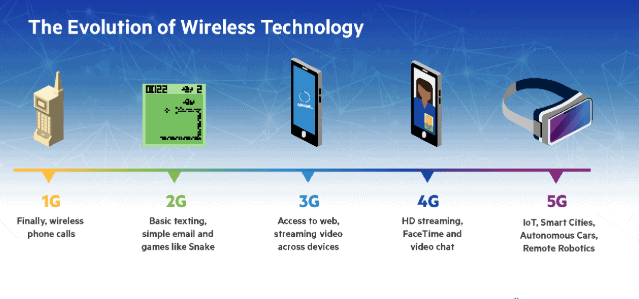

About once every decade, wireless technology experiences a paradigm shift. To truly understand how we got here, it is useful to chart the rise of wireless standards from the first generation (1G) to the imminent roll-out of global 5G.

Which are the stocks that will set to benefit from the Internet of Things era?

1G

Back around 1980, or 1979 to be exact, the first generation of mobile networks or 1G was launched by Nippon Telegraph and Telephone (NTT). Various countries such as the US started to progressively roll-out 1G operations in the 1980s.

However, there were major drawbacks to the technology such as poor coverage, low sound quality, no compatibility between systems and calls were not encrypted.

The price-tag for a mobile “gold brick”, which weighs 2 pounds and requires charging for every 30 minutes of talk-time, was a hefty USD$3,995 at that time, which is close to USD$10k in today’s money and yet there were millions who clamored for the product.

The success of 1G paved the way for the second generation of phone, appropriately termed 2G.

2G

The second generation of mobile networks, or 2G was launched in Finland in 1991. 2G improved the quality of voice traffic where calls could also be encrypted.

For the first time, people could send text messages (SMS) and multimedia messages (MMS) on their phones. This led to mass adoption by consumers and businesses.

Operators invested heavily into new infrastructure such as mobile cell towers and by the end of the 2G era, max speeds of 0.4Mbit/s were achievable, up from 0.1Mbit/s in the earlier 2G days. For reference, 4G+ max speeds are now up to 979Mbit/s and in future, 5G max speeds can go up to 10,000Mbit/s with a typical download speed of 150-200Mbit/s.

3G

The third generation wireless was a major breakthrough for data usage when it was launched by NTT Docomo shortly after the turn of the century, back in 2001. For the first time, users could access data from any location in the world as the “data packets” that drive web connectivity was standardized.

3G’s increased data transfer capabilities led to the rise of new services such as video conferencing etc. Blackberry was introduced in 2002 with 3G iPhone following suite in 2007.

This version of the iPhone cost half the price of the previous version and had a built-in GPS. Apple also unleashes its Apple App Store.

4G

4G technology, the current standard, was first deployed in 2009 as the Long Term Evolution (LTE) 4G Standard. 4G offers fast mobile web access which allows us to use our phones to stream our favorite movies on Netflix, post new photos and videos on Facebook and hail a ride on Grab/Uber.

While the transition from 2G to 3G was a simple replacement of a SIM card, mobile devices need to be specifically designed to support 4G which was a major pay-day for device manufacturers introducing new 4G-ready handsets.

5G

The new gold standard in wireless technology provides greater download speeds, lower latency and the ability for networks to connect more devices.

The 5G evolution will change the phone in your pocket to the next IoT. Similar to the 3G to 4G transition, one will need a 5G compatible phone to benefit from the superior connectivity speed.

5G promised to transform everything from banking to healthcare with new innovations such as remote surgeries etc made possible by this technology evolution.

The next few years will usher in a brand new version of what a connected world of IoT looks like. The video below provides a quick preview.

The move to 5G will create huge opportunities for many companies. According to market research firm International Data Corporation (IDC), 5G global infrastructure spending is set to grow from $528m in 2018 to $26bn in 2022, a CAGR of 118%.

4 blue-chip stocks to ride the 5G wave

Below are 4 blue-chip US stocks in my watchlist that I believe could benefit from increased 5G spending.

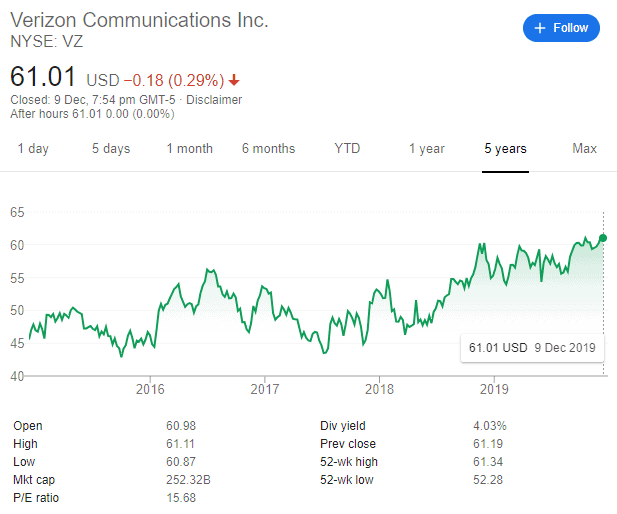

Verizon Communications (VZ)

Verizon is an integrated telecommunications company whose business is now mostly wireless dependent (70% of revenue)

Verizon dominates the ownership of key 5G spectrum bands in the US, controlling 76% of the 28GHz band and 46% of the 39 GHz band – crucial high-frequency transmission areas core to 5G’s promise of higher data transfer rates.

The company is testing 5G broadband services to homes and plans to expand deployment in late 2019. The company, however, has said it does not expect meaningful revenue from 5G wireless broadband services to homes until 2021.

The company has been stuck in a trading range of between USD$45 and USD$55 from 2013 to 2018 and recently broke out to hit USD61 (last price), giving the company a market cap of USD$252bn. The company trades at about 15x PER with an attractive 5-6% shareholder yield.

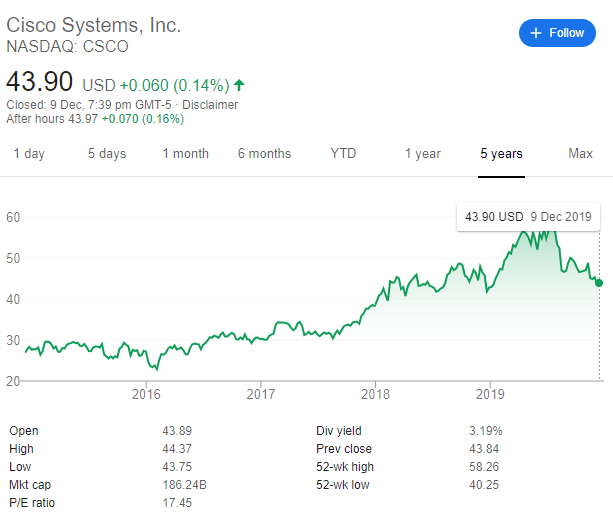

Cisco Systems (CSCO)

The used-to-be darling of the tech world, Cisco Systems has repositioned itself as a cloud computing and subscription-based software market leader.

The US government is pressuring countries not to buy gear grom Huawei, China’s biggest networking gear maker. That should benefit network gear makers such as Cisco.

The company’s “cloud-to-client” application plans to offer more flexible software-based alternatives to traditional networking hardware that allows telecommunication companies to provide 5G service on their existing network without the need for significant infrastructure upgrades.

This technology is designed to encompass every aspect of 5G into a seamless network, providing security and enhancing video optimization.

The company’s current share price of USD$43.90 is close to its 1-year low of USD$40.25/share, due to weak earnings guidance forward. Cisco has a market capitalization of USD$186bn and spots a forward PER 15x with 3-4% shareholder yield. With 5G revenues funding future profits, the stock should hold investors in good stead for years to come.

Qualcomm (QCOM)

Qualcomm manufactures digital wireless communications equipment and is a market leader in wireless chips.

Any list of 5G stocks would be incomplete without Qualcomm, a company with an impressive portfolio of intellectual property related to 5G technology.

The company recently settled with Apple which allows the company to supply chips for the iPhone for at least the next 6 years. Apple can now release a 5G compatible iPhone sooner than previously expected, benefitting both companies.

Due to its widespread 5G IP patents, royalties should be meaningful to shareholders for years to come.

The company is expected to generate EPS of USD$4.17 in FY2020 which translates to a forward FY2020 PER of 20x. EPS is further expected to accelerate to USD$6.11 in FY2021 which will translate to a forward FY2021 PER of 14x.

With a market cap of close to USD$100bn and a shareholder yield of 4%, this highly profitable company with operating margins in excess of 35% and ROIC of more than 40% is a growth cum value counter worth considering.

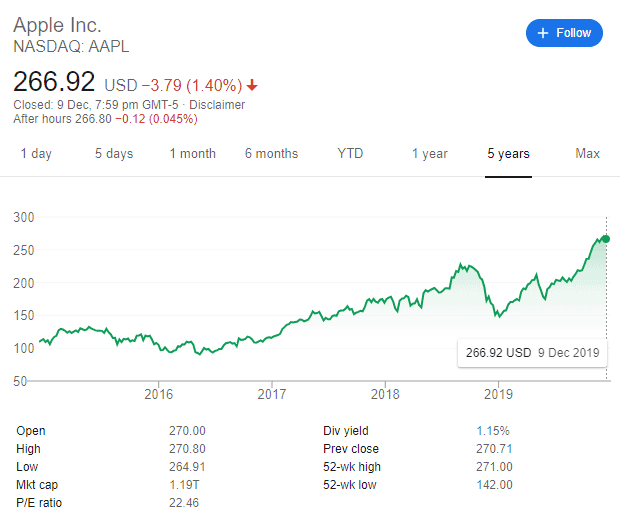

Apple (AAPL)

Last but not least, we have the King of Mobile, Apple which requires no further introduction. As one of the primary innovators in the wireless market, Apple will likely continue to enjoy a substantial presence in this industry.

Apple is expected to roll out 5G iPhones in late 2020. iPhone sales will likely get a bigger-than-expected boost in 2021 as wireless firms step up 5G marketing.

As highlighted, the settlement with Qualcomm in April this year is a win-win for both companies, with Apple now able to release a 5G compatible iPhone sooner than expected.

The company is Warren Buffett’s largest holding, not without a good reason.

As the largest market capitalization company in the world (not yet counting for Saudi Aramco’s listing) at USD$1.2trn, the company spots a forward 2020 PER of 20x.

Not cheap when compared to its previous historical PER trading range of 15x but a potential steal if 5G iPhones are once again going to dominate the mobile industry for the coming decade.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.