Best ETFs in Singapore

You might not know but there are many Singapore ETFs that you can use to structure a resilient inflation-proof passive portfolio.

Out of the 43 ETFs currently trading on the Singapore Stock Exchange (SGX), we will highlight 4 ETFs that we believe are the best-in-class that an investor can purchase directly on the SGX while concurrently structuring a portfolio that is almost recession and inflation-proof.

I will break down this article by first providing a brief introduction of WHAT ETFs are (for the benefit of newbies) and WHY buy ETFs in Singapore. I will then dwell a little on HOW to purchase ETFs in Singapore, either through a lump-sum approach or a regular savings plan approach. Lastly, I will introduce the 4 best ETFs in Singapore to construct a resilient inflation-proof passive portfolio that a Singaporean investor might wish to consider.

The selection took into consideration ETFs that exhibit high volume on the stock bourse and their unique characteristic (non-correlation) when viewed together as part of a portfolio structure.

What are ETFs?

For those who are not familiar with ETFs, the short-form of Exchange Traded Funds, it is a type of security that holds a basket of other securities – such as stocks.

To put it in layman terms, when you buy an ETF, you are actually getting exposure to a basket of stocks. Say, for example, if you buy the SPDR STI ETF (ticker: ES3) listed on the Singapore Exchange, you are essentially getting exposure to the Top 30 Blue-Chip stocks in Singapore.

These stocks are typically the largest stocks in the exchange. While not necessarily the best-performing ones, they are large stocks that have less risk of an implosion that can happen to a penny or small-cap stock.

Why buy ETFs in Singapore?

For the typical Singapore investor who has no clue which particular Singapore stock to purchase, instead of randomly picking a counter to buy, he/she is better off purchasing an index fund ETF, like the SPDR STI ETF which provides both diversification attributes and reduces the overall unsystematic risk (or stock-specific risk) profile of their portfolio.

It is hence a convenient option to have a diversified portfolio of stable stocks, all through one single counter or ETF.

In many ways, ETFs are like mutual funds; the key difference being that ETF shares are listed and traded on exchanges just like a normal share.

Types of ETFs

Note that ETFs are not subjected to just stock-specific such as the SPDR STI ETF which we used as an example.

There are Bond ETFs, Industry ETFs, Commodity ETFs, Currency ETFs, and Inverse ETFs. Inverse ETFs in particular, have been gaining popularity in recent times to hedge against a bear market downturn.

For a Singapore investor, the ETF options in Singapore are generally quite limited, with the more popular ones mainly index ETFs looking to replicate the performances of a basket of stocks that “best” represent a particular geographical region.

For example, a country index ETF which is hotly traded on the Singapore Exchange is the iShare MS India US$ (ticker: I98), an India Index ETF that seeks to provide investors with diversified exposure to large and mid-sized companies in India.

How to purchase ETFs in Singapore

There are a number of ways that a new/retail investor can purchase Singapore etfs..

Lump-Sum investment of ETFs in Singapore

For a lump sum investment, one can purchase the ETFs listed on the Singapore Exchange through an investment brokerage like UOB Kayhian, DBS Vickers, Maybank Kim Eng, etc, similar to how a stock purchase is done.

We have previously written on the best brokerage that a Singaporean investor can use to purchase stocks/ETFs on the Singapore Exchange. Jumping straight to the conclusion, the lowest-cost approach one can engage to purchase ETFs in Singapore is to use a Fintech brokerage such as Tiger Brokers which has a ZERO min fee and a commission fee of just 0.08%

Alternatively, one can also choose to use FSMOne, where the minimum fees are similar at S$10 while the commission rate is slightly lower at 0.08%. This will be under a custodian account (also prefunded) although no extra fees will be charged for custodian services pertaining to SG stocks.

One can refer to the table below for the brokerage cost summary:

The potential concern a newbie investor might have when buying ETFs in Singapore on a lump sum basis is buying right at the peak of a stock market bull run.

To alleviate that concern, one can choose the Regular savings plan route.

Regular savings plan investment of ETFs in Singapore

A potentially less painful way to invest in ETFs is done by engaging a regular savings plan approach.

Say you have got S$10k capital to spare for investment. Instead of purchasing all S$10k on ETFs on a lump-sum basis, you can choose to split them into 20 equal installments of S$500 each to be invested on a recurring basis each month.

When the stock price of the ETF you are looking to buy, say, for example, the SPDR STI ETF is down, your S$500 can buy more units of the stock. When the price is down, your S$500 buys fewer units. You can set this up to invest the funds automatically over a horizon of 20 months.

In this way, you avoid the risk of spending your full S$10k at a potential “peak” in the market.

How do we go about purchasing ETFs in Singapore on a regular savings plan basis?

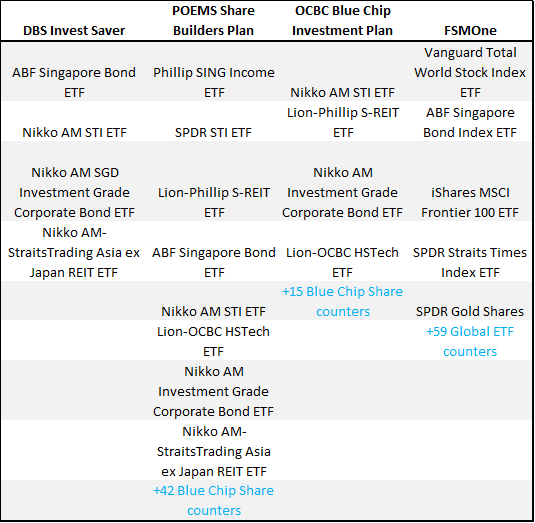

There are basically 4 options available here in Singapore. One can purchase through 1. DBS Invest-Saver, 2. POEMS Share Builders Plan, OCBC Blue Chip Investment Plan and 4. FSMOne.

The table below summarizes the available products for the 4 RSP platforms (Updated June 2021)

In terms of the lowest-cost approach when purchasing ETFs in Singapore on an RSP basis, my recommendation will be to go for FSMOne, a conclusion that I have shared with my readers previously in this article on cheapest RSP approach.

Out of the 4 ETFs that I will be introducing later, 3 are available to be purchased on the FSMOne platform using RSP. Unfortunately, one is not available. I will touch on that next.

4 ETFs in Singapore to create a resilient portfolio

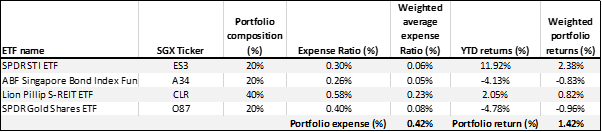

So my selection criteria are based on the NAOF portfolio structure (20% equity, 20% bonds, 40% REITs and 20% Gold), but one that is more localized for the Singaporean investors. These ETFs also need to fulfill the criterion of high traded volume (on average more than S$1m worth traded each day). However off the topic, in Asia Japan reit etf are considered the best options in exchange traded funds category.

The YTD performances for each ETF is updated as of 21 June 2021

1. SPDR STI ETF – ES3 (20%)

The SPDR STI ETF (ticker: ES3) is one of the most popular ETFs in Singapore, with daily traded value easily above S$5m.

This is an index fund that tracks the Straits Times Index or STI for short, our very own index here in Singapore that tracks the 30 biggest companies on SGX.

The STI is diversified across different industries and hence by purchasing this ETF, an investor is not just getting diversification in terms of quantity, but also in terms of industry exposure. Not all industry reacts in the same way in a downturn. Some like utilities and consumer staples are more resilient in a recession compared to cyclical companies such as Energy counters.

There are 2 STI ETFs in Singapore: SPDR STI ETF and Nikko AM STI ETF.

Our preferred option is SPDR STI ETF which has a longer history (inception since 2002 vs. Nikko AM STI ETF inception in 2009) and has much better liquidity (more than S$5m traded a day) compared to Nikko AM STI ETF (less than S$1m traded a day).

The SPDR STI ETF will form our equity portion of our portfolio structure and encompass 20% of portfolio value.

SPDR STI Expense ratio: 0.30%

YTD June 2021 performance: 11.92%

2. ABF Singapore Bond Index Fund – A35 (20%)

The ABF Singapore Bond Index Fund (ticker: A35) is a popular fixed-income ETF that serves as a hedge against a market sell-down.

When investors look to “de-risk” from the equity market, they will tend to park their investments in safer alternatives such as government bonds.

The ABF Singapore Bond Index Fund allows an investor to purchase some of the highest yielding AAA-rated government bonds.

The fund’s largest holding as of Mar 20 consists of bonds issued by the Republic of Singapore. There are also bonds issued by the Land Transport Authority of Singapore (LTA) as well as the Housing Development Board (HDB).

The average returns are about 2.8% since inception.

The ABF Singapore Bond Index Fund ETF will encompass the bond portion of our portfolio and account for 20% of the portfolio value.

ABF Singapore Bond Index Fund expense ratio: 0.26%

YTD June 2021 performance: -4.13%

3. Lion Phillip S-Reit ETF – CLR (40%)

The Lion Phillip S-Reit ETF (ticker: CLR) is one of the three listed REIT ETFs in Singapore made available to Singaporean investors.

While not as big as Nikko AM REIT ETF in terms of NAV size, the Lion Phillip S-Reit ETF is more “popular” based on the daily traded value in excess of S$1m vs. Nikko AM REIT ETF less than S$500k daily traded value.

This could be due to its 100% SG-listed REIT exposure which likely finds favor among Singaporean investors.

REITs are an asset class that is extremely popular with Singaporean investors due to their high-yielding nature, thus making them an ideal asset to generate a recurring source of passive income.

While REITs generally still exhibit a positive correlation to stocks, the drawdown in a market sell-off is likely less negative.

I have written previously an article on why I am still buying REITs even when they look expensive.

This is the only ETF that is not available to be purchased on an RSP basis on the FSMOne platform and one will need to use POEMS Share Builder Plan or OCBC Blue Chip Investment Plan to invest on RSP.

The Lion Phillip S-REIT ETF will account for 40% of our portfolio structure. The reason for the seemingly high ratio is due to its relatively resilient nature towards a market downturn while its high yield nature will act as a good “cash-shield” to help supplement one’s retirement expenses without having to sell units at depressed prices.

In addition, REITs are also seen as a good inflation hedge and might be an useful asset to own as part of a diversified portfolio.

I have also written an article on Lion Phillip S-REIT which readers might want to check out before purchasing the counter.

Lion Phillip S-Reit ETF expense ratio: 0.58%

YTD June 2021 performance: 2.05%

4. SPDR Gold Shares ETF – O87 (20%)

Last but not least, we come to SPDR Gold Shares ETF (ticker: O87) which is a commodity ETF that is now seen as a “safe haven” amid rising inflation risk.

Instead of going to the pawnshop or bullion shop to purchase physical gold to act as a hedge (against a market sell-off and inflation), one can instead choose to purchase the SPDR Gold Share ETF in Singapore conveniently through your brokerage (do note that it is traded in US$) without the hassle of finding a vault to store all your physical cash-hoard.

Gold also plays an important role in “inflation-proofing” your portfolio, a potential risk that I believe could be the last straw that breaks the camel’s back when combined with a recessionary environment or what is commonly termed as the dreaded “stagflation”.

In that scenario, you will probably be thanking your lucky stars (or me hopefully) that you have got a proven inflation-hedge asset in your portfolio.

The SPDR Gold Shares ETF will account for 20% of our portfolio value.

SPDR Gold Shares ETF expense ratio: 0.40%

YTD June 2021 performance: -4.78%

Portfolio Performance (YTD June 2021)

By purchasing these 4 ETFs available in Singapore and creating a portfolio based on the above structure, one will have generated a YTD return of 1.42% (before expenses). This might seem a tad disappointing, especially with the STI Index performing so strongly on a YTD basis.

However, the beauty of the NAOF portfolio is not to outperform the equity market in a bull market. That is unlikely to happen. The NAOF portfolio is constructed to outperform the overall stock market consistently when evaluated over a long horizon + provide strong downside protection in an inflationary environment.

I previously wrote in an article: Unveiling the Best Portfolio Allocation Structure where I compared the performances of the NAOF portfolio structure against popular allocation structures such as the All-Weather Portfolio, the Permanent Portfolio, the 60:40 Portfolio, etc and the conclusion then was that the NAOF portfolio has proven to be the best-performing risk-adjusted portfolio when compared over a long-horizon (since 1970).

While the data used was based on US asset returns, the underlying concept between a Singapore-focused portfolio and a US-focused portfolio is similar.

More importantly, I believe that the NAOF portfolio will outperform very strongly in an inflationary environment.

Conclusion

As a recap, ETFs are low-cost instruments that allow an investor to achieve portfolio diversification all in a single location.

For a newbie investor, it is a good investment asset to get your feet wet while you learn more about stock fundamentals, by which you can then look to invest in individual equities.

While there are not that many ETFs in Singapore that are ideal investment assets, (due predominantly to their low liquidity) the four key ones I highlighted in this article all have decent levels of trading liquidity which will allow for retail participation.

I have also demonstrated how one can construct a resilient portfolio using these 4 ETFs listed on the Singapore Exchange, one that has shown to be able to withstand the current COVID-19 driven market downturn.

For those looking to dollar cost average into the NAOF portfolio asset classes, one can use the FSMOne platform to dollar cost average into 1) STI ETF, 2) ABF Bond ETF, and 3) GLD ETF and use a Robo Advisor such as Syfe’s 100% REIT portfolio to dollar cost average into 4) a portfolio of REITs.

Would you invest in ETFs in Singapore? Do feel free to share your comments.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- WHICH ARE THE BEST TAX-EFFICIENT ETFS TO INVEST IN?

- ARE YOU OVERPAYING YOUR REIT MANAGER? WHICH S-REITS HAVE THE “HIGHEST” MANAGEMENT FEES?

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- 10 GREAT REASONS FOR REITS INCLUSION IN YOUR PORTFOLIO AND 3 REASONS TO BE CAUTIOUS

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

4 thoughts on “Best ETFs in Singapore to structure your Inflation-Proof passive portfolio”