There is no doubt that a sector rotation is currently in play, with rising 10-year bond yields translating to a sell-off in tech-related counters, with more “traditional” sectors such as financials (think banks) and communications companies being favored.

You might be wondering why saas stocks should be sold off in a rising yield environment, you might be wondering?

There are many reasons which might seek to explain the current tech weakness but I will just like to summarise it to 2 key points:

- Just a reason for the market to take profit on a sector that has been performing incredibly well in 2020

- The future cash flow of these tech stocks is now being discounted at a higher rate.

While Point 2 is the more “rational” and “logical” reason behind the tech sell-off, my sense is that Point 1 is the more “straight-forward” and “simple” reason explaining the current phenomenon.

I will be writing another more detailed article on my thoughts on the current bond yield environment and how should one be looking to position his/her portfolio against this backdrop.

In this article, I will be focusing on identifying 5 communication stocks that might continue to be a beneficiary of this current sector rotation in 2021.

These 5 communications stocks are not just benefiting from a sector rotation driven by higher bond yields but also from improving company-specific fundamentals, making them ideal consideration candidates for your portfolio.

How I screened for the best communication stocks

I turn to my favorite stock screener when it comes to screening for US stocks: Stock Rover.

The chart below illustrates the best performing sectors in 2021 YTD. Energy stands head and shoulder above the rest (due to oil prices demonstrating a huge rebound), followed by Financial Services (as a result of higher yields which tend to benefit your traditional banks) and Communication sector rounding up the Top 3 sector performers.

Within the broad communications sector, it can be further segregated into different industries.

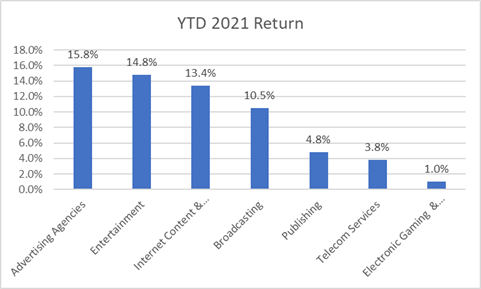

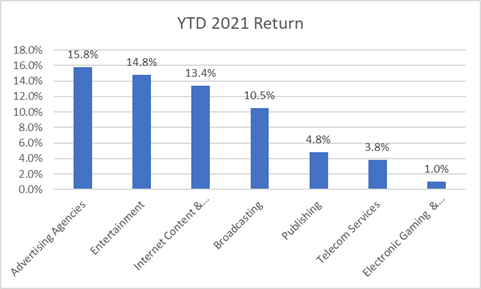

The top performances of the different industries within the communication services sector are highlighted below.

As can be observed, 1) Advertising Agencies, 2) Entertainment and 3) Internet Content & Information are the Top 3 industries within the communication services sector.

Next, I will look to identify some of the top-performing communications stocks within these individual industries.

Stock Rover

The best stock screener to find US-related stock ideas. Check out how I use the Stock Rover Screener to find multi-bagger gems

Best Communication Services Stocks #1: Magnite

Magnite Inc is an independent sell-side advertising platform that combines Rubicon Project’s programmatic expertise with Telaria’s leadership in CTV. Communications companies like Magnite provide a technology solution to automate the purchase and sale of digital advertising inventory.

Publishers use the company’s technology to monetize their content across all screens and formats, including desktop, mobile, audio, and CTV. Anchored in sunny Los Angeles, California, New York, and London, Magnite has offices across North America, EMEA, LATAM, and APAC.

Magnite is a company that most people would not be aware of. A more “famous” peer would be The Trade Desk or TTD for short.

I first highlighted the stock, Magnite to my readers back in June 2020 when the company was still known as Rubicon Project, in this article: Top 8 Technology Trends accelerating due to COVID and the stocks to benefit from it.

While TTD is known for its demand-side advertising platform, Rubicon Project (now Magnite) is the equivalent of the Sell-side advertising platform.

Back in June 2020, Magnite was trading at less than $10/share. Fast forward 9 months later and the share price is already at $50/share and this might just be a start.

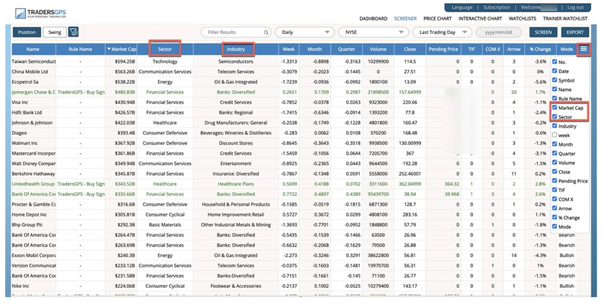

If you are looking to trade Magnite using the TradersGPS system, it would have identified a positive entry to enter back in Oct 2020, back when the share price was around $10/share. I will be looking out for another valid entry point in the coming days.

Best Communication Services Stocks #2: Comcast

Comcast company is made up of three parts.

The core cable business owns networks capable of providing television, Internet access, and phone services to roughly 59 million U.S. homes and businesses, or nearly half of the country. About half the homes in this territory subscribe to at least one Comcast service.

The firm is also the largest pay-television provider in Italy and has a presence in Germany and Austria.

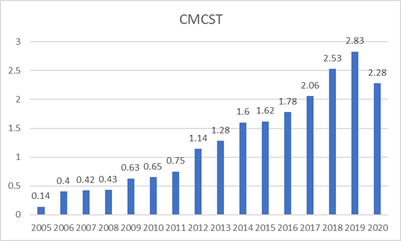

I first highlighted Comcast to my NAOF readers back in Feb 2020, in this article: 5 US recession-proof companies with 14 years of consecutive EPS growth

Back then, the stock was trading at around $45/share vs. the current $55/share, a decent 20% appreciation over a 1-year horizon.

While its Pay TV business is in a structural decline and will remain a strong headwind for the company, the rest of its core business remains strong and a very sticky one that will allow the company to escape unscathed when the next recession arrives.

According to the street’s estimate, after the one-off 2020 blip, Comcast’s EPS is expected to rebound strongly in 2020, with an average EPS of $2.83/share, growing strongly to $3.61/share in 2022.

Comcast is one of those communications stocks which I am comfortable in selling a Put option on to generate short-term income. With the stock currently trading slightly above $55/share, selling a Put option contract with a strike at $52.50 would generate a premium of $66/contract, translating to an annualized premium of 18% which is pretty decent in my view.

Best Communication Services Stocks #3: Twilio

Twilio is one of those communications companies that allows software developers to integrate messaging and communications functionality into existing or new applications via application programming interfaces, or APIs, and software development kits, or SDKs.

The firm’s Programmable Communications Cloud addresses several use cases, including Programmable Voice to make and receive phone calls, Programmable Messaging for SMS and MMS delivery, and Programmable Video that allows developers to embed video functionality in mobile and web applications.

Twilio is one of the communications stocks in my forever portfolio and I first highlighted the counter in this article: Finding great companies with network effect.

As the world continues to migrate countless ‘jobs-to-be-done onto smartphones, it’s almost certain that you’ve used Twilio’s technology. When you first validated your number on WhatsApp or Twitter — or even made in-app contact with romance in mind — Twilio had your back.

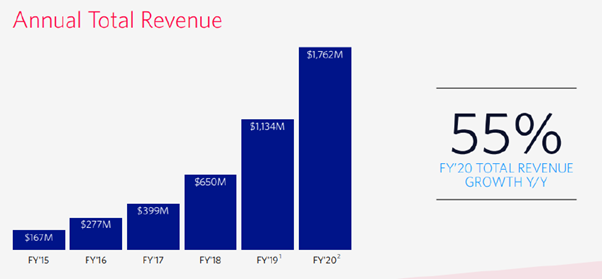

Twilio allows businesses to embed voice, messaging, and video into their apps. This empowers 172,000 companies to tell their customers that their flight is boarding, their table is ready, their taxi is waiting, or anything else that requires instant contact.

The Twilio of the last decade will not be the Twilio of the next decade. The company is pivoting from the communications sector for mobile apps into an “end-to-end customer journey platform.”

This pivot not only increases the addressable market but will increase Twilio’s percentage of market share. This is because of the omnichannel approach where Twilio breaks down silos to have an advantage over mid-size competitors.

There are also further opportunities and tailwinds for Twilio to accelerate beyond the 30% forecasted growth. This includes industries like healthcare and financial services transitioning more towards cloud communications, the various ways to leverage omnichannel data (including even advertising or in sales departments), and the internet of things and 5G.

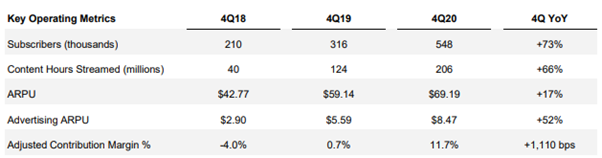

Best Communication Stocks #4: FuboTV

FuboTV Inc offers consumers a live TV streaming platform for sports, news, and entertainment through FuboTV. The company generates revenues through the sale of subscription services and the sale of advertisements in the United States.

FuboTV is positioned to capture an industry-wide shift to streaming TV, as the company’s distinct competitive advantage lies in its ability to provide live sports content at a lower cost than pay-TV equivalents.

The majority of OTT providers have focused predominantly on offering inexpensive entertainment content, forcing sports fans to continue to rely on Cable TV for live viewing. FuboTV gives sports fans the best option to cancel their more expensive Pay TV plans by offering access to the same, and in some cases, even more, live-sports content.

Another exciting growth channel would be FuboTV’s unique positioning for sports betting. The growth of online sports betting presents a major growth opportunity for fuboTV.

The online sports betting market is expected to reach $155 billion by 2024 according to Zion Market Research. In its shareholder letter, fuboTV management announced its intention to expand into the online sports wagering market, calling the industry “complementary to our sports-first live TV streaming platform.”

“As our cable TV replacement product is sports-focused, we believe a significant portion of our subscribers would be interested in online wagering, creating a unique opportunity to drive higher subscriber engagement and open up additional revenue opportunities. Simply put, we expect wagering will lead to more viewing, and this increased engagement will lead to higher ad monetization, better subscriber retention, and a reduction in subscriber acquisition costs.”

We have been aware of the cable TV decline for quite some time, with the key beneficiaries being streaming companies such as Netflix and more recently Disney with their Disney+ offering. One of our favorite streaming plays would be Roku (a hardware provider) which we covered in this article: Where to invest in 2021? 7 Investing themes for 2021.

FuboTV, with its market-leading position in the streaming segment targeting sports, will be well-positioned to grow its market share with the demise of cableTV.

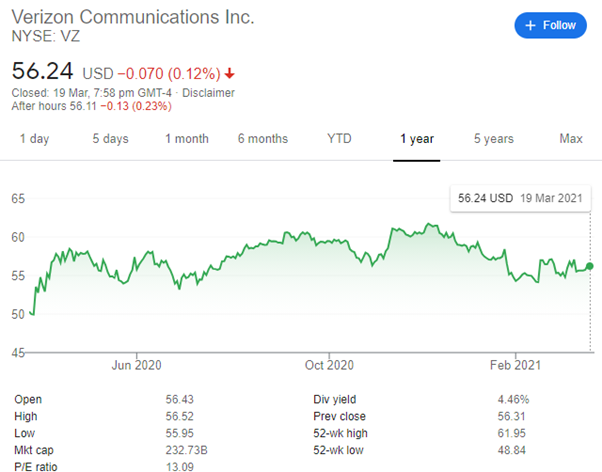

Best Communications Services Stocks #5: Verizon

VZ is the largest provider of wireless services across the U.S., which makes it one of the most suggested communication companies to look at.

A saturated market for wireless services has slowed Verizon’s topline growth in recent years, but the rollout of 5G services nationwide is expected to re-energize their growth. Verizon expects to reach 30 million homes with 5G services within five to eight years. Faster internet speeds will provide a boost to earnings by encouraging more subscribers to upgrade to premium plans. At present, only 17% of Verizon customers have premium unlimited data plans.

The company is also building out its services in video streaming, partnering with Walt Disney (DIS), Hulu, ESPN, and Discovery (DISCA). In the area of industrial applications for 5G, Verizon is partnering with Amazon’s cloud computing business and IBM.

Verizon expects to expand cross-selling opportunities via its $6.2 billion acquisition of Tracfone, the leader in prepaid wireless services. Tracfone has 21 million paying customers, and Verizon expects to convert some of these users to its more profitable post-paid services.

Verizon is one of the communications stocks in which Berkshire Hathaway took a huge stake when the fund disclosed its investment for 4Q20.

While its share price performance in 2020 has been disappointing, to say the least, stuck in a range of $50-60 for the past 1-year, this provides me with a good opportunity to generate short-term income through Put Option Selling on the counter.

Conclusion

Communication stocks might continue to weakness strength in the coming months if the 10-year yield continues to trend higher.

I have provided several communication companies and it’s stocks that might benefit from this sector rotation. Some of which are familiar names such as Verizon and Comcast which have been laggards for many years and might be poised for a break-out in the coming months.

Others are less well-known names such as Magnite, FuboTV, and Twilio which are smaller-cap in nature and are inherently more volatile.

These stocks have been screened using the Stock Rover stock screener platform.

An alternative way to screen for these stocks would be to use the TradersGPS platform where one will be able to sort some of the strongest momentum stocks based on sectors and industry.

For those who are interested to learn more about the TradersGPS platform and how Collin identified Dicks Sporting Goods (DKS) as his latest momentum stock pick, you can check out the free Training Session which will be held tonight 7pm on 22 March 2021 over Zoom. Just click on the link here and register your interest.

Do Like Me on Facebook if you enjoy reading the various investment trends and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- 8Best Stock Brokerage in Singapore [Update July 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.