SG Momentum stocks to buy now

When one talks about investing or trading in general, the usual norm is to buy low and sell high. While such an investing philosophy has been widely accepted, momentum investing is the art of buying high and selling higher.

Buying momentum stocks takes a different path compared to the traditional form of investing. A stock generates momentum, when there is a lot of activity, usually by the institutional investors or whom we often termed as the “bigger boys”. They get first dips into the stocks, followed by the savvier retail investors who can identify these trending, high momentum stocks earlier. Last into the game tends to be the mass retail investors who are often left “holding the baby”.

In this article, I will be highlighting what is momentum investing, how to select momentum stocks and lastly, identifying 4 SG momentum stocks that could be prime for more upside in 2021.

What is momentum investing?

Momentum investing is a type of investing strategy that involves buying and selling securities that are most likely to see a significant appreciation or decline in a pretty short period. We are typically looking at an investing horizon around 6-months to 1-year (not day trading).

With momentum investing, it is not likely that you will be buying “at the bottom”. Instead, it often entails buying stocks that have recently broken out of their 52-weeks high level or shorting stocks that have broken out of their 52-weeks low level.

Momentum stocks or growth stocks typically lead the way when the markets are rallying and such a strategy can be particularly rewarding if one’s timing is good.

However, it can also be frustrating when you identified a strong momentum stock that has rallied more than 20% over a short time, and just when you get yourself vested, hoping to ride the momentum further, that “strong” momentum fades away, leaving your capital locked up and you looking at substantial losses.

To have the best momentum picks, investors need to have the right set of tools such as TradersGPS which makes identifying momentum stocks at their infancy stage a relatively easy process.

One of the biggest benefits of momentum investing is also the fact that you can play the markets both on the upside as well as on the downside.

How to select momentum stocks?

There are different ways to find momentum stocks. One can use a paid screener such as those by SeekingAlpha.

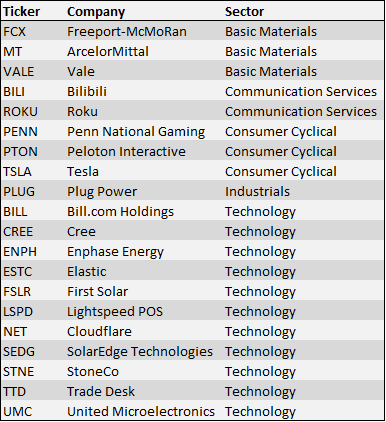

The table below shows the highest momentum stocks rated A+ by SeekingAlpha.

These are large-cap stocks with a market cap of more than US$10bn with a very strong momentum tailwind.

Alternatively, one can also use a screener such as the Stock Rover screener to screen for high momentum stocks. The table below shows the highest momentum stocks identified by the Stock Rover Screener, also with a similar market cap criterion.

It is pretty easy to screen for high momentum stocks using screening tools such as SeekingAlpha or Stock Rover.

Stock Rover

One of the best fundamental screeners for US stocks, Stock Rover is a must-have for all serious investors looking to get an edge in investing/trading

The big question is always: Are we buying these high momentum stocks at the tail-end of their momentum, thus risking buying at the peak, or is the stock uptrend still at its infancy stage?

You do not need to screen for the highest momentum stocks (top 2-3%) as I have shown in the table above. Instead, you can be screening for momentum stocks that are in the Top 10% while yet at the same time exhibiting market-beating characteristics such as having returns that have significantly outperformed the general market index.

For example, the Stock Rover screener identifies 78 momentum stocks that are in the Top 10% in terms of the proprietary-generated momentum rating score. These stocks have also outperformed the S&P 500 index by at least 30% over the past 3-months.

Careful selection of these momentum stocks might result in multi-baggers. Of course, the results might be better when implemented alongside some technical factors such as volume increment or the use of moving average technical indicators.

This is where the TradersGPS system excels. It can identify a momentum stock that looks to be trending based on various proprietary technical indicators baked into the system. Without the need to use multiple “overlays” of technical indicators, one of the most popular strategies of the system uses a simple “green” arrow to identify purchasing of a momentum stock, potentially in its infancy stage.

The Systematic Trader

An easy to use, intuitive platform that identifies momentum stocks. Its proprietary platform, TradersGPS shows you the RIGHT stock to be entering at the RIGHT time.

For more information on TradersGPS, one can refer to the comprehensive review that I have written on the platform.

However, do take note that the TradersGPS platform is not the “Holy Grail” of investing platform. Collin Seow (the man behind the system) recently highlighted that his “live” trade portfolio only has a hit rate of 50+% (out of 10 stock selection, only roughly 5-6 are winning trades) but that 50+% has generated a total portfolio return of over 50%.

This is due to the system “riding the momentum” on strong trending counters (without the temptation to sell your winners early), generating high double-digit returns on average, while at the same time exiting on losing trades early (with average losses of just 9% on losing trades).

Collin will look to disclose more of his trades in the upcoming free webinar session on 29 December 2020.

4 SG momentum stocks to buy now

I have identified 4 SG momentum stocks using the TradersGPS platform.

These are stocks that look to be breaking out of their trading channel or recently-achieved high, which if sustained, will provide the necessary “fuel” to allow their share prices to continue trending higher.

The beauty of the TradersGPS system is that it does not require the monitoring of multiple technical factors such as volume increment, Moving Averages crossover, MACD etc, where the interpretation of these technical factors might be subjective at times.

For its key Position Daily (6-months) strategy, all one needs is to identify the “Green Arrow” with “TIF”, the presence of both indicating a rising momentum in the stock.

Let’s take a look at the 4 SG stocks with rising momentum identified by the TradersGPS system.

SG Momentum stocks #1: Keppel Corp

I have written on Keppel Corp on several occasions. Keppel Corp is one of the 5 undervalued stocks that I believe is worth taking a second look.

I cover it in this popular article: 5 Undervalued stocks in SG to buy now and briefly explained my rationale in that article.

The next catalyst for Keppel would likely be the 100-day strategic review conclusion, first announced by management during its 3Q20 results and likely to be completed by the end-2020 or early-2021. The street will be on the lookout for how Keppel is planning to deal with its O&M division, the most ideal case being a divestment and subsequent merger with Sembcorp Marine.

Looking at how Sembcorp Industries’ share price has performed post the demerger of Sembcorp Marine, Keppel’s share price could follow a similar path.

As a momentum stock, Keppel exhibited strong momentum in early November when the counter was trading at S$4.60/share and there was a BUY confirmation by the TradersGPS system. The counter has since trended higher to the current level of S$5.40, just a fraction away from its recent high of S$5.46, which if broken, could signal further upside ahead.

I will be on the look-out for that trigger point to possibly make a second entry into the counter in early 2021.

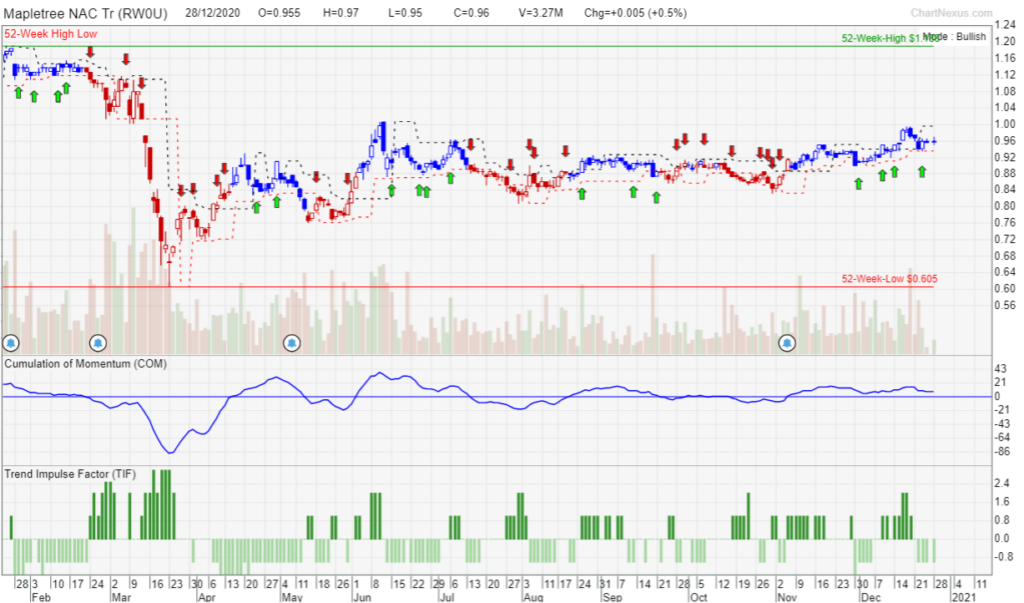

SG Momentum stocks #2: Mapletree NAC Trust

Another stock that I have written before in this article: Best Performing Singapore REITs (Updated in December 2020) and one of my current preferred REIT selection, Mapletree NAC is a counter that has seen its share price fell from a peak of S$1.48 back in June 2019 to a low of S$0.70 in late March before rebounding back to the current level of S$0.96.

Hit by continual protest issues in HK which halted operations at its key asset, Festival Walk for 1.5 months back in 2019, the REIT reported dismal operating performance for its FY2020 results. The street is however expecting revenue to rebound relatively strongly in FY2021 with an 8.35% YoY growth.

According to the OCBC estimates in this interesting REIT sector report, Mapletree NAC’s DPS is expected to drop to approx S6cts in 2020 before rebounding to S6.9cts in 2021. Based on its current price of S$0.96, that equates to a forward 2021 yield of 7.2%, which is generally still acceptable for the risk that one is assuming in this case.

The Street is still generally positive on the counter, with the average street rating at S$1.10 for the counter which implies an upside potential of c.15% from the current share price level.

According to the TradersGPS system, there was a positive entry recently in mid-December when the price was trading at around S$0.95/share. While the price subsequently hit a high of S$0.995/share, it was not able to breach the psychological S$1/share level and has retraced back to the current level of S$0.96.

However, the momentum remains positive for the stock, and a successful breach of the S$1/share level in 2021 could mean upside potential to the 52-week high of S$1.18/share.

This is a REIT that I don’t mind owning as I get paid a decent 7% yield while waiting for the market to re-price the counter.

SG Momentum stocks #3: Food Empire

Food Empire is the smallest cap stock in this list of momentum stocks. I have not written about Food Empire previously in any of my SG-focused articles due predominantly to its small market cap, hence, do take note of the higher risk nature of the counter.

However, there was a positive Buy entry given by the TradersGPS system on 23rd December and more interestingly, it seems to have cleared its recent resistant level of S$0.64/share. While the “clearance” isn’t yet convincing, a momentum push could trigger the stock to trade higher to its last high level of S$0.75/share, which represents close to 18% upside from its current level.

Food Empire is a small-cap stock that is not that widely covered by the street. The 2 brokerage houses that still actively cover it, UOB Kay Hian and RHB have a target price of S$0.88/share and $0.80/share respectively on the counter.

One needs to be more cautious when trading in a small-cap stock like Food Empire. However, the current momentum for the stock could push the stock to test its 52-week high level of $0.75/share in 2021.

SG Momentum stocks #4: Wilmar

Readers of NAOF will be pretty familiar with Wilmar, a stock that I have covered numerous times and also one of the featured undervalued counter.

Despite being a “commodity” play, I see Wilmar as one of those stocks which have a fully integrated business model that will continue to benefit from the rising affluent of the Chinese (and their propensity to spend on branded consumer staple products) in the coming decade and beyond.

The company has been very active in buying back its shares in December 2020, with numerous transactions of share buybacks since 18 November 2020. Before this, Wilmar had not bought back its shares since Aug 2016.

Its Chairman Mr. Kuok Khoon Hong has also in early November raised its stakes in Wilmar by 2m shares at an average price of S$4.28/share.

Following a lackluster performance since the highly anticipated listing of its key subsidiary, Yihai Kerry, Wilmar seems to have found its MOJO of late, with a positive BUY signal on 18 December 2020 at an entry price of S$4.38.

The price has been on a strong rebound since then, currently trading at S$4.61/share, and could potentially look to breach its high of S$4.90/share in 2021 if the share price momentum is maintained.

Conclusion

Buying momentum stocks can provide big rewards but at the same time, they are risky. It takes a lot of practice and market knowledge to be able to pick the right momentum stocks.

Momentum based movements in stocks start with a series of events. The big boys are usually the first to be well-positioned in these momentum stocks, followed by the savvy retail investors who are still “not too late” in the game while the mass retail investors are often left “holding the baby”.

The TradersGPS system has simplified the stock selection process by using its proprietary system to identify momentum stocks early in its infancy stage of price appreciation/depreciation. It provides you with the tool to be the savvy retail investor vs. being a mass retail investor who “FOMO” and often makes the wrong purchase decision.

At the end of the day, momentum investing is not suited for all types of investors. To be a good momentum investor, you need to be fairly tolerant of the risks that come with momentum trading. More importantly, you need to have the discipline in following a system that works. That means cutting your losses no matter how “fundamentally” sound that stock (think Alibaba) might be.

Investors having a conservative risk profile as well as a “value mindset” will find it difficult to be successful with momentum investing.

The above 4 SG stocks have been identified by the TradersGPS platform as possible momentum stock candidates. While the longer-term mode of these stocks are bullish, most of the 4 SG momentum stocks identified in this list have been trading in a channel and hence, some might not view them as real momentum plays until a breakout is confirmed.

My preferred mode of investing in momentum stocks are through the usage of options, predominantly buying call options where my risk is defined by the premium that I pay, while my potential upside (if I have identified these momentum stocks correctly) could be significant.

Unfortunately, there is no option market available for SG stocks.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 17 US COMPANIES MOST AT RISK FROM ESCALATING US-CHINA TENSIONS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.