How to identify momentum stocks the easy way

At the end of 2020, I wrote an article highlighting 4 Singapore momentum stocks to buy into 2021. All 4 SG stocks have appreciated in value of approx. 3-22% over 3 weeks and it does seem like their current price momentum could result in another leg up for these counters.

I will briefly talk about these 4 names later and why I believe that there might still be further upside potential for these 4 SG stocks.

For readers of NAOF, you will probably be familiar that when it comes to identifying the right momentum counters to partake in, I rely on the TradersGPS system which allows me to easily identify momentum stocks that are still in their infancy stages.

The TradersGPS system is a proprietary system that is developed by Collin Seow and his team and this proprietary platform is accessible through his Systematic Trader course which has been voted as the top investing course by Seedly.

I have written an extensive review article on The Systematic Trader Course which provides more insights on what this course is all about and how exactly to use the TradersGPS system. Collin will be holding a 2.5hrs FREE online session TODAY on the 19th of Jan 2021, starting at 7 pm. So make sure you sign up for it.

The Systematic Trader

The Systematic Trader course teaches you how to use the proprietary TradersGPS system which looks to identify the RIGHT stock to buy at the RIGHT time.

Check out their free webinar session today!

In this article, I will be identifying another momentum SG stock in play using the TradersGPS system, one which I believe might have further upside to go if it successfully breaks out of its recent 52-week high mark.

Before that, let me first have a quick review of the 4 Singapore momentum stocks identified back in late Dec 2020 to see if there might be further upside potential in their share prices.

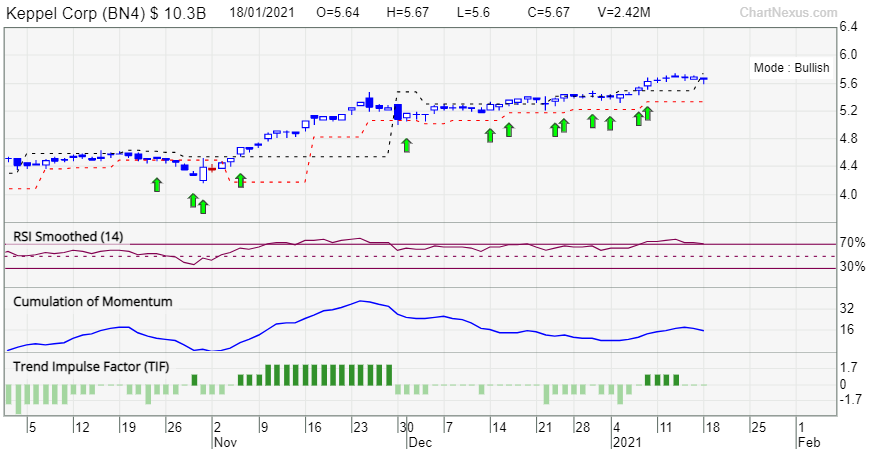

SG Momentum Stock #1: Keppel Corp

Keppel Corp’s share price has appreciated by approx. 5% since the time I wrote it and the counter has successfully breached its previous resistant level of $5.46, with the stock’s last traded price at $5.67. This is also the level in which there was a 2nd positive BUY indicator by the system, back on 8 Jan 2021, to enter into the stock.

Keppel Corp is a counter that I have written quite extensively about previously.

I cover it in this popular article: 5 Undervalued stocks in SG to buy now and briefly explained my rationale for why I believe Keppel is undervalued in that article.

I have also written on Keppel on the potential combination with the now demerged Sembcorp Marine entity to form a larger offshore rig building entity.

The next catalyst for Keppel would likely be the 100-day strategic review conclusion, first announced by management during its 3Q20 results and likely to be completed by early-2021. The street will be on the lookout for how Keppel is planning to deal with its O&M division, the most ideal case being a divestment and subsequent merger with Sembcorp Marine.

I am relatively comfortable in taking another stake in Keppel Corp at the current price to see if the price momentum for Keppel can be sustained.

SG Momentum Stock #2: Mapletree NAC Trust

Among the 4 stocks in this list, Mapletree NAC Trust saw the smallest appreciation of 3%. However, it is still a counter that I am comfortable in holding for its juicy 7% forward 2021 yield.

There is now another potential positive BUY indication to enter into the counter, that is if Mapletree NAC Trust successfully breaches the $1/share level.

A convincing “penetration” of this level might be an early indication that the trust could retest its 52-week high of $1.18/share.

I have written about Mapletree NAC Trust in this article: Best Performing Singapore REITs (updated in December 2020) which readers might be interested to revisit. In that article, I highlighted the best and worst-performing Singapore REITs for 2020 as well as highlight a handful of SG REITs that are currently on my watch-list.

Additional Reading: 10 Great Reasons to buy Singapore REITs and 3 Reasons to be cautious [Update 2021]

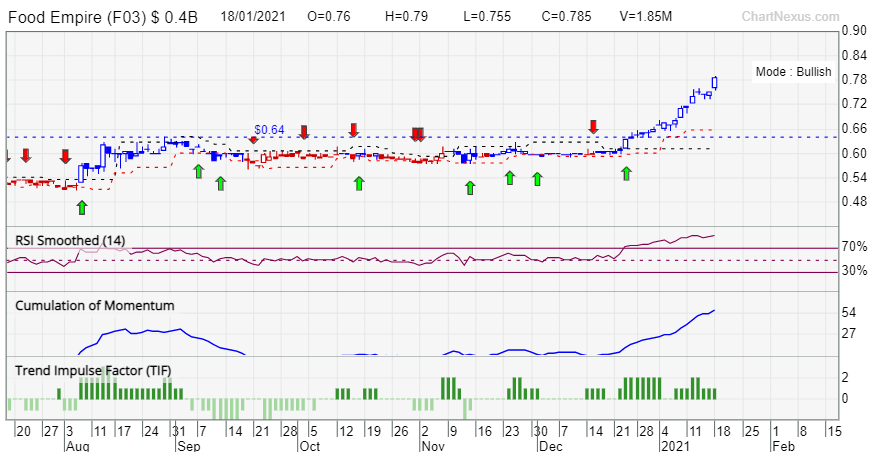

SG Momentum Stock #3: Food Empire

I identified Food Empire as a potential SG momentum stock when it was trading at around $0.64/share. There was a positive BUY entry given by the TradersGPS system on 23rd December 2020. I highlighted that a convincing clearance could push the share price to its last high level of $0.75/share.

This level has also now been cleared, with the counter currently trading at $0.785/share (22% appreciation from our initial entry-level), pretty close to the street’s average target of $0.84/share.

I will be slightly cautious in taking an additional position in Food Empire now following its strong run-up and will be waiting for a pullback before making my next entry, assuming there is another positive BUY signal from the system.

One needs to be more cautious when trading in a small-cap stock like Food Empire. However, the current “force” is undoubtedly strong for this counter.

SG Momentum Stock #4: Wilmar

Readers of NAOF will know that I have been positive about Wilmar since the company’s long-awaited IPO of its key subsidiary Yihai Kerry came closer to fruition.

Additional Reading: Is Wilmar substantially undervalued?

Following a lackluster performance, since the highly anticipated listing of Yihai Kerry came to a closure, Wilmar seems to have found its MOJO of late, with a positive BUY signal on 18 December 2020 at an entry price of S$4.38.

I highlighted that the price has been on a strong rebound since then, trading at $4.61/share when I first wrote the article, and is currently trading at $5.35/share, a good 16% appreciation from the initial level.

The company has continued to buy back its shares, with the last active buyback happening on 6 Jan 2021 at a price of around $4.85.

Wilmar’s current share price is at an all-time high and the street has been pro-active in raising its target price high, with a street high target price of $6.80/share from Maybank. UOB has also recently up its target price to $6.40/share.

Its subsidiary Yihai Kerry Arawana’s share price almost tripled from its initial price of CNY50 to CNY146 at its recent peak. With the current price of Yihai at CNY123/share, that implies a market cap of CNY645bn or S$132bn equivalent vs. Wilmar’s market cap of S$34bn.

Am I missing the picture here? It’s either Yihai is grossly overvalued or Wilmar is grossly undervalued.

SG Momentum Stock #5: Valuetronics (NEW)

Valuetronics is considered a small-cap counter that I have written about previously in this article: 5 Singapore Small Cap Companies worth considering with net cash > 50% of market cap

At that point of writing, the company has a market cap of around $242m. On the other hand, the company boasts a net cash balance of S$186m. This puts its net cash at 77% of its market cap. The company also paid an FY20 DPS of HK$0.20 which translates to an attractive yield of 6.2% based on the current price.

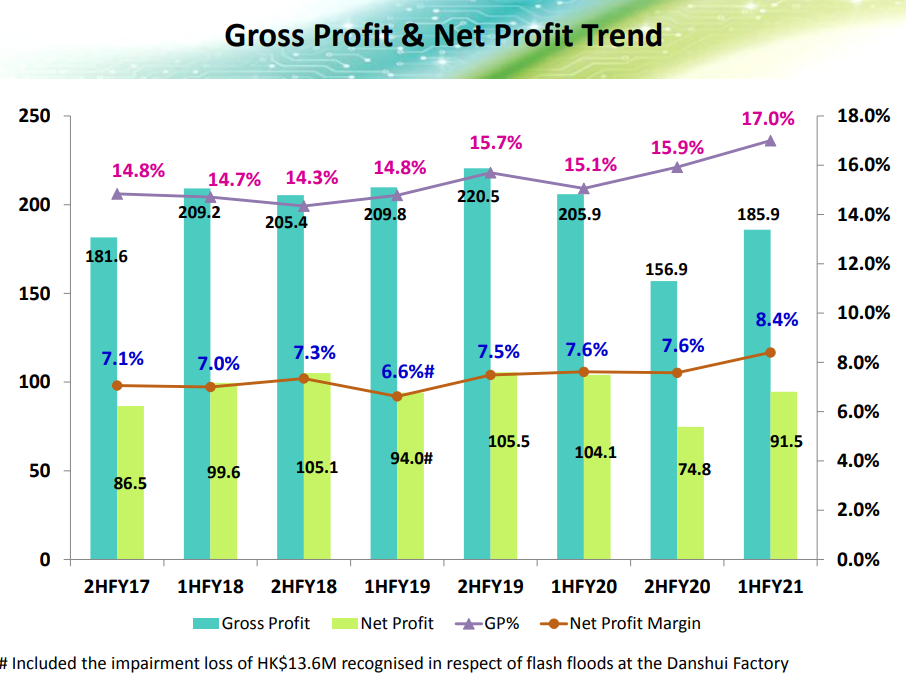

The company is still very much profitable despite COVID-19 negatively impacting its operations. The company generated HKD 75m in profits for 2HFY20. This improved to HKD 91.5m in its latest 1HFY21 results (despite a 12% YoY drop in profitability vs. 1HFY20). This is achieved on the back of a strong gross profit margin of 17% achieved in 1HFY21, the highest level in recent years. Consequently, the net profit margin of 8.4% is also at the highest level over the past 4 years.

Net cash balance improved marginally from S$186m as of FY2020 to S$194m. The company also maintains its interim DPS of 5 HK cents which is a welcome relief.

Assuming a full year DPS of 20 HK cents, that will translate to S3.4 cents which equates to a yield of approx. 5.2% at the current share price level.

Valuetronics is looking to breach its 52-week high level of S$0.68/share, achieved back in May 2020. If its share price successfully exceeds that level, the next target price will be at S$0.80/share.

The TradersGPS system has a BUY signal for Valuetronics in early 2021, with an indicative entry price of S$0.60/share. However, the counter was still trending in a range and did not manage to break out until 12th Jan 2021 where it appreciated by 10% that day, likely a result of semi-conductor bullishness, although the company, as a contract manufacturer, will not likely see direct benefits in terms of pricing.

Nonetheless, its substantial exposure to the autonomous vehicle industry and smart lighting industry bodes well for the company’s long-term growth prospect.

I have previously researched Valuetronics and will like to share this with my readers. This was done when the counter was trading at around S$0.52/share (key figures have been updated).

Value emerging in Valuetronics

I have been following Valuetronics for years and its current COVID-19 driven share price weakness presents an opportunity for the long-term investor to take a position in this well-run integrated EMS provider.

Valuetronic’s origin started as an integrated manufacturing service provider for its customers but has since scaled the value chain with more in-depth engagement with its customers in the arena of design and development of products.

This increases the stickiness of its service offerings as the company is NO longer viewed as a run-of-the-mill outsourced manufacturer.

An increasingly diversified company

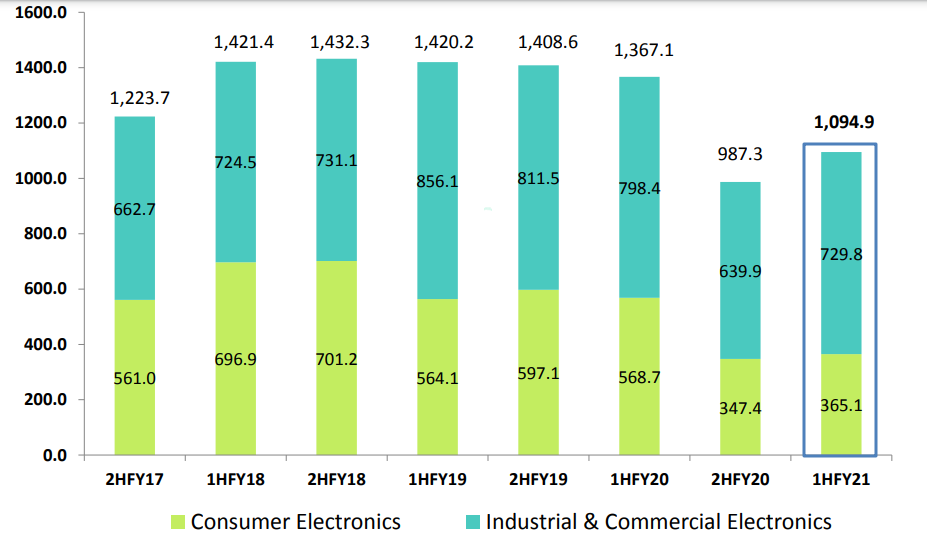

Valuetronics operates in 2 key divisions: 1) Consumer Electronics (CE) and 2) Industrial and Commercial Electronics (ICE). Revenue between both divisions is now skewed towards the higher-margin ICE division vs. a few years back where the lower-margin CE division dominated the bulk of the Group’s revenue.

The subsequent decline of LED lighting demand from Philips resulted in both revenue and earnings disappointment as its share price took a tumble in 2014-15.

With demand from mass-market LED lighting dwindling, the company refocuses its attention on diversifying its revenue base through higher-margin projects from the ICE division. Revenue from this segment subsequently increased from c.30% of Group’s revenue to the current level of 67% (based on 1HFY21), with Valuetronics also benefitting from margins improvement due to better sales mix.

This division also does not present customer concentration risk with no single client encompassing more than 10% of the Group’s revenue.

The future of IoT lighting remains bright

A key breakthrough came from the revival of its CE division when the company started producing IoT lightings for Philips in 2QFY17 and this has resulted in the division’s revenue returning to its original heydays seen in FY14-15.

The difference right now is that demand for IoT lighting is only in the early stage, with penetration in the US (the largest market for IoT lighting) only in the mid-teens while other developed countries are only seeing penetration rates in the high single digits to early-teens.

We believe that peak demand will only be reached when the penetration rate hits the c.25-30% level, similar to mass-market LED lighting.

While pricing points are definitely on the higher end, we see adoption rates increasing for such smart lightings that can also be paired alongside voice-command smart appliances such as Google Homes/Amazon Echo to form an “integrated” smart home.

Imagine a home where switches might no longer be relevant and you can command your lighting features (colors, intensity) through a simple voice command. Besides home applications, IoT lightings will also be widely deployed for commercial purposes, particularly in the area of Li-Fi, an emerging technology in which LED lighting provides a broadband internet connection through light waves.

This means that future lighting systems will fulfill 2 functions: 1) basic illumination and 2) high-speed wireless networking. Valuetronics key customer, Philips has vowed to take Li-Fi technology mainstream, having already licensed its technology to OEMs, ensuring that the Li-Fi capability could be bundled in luminaries in many brands.

We believe that Valuetronics will be one of the key OEMs that will have access to Philips Li-Fi technology which remains at the very nascent stage of adoption. How many of us have heard of the term Li-Fi? And would we have thought that our lights will be able to provide us with broadband connectivity that is 100x faster than the traditional Wi-Fi?

The drivers for IoT lighting are aplenty we are likely only at the early adoption stage. Again, while many of us are already using LED bulbs, how many of us have lightings in our homes that can be controlled through voice activation or one that is “smart” enough to turn itself off when no human movements are “sensed” for a set period, thereby conserving energy?

While not falling under the needs category, this is a feature that most homes will want to have in the not so distant future where almost everything can be interconnected.

Connected-autonomous vehicles the future of driving

Cars of the future will be increasingly connected, with smart devices being integrated within the vehicle system, such as Apple CarPlay and Android Auto. Valuetronics currently assemble in-car connectivity modules for Aptiv, a leader in self-driving car technology.

The company first secured Aptiv as its customer in FY2016 and started supplying in-car connectivity modules to one of their automaker customers, GM which is the Big 3 Detroit car-maker. GM, which boasts car brands such as Buick, Cadillac, Chevrolet, Holden, Wuling, and GM Korea, currently has 46 models that are Apple CarPlay enabled and we could continue to see this figure increasing.

By partnering with Aptiv, Valuetronics not only have access to GM’s pool of car models for in-car connectivity demand but can also leverage the future trend of self-driving vehicles. It is hence noteworthy that the company remains as one of Aptiv’s most valued automotive supplier, is one of nine in a long list of suppliers to receive Aptiv’s highest supplier recognition award in FY17.

This is a big picture outlook for Valuetronics. For those who are interested to just trade the counter, there might be an opportunity if the counter can convincingly breach its last high of $0.68/share.

Again, I will be on the lookout for a positive BUY signal from TradersGPS to average into the counter.

Conclusion

Buying momentum stocks can provide big rewards but at the same time, they are risky. It takes a lot of practice and market knowledge to be able to pick the right momentum stocks.

The TradersGPS system has simplified the stock selection process by using its proprietary system to identify momentum stocks early in its infancy stage of price appreciation/depreciation. It provides you with the tool to be the savvy retail investor vs. being a mass retail investor who “FOMO” and often makes the wrong purchase decision.

If you are interested, do sign up for the FREE online session happening on the 19th of Jan 2021 through the link below.

I believe that the 4 SG momentum counters earlier identified still have legs for further upside appreciation despite their rally over the past 3 weeks.

The 5th SG momentum counter which I introduced in this article is often seen as a value play due to its strong and sustainable dividend yield.

A combination of Momentum + Value could see this counter appreciating further in 2021.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- 8Best Stock Brokerage in Singapore [Update July 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.