Singapore Small Cap Companies

The SGX is home to many small-cap companies. While some like investing in small-cap companies, betting for that huge upside potential, I believe that most of the small-cap companies listed here in Singapore lack the necessary growth catalysts to make them exciting prospects.

In this article, I will be highlighting 5 Singapore Small-Cap companies with loads of cash on their balance sheet. My screening criteria requires for their net cash (cash and cash equivalent – total debt) to be over 50% of their market cap.

Also, these companies have to be profitable.

Evaluating a company based on cash on hand is often viewed as a part of “Value Investing”. The more net cash as a percentage of their market cap, the more “undervalued” the company is from the eyes of a value investor.

While there is no certainty that such “undervaluation” will translate to excellent long-term share price returns, it is always comforting to know that the probability of these companies going “bust” as a result of financial distress is comparatively much lower compared to a debt-laden company.

This is all the more critical in the current macro environment where COVID-19 has substantially impacted the global business landscape, with major economies currently facing their worst recessions in recent history.

Without further ado, let’s look at these 5 Singapore Small-Cap companies whose net cash is more than 50% of their market cap.

Are they worth investing in?

Singapore Small Cap Companies #1: Hong Leong Asia

Hong Leong Asia is the Trade and Industry arm of Singapore conglomerate, Hong Leong Group. The company’s key holding is its 41.8% stake in China Yuchai which is a company listed on the NYSE. According to its latest financials, the company has got S$1.38bn in cash, c.S$952m in total debt and hence translate to net cash of c.S$431m

With a current market cap of just S$366m, the company’s net cash as a % of its market cap is almost 120%! At first glance, investing in Hong Leong Asia seems like a no brainer for a value investor. How do you get any better with your cash hoard being more than your market cap? Before I analyze this, let’s first delve a little into its stake in China Yuchai.

As highlighted, the company has got a 41.8% stake in NYSE-listed China Yuchai which boasts a market cap of US$670m. This represents that Hong Leong Asia’s 41.8% stake in China Yuchai is worth US$280m or SGD$383m based on the current market cap. This is already more than its current market cap which means that an investor is getting its other businesses “for free”.

The chart below shows the share price performance of Hong Leong Asia vs. that of China Yuchai. While China Yuchai’s share price has rebounded strongly since March 2020 and is currently trading at its 52-week high, Hong Leong Asia is currently trading at 30% from its 52-week high level.

A reason could be the deteriorating prospect of its “other businesses” not associated with China Yuchai. China Yuchai announced a 1H20 profit of US$43.2m (c.SGD$59m). Based on its 41.8% stake, that translates to a profit of S$24.7m. However, in its latest 1H20 result, Hong Leong Asia only reported a profit of S$19.4m which means that its other businesses incurred losses of c.S$5.3m.

Back to its net cash position of S$431m which is a consolidated amount. China Yuchai reported a net cash position of approx. S$760m. This will imply that excluding China Yuchai’s strong net cash position, the Group’s remaining business is in net debt of c.S$330m.

This might be a reason explaining the key discrepancy between both companies’ share price performances and why Hong Leong Asia’s net cash being 120% of its market cap might not scream undervaluation after all on this standalone metric.

Singapore Small Cap Companies #2: Valuetronics

I have written about Valuetronics previously, highlighting the counter as one of the 10 companies that fall under the “value investing” category. How do I find value stocks in SG?

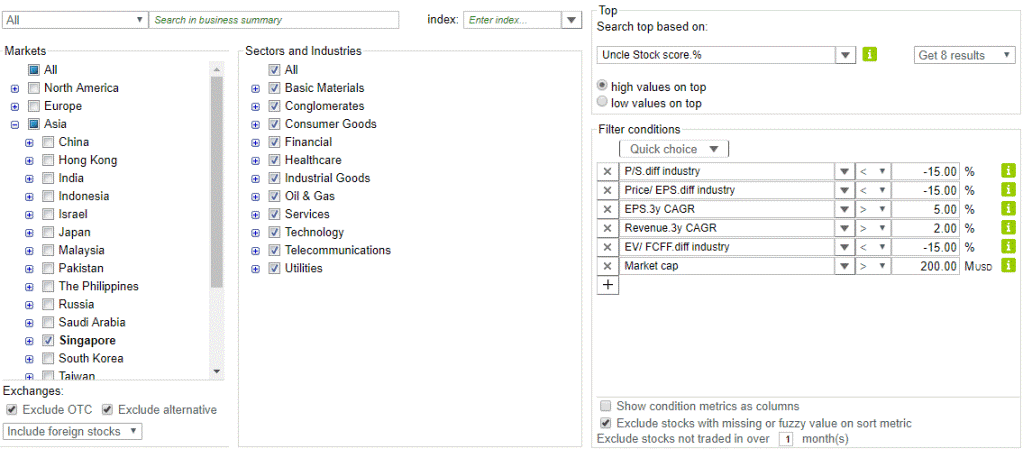

First, I will use a stock screener like Uncle Stock. It is not the best stock screener out there in my opinion particularly if you are just focusing on US stocks but for this article where the focus is on finding value stocks in Singapore and Asia, this stock screener is among the best out there.

So I use 6 screening criteria. P/S, P/E, and EV/FCFF are relative valuations when compared against industry peers. The idea is to find companies that are relatively undervalued based on these criteria when compared to their industry peers. These ratios have to be at least 15% below the industry average.

I also look at EPS and Revenue growth to ensure that these stocks have been growing decently (revenue CAGR of 2% and EPS CAGR of 5%) over the past 3 years and are not value traps.

Lastly, I look at Singapore stocks that have a market cap of at least USD200m. I found 10 stocks listed in SGX that met those criteria. Valuetronics is one of them.

The company has a market cap of around S$242m. On the other hand, the company boasts a net cash balance of S$186m. This puts its net cash at 77% of its market cap. The company also paid an FY20 DPS of HK$0.20 which translates to an attractive yield of 6.2% based on the current price.

The company is still very much profitable despite COVID-19 negatively impacting its operations. The company generated HKD$75m in profits for its latest half-year 2HFY20 results. On a full-year basis, the company generated HKD$179m in profits (S$32m). That translates to a trailing PER multiple of just 7.6x.

However, the company guided that its FY2021 financial results are expected to be significantly lower compared with FY2020. This could be the key reason why the market is not excited about the company despite it trading at such depressed valuation in terms of its net cash vs. market cap.

Singapore Small Cap Companies #3: Innotek

Innotek is a precision metal components manufacturer serving the consumer electronics, office automation, and mobility device industries. The company has a market cap of about S$91m. Interestingly, the company has cash and cash equivalent, including short-term investments totaling S$73m. With almost no outstanding bank loans, just S$225k, (exclude lease liabilities), the company’s net cash position relative to its market cap is at a robust 80%.

The company recently announced its 1H20 results which look weak on the surface, with net profit declining by 52% to S$3.7m. However, if one were to dig a little deeper, you will realize that there is a strong rebound in quarterly performance for 2Q20.

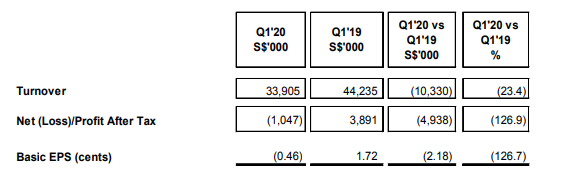

While the company has ceased quarterly reporting, it highlighted that its 1Q20 generated a loss of S$1.047m vs. 1Q19 profit of S$3.891m

On the other hand, its 1H20 results showed a profit of S$3.734m. This implies that the company generated S$4.781m in 2Q20 alone. Compared with 2Q19 profit of S$3.837m and it is a good 25% improvement in 2Q20 vs. 2Q19.

Assuming that the company generates the same level of profit in 2H20 vs. 2H19, FY20 profit could be in the region of S$13m which translates to a forward PER multiple of just 7x.

Unlike Valuetronics which provided a more somber outlook of its operating performance in the coming quarters, Innotek is seemingly more upbeat, expecting its TV segment and automotive segment to witness a gradual recovery in the second half of the year. Its office automation segment however remains under pressure.

With a DPS of S$0.015, the stock currently yields 3.75%.

A potential catalyst for the stock, besides a better than expected earnings in 2H20, would be deploying its massive cash hoard into an earnings-accretive acquisition. Alternatively, the company should also look to return excess cash to shareholders in the form of a special dividend if they have got no immediate requirement for it.

Singapore Small Cap Companies #4: Challenger

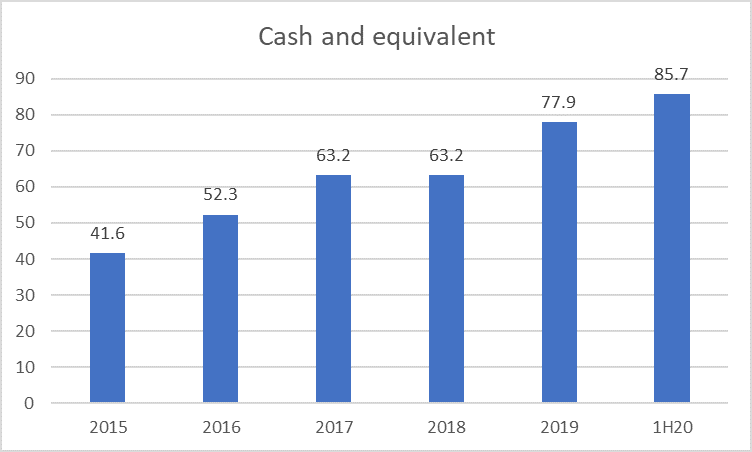

Challenger is no stranger to most, with the company having store presence in big and small shopping malls in Singapore. The company has a market cap of S$155m while concurrently boasting a net cash position of S$85.7m as of 1H20. This put its net cash as a percentage of market cap at 55%

Despite battling a tough operating environment due to COVID, the company managed to generate a higher net profit of S$9.7m in 1H20 vs. S$8.3m in 1H19 or a 16% improvement. Its net cash grew from S$78m in end-2019 to the current level of S$85.7m.

From 2015 to 1H20, the company doubled its cash hoard from S$41.6m to S$85.7m. This represents a c.S$10m increment in cash each year. On the other hand, over the last 5 years, Challenger’s share price has remained relatively stagnant.

The company made headlines back in June 2019 when the company’s voluntarily delisting effort was blocked by minorities. Management wanted to take the company private with an offer price of S$0.54 which was rejected by minorities who believed that the company is worth much more than the offer price.

With Challenger’s share price now at S$0.45, a 17% discount from the privatization offer price, this small-cap companies look interesting from both a potential follow-up privatization angle as well as improving company earnings through a tight cost control measure.

Assuming an extrapolation of its 1H20 results, the company is currently trading at a forward PER multiple of 8.2x.

Singapore Small Cap Companies #5: Fu Yu Corporation

Similar to Innotek, Fu Yu provides services for the manufacturing of precision plastic components and the fabrication of precision molds.

With a market cap of S$188m and a net cash hoard of S$101m, the company’s net cash as a percentage of market cap stands at 54%.

The company saw earnings increasing by 46% in 1H20 to S$7.4m despite a 26% decline in revenue. This was mainly attributable to higher other operating income which consists mainly of forex gain as the bulk of its cash asset is in USD.

Assumed that the company can generate a full-year net profit of S$12m (management guided for a challenging 2H20 operating environment), based on a dividend policy of 50% of net profit, the expected dividend payment could be in the region of S$6m, translating to approx. 3% yield. However, based on the historical track record, its yield could potentially be double at 6%.

Fu Yu is a company that is actively covered by RHB. The brokerage remains positive on the counter, with a target price of S$0.30. The brokerage firm believes that the company is an attractive target for privatization or acquisition.

Conclusion

These 5 Singapore Small-Cap companies have a robust balance sheet where their net cash balance is a significant proportion of their market cap.

While there is a certain degree of downside share price protection from its strong cash hoard, one should not be solely investing in the company for this particular reason.

Unless the company starts to deploy its cash capital into earnings-accretive acquisitions, such cash balances sitting in the bank accruing extremely low-interest rates will not be beneficial to shareholders.

Companies should look at returning excess cash to shareholders in the form of a special dividend if there are no plans to deploy them in the foreseeable future.

These 5 Singapore Small Cap companies are all decent value candidates. However, the two that appeal to me most at the current juncture, taking into consideration their forward growth prospect vs. relative valuation at present are Innotek and Challenger.

Innotek could look to surprise the market positively in 2H20 if the strength seen in its 2Q20 results follow through into 2H20. A huge catalyst will be the deployment of its strong net cash position into an earnings accretive acquisition.

For Challenger, the company’s continual accumulation of cash in the current challenging economic context is noteworthy. I will not rule out the founder making another attempt to take the company private. However, the price has to be substantially above the mid-50s level previously offered, especially after taking into consideration its current record cash level.

Investors will be paid a decent 3+% yield to wait for the next possible corporate event. In the meantime, the company will likely continue to generate substantial free cash flow, further adding to its cash hoard.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 10 SINGAPORE BLUE-CHIP STOCKS YIELDING MORE THAN 5% [UPDATE AUGUST 2020]

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY [JULY 2020 UPDATE]

- 4 SINGAPORE DIVIDEND STOCKS WITH INCREASING DIVIDENDS FOR THE LAST 10 YEARS. THIS STREAK COULD CONTINUE IN 2020

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 2]

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 1]

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “5 Singapore Small Cap Companies worth considering with net cash > 50% of market cap”