Singapore Growth Stocks for consideration

The current COVID-19 health pandemic has pretty much “decimated” Singapore’s economy where the latest GDP growth forecast was estimated to be at -7.0% to -4.0% for 2020. We hear of many of our favorite restaurants potentially closing down for good, according to a survey done by Chope.

Amid the current the challenging times, we sieve out 10 Singapore growth stocks which are expected to witness earnings growth in 2020, quite a feat to say the least. Within this list, I excluded certain industries such as REITs and Property Developers where EPS growth might not be too relevant or they exhibit earnings “lumpiness” profile as a result of irregular project recognition.

According to the street estimates, these Singapore growth stocks are expected to see their 2020 earnings appreciate by between 13% to 63%. We take a look at these stocks to see if their EPS growth can possibly extend beyond 2020.

This list of Singapore growth stocks will start from the lowest EPS growth to the highest EPS growth.

You can refer to Part 2 here.

Singapore Growth Stocks #10: Tianjin Zhongxin Pharmaceutical

Sitting at number 10 with an expected EPS growth of 13% is Tianjin Zhongxin Pharmaceutical Group. The Group, together with its subsidiaries, produces and sells Chinese herbal medicines, proprietary Chinese medicines, chemical raw materials and preparations, and nutritional and health products primarily in the People’s Republic of China.

The company sells its medicinal products under its brand to the wholesalers, and purchases medicinal products and biological products under other brands from distributors and sells these to other wholesalers.

The company was founded in 1992 and is based in Tianjin, the People’s Republic of China.

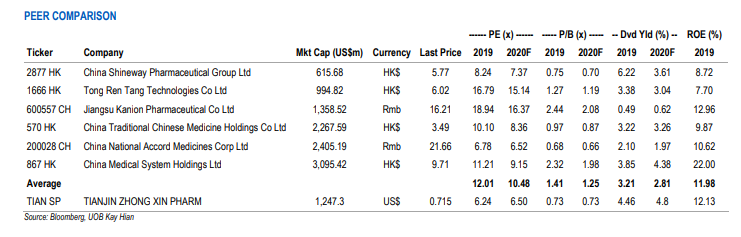

The counter is not actively covered by the street, with only UOB Kayhian still actively covering the counter. According to UOB, in its last updated report on 21st April, the brokerage house expects the counter’s net profit to increase from RMB626m in 2019 to RMB702m in 2020.

2020 Revenue and EPS growth are expected to be driven by its blockbuster cardiovascular drug (速 效救心丸) which grew 13.3% YoY in 2019 and sales of two other major products (胃肠安丸 and 清肺消炎丸) which grew by 24% and 32% YoY respectively in 2019. According to the broker, it expects the COVID-19 impact on the company to be minimal in 2020.

Traditional Chinese medicine *TCM) has been used as an alternative treatment to treat COVID-19. Backed by the Chinese government, TCM was added into the official COVID-19 treatment guidelines along with standard western medicine to relieve respiratory symptoms caused by COVID-19.

Although the efficacy of herbal treatments has not been proven, the boost in demand for TCM may help TCM companies such as Tianjin Zhongxin whom respiratory products account for roughly 10% of its total medicine manufacturing revenue.

Tianjin Zhongxin is dual-listed and its SGX shares are currently traded at a substantial discount to its A-shares (600329 CH). Thus UOB believes there is still plenty of upside for the company as the current share price does not match the company’s good fundamentals.

Given that the counter is only covered by 1 brokerage house, there might be significant variability on its EPS growth for 2020.

The counter has been listed on the SGX since 1997. Hence any financial statement “uncertainties” on China-related stocks should not be a major issue with this company. Granted the Luckin Coffee sales scandal (Wall Street Journal has written an interesting “behind the scene” expose) has further thrown a bad light on China-based companies, it is hence understandable that investors are not willing to ascribe a significant valuation multiple to these counters.

With a yield of about 5% and the company in a net cash position, it does seem that Tianjin Zhongxin might be worth considering as a “speculative growth counter” in your watchlist, with potential for further earnings growth post-COVID-19.

Singapore Growth Stocks #9: Fu Yu Corporation

Sitting at number 9 with an expected 2020 EPS growth of 15% is Fu Yu Corporation. The company is an investment holding company that engages in the manufacture and sub-assembly of precision plastic parts and components primarily in Singapore, Malaysia, and China.

The company is also involved in the fabrication of precision molds and dies; trading activities; and provision of management services. It serves companies in the printing and imaging, networking and communications, consumer, medical, and automotive sectors.

The company was formerly known as Fu Yu Manufacturing Limited and changed its name to Fu Yu Corporation Limited in 2004. Fu Yu Corporation Limited was founded in 1978 and is headquartered in Singapore.

Despite it being a small-cap company with a current market cap of approx. S$170m (base on the current share price of S$0.22/share), the counter is quite actively covered by 4 brokers here in Singapore.

CIMB and DBS both have a HOLD rating on the counter with a similar target price of S$0.21/share.

RHB Research and UOB Kayhian are more positive on the counter with a BUY rating and target prices of S$0.28 and S$0.25 respectively.

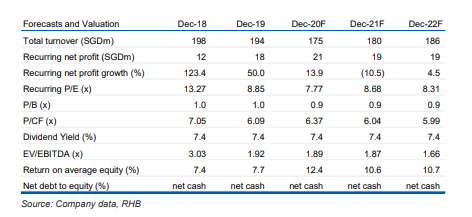

The more positive brokerage, RHB expects Fu Yu’s positive growth momentum to continue with further new projects in the medical and consumer as well as automotive fronts. With a strong net cash balance sheet, the company is thus expected to continue rewarding shareholders with an attractive dividend yield of >7%. Fu Yu remains one of the Top Picks of the brokerage house.

On the other hand, CIMB is more cautious on the counter and recently downgraded Fu Yu from A BUY to a HOLD with their expectations that 2Q20 earnings will be weak,. Nonetheless, the brokerage house still expects Fu Yu to dish out a dividend yield of 7.3%, with downside risk mitigated by the fact that net cash was 57% of Fu Yu’s market cap as of 31 March. The brokerage only expects Fu Yu to grow core EPS by 2% in 2020 due mainly to favorable foreign exchange impact.

Overall, there is quite a fair bit of uncertainty on Fu Yu’s operating climate in 2020, particularly for 1H20. Hence, 2020 EPS growth of 15% by the street is still a big uncertainty, with a large part likely the result of FX gain and should not be seen as recurring.

However, the key consensus is that the company sports a strong balance sheet, and the dividend is not expected to be cut in 2020 despite the challenging operating environment.

I will personally be looking out for sustainable gross profit margin improvement from product mix and management ongoing efforts to enhance operational efficiency.

Singapore Growth Stocks #8: Avi-tech

Sitting at number 8 with a forward EPS growth of 17% is Avi-tech Holdings. The company provides burn-in, manufacturing and printed circuit board assembly, and engineering services for the semiconductor, electronics, life sciences, aviation, and other industries.

It operates through three divisions: 1) Burn-In and Related Services, 2) Burn-In Boards and Boards Related Products, and 3) Engineering Services and Equipment Distribution.

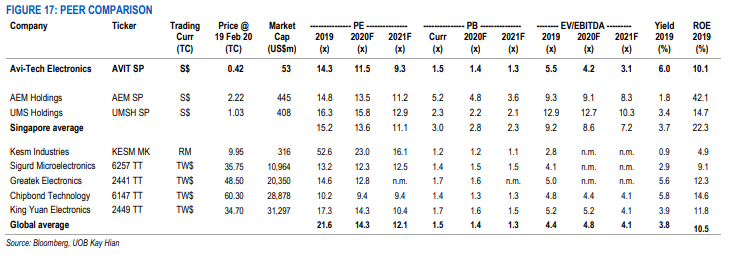

The counter is covered by both UOB Kayhian and RHB, with both having a positive rating on the stock. UOB initiated coverage of the stock back on 19 February 2020 with a TP of S$0.57. The brokerage house believes that Avi-Tech will be a beneficiary of the structural growth of automotive electronic components due to the increased adoption of safety-related vehicular systems as well as stronger penetration rates of electric and hybrid autos and the large market potential for autonomous vehicles.

The brokerage house estimates an EPS CAGR of 23% for Avi-Tech over the next three years, driven by the steady rise in electronic components within the automotive sector.

RHB similarly has a positive view of Avi-Tech, expecting earnings to have already bottomed in 2019 and expect to see FY20F EPS up by 12% YoY. RHB expects the company’s performance to pick up in 2HFY20 with strong growth from burn-in services, which has much higher gross margins. This coupled with previously done cost-cutting measures should help improve margins.

Another company with a strong balance sheet, Avi-Tech is in a net cash position and generates strong operating cash flow. Hence, RHB believes it is in a position to reward shareholders with the same level of DPS as in 2019 or potentially more, with a forecasted yield of c.6+% at the current price level.

Avi-Tech’s share price has rebounded post the March Covid-19 sell down.

Assuming that 2020 earnings come to fruition based on the street’s estimates, then the counter is currently trading at c.10x FY2020 PER which seems like a discount compared to peers’ such as AEM and UMS, according to UOB Kay Hian peer comparison done in its initiation report back in February.

However, a key risk could be the implosion of the trade war between the US and China which potentially could be back on the table as relations between the US and China has now been pushed to the brink amid accusations between the two nations on who started the COVID-19 health pandemic.

Avi-tech has not managed to grow its revenue in its latest 2QFY20 results (end-2019) and earnings growth was mainly driven by margins improvement. The ability to resume revenue growth, coupled with strong margins improvement as a result of previously done cost-cutting measures will result in substantial operating leverage for the counter.

However, at this juncture, that is not yet a certainty.

![Top 10 Singapore Growth Stocks for 2020 [Part 1] 1](https://newacademyoffinance.com/wp-content/uploads/2020/11/tiger-brokers-2.jpg)

Tiger Brokers

With ZERO min/0.08% variable commission charges, Tiger Brokers is the cheapest brokerage account to purchase your SG stocks.

Use their mobile platform to find the hottest trending stocks in SG, HK, China and US.

Singapore Growth Stocks #7: Penguin International

Penguin International sits at number 7 on the list with an expected 2020 EPS growth of c.18%. The company provides integrated marine and offshore services worldwide. Penguin operates in two segments, 1) Chartering; and 2) Shipbuilding and Ship Repairs/Maintenance.

It specializes in the design, construction, repair, and operation of high-speed aluminum vessels, including offshore crew boats, armored security boats, patrol boats, firefighting search-and-rescue vessels, passenger ferries, windfarm support vessels, and pleasure craft.

The company also offers ferry services and chartering of motor launches. Besides, it owns and operates shipyards in Singapore and Batam, Indonesia; and manages and operates landing craft, Flex crewboats, and fast supply intervention vessels.

Penguin International is covered by 3 brokerages in Singapore, CIMB, Phillips, and UOB, with all 3 houses having a positive rating on the counter. In its small/mid-cap assessment done in March 2020 on COVID-19, UOB highlighted that Penguin International is one of the few small-mid cap stocks that have a minimal impact from COVID-19.

This is due to Penguin’s shipbuilding portfolio being more diversified compared to the past where it was highly concentrated in Africa and a single product. Since then, it has expanded into more new markets including Taiwan, Australia, and Europe. Besides, it has added its product portfolio to include fire fighting ships, windfarm vessels, and passenger ferries.

With a robust order backlog and a strong balance sheet with net cash of S$60m, Penguin remains one of the few bright spots in the industrial sector that has been significantly impacted by the COVID-19 outbreak.

Both Phillips and CIMB has yet to provide an assessment of the company post its 4Q19 results in late-February, hence their 2020 EPS estimated might be slightly outdated. The company currently is highly order book driven as recurring revenue in the form of vessel charter remains low. This might result in a significant level of earnings lumpiness in the coming years.

CIMB estimates Penguin to generate only low single-digit EPS growth for 2021 and 2022.

Singapore Growth Stocks #6: UMS Holdings

UMS Holdings sits at number six with a forecasted 2020 EPS growth of 18%. The company provides high precision front-end semiconductor components, and electromechanical assembly and final testing services.

It operates in two segments: 1) Semiconductor and 2) Others. The Semiconductor segment offers precision machining components and equipment modules for semiconductor equipment manufacturers.

The Others segment provides water disinfection systems shipment services; and supplies base components to oil and gas original equipment manufacturers, as well as trades in nonferrous metal alloys.

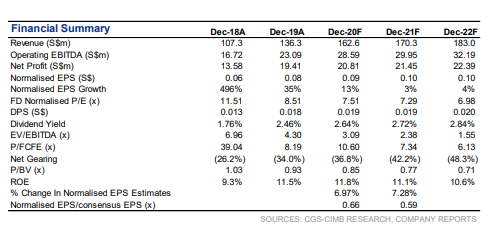

UMS is covered by 4 brokerage houses here in Singapore with 3 having a positive rating (CIMB, DBS, and Maybank) while KGI Securities is the only house with a negative Sell call on the stock.

By now, most would already know that UMS is highly concentrated to one particular customer, that being Applied Materials (AMAT) which encompasses approx. 90% of UMS revenue. Hence, a slowdown in AMAT’s operating outlook will have a direct impact on UMS’s revenue. AMAT was relatively positive on its outlook before the COVID-19 where it withdrew its 2020 forecast. It was forecasting EPS growth of 26% in FY2020 and 10% in FY2021

A surprise in its latest 1Q20 result was an interim dividend increase to 1.0Scts from 0.5 Scts previously with management forecasting a return to 6.0 Scts annual dividend. At that dividend level, the yield on UMS will be approx. 6.7% on its current price.

Management is cautious about the outlook near term and expects some challenges due to supply chain disruptions, manpower constraints, and other issues from the COVID-19 fallout. KGI Securities also noted outlook uncertainty beyond 2020 as semi-conductor Capex spending is being curtailed.

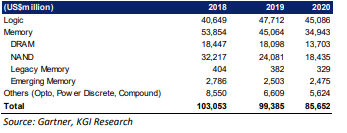

The brokerage house quoted 2020 Gartner forecasts for capital spending by the semiconductor industry, highlighting a further detail to US$86bn in 2020 from the US$99bn level in 2019.

DBS on the other hand is more positive on the semiconductor sector on the back of the acceleration of 5G, artificial intelligence, and other technology-driven developments such as Smart Cities and increased demand for data.

Out of these 5 stocks, the average price appreciation from the March low was approx. 45%. Fu Yu price appreciation is the lowest at c.22% while UMS has seen the greatest price appreciation of 65% from the recent low.

This is understandable given that Fu Yu’s 2020 EPS growth will likely be driven by non-recurring FX gains. Out of the 5 stocks, Avi-Tech looks the most interesting in terms of potential for recurring growth to continue.

In the next article, we will review the next 5 Singapore growth stocks with the greatest earnings acceleration, according to a forecast done by the street.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- VALUE INVESTING IN SINGAPORE: 10 SG VALUE STOCKS THAT MIGHT MAKE SENSE

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

- 10 SINGAPORE BLUE-CHIP STOCKS YIELDING MORE THAN 5% (2020)

- BEST STOCK BROKERAGE IN SINGAPORE [UPDATE MAY 2020]

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Top 10 Singapore Growth Stocks for 2020 [Part 1]”