Capping a disastrous end to 2019

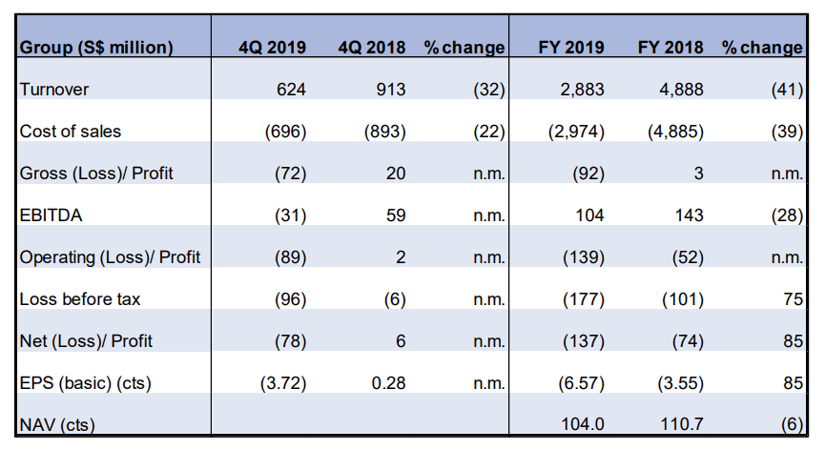

Sembcorp Marine announced its 4Q19 results before the market opens on 20 February. The company incurred 4Q19 losses of S$77.7m, bringing full-year 2019 losses to S$137m. We previously expected full-year 2019 losses to be in the region of S$100-110m.

We believe the main reason why losses came in significantly more-than-expected is due to the slowing revenue recognition profile of the company this quarter.

4Q19 revenue slowed to a pace of only S$623m compared to an average of S$750m for 9M19. The reduction in revenue, coupled with the company’s persistently high fixed costs resulted in gross losses of S$72m in the current quarter alone.

We believe that the revenue outlook for the company remains dim, with the company now expected to book quarterly revenue in the region of S$600m. This figure could potentially be lower if new order wins remain elusive.

Such a revenue run-rate will spell disaster to Sembcorp Marine’s bottom-line, given that the company probably requires a revenue break-even level in the region of S$750-800m, on our estimation. This is despite relief from the absence of accelerated depreciation expense from the Tanjong Kling yard in 2020.

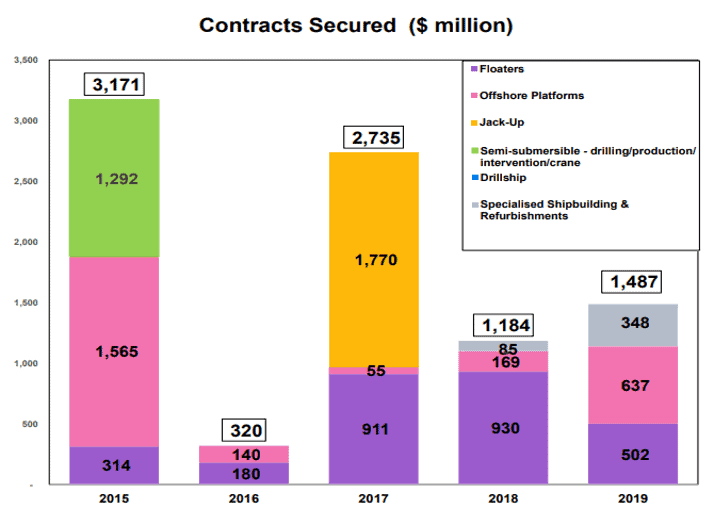

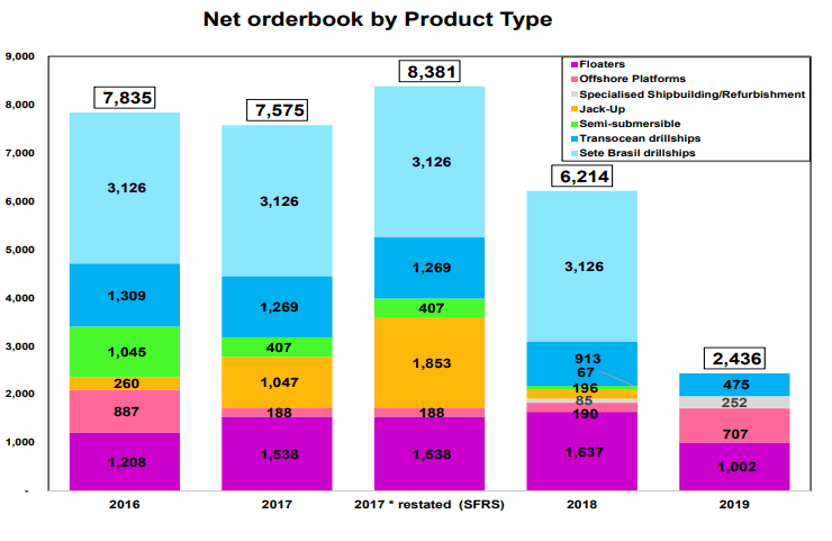

Overall order wins in 2019 remain slow despite a modest uptick of S$300m vs. 2018 depressed orders of S$1.18bn. The company ended the year with an order back-log of S$2.44bn. Assuming limited new order wins in 2020, the company now runs the risk of running dry its order back-log within the next 12 months.

According to Sembcorp Marine’s management guidance, the company expects the trend of losses to continue into 2020. By our forecast, the rate of losses in 2020, assuming an average revenue run-rate of S$600m/quarter, could balloon to S$180-200m.

This will reduce Sembcorp Marine’s equity base to S$2bn. With debt totaling approx S$4.4bn and cash on hand of c.S$400m as of end-2019, this will result in a net-debt level of S$4bn (assuming no significant change in their cash-generating position) which will result in a net-debt-to-equity ratio of 2x.

Such an elevated net debt/equity ratio could potentially be a breach of their bank financial covenants.

Day of reckoning might be coming

It is difficult to see how Sembcorp Marine’s operational outlook can improve in 2020 and beyond.

The offshore drilling segment remains fraught with uncertainties, with the rig glut situation not witnessing improvement. Transocean, the largest offshore drilling operator, highlighted that the industry faces short-term operational risk pertaining to the COVID-19 virus, which is expected to crimp oil demand. However, the company remains positive about the longer-term outlook of the industry.

The question remains to be seen if Sembcorp Marine can operationally sustain beyond 2020. At its current rate of new order wins, taking into consideration the current weak oil demand outlook, it is hard to foresee the company emerging out of its operational slump anytime soon.

We have previously written that Sembcorp Marine might be playing a waiting game, one that involves Temasek coming to its rescue.

With Temasek now taking a majority stake in Keppel, we see this as a prelude towards a potential consolidation of our local yards in the near future, a scenario only possible if spearheaded by the former, the largest shareholder of both Keppel and Sembcorp Industry (parent of Sembcorp Marine).

This is likely a key reason why we believe that the share price of Sembcorp Marine has not already dip below S$1/share. With a market cap of approx. S$2.6bn at its last closing price of S$1.24, the counter is trading at a PBR of 1.2x.

According to the research from UOB Kay Hian, this is a premium compared to locally listed yards, Keppel and Yangzijiang (sector average of 1.0x) as well as South Korean Yards (sector average of 0.9x).

Conclusion

Sembcorp Marine’s 4Q19 results were definitely below the street’s expectations, with most brokerage houses expected a QoQ improvement. Instead, its 4Q19 losses ballooned to S$78m.

It is hard to foresee how the company’s operational outlook might improve ahead, given an extremely tepid oil industry that is facing the largest oil demand decline in recent history.

Even if a subsequent “consolidation” between Keppel O&M and Sembcorp Marine is to materialize, spearheaded by Temasek through a potential privatization, it is still uncertain what the price premium Temasek might pay for this entity, one that is already trading above book.

A better alternative to play this privatization angle would be through Sembcorp Marine’s parent, Sembcorp Industry, the latter likely to see a substantial valuation re-rating by simply divesting its 61% stake in Sembcorp Marine to become a pure-play utility company.

At risk of sounding like a broken recorder, I believe this is the best solution for our local yards to compete against the South Koreans and China heavyweights, themselves undergoing a consolidation phase at the moment to reduce operational expenses.

With new orders unlikely to improve significantly in the near horizon, this might be the only viable solution to ensure that our yards literally stay afloat in one of the longest downturn (since 2014) this industry has ever experience.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.