FSMOne: Upping the game of “cheap” investing

FSMOne Fees for Regular Savings Plans (RSP) in ETFs are likely the most competitive among the local brokerage houses. Investing in US-domiciled ETF might now also be more economically feasible (although there will always be lingering concerns over tax-efficiency).

(The original article was first published back in Nov 2019 and we update the latest FSMOne RSP ETF list in this article. I will also highlight a quick “problem” that I personally faced when trying to invest in the ETFs through the RSP method).

FSMOne.com investors will now be able to apply for RSP on a selected list of 40 38 (Vietnam and Russia Single Country Equity ETF have been removed from the list, as of 5 March 2020) ETFs listed on SGX, HKEX, and US stock exchanges. I have listed down all 38 ETFs from their site over here for easy viewing.

The minimum investment amount for ETF RSP can be as low as S$50 (out of the 38 ETFs, only the SPDR Gold Shares ETF requires a minimum SGD RSP amount of S$250)

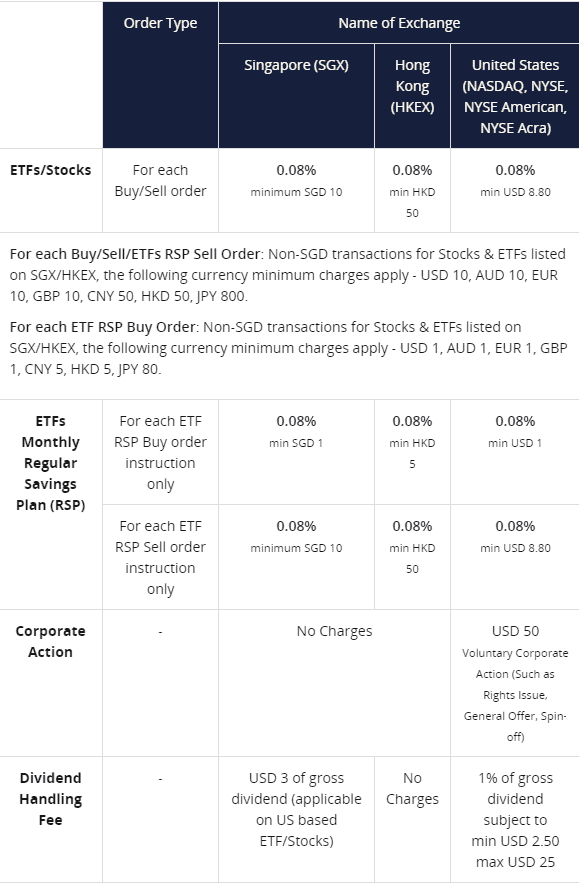

FSMOne fees are also kept low at only 0.08% commission rate, subject to a minimum amount of S$1, HK$5 or US$1 respectively. Investors are also able to optimize their investment amount as they will be able to subscribe for fractional shares of HK-listed and US-listed ETFs and up to 1 share of SGX ETFs

However, do note that the above low minimum amount is only applicable to BUY orders. For SELL orders, the minimum amount increases to S$10, HK$50 and US$10.

Also do note that there are other FSMOne fees associated with the different exchanges that are shown below. For the purpose of this article, I will be omitting these costs which are generally negligible with the exception of the Exchange CCASS Fee applicable for HKEX which has a min-sum of HK$5. This will effectively bring the total min costs for the purchase of ETF products through the HKEX at HK$10 vs. the quoted HK$5 min.

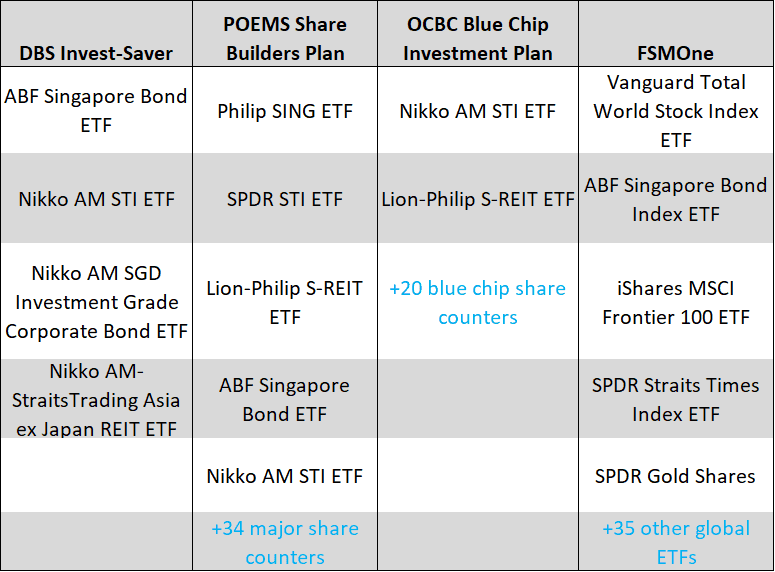

I have previously written about RSP investing in my article: CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW. In my article, I detailed the various RSPs and the associated fees available mainly through our key local brokerages: 1. DBS/POSB, 2. OCBC and 3. POEMS.

I broke down the individual costs based on the RSP amount to be invested (assumed investing in Nikko AM product). For a smaller RSP amount of S$500/month and below, the conclusion was to stick with DBS Invest Saver as that is the cheapest solution.

For a larger RSP amount of S$1,000/month, one can look at the option of OCBC and POEMS which are pretty cost-competitive and for even larger RSP of S$2,000/month, using POEMS could be the ideal choice due to their larger options availability.

I have updated the tables below to include FSMOne fees on the list.

FOR S$100/MONTH REGULAR SAVINGS

FOR S$500/MONTH REGULAR SAVINGS

FOR S$1,000/MONTH REGULAR SAVINGS

FOR S$2,000/MONTH REGULAR SAVINGS

With the exception of the low S$100/month RSP plan where FSMOne Fees (All-in) is slightly north of 1%, for the larger amounts in our consideration, the cost of RSP using FSMOne is extremely low at between 0.23%-0.35%! This basically blows the competition away!

FSMOne charges a commission of only 0.08% compared to the cheapest RSP provider, DBS Invest Saver at 0.82% (alternatively, OCBC and POEMS charges a high fixed cost which increases the overall cost for low RSP amount).

Even with an RSP amount of S$1,000/month, the sales charge only amounts to S$1 dollar!

Another major game-changer is FSMOne’s wide variety of international offerings which is an area that was sorely lacking in the past.

You can see the updated table below for the available products for the 4 RSP platforms.

Note that DBS has added two additional options: 1) Nikko AM SGD Investment Grade Corporate Bond ETF and Nikko AM – StraitsTrading Asia ex Japan REIT ETF.

RSP of a diversified, international portfolio is inherently expensive

In my previous article, I highlighted that to invest in an RSP manner, but yet have a diversified international exposure, it will be inherently costly.

I will need to choose a platform like Standard Chartered Bank to invest in the IWDA ETF (one of the lowest ALL-IN cost ETFs). However, the minimum sales charge of S$10 on the Standard Chartered platform essentially means that an S$100 RSP allocated to IWDA will incur a massive ALL-IN cost of 10.725%!

Based on our “Pseudo Portfolio” (60% SG bond; 20% SG equity, 20% global equity) created, this will result in a total portfolio cost of 2.7% which does not make economical sense.

Our simple solution to “go-around” the high cost associated with such an approach is to allocate our international funds to a Robo advisor such as MoneyOwl.

This will reduce our ALL-IN portfolio costs to 0.93%. This was the cheapest method that we have thought of previously.

How things have changed in less than 2 weeks

FSMOne’s offering of global ETF counters now changes that notion.

With a sales charge of 0.08% (subject to S$1/US$1/HK$5 min), I can now get international exposure at a much lower ALL-IN cost, despite a low RSP amount.

Before you proceed, do note that there will be quite a fair bit of calculations from hereon. If you are someone who likes to Math the shit up, then please kindly proceed.

Example 1: Using just FSMOne platform (S$500/month RSP)

Let’s say we choose to invest in a core international equity fund such as the iShares Core MSCI AC Asia ex-Japan Index ETF. This ETF has an expense ratio of 0.33%. Including the sales charge (based on S$100 equivalent invested), ALL-IN costs will be approx. 1.18%.

60% (S$300) allocated to ABF Singapore Bond ==> ALL-IN cost of 0.44%

20% (S$100) allocated to SPDR Straits Times Index ETF ==> ALL-IN costs of 1.16%

20% (S$100) allocated to iShares Core MSCI AC Asia ex-Japan Index ETF ==> ALL-IN costs of 1.18%

Total Pseudo Portfolio costs = 60% * 0.44% + 20% * 1.16% + 20% * 1.18% = 0.73%

So our ALL-IN portfolio costs essentially drop from 0.93% to 0.73%. Using FSMOne instead of a combination of DBS Invest Savers + MoneyOwl has now become our lowest cost option.

In fact, one can further reduce the overall portfolio cost by investing a larger nominal amount. Instead of S$500/month, let’s just increase that amount to S$1,000/month.

Example 2: Using just FSMOne platform (S$1000/month RSP)

60% (S$600) allocated to ABF Singapore Bond ==> ALL-IN cost of 0.28%

20% (S$200) allocated to SPDR Straits Times Index ETF ==> ALL-IN costs of 0.66%

20% (S$200) allocated to iShares Core MSCI AC Asia ex Japan Index ETF ==> ALL-IN costs of 0.68%

Total Pseudo Portfolio costs = 60% * 0.28% + 20% * 0.66% + 20% * 0.68% = 0.44%

That is a pretty significant costs saving.

Can one now invest in a US domiciled ETF?

A popular option for this FSMOne ETF will likely be the availability of core equity funds such as the Vanguard Total World Stock Index Fund (VT).

However, we have previously highlighted in our article: DIY OR ROBO? THE 1.6% OPPORTUNITY COST DILEMMA that the withholding tax cost of investing in VT could be approx. 1.16% (based on an assumed yield of 3%). Including an expense ratio of 0.09%, this could bring costs to 1.25% (excluding sales charge). Including the sales charge (based on the invested amount of S$100), ALL-IN costs will be closer to 2.3%.

Using Example 1 (S$500/month)

Total Pseudo Portfolio costs = 60% * 0.44% + 20% * 1.16% + 20% * 2.3% = 0.96%

Cost increase from 0.73% to 0.96%

Using Example 2 (S$1000/month)

Total Pseudo Portfolio costs = 60% * 0.28% + 20% * 0.66% + 20% * 1.8% = 0.66%

Cost increase from 0.44% to 0.66%

0.66% is a very competitive pricing option. FSMOne has now provided the man in the street with a very affordable way to regularly partake in US-domiciled ETF investing, even after accounting for dividend withholding costs. However, I am still not a big fan due to the issue of estate taxes.

This is based on a diversified portfolio that includes both local ETFs and US-based ETFs. For those looking to do an RSP on a single ETF like VT, the ALL-IN costs will still be a hefty 1.8% based on Example 2.

Actual cost likely to be even lower

To be fair, the yield on VT is unlikely to be as high as 3% based on our assumption. According to the data provided by FSMOne, the current yield of VT is about 2.1%. Based on this amount, the associated withholding tax cost will be 0.81% vs. the previous assumption of 1.16%.

ALL-IN costs including sales charges will now be around 1.85%. This will be pretty similar to using a Robo-advisor.

Total Pseudo Portfolio costs (Example 1) = 60% * 0.44% + 20% * 1.16% + 20% * 1.85% = 0.87%

Total Pseudo Portfolio costs (Example 2) = 60% * 0.28% + 20% * 0.66% + 20% * 1.45% = 0.59%

Even by investing in a less tax-efficient product like VT, we can still reduce our ALL-IN diversified Pseudo Portfolio cost to 0.87% in example 1 which is still lower than robo-advisor option we have highlighted in our previous article.

If we choose to adopt a more tax-efficient product, the actual cost will be closer to 0.73% based on example 1 of S$500/month in RSP.

[UPDATE]: An issue faced when purchasing non-SGD ETFs

One of the problems I faced when I tried to invest in a non-SGD denominated ETF was that the ETF could not be purchased unless you manually transfer it to the right currency. For example, I decided to purchase 2 ETFs using the RSP manner, one a SGD-denominated ETF while the other is an HKD-denominated ETF.

I instructed my bank to do an auto-recurring transfer every month for an amount of S$1,000 equivalent (S$500 for the SGD-denominated ETF and S$500-equivalent for the HKD-denominated ETF) to my SGD Cash Account and I assumed that the S$1,000 would be deducted automatically by FSMOne to purchase the 2 ETFs.

However, only the SGD-denominated ETF was purchased while the HKD-denominated ETF was rejected. I had to manually convert the remaining S$500 into the HKD-equivalent amount in FSMOnes’s multi-currency cash account so as to be able to purchase the HKD-denominated ETF.

This is something quite of a hassle to me as the idea of a recurring RSP is to make it as automated as possible. I understand that this is an area in which FSMOne is working to improve on its back-end.

Conclusion:

So what does all this means? FSMOne essentially provides us with a much cheaper DIY approach to regularly invest in international ETFs at a cost that is very competitive. This is something that our 3 original brokerages (DBS/OCBC/POEMS) do not offer. One can now get a diversified portfolio at an ALL-IN FSMOne fees of 0.73% based on our original Pseudo portfolio.

For those with a larger RSP amount each month (S$1k) where our previous conclusion was to stick with OCBC or POEMS, one can now consider using FSMOne given its competitive pricing nature as well as a wider array of products.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- LION-PHILLIP S-REIT ETF: SHOULD YOU BE BUYING THIS REIT ETF?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- THE IDEAL RETIREMENT PORTFOLIO STRUCTURE

- WHAT IS A REGULAR SAVINGS PLAN?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

9 thoughts on “FSMOne Fees: the cheapest regular savings plan (RSP) for ETF (2020)”

Hi,

You mentioned that the Sales Charge for FSMOne is only $1 and it’s cheaper than POSB Invest Saver (0.82%) in most scenario.

What about the management fee for FSMOne?

If i’m not mistaken, the Sales Charge of $1 for FSMOne does not include Management Fees while the Sales Charge of 0.82% for POSB Invest Saver has 0 Management Fees.

Hi Junhao,

Sorry I missed this out. Hmm what management fee are you referring to? My understanding is that the management fees will only be incurred for their “managed portfolio services”?

can we use CPF OA investment account with this broker ? can buy S&P 500 etf ? or only STI under CPF ?thanks

Hi Des,

Yes you can use CPF OA with FSMOne. You can use CPF OA for RSP (mainly in CPF-approved unit trusts with FSMOne as well)

If you are talking about FSMOne RSP ETF which is the topic of this article, then you cannot use CPF, only cash.

Hence nutshell, if you want to use CPF RSP, only approved unit-trusts.

Hi oppa!

The US ETFs looks very tempting!

Considering that these US ETFs are subjected to dividend withholding tax of 30%, will it still make sense to perform RSP (despite the relatively cheaper RSP fee vs DIY on your regular brokerage)?

Will like to hear your views on this, thanks!

(PS: I am torn whether to buy directly or RSP for US ETFs)

Hi Seri,

See that you are a fan of Crash Landing on You. Haha.

Back to your topic, for US ETFs, yes there is the withholding tax issue. If you purchase lump sum, you can perhaps consider the UCITS one listed on London stock exchange which has lower dividend withholding tax of 15% and no estate tax issue. The ticker is CSPX. No easy solution to affordably execute on RSP basis for UCITS shares.

If you want to have exposure to US-domiciled ETFs, I think it makes sense to do RSP in today’s context. US market is selling down with no telling how much lower it might go so you should consider dollar averaging down.

For example if buying the Nikko AM Singapore STI ETF https://www.nikkoam.com.sg/etf/sti

This ETF charges: Management fees 0.2% + Trustee fees 0.045% p.a.

If this ETF is bought using the DBS RSP these fees are included in the 0.82% charged

So if bought using FSMOne all these additional charges will be added on top of the 0.08% ?