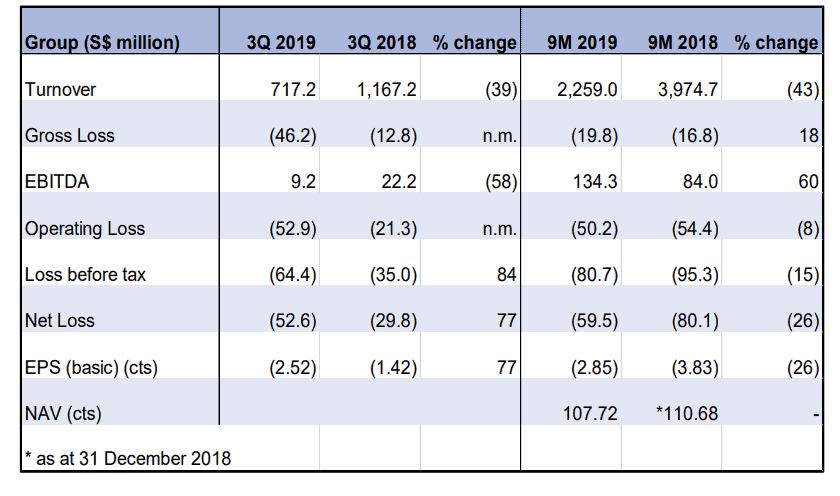

Sembcorp Marine announced its 3Q19 results this morning. The company incurred S$53m losses in this quarter alone (3Q18 losses of S$29.8m), bringing YTD total losses to S$59m.

While the losses might seem massive, management has previously guided that the company will incur significant losses in 2H19 as a result of low work load, a direct consequence of the lack of new order wins.

We expect Sembcorp Marine to announce full year losses of around S$100-110m. This will in turn negatively impact the performance of its parent Sembcorp Industries as well, due to announce their results tomorrow.

Low turnover to result in further losses ahead

Sembcorp Marine generated revenue of S$717m in 3Q19, a 39% YoY declined compared to 3Q18. This did not come as a surprise, given that management has previously guided that revenue weakness (due to the lack of new orders) will be particularly evident in 2H19.

With its finance cost ballooning by 31% YoY to S$35.3m, this resulted in overall net losses of S$53m incurred by the company.

We believe that the company will be announcing similar set of losses in 4Q19 if revenue recognition remains weak. Based on current revenue run-rate, it seems to imply that the break-even revenue for Sembcorp Marine is significantly higher than S$2.8bn (S$720m*4).

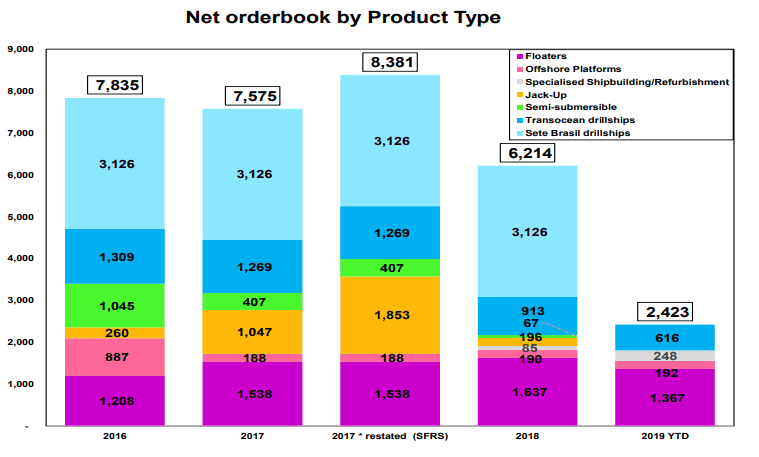

Backlog does not support sufficient revenue recognition ahead

We reckon its breakeven revenue to be closer to S$3.5bn based on current context with the company having to incur accelerated depreciation for its Tanjong Kling yard.

This breakeven level should reduce to around S$3-3.2bn in 2020E. Based on its current YTD backlog of S$2.4bn, the company could be running out of revenue to recognise by mid-1H20, assuming a revenue run-rate of S$800m/quarter.

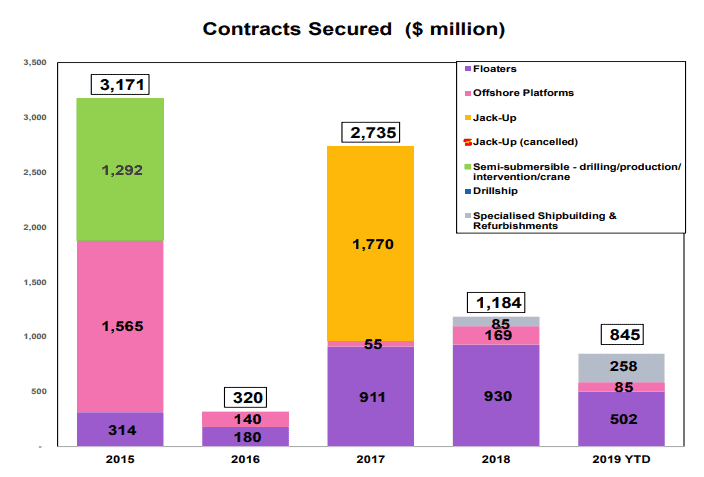

New order wins remain tepid

The company announced that YTD new order wins amounted to S$845m. This included the latest Floating Production Unit fabrication and integration project from Shell, worth approx. S$270m.

As mentioned, YTD new order wins of S$845m is a far cry from the forecasted breakeven level of S$3-3.2bn for 2020. The company has either the option to 1) slow its quarterly revenue recognition substantially (below S$700-800m/quarter) which will result in massive losses as fixed overhead and finance costs cannot be sufficiently covered or 2) be aggressive in revenue recognition but risk running out of revenue to recognise before 1H20.

Sembcorp Marine: A waiting game

It seems like Sembcorp Marine is currently playing a waiting game. One that involves the interjection of Temasek to rescue the company.

Given that global oil demand has now turned more cautious on slowing global GDP and persistent trade tensions between US and China, we do not expect oil prices to rise significantly hereon, notwithstanding a potential oil shock due to skirmishes in the Middle East.

Even with higher oil prices, that will not naturally translate to higher revenue for Sembcorp Marine. We have written previously that our local yards are not direct beneficiaries of higher oil prices, particularly if prices are not sustainable.

Oil companies remain cautious in terms of project spending. Coupled with an excess supply of drilling/production assets and such a scenario does not bode well for yards.

With Temasek now taking a majority stake in Keppel, we see this as a prelude towards a potential consolidation of our local yards in the near future, a scenario only possible if spearheaded by the former, the largest shareholder of both Keppel and Sembcorp Industry (parent of Sembcorp Marine).

This is the key reason why the share price of Sembcorp Marine has been so resilient of late, as market speculate that a consolidation will amount to a decent market premium paid for Sembcorp Marine.

However, UOB, in their recent report, recommended a SELL call on Sembcorp Marine, on the premise that a merger will be at least 12 months away and its current weak operating outlook does not justify its current valuation.

We have written about our preferred choice on how to play this merger game: HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

What this could mean for SCI.

Sembcorp Industry, 61% owner of Sembcorp Marine, is set to announce its results tomorrow.

We believe Group performance will be dragged down by marine, which is to be expected.

The market will be more focus on the operational performance of its Energy division, particularly the sustainability of its recovering operating performance in India and China. This should mitigate weaker performances likely seen for UK and Singapore.

Some foreboding signs in India

The Ministry of Trade and Industry just announced yesterday that the joint project between Singapore and Andhra Pradesh to develop the state’s new capital called Amaravati has been officially terminated. Sembcorp Industries and CapitaLand have been part of a consortium awarded the opportunity to develop the city.

Conclusion

We believe that this quarter weak set of financial performance by Sembcorp Marine has to a large extent been factored in by the market. Share price opened down 2-4%.

However, with a tepid new order win outlook, Sembcorp Marine might be in danger of running its order backlog dry pretty soon. A consolidation between Sembcorp Marine and Keppel O&M might be the only feasible long-term solution to strengthen the competitive advantage of our local yards compared to larger peers in Korea and China, which themselves are currently also in a consolidation phase.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER STOCKS WRITE-UP

- VENTURE 6% PRICE DECLINE POST-RESULTS; SATS’ 2QFY20 COULD REMAIN WEAK

- YANGZIJIANG’S SHARE PRICE IS UP 7%. CAN MOMENTUM PERSIST POST-RESULTS ON 7TH?

- SINGAPORE AIRLINES 2QFY20 PREVIEW. HERE IS WHAT TO EXPECT.

- RIVERSTONE 3Q19 PREVIEW: POTENTIAL TO SURPRISE?

- SHENG SIONG 3Q19. 4 KEY AREAS TO LOOK OUT.

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.