The STI index is one of the best-performing market indexes globally on a YTD basis (pretty surprising, but more on that later), currently up more than 11% since the start of 2021, based on data from Factset. This compares favorably vs. regional peers such as Malaysia (down 3% YTD), Indonesia (down 1%), Philippines (down 8%), China H-Shares (up 2%).

The outperformance so far is likely attributable to strong performances seen from our 3 local bank stocks, all of which are currently near their all-time high levels. DBS Group on a 1-year horizon has seen its price appreciating more than 40%, making it one of the top performers in the STI Index.

I recently wrote an article titled: Top 10 best performing Singapore Blue-Chip Stocks (1Q21) where DBS was ranked #10 in terms of price-performance for the first quarter of 2021. Check out which other Singapore blue-chip stocks performed even better than DBS during that period.

7 Singapore Blue Chip Stocks yielding more than 4% (exclude REITs)

With many of the Singapore blue-chip stocks rallying on a YTD basis despite many cutting their dividends in-lieu of 2020’s recessionary environment as a direct result of COVID-19, it is increasingly difficult to find Singapore blue-chip stocks that are yielding in excess of 4%.

Blue-chip stocks such as Comfort Delgro, Singtel, SATS, etc which once upon a time have all been very steady dividend payers, have slashed their dividends substantially in a bid to conserve their capital amid the current challenging operating environment.

Below, we look to identify 7 Singapore Blue-Chip stocks that are still currently yielding more than 4% based on their current price. To be considered as “blue-chip” in nature, these stocks need to have a market cap in excess of SGD$1bn. This list excludes REITs and Business Trusts.

Are they possibly undervalued?

To answer that question, I first look at their historical dividend payment trend. Next, I look at their current dividend yield relative to their historical dividend yield to identify signs of potential undervaluation. I would then reference their forward DPS with what the street is expecting to see if a significant reduction might be on the cards which will make their current yield inflated.

Based on their average historical DPS payment and historical yield, I derived my fair value of the counter by dividing the average DPS by the average yield. This is a simplistic fair value calculation based on the Dividend Yield Theory.

I wrote in this article: Dividend Yield Theory – the underappreciated valuation tool, highlighting the usage of a counter’s historical dividend yield to evaluate if they might be fundamentally undervalued. Personally, I believe this might be a better valuation tool for comparing US stocks vs. Singapore stocks due to the formers’ more robust dividend-paying profile. Nevertheless, it is a good reference point.

I will now showcase 7 Singapore blue-chip stocks that are currently yielding more than 4%. This is from the lowest yield to the highest yield. The stocks have been screened using SGX Stock Screener.

7 Singapore Blue-Chip Stocks yielding more than 4%

Singapore Blue-Chip Stock # 1 – Starhub

Once a dominant telecom provider here in Singapore, Starhub has fallen on hard times, with its share price declining from a recent high of S$4 back in late 2016 to its current level of S$1.24. The street remains generally neutral on the counter, with most brokerage firms having a HOLD call on the counter.

To be fair, telecom service providers have all been hard hit around the world, not just Starhub. The company has been gradually cutting its dividend from S$0.20/share to the 2020 level of S$0.0475/share. Based on the current dividend payment, the 2021 DPS is expected to be at S$0.050/share. At its current share price, this translates to a yield of 4%

Assuming that a S$0.05 DPS is now the normalized dividend payment, Starhub, with a historical average yield of 7% should translate to a fair value of S$0.71 (based on the dividend yield theory) which is a substantial discount to its current price.

Hence, there is definitely a reason as to why Starhub’s price has been so weak and despite the fact that the counter is now looking very cheap on a historical price basis, it might still be considered “expensive” as a result of the huge decline in its dividend payment.

For now, this is not a blue chip stock that I will be looking to bottom fish but if there are signs that its dividend payment has bottomed, with a possibility of higher dividend payments in the coming quarters, then the counter might possibly be worth a second look.

Singapore Blue-Chip Stock # 2 – Sheng Siong

Sheng Siong is a stock that needs no further introduction. The company has been on investors’ radar of late as Singapore enters into another “CB-like” restriction due to a surge in COVID-19 cases. Sheng Siong, as one of the dominant supermarket players here in Singapore, is expected to see demand for its grocery products increase as a result of this enhanced restrictions.

However, we are no longer seeing the kind of snaking queues like what happened during the first lockdown 1-year ago and this time round, consumers are more rationale when it comes to their grocery purchases.

While i do not expect strong earnings growth for 2021 vs. a high 2020 base, Sheng Siong remains a key beneficiary of such periodic “lockdowns” or enhanced restrictions put in place by the government to curb the spread of the virus.

The company paid a mega dividend of 6.5 cents for 2020. This translates to a yield of around 4.1% based on the current price. Historically, its yield has averaged around the 3.5 cents level. Assuming that 2020 might be a one-off bumper year in terms of dividend payments and the company is likely to revert to the more normalized level of around 3.7 cents based on my estimate, the normalized yield for 2021 might only be around 2.3%

Sheng Siong has an average DPS of S$0.035 over the past 5 years with an average yield profile of 2.2%. If we are to use these numbers, its calculated fair value (Average DPS/ average yield) based on our Dividend Yield Theory would be approx. S$1.60.

At the current level of S$1.58, it does seem like the counter is trading pretty fairly, based on a normalized dividend payment assumption. If the company surprises on the upside and maintains its elevated dividend payment structure in 2021 aka. paying 6.5 cents in dividend per share, then it will be looking extremely attractive from a dividend angle.

Singapore Blue-Chip Stock # 3 – Olam

Olam International is a major food and agri-business company, operating in 60 countries and supplying food and industrial raw materials to over 19,800 customers worldwide. Olam is among the world’s largest suppliers of cocoa beans and products, coffee, cotton and rice.

With the rest in commodity prices of late (both soft and hard), one might expect the company to be a beneficiary of rising commodity prices. Since the start of 2021, the company’s share price has appreciated by 15%, slightly outperforming the overall STI Index.

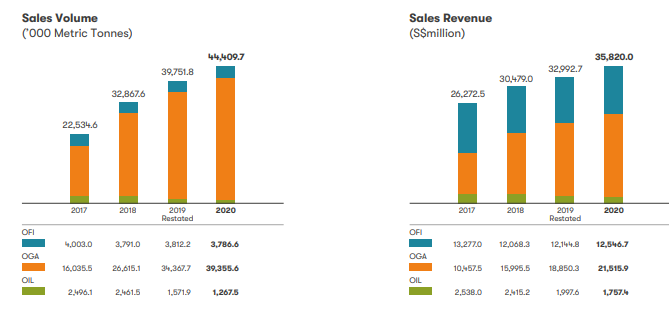

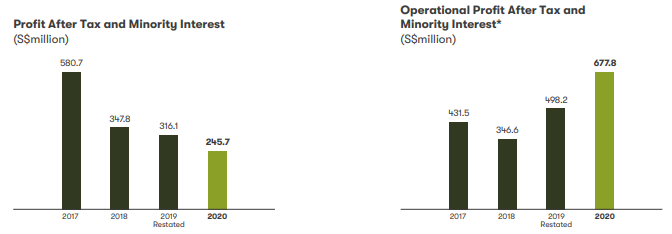

While the company’s top-line has shown steady improvement over the past 4 years, that has not translated to higher reported net profit, particularly in 2020 where its profit after tax declined to S$245.7m from the previous year earnings of S$316.1m as a result of a one-off, non-cash impairment charge made to one of its palm plantation projects.

Nonetheless, on a recurring operating basis, the company has been able to improve its operational (excluding one-off impairment charges) profit after tax to S$677.8m in 2020. Against a strong commodity market backdrop, one should expect the company to show growth in its normalized profit in 2021.

The company is currently in the midst of a re-organization which will continue into 1H22, with a potential IPO of one of its business segment. That could act as a short-medium term catalyst. In the meantime, Olam noted in its 2020 annual report that volume and demand for food and agri-products have picked up significantly due to the rapid recovery seen in China and other Asian economies.

The company announced a DPS of S$0.075 in 2020, a slight decline from the S$0.08 level declared in 2019.

Over the past 5-years, the company has declared an average DPS of approx S$0.07. With an average yield of approx 3.8%. This puts its fair value at S$1.84 based on the dividend yield theory which is slightly in access of what the company is currently trading at.

The company is looking to break its 52-week high level of approx S$1.825/share. This counter might be an interested trading candidate based on the TGPS system where there was a positive signal to enter at the S$1.79/share level.

Singapore Blue-Chip Stock # 4 – Hongkong Land

Hongkong Land was one of the best performing Singapore blue-chip stocks in 1Q21, coming in at no.7 with a 3-months return of 17.7%. The company has also been a steady dividend payer, with its DPS rising from US$0.13 in 2009 to the last reported level of US$0.22 in 2020.

The counter is one of those “boring” and “undervalued” property developer counters that have been a laggard for the past decade. 2020 has been a challenging year for Hongkong Land, with the company recently announcing plunging profits due to the direct impact of COVID-19 where its properties now command much lower valuations, resulting in a loss attributable to shareholders of more than $2.6bn for 2020.

Nonetheless, its share price has been on an uptrend since bottoming out in late 2020 and that momentum could continue as the HK property market recovers from the impact of COVID.

There are market rumors that Hongkong Land might be the next privatization candidate by the Jardine Group, with the latter recently announcing the privatization of Jardine Strategic.

This might be an interesting Singapore blue-chip stock to hold for the privatization angle, while concurrently being paid to wait.

With a forecasted DPS of $0.22 and an average yield of 3.6%, the theoretical fair value of Hongkong Land, using the dividend yield theory is approx S$6.11 which is a 26% upside from the current level. There are currently not many analysts covering this counter on the street (just 2), with the most positive rating being dished out by CIMB with a 12-month TP of S$5.70 on the counter.

![7 Singapore Blue-Chip stocks still yielding more than 4% [June 2021] 1](https://newacademyoffinance.com/wp-content/uploads/2020/11/tiger-brokers-1.jpg)

Tiger Brokers

Tiger brokers now offer Singapore investors ZERO min commissions when it comes to purchasing SG stocks. With one of the most comprehensive mobile platform in the market, check out how this fintech brokerage firm is changing the investing landscape

Singapore Blue-Chip Stock # 5 – Yanlord Land

Yanlord Land is a small-cap property developer listed in Singapore, with its operational base in China. While it used to be a property darling a decade ago, interest in this counter has waned substantially. Currently, only 2 brokerage houses (DBS and OCBC) covers the stock actively and both have a Neutral rating on the stock.

However, the counter does have a pretty attractive yield of 5.4% based on its current share price. Based on its historical track record, it does seem like the company is committed to paying S$0.068/share in dividends, which has been its DPS since 2018.

Assuming that the company commits to maintaining its DPS at S$0.068 and with an average yield of 4.7%, Yanlord land’s fair price can be calculated to be S$1.46/share which represents approx. 16% upside from the current level.

I have got ZERO visibility to this company’s operational outlook, to be honest, and hence have very little confidence over the counter’s long-term outlook. However, those who are positive about the China property market might want to consider this small-cap developer which is currently yielding an attractive 5.4% based on its current share price.

Singapore Blue-Chip Stock # 6 – UOb Kay Hian

UOB Kay Hian Holdings Limited is a Singapore-based, global investment bank that engages in brokerage services, private wealth management, investment banking, investment management and financial research.

With the rise in retail interest in the stock market, UOB Kay Hian has been a beneficiary of increased trading activities as well as margin lending.

The group’s 2020 operating revenue grew by 57.6% to S$587.6m (2019: S$372.7m) while profit after tax grew by 132% to S$160.7m (2019: S$69.3m), reflecting their efficient operating leverage. The higher top-line is likely also boosted by the acquisition of DBS’s remisier business in 2019.

As a result of its existing dividend policy in place where the company is committed to payout 50% of its earnings to shareholders, there was a bumper dividend payment of S$0.095/share in 2020, which is a significant increase over the past 4 years average DPS of around $0.046.

The huge dividend payment in 2020 might be one-off in nature and might not necessarily recur. Hence there is definitely greater variability when it comes to calculating the fair value of UOB Kay Hian using the Dividend Yield Theory.

Nonetheless, according to UOB kay Hian’s management in its 2020 annual report, the company highlighted that it remains positive on the overall trading momentum in 2021 but cautioned on market volatility.

While its current yield of 5.8%, based on a DPS of S$0.095 looks to be attractive, that yield might decline to just 3% if its business normalizes. Given that the company sticks rather closely to its dividend payout ratio of 50%, there is definitely greater variability pertaining to its DPS payment (since EPS is likely to fluctuate for its business model), more conservative investors who wish to have greater visibility over their dividend payment might want to give this counter a miss.

Singapore Blue-Chip Stock # 7 – China Everbright

Another market darling in the past that has fallen on hard times, China Everbright saw its share price collapsed from HKD$15+ back in 2015 to the current level of HKD$4.58. The company is not actively covered by any analysts, with the last coverage by DBS Vickers back in August 2020.

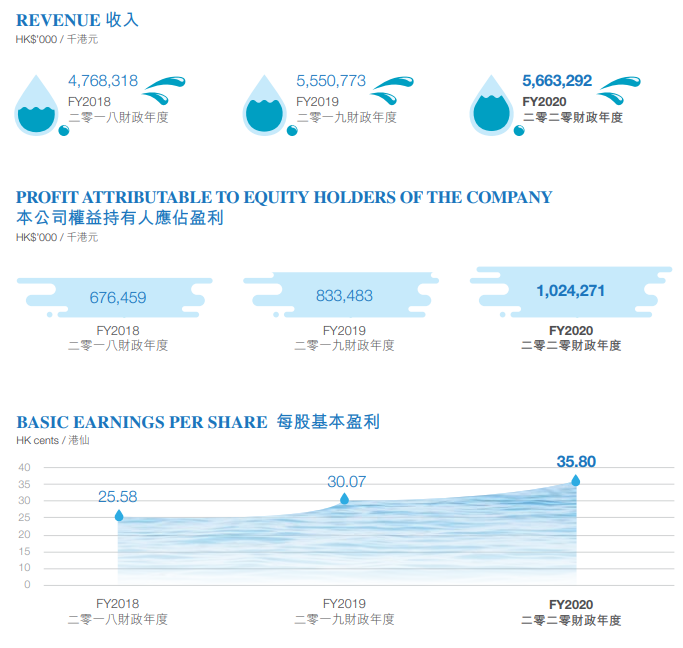

The company has generated steady improvement in both its top and bottom-line for the past 3 financial years. The company has also raised its DPS from S$0.0035 in 2015 to the current level of S$0.0171 in 2020. Based on the current DPS of S$0.0171 vs. its share price of SGD$0.26, the company’s yield is 6.6%.

The market is likely jaded with China-related stocks listed in Singapore which generated lots of hype in the past but most have disappointed, both in terms of their earnings performance as well as their share price performance.

Despite its rather steady financial performance, China Everbright is currently ignored by the market. Might this be an opportunity, given that the counter sports a very attractive 6.6% yield and has also been a steady dividend payer over the past 5 years? Only time will tell.

As can be seen from the chart, the counter is attempting to break a key resistance level around the S$0.26-0.27/share level. While there has been a positive entry at S$0.235/share based on the TGPS system, one might want to hold off entering this counter until it has clearly broken through the near term resistance level.

For those who are interested to learn more about the TradersGPS platform which allows one to systematically select the RIGHT stock to enter at the RIGHT time, the man behind the system, Collin Seow, will be conducting a 3-hrs online session, absolutely FREE. Those who are interested can sign up from the link below.

![7 Singapore Blue-Chip stocks still yielding more than 4% [June 2021] 2](https://newacademyoffinance.com/wp-content/uploads/2021/06/tgps-2.png)

The Systematic Trader

The systematic trader program, which uses the proprietary TradersGPS platform, teaches you how to select the RIGHT momentum stock to enter at the RIGHT time

Conclusion

The above 7 Singapore blue-chip stocks all have a market cap in excess of SGD$1bn and also have a dividend yield in excess of 4%.

I have excluded Singapore REITs from this list as there will be many REIT candidates which will yield in excess of 4%. That will likely be an article for another day. In the meantime, I have previously written a comprehensive 2 parts article on how to select the right REITs to purchase in Singapore which one can refer to from the links below.

HOW TO BUY REITS IN SINGAPORE. 10-KEY S-REIT QUANTITATIVE FILTER (PART 1)

HOW TO BUY REITS IN SINGAPORE. 8 ADDITIONAL FACTORS TO CONSIDER (PART 2)

Among the 7 Singapore Blue Chip stocks in this list, I favor looking at Olam with a trading angle if the counter does indeed break its near-term resistance level and potentially ride the upward momentum trend while continuing to enjoy a decent yield of c.4% from the company (based on current price) which has also been a steady dividend payer of-late.

Alternatively, one could also look at Hongkong Land if one has a longer-term holding horizon as a steady dividend payer, with a privatization to boot. While Sheng Siong is the company in this list that has the most stable fundamentals, its attractive dividend yield at present might not be sustainable.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 1]

- BEST STOCK BROKERAGE IN SINGAPORE

- VALUE INVESTING IN SINGAPORE: 10 SG VALUE STOCKS THAT MIGHT MAKE SENSE

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- TOP 5 RESILIENT SINGAPORE STOCKS TO BUY AMID COVID-19 UNCERTAINTY

- TOP 5 UNDERVALUED SINGAPORE DIVIDEND STOCKS (2020)

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “7 Singapore Blue-Chip stocks still yielding more than 4% [June 2021]”