Table of Contents

Net Worth by Age: Are you ready for retirement?

The topic of calculating one’s net worth is always an interesting, thought-provoking subject that ignites a furry of emotions.

“My net worth seems to be higher than the average, why am I still struggling to make ends meet?”

“Oh sharks, my net worth is less than my peers. Can I still afford to retire well?”

It is also a pretty sensitive and often taboo subject that most will avoid unless you are a “multi-millionaire with an equally ultra-big ego to boost”.

Despite its sensitivity, calculating one’s net worth should be an exercise taken by all. We might not wish to talk about it but neither should we be clueless about it.

I will look to breakdown this article into three main segments:

- A brief discussion as to what net worth is all about and how to calculate one’s net worth

- A quick look at the average and median net worth of Singaporeans

- An in-depth discussion of net worth by age. What is that figure for an average person which requires $2,000 in monthly retirement expenses in today’s dollars?

There are many articles making comparisons on determining your average net worth by age. Most of these articles are based on the “magic” net worth figure according to a national average or median figure.

For example, the average American net worth of families (head of the household) between the ages of 35 and 44 was $288,300. The median figure was reported at $59,800. This is according to the Federal Reserve Board’s triennial Survey of Consumer Finances, based on data collated for 2019. This data is updated every 3 years.

| Age | Median Net Worth (2019) | Mean Net Worth (2019) |

|---|---|---|

| Less than 35 | $13,900 | $76,300 |

| 35-44 | $91,300 | $436,200 |

| 45-54 | $168,600 | $833,200 |

| 55-64 | $212,500 | $1,175,900 |

| 65-74 | $266,400 | $1,217,700 |

| 75 or more | $254,800 | $977,600 |

As you might already notice, there is a wide disparity between the average and median figures. Why is that the case and what is the difference between median and mean net worth? I will discuss that in the next segment.

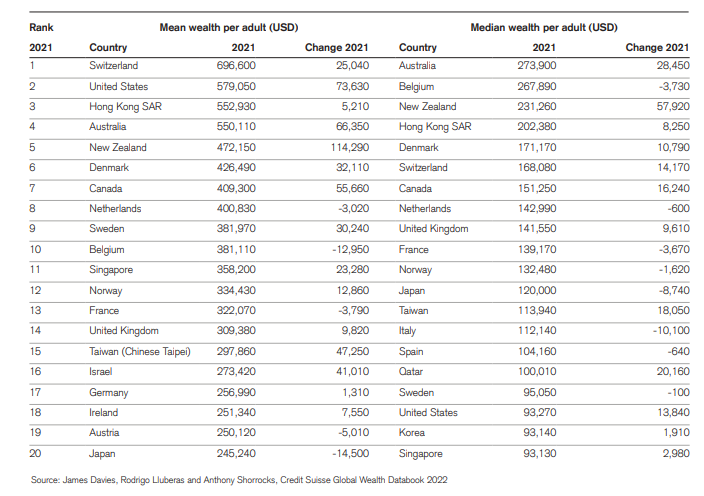

Following that, I will also take a quick look at the average and median net worth of Singaporeans, based on the latest Credit Suisse Global Wealth Report, published in 2022. This report, however, does not break down the net worth of Singaporeans by age.

To obtain that figure, I will reverse engineer it using what your projected future expenses might be.

I think such a comparison is more relevant to the masses. The main problem with projecting your net worth based on a multiple (10x, 20x, etc) of your annual income is that most people have a different lifestyle. What do I mean by that?

Take, for example, a person named John (currently age 65) who last generated an annual income of $100,000 before he retires. On a ballpark figure, some believe that he should have a targeted net worth figure 10X that of his last annual income at age 65 (just before he retires), which equates to $1,000,000.

What if I say that John has a lifestyle that requires him to expense $100,000/annum? Now, is that $1,000,000 in net worth going to be sufficient?

Compare that against Peter, also at age 65, who like John, drew a salary of $100,000/annum before he retires. Similarly, his targeted net worth should be $1,000,000. However, unlike John, Peter is a thriftier man who is expected to require just $30,000/annum (before inflation) in retirement expenses.

Is it a fair statement to say that both men should have the same targeted $1,000,000 net worth figure to “retire well”? No.

While it is always easy to benchmark one’s net worth by age according to the national average or median number or use a multiple of one’s current income etc, a more realistic figure should be based on one’s expected retirement expenses to gauge if he/she is indeed on track to retire well.

That is the objective of our article.

Let’s first take a quick as to what an individual’s net worth is all about and how to calculate that figure.

What is Net Worth?

Knowing your net worth is one of the most important aspects of personal finance. It’s one of the best indicators we have to see if we are on target to meet our goals.

It is a powerful indicator of your financial health.

To calculate your net worth, simply subtract the total value of your debts (aka liabilities) from the total value of your assets.

To put it in layman’s terms:

Net worth = Assets – Liabilities

If your assets are more than your liabilities, your net worth is positive. Congratulations, you are taking the first step towards retirement success.

If your assets are less than your liabilities, your net worth is negative. This is the time to take a serious look at your finances and see how you can best turn that negative net worth into a positive one.

What does net worth include?

What are your assets and liabilities? Do you estimate how much your house or car might be worth if you sold them? If you still owe the bank money on your house or car, are those assets or liabilities?

Assets

- Savings in your bank account

- The market value of your investment portfolio

- The market value of your retirement savings in your retirement accounts

- The market value of your house/s, car/s, etc

- The market value of your endowment policies

- Items of significant value such as your jewelry, antiques, etc

Liabilities

- Mortgages on your primary and secondary properties

- Car Loans

- Student loans

- Credit Card loans

- Personal loans

- Back taxes

- Medical fees etc

Your first goal is to ensure that when you subtract your liabilities from your assets, that figure is a positive one.

If that figure is negative (just like the 25 percentile Americans from Ages 18-29), your objective is to turn that figure into a positive one by paring down your liabilities (mainly loans) as much as possible.

Now that you have a rough clue of what net worth is all about and how to calculate that figure, let’s move on to the next segment which is finding the average and median net worth of Singaporeans.

Additional Reading: The Average Salary in Singapore

The average and median net worth of Singaporeans

According to Credit Suisse Global Wealth Report, Singapore is ranked 11th in the world in terms of average wealth per adult with an average net worth of USD358,200. Within Asia, it is second only to Hong Kong.

In terms of median wealth per adult, Singapore is ranked 20th, with a median wealth per adult of USD93,130

USD358,200 is equivalent to approx. SGD477,000. This seems like a pretty big net worth figure for the average Singaporean. A better figure to represent the AVERAGE Singaporean would be using the median net worth figure. This figure stands at USD93,130 or SGD124,000.

Why is there such a significant skew between the average figure of SGD477,000 and the median figure of SGD124,000?

Difference between average and median figure

Let’s use a quick example to illustrate the difference between Average and Median net worth

Assume there are just 5 individuals which represent the entire nation’s population. They are arranged from the smallest net worth to the largest

Individual 1 net worth: $100,000

Individual 2 net worth: $120,000

Individual 3 net worth: $150,000 (Median)

Individual 4 net worth: $170,000

Individual 5 net worth: $1,000,000

The average net worth is calculated by summing up the 5 individuals’ net worth amount and dividing them by 5, by which we get a figure of $308,000

The median net worth is simply the 3rd individual net worth amount (the person representing the 50th percentile) of $150,000

One can observe that due to the substantial net worth disparity between Individual 5 and the other individuals, the average income of the 5 individuals becomes substantially higher, giving the false impression that the average net worth of these 5 individuals is indeed much higher than the norm.

In reality, the skew is due to wealth inequality and hence a more accurate depiction of the “real” average net worth would be using the median net worth which is a figure 50% below that of the average net worth number.

For a nation, the median net worth figure represents the 50th percentile of its population (one where the net worth of each individual is listed from the smallest to the largest).

In Singapore (population of 5.45m), if you have a median net worth of more than $124,000, you are likely ahead of close to 2.72m of the population.

This figure is just a “good-to-know” figure or a “feel good” figure, the latter if you have a net worth figure that is substantially ahead of that figure.

However, it doesn’t say much. Again, a young adult age 30 with a net worth of $124,000 is likely to be financially much stronger than a soon-to-be-retiree (say age 64) with the same amount of net worth figure, all else constant.

In Singapore, there is no readily available figure providing you with the breakdown of the average net worth by age, which makes it even more difficult to have a “realistic” comparison of where you (a Singaporean belonging to a certain age group) currently stand compared to your peers in the same age group.

However, as I earlier mentioned, while having such a breakdown (like in the US example) would be informative, such information is not sufficient to determine if one’s net worth is indeed adequate for a comfortable retirement because every individual’s lifestyle and retirement requirement is different.

This brings us to the next segment, which is determining a realistic net worth by age based on an individual’s forecasted retirement expense requirement.

Net Worth by Age based on retirement expense requirement

Let’s assume a Singaporean named Tom who is currently aged 30. He calculated his current monthly expense to be approx. $2,000/month and he believes his current lifestyle (expenses) is representative of what it will be like when he retires at Age 65 (planned retirement age).

Due to the impact of inflation (assumed 3%), his current $2,000/month expenses will translate to a projected monthly expense of $5,630 in 35 years.

Tom will like to know what his projected net worth should be at each age milestone to determine if he is indeed on track to retire well.

I look to calculate that using the NAOF retirement spreadsheet. However, do note that I exclude the impact of real estate net worth (market value of the house – existing home mortgage) in the calculation and mainly only focus on savings/investments as the MAIN net worth driver.

Below are the key assumptions used:

Planned Retirement Age: 65 years old

Projected monthly retirement expense (Today’s dollars): $2,000

Projected Inflation Rate: 3%

Projected Market Return before Inflation: 7%

Projected Death: 95 years old (retirement duration of 30 years)

Full Retirement Sum of $414,000 is achieved when Tom is age 55.

Monthly investment required: $470 (excluding savings through pension aka CPF for Singaporeans)

From 30 years old (current age) to 65 years old (planned retirement age), Tom will be actively “building” up his net worth through a combination of savings and investments.

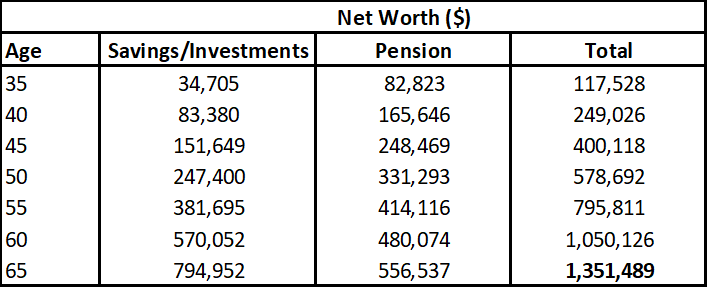

The table below shows what the minimum net worth (excluding property) should be like at each age milestone so as to be able to comfortably retire at the age of 65, with a projected monthly spending of $2,000 (in today’s term) or c.$5,600 (in future terms) thereafter till he reaches age 95.

For the 30-year-old Tom, this is his net worth by age projection which will ensure that he has a comfortable retirement, based on his planned retirement age of 65.

What is a good net worth at Age 35 and below

In the US, the average net worth for a person in the age bracket 35 and below was USD76,300 while the median net worth was USD13,900.

For a Singaporean like Tom who is projecting a monthly retirement expense of $2,000 (in today’s dollars), that figure is approx. SGD$117,528 by age 35.

Your goal at this point in your life is to first ensure that you have a POSITIVE net worth. Make sure that you are not over-leveraged with debt.

Look to “pay yourself first” by contributing a portion of your income towards investing.

Every day that passes before you start investing is money lost. There is no magic involved in investing, just a secret ingredient by the name of TIME.

The more time you have, the more you allow the power of compound interest to work its magic for you.

Even a small amount of money invested now will grow exponentially due to the power of compounding interest and these can be your retirement contributions.

You can start investing using a low-cost brokerage platform such as Tiger Brokers/Moo Moo/uSmart or if you wish to select to use a platform that provides you with a dollar-cost averaging approach, you can select a low-cost platform such as FSMone which allows you to start investing cheaply ($100/month) into ETFs (for diversification) on a monthly recurring basis.

Make it a habit to consistently contribute to your investment portfolio. The ideal way to consistently invest is to automate the “pay-yourself-first” process as much as possible.

What is a good net worth at Age 35-45?

In the US, the average American net worth for families between the ages of 35 and 44 was USD$436,200 and the median was reported at USD$91,300.

For a typical Singaporean like Tom, that net worth figure should be hitting around SGD$117,528 when he is age 35 and increasing to SGD$400,118 when he is age 45

At this stage of your life, you might find yourself financing life on credit cards due to increased demands for your money.

Everything requires money. Your home, car, spouse, kids, etc.

If you have got credit card debt (one of the highest-interest accruing debts), it is going to be a struggle to stay on achieving your net worth target. The Average Effective Interest Rate (EIR) on your credit card is usually in the mid-teens but it can also be much higher.

You and your spouse need to take a hard look at your income and expenses. Do they gel or are you spending more than your cash inflow?

You probably will face multiple cash requirements at this age. Mortgage, car loans, kids’ education, expensive vacations. If you find yourself spending more than you should and your net worth is falling way behind your original expectation, it is time to make changes.

What is a good net worth at Age 45-55?

The average American net worth between the ages of 45-54 is USD$833,200 and the median is USD$168,600.

For a typical Singaporean like Tom, your net worth should be in the region of SGD$400,118 when you hit 45 and that should grow to about SGD$795,800 when you hit 55, a pretty sizable jump over a 10-year horizon, amounting to almost $400,000

While this might seem like a herculean task to grow your net worth by $400,000 over a 10-year horizon, it is not that difficult to achieve.

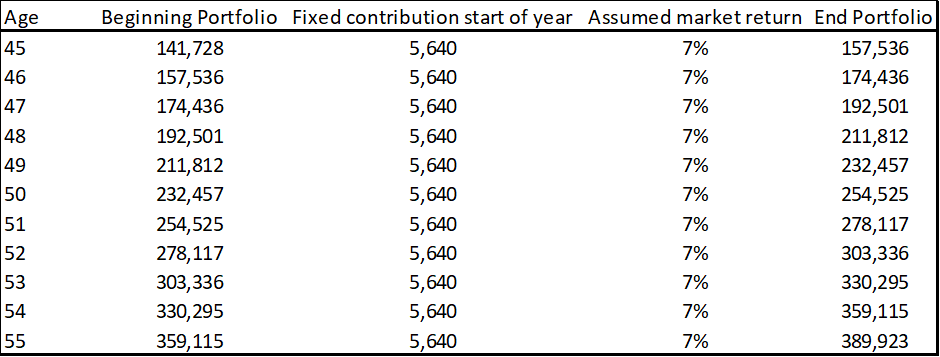

In fact, all you need is to contribute c.$470/month into your current savings/investing portfolio (which should have a value of around $151k at the start of age 45) and let it compound at the average rate of 7% per annum over the next decade.

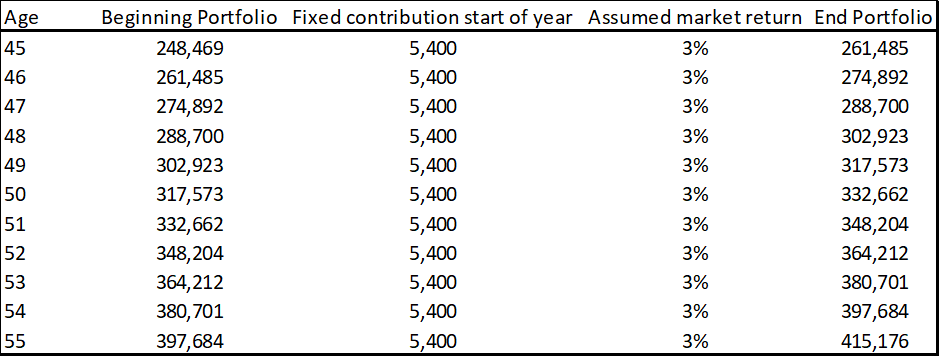

For your pension savings, the assumption here is that you have already achieved $248,469 at the age of 45. Assuming an annual contribution of $5.4k, compounded at an average rate of 3%,

First off, this is likely to be the time in your career when you are earning the most money you will ever make.

Against that backdrop and assuming that you have already settled the bulk of your loan repayments (except for your mortgage loan), you will likely be able to fork out a sum of just $470/month or a lump sum payment of $5,640/annum to “pay-yourself-first” at the start of each year for your investment portfolio, to achieve your savings/investment goal

This is assuming that you have already accumulated a savings/investment portfolio of $141,000 at the start of 45 years -old. Your investment portfolio will hit close to $390k by the end of Age 55 (> our target of $381,695)

In the case of your pension portfolio, you will need to ensure that it already has about $248,469 at the start of age 45. You will need to contribute approx $5,400/annum for your pension funds, growing at a rate of 3% to hit a portfolio value of $415,000 by the end of age 55 (> our $414,116)

What is a good net worth at Age 55-65?

The average net worth for Americans between the ages of 55 and 64 is $1,175,900 and the median is $212,500. Notice the huge disparity between the average net worth and median net worth of Americans in this age group.

Wealth inequality has become extremely obvious for this age group and that is one reason why most Americans reaching retirement age are extremely concerned over their ability to finance their retirement years ahead.

For the average Singaporean like Tom, your net worth figure should be close to SGD$800,000 when you hit age 55.

At this stage, one key assumption is that you would have achieved a full retirement sum (pension) of approx $414k where you will “lock in” that figure to ensure a monthly payout of $3,039 when one hits age 65, based on the Singapore pension scheme.

For Tom, he should re-evaluate to see if his monthly retirement expenses are still realistic at this stage. His $2,000/month original retirement expenses (when he is age 30) have now been inflated to around $4,187/month.

Can he realistically have a comfortable retirement based on a current monthly expenditure of $4,187/month? If so, then he is on track to retire in 10 years, assuming he has accumulated a current net worth of SGD$800,000 thus far.

As we age, medical debt might become a huge problem if we are not covered by medical insurance. Take note of this area and make sure you are sufficiently covered in this aspect because an unfortunate medical incident can potentially “wipe out” a huge chunk of your net worth if you are not properly insured.

Net worth by retirement

The average net worth for Americans between the age range of 65 and 74 is $1,217,700. However, the median net worth is $266,400.

For the typical Singaporean, your net worth at Age 65 should be close to $1.35m, based on Tom’s projected monthly expense.

Now, you have to make some final decisions about your lifestyle. Will you move to a smaller, cheaper home to monetize some of your home equity? This might be a possibility if you have not yet hit the $1.3m net worth target, which we exclude home equity, in the example above.

Realistically, if you have been conscientious in reducing your mortgage payment, your home equity should at least be worth SGD$200k/pax or SGD$400k between you and your spouse.

Based on our calculation, Tom, the typical Singaporean, is expected to spend approx. SGD$67,500 in retirement expenses when he is Age 65 and this figure should continue climbing higher by 3% (due to inflation) each year.

Based on a net worth of $1.35m, you are essentially withdrawing 5% of your net worth per annum. This seems like a relatively high ratio, especially if you wish to benchmark against the popular 4% safe withdrawal rule.

I have written about the 4% safe withdrawal rule on numerous occasions, such as in this article:

Why 60:40 equity/bond allocation isn’t the ideal structure for a 4% withdrawal rule portfolio

How you structure your portfolio early will determine if you are indeed able to retire well.

Supercharging your retirement portfolio

Don’t feel bad if your net worth is not where it should be based on the “national norm”. Financial situation differs and as long as you are living within your means, you can have an equally comfortable retirement even if your net worth is not “up to par”.

In this article, I have highlighted that the calculation of net worth by age should not be based on a standard country median or average number or even based on income.

Instead, it should be based on your projected retirement expense. If you project a larger retirement expense because of your wish to “travel around the world” perpetually till the day you die, then you have got to definitely accumulate a larger retirement portfolio nest.

If you are looking at a simple retirement lifestyle, with the occasional retirement travel trips planned each year, then your monthly retirement expenses need not be excessive and consequently, your overall retirement portfolio need not be as large a value as a couple who wishes to travel around the world.

A simple $2k/month in expenses today will balloon to almost $5,630 for a 30-year-old who is planning to retire in 35 years time at age 65. This is due to the effect of inflation and an area which is often overlooked.

As mentioned earlier, for those who are looking at a larger monthly spend, a larger retirement portfolio (in excess of SGD$1.3m) will likely be required.

If you are young, now is the time to start accumulating your retirement portfolio aggressively as time is on your side.

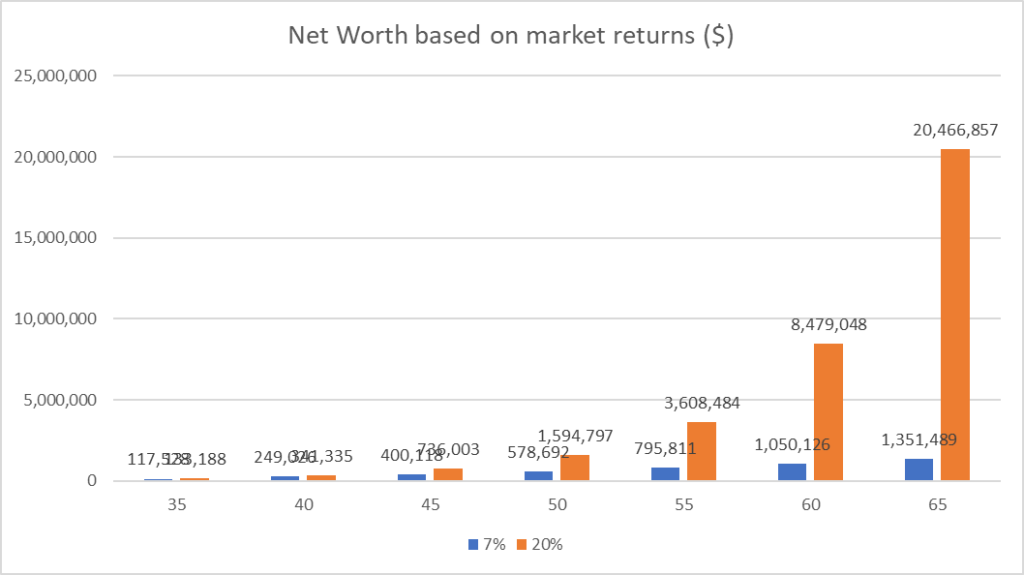

One way to do that is to supercharge your portfolio through the selection of high-quality growth stocks that have historically generated annualized returns of c.20%. Compare that vs. a market return of 7% annualized.

Using the same example above where one contributes approx $470/month into his/her portfolio. Instead of growing at an average market return of 7%/annum, that portfolio grows at 20% instead. Your ending net worth will no longer be at a “paltry” $1.35m but a massive $20.5m (assuming no change to your pension contributions and returns)

This is what you could potentially achieve with Alpha Blueprint Stocks, quality growth stocks that are often the market leaders in their respective industries and have proven to be extremely resilient in both good and bad markets, with a historical annualized average return of 20%.

For those who are interested to find out more about Alpha Blueprint Stocks and how you can easily create a portfolio around it, click on the button below:

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.