Table of Contents

THNQ ETF review

Is Artificial Intelligence or AI for short going to be the theme of the decade?

AI has been the talk of the town since the overnight success of ChatGPT, which has demonstrated that the demand for AI is going to be spectacular.

“Every company will become an AI company – not because they can, but because they must. AI is the only way to scale expertise.”

IBM’s CEO Arvind Krishna

While AI is not likely to be a fad, it remains a challenge to identify a winning AI trend or an AI stock, given that the technology in this niche industry changes so rapidly, that the winners of today might well become the losers of tomorrow.

Take, for example, Netscape, the undisputed leader in the early days of the internet. Where is the company now? It became irrelevant when it was no longer able to keep up with the rapid changes of new technology.

In its place came the likes of Amazon and Apple, which were able to correctly leverage the powers of the internet to create new markets and business models that consumers wanted.

That is why identifying the right AI stock to play the AI revolution remains an extremely challenging task.

Might buying an AI-related ETF, such as the THNQ stock (Robo Global Artificial Intelligence ETF), be a safer alternative for investors?

THNQ stock: ROBO Global Artificial Intelligence ETF

The ROBO Global Artificial Intelligence ETF (THNQ) is one of the 3 AI/Robotics ETFs offered by Robo Global. The other 2:

AI/Robotics ETFs are ROBO Global Robotics and Automation ETF (ROBO) and,

ROBO Global Healthcare Technology & Innovation ETF (HTEC).

Of the 3 ETFs provided by Robo Global, THNQ has got the smallest asset under management (AUM) at just under $30m, which makes this a rather “risky” small-cap play.

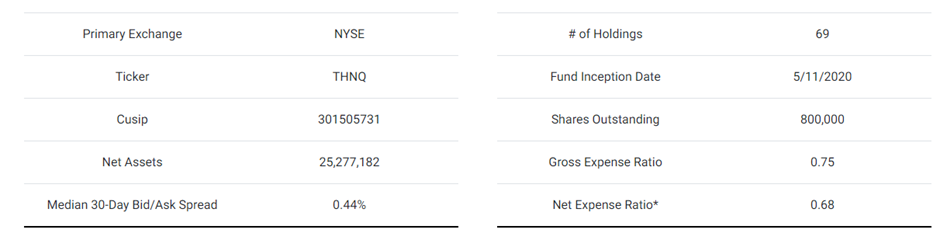

The below table summarizes some of the key data of THNQ stock.

THNQ Holdings

THNQ ETF invests in companies around the world that are leading the AI revolution.

Included in THNQ are companies developing the technology and infrastructure enabling AI, such as computing, data, and cloud services, as well as companies that apply AI in various verticals, from business processes to e-commerce and healthcare, etc.

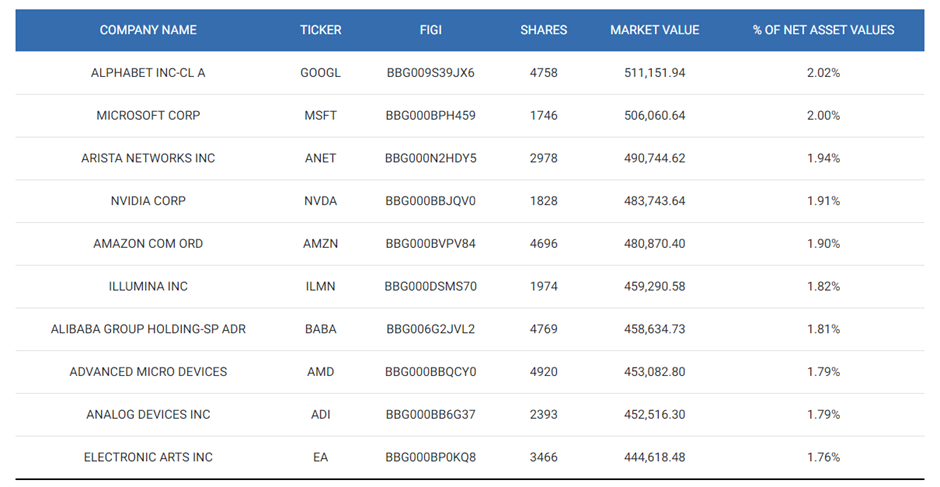

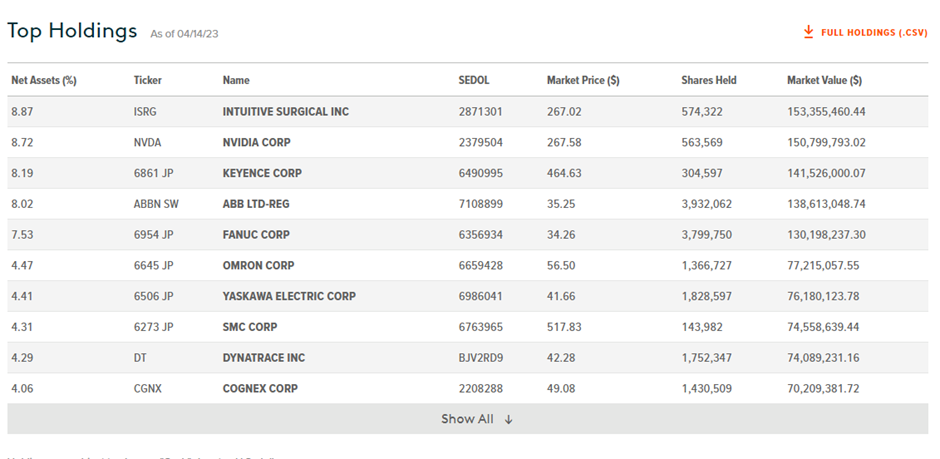

The AI ETF currently holds a portfolio of 69 stocks. The Top 10 THNQ holdings are listed in the diagram below:

As can be seen, many of the top THNQ holdings are your larger-cap blue-chip tech stocks that are likely market leaders in their respective industries.

They are, however, not known to specialize in AI products/services. The AI business is probably just one of the companies’ key segments or a component that the company is engaging to help drive growth in their business verticals.

For the full THNQ holdings, one can refer to this site for more information.

I took a quick look at the full THNQ holdings and did not come away with any insights on specific holdings that might be particularly leveraged to AI.

While the stock holdings in THNQ likely incorporate elements of AI in their business operations, so do 1000s of other companies out there as they try to gain an edge over their competitors.

Additional Reading: Pure Play AI Stocks (2023)

Performance of THNQ stock vs. other AI ETFs (17 April 2023)

YTD 2023

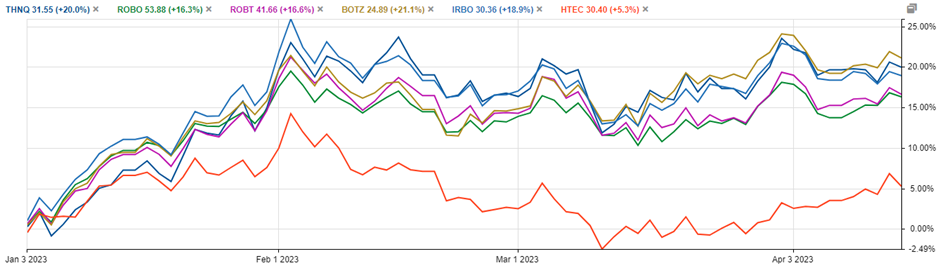

The diagram above shows the YTD performance of THNQ vs other key AI-related ETFs. THNQ ranks second in terms of performance, with a YTD 2023 total return of 20%. BOTZ, the largest AI-related ETF in this list (in terms of market cap) generated the best returns YTD 2023, coming in slightly ahead of THNQ at 21.1%

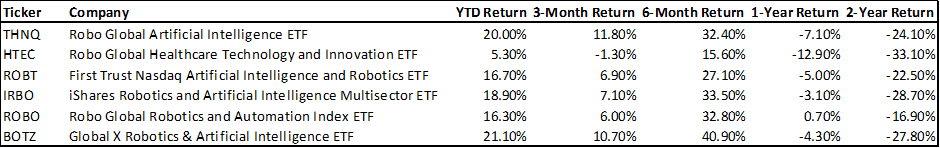

The table below shows the performance of THNQ vs. other AI-related peers over the different time horizons. (data as of 17 April 2023)

As can be seen from the table, the performance of THNQ ETF has outperformed those of peers on a relatively short-term basis (3-4 months) but generates average performances on a longer-term basis.

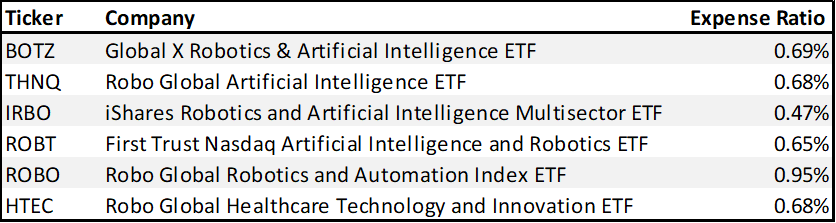

Expense ratios of THNQ stocks vs. peers

The AI-related ETF with the highest expense ratio is ROBO ETF (0.95%) while that of IRBO ETF has got the lowest expense ratio (0.47%). THNQ’s expense ratio is considered average when compared to peers.

Is THNQ stock a “gem” of an AI-ETF?

While THNQ could be one way for an investor to partake in the AI revolution, it is unlikely that you can generate much “alpha” from its holding of AI-related stocks.

Many of the stock holdings are your large-cap blue chip technology names such as Microsoft and Alphabet, which makes it a safe bet, one which will perform generally in line with the broader tech market (dominated by your large tech names).

However, if an investor is interested to play a basket of “purer” AI names, then there are better alternatives out there such as the ROBT ETF, where the AI-related stock holdings are of a smaller cap nature (smallest holdings at $200m market cap), and thus could potentially generate additional “alpha” from AI stocks.

The risk level associated with ROBT ETF is consequently also much higher vs. other AI-related ETFs.

Would I be tempted to invest in THNQ stock for its AI element? The answer is NO. Currently, I am vested in one AI-related ETF using the method below.

How I partake in AI-related ETFs

I see AI as one of my key thematic plays for the long term. Hence, I would use a long-term dollar cost average strategy to invest in one of the AI-related ETFs.

I would use the Syfe Robo Platform and select an AI-related ETF as a key holding for my thematic portfolio and engage a monthly dollar cost average approach where I will invest $X into this portfolio, of which approx. 20% of the capital will be allocated to this AI-related ETF.

As THNQ is an extremely small-cap stock, it is not being offered by Syfe. Instead, the AI ETF that I am dollar cost averaging into is the BOTZ ETF, by virtue of it being available on the platform.

The “unique” angle of BOTZ ETF vs. other AI-related ETFs is that BOTZ holds a rather concentrated portfolio of AI-related stocks, with its Top 10 holdings encompassing more than 40% of the fund’s net assets.

Many of its top holdings have a focus on robotic themes such as machine vision etc, which could also be broadly classified as part of AI.

The other AI/Robotic ETF that is available for one to dollar cost average using the Syfe platform is the ARKQ ETF (Ark Autonomous Tech & Robotics ETF).

By the way, for those who are interested to learn more about ETFs and my preferred ETFs for the various categories, do check out the link here.