Investor Education Series: Power of Compound Interest

Some of you might have already read about the 8th wonder of the world: the power of compound interest. For some, this remains a mystery. What exactly is compound interest and why are many people fascinated with it?

When it comes to achieving financial success or retiring with a comfortable nest egg, a lot boils down to good habits practiced over a long period of time. If you start your financial planning journey early, say when you are at Age 20 with a good 45 years horizon, you are in a much more comfortable position as compared to someone who is starting that journey only at Age 40. That extra 20 year makes a ginormous difference when it comes to setting up yourself for financial success.

A lot of this is due to the power of compound interest. The power of compound interest is not evident over the short-term. But over the long-run (measured in decades), Wow! Compounding can truly create an impressive wealth snowball.

The problem is this: Many people know or read about the power of compound interest but when it comes to execution, they hesitate or they just froze on the spot like a deer in the headlights. This could be due to “uncertainty” over how to let that compound interest work its magic and their ultimate decision is to “do nothing” and leave their savings in a “zero or low-interest” savings account.

They seek high and low for the best “risk-free” interest account (which typically yields no more than 1.5-2% in today’s context) when what they should actually be doing is having a “game plan” to harness the power of compound interest.

Let me show you why some folks consider compounding to be one of the most powerful force in the financial universe.

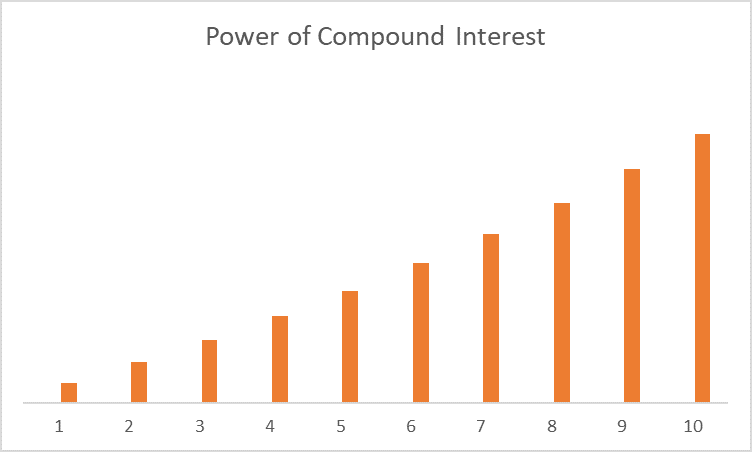

The Power of Compound Interest

On the surface, compound interest is a borrowing topic. It is just generating interest on top of interest. So today, assume you have got $100 which you can invest and earn 10% interest. In your first year, your interest is $10 and compound interest will say that this $10 will generate you an additional $1 in the following year.

Now at this point, you might be wondering…. What the heck! All this “trouble” to generate an additional $1. What’s all the fuss about compound interest.

Take this XKCD comic for example. It seems to belittle the power of compound interest like it is no big deal after all.

Yes, it might not seem much, but that is exactly what you will get by “chasing” after the highest cash management services which generate a “guaranteed” return of 2% per annum. And mind you, these cash management services are theoretically “not guaranteed” and even if they are, it is unlikely to last with the general interest rate environment on a downtrend. So you might be promised 2% now, but this ratio will likely continue to drop in the foreseeable future.

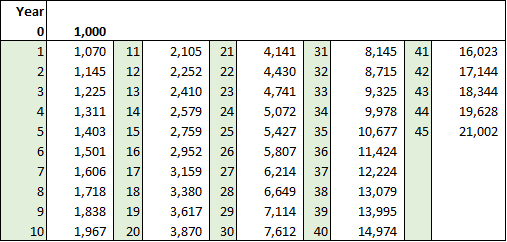

So what happens when you start compounding that $1,000 in the stock market instead? That $1k almost double to $2k after a decade or to be exact, $1,967. In this example, we assume that the stock market generates a consistent average annualized return of 7%/annum.

The power of compound interest is not evident, however over just a decade.

What happens when we extend the horizon over 45 years, what a 20-year-old typical investment horizon would look like before he hits retirement age.

So assuming again an average long-term annualized return of 7%/annum, a 20-year-old investing $1,000 in Year 0 will see this amount “ballooning” to $21k after 45 years.

As you can see from the table above, compounding doesn’t do much during the first few years. After a decade, your $1k will nearly double if invested in the market. The longer your money remains invested, however, the more powerful compounding becomes. After 2 decades, it will grow to nearly $4k. From there, the growth becomes accelerated and after 40 years (yes it’s a long time), you are essentially generating your initial capital of $1k every single year.

Compound interest might not seem so magical over a short horizon but over a long period, that “magic” will be rather evident. You are essentially “reaping the harvest” of your capital sowed many years ago that will go towards funding your retirement expenses over the next 3-4 decades.

So naturally, the next question to ask is, can the stock market generate an average annualized return of 7% over the foreseeable future? Is this the best asset class for a 20-year-old to invest in?

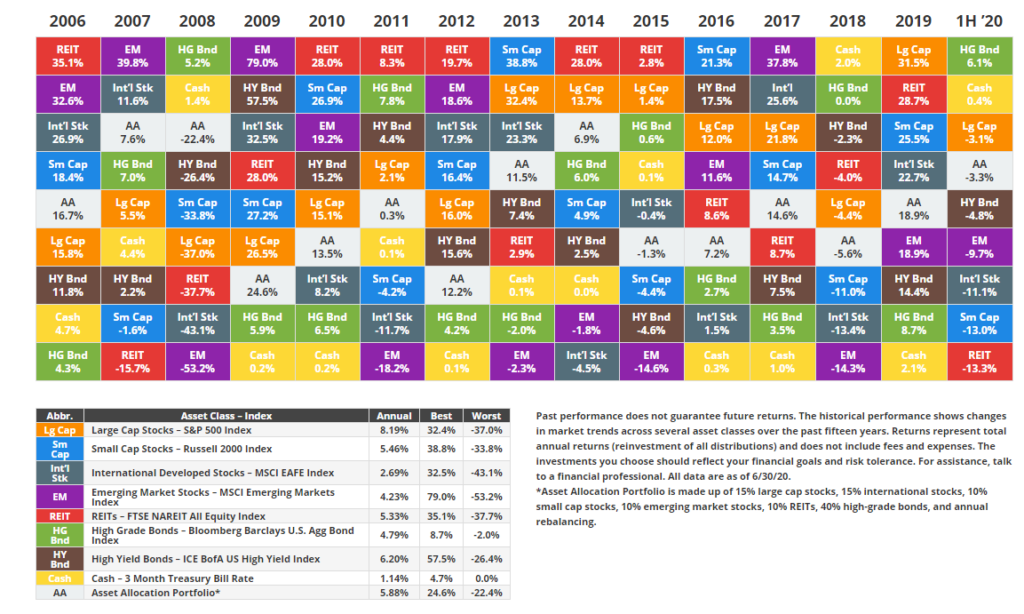

Large Cap Stocks are the best performing asset class over the past 15 years

There is no guarantee that the stock market will continue to generate an annualized return of 7%/annum. There is no “certainty”. While one can refer to the historical performance of different asset classes, at the end of the day, the same caveat exists: “historical performance is not representative of future performance”.

Nonetheless, investing in the stock market (particularly in large-cap stocks) over the past decade and a half has been a rather fruitful journey as demonstrated in the diagram below.

Investing in a basket of large-cap stocks such as the S&P500 (represented by the SPY ETF) generated an annualized return of close to 8.2% (assuming that dividends are reinvested)

Having cash on the other hand (based on 3-month Treasury Bill rate) only generated an annualized return of 1.1%.

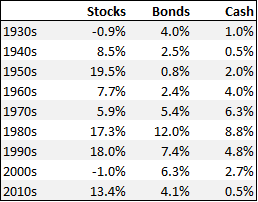

Maybe 15 years is too short a horizon. How about 92 years of market return data?

Using NYU professor Aswath Damodaran’s annual asset class returns, one can calculate the annualized return (before inflation) of the 3 key asset classes since 1928:

- Stocks represented by S&P 500 (large-cap) – 9.7%

- Bonds represented by 10-year treasuries – 4.9%

- Cash (3 month -bill) – 3.4%

After inflation, the returns can be calculated as such, assuming a 3% average inflation rate

- Stocks represented by S&P 500 (large-cap) – 6.7%

- Bonds represented by 10-year treasuries – 1.9%

- Cash (3 month -bill) – 0.4%

Of course, inflation today is a lot lesser than the average rate of 3%. Will the inflation rate stay low? I have written several articles highlighting the risk of a potential huge spike in inflation due primarily to all the money printing that has been going on for decades. Will it happen this year or next? Who knows but that risk is considerably higher now in my opinion.

Investing in the stock market is potentially a “good hedge” to counter the effect of inflation. The other key asset class would be gold.

Coming back to the asset-class performance, it would seem that the stock market remains the key asset class to be in, whether it is over a long horizon of 90+ years or “shorter” duration of 15 years.

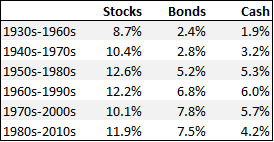

Perhaps it would also be useful to breakdown the performances of the 3 different asset classes based on their performances over each decade.

As well as its rolling performance over a 4-decade horizon (before inflation)

On average, the performance of stocks generated an 11% return over a rolling 4-decade horizon. Even after considering inflation, that after inflation-adjusted return is 8%.

Hence for a young investor enjoying the tailwind of “plenty of time”, investing 100% of his/her savings in stocks seems to be the “logical” choice to take.

With the selection of asset class “out of the way”, the next question is whether one should engage in “lump-sum investing” or “dollar cost average” to reap the maximum benefit of compound interest.

Dollar-Cost vs. Lump Sum

Dollar-cost averaging is the strategy of breaking down a large sum of money and periodically deploying these smaller chunks of funds into investable assets such as stocks/bonds etc.

It forms the backbone of a regular savings plan, which is a consistent and disciplined way to invest. By automating a regular savings plan, for example, investing x dollars on a particular date of every month, it removes the emotional and psychological aspect of trying to time a market entry.

The Dollar Cost Averaging strategy is often compared to Lump Sum Investing. Which is better you might ask?

An evidence-based answer will point to the Lump Sum Investing strategy as the superior investing methodology.

In a scenario where one has a lump sum of $100,000 to invest, it will be better to choose the Lump Sum Investing method vs. spreading the $100,000 over X number of periods to be invested.

I have written about this comparison previously in this article: A better alternative to Dollar Cost Averaging.

Using actual historical data of the US market from 2000-2019, we created two portfolios that have the same 100% exposure to the US market. However, one deploys a dollar-cost averaging approach, investing $10k each year for the next 20 years from 2000-2019 for a total capital outlay of $200k while the second portfolio engages a lump sum investing strategy, deploying $200k in 2000 and letting the market and the power of compound interest work its magic over the next 2 decades.

Conclusion: The lump-sum approach beat the dollar-cost averaging approach in 19 out of the 20 years horizon (based on the starting year of investing). The only year where lump sum did not triumph dollar cost is if both portfolios were started in 2000 which is the height of the dot-com bubble.

Hence unless there is a prolonged downturn in the market (3 years and more consecutive market decline), investing through a lump sum approach is the superior methodology.

Despite the superior returns of lump-sum investing vs. dollar-cost averaging as illustrated by actual stock market performances, a key advantage of the dollar-cost averaging strategy touches the emotional component of investing, particularly when it comes to loss aversion.

Humans tend to prefer avoiding losses vs. acquiring equivalent gains which seems to partially explain why the dollar cost average approach is popular.

Of course, we also highlighted the simple fact that dollar-cost is so much easier for one to get started in his/her investment journey vs. a lump sum approach.

How to let the power of compound interest work for you

Start early:

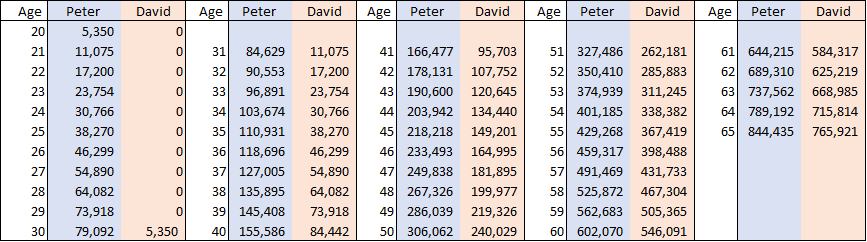

Let’s assume there are 2 friends, Peter and David, both who are currently Age 20. Peter starts investing $5,000 annually immediately from Age 20 to Age 30 (10 years) for a total capital outlay of $50k. David on the other hand started investing only from Age 30 onwards to Age 60 (30 years) for total capital of $150k.

Guess who ends up with more $$$ at Age 65? Peter who started early and contributed only $50k ended up with a portfolio of $844k while David who started late and contributed a total of $150k capital ended up with a portfolio of $766k.

Start early!

Contribute consistently:

You might not have a lump sum of money lying around somewhere all-ready to be deployed into the market. That is ok. Save and contribute consistently.

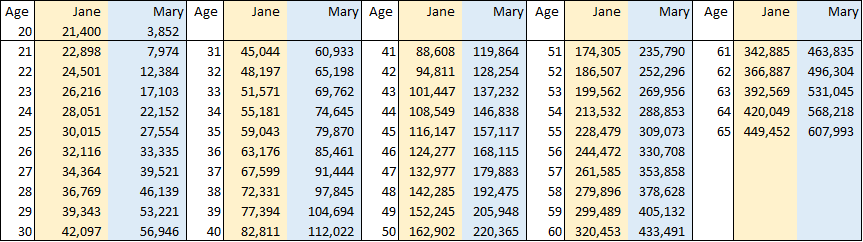

Let’s assume again there are 2 friends, Jane and Mary, both who are currently Age 20. Jane inherited a lump sum of money ($20k) and decided to put all into the market from Day 1. Mary on the other doesn’t bank on inheritance but instead invests $3,600 each year from Age 20 to Age 30 for a total contribution of $36k.

By just diligently saving and investing $16k more, Mary’s portfolio ended up with a total value of $608k when she is Age 65 vs. Jane’s portfolio of $449k or c.$150k more.

Strategic DCA (optional):

I highlighted this strategy in this article. Instead of contributing a fixed amount of capital every year, we look to incorporate some element of “market timing” by adjusting our contribution amount based on the market’s performance.

If market performance is positive in Year 1, we will maintain the same amount of capital contribution in Year 2. If the market return is negative but more than -10% in Year 1, we increase our capital contribution by 50% in Year 2. If the market return is less than -10% in Year 1, we increase our capital contribution by 100% in Year 2.

In this way, we look to invest a bigger amount into the market when it is “cheaper”(represented by a down year).

Our random test shows that this strategy outperforms the normal DCA methodology of a fixed contribution, although not by much.

At the end of the day, for most new investors, being patient and staying in the market consistently reduces the hassle of “timing” the market while yet still produce an end-result that is ideal enough.

How to become a millionaire with just $300 savings every month

While not everybody will have $200k lying around to be deployed for lump-sum investing, one doesn’t need that much to become a millionaire when he/she retires. Let me show you how that can be achieved for a 20-year old with 45 years investing horizon before he/she retires.

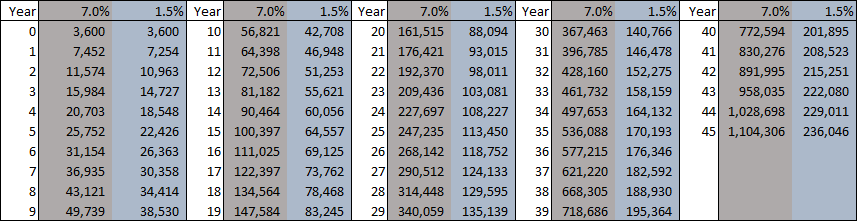

Assume that a 20-year old save $300 every month and invest $3,600 ($300*12 months) in the stock market on Jan 1st for the next 45 years. How would his investments grow? I have previously ascertained that investing in the US market (large-cap stocks represented by the S&P 500) generates a long-term return (after inflation) of approx. 7%. Let’s use that as our core assumption.

Based on the table above, saving $300 every month and investing a lump sum of $3,600 every year into the market with an average return of 7% generates a total portfolio value of S$1.1m at the end of the 45 years. Your total capital injection is $162k.

The power of compound interest has “magically” turned your $162k capital into a million-dollar portfolio.

Imagine putting those $ 300 monthly savings in your “high yield” risk-free account generating a 1.5% yield. After 45 years, your portfolio would have grown to just $236k based on a capital injection of $162k.

Conclusion: If you want to be wealthy, don’t hassle over finding the highest “risk-free” cash management service. Instead, find the right asset combination that fits your risk profile and let the power of compound interest work its magic.

For a 20-year old, that should be allocating a “good” portion of his/her savings into the stock market.

Bottom-line

There are 3 key takeaways to “realize” the power of compound interest:

- Start early: The sooner you start, the more time compounding has to work in your favor, and the richer you will become. The best time to start investing is Yesterday. Yes, if you start investing at age 19, you will be better off than if you start at age 20. However, that is not to say that someone age 50 should give up totally. Compounding will continue to be your friend and you should not hesitate to invest.

- Stay disciplined and make regular contributions: Investing is not a race but a marathon. Don’t expect to become an overnight millionaire sensation betting on the stock market. Instead, make a regular contribution to your retirement accounts and do what you can to increase your deposits as time goes on. Your goal should be to generate as large a saving rate as possible while yet still having a “quality” lifestyle.

- Don’t try to time the market: Unless you have got a magical crystal ball in front of you, you shouldn’t be looking to time the market. Be patient and instead let the power of compound interest work its magic for you. By entering in and out of the market, you might miss out on some of the biggest UP days in the stock market. Alternatively, we have shown an alternative manner to dollar cost average which could potentially enhance the effect of compounding.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Value Investing using options: Why value investors should also be option traders

- What is ROE? Which S&P500 stocks have strong ROE ratios?

- Thematic ETFs partaking in the hottest trends

- Best performing ETFs which consistently outperform the S&P500 over the past decade

- Too late to buy Gold? How to play it with Options for >100% annualized ROI

- Philip Morris: How to put its 6% yield on steroids

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.