In a previous article, I wrote about how to hedge against a stock market decline, using 5 levels of hedging. I did not mention gold, which might be more of a useful hedge against a broad-based decline in fiat currencies, particularly the USD as well as the increased probability of inflation rather than a stock market decline. However, with the strong rise in gold prices in recent days, is it too late to buy gold now?

Trade War + Central Bank printing = More upside for gold?

War is inflationary and we are currently in the midst of a massive trade war between the US and China that recently reach a new peak of “pent-up” grievances. Donald Trump’s rapid-fire escalation of attacks on China, with the ban of TikTok and WeChat taking center stage as well as sanctions of Hong Kong’s top official Carrie Lam, risk igniting a cold war between the world’s two superpowers that could result in massive disruption of the global supply chain.

Cheap products such as car parts that were once made in China’s city of Wuhan can no longer land in the US. This is not just a single city issue but one that transcends the entire nation with deglobalization potentially increasing the overall cost of production worldwide.

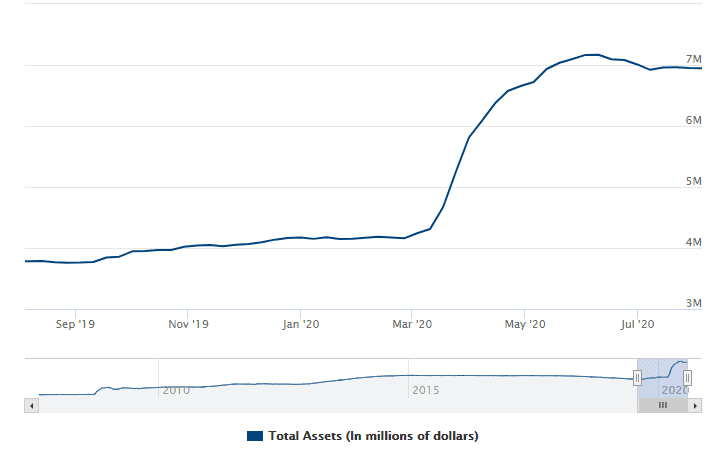

Moreover, the Fed has been flooding its financial system with cash. The central bank assets have now ballooned to USD$7trn and that figure is likely to keep rising. The Fed is also mulling a more accommodative stance towards inflation, with short-term rates unlikely to rise anytime soon.

The combination of a rapidly worsening US-China trade relationship and global money printing press going into overdrive might partially explain why gold is currently at an all-time high level of US$2,030/oz. After a neck-breaking rally, it’s natural to ask if we are already too late in the game?

Still more upside?

According to Steven Sosnick, Interactive Brokers’ chief strategies, he commented that “gold bugs are the cicada of the investment ecosystem. They hibernate for years and emerge in a frenzy in reaction to some fear that ultimately subsides and then they go away until the next maelstrom sparks their re-emergence.”

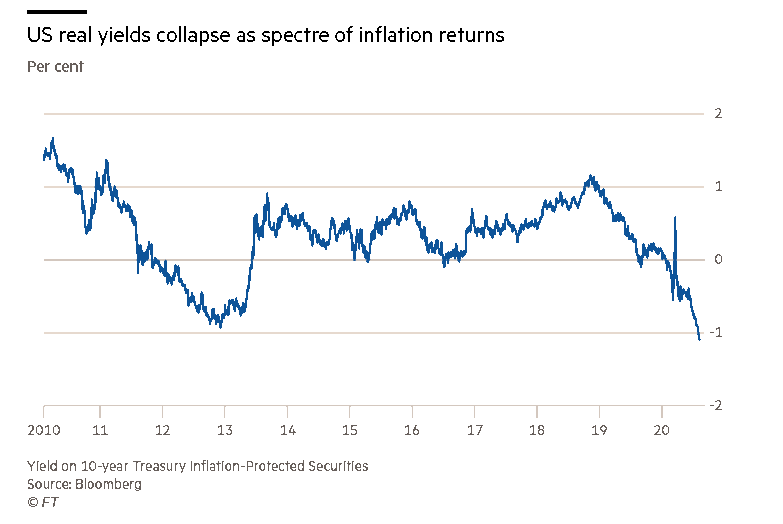

They have made a grand entrance thus far in 2020 and one particular reason why that party can continue for the rest of 2020 is due to negative real yields. According to Citi economists, they believe the metal could reach US$2,100/oz this quarter and US$2,300/oz in the next 6-12 months, with “risks skewed to the upside”.

They highlighted that at its core, the rally in gold was being driven by central banks’ monetary easing, which had resulted in negative real yields. This is when the return investors get on bonds is equal to or below the rate of inflation. Such a scenario reduced the “opportunity cost of holding a zero-coupon asset such as gold”.

And because the Fed and other central banks will have their hands tied when it comes to raising interest rates as a result of high unemployment even if inflation is to start picking up, this could mean a substantial negative real yield for investors. Such a backdrop will favor the outperformance of gold.

Beyond global currency debasement, one more issue looms in the background that is not fully reflected in gold’s price: the US presidential election.

If Donald Trump is re-elected, gold should benefit because of the uncertainty surrounding Trump’s drastic actions that he might take in his second-term. If Joe Biden wins, gold could also advance because conservatives will fear that he will further debase the dollar with tax-and-spend policies.

Whatever the outcome of the US election, it would seem that gold will remain as the feel-good asset during times of duress. While we might be in a global economic standstill, the current stock market, while fraught with anxiety, is nowhere near a doomsday scenario, at least for now.

So for those who are looking to hedge against the still distant prospect of stagflation (hyperinflation + economic contraction), gold might be a key weapon of choice in your trading arsenal.

GLD a popular ETF to partake in gold

SPDR Gold Trust (GLD), the largest, most popular gold ETF, is an investment fund that holds physical gold to back its shares. The share price tracks the price of gold, and it trades like a stock, but the vast majority of investors don’t have a claim on the underlying gold.

The reason for this is that you can only request physical delivery of metal if you own a minimum of 100,000 GLD shares (most investors don’t). Even if you do own enough shares, the GLD ETF reserves the right to settle your delivery request in cash.

So why is GLD appealing to investors if you never actually own any gold?

For one, the fund is both convenient and low cost. If you’re looking for an inexpensive way to invest in the direction of the gold price, GLD is ideal.

The other advantage is you can employ leverage with options, which can be risky, but it’s something you can’t do with gold bullion (more on this later). If you’re an investor who doesn’t plan to take delivery and you’re comfortable with a higher degree of risk, GLD can be a good way to gain exposure to the price of gold.

NAOF passive portfolio outperform due to GLD

I have written about GLD numerous times, particularly in this article: Best ETFs in Singapore to structure your passive portfolio where local SG investors can purchase GLD ETF directly from the SGX bourse – ticker O87 and use that asset class to form part of their passive portfolio.

I recommended 4 ETFs in that article as a basis to structure a passive portfolio, which as of today, generated a total portfolio weighted return of 0.8%. This looks laughable on the surface but when compared to the STI Index which is down 21% YTD, the outperformance is close to 22%.

For those who believe that gold will continue to rise, then the GLD ETF, which can be purchased on SGX might be a simple way for you to partake in this “golden” asset. Alternatively, one can also dollar cost average into GLD ETF through FSMOne, although the monthly recurring amount is relatively high.

Using options as a leverage tool to purchase GLD

I like using options as a possible leverage tool to purchase GLD. This can only be done in the US market (no options market in Singapore).

A key reason is that it is a highly liquid ETF and hence, one does not have to be concerned with liquidity as well as spread issues (Bid-ask spread is extremely narrow).

Instead of forking out a total of USD$19,100 to purchase 100 shares of GLD, I can use a capital of USD$2,500 to purchase a Deep-ITM Call Option (Delta of 0.80) with a Strike Price of 170 and a duration of 160 days to expiration (15 Jan 21 expiration).

With GLD currently trading at USD$191/share, the implied intrinsic value of the counter is USD$21/share which means that I am just paying USD$4/share for time value in this scenario or paying just USD$2.50 a day as an additional cost to control USD$19,000 worth of GLD shares with just USD$2,500 in the capital.

At the end of 2020, if gold prices appreciate from the current level of USD$2,050/oz to Citi’s forecast of USD$2,300/oz or a 12% appreciation, I would expect GLD to have a similar level of appreciation from USD$191 to USD214.

This will mean that my call option, which I purchased for USD$25/share will now be worth approximately USD$44/share (The forecasted price of USD$214 – Strike price of USD$170), implying a total profit potential of USD$19/share or an ROI of 19/25 = 76% (annualized = 173%) for the trade.

My breakeven level is GLD at USD$195/share upon expiration, USD$4 above the current level.

The downside risk is of course GLD collapsing below USD$170 for whatever reason, by which I risk a total capital amount of USD$2,500 (max risk).

Alternatively, I can also structure a vertical with a sale of a call option at a strike of USD$215 (fair value price), generating an income of USD$5.70 which more than offset the time value premium I paid for my long call.

In this scenario, my max ROI will be cap at 19/(25-5.70) = 98%.

Potential risk

The downside risk to this trade might primarily be a stronger US Dollar. The stronger the dollar, the weaker gold tends to become. Yet this trade is animated by the simple belief that the market mob will remain scared of their government money-printing antics, the second wave of COVID-19 escalating, and a worse-than-expected economic recovery in 2H20.

Another risk is the tracking error of GLD vs. spot gold prices. The tracking error of GLD is slightly more than 1%/annum where 0.40% is due to its expense ratio. Over the last 5 years, GLD has risen about 79% vs. spot gold price rise of 85%. While not a concern over a short duration, GLD is not a suitable asset to be holding over a longer-term horizon as the disparity between its price-performance vs spot gold will get increasingly large.

Conclusion

For most people, using options to purchase GLD might be way too complicated for them. In this case, a simple purchase through the local bourse might suffice. While my recommended portfolio allocation to gold might seem high at 20%, we are currently in unprecedented times when it comes to monetary stimulus and the fact that zero and negative interest rates are here to stay for a long long time.

These facts support having a relatively higher proportion in gold at present vs. normal times (when rates are supposed to be at the 3% level and not in negative territory). However, as mentioned, purchasing GLD ETF will entail a certain level of tracking error which might not be a problem over a short duration (< 1 year) but a major issue over a longer horizon.

For those who are interested to find out more about how you can trade options effectively and how you can generate a consistent stream of passive income every month, do join me in this FREE 2 hours Options Training Session where I will share with you more about the flexibility of using options and how they can be a useful tool in your trading arsenal.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- HYPHENS PHARMA: IS THIS PHARMA COMPANY UNDERVALUED?

- SEMBCORP INDUSTRIES: WHAT MIGHT BE ITS FAIR VALUE?

- SEMBCORP INDUSTRIES AND MARINE DEMERGER: WHAT YOU NEED TO KNOW AND WHAT TO DO

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 2]

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 1]

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “Too late to buy Gold? How to play it with Options for >100% annualized ROI”

Really nice analysis, hoping your call option is doing well; albeit the drop in GOLD recently.

What are your thoughts on institutions hedging against fiat money using cryto/digital currencies? With outflows from safe havens such as metals to crypto, will this influence the supply & demand or even trading volume we see across the traditional commodities?

Hi Winston,

Thanks for stopping by. Yeah took a slight but its ok. Seems to be slowly rebounding. Yes, definitely there has been a shift in demand from safe haven like Gold to alternatives such as bitcoin. I have written a simple article on bitcoin which you can check it out as well and I do have the intention to research and write of such content for readers. I wont comment about soft commodities but for traditional commodities like gold and silver which are previously seen as safe haven or more of a hedge against inflation, their demand might be tapered by the rise of cryptos. But unlikely that demand will just evaporate.