Outperforming stocks for 2021

Tesla stock has been on a roll for the past 1-year and that momentum seems to remain in place for 2020 as the stock has already appreciated by 20% YTD 2021.

In this article, we identify 6 outperforming stocks that have appreciated MORE than Tesla and yet might still be better buys in 2021.

A blockbuster 2020 for Tesla

Tesla stock is not without its controversy, with the counter being a heavily shorted stock for years. The positive momentum started gaining traction swiftly in 2020 when the counter appreciated by close to 8X, with the counter starting the year at $90/share and ending at $700/share.

The bulls cite a number of reasons why Tesla stock has appreciated swiftly in 2020:

- Tesla enters the fast-growing compact SUV market with the launch of its Model Y in early 2020. Elon Musk expects the Model Y to eventually be its largest selling model, outselling the Model 3, Model X, and Model S combined.

- Emission credit sales were up 2.5x YoY and was a big driver of Tesla’s profitability over the last year. Although these revenues are not sustainable, the policy goals for clean energy of the Biden administration could bode well for Tesla and its regulatory credit business in the coming years.

- Tesla was able to cash in on China, with its Shanghai facility starting production towards the end of 2019. Tesla revenues from China grew 90% over the first 9 months of 2020 and Tesla’s quick execution on the plant shows that it can execute very well under the right conditions, boding well for its upcoming facilities in Germany and Texas

- Tesla is well ahead of its competitors in the self-driving race and intends to offer self-driving software subscriptions for 2021, a revenue model much sought after by technology investors, given the stable and recurring cash flow that it brings in

- Tesla has made strong headways in reducing battery costs and improving its performance. The company also outlined plans to produce its own batteries and even mine its own lithium in the years ahead.

Will 2021 continue to be a blockbuster year for Tesla? Only time will tell. However, there are 6 stocks that have actually outperformed the high-flying Tesla in 2021 and over the course of the past 1-year. A couple of these stocks might be more well-known but the majority of them are flying under the radar and could be potential stock considerations for your portfolio.

I use the Stock Rover screener to screen out these 6 mid to large-cap stocks that have outperformed Tesla over the short term, with their strong price momentum potentially signaling more upside for these counters ahead.

Stock Rover

One of the best stock screeners out there to screen for US gems, the Stock Rover screener is a must-have for any serious fundamental investors looking to find an edge.

Starting with the smallest market cap, these are the 6 outperforming stocks that have appreciated more than Tesla in 2021 and over the course of the past 1-year.

Are these stocks better buys than Tesla as we head into 2021?

Outperforming Stock #1: SunPower

Like Tesla, SunPower is a leading player in the renewable energy sector. SunPower is the industry leader in residential and commercial solar deployment.

Unlike Tesla, which is now worth $800bn, SunPower is just 1% of its market cap at $8bn. The company’s business has long been built on manufacturing the most efficient solar panels on the market.

It developed residential and commercial solar solutions to fuel solar panel installations and even built a large utility-scale solar business.

But over the last few years, it has shed its utility-scale solar business and has spun off its manufacturing assets into a Singapore-based entity called Maxeon Solar.

What is left is a company that provides tools to developers in North America. The company has an exclusive agreement to sell industry-leading efficiency Maxeon solar panels to its clients and also provides quoting tools, hardware designs, and monitoring technology to the dealers and installers that it works with.

Instead of being a manufacturer, the company is now targeting to become a technology company in the middle of a booming residential and commercial solar business.

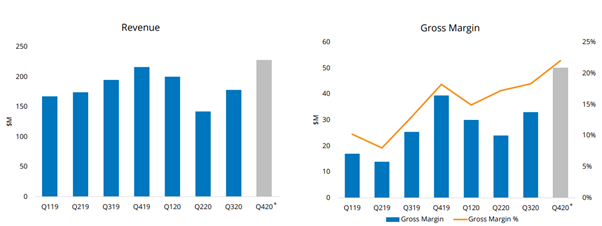

The company could start generating software-type margins and unlimited growth with very little capital investment. This can be seen from its rapidly improving gross margin trend.

SunPower is also tying together hundred of storage systems across the US to bid into competitive electricity markets with that is known as a virtual power plant.

We are just starting to see what SunPower can become now that it’s a residential and commercial focused solutions provider in the solar industry. And with an asset-light model, it could potentially grow earnings rapidly over the next decade as the company scales.

Outperforming Stock #2: Fiverr International

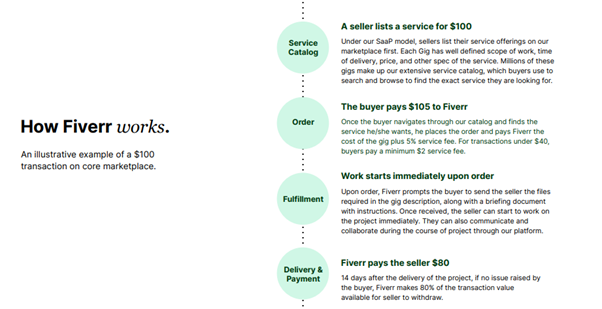

Fiverr connects gig workers with businesses through its online marketplace. The platform offers hundreds of different categories of digital services that businesses can tap to find top-quality freelancers.

The perception of freelance work has shifted dramatically in recent years. Businesses used to see traditional employment relationships as the best indicator of high-quality work, leaving only those who couldn’t get “real” jobs to freelance. Now, though, gigs have become a way of life for a large and growing number of people.

Workers like the flexibility that freelance work offers them, and they’re willing to take on the responsibilities of running their own businesses to get that flexibility. Workers have also found that traditional employment no longer offers any guarantee of job security, and many people have sought out gigs by necessity after layoffs or furloughs.

For businesses, hiring freelance contractors is a lot simpler than managing an employment relationship, and it can be a lot cheaper as well. There’s considerable risk involved in finding and hiring employees, too. The ability to see how contractors perform on individual projects without any long-term commitment makes gig work a lot safer for companies needing key services.

With an addressable market of $100 billion and rising just in the U.S., the gig economy has ample opportunities for those companies seeking to tap into it. Fiverr has already aggressively moved forward with its freelancer platform, and it has a long way to grow ahead of it.

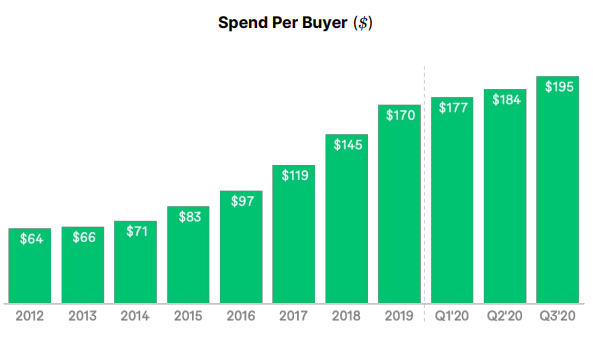

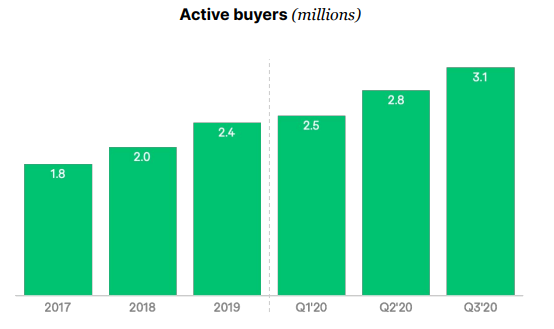

The company has been aggressively adding active buyers and that is achieved without a sales force. Not only are active buyers increasing, the spend per buyer has also been increasing.

Fiverr is confident that its strategy will keep producing success. It expects 77% to 81% of revenue growth in the upcoming 4Q and is optimistic about the higher quality of its most recent cohort of new clients compared to past cohorts.

Outperforming Stock #3: Twist Bioscience

Twist Bioscience is a biotechnological company. The company wields the leading technology platform for synthesizing DNA. This synthetic DNA is most often used in genetic engineering experiments or for creating reference probes for DNA sequencing applications. The company is also exploring the potential to use synthetic DNA for storing digital data and for designing biologic drugs.

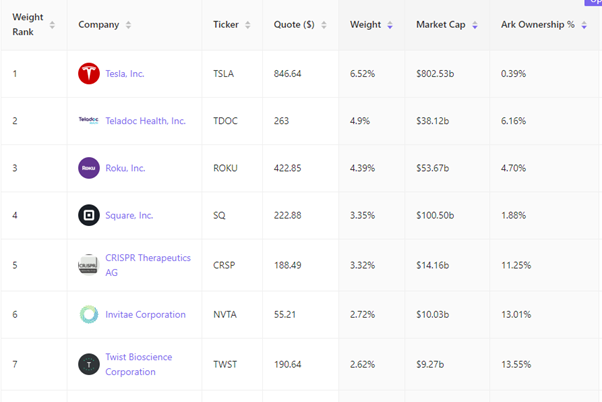

Twist Bioscience is one of the largest holdings of fame growth investor Catherine Woods, whose ARK group of ETFs have been one of the best performing ETFs in 2020 and likely 2021 thus far.

Twist Bioscience is the 7th largest ARK holdings (out of 154 holdings) across its 5 key ETFs, with a weight of 2.62%. ARK is also likely one of the largest institutional shareholders of Twist Bioscience, with an ownership stake of 13.55%.

Among the list of 6 outperforming stocks, I consider Twist Bioscience to be one of the higher risk one, given that the world of biotechnology is changing rapidly every single day.

There is however no doubt that DNA sequencing is a high growth industry in the coming decade.

The bigger question is whether Twist Bioscience will remain as one of the leading market player in this industry.

It will probably be easier to follow a reputable growth manager who has a good track record of identifying winners. Catherine Woods is definitely one of them.

Additional Reading: Growth Investing. How to find growth stocks to invest in.

Outperforming Stock #4: Futu Holdings

Futu Holdings might be a stock that most Singaporeans are unknown of but they already have a presence here in sunny Singapore.

The company is the parent company behind the Moomoo trading app which will be launched on the 1st Feb 2021 here in Singapore and aims to bring low cost investing to Singaporeans.

They will be in direct competition with one of the peers, Up Fintech, better known as Tiger Brokers, the latter already having a presence in Singapore and is one of the companies which I have previously blogged about.

Additional Reading: How I use Tiger Brokers to find stocks gems

Online brokerages such as Tiger Brokers and Futu have been hired to help arrange almost every blockbuster overseas share sale by China’s new economy firms over the past year such as XPeng and Li Auto.

Tiger Brokers

A fintech brokerage backed by Xiaomi, Tiger Brokers is a low-commission cost brokerage platform that allows Singaporeans to buy HK, China, SG, and US stocks on the cheap

Tiger took part in 26 Chinese Firm IPOs in the US in 2020 while Futu was involved in half of such ADR deals. Their involvement helped a record 36 Chinese firms go public in the US even amid souring relations between the world’s two largest economies, threats of delisting, and restrictions on investments.

Both Futu and Tiger now have more than 1 million brokerage clients, providing trading flows and the cachet to get in on more deals.

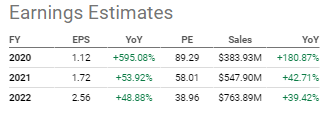

Despite being a start-up still in its early days, the company has been profitable and its EPS is expected to increase by 600% in 2020, moderating to a still hefty growth rate of 54% in 2021 and 49% in 2022, according to consensus estimates.

The stock has appreciated by 118% YTD compared to Up Fintech’s 124%.

This is one relatively unknown stock that might see stronger gains ahead due to increase retail participation. However, the inverse will likely also be true when a major stock correction is to happen which will see these investors heading in drove for the exit.

Outperforming Stock #5: Plug Power

Plug Power offers proton exchange membrane, or PEM, fuel cells, which is the most common fuel cell technology in use currently. It requires a platinum catalyst, which makes it expensive.

However, PEM fuel cells are compact, can start or stop quickly, and can operate at lower temperatures. All these characteristics make them more suitable for transportation applications.

Its fuel cells are used by Amazon, Home Depot, and Walmart in their forklifts. It’s also targeting European car manufacturers, which are investing in developing hydrogen fuel cell-powered vehicles.

Through the first 5 months of 2020, Plug Power performed well for investors, climbing 33% amid a market wide sell-off as a result of COVID-19.

Then summer rolled in and the stock got heated up. Investors celebrated the company’s announcement regarding acquisitions of United hydrogen Group and Giner ELX, 2 deals that led management to boost its 2024 forecasts even higher.

As a result, shares of Plug Power surged by 1000% in 2020 amid all the optimism surrounding its prospect to generate strong revenue growth in the coming years.

That momentum has continued in 2021, with the counter appreciating by 97% YTD.

While Plug Power hasn’t achieved profitability yet, it is an experienced player in hydrogen fuel cell technology and has already entered into the huge potential hydrogen EV market. The company has been growing sales at an average rate of 35% over five years and may grow at a faster pace in the coming years.

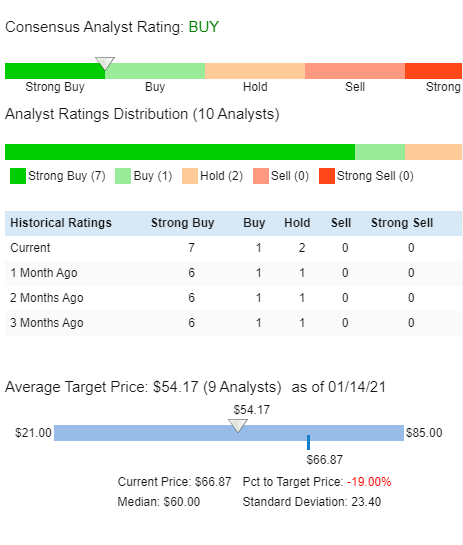

This is one stock that most analysts have a positive view on. However, its current share price of c.$67/share is 19% higher than the average target price of $54/share.

One will need to hold a long-term view of the counter to be vested at its current share price.

Outperforming Stock #6: NIO

Shares of NIO rose 1110% in 2020. The Chinese electric vehicle (EV) company’s stock soared thanks to signs of incredible momentum and long-term growth potential for the industry.

This is a company that is touted as the Tesla of China.

Momentum built for NIO stock amid signs that the Chinese government would make a powerful push to transition the country to electric vehicles. The company also posted strong vehicle delivery numbers, and its monthly delivery updates across last year showed impressive growth for the business.

China has a population of roughly 1.4 billion people, presenting a massive addressable market for NIO in its domestic market alone. The EV market has been expanding even faster in China than in the U.S., and there’s still a huge runway for growth. However, investors also have to keep valuations in mind — as well as the likelihood that an influx of competition may limit growth opportunities for industry leaders that have enjoyed explosive stock gains.

With a market cap of US97bn, NIO is the largest market cap stock in this list of 6 outperforming stocks.

The company was recently upgraded by Nomura with a target price of $80.30/share. Nomura cited: “We like NIO Inc. for the company’s Tesla-like top-down approach in launching its EV pipeline – starting with its luxury flagship model ES8, followed by more consumer-friendly models and variants (i.e., ES6, EC6). We believe NIO has successfully established itself as a premium auto brand given car buyers are willing to pay a price similar to those for entry-level models of major European luxury original-equipment-manufacturers (OEMs).”

Like Tesla, NIO is not targeting to profit from just the sale of EVs but recurring revenue generated from providing battery swapping services, which is viewed as a game-changer. Nio’s battery-as-a-service (BaaS) is a significant milestone for the company and is likely to boost sales going forward.

The company has the first-mover advantage in BaaS and has improved swapping time to about 4.5 mins without human-labor (according to the youtube video) and with plans to add mini-hotspots covering most parts of the major cities in China, the company hopes to redefine the whole user experience of owning an EV.

Conclusion

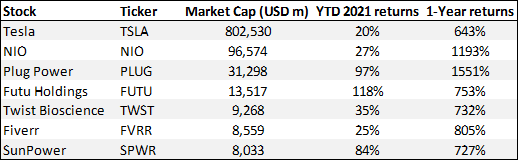

The table below shows the returns of the 6 outperforming stocks relative to Tesla in 2021 as well as over a 1-year horizon.

This article is by no means a recommendation to buy these 6 outperforming stocks but just to bring to NAOF readers attention of certain stocks that might be good long-term buy and hold candidates that are currently flying under the radar.

I am personally more interested in Fiverr, Futu, and NIO. These are stocks that are potentially prime to see mass user adoption, one of the key criteria that I use to identify multi-bagger stocks.

However, I do note the elevated risk nature in these stocks, which are mostly growth stocks with obscene valuation.

Investors will need to adopt a long-investing horizon and be comfortable with these companies’ growth prospects if they wish to invest in the counters at present, many of which are at all-time high levels.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- 5 outperforming stocks that crush the S&P500 in 1Q20

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.