Leveraging on Tiger Brokers platform

I have talked about using the Tiger Brokers platform in this comprehensive review of the up-and-coming fintech brokerage player that is looking to “revolutionize” low-cost trading here in Singapore.

Maybe revolutionize is too big of a word to be used in the current context but more of playing catch up and putting pressure on existing brokerage incumbents to follow up. This will only benefit retail investors like us, who for the longest of time have been paying a rather substantial amount in minimum commission fees that reduces our portfolio returns.

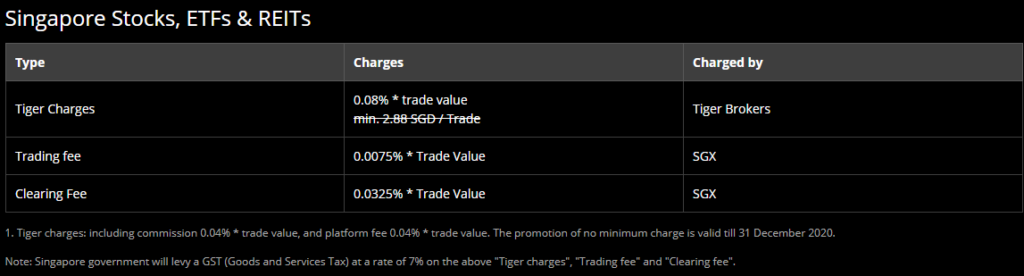

Since Tiger Brokers introduced their zero minimum brokerage fee structure, POEMS has also followed suit with such a structure while other foreign brokerage such as SAXO has also introduced “zero-commission trades” for Singapore stocks for a limited period. This is only for new sign-ups.

While existing brokerage incumbents such as DBS Vickers, UOB Kay Hian, Lim and Tan, etc have maintained their relatively high minimum commission structure, it might only be a matter of time before they are forced to “play ball”. Again, retail investors will rejoice when that happens.

For a complete review of the brokerage in Singapore, you can refer to this article: Best Stock Brokerage in Singapore

Hence, it is fair to say that Tiger Brokers has indirectly changed the competitive landscape here in Singapore with their aggressive commission structure.

While Tiger Brokers stands out in terms of their low-cost commission structure, competing on price is never a long-term solution in terms of possessing a comparative advantage. I have written in my review article that what catches my attention beyond its low-cost structure is Tiger Brokers interactive mobile platform which is one of the best that I have seen within the Singapore market.

Tiger Brokers

One of the new fintech brokers that is bringing low-cost commission trading in Singapore to a whole new level.

Check out its interactive mobile platform that is one of the best within the Singapore context.

While not as comprehensive as US fintech brokerage players, it is likely the best here in Singapore, with the platform providing various functions not often available to retail investors, that allow a newbie to make better investment decisions.

I will go more in-depth into demonstrating how I use one of their services to find stock gems and leverage the idea using options (which is also part of their offerings).

Of course, to be honest, there is room for improvement. Since Tiger Brokers has a Chinese background (for those who are not familiar with Tiger Brokers’ history, please refer back to my review article), it is not surprising that one can spot spelling errors when using the platform and certain sentence structure looks like an “AI” translation from Mandarin to English.

This might impact Tiger Brokers’ professional image in the long run, especially if they intend to cater their services to English-speaking clientele.

All-in-all, I would say that it is still a good effort on the part of Tiger Brokers and I believe that it is only a matter of time before they introduce more products and investing solutions such as CFDs, recurring dollar-cost averaging into low-cost ETFs, trading of bitcoins, etc to the masses.

Finding stock gems using Tiger Brokers platform

I have previously written about Tiger Brokers mobile functionality in my review article, hence I will not be repeating that here in this article.

Instead, I will like to demonstrate how I use Tiger Brokers’ mobile platform to find stock gems.

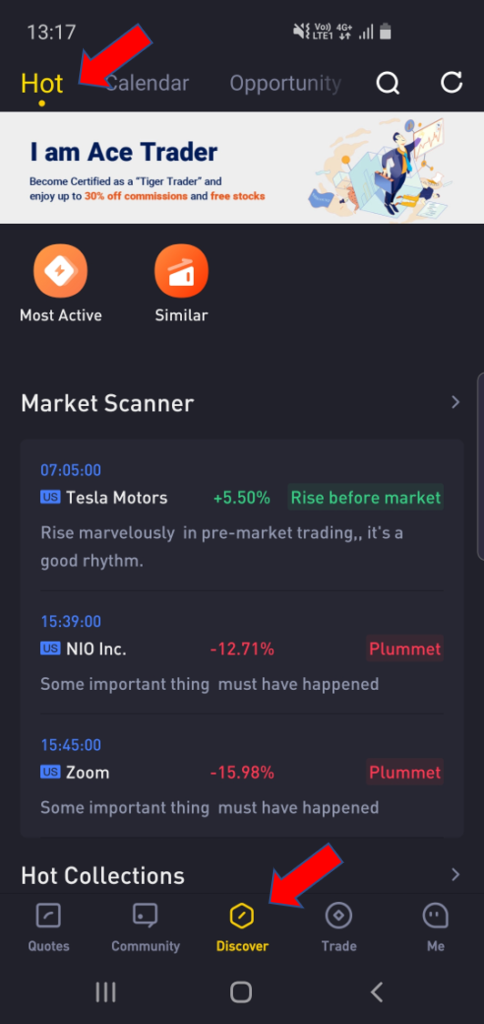

When you hit on the “Discover” main-tab, under the “Hot” sub-tab, you will be brought to a segment where the platform will show you which are some of the top price movers in their “Market Scanner” segment. However, they will not provide a direct explanation as to why the prices are moving so drastically. One can however look at the individual company “news” to provide clues on the price movement.

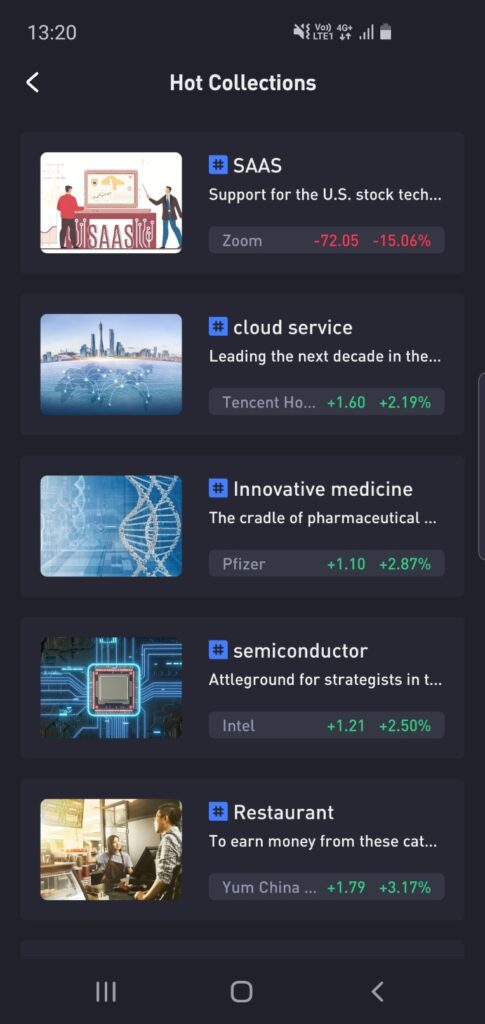

In the Discover tab, there is also a segment called “Hot Collections” which is a compilation of stocks in niche sectors such as SaaS, Cloud Services, Innovative medicines, etc, just to name a few. There are many categories in this Hot Collection segment which an investor can use to generate stock ideas.

It might be useful if Tiger Brokers can provide a quick snapshot as to how a portfolio consisting of stocks identified in the individual niche sectors would have performed over a period of time.

What I find lacking, however, is more solutions for value investors and dividend investors who are looking from the angle of generating passive income from their yield portfolio.

While their Hot Collections segment is a solution that I use pretty often to get stocks inspiration, it is not the focus of today’s article. Instead, I will like to delve a little more into their “Tiger lab”

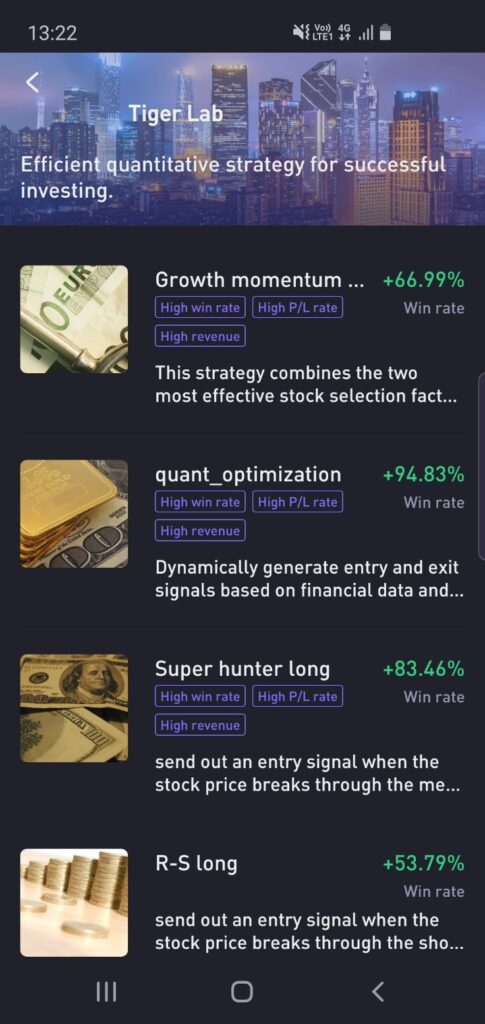

Tiger Lab

Tiger Lab is where the brokerage’s quantitative team selects unique quantitative investment strategies for you.

There are currently 4 quantitative strategies available:

- Growth Momentum

- Quant Optimization

- Super Hunter Long, and

- R-S Long

The descriptions of the 4 quantitative strategies are highlighted below:

Growth Momentum

This strategy combines the two most effective stock selection factors which are the growth factor and momentum factor.

The strategy will find buy growth stocks which are demonstrating rising momentum based on the movements of the moving averages and sell when the momentum weakens.

According to Tiger Brokers, this strategy has a Win Rate of 67% and 26% annualized returns, trouncing the S&P 500 by a large margin since 2018.

Quant Optimization

This strategy dynamically generates entry and exit signals based on financial data and historical statistical data.

As to what those data and statistics are, Tiger Brokers did not further elaborate. However, according to them, this strategy has a high win rate of 95%!

Super Hunter Long

This strategy purchases a stock when the price breaks through the medium-term trend line, with the goal of capturing a reversing medium-term trend.

Such a strategy has a win rate of 83% although the average annualized return is on the “low” end at 7.4%.

R-S Long

This strategy purchases a stock when the price breaks through the short-term trend line with high volume, with the goal of capturing a reversing short-term trend.

Such a strategy has a win rate of 54% but a low annualized return of 2.6%

Do note that the quant strategies highlighted above are based on historical data that does not represent any certain trend of relevant securities in the future.

My favorite is using the Quant Optimization strategy, not because it has a high win rate (I usually take such ratios with a pinch of salt)but because for this particular strategy, Tiger Brokers will highlight the specific entry and closure of the stocks as and when it happens.

So, for example, it will show that there is a positive entry for the stock Home Depot recently on 25 November 2020 at a trigger price of $273.96/share, and the trade was entered at $275.24.

When a stock is exited, it will also highlight the price and date of that exit.

Based on what Tiger Brokers is showing, trades are usually exited for double-digit returns. So far, the only stock that was exited with a loss was Altria, which generated a loss of 16.5% over the holding horizon.

Leveraging stock gems using Tiger Brokers options

The latest stock recommendation using this quant optimization strategy is Home Depot (HD) which was a stock that was recommended on 25 November, with an entry price of $275, not too far off from the current share price of $277 (as of 1 Dec 2020)

I do like the counter and I believe that it is not just a COVID-19 beneficiary play, as seen from its Financial Year 2021 operating performance (financial year ends in Jan), but also a long term play due to its innovative and successful multichannel strategy which combines both online purchase and in-store pickup.

HD is also a steady dividend payer (11 years of dividend increase), with its current yield just slightly north of 2%. Hence, a dividend investor might consider owning physical shares of Home Depot for its dividend potential.

My focus, however, isn’t on HD’s steady dividend potential but its price appreciation potential over the coming 6 months. However, I do wish to generate some income from this stock in the near term as well. That is where I structure a Poor Man’s Covered Call on HD using Tiger Brokers’ option offerings.

What exactly is a Poor Man’s Covered Call?

Some might have heard of the covered call strategy, one which involves buying at least 100 shares of a counter and subsequently selling a call option. The purpose of selling the call option is to generate short term income from the sale.

The Poor Man’s Covered Call or PMCC for short, is an alternative to the covered call strategy. Instead of owning 100 shares of a stock, which could mean quite a big capital outlay (in HD case, 100 shares of HD will represent a capital outlay of US$27,500 without margin), I instead have a similar “exposure” to that 100 HD shares by purchasing 1 call option contract (1 option contract = 100 shares). I can then sell a separate call option contract to structure the PMCC.

For more information on PMCC, you can refer to this article which I have previously written.

The advantage of structuring a PMCC over a covered call is that purchasing 1 call option contract is a lot cheaper as compared to purchasing 100 shares of the stock.

Structuring the Long Leg

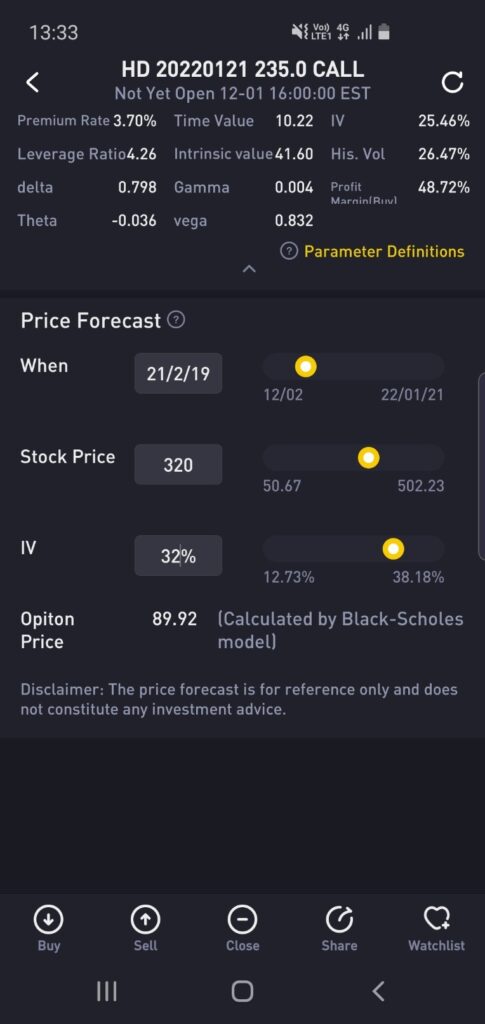

In this case, purchasing 1 call option contract on HD with expiration in Jan 2022 and a strike of $235/share (corresponding to a delta of 0.80) will amount to approx. US$52/share or US$5,200/contract, as can be seen on Tiger Brokers’ option chain information. This is significantly lower than the capital outlay of US$27,500 if I purchased 100 shares of HD outright.

However, do note that as a call option owner, I am not “legally” a shareholder of HD and hence not entitled to any dividend payment.

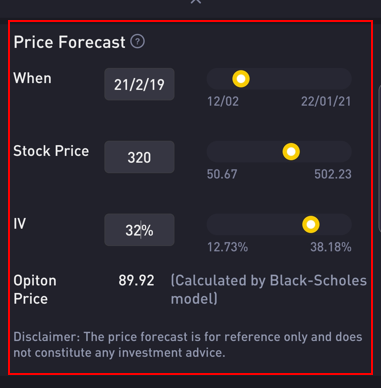

Using Tiger Brokers option price calculator, if the share price on 19 Feb 2021 is at $320/share (my target price for the counter) vs. the current price of $277, the option which we have earlier purchased for US$52/share will now be worth c.US$90/share.

Simply put, the ROI if I was to purchase the 100 shares of HD at $277/share and sell at $320/share will be 15.5%

If I purchase the long-dated call option instead through Tiger Brokers’ option platform at $52/share, the ROI from this options trade will be a rather significant 74% (($90-$52)/$52) when the underlying only appreciate by 15% to US$320/share.

Structuring the Short Leg

So far, I have talked about only the Long Call Option. However, the PMCC structure also involves a Short Call leg.

Again, using the Tiger Brokers’ option platform, I can select to sell a call option that is expiring in 3 months on 19 Feb 2021. I have already identified the price of US$320 as my short-term target price for HD, hence I will sell a call option at this particular strike price, generating a premium of US$95 from this options trade.

If HD’s share price closes below US$320/share on 19 Feb 2021, the US$95 amount becomes my profit. If HD closes above US$320/share on 19 Feb 2021, I still get to keep the US$95 but now I am forced to sell 100 shares of HD at US$320/share.

Recall that I am still in possession of one long call option (100 shares) which can be closed (prematurely) to offset the short call leg.

In a nutshell, if the price on expiration (19 Feb 2021) is at US$320 or above, my maximum profit is (US$90 – US$52) * 100 shares + US$95 (premium from sell leg) = US$3,947 over a capital outlay of US$5,200.

If the share price remains below US$320/share on 19 Feb 2021, I get to keep the full premium of US$95/contract which equates to an annualized yield of 7% based on my capital outlay of US$5,200.

Structuring a low risk option strategy using Tiger Brokers option platform

Do note that options are leveraged products that should be executed only with proper knowledge of how it works.

However, a PMCC strategy is a low-risk options strategy (not much different from owning a stock outright, except for the leverage component which works both ways) that one can use to execute using the Tiger Brokers’ option platform to increase your yield potential.

While Tiger Brokers’ option platform offering is not the best out there (more established players like Interactive Brokers and ThinkorSwim), I do like its intuitive options price calculator which allows me to quickly calculate what my potential ROI will be based on my assumptions on the underlying share price movement (and how long it will take to achieve that price movement).

Conclusion

Options trading is just one of the many features which Tiger Brokers currently offer to its users. While many users are still attracted mainly to Tiger Brokers’ low commission structure at present, I believe that what stands out for this new fintech player is its intuitive mobile platform that offers its users the solution to trade/invest in multiple assets (equities, options and even funds on an RSP basis) pretty much hassle-free on a single platform.

Is it the best? I would say there is room for improvement when I benchmark them against the US fintech brokers but they are already a few steps ahead of the local competition when it comes to trading/investing using your mobile, a “phenomenon” that is not widespread among the retail masses a decade ago but one I am sure will be extremely prevalent in the coming decade.

I do look forward to more product offerings by Tiger Brokers, especially in areas such as offering Bitcoin trading as well as RSP solutions for ETFs and even stocks.

I believe that its low commission rate, while a major plus for the retail mass at present, should not be seen as its long-term competitive advantage. Only through constant product innovation as well as better customer service offering can this fintech player (originating from China) stand head-and-shoulder above the rest of the competition.

Currently, there are still concerns over whether the company can survive for the long-term in this uber-competitive Singapore brokerage landscape. While there is no guarantee that Tiger Brokers will still be among the list of brokerage houses in Singapore a decade from now, it is comforting to know that Tiger Brokers uses DBS and Interactive Brokers as its custodian providers. This means that clients’ cash and investments are kept separately from Tiger Brokers’ accounts, thus assuring that even in the unfortunate circumstances that Tiger Brokers “closes shop”, its clients’ cash/investment will not be impacted.

Do check out my comprehensive review on the Tiger Brokers platform.

This article is written in partnership with Tiger Brokers

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- New IPO stocks performance in 2020

- Best China ETFs to buy [2020]

- Most Shorted Stocks: How to Profit from a Short Squeeze

- Best Stock Brokerage in Singapore [Update November 2020]

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.