Is Tesla Stock a Buy or Sell at a 44% discount from the current level?

Tesla, still the world’s largest automotive company despite witnessing close to a $1 trillion decline in its market cap over the past 1 year, has been the talk of the town of late. The stock declined by 12% on 3rd Jan (not the best way to start the first trading day of 2023), its largest 1-day decline in almost 2 years, as delivery figures came in weaker than expected.

Over the past 1 month, Tesla’s share price has plummeted from $180 to the current $108 per share, a more than 40% decline. On a 1-year basis, that decline is more than 70%, “outshining” Meta (1-year decline of 63%), seemingly the most hated big tech stock in 2022.

Consequently, Tesla’s market share has declined by more than $950 billion in value since the stock hit a peak in November 2021. Its current market cap is $340bn.

Now, might there be value in Tesla if its price declined by another 44% to hit $60 or a corresponding market value of just $190bn? Is Tesla Stock a Buy or Sell at $60?

How can one “lock in” a Tesla price of $60/share while being paid to do so?

We will explore some of these questions in this article, but let us start with a quick summary of what happened to Tesla of late.

Tesla’s agony since Musk’s Twitter takeover

Tesla’s shareholders have been feeling the pain since Elon Musk took a stake in Twitter back in March 2022 and shortly made a buyout offer in April.

To fund his acquisition of Twitter, Musk had to sell a significant chunk of his Tesla shares, amounting to $8.5bn.

That selling continued with another large chunk in late July amounting to $6.9bn and another in November, amounting to $4bn after the Twitter deal closes.

While the market attributes a significant chunk of Tesla’s price decline to Musk’s Twitter sideshow, its latest price decline (3rd Jan 2023) was more fundamental.

The electric vehicle maker said Monday that it delivered about 1.31 million vehicles last year, up roughly 40% from 2021. Sounds fantastic, isn’t it?

Well, not so much if the original growth expectations were for a 50% increment.

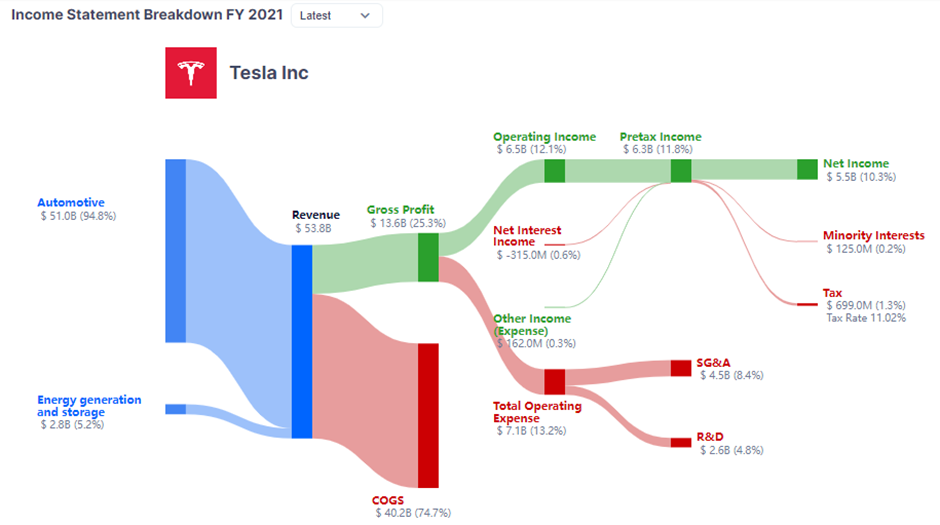

Tesla is expected to post record full-year revenue and profit for 2022 when it reports 4Q22 results due on 25 Jan.

However, the focus has now clearly shifted towards 1) the risk of demand destruction as consumer purchases slow down amid a potential recessionary environment and 2) the impact of an aggressive price discount on its gross margin

Street’s estimate ahead

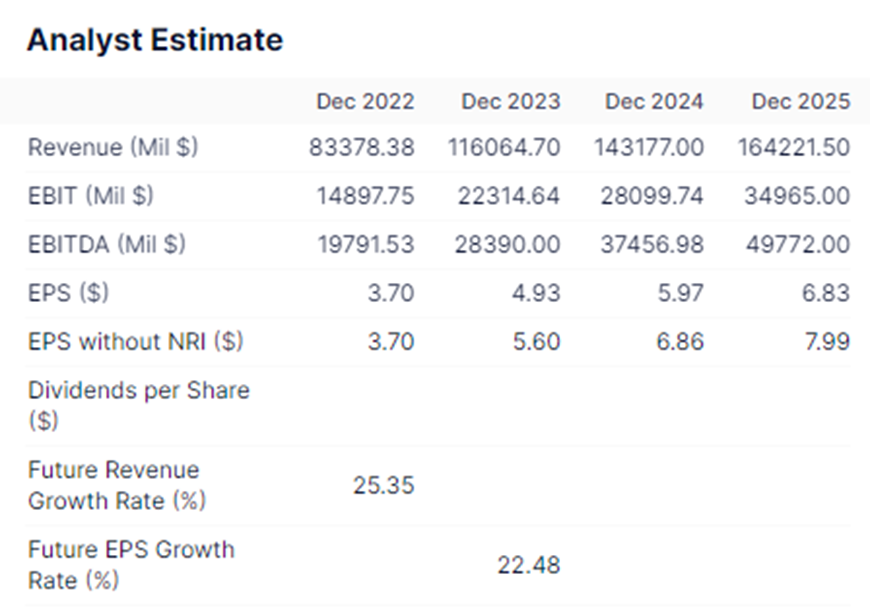

According to the street’s price forecast, Tesla’s “fair value” ranges from a high of $450/share to a low of $85/share over the next 12 months, with a median value of $250, representing more than a doubling in share price over the next 1-year.

The street is also forecasting Tesla to generate Earnings Per Share of $5.60 in 2023. Based on the current price of c.$108, that amounts to roughly 19x forward P/E, not exactly expensive for a company that is expected to grow its EPS by > 20% per annum over the coming years.

Will Tesla go bust?

Musk has previously warned that Tesla might go bankrupt. But based on its current balance sheet strength where the company is in a large net cash position (cash on hand > debt) and its Debt to Equity ratio is at just 0.15x, there should not be any major concerns of the company going bust in the short-term.

Tesla Stock: Buy or Sell at $60?

Now, what if we can purchase Tesla’s shares at a further discount of $60/share, a 44% discount on its current share price? At the $60 level, it is lower than even the most bearish analyst’s price target.

And the best part is, I am being paid upfront for this opportunity to purchase Tesla at such a discounted price. Yes, I would be paid $84 for this opportunity. Not mind-blowingly big money, but if we look at it from an ROI (returns on investment) angle, this is a 168% annualized ROI on my “invested capital”.

Ok, not too shabby now, right? So how exactly does this work?

My trading/investing strategy for Tesla

I am not a mega bull on Tesla, not when it was priced at $400/share (post-split) and Tesla fans were calling for the company to “hit the moon”. Yes, maybe one day that could still be a reality, but for now, the risk is more towards “catching a falling knife”.

On the other hand, I don’t expect Tesla to disappear “out of the blue” or to face financial difficulties, even amid the current rising rate environment.

While a deep recession could result in a “total demand destruction”, that is not yet my base assumption.

Hence, I am more than comfortable taking a stake in Tesla at $60/share, if it does decline to that level.

My trading strategy for Tesla would be to sell 1 short-term 45-days Put on Tesla at a strike price of $60/share.

What this means is that if Tesla’s price is to fall below $60/share at the end of the 45 days contract horizon, my obligation would be to purchase the shares at $60, regardless of how much lower the actual market price might be, at that instance.

For promising to buy at $60 at the end of the contract horizon (my obligation), I am being paid $84 for this Put Option Contract.

If the price of Tesla remains above $60 after the 45-day horizon, I don’t need to fulfill this obligation and I get to keep the full $84 premium.

Risk: I would like to highlight the risk here is taking ownership of 100 Tesla stocks at $60/share, even if the price, over the next 45 days, might collapse to say $40/share (never say never). My unrealized losses ($20/share or $2,000 for 100 shares), when that happens could be substantial.

Conclusion

I am taking a calculated risk here on Tesla, through the usage of options, that will allow me to “get paid while I wait” for the counter to hit my desired entry price of $60/share, which is a 44% discount from its current share price level.

The premium that I get to collect amounts to $84/option contract, not a big amount, but when one looks at it from a returns angle, it becomes a substantial annualized ROI of 168% from a capital outlay of $600.

Coming back to the question, Tesla Stock: Buy or Sell at $60?

Tesla, while not a long-term stock that I would buy at its current $108 price, even after a > 70% price decline from its all-time high, is a stock worthy of my consideration at $60, based on the following reasons:

- At that price level, the company will be trading at a forward P/E of just 10.7x

- That price level is lower than the most bearish street’s estimate at present

- The company is still expected to grow EPS at a 20% annual rate over the next few years

- No credit-related concerns based on its current balance sheet status

Not a recommendation to Buy or Sell. Please do your own necessary due diligence work.

In the current market environment, it is no longer sufficient to engage in a simple passive buy-and-hold investing strategy if one wishes to generate alpha for his/her portfolio. One would need to learn a new skill set to generate stronger returns through the appropriate stock selection.

For those who are interested to learn a simple strategy to pick the Right blue-chip stocks to invest in at the Right time, do hit the button below.

1 thought on “Tesla Stock Buy or Sell at $60?”

good article. May i know how does the annualised of 168% being derived?