- Hyper Growth Stocks Crash

- Lesson #1: Beware of hyper-growth sales but also hyper-growth losses

- Lesson #2: Avoid cash burning hyper growth stocks

- Lesson #3: Be wary of companies that are sensitive to rising rates

- Which might be companies with potential further downside?

- Conclusion

- SEE OUR OTHER WRITE-UPS

Hyper Growth Stocks Crash

Do you know which is the worst-performing hyper-growth stock that has collapsed by 97% in a single year?

Yes, you heard me right. A mind-boggling 97%. That dubious honor belongs to once high-flying stock, Carvana (ticker CVNA) which saw its share price decline by a massive 97.5% over the past 1-year.

At its peak, Carvana was worth approximately $360/share. Now it is a penny counter going at less than $10/share, $7.36 to be exact as of this writing.

The company was once touted as the Amazon of used cars. Its business proposition stems from providing extreme convenience for people to purchase secondhand vehicles. You can buy a car through a “vending machine”.

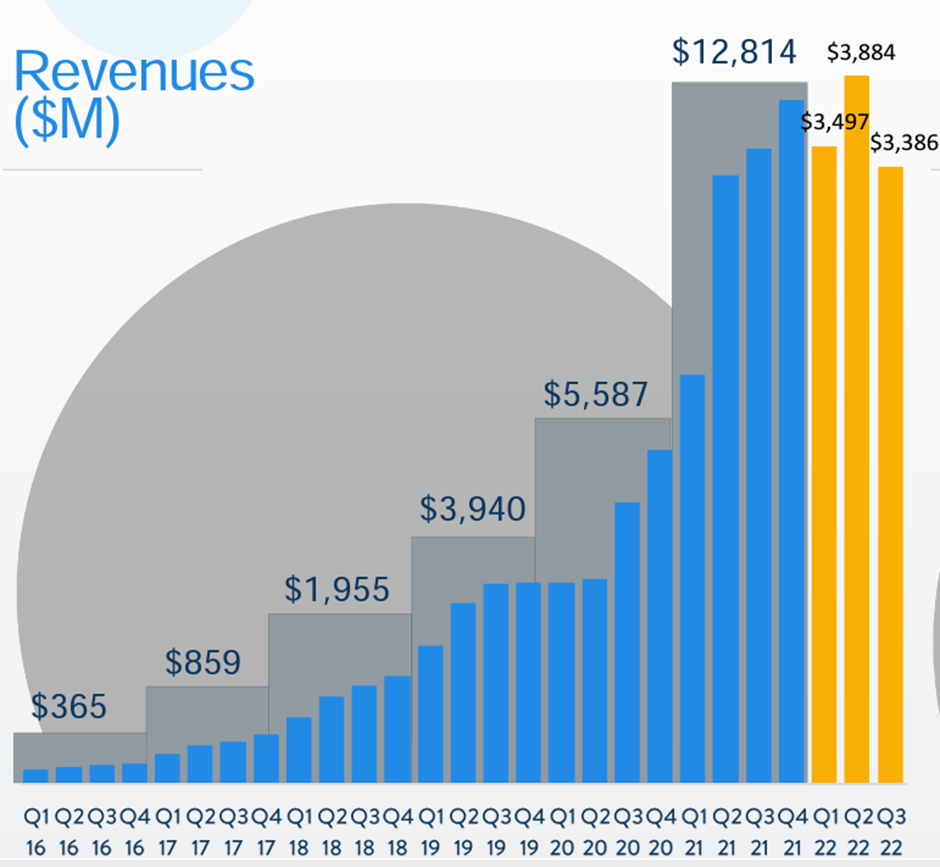

Sounds pretty cool and revolutionary. For years, the company has been riding on ever-higher top-line growth. That all came to a halt in 2022 when cracks started appearing and the company reported slower revenue growth.

To be fair, it is not as though its revenue has completely fallen through the roof. It is still at a “respectable” level from a historical basis. The problem is that while its revenue is slowing, the company’s expenses continue to be on the rise.

This is what we termed as operational deleveraging (opposite of operational leverage). Such companies cannot afford to see slowing sales. When that happens, it will have an extremely detrimental impact on its bottom-line profits.

Now Carvana is not alone in this space.

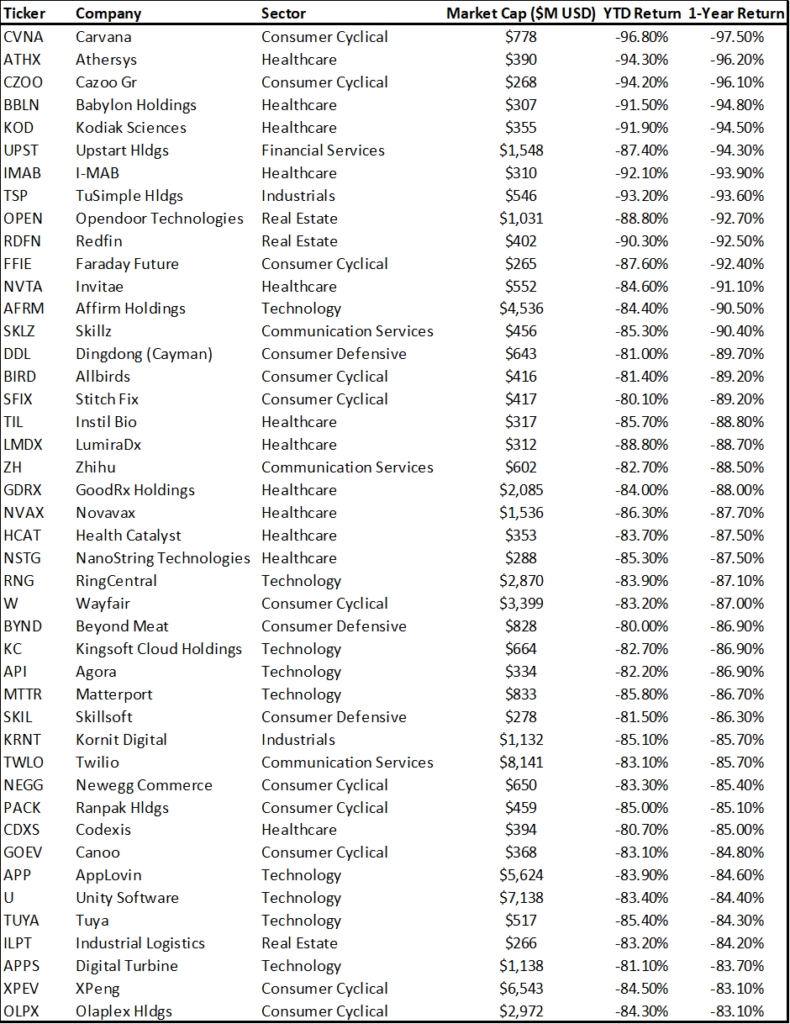

The table below shows the > 40 worst-performing US stocks, with their YTD and 1-year share price witnessing more than an 80% decline.

These were once multi-billion high-flying hyper-growth stocks favored by the market. Many have now been reduced to < $1bn in market cap.

Some of the more popular names in this list include the likes of Upstart Holdings (UPST), Redfin (RDFN), Affirm Holdings (AFRM), Skillz (SKLZ), Stitch Fix (SFIX), Novavax (NVAX), Beyond Meat (BYND), Twilio (TWLO), AppLovin (APP), Unity Software (U), Digital Turbine (APPS) and XPeng (XPEV).

Hypergrowth stock, Sea Ltd (SE) just barely missed this list as its YTD decline was “only” 79%.

Most of these stocks have got a few common characteristics that have resulted in their downfall.

Here are the 3 key lessons from the hyper-growth crash

Lesson #1: Beware of hyper-growth sales but also hyper-growth losses

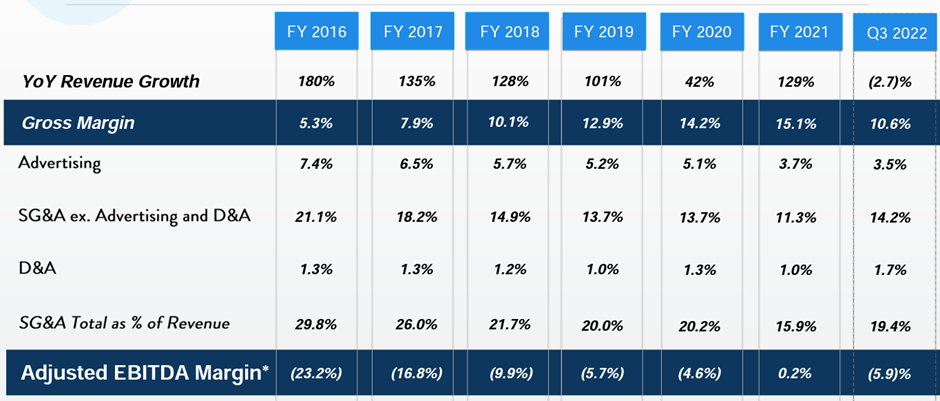

Beware of companies that are generating rapid sales growth while yet being increasingly unprofitable on the bottom line. This is the core characteristic that most of these hyper-growth companies exhibited over the past few years.

During good times, the market tends to ignore the fact that these companies are highly unprofitable entities. That is fine as long as they continue to grab market share, grow their user base, and translate that into higher top-line growth. Sales growth is all that matters.

You can be sure that this will come back to “bite them in the butt” during bad times when revenue growth slows, or worst still, becomes negative.

Lesson #2: Avoid cash burning hyper growth stocks

A majority of these worst-performing companies are cash burners. They exhibit negative free cash flow. These companies are reliant on third-party funding to support their growth because their business is not generating sufficient cash internally to support their expansion plans.

Consistent cash burners are a major red flag, no matter how strong their sales outlook might be. I am not fully against investing in hyper-growth companies, but one of the key metrics that these companies must fulfill is the ability to fund their growth and not be dependent on bank loans.

As we all should know by now, banks tend to be “fair weather” friends. During good times, they will provide all the cash needed for you to supercharge your business. However, during bad times, they will be among the first to come knocking on your door to demand repayment.

Lesson #3: Be wary of companies that are sensitive to rising rates

After a decade of an unusually low-interest rate environment, we are now facing rapid rate interest rate hikes as the world battle against the forces of inflation, which is a result of years of relentless money-printing and easy money policy.

Companies that went on a debt binge to fuel their growth are now facing the consequences as their once ultra-cheap debt is now costing them “an arm and a leg”. This further adds to pressure on the bottom line as the company’s financial cost balloons.

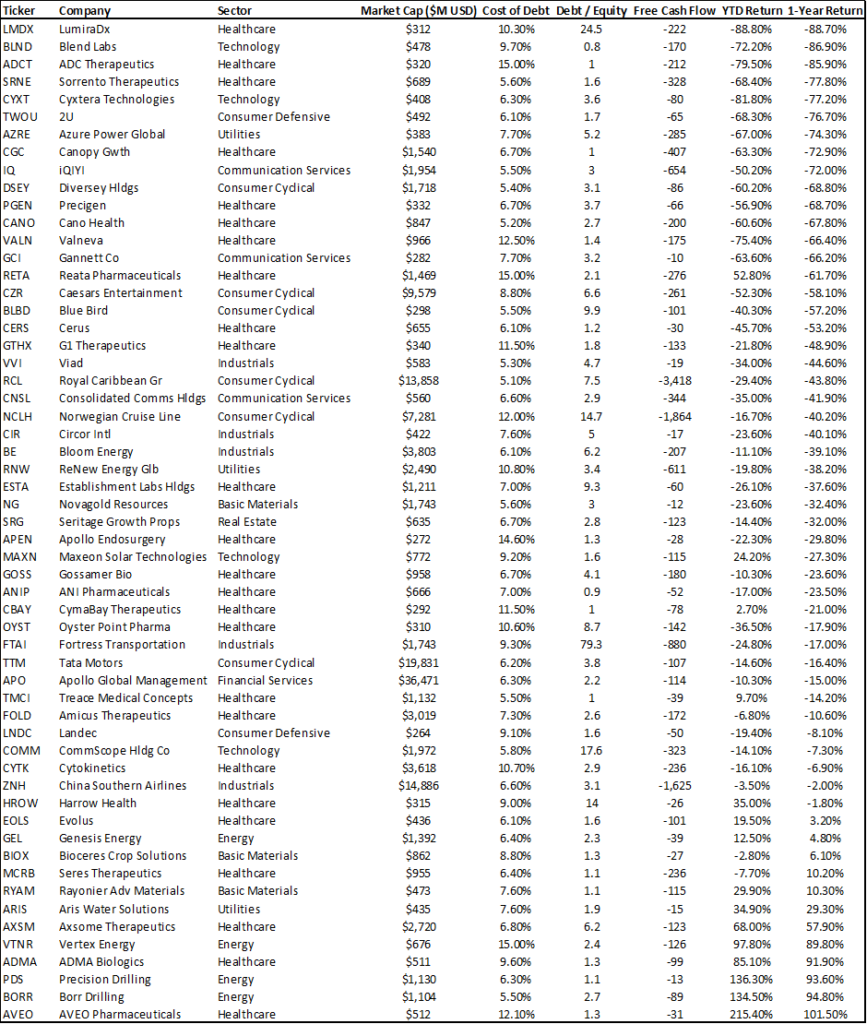

Some of the companies in the above list are witnessing cost of debt funding as high as 15%/annum! How they can continue financing these “loan shark” rates as their business fundamentals continue to deteriorate is beyond my comprehension.

Which might be companies with potential further downside?

I did a quick screening using my stock rover screener to find stocks that are 1) have Net losses, 2) Generate negative free cash flow, 3) have a debt/equity ratio > 0.8, and 4) Cost of debt > 5%.

These stocks could have further downside risk and might be ideal shorting candidates.

The table below presents the results of my finding.

Those generating positive returns on a YTD/1-year horizon despite their negative fundamentals tend to fall under the energy and healthcare sector. These stocks are either supported by a positive industry environment (energy counters) or biopharma stocks where it is pretty common to witness positive price returns despite bottom-line losses.

Focus on High-Quality Stocks

Hyper-growth investing can be extremely risky. These companies might do extremely well in a bull market environment, attracting all the media attention and consequently, retail money following all the hype.

But many of these hypergrowth stocks lack the necessary fundamentals to survive a bear market or an economic recession.

Would you have the confidence to stick with your hyper-growth stocks when they have declined by 80%? For most retail investors, the answer is probably a NO. They do not have the conviction level to continue sticking with these stocks “through thick and thin”. These stocks could easily crater and disappear under the weight of their financial liabilities.

A better solution would be to focus on high-quality stocks that you know will survive any bear market or any economic recession. These companies have shown time and time again that they can emerge as a stronger and bigger entities from these downturns.

These are the companies that we wish to be capitalizing on in a bear market like the current one, to buy when there is fear in the market, and consequently reap the rewards when the market turns.

For those who are interested to learn a simple method to find these high-quality winning stocks with a good track record of consistently outperforming the market, do check out the link below:

Conclusion:

Investing in hyper-growth stocks is not a walk in the park, and not for the weak-hearted. How many of us can stomach a 97.5% decline in our stock holding?

The 3 key lessons for most retail investors are summarized as such:

Lesson #1: Beware of hyper-growth sales but also hyper-growth losses

Lesson 2: Avoid cash burning hyper growth stocks

Lesson 3: Be wary of companies that are sensitive to rising rates

For the man-in-the-street, instead of risking your hard-earned capital on risky hypergrowth counters, a better solution would be to find high-quality blue-chip stocks that have been unfairly beaten down.

I have got just that solution for you. Click on the button below to find out more.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only