Table of Contents

How to find growth stocks

When it comes to investing, there are various schools of thought and different investing strategies that investors can use to make money in the stock market. One extremely popular strategy is Growth Investing: How to find growth stocks to invest in.

This strategy involves buying shares of companies whose businesses are expected to increase their revenue (or profits) at a faster-than-average rate. Good mature companies typically grow their revenue and profits by single-digit CONSISTENTLY year-in-year-out.

Growth companies, however, are expected to grow these financial metrics much faster, typically in the double-digit arena. In short, they grow value beyond the market average rate and are typically investing in a growth company is everybody’s dream.

The best growth companies that can grow their key financial metrics for an extended period of time tend to be rewarded with a higher share price, enabling early investors to profit from their massive share price appreciation.

Investors in growth companies are typically not interested in the payment of dividends. Most growth stocks do not yield a dividend. Instead, as previously highlighted, capital appreciation takes center stage.

Do note, however, that high rewards tend to portend high risk. There is no free lunch in this world. Therefore, it is important to know the basics of what growth investing entails, how to find the right kind of growth stocks in their early stage that is poised to take off, and lastly its associated risks.

For investors who find growth stocks risky, you might be better off selecting a more stable investing method, such as my way of finding high-quality blue-chip counters that you can sleep well at night with.

Without further ado, let’s get started on this topic of growth investing.

Where to find growth stocks to invest in

Growth stocks are everywhere. You just need to know where to look for them. Many of the best-performing growth stocks over the past two decades are companies manufacturing mass-consumer-type products that we use every single day. Think Apple, Microsoft, Tesla, Amazon, etc.

They might not be that hard to find. You just need to be more aware.

Mass-consumer products

Many of the biggest growth stocks out there are also mass-consumer-related stocks that most will be familiar with. Stocks like Amazon.com, Netflix, etc all started as small players in their respective markets but slowly convinced mass consumers to purchase from them or subscribe to their services. That helped drive huge revenue and profit growth over the years, turning these growth stocks into multi-bagger winners.

So how can one identify the next Amazon or Netflix which are still in their infancy stages? One method is to look at the products and services that you are currently using regularly. Ask yourself: Are there any products or services that you are using frequently? Which are the companies behind these products and services?

A quick internet search can help you find the companies that are behind the products or services that you have grown to love. If they are publicly traded companies and still in the early stages of the growth cycles, then you may have stumbled upon a potential winner.

For example, shoe retailer Crocs is now viewed as a cool and fashionable trendy item to own, especially after its partnership with Justin Bieber which saw all its limited-edition shoe being sold off in a matter of hours.

How about e.l.f Beauty, a cosmetic company that some women might be aware of and a company whose share price has been quietly trending higher, unbeknown to most.

I am not implying that these companies are going to be the next Amazon or Netflix, but they might be interesting mass consumers’ growth stock ideas for further investigation.

Benefiting from macro trends

The best growth stocks tend to benefit from a massive change that happens in society. Growth companies that capitalize on a trend that takes years to play out can often see their revenue and profits grow for years on end and generate strong returns for their happy shareholders.

So, what are some interesting macro trends to look out for?

I have written about several interesting investment trends in this article: 6 Top Investment Trends (2020). I also talked about 8 technology trends that might benefit from COVID.

Just to highlight a number of those trends here in this article:

Digitalization of payment:

The market assumes that COVID-19-related adoption of contactless/digital payments is a near-term benefit for payment providers, offsetting some of the consumers’ spending headwinds. However, contactless and digitalization of payments is part of a multi-year secular growth driver in payments, with COVID-19 as just the accelerator.

While these companies are no longer “small” some of my favorite plays in this category can still be multi-baggers over the next 5 years, stocks such as Square, Paypal, and Adyen. This is in addition to your typical beneficiaries of this digital payment trend, blue-chip growth stocks such as MasterCard and Visa.

Ad spending shifting from offline to online:

TV viewership has climbed, but digital consumption has increased even more: the use of social platforms and streaming services has risen almost everywhere; gaming has also grown dramatically.

Advertisers have adapted by following consumers, which means prioritizing digital advertising. The online environment is favorable for “direct response” campaigns – those encouraging quick purchases by consumers – an attractive proposition for brands spending cautiously and looking to drive sales.

That’s why more advertisers are spending their ad dollars on online channels so they can still keep in touch with their consumers. This spending shift is creating a huge opportunity for growth companies that excel at reaching consumers online.

Jump starting health-tech

Investors probably do not fully appreciate the impact COVID-19 will have on accelerating big tech’s entrance into healthcare. There has been a significant shift in consumer preferences towards digital health solutions which is likely here to stay.

Digital health is the provision of healthcare through the use of technology so that it can supply cutting-edge services to improve health outcomes such as

Remote medical consultations via video conferencing (Teledoc)

Electronic health records (Veeva)

Patient monitoring systems and wearable device integrations that can monitor a patient’s vital signs such as heart rate and blood pressure (Fitbit, Garmin)

Use of mobile technologies such as smartphones for healthcare delivery (Apple’s health-kit)

Fitbit makes for an interesting growth stock, with the company barely affected by COVID-19. However, do note that the competition might be rather intense in its core business of selling smartwatches or wearable devices, an area in which the 1000-pound gorilla, Apple, shares a slice of the market pie.

These are just a few of the macro shifts that are taking place in our society today. The next time you notice one happening, do a little research to see if any of these growth companies will benefit from the trend.

Following growth investing Gurus

Wall Street fund managers usually have huge research budgets at their disposal to find great businesses. It can be an eye-opening experience to pick through their recent buys and sells to see which growth stocks they like.

There are several growth fund managers that I like to follow and they are a wonderful source of growth stock ideas. Here are a few of my favorite growth investors.

Pat Dorsey

Dorsey is the Founder of the Chicago-based Dorsey Asset Management and is a former director of Equity Research at Morningstar. He is also the author of the highly acclaimed books The Five Rules for Successful Stock Investing and The Little Book that Builds Wealth.

He believes investors should target 10 to 15 moated businesses that can compound at high rates over time and make a long-term investment in them to create major wealth.

Some of his current growth stocks are Smartsheet, Paypal, Roku, Meta, Disney

Catherine Wood

Catherine Wood is the CEO and CIO of ARK Investment Management LLC, the company behind the popular ARK-family of ETFs which has done extremely well in recent years.

She believes that ARK can identify large-scale investment opportunities in the public markets resulting from technology innovations centered around DNA sequencing, robotics, AI, energy storage, and blockchain technology.

Some of their key growth stock holdings in their super popular ARK innovation ETF are Tesla, Invitae, Square, Crispr Therapeutics, and Roku.

Stephen Mandel

Billionaire hedge fund manager Stephen Mandel founded Lone Pine Capital 23 years ago and boasts one of the best long-term track records in the industry. The all-star manager made nearly $1bn last year, one of the top earners among the world’s biggest hedge fund managers.

In the latest filing, his fund purchased growth stocks such as DataDog, Zoom, and Booking Holdings, although his largest addition in the quarter was to PayPal Holdings and Facebook. His largest holding is in Shopify.

There are also a plethora of websites out there that make it easy to track and rank what notable growth investors are doing, including Dataroma, TipRanks, and Guru Focus. Growth investors can visit any of these sites and quickly learn what many big-time money managers have been buying and selling in recent months to come up with stock ideas of their own.

Here are the links to the latest portfolio holdings of the 3 growth gurus I highlighted:

- Pat Dorsey’s Dorsey Asset Management

- Stephen Mandel’s Lone Pine Capital

- Catherine Woods’ Ark Portfolio

Stock screening tools to identify growth stocks

Besides tracking investing gurus known for their growth stock picks, I do my screening of stocks which I use to find growth “gems”. There are several stock screeners out there for investors to choose from, however, my personal favorite FREE screening website to use is FinViz. This website has data on more than 7,000 companies and investors can input different parameters to help them find stocks that fit their criteria.

Stock Rover

An All-in-one Fundamental Stock Screener that EVERY serious investors should have in their investing arsenal.

This is my GO-TO Stock Screener for evaluating US stocks and ETFs

![Growth Investing: How to find growth stocks to supercharge your portfolio [2023 update] 1](https://newacademyoffinance.com/wp-content/uploads/2020/11/stock-rover-2-5-1024x570.png)

Another useful screener which I believe ranks among the very best is this website called Stock Rover. However, it is not free but the basic plan, which comes in at just US$7.99/month allows one to screen for more than 8,500 US stocks, etc with lots of customizable views and metrics.

The above-highlighted screeners are predominantly centered on fundamental criteria. For those who wish to use a technical platform to find growth stocks that are trending or have strong momentum, I personally use the Traders GPS platform which is a proprietary platform that is developed by Collin Seow. Collin runs the Systematic Trading Course that was recently voted the Best Investment Course to take in Singapore by Seedly, with close to 1,000 reviews written (4.9 stars out of 5.0), almost 3x that of the next best course.

The Systematic Trader Course

An investing course that is voted as the Best Investing Course by Seedly reviews, the Systematic Traders Program uses the proprietary platform, TradersGPS which tells you WHAT stock to buy, WHEN to buy and HOW much to buy.

![Growth Investing: How to find growth stocks to supercharge your portfolio [2023 update] 2](https://newacademyoffinance.com/wp-content/uploads/2020/11/tgps-2-5.png)

Once I have identified a growth stock that meets my fundamental criteria, I will head over to the Traders GPS platform to better time an entry. For example, the platform identified ZM as a strong trending stock in play back in late August with an entry price of around US$280/share.

That stock is now a double-bagger over the short course of 2 months.

Another growth stock that the platform has recently identified is Datadog, a stock that growth investment guru Stephen Mandel also owns.

For those who are interested in finding out more about The Systematic Trader course, you can join their SMT Masterclass live web class (attend online) workshop where Collin will demonstrate to you firsthand how his system works and how easy it is for you to “Follow the System” (FTS) to find good trending stock candidates to buy into before they start running higher.

Key Financial Metrics for growth stocks

Here are a few metrics that I regularly use to screen the market for growth stocks:

$500m Market Cap and more: I look for companies that have at least US$500m in market cap. This is considered very small in the context of US stocks but it ensures that I exclude penny counters while yet at the same time take into consideration small-cap stocks that have multi-bagger potential.

Strong Sales Growth: A key metric when evaluating growth stocks is how fast are these companies growing their sales. While they might not yet be profitable on the bottom line, they need to exhibit strong sales growth.

Strong Gross Margins: I will like my strong sales growth stocks to be one that generates a high level of gross margin. This demonstrates a certain level of pricing power. I have previously written about SaaS companies that have high gross margins. These are companies I like that have both a recurring revenue business model which is also of a high margin nature.

Improving margins profile: While growth stocks might be loss-making (negative net income) due to the need to re-invest profits and resources into human resources and R&D etc for future growth, these stocks must exhibit a certain level of operational leverage where at least their gross profit margins are growing alongside rapid sales growth.

Balance Sheet: While debt isn’t always a bad thing, I don’t like to invest in companies that carry huge amounts of debt on their balance sheet. That’s why I like to use the debt-to-equity ratio to eliminate highly indebted companies from my search. This ratio compares the amount of total debt that a company has to its shareholder equity, which can be thought of as the net worth of the business. A good rule of thumb is to set the debt-to-equity ratio below 80%.

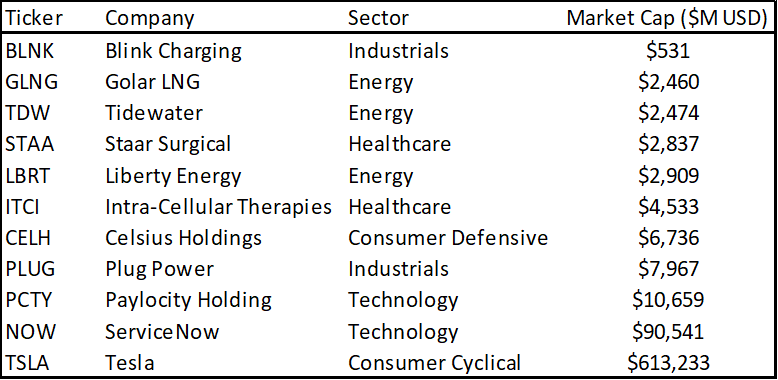

With these parameters in mind, let’s run a stock screen using the following criteria (Updated 2023)

- Based in the US

- Market Cap over US$500m

- Strong Sales growth of at least 20% on average over the past 5 years and sales growth is expected to be >=20% for the current and next fiscal year

- Debt to equity ratio below 0.80

- Gross margin (now) > Gross margin (1 year ago)

There are a total of 11 stocks that meet these criteria based on the Stock Rover screener:

While there is no bulletproof formula for creating the best list of growth stocks, using screening tools like Finviz and Stock Rover can be a great way to identify potential winners in their early stages.

Take for example the list of high-growth stocks above which has been screened using the Stock Rover screener. Some of these stocks are still in negative net income territory, stocks such as Blink Charging (BLNK), Celsius Holdings (CELH), etc.

Hence the risk might be high as these loss-making entities can easily “disappear” in the next economic downturn.

Risks of Investing in growth stocks

Growth Investing is seen as riskier for two main reasons.

First, it involves paying “more” for a company in relative terms and so there is a greater potential for substantial price declines.

Second, because so much of a growth stock’s value is predicated on future gains, even a small change in investors’ perception of that potential could have a large impact on the share price.

Take for example the stock Fastly. It is a loss-making hyper-growth stock that used to be a market darling. The counter was trading at a hefty sales multiple of 30+x price to sales (not price to earnings) at its peak back in late-2020 and a corresponding share price of >$130/share.

The counter is now trading at a fraction (90% decline) of its previous high. Imagine you are the unlucky investor who bought when the counter was trading in excess of $100/share. Would you have the conviction to average down when its price keeps dropping?

Do you have the conviction to buy even more fastly at its current price of $15/share? Most retail investors do not.

Is Growth Investing for You?

Growth investors have to be willing to take on risk, but the rewards can be great. Many mutual fund investors use growth funds as investment vehicles to get exposure to good growth stocks. Whether you choose to invest in a growth-focused index fund or take the time to individually find stocks with high-growth potential, growth investing can help you reach your long-term financial goals.

If growth investing feels too risky for you, consider the value investing approach. Value investing looks more at whether a stock is attractively valued than at its future growth prospects, seeking to find out-of-favor companies (value stocks) that have had their share prices unfairly beaten down.

However, do note that value stocks can stay cheap indefinitely. These are companies that are cheap for a reason and they are typically termed as “value traps”.

A better and safer approach

Investing in growth stocks can be exciting. Beyond looking at just a few key financial metrics which I highlighted that one can use to screen for potential growth stock candidates, there are other traits that make a growth stock a GREAT one.

For example, the presence of economic moat, particularly having the most sought after “network effect”, something which I highlighted in this article: Finding great companies with network effect.

In the meantime, investors who are looking to find a better and safer approach to stock selection should check out the Stock Alpha Blueprint Course, an easy-to-comprehend stock selection course that teaches you how to identify high-quality blue-chip stocks that have a strong track record of outperformance.

Not only would you learn how to identify these good quality stocks to invest in, you would also be shown the RIGHT TIME to be investing in these stocks. So for those of you who wish to partake in the growth potential of “sexy” stocks but avoid the huge downside risks often associated with these hyper-growth counters, then check out the Alpha Blueprint Course today.

Just click on the button below to find out more.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

5 thoughts on “Growth Investing: How to find growth stocks to supercharge your portfolio [2023 update]”

cohere , https://nextsetup88.com

Hi, Neat post. There is a problem with your web site in internet explorer, would test this?IE still is the market leader and a huge portion of people will miss your fantastic writing due to this problem.

Great post thanks for sharing useful information…I like to read articles on blogger passion.