Riding on the bandwagon of the hottest SaaS stocks

SaaS Stocks or Software-as-a-service stocks has emerged as one of the hottest themes in the stock market of late, driven by the acceleration in digital transition as a result of COVID-19 as well as a strong preference for stocks with a high level of recurring revenue stream that makes these stocks highly attractive during times of economic uncertainty, like the current one we are facing.

What exactly are SaaS companies? To keep things simple, SaaS companies sell software to their customers as an ongoing subscription instead of charging a one-time fee. For example, if you are a small online business owner and you set up your “virtual” shop using Shopify’s online platform, then you have used a software-as-a-service.

In this article, I seek to screen for some of the hottest Software-as-a-service (SaaS) stocks that exhibit two key components:

- They generate Gross Margins in excess of 70%.

- They are forecasted to grow their revenue by at least 20% in the coming year

One of the key criteria that I use to sieve out strong growth stocks that might become the next “Amazon” are those that command a high gross margin. These Growth stocks might be loss-making in the interim as they emphasize on growing their customer base vs. cost control. That often results in elevated marketing and hiring expenses which translates to a “not-so-pretty” bottom-line.

However, once they have achieved sufficient scale and taper back on these administrative/direct sales-related expenses, their high gross margin profile will result in sizable cash flow and profitability improvement.

Without further ado, let’s take a look at this list of high-margin SaaS stocks that are forecasted to exhibit some of the fastest growth in the coming year. 20 companies made this list and it is sorted from the largest market cap to the smallest. The smallest company in this list only commands a market cap of US$3bn and could be a multi-bagger in the years to come.

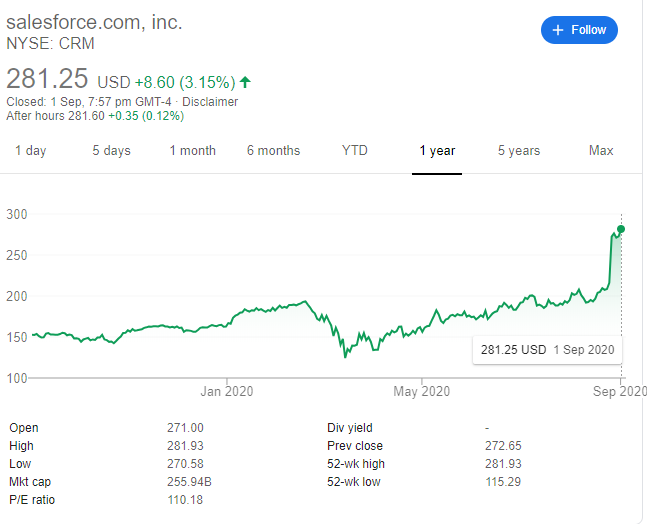

SaaS Stock #1: Salesforce

No.1 on our list and the largest of them all is Salesforce. This company is the pioneer of SaaS and it holds the highest SaaS market cap. Salesforce is the world’s largest provider of cloud-based CRM (customer relationship management) solutions. It controlled 18.4% of that growing market last year, according to IDC, more than the combined market share of its four largest rivals.

Salesforce also bundles its CRM services with a wide range of sales, marketing, and commerce cloud services. Its solutions help companies streamline their workflows, automate business processes, and make analytics-driven decisions, all of which cut costs, save time, and reduce the need for human employees.

The company saw a huge bump in its share price recently after releasing a strong 2Q20 results on 26 August where its revenue and adjusted earnings grew 29% and 152% respectively. The company now expects its revenue to grow 21% to 22% in the coming year, with adjusted earnings rising by a faster clip between 24-25%.

With a gross margin of almost hitting 75%, Salesforce is a “must-own” SaaS stock that will likely continue to exhibit its dominance in the years ahead.

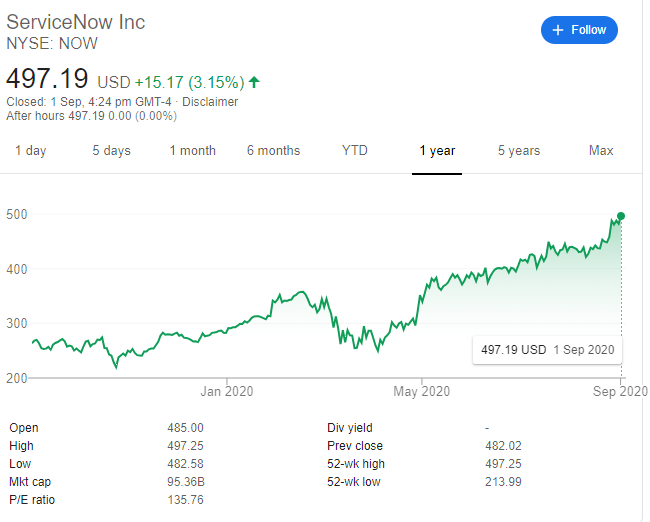

SaaS Stock #2: ServiceNow

With a market cap close to US$130bn, ServiceNow ranks no. 2 on this list. ServiceNow, which helps companies manage their digital workflows with cloud-based tools, aggressively expanded via acquisitions after its IPO in 2012. It served over 6,200 customers at the end of 2019, including 80% of the Fortune 500. 890 of those customers were locked into annual contracts worth over $1 million.

1H20 revenue grew 30% YoY and its adjusted net income surged 69%. For the full year, the street is expecting its revenue to grow at c.27% and earnings at 33%. The company grew its margin from 57% to the current level of 78% in the last 10-years.

There are however concerns that ServiceNow, which trades at over 100x forward PER and 19x this year sales might be elevated. Those lofty valuations, along with its decelerating growth, might suggest a limited upside in its price, which just hit an all-time high this week.

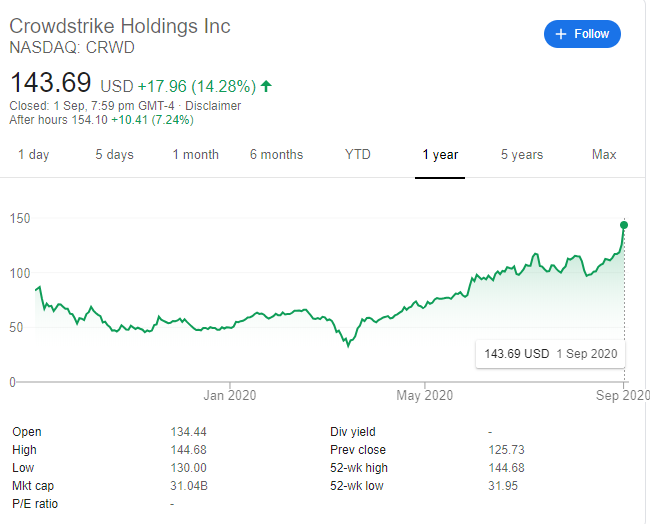

SaaS Stock #3: Crowdstrike Holdings

Another market favorite, this is a stock that was recommended by the Motley Fool team not too long ago that “looks” to be a dog when they first recommended it but this “dog” has since proved its worth with the recent acceleration in price, likely in anticipation of strong results set to be announced today, 2 September, after market close.

The Motley Fool team has demonstrated a strong track record of identifying winning stocks and those who want to find out more about their investment thesis on CrowdStrike should consider subscribing for their Stock Advisor service which I have done a detailed review in this article and for a very low price of just US$99/year which equates to just US$0.27/day, you can get access to pretty top-quality investment ideas from the Motley Fool team that has certainly proved their mettle.

This is their summary thesis on Crowdstrike:

The digital revolution hasn’t just forced companies to embrace technology. It’s also left them potentially exposed to all the threats that are part and parcel of collecting and storing data. Moreover, as the complexity of IT infrastructure has risen, so, too, have the complications involved in making sure that key information and resources are safe. When so many mission-critical resources are stored in the cloud, the number of threats rise exponentially.

CrowdStrike Holdings recognizes that cybercrooks keep leveling up their game. But the company has put the power of positive network effects on its side. By effectively helping its entire base of enterprise clients collaborate with one another about the attacks they’ve faced, CrowdStrike’s Falcon platform learns from experience and immediately puts that knowledge to use in detecting threats and anticipating the next attack

The company is expected to grow its revenue above 60% over the coming 1 year. With a gross margin of 71.7%, there is certainly scope for the company to improve its operating margins in the coming decade.

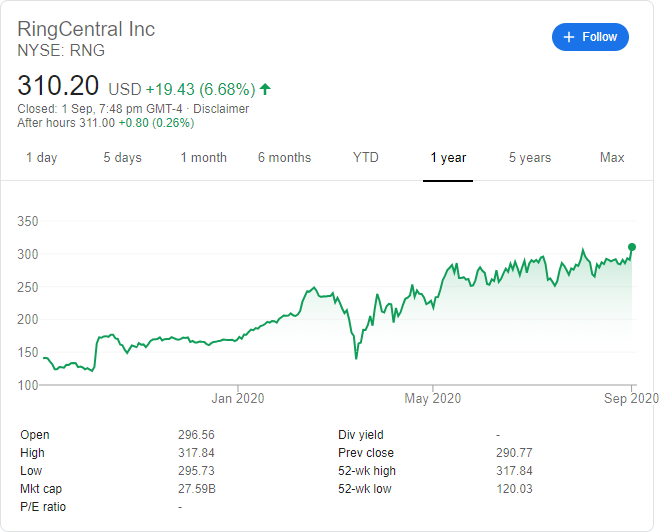

SaaS Stock #4: RingCentral

RingCentral, Inc. provides software-as-a-service solutions that enable businesses to communicate, collaborate, and connect in North America. The company’s products include RingCentral Office that provides communication and collaboration across various modes, including high-definition voice, video, SMS, messaging and collaboration, conferencing, online meetings, and fax.

The stock is one of the biggest winners that aren’t yet on most investing radars. RingCentral has nearly doubled, and the more you learn about it, the easier it is to understand why it’s doing so well. RingCentral has a cloud-based platform that makes a company’s phone system more portable. Companies pay at least $19.99 a month per employee for a platform that takes inbound calls and automatically routes it to a recipient’s IP phone, mobile device, PC, or video conferencing setup.

Portability is everything these days, and as more people shift out of the traditional office to either a home-based hub or a hybrid solution, they’re going to want their incoming company calls to follow them around.

The company’s revenue rose 29% in the latest quarter fueled by a 32% surge in subscription revenue that now accounts for 92% of its top-line results. The company is expected to grow its revenue by 26% on a full-year basis. The company sports a gross margin of 73%.

RingCentral has a hot platform that’s getting even more popular with folks moving out of big-city offices and it should continue to do well.

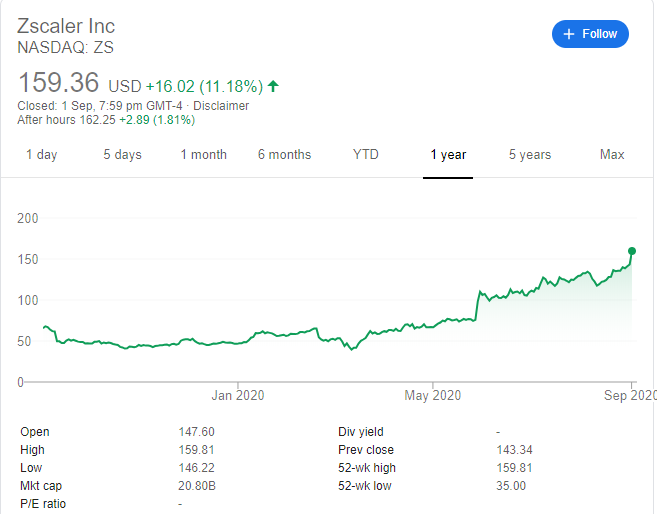

SaaS Stock #5: Zscaler

Zscaler, Inc. operates as a cloud security company worldwide. The company offers Zscaler Internet Access solutions that connect users to externally managed applications, including software-as-a-service applications and Internet destinations; and Zscaler Private Access solution, which is designed to provide access to internally managed applications, either hosted internally in data centers and private or public clouds.

One of their core products is their Zscaler Private Access, ZPA, and this allows users to securely access corporate apps without network access, so through the cloud. And ZPA was a driver behind the company’s last earnings report. The report highlighted that Zscaler’s ZPA usage grew 10 times since the last quarter. One could infer that this is due, in part, to the work-from-home wave.

The company’s emphasis on mobile devices makes Zscaler uniquely suited to securely provide remote access to employees working from home.

The company is expected to report quarterly results next Wednesday on 9 Sep. Guidance for the fiscal fourth-quarter calls for revenue of $117 million to $119 million, representing 37% growth at the midpoint compared to last year. On a full-year basis, revenue is expected to grow by 40% YoY. The company sports a gross margin of 79%.

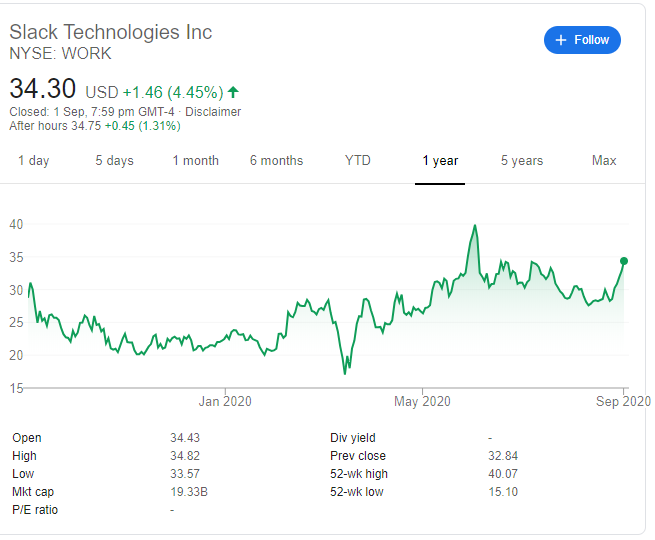

SaaS Stock #6: Slack Technologies

Slack has experienced rapid growth helping employees communicate more efficiently. It’s replacing email at the workplace, and with more people working from home during the pandemic, Slack has come into its own this year.

It ended 2019 with more than 660,000 organizations using its platform and 110,000 of those on a paid subscription plan. But through the first half of the year, its customer base has already spiked to over 750,000 organizations.

Slack is the brainchild of Stewart Butterfield, a longtime tech entrepreneur whose credits include co-founding the photo-sharing service Flickr. He started Slack with a simple idea: give users the ability to define exactly how and with whom they want to collaborate.

The first thing new users often notice is that they can send each other instant messages including files or multimedia of just about any kind. But that’s just the beginning. Slack lets companies organize conversations into channels that can be tailored to include as many or as few people as necessary. The more complex your company — the more teams, or projects, or tasks — the more valuable this is. You can even add outside vendors or contractors if you want. Moreover, Slack saves all those chats, so users can search through a channel’s history instead of having to ask the same questions over and over.

Slack’s share price has been a roller-coaster this year, appreciating to a high of US$40 in early June 2020 before collapsing by 30% in mid-August. Price is now back on an uptrend. With forecasted revenue growth of 38% and the 2nd highest gross margin of 85% in our list, Slack is the 6th largest market cap SaaS company that we are featuring in this list.

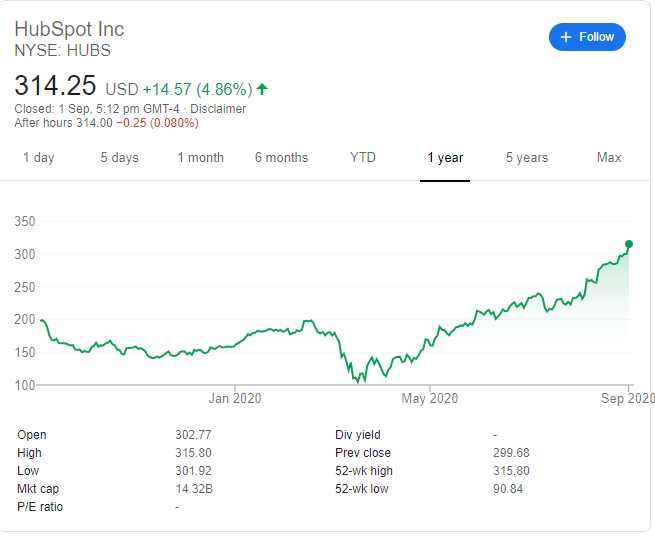

SaaS Stock #7: Hubspot

Hubspot is a company that provides marketing, sales, and customer service software that helps clients develop an inbound marketing strategy and then implement it effectively.

It allows the company to place and manage ads in various digital outlets, track engagement, keep track of customer interactions, and more. HubSpot’s software is most appropriate for small and midsize businesses.

Some numbers that show the success of HubSpot in recent years:

In the past three fiscal years, revenue has grown at 35.5% annually.

Over the same period, total customers have grown at 37.8% annually. (A customer is defined as an entity paying for at least one HubSpot product.)

The total subscription dollar retention rate has fluctuated by a few basis points per year, always near 100%. This metric tells us customers are spending the same amount with HubSpot from period to period. Ideally, this number should be greater than 100%, which would indicate that customers are spending more with HubSpot in the current period than they did in the prior one, due to either buying more products or paying more for existing products.

HubSpot is expected to grow its revenue by 23% this year, which is a decline from its past 3 years’ average annual growth rate of 35.5%. This might be a cause for concern, despite the company ranking highly in terms of its gross margin profile of 80%.

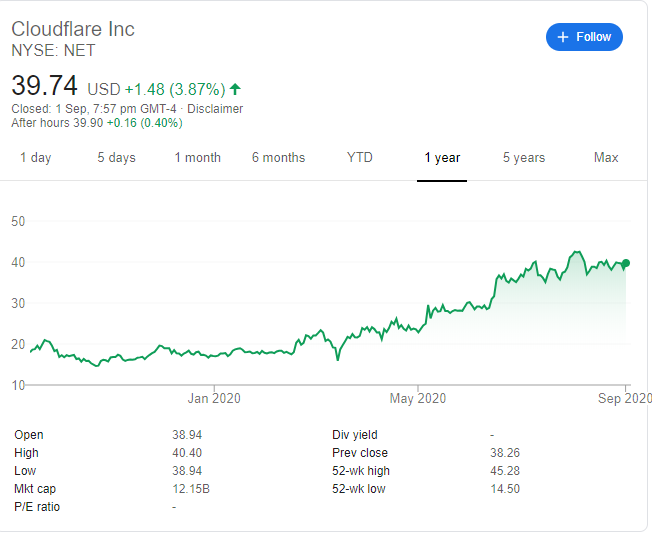

SaaS Stock #8: Cloudflare

Cloudflare is an interesting company that deals with both cybersecurity as well as content-delivery services that help keep web pages and applications safe from attacks and allow them to transmit information quickly.

The company helps support over 27 million website properties, blocks over 72 billion cyber threats per day, and has a diverse and fast-growing customer base that spans the globe.

The web-security specialist’s stock has soared more than 100% year to date, and Cloudflare now has a market capitalization of roughly $12 billion. That puts the company’s current valuation at about 30 times this year’s expected sales — a figure that reflects expectations for continued business momentum. The company is posting impressive sales growth, and it’s recording strong gross margins (72% last quarter) that suggest the business should be very profitable when management shifts from building its customer base to focusing on earnings.

In response to the challenging business climate created by COVID-19, the company has been delaying payment requirements for services. That’s meant that less revenue is going in the books, but the business should see a surge down the line, and having a pay-later program should help bring new customers into its ecosystem that will stick around for the long haul.

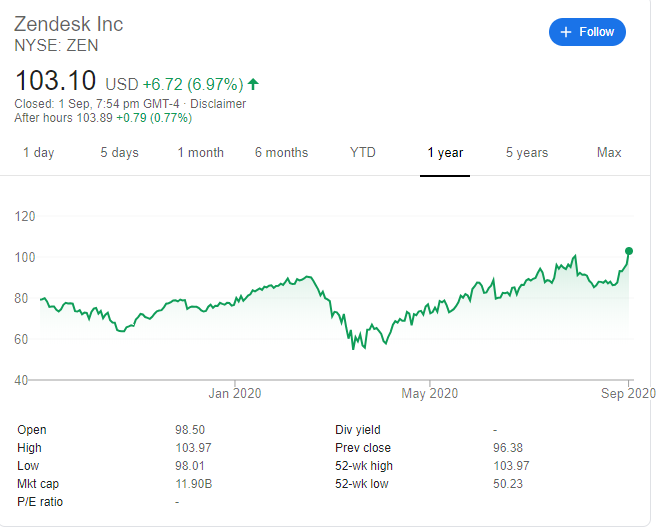

SaaS Stock #9: Zendesk

Customer support has changed rapidly over the last decade, as the internet has allowed consumers to reach out in new ways. And one of the increasingly common ways to reach a company is through a Zendesk widget on a company’s website.

Like Okta, Zendesk has spent a lot of money growing revenue and building out its business, leading to the losses that you see below.

Zendesk’s ultimate value is in providing the tools businesses need to offer customer support. And with a growing suite of automated and personal solutions, this is a company whose clients will increasingly need its services — especially clients that are themselves prepared to be growth drivers for the broader economy looking ahead. I like Zendesk’s potential for further gains.

The company is expected to grow its forward revenue by 24% this year. Zendesk spots a pretty good gross margin of 74%.

SaaS Stock #10: Aspen

This is a stock that is slightly different from the rest of the tech plays on this list. The reason being its core business is in supplying software services to an industry that is currently unloved: process industries which include oil & gas, chemicals, pharma, etc.

The stock has crashed hard from its Feb high and has yet to recover its losses this year, unlike many of the SaaS companies in this list whose share prices have propelled way beyond their last peak before the COVID-19 driven crash.

The company software suites include aspenONE Engineering, aspenONE Manufacturing, and Supply Chain, and aspenONE Asset Performance that are integrated applications, which allow end-users to design process manufacturing environments, monitor operational performances, respond and adapt to operational changes, predict asset reliability and equipment failure and manage planning and scheduling activities, as well as collaborate across these functions and activities. It also provides software maintenance and support, professional, and training services.

Despite the challenging outlook of its customers, the company is expected to grow revenue by 24% in the coming year. What is amazing is that this company spots the highest gross margin in this list at 90%. In terms of both Price to Sales ratio and Price to earnings ratio, this company is likely one of the cheapest at 15x and 35x respectively.

We will continue with the rest of this list in Part 2.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- Top 20 Best Growth Stocks to buy [2020]

- Thematic ETFs partaking in the hottest trends

- 6 Top Investment trends (2020): Finding safe havens in a pandemic-driven market

- Top 8 technology trends accelerating due to COVID and the stocks to benefit from it

- 5 outperforming stocks that crush the S&P500 in 1Q20

- Best performing ETFs which consistently outperform the S&P500 over the past decade

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

5 thoughts on “Top 20 SaaS Stocks: Which are those with strong Gross Margins and Revenue Growth? [Part 1]”