Table of Contents

Breakout Stock Screeners You Need to Know

Active trend traders would be familiar with breakout stocks. This is a strategy of finding a stock whose price moves above a resistance level or moves below a support level on increasing volume.

A trader would enter a long position after the stock breaks above resistance or enter a short position after the stock breaks below a support level. When done right, the breakout trader could benefit from a major price trend, be it on the upside or the downside.

In this article, I will highlight and run you through 3 breakout stock screeners to find potential breakout stocks.

Breakout Stock Screeners #1: Koyfin

I have talked about the Koyfin stock screener previously, one of the best FREE stock screeners that cover more than 20,000 stocks across the globe.

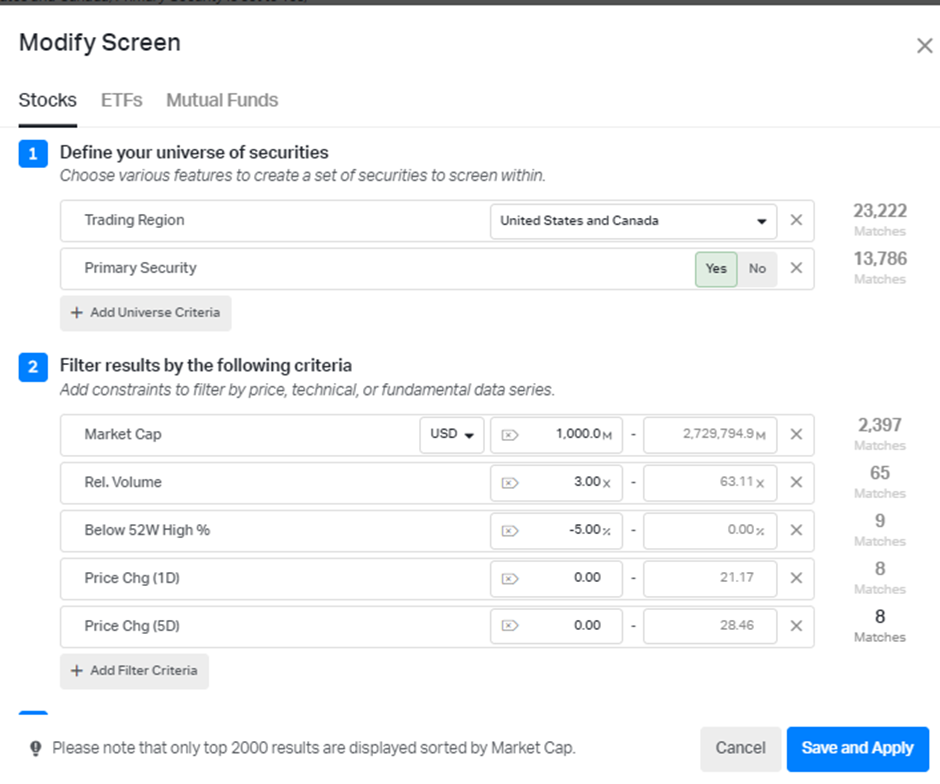

One can use the Koyfin platform to customize his breakout stock screener. As can be seen from the screener snapshot below, I customize my screen based on the following criteria:

- Market cap requirement of > USD1bn

- Relative Volume of at least 3x. This measures the latest 1-day volume of the counter and compares it against its past 10-day average. The latest volume amount will need to be at least 3x that of its 10-day average volume level.

- 5% below its 52-week high level. This is not exactly a “breakout” strategy by the strictest definition as Koyfin does not provide a screener to identify a stock that just close above its 52-week high level. Instead, we select stocks that are trading just slightly below their 52-week high level (5% below) and this is a play that the 52-week breakout will ultimately materialize on high volume.

- Price Change (1-day & 5-day). I would only like to select stocks where there are positive 1-day and 5-day price movements.

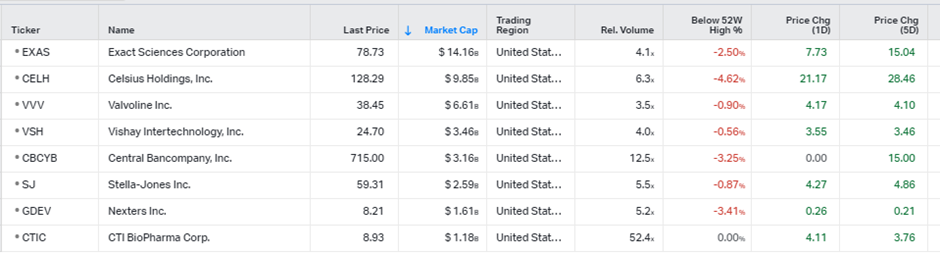

With this simple breakout stock screener criteria, I manage to find 8 US potential breakout stocks that currently fit this description.

While there are certain limitations associated with Koyfin’s breakout stock screener, it can be easily set up and one major advantage is that this simple breakout stock strategy can be used to identify potential breakout stocks in different stock exchanges.

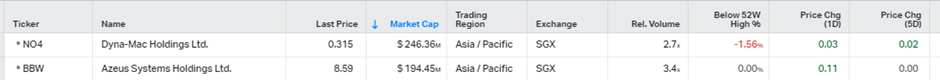

For Singapore investors looking at potential Singapore breakout stocks trading on high-than-average volume (as of 11 May 2023), here is a list of Singapore breakout stocks that are being screened using similar criteria (except min market cap changed to S$100m and relative volume change to > 2x)

There are just 2 stocks that fit the criteria and they are both small-cap in nature.

For those who are interested to check out the Koyfin stock screener, you can sign up for a free account over here.

Additional Reading: Best Free Singapore Stock Screeners that Rivals Bloomberg

Breakout Stock Screeners #2: Stock Rover

The second breakout stock screener that I use is the Stock Rover Screener. Regular NAOF readers will know that I am a big fan of the stock rover screener and I view it as the most robust fundamental stock screener out there due to its customization abilities.

The only limitation is that this platform only restricts to screening for US/Canada counters.

Using the Stock Rover platform, I can screen out for breakout stocks in their “purest” sense. Unlike Koyfin which does not allow me to select stocks that are trading above its 52-week high, I can do so using the Stock Rover platform.

In addition, I can also exclude stocks where the latest price movement breakout is too significant. Take for example, using Stock Rover’s free-form screening equation, I can screen for stocks using the 3 key criteria:

- Price vs. 52-week high % > 100 and Price vs. 52-week high % < 105: What this means is that I am looking for stocks that have just breakout above their previous day’s 52-week high but less than 5%. Take, for example, a stock’s 52-week high is $100. It broke above this level and closes at $103. This stock will be identified as a breakout stock that is not “excessive”. However, if it ends at $106 (> 5% above its last 52-week high of $100), then the stock will be excluded from the list. This is how customizable the Stock Rover screener can be.

- Volume [Now] > 3* 10–Day Volume (Ave): This is similar to the Koyfin volume parameters. However, one is not restricted to only selecting the 10-day average volume and can use a shorter 5-day average volume or longer 1-month average volume parameters.

- Market cap > US$1bn

I get a more refined list of 4 stocks here, which is pretty similar to what I have screened out for using Koyfin, except for Alcon stock.

For breakout stock traders, do feel free to comment what might be some parameters that you use in the comment box below!

For those who are interested in signing up for a Free Stock Rover account, you can do so over here.

Additional Reading: Stock Rover Review Guide

Breakout Stock Screeners #3: TradersGPS

The last breakout stock screener that I am introducing here is not by definition a fundamental/technical screener but a proprietary trading platform developed by Collin Seow to screen for high-momentum stocks.

This is the TradersGPS platform, one where users can identify momentum stocks to “Buy High and Sell even Higher”.

One can use this platform to screen for momentum counters in numerous markets which include Singapore, Hong Kong, the US, Malaysia etc.

Take for example, it has highlighted VVV (which has appeared in our previous breakout stock screeners as well) as a potential stock to trade due to rising momentum. Here is what users will see on the chart.

The stock has just broken out of its 52-week high resistant level and there is a positive entry based on the entry concept of ‘Green Arrow with TIF” or GAT for short.

The fact that this is a breakout stock coupled with a “positive” GAT confirmation will provide students with that additional confidence that the breakout trend will likely persist.

The beauty of the TGPS platform is that it does not look to just identify stocks that are breaking out higher vs. its 52-week resistance level. As long as there is a GAT confirmation, it could be a potential entry.

Take for example Spotify (chart below). The counter is trading at its 52-week high. However, there has been an alert or positive GAT entry months ago (start of January 2023) that momentum is regaining for this stock and a momentum trader can look to enter at that point.

An entry at the start of 2023 based on the signal given by the TGPS platform with an entry price of $84/share would have resulted in a 75% capital gain based on the last price of $147/share.

The TGPS is good at finding stocks that are gaining momentum.

One of my favorite plays is to combine a positive GAT entry with the stock looking to breach its 52-week high resistant level.

For those who are interested to learn more about the TradersGPS platform, you can sign up for a FREE training session here.

Additional Reading: TradersGPS Review

Best Breakout Stocks Screeners

There are frankly many breakout stock screeners out there, appealing to different traders. A breakout trade should just be one of the many trade strategies in your trading arsenal if you are a trader by nature.

This should also be coupled with a strong risk management strategy to position size appropriately and cut loss/take profit at the right time without your emotion getting in your way.

Frankly speaking, I love all the 3 stock screeners that I have highlighted in this article here today. I use the Stock Rover Screener mainly for US stocks and Koyfin for SG stocks + other regional stocks. They are mainly based on longer-term investing strategy although I would also indulge in some opportunistic trades, like the breakout strategy highlighted here.

The TGPS platform is used mostly for shorter-term trading through the identification of stocks gaining momentum (not necessarily breakout).

Do drop a comment below if you find this article helpful!