Sector Investing: How to engage in sector investing through ETFs

Sector investing is a form of targeted investing strategy by gaining exposure to only a selected group of stocks in specific segments of the economy, for example, healthcare, energy or Information technology (IT), etc.

It is similar to thematic investing although thematic investing often cuts across different sectors to align with a particular opportunity or objective. For example, a thematic portfolio focusing on 5G could have a portfolio consisting of stocks in both the IT as well as communication services sectors.

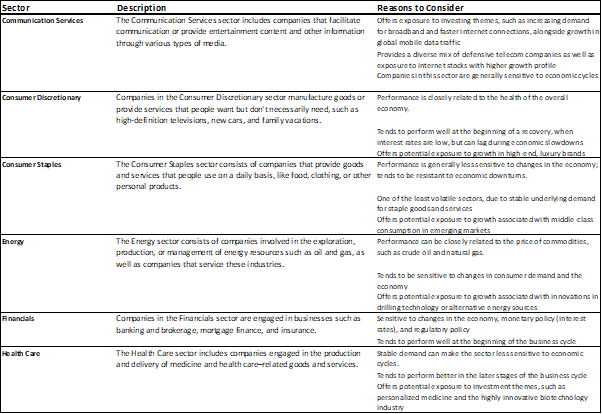

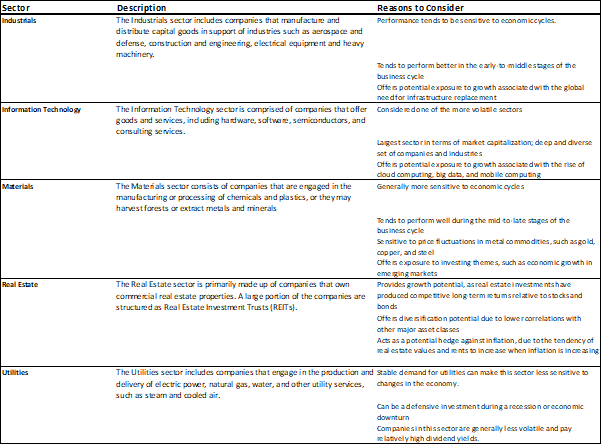

The US market is typically divided into 11 sectors. They are the 1) Communication Services, 2) Consumer Discretionary, 3) Consumer Staples, 4) Energy, 5) Financials, 6) Healthcare, 7) Industrials, 8) Information Technology, 9) Materials, 10) Real Estate and 11) Utilities.

The table below summarizes the description for the various sectors and the reasons one should consider investing in these sectors.

Sectors are further broken down into industries. For example, within the Communication Services sector, it comprises of the following 7 major industries, namely 1) Advertising Agencies, 2) Broadcasting, 3) Electronic Gaming & Multimedia, 4) Entertainment, 5) Internet Content & Information, 6) Publishing and 7) Telecom Services.

In this article, we will just be focusing on identifying the best and worst-performing sectors in the US and how to engage in sector investing through ETFs.

Best and worst performing sectors in the US (YTD 2021)

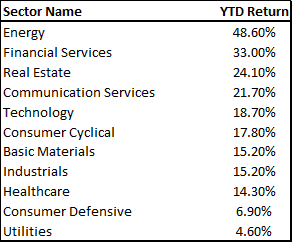

The table below summarizes the performance of the best and worst sectors in YTD 2021. The honor of the best-performing sector belongs to the Energy sector, which generated returns of almost 50% on a YTD basis.

Financial Services come in a distant second with YTD returns of 33% and Real Estate rounding up the Top 3 with YTD returns of 24%.

The 3 worst performing sectors are 1) Healthcare (YTD returns of 14%), 2) Consumer Defensive (YTD returns of 7%) and 3) Utilities (YTD returns of 5%). These are mainly defensive sectors that have lagged the market in a year characterized by a strong economic rebound.

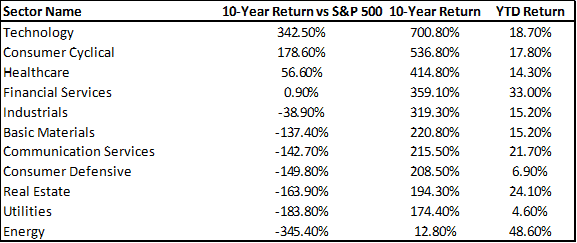

While the Energy sector has performed credibly in YTD2021, this is a sector that has generated paltry returns of just 13% over a 10-year horizon. Comparatively, the Technology, Consumer Cyclical and Healthcare sectors have been the best place to invest over the past 10-years, generating returns of 700%, 537% and 415% respectively.

These are the only 3 sectors that have managed to substantially outperform the S&P 500 over the past decade.

The Technology and Consumer Cyclical sectors have been steady outperformers (vs. S&P 500) over the past decade.

While there is no guarantee that these 2 sectors will remain as the hot sectors in the current decade, they are the 2 sectors that have one of the highest forecasted EPS growth by the street over the coming 5 years.

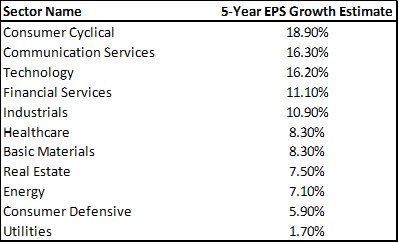

Based on the street estimates, the 3 sectors that are likely to grow their EPS in the high-teens on an annualized basis over the next 5-years are the 1) Consumer Cyclicals (19%), 2) Communication Services (16%) and 3) Information technology (16%) sectors.

For those who believe that growth will continue to take precedence over value (aka cheapness), one could focus on sector investing in these 3 categories.

How to engage in sector investing

The easiest way to engage in sector investing is through the purchase of sector-focused ETFs. There are passive ETFs dedicated to replicate the performances of each sector. For example, if one wishes to invest in the consumer cyclical sector, one could select the Consumer Discretionary Select Sector SPDR Fund (XLY) which is the largest ETF (in terms of net assets) that passively tracks the Consumer Discretionary (Cyclical) Select Sector Index.

This is an ETF that is passively managed, hence its expense ratio is low at just 0.12%. There are, however, 2 other passively managed broad-base Consumer Cyclical ETFs that have lower expense ratios and generated better performances than the XLY over the past 5-years.

They are the Fidelity MSCI Consumer Discretionary Index ETF (FDIS) and the Vanguard Consumer Discretionary Index Fund ETF (VCR). Both these ETFs have expense ratios of 0.08% and 0.10% respectively and have also significantly outperformed XLY over the past 5 years. Both these ETFs are also rated 5 stars by Morningstar Rating.

For those who wish to select more niche ETFs within the Consumer Cyclical that invest in focused industries such as Home Construction (which is an industry within the consumer cyclical sector), one can select an ETF like the iShares US Home Construction ETF, ticker ITB.

Do note that investing in an ETF such as the ITB exposes investors to greater concentration risk as it is focused on a niche industry (home construction) vs. the more broad-base consumer cyclical sector.

Which are the best sector ETFs to purchase for sector investing

I have screened out the best sector ETFs to purchase within the 11 major sectors. This is based on selecting ETFs on the following criteria

- Large net assets of at $800m

- Passively managed ETF with low expense ratios of less than 0.20%

- Morningstar Rating of at least 4 stars and above

- Strong sector performances vs. peers over the past 5-years

As can be seen from the low expense ratio criterion, the emphasis is on selecting passive ETFs vs. active ETFs.

Sector Investing: Best Communication Services ETF

The best communication services ETF to invest in is the Fidelity MSCI Communication Services Industry ETF, ticker FCOM.

AUM: $979m

Expense Ratio 0.08%

Morningstar Rating: 4 stars

Style: Giant, Core Growth

5-year returns: 108%

The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Communication Services 25/50 Index.

The fund invests at least 80% of assets in securities included in the fund’s underlying index.

The fund’s underlying index is the MSCI USA IMI Communication Services 25/50 Index, which represents the performance of the communication services sector in the U.S. equity market.

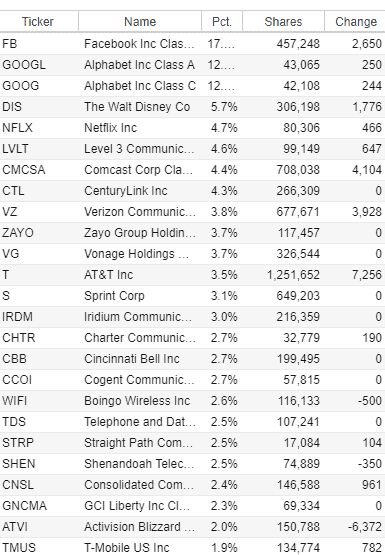

The top 5 holdings include stocks such as Facebook, Google, Disney, Netflix and Level 3 Communication.

Sector Investing: Best Consumer Discretionary ETF

The best consumer discretionary ETF to invest in is the Vanguard Consumer Discretionary Index Fund, ticker VCR.

AUM: $7,490m

Expense Ratio 0.10%

Morningstar Rating: 5 stars

Style: Large, mid and small, Core Growth

5-year returns: 178%

The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index/Consumer Discretionary 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the consumer discretionary sector, as classified under the Global Industry Classification Standard.

The Advisor attempts to replicate the target index by seeking to invest all, or substantially all, of its assets in the stocks that make up the index, to hold each stock in approximately the same proportion as its weighting in the index.

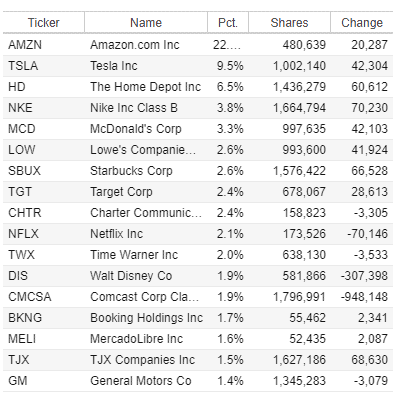

The top 5 holdings are Amazon, Tesla, Home Depot, Nike and McDonald’s

Sector Investing: Best Consumer Staples ETF

The best consumer staples ETF to invest in is the Fidelity MSCI Consumer Staples Index ETF, ticker FSTA.

AUM: $839m

Expense Ratio 0.08%

Morningstar Rating: 4 stars

Style: Giant, Core Growth

5-year returns: 54%

The investment seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Consumer Staples 25/50 Index.

The fund invests at least 80% of assets in securities included in the fund’s underlying index.

The fund’s underlying index is the MSCI USA IMI Consumer Staples 25/50 Index, which represents the performance of the consumer staples sector in the U.S. equity market.

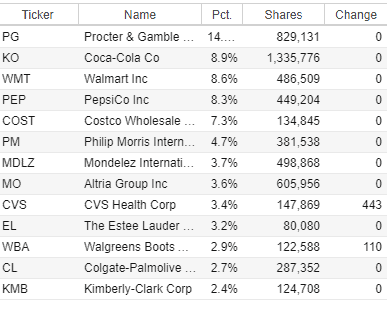

The top 5 holdings are P&G, Coca-cola, Walmart, Pepsi and Costco.

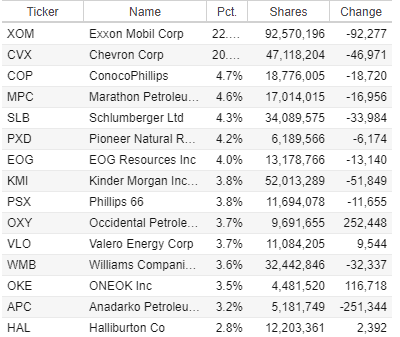

Sector Investing: Best Energy ETF

The best energy ETF to invest in is the Energy Select Sector SPDR Fund, ticker XLE

AUM: $22,809m

Expense Ratio 0.12%

Morningstar Rating: 5 stars

Style: Large, Deep Value

5-year returns: -1.5%

The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Energy Select Sector Index.

In seeking to track the performance of the index, the fund employs a replication strategy.

It generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index.

The index includes securities of companies from the following industries: oil, gas and consumable fuels; and energy equipment and services.

The top 5 holdings are Exxon, Chevron, ConocoPhillips, Marathon Petroleum and Schlumberger

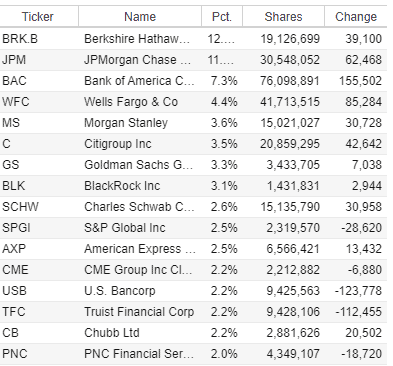

Sector Investing: Best Financials ETF

The best financial ETF to invest in is the Financial Select Sector SPDR Fund, ticker XLF.

AUM: $43,993m

Expense Ratio 0.12%

Morningstar Rating: 5 stars

Style: Giant, Core Value

5-year returns: 124%

The investment seeks investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Financial Select Sector Index.

The fund generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index.

The index includes securities of companies from the following industries: diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts (“REITs”); consumer finance; and thrifts and mortgage finance.

The top 5 holdings are Berkshire Hathaway, JP Morgan, Bank of America, Wells Fargo and Morgan Stanley

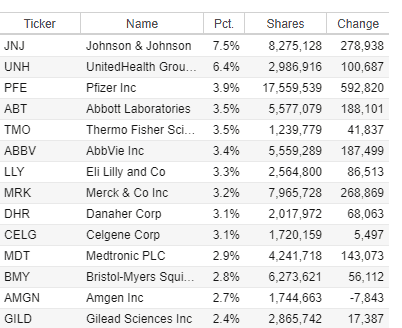

Sector Investing: Best Healthcare ETF

The best healthcare ETF to invest in is the Vanguard Health Care Index Fund ETF, ticker VHT

AUM: $19,647m

Expense Ratio 0.10%

Morningstar Rating: 4 stars

Style: Giant, Core

5-year returns: 105%

The investment seeks to track the performance of a benchmark index.

The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index (IMI)/Health Care 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the health care sector, as classified under the Global Industry Classification Standard (GICS).

The Advisor attempts to replicate the target index by seeking to invest all, or substantially all, of its assets in the stocks that make up the index, to hold each stock in approximately the same proportion as its weighting in the index.

The top 5 holdings are Johnson and Johnson, UnitedHealth, Pfizer, Abbot and Thermo Fisher Science

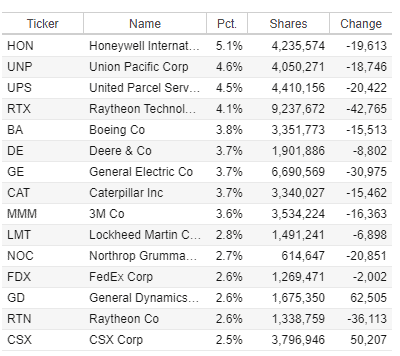

Sector Investing: Best Industrial ETF

The best industrial ETF to invest in is the Industrial Select Sector SPDR Fund, ticker XLI

AUM: $19,394m

Expense Ratio 0.12%

Morningstar Rating: 4 stars

Style: Giant, Core

5-year returns: 93%

The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Industrial Select Sector Index.

Under normal market conditions, the fund generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index.

The index includes securities of companies from the following industries: aerospace and defense; industrial conglomerates; marine; transportation infrastructure; machinery; road and rail; air freight and logistics; commercial services and supplies; etc.

The top 5 holdings are Honeywell International, Union Pacific Corp, United Parcel Services, Raytheon and Boeing.

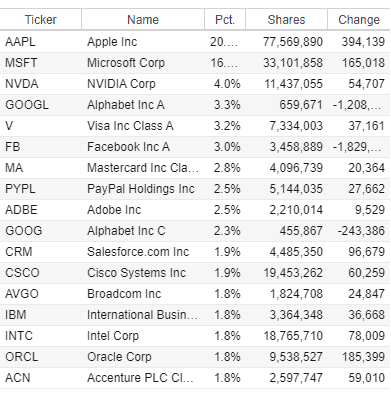

Sector Investing: Best Information Technology ETF

The best information technology ETF to invest in is the Vanguard Information Technology Index Fund ETF, ticker VGT

AUM: $57,934m

Expense Ratio 0.10%

Morningstar Rating: 5 stars

Style: Giant, Core growth

5-year returns: 271%

The investment seeks to track the performance of a benchmark index.

The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index/Information Technology 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the information technology sector, as classified under the Global Industry Classification Standard.

The Advisor attempts to replicate the target index by seeking to invest all, or substantially all, of its assets in the stocks that make up the index, to hold each stock in approximately the same proportion as its weighting in the index.

The top 5 holdings are Apple, Microsoft, NVIDIA, Alphabet and Visa.

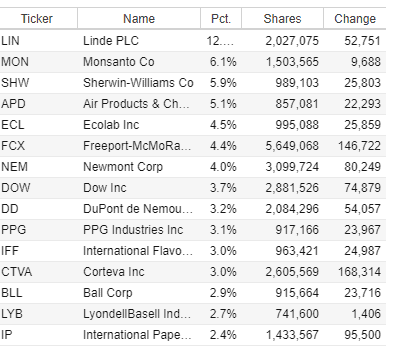

Sector Investing: Best Material ETF

The best material ETF to invest in is the Vanguard Materials Index Fund ETF, ticker VAW

AUM: $5,055m

Expense Ratio 0.10%

Morningstar Rating: 4 stars

Style: Large, mid & Small, Core

5-year returns: 86%

The investment seeks to track the performance of a benchmark index.

The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index (IMI)/Materials 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the materials sector, as classified under the Global Industry Classification Standard (GICS).

The Advisor attempts to replicate the target index by seeking to invest all, or substantially all, of its assets in the stocks that make up the index, to hold each stock in approximately the same proportion as its weighting in the index.

The top 5 holdings are Linde, Monsanto, Sherwin-Williams, Air Products and Ecolab.

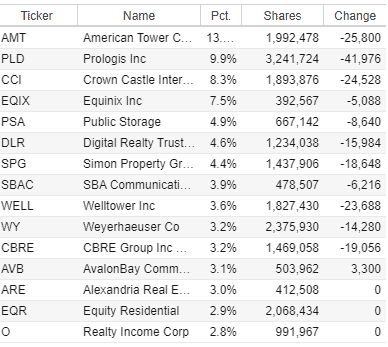

Sector Investing: Best Real Estate ETF

The best real estate ETF to invest in is the Real Estate Select Sector SPDR Fund, ticker XLRE

AUM: $4,348m

Expense Ratio 0.12%

Morningstar Rating: 5 stars

Style: Large, Core growth

5-year returns: 61%

The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of publicly traded equity securities of companies in the Real Estate Select Sector Index (the “index”). Under normal market conditions, the fund generally invests substantially all, but at least 95%, of its total assets in the securities comprising the index.

The index includes securities of companies from the following industries: real estate management and development and REITs, excluding mortgage REITs.

The top 5 holdings are American Tower, Prologis, Crown Castle, Equinix and Public Storage.

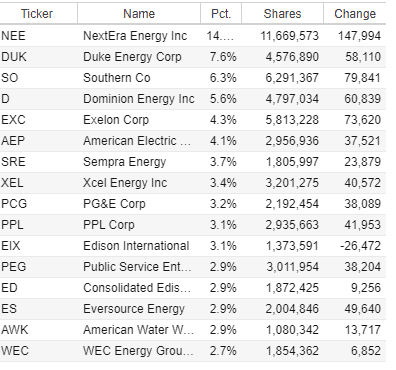

Sector Investing: Best Utilities ETF

The best utility ETF to invest in is the Vanguard Utilities Index Fund, ticker VPU

AUM: $6,637m

Expense Ratio 0.10%

Morningstar Rating: 4 stars

Style: Large, mid and small, Core value

5-year returns: 48%

The investment seeks to track the performance of a benchmark index.

The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index (IMI)/Utilities 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the utility sector, as classified under the Global Industry Classification Standard (GICS).

The Advisor attempts to replicate the target index by seeking to invest all, or substantially all, of its assets in the stocks that make up the index, to hold each stock in approximately the same proportion as its weighting in the index.

The top 5 holdings are NextEra Energy, Duke Energy, Southern Co, Dominion Energy and Exelon Corp.

Conclusion

Sector investing provides lesser diversification compared to an index investing approach such as buying the entire S&P 500 stocks through the SPY ETF, the latter comprising of stock counters from different sectors.

A sector investing strategy might be more suitable for investors who have a particular view of where the current business cycle might be. For example, an early economic recovery scenario will likely favor investing in financials.

We have seen that YTD 2021 has been the year of partaking in recovery themes/sectors where energy, consumer discretionary and financials have been the top sectors in terms of share price performances this year.

However, there remains widespread uncertainty over the recovery prospects of major economies as a result of the spread of the Delta variant.

In this article, I have also provided ideas for low-cost, passive sector ETFs that one can select to partake in. As usual, the above ETFs highlighted are not meant to be a recommendation to Buy or Sell but more for educational and sharing purposes. Please do your due diligence.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Is now the time to buy Chinese stocks?

- Megatrend Investing: Best Performing Megatrend ETFs in 2021

- Best ETFs in Singapore to structure your Inflation-Proof passive portfolio

- Best Value ETFs to buy in 2021

- Best China ETFs to buy [2021]

- 10 Largest ETFs in the US: Should you invest in any of them?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.