Best Value ETFs that consistently outperform the market

There is increasing interest in value stocks, which have been in the shadow of their growth counterpart over the past decade. However, with rising interest rates, value investing seems to be increasingly favored upon, with strong outperformance seen in Value ETFs vs. the market as well as Growth ETFs in 2021

A quick google search on best value ETFs for 2021 throws out several familiar large-cap ETFs such as the uber-popular Vanguard Value ETF (VTV) which has a market cap of $126bn and consists of large-cap names such as Microsoft, Berkshire Hathaway, and JP Morgan as the ETF top 3 holdings.

In this article, we will briefly highlight what value investing is all about as well as highlight the best value ETFs to buy in 2021.

Most of the popular value ETFs such as the large-cap VTV and the mid-cap VOE have outperformed the market so far in 2021, generating excess returns of 5% and 8% respectively. However, when we extend the horizon over a 5-years duration, both these ETFs have underperformed the S&P 500 by 35% and 43% respectively.

Are there any value ETFs that have outperformed the S&P 500 over a 5-10 years horizon? In this article, we will be selecting the best value ETFs to buy in 2021, based on their historical track record of outperforming the general market over the past 5-10 years, a period where value investing has been “frowned upon”, with many proclaiming that “value investing is dead”.

First up, a quick tutorial on what is value investing.

What is value investing

Value investing typically involves buying companies that are trading below their estimated intrinsic value because of unfavorable developments that are deemed to be temporary. It is an attractive investment strategy for long-term investors who prefer to buy stocks trading at a discount, or “cheap” stocks, and holding these stocks until their stock price converges with the fair value price.

The main problem with buying cheap stocks is the “value trap” conundrum. One where a cheap stock can get even cheaper because of worsening fundamentals such as margin erosion and loss of market share etc.

Deriving the right “fair value” or intrinsic value for a company is also more of an art rather than science, with different personnel deriving drastically different fair value prices due to the variation in assumptions applied.

Two popular stock valuation methods to derive the fair value of a stock used in value investing are the 1) Discounted Cash Flow or DCF method and the 2) Discounted Dividend Model or DDM method.

I have written about both these methods in the articles below:

Suffice to say, value investing which has been popularized by Benjamin Graham and his protégé Warren Buffett has gained a huge following over the last 50 years. However, the past decade (since GFC) has been a real test for value investing disciples. While there might be a different definition of what constitutes value investing and the exact approach that it should be done, few have argued against its awful stretch of underperformance vs. the broader market since GFC.

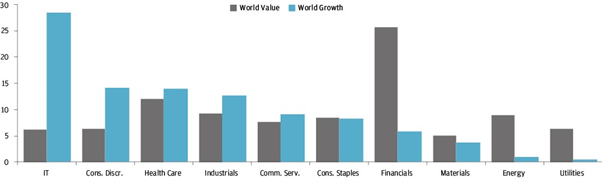

The tide seems to have turned in 2021, with value stocks FINALLY outperforming their growth counterparts. This is largely the result of a resurging interest for financial stocks as well as energy stocks, both sectors being a substantially larger component for the Value category vs. the Growth category as seen from the diagram below from JP Morgan.

Both energy and financial stocks have been the best-performing stocks YTD, which is typical of what happens in the aftermath of a recession, ie early-stage economic growth.

Inflation is another major economic risk that seems to be hitting the headlines of late. Higher inflation tends to favor energy stocks (oil stocks) while the prospect of rising interest rates to combat the effect of higher inflation will benefit banks.

There is no doubt that value investing has gained some momentum in 2021 as investors’ focus shifted to undervalued sectors of the market amid the risk of a higher interest rate environment which tends to hurt growth stocks more than their value counterpart.

Investors can look to partake in value investing by purchasing a basket of value stocks through a value ETF. For more details of what an ETF is as well as identifying the 10 largest ETFs in the US, one can refer to this article.

Additional Reading: Best Performing ETFs (2023)

Best Value ETFs to buy in 2021

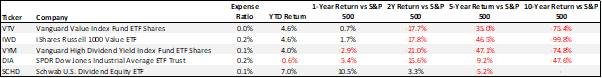

The table below lists the Top 5 largest value ETFs in the market today and their respective performances vs. the S&P 500 over the past 5 years. The largest of them all is undoubtedly VTV which has a market cap of $126bn, followed by the iShares Russell 1000 Value ETF.

Most of these value ETFs have very low expense ratios which makes them ideal candidates to dollar cost average over the long run.

As can be seen, most of these value ETFs have outperformed the S&P 500 for 2021 as well as on a 1-year horizon, with SCHD being the best performing large-cap value ETF over this period. However, many of the large-cap value ETFs have underperformed the S&P 500 index over a longer horizon (5-years and 10 years).

Is there any value ETFs that have consistently outperform the S&P 500 over a longer horizon? We identify 3 Value ETFs to buy in 2021 (1 small-cap, 1 mid-cap, and 1 large-cap) that exhibit such strong historical outperformance.

A word of caution though, historical performances are by no means representative of future performances and there is no guarantee that this outperformance can continue over the coming years/decade.

Without further ado, these are the 3 Value ETFs to consider for your portfolio in 2021.

Best Value ETF to buy in 2021 #1: Invesco S&P 500 Smallcap 600 Revenue ETF (RWJ)

Category: Small Value

Morningstar Rating: 5 stars

Net assets: $682m

Expense ratio: 0.39%

Style: Micro, Core Value

Description

The index is designed to measure the performance of positive revenue-producing constituent securities of the S&P SmallCap 600 Index (the Parent Index). The Parent index is comprised of common stocks of approximately 600 small-capitalization companies that generally represent the small-cap universe of the U.S. equity market.

Top Stocks constituent

The ETF typically invests in small-cap value (aka cheap) stocks that have shown positive revenue growth momentum. One will likely notice that this ETF top holding is Gamestop which is unlikely to be a “value” stock-based on today’s price. Hence when this ETF rebalances (typically every 6 months), it is likely that the counter will no longer be the ETF top holding.

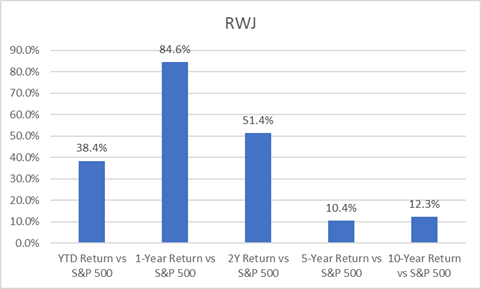

Investing in small-cap value stocks that have a track record of growing revenue has been a fruitful strategy, with this ETF showing strong outperformance vs the S&P 500 over a 1-year, 2-year, 5-year, and even 10-year horizon, extremely rare for an ETF that is focused on value investing.

This is one value ETF to buy in 2021 if you are open to having small-cap exposure where the volatility is much higher than average.

Best Value ETF to buy in 2021 #2: Cambria Shareholder Yield ETF (SYLD)

Category: Mid-Cap Value

Morningstar Rating: 5 stars

Net assets: $353m

Expense ratio: 0.59%

Style: Deep Value

Description

The fund is actively managed and seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities, including common stock, issued by U.S.-based publicly listed companies that provide high “shareholder yield.”

Its investment adviser, Cambria Investment Management, L.P. (“Cambria” or the “Adviser”), defines “shareholder yield” as the totality of returns realized by an investor from a company’s cash payments for dividends, buybacks, and debt paydown.

Top Stocks constituent

This value ETF focus on identifying stocks that have the highest shareholders’ yield, which is a combination of not just its dividend payments but also include its share buyback.

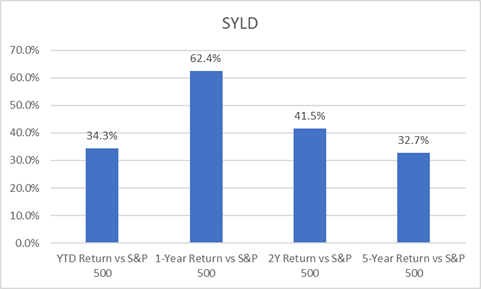

This is pretty interesting to note. Very often, buying the highest-yielding stocks does not translate to having the best financial performance. However, when combined with share buybacks and debt repayment, such stocks, as shown by the performance of the ETF, do outperform the market rather substantially.

Over a 5-years horizon, the ETF has outperformed the S&P 500 by a massive 32%, with both its 1-year and 2-year outperformance equally impressive.

The ETF has likely benefitted from the performances of Gamestop which again is the top holding in this ETF which will likely be sold outcome the next ETF rebalancing. There are also bigger companies in this ETF as compared to RWJ, stocks such as Texas Instruments and Home Depot are large-cap stocks that have generated strong shareholder yield.

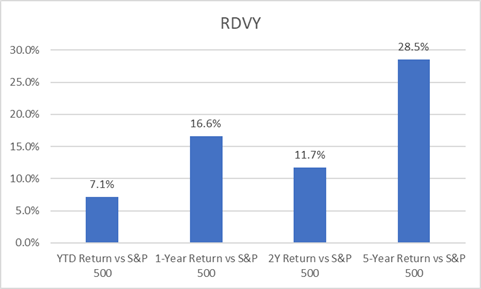

Best Value ETF to buy in 2021 #3: First Trust Rising Dividend Achievers ETF (RDVY)

Category: Large Value

Morningstar Rating: 5 stars

Net assets: 4,461m

Expense ratio: 0.50%

Style: Giant, Core Value

Description

The investment seeks investment results that correspond generally to the price and yield (before fees and expenses) of the NASDAQ US Rising Dividend Achievers Index.

The index is designed to provide access to a diversified portfolio of small, mid, and large-capitalization companies with a history of raising their dividends while exhibiting the characteristics to continue to do so in the future by including companies with strong cash balances, low debt, and increasing earnings.

Top Stocks constituent

This ETF focuses on finding companies that have both a good track record of raising their dividends as well as having the ability to do so based on balance sheet strength as well as earnings growth. This value ETF has outperformed the S&P 500 by 17% over 1-year, 13% over 2 years, and 30% over 5-years.

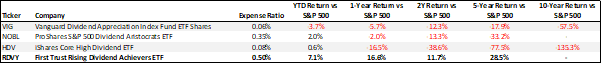

It is interesting to note how this large-cap value ETF performs against other dividend-focused ETFs such as the iShares Core High Dividend ETF, the ProShares S&P 500 Dividend Aristocrat, and the Vanguard Dividend Appreciation Index Fund.

As can be seen from the table, dividend-focused ETFs have typically underperformed the general market over a longer horizon, with many of these larger dividend-focused ETF’s short-term performances being sub-par as well.

As to why there us such discrepancies in their performances despite the core theme of dividend investing, this will be another article for another day.

Stock Rover

The best fundamental stock screener for US stocks, Stock Rover is a “must have” for all serious long-term investors

Conclusion

Value ETFs have underperformed the general market over the past decade but are seeing a resurgent of interest amid stronger performances in YTD 2021. Many of the large-cap value ETFs might look like decent candidates to buy at present, however, they lack a strong track record of outperformance over the long term.

We have instead identified 3 value ETFs to buy in 2021 that have not only performed credibly on a YTD basis but have also generated strong price outperformance vs. the S&P 500 over the past 5-10 years. These value ETFs are all rated 5-stars by Morningstar.

For those who are more of a risk-taker, you can choose to select RWJ and SYLD ETFs which tend to hold more small-cap value stocks (and thus more inherently volatile). Those who are more risk-averse could select the RDVY ETF which is fairly liquid and holds larger cap value stocks which the masses are more familiar with.

Investors who are more inclined to growth investing can check out the article below:

Top 5 Growth ETFs that beat ARK funds in 2021

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- 1Q 2020 TOP HEDGE FUND LETTERS TO SHAREHOLDERS

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 2)

- 8 OUTPERFORMING STOCKS TO BUY NOW (PART 1)

- 4 RECESSION-RESISTANT STOCKS WITH A FORTRESS BALANCE SHEET

- 4 STOCKS WITH MORE THAN 80% RECURRING REVENUE OWNED BY GURUS

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.