Not much has been written about Inflation. However, it is one of the Four Key unknowns that affect one’s retirement plan. Granted that inflationary pressure has been low in the past decade. However, having a complacent mindset with a low inflation assumption baked into one’s retirement calculation might be a recipe for disaster.

Compound Interest vs. Inflation. The battle for your money

Most of us would already have known about the magical wonders of compound interest. Well, Inflation works in the opposite direction. In the real world with real investment, you have both forces at work on your money.

For example, if you have $100 in a savings account earning 3% interest (Yes that’s fantastic in today’s environment), that compounds to $180 when you check your account balance after 20-years. Great!

But if inflation runs at 3% /annum on average over that same 20-years horizon, your nice $180 account balance will actually only have the exact same value as $100 does today. Not so great anymore.

Inflation is a critical point to bear in mind when planning for retirement. Don’t just focus on the returns.

Four key unknowns of a retirement portfolio

- How your investment returns might be post-retirement

- What your annual spending needs are

- Unforeseen medical expenses

- Inflation rates

How your investment returns might be post-retirement

On the first point, we have blogged about what the ideal portfolio structure one should have, incorporating the 4% withdrawal rule as a basis of post-retirement income funding.

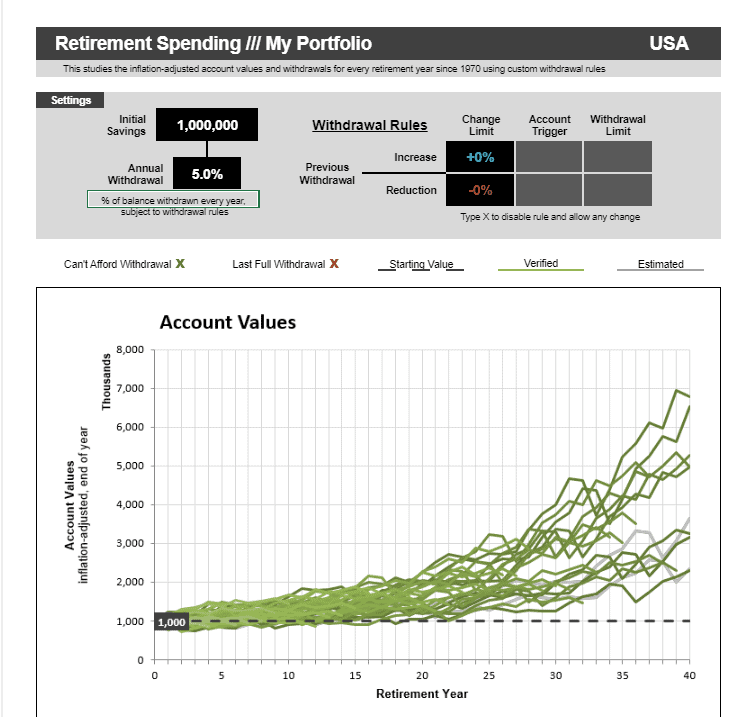

Our conclusion is that a 60:40 structure might not be as robust as our preferred asset allocation structure of 20% stocks, 20% bonds, 40% REITs and 20% Gold.

Our ideal structure has shown to be able to allow for a Safe Withdrawal Rate of 6.4% compared to a 60:40 portfolio that has a Safe withdrawal Rate of only 4.2%, based on data stretching from 1970 to 2018.

Note that our ideal platform is one that is structured to significantly outperform in an inflationary environment, due to its substantial weighting in Gold as well as REITs, both assets which are normally seen to protect against inflation.

Ideal Portfolio vs. All-Weather Portfolio

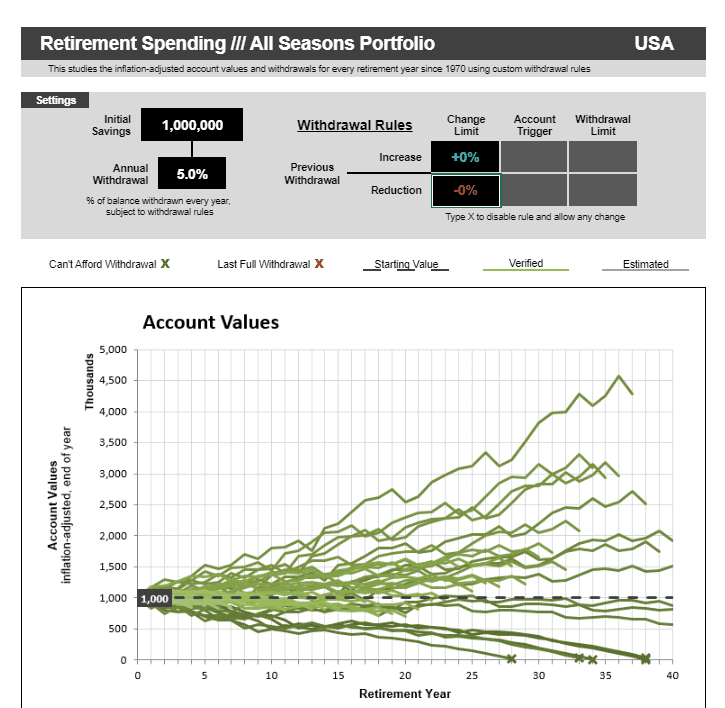

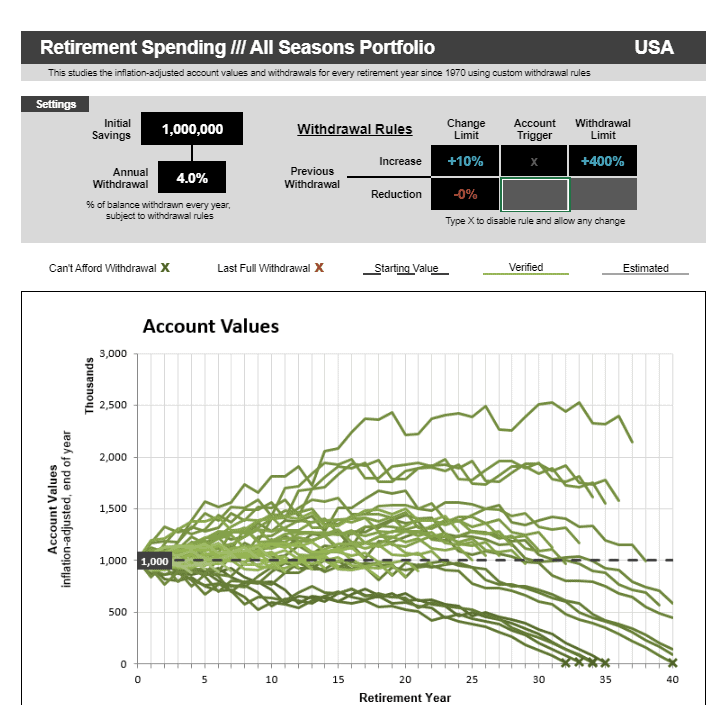

How would such a portfolio match up against an “All-Weather Portfolio” as popularised by Ray Dalio? Financial Horse has previously written about this All-Weather Portfolio from the Singaporean’s perspective which I thought was pretty interesting.

However, based on the data from portfoliocharts, such a portfolio structure would have resulted in a safe withdrawal rate of only 4.9% (still higher than 60:40 structure) compared to our ideal structure’s safe withdrawal rate of 6.4%. That is a 150bp differential which is rather substantial.

Put it in another way, a portfolio invested based on the All-Weather Portfolio would have run out of cash in a handful of scenarios, based on a 5% withdrawal rate and taking into consideration actual inflation data (Account values and withdrawals have already been adjusted for inflation).

On the other hand, an investment in our ideal portfolio structure, using the same assumptions, will have a 100% success rate.

For now, on a like for like basis, it does seem like my Ideal Portfolio structure is still superior to that of the All-Weather Portfolio.

While we have no crystal ball in front of us to determine what our investment returns might be post-retirement, having a portfolio structure that has demonstrated to withstand almost any economic situation will help to mitigate the risk associated with one of the four key unknowns in our retirement years.

What your annual spending needs are

On the second point, I have also written an article detailing the step-by-step method to calculate how much one will need in his/her retirement years.

The figure is pretty shocking at close to $1.5m for the typical Singaporean.

You can read more about the article here and why one should not be discouraged and can actually meet your retirement needs with a monthly investment amount as low as $110-270 over a 35 years horizon.

Unforeseen medical expenses

On the third point which is something that I have not yet blogged in detail: covering unforeseen healthcare needs in our later years. It is therefore crucial that one will need to have adequate medical insurance to ensure that major lump sum healthcare costs are well covered.

I will be writing more about this topic in future articles.

Inflation rates

I have digressed a little, but today’s article is mainly focused on the effect of Inflation, which can potentially be a silent killer of retirement but an area that is largely ignored by the masses. This is understandably so, given that inflation hasn’t been a concern this past decade. But should it be one in the coming years ahead?

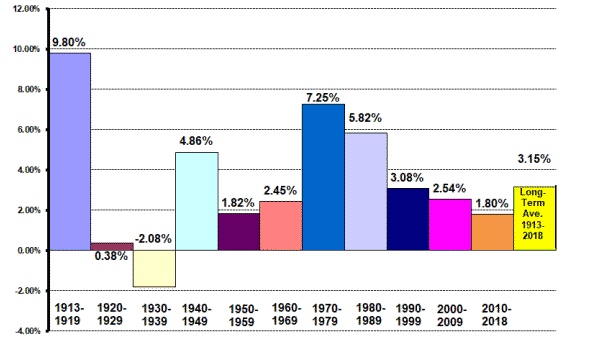

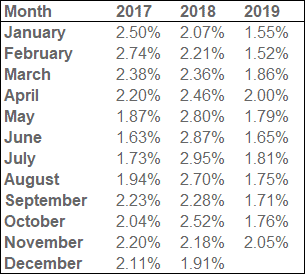

Inflation has been running low over the past decade for most developed countries. In the US, the inflation rate from 2010-2018 was at 1.8%, the lowest ever average decade inflation rate since the 1930s.

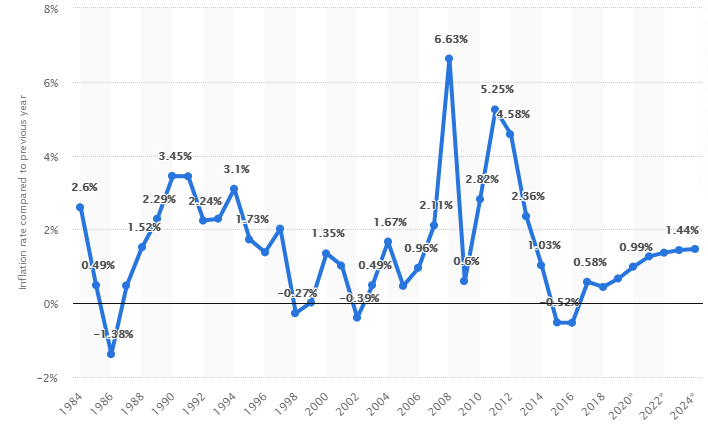

In Singapore, the average from 2010-2018 is at a similar level of 1.8%, according to data from Statista. From 2019-2024, the forecast average inflation rate is only going to be 1.2%.

Let us digress a little again on an interesting fact that is relevant to most Singaporeans. We have shown that the average inflation rate is only approx. 1.8% over the course of 2010-2018.

For Singaporeans’ retirement scheme, aka, CPF LIFE, how has the Full Retirement Sum increased during this same period.

The Full Retirement Scheme or FRS for short has increased from $123,000 in 2010 to $171,000 in 2018. That is a CAGR of 4.2% over this 8-years horizon! It seems like the minimum sum is increasing at a much faster rate compared to the actual inflation rate on the ground.

I am not trying to imply any hanky-panky actions on the part of our government. They probably have the foresight that the inflation rate will start catching up significantly in the not so distant future?

Back to our topic proper. Given that we have had 30-years of low inflation, many folks forget the impact of living in a high inflation environment, like in the 1970s where average inflation rates were at 7% for that “lost-decade”. On a longer-term basis, the average inflation rate is expected to be around the 3% region.

Should we be concern about rising inflation rate?

My personal opinion is YES. Definitely. A spike in inflation rate not only eats into one’s purchasing power, which is particularly critical for retirement folks, but it could also spell the end of the record run in the stock market, which some belief is already running on fumes, supported by the FEDs QE measures, one of which is to adopt a “lower-for-longer” interest rate policy.

Lowering rates to support the capital market is fine when inflationary pressures are low. In fact, I expect the FED to continue lowering rates if the US economy remains on a weak footing. Negative interest rates perhaps?

However, an inflationary environment, coupled with stagnant economic demand, or what one term as stagflation, could be the straw that breaks the camel’s back. In such a scenario, it will be almost impossible for the FED to pump prime the stock market by further lowering short-term interest rates. Instead, the FED will have to consider rapidly raising rates to curb the devastating effect of inflation, just like what the legendary Paul Volcker (who passed away on 8 December 2019) has done in the late 1970s and early 1980s.

A rising rate environment not supported by economic growth could well result in a market collapse which also presents sequence of returns risk for a retiree (on-top of lower purchasing power) who might be forced to liquidate his/her portfolio in a severe stock market correction, resulting in a potential income shortfall in their later years.

Hence, a proper portfolio structure is critical, like what we have highlighted in Point 1. One that can withstand the devastating impact of stagflation.

Are we at risk of an imminent spike in inflation?

The good news is that inflation risk is not yet evident.

I have been monitoring the US annual inflation rate and so far, that hasn’t been a cause for concern. No doubt that the latest November 2019 annual inflation figure of 2.05% is the highest since November 2018, it remains well below the long-term average of c.3%.

FED Chairman Jerome H. Powell indicated in the last FED meeting in October that the central bank will need to see real-life increases in inflation before taking any drastic action of raising interest rates.

“We would need to see a really significant move up in inflation that’s persistent before we would consider raising rates to address inflation concerns. We of course have watched the situation in Japan and now the situation in Europe. We note that there are significant disinflationary pressures around the world, and we don’t think we’re exempt from those”.

Jerome H. Powell

Could the situation reverse significantly?

However, the recent skirmish between the US and Iran could translate to a full-blown war between the two nations. In that scenario, we should expect oil prices to appreciate, potentially even hitting the USD$100/barrel mark.

Might that result in a higher inflation rate? Probably if oil prices remain sustainably high due to permanent supply disruption.

Add to that the “seemingly unresolved” trade conflicts between the US and China (Phase 1 targeted to be signed on 15 Jan 2020), if worsened, could result in higher prices on food and consumer products and further elevate the inflationary environment. In China, we have already seen inflation rate (3.8%) in October 2019 at the highest level since January 2012 due to food price spike.

How should we plan for inflation?

While it might not be a major concern now, don’t let this “silent killer of retirement” lull you into ignoring the risk it can do to your purchasing power as well as portfolio performance. As you plan for retirement, it is critical that you have fully considered the risk of inflation (no matter how obscure it might seem at this juncture) and built it into your retirement plans.

Three main areas to address the risk of inflation

1. Engaging an “inflation-proof” portfolio structure

To address one of the Key Unknowns pertaining to portfolio returns post-retirement and how inflation might have a detrimental impact, one can potentially stress-test the robustness of the portfolio.

Let’s assume we base our retirement income using the 4% withdrawal rule. The 4% Withdrawal Rule does take into account the impact of inflation to some extent. In my previous write-up, I have used an inflation assumption of 3%.

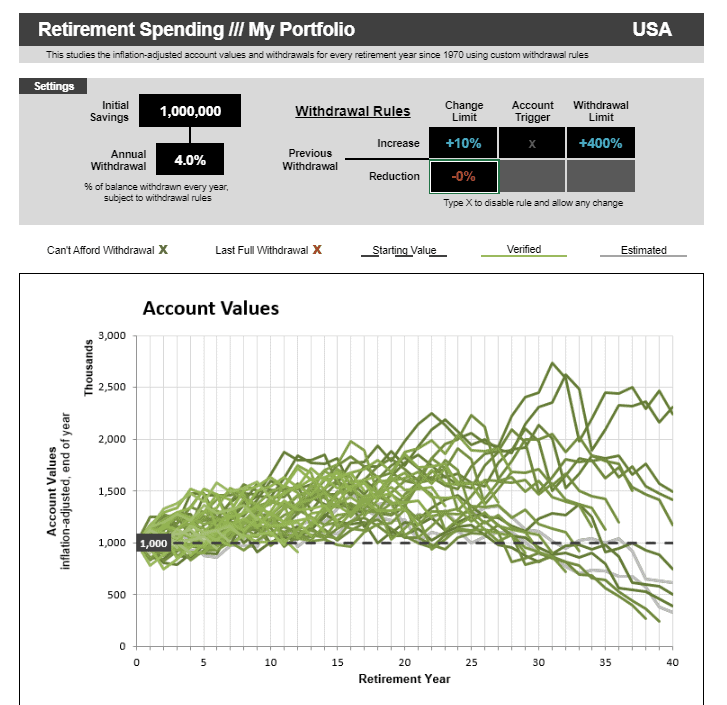

The below diagram illustrates the various scenario analysis for my Ideal Portfolio structure.

Withdrawals are made based on:

- After adjusting the impact of actual inflation

- Include a 10% annual increment (even after inflation) as a buffer for higher inflation

- Having a min base of $40,000 (4% of $1m). Allows for no withdrawal reduction

And yet, the portfolio did not run out of capital in all scenarios.

The same scenario used for the All Seasons Portfolio is shown below:

2. Supplement the Ideal Portfolio with Inflation hedges

Besides having an “inflation-proof” structure, another benefit of Portfolio 2 is that it is a relatively high yield portfolio vs. a traditional 60:40 portfolio, due to its significant REITs presence (40%). This can potentially serve as an effective bond shield where dividend income can be deployed to first offset retirement expenses before drawing down on the capital.

For a DIY portfolio, one can also have a high proportion of dividend growth stocks in the 20% equities allocation. This not only serves as an ideal source of stable and growing income, but we have previously noted that dividend growth stocks have shown to demonstrate the best returns over the long-run in our article: 7 Golden Rules of Dividend Investing.

Such a structure will ensure that almost 80% of the portfolio exposure is “inflation-resistant” to a certain degree. The only exception is that of the 20% allocation to long-term (20 years) bonds which will likely be negatively impacted in a strong rising rate environment. Alternatively, one can invest in Treasury Inflation-Protected Securities (TIPS) for example the PIMCO 15+ Year US TIPS ETF to have that additional protection from rising interest rates while getting the benefit/diversification of bond exposure in a portfolio.

In this case, almost 100% of the portfolio is “insured” against inflation.

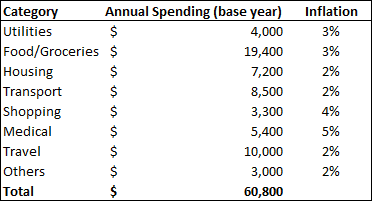

3. Inflation assumption by Spending category

To get a more accurate depiction of one’s spending requirement post-retirement, it might be more accurate to adjust the spending requirement of each category based on various inflation rates vs. using an average number of 3%/annum.

For example, one can break down his/her spending into these categories and assign a corresponding inflation target.

Assuming that there are 20 years left till retirement, base on the same inflation rate as depicted for each category, a $60,800 annual requirement will translate to $103,400 annual requirement in 20 years time.

One can adjust the individual category inflation assumption periodically to come out with a better estimate of what his/her retirement spending might be.

Conclusion

Inflation is a significant risk to one’s retirement but yet is an area that is often neglected by most, particularly in the last decade where inflation has been relatively benign.

However, that is never an argument to ignore the associated risk of inflation. By the time the pain is felt, it might be too late.

Hence, one should develop a retirement portfolio with inflation risk in mind, focusing on the right asset allocation which gives the greatest protection and hedge against inflation.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Inflation: Don’t ignore this silent retirement killer”

Inflation is indeed a silent retirement killer. Hence putting money in the bank erodes the value of our $. Property investment is a good hedge against inflation. Stocks with high dividends is another potential instrument.

Hey Danny, thanks for dropping by. Yes, I do agree with you on the property and dividend instruments. However, most of us unlikely to be able to afford multiple properties as an investment tool to hedge against inflation.