Thematic investing: Is this suitable for you?

I was first introduced to the concept of thematic investing about 10-years ago through the Motif platform, a small fintech player that specializes in bringing thematic investing to the retail masses. I wasn’t eligible to sign onto their platform which is predominantly for US investors but I was following some of the thematic portfolios that were created on the platform.

Unfortunately, Motif Investing announced their plans to officially shut down in May 2020 after 10-years in the business, with clients’ portfolios being transferred over to Folio Investing.

Thematic Investing, in a nutshell, involves creating a investment portfolio by gathering together a collection of companies involved in certain areas that you predict will generate above-market returns over the long term. Themes can be based on a concept such as aging populations or a sub-sector such as cloud computing etc.

Thematic investing usually have much fewer stocks selected compared to the traditional mutual funds where the latter typically encompass 50-100 stocks. Thematic investment portfolios, on the other hand, usually have much fewer stocks with a particular focus on a key area. If that area performs well, returns will outperform that of the typical mutual funds. Thus making this trading or investment strategy enticing.

Critics of thematic investment portfolios see such strategies as “marketing ploy” that is designed to attract quick money from the public rather, encouraging retail investors to chase the latest fad, often too late in the game.

These investment portfolios are usually “high-risk” in nature because they are not well-diversified across multiple industries and are highly concentrated in certain sub-sectors. On a investment portfolio structure basis, there is also no diversification across different asset classes such as equities, bonds, commodities, REITs, etc.

Nonetheless, thematic investing remains an area that has attracted a lot of attention of late, particularly with the advent of COVID-19. While active fund management has been on a decline even prior to the start of COVID-19, thematic equity investing has gain traction amid COVID-19, experiencing positive fund flows throughout this period.

In times of uncertainty, investors look to areas of the market that are likely to deliver with greater certainty. Investment themes, with strong structural drivers such as online consumerism, gaming, supermarkets with a significant online presence, etc look to be in a much better position to weather the COVID-19 storm vs. your typical stocks. While COVID-19 presents headwinds for many assets, the crisis has had the effect of speeding up the timeline on some of these structural trends, a notable one being e-commerce.

Take a look at China for example. We have seen e-commerce penetration levels increase further as a result of COVID-19, thus benefitting players such as Alibaba, JD, Tencent, etc. Online consumerism adds further support to the larger China consumption story, one of the most important themes in the past decade as well as the current one.

So how can a Singaporean investor partake in thematic investing?

Thematic Investing in Singapore

DIY Investing

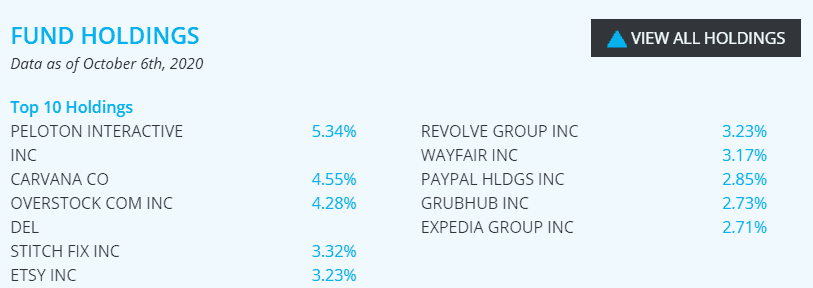

When can do it on a DIY basis, the easiest way is through the selection of a thematic ETF. One of my personal favorites is the IBUY ETF (Amplify Online Retail ETF) which rides on the trend of online consumerism. The index is a globally-diverse basket of publicly-traded companies that obtain 70% or more of revenue from online or virtual sales.

Surprisingly, Amazon is not among their top 10 holdings, with Peloton Interactive in the No.1 slot with a weighting of 5.34% as of 6th October. The diagram below shows the ETF top 10 holdings, which together already encompass approx. 35% of the total investment portfolio weighting.

This ETF generated a 1-year return of 89%, with an annualized return of 32.9% since its inception on 20 April 2016.

As can be seen, the performance of thematic ETFs can easily trounce that of the broader market, as represented by the S&P500 index which generated a corresponding 1-year return of “just” 15.2%.

This is the simplest and cheapest form of DIY thematic investing, buying a particular thematic ETF that has consistently perform well instead of selecting individual stocks that fall in that particular category.

One key expense to note for a DIY investor is the expense ratio of such thematic ETFs which can be quite high. For example, the IBUY ETF has an expense ratio of 0.65% which is still within my acceptable range. However, when compared to some of the traditional index ETF such as the SPY and VOO etc, the expense ratio is on the high side.

The second key expense to note is the commission cost, which is dependent on the brokerage that one is using. If you are using a low or zero cost commission platform such as Interactive Broker or TD Ameritrade, then commissions are of no particular concern. I am assuming that one is not deploying “margin” provided by these platforms which will incur leverage costs.

The third key expense which is more “hidden” is the dividend withholding tax which will be incurred for a Singaporean investor. This is the tax that is incurred if the companies in the fund pay dividends, regardless of whether these dividends are subsequently being re-invested. The standard dividend withholding tax rate is 30%. However, most of these thematic funds (unless they are high-yield themes) do not pay a high dividend rate. Capital appreciation is generally the core investment strategy when investing in these ETFs.

I would say that the “ALL-IN” recurring cost is typically in the region of 0.6-0.8% for such thematic ETFs.

Buying through a Robo Advisor such as OCBC Roboinvest

i have previously written a comprehensive guide on Robo Advisors here in Singapore.

OCBC Roboinvest is probably one of the very few Robo advisors in Singapore that provides retail investors the option of partaking in thematic investing. However, a word of caution: These exchange traded funds are generally classified as “high risk” so do note that you need to have a higher risk appetite while considering such a trading or investment strategy.

Unlike the “traditional” Robo advisors which will generally invest your funds into a portfolio mix that comprises of both equities and bonds (ratios between the two asset classes is dependent on your risk appetite), OCBC despoit account allow you to participate in 33 different portfolios across 6 markets for a range of risk appetites. There will be 1-2 portfolios that are “structured” like the typical portfolios, ie with a mixture of equities, bonds, commodities, etc.

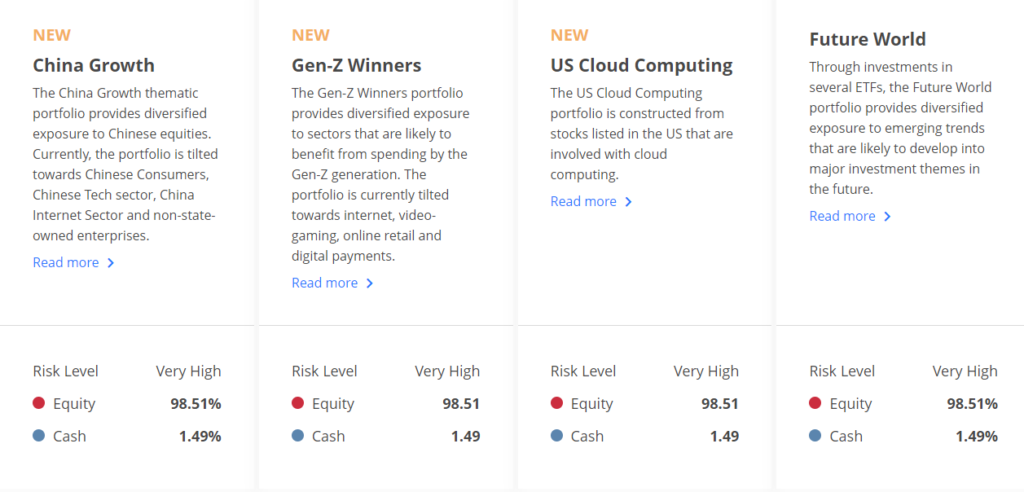

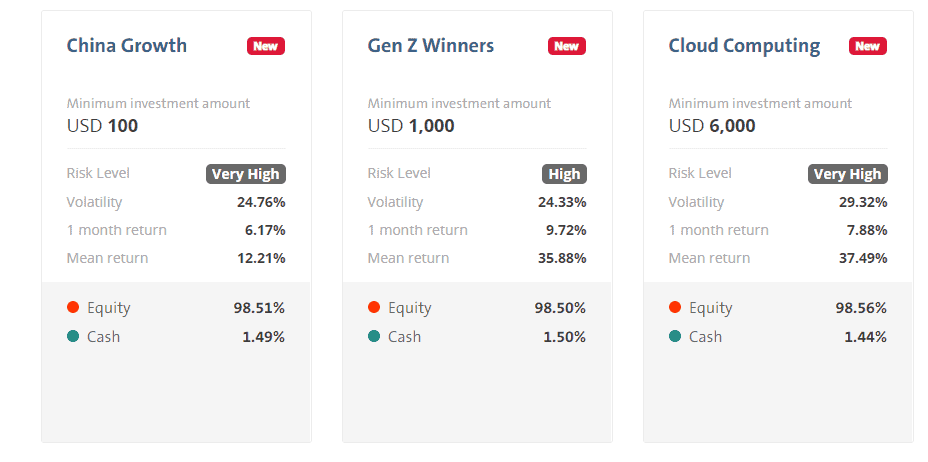

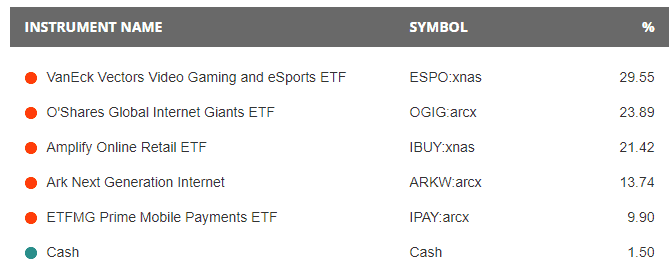

However, the key differentiating point I would say is that the majority of their portfolios are structured according to certain themes in mind. For example, some of their latest investment portfolio additions are based on themes such as China Growth, gen-Z Winners, US Cloud Computing, etc. You can see that OCBC Roboinvest classify these portfolios as “Very High” risk.

The bulk of the portfolio (98+%) is invested in individual stocks or exchange traded funds (ETFs), with the remaining 1+% in cash for platform fee payment, on side note this doesn’t seem to be an good example for diversified exspoure in financal markets. OCBC desposit account charges an annual recurring platform fee of 0.88% of the portfolio under management. This is one of the highest platform charges among the local Robo advisors.

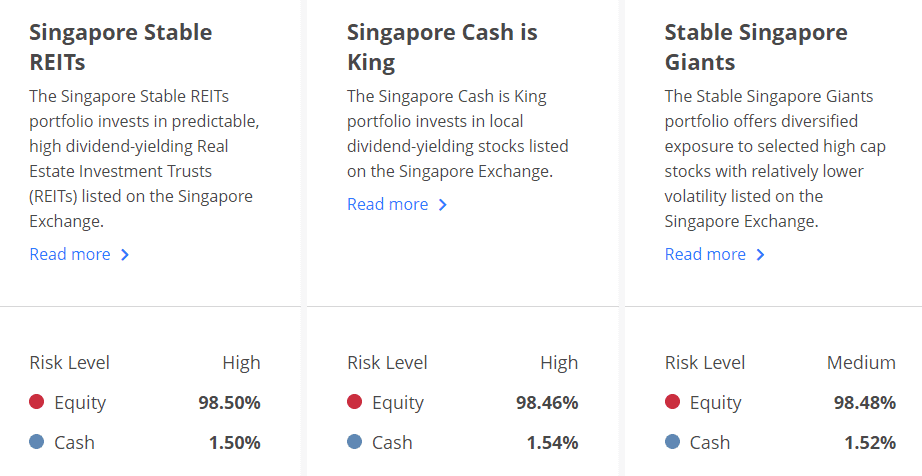

For those who wish to invest in a portfolio closer to home, 3 portfolios are invested exclusively in Singapore stocks.

While their risk appetite is not “Very” high, there is still a high probability of capital losses which should not come as a surprise given how poorly the Singapore market (and its associated blue-chip stocks) have performed over the past decade.

For those who are very risk-averse, you can select their “defensive” investment portfolio which invests predominantly in fixed income securities (74%), followed by equities (20%) and some commodities (5%), cash (1.5%). This might be a strategy to seek shelter in defensive plays while potentially “timing” a better entry into equities upon a market correction.

Do note that these investment portfolios can be constructed based on the direct purchase of individual equities or through ETFs. Take for example their defensive portfolio as highlighted above, it is composed of different ETFs such as the Vanguard Short-term bond ETF, Vanguard High Dividend Yield ETF, etc.

Key expenses associated with investing through a Robo advisor such as OCBC Roboinvest is 1. Platform fees, 2. Expense ratios (if vested in ETFs) and 3. Dividend withholding costs.

Unlike a DIY approach that could incur substantial commission costs (if using local brokerage rather than international online brokerages) if done frequently, investing through a Robo advisor such as OCBC Roboinvest will not incur such costs as they are indirectly being absorbed through the platform fees. (Note that if the Robo advisors invest in unit trusts, there could be additional sales charge, trailer fees, etc involved if these costs are not being rebated to investors. No such expense for OCBC Roboinvest).

However, Robo advisors like OCBC Roboinvest typically charge a platform fee which ranges from 0.4%-0.9%. OCBC deposit account has one of the highest platform fee charges among the local Robo advisors, coming in at 0.88%/annum (charged every month) based on investment portfolio under management. This fee is recurring in nature.

If the investment portfolio consists of ETFs, such as the newly created China Growth portfolio, then there will be an additional layer of expense ratios to be incurred by investors. For example, its China Growth portfolio consists of ETFs where the expense ratios are typically in the 0.6-0.7% region. Combined with the platform fees and the total cost of investing in these thematic portfolios could be easily 1.5-1.6%/annum. This is something like a fund of fund structure.

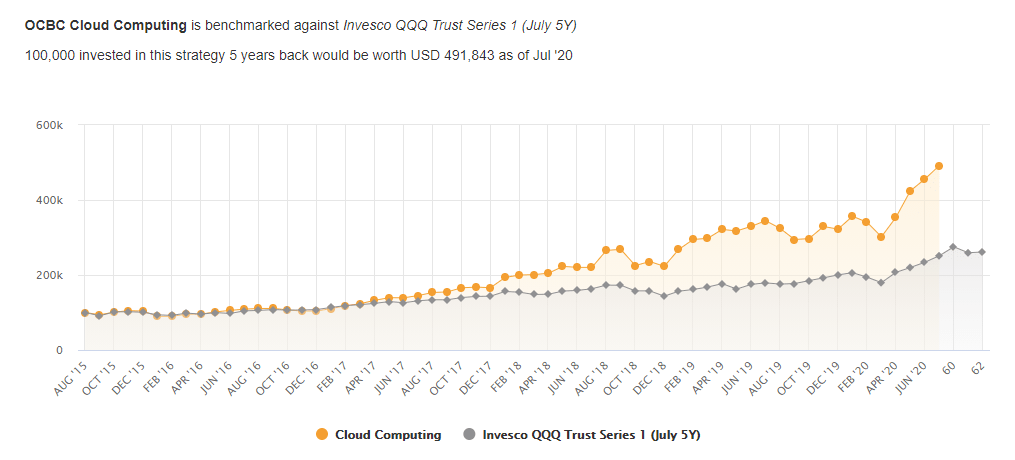

Well, if you are “guaranteed” annualized returns of 53.72% (1-year performance of the China Growth portfolio), I will happily pay that 1.6% annual portfolio cost!

The dividend withholding cost of 30% tax again is a common issue for Singaporean investors looking to buy into US-domiciled stocks/ETFs. However, as previously mentioned, these portfolios (unless they are high yield US portfolios) typically do not pay a high dividend yield.

An easy way to get started for new investors with low capital requirements

Based on my recollection (i might be wrong), OCBC Roboinvest used to have a pretty high initial investment threshold of S$3,500. This might be seen as a “barrier” for new investors who do not wish to invest such a huge amount but instead looking for a “dollar average cost” approach.

Investors can now get started with an initial capital of as low as USD$100 which is the minimum investment amount for many of its portfolios. This is an easy way for new investors to engage in a dollar-cost average approach.

Note that OCBC Roboinvest was not set up with the notion of “dollar-cost averaging” in mind. OCBC has another investment product: Blue Chip Investment Plan (BCIP) which is specifically for that purpose.

BCIP allows an investor to purchase in 17 share counters as well as 3 ETFs regularly with a low minimum capital outlay of S$100/month. On a cost basis, there are commission charges involved with a minimum fee of S$5 or 0.3% of the total investment amount, whichever is higher. However, there are no recurring platform fees of 0.88% for BCIP.

Unlike BCIP, OCBC Roboinvest is not a regular savings plan and customers can curate the timing of investing their funds. However, that is not to say that one cannot engage an RSP approach and set up standing instructions to fund your OCBC Roboinvest portfolio. But the actual purchasing process for recurring transactions will have to be done manually (more on this later).

DIY vs. OCBC Roboinvest

So should one be engaging on a DIY approach to thematic investing or use the OCBC Roboinvest platform?

The major pro for using OCBC Roboinvest over DIY is that the former helps you to rebalance your portfolio periodically to maximize your returns. This is a feature for all Robo advisors (not just OCBC Roboinvest). For example, assuming that your portfolio consists of 60% equity and 40% bonds, in a bull market, the equity ratio might increase to say 70% and portfolio rebalancing (to maintain the 60:40 ratio) will essentially mean that you are selling HIGH (equity) and buying LOW (bonds).

Done consistently over a long period (assuming the presence of volatility in all asset classes), this will tend to generate superior results over one that is not rebalanced constantly which might result in a substantial over-weight in one particular asset class.

The other benefit of OCBC Roboinvest is the ability to further “diversify” your portfolio across different funds vs. buying just 1-2 particular ETFs. However, that also means much higher cost as you will essentially be paying 2 layers of fees: platform fees and ETF expense ratio.

However, if you are selecting a portfolio that is vested directly in stocks (not ETFs) then there will just mainly be the platform fees to consider (exclude dividend withholding tax) which is currently at 0.88%. This cost will be pretty comparable with a DIY approach where the ETF expense ratio for such thematic funds is generally in the 0.6-0.8% arena.

You are thus paying slightly more for the benefit of portfolio rebalancing done by OCBC Roboinvest. OCBC Roboinvest’s portfolios that vest in stocks are generally equal-weighted, ie all the stocks in the portfolio, regardless of market cap, has the same portfolio weighting.

I will avoid paying dual fees when using OCBC Roboinvest (since returns are not “guaranteed”). I am generally indifferent between a DIY approach, buying 1-2 ETFs with expense ratios of 0.6-0.8% vs. purchasing a thematic portfolio comprising of stocks through OCBC Roboinvest and paying a 0.88% annual platform fee with the additional benefit of portfolio rebalancing.

How to set up your OCBC Roboinvest account

Setting up your OCBC Roboinvest account is pretty seamless if you already an OCBC account holder. Banks such as OCBC, UOB, and DBS have a slight advantage over other fintech Robo advisors when it comes to pushing out a financial product, in this case, an alternative investment option for “savers” to better deploy their savings since they are already on the platform. However, it doesn’t seem like our local banks are capitalizing on this advantage to be aggressive in capturing market share, which can be done through a lowering of their platform fees substantially.

If OCBC is offering its product at an uber-competitive rate of 0.4%, I am sure there will be many more investors jumping onto its thematic portfolio bandwagon. The “high risk” nature of their portfolios might however be a cause for concern.

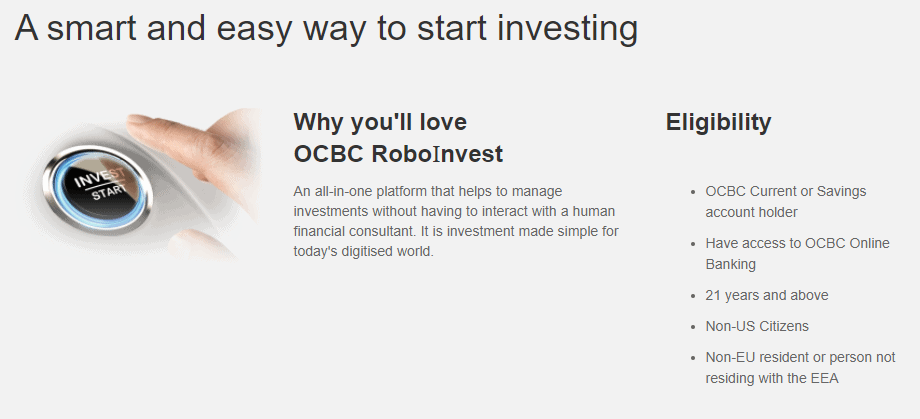

Step 1: Eligibility

Make sure you are eligible to sign up for OCBC Roboinvest

Step 2: Select a portfolio of your preference after inputting your investment experience

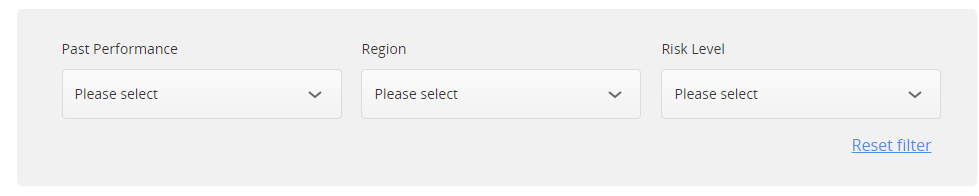

You can screen for the portfolios based on 1. Past performance, 2. region, and 3. Risk level. Do note that many of the portfolios are recently incepted and do not have a long track record. Neither is past performance representative of future performance.

You will be able to see different portfolios with the different risk profile, their general portfolio composition as well as the minimum investment amount. The minimum investment amount can be as low as US$100 to as high as SGD$60,000+ (mainly for the HKD-denominated portfolios)

Click into the individual portfolios to find out more information about the fund such as its past performance as well as detailed allocation and constituents.

Do take note if you are investing in a portfolio consisting of individual stocks (above) or ETFs (below). A portfolio consisting of equal-weighted stocks.

Investing in a portfolio consisting of ETFs will have an additional layer of recurring cost (ETFs expense ratio) on top of the 0.88% platform fee.

I notice that many of the “low-barrier” portfolios with a low minimum investment amount of US$100 are mainly vested in ETFs. This means that while it is a lot easier for a new investor to get started on its platform, the recurring cost will likely be double that of investing in a portfolio comprising of stocks.

For those looking to vest in Singapore stocks, the minimum investment starts from S$5,000.

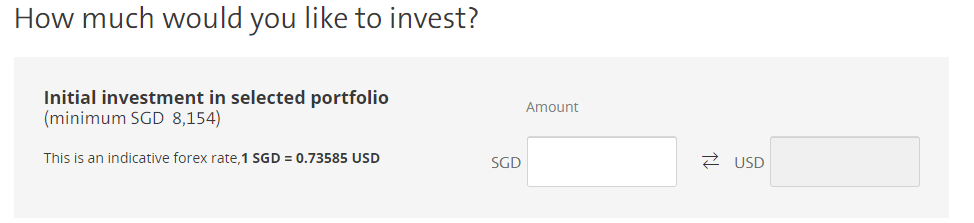

When you are ready to invest, click on the “Invest Now” button at the bottom and you will be brought to a currency conversion screen if you are investing in a portfolio denominated in a foreign currency other than SGD.

Fill in the amount (in SGD) that you will like to invest in the box.

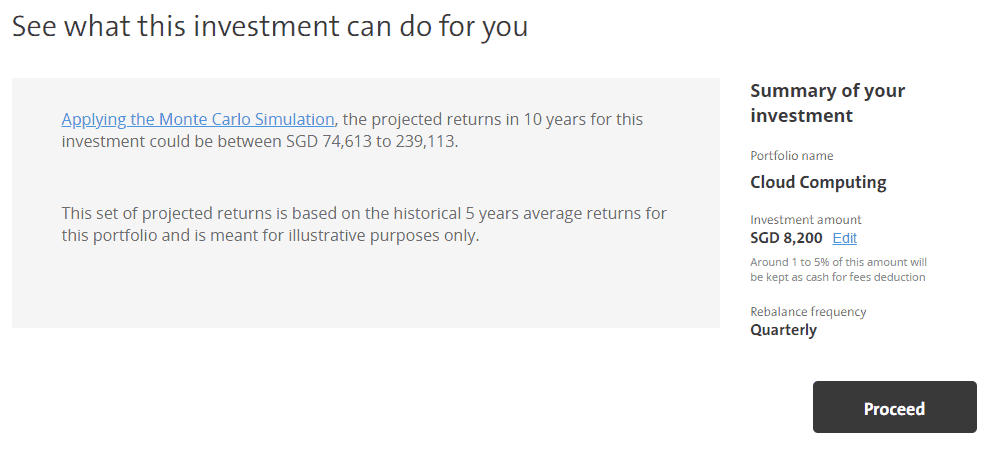

You will then be brought to a “projection” page where it will show how much that initial investment amount will become after 10-years, based on the Monte Carlo Simulation. Take the figure with a pinch of salt.

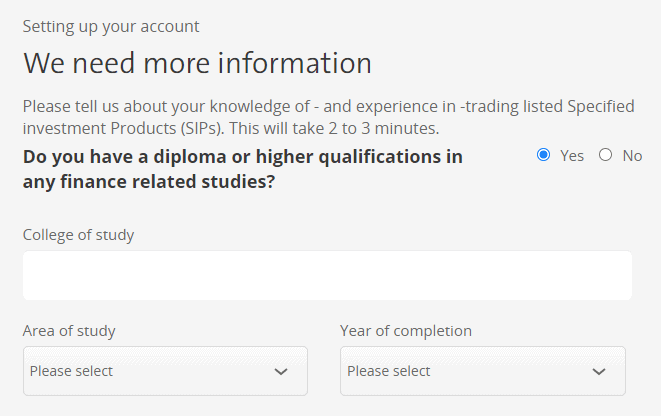

Step 3: Customer Account Review

You will then need to take 2-3 mins to fill up your personal information.

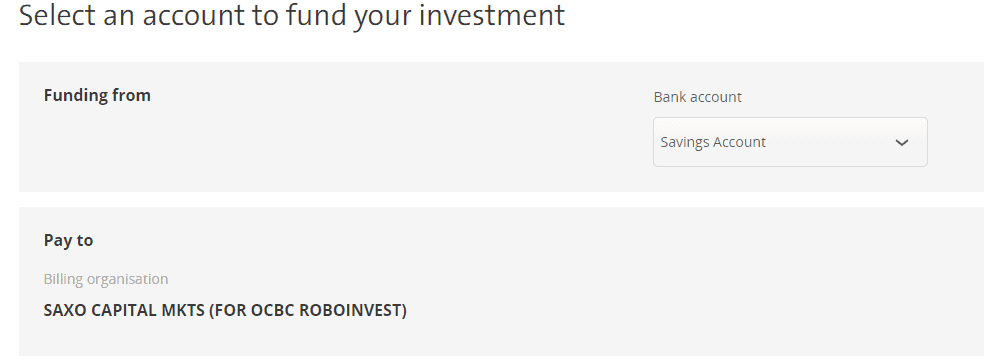

Notice that the billing organization is to Saxo Capital Markets. Saxo Capital Markets is the appointed custody and trades execution agent for all the investments through OCBC Roboinvest. Your assets will be held with Saxo Capital markets, an online trading and investment specialist which is a trusted custodian and a licensed subsidiary of Saxo Bank A/S.

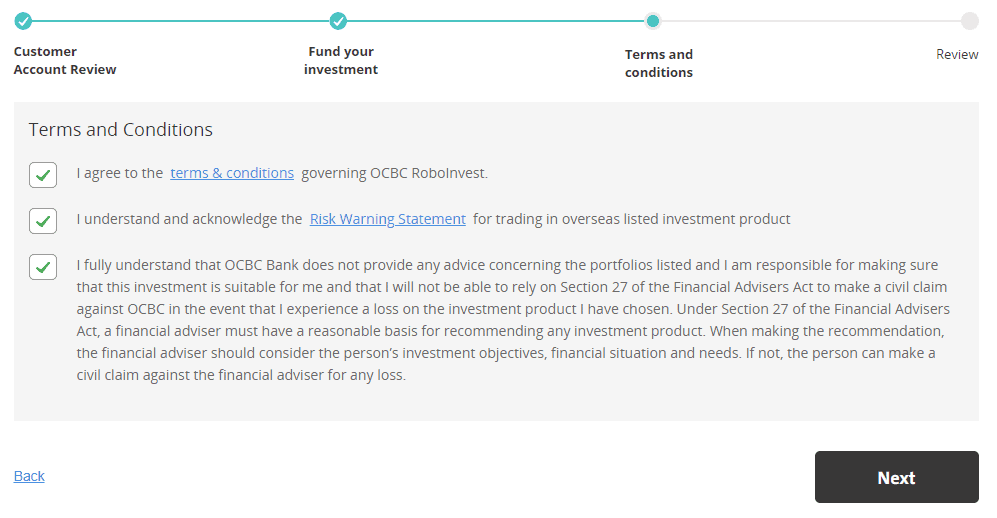

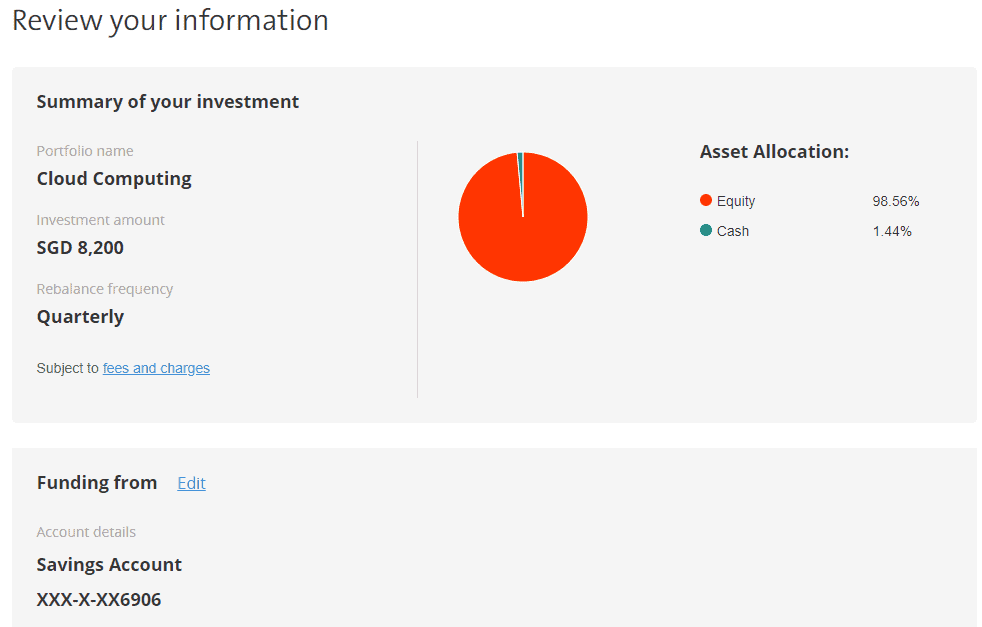

Agree to the terms and conditions and review your trade before confirming.

Wait for OCBC Roboinvest to invest your funds which might take 2-3 working days for deployment.

There you go, pretty easy and straight-forward.

Conclusion

OCBC roboinvest is a collaboration between OCBC and Fintech firm Planar Investments Pte Ltd (WeInvest) and is exclusively available only to OCBC customers.

However, do note that thematic investing is not for everyone. While OCBC Roboinvest also provides “traditional” type investment portfolios for its clients, I believe its unique proposition remains the availability of these thematic portfolios which make it easy for investors to partake in a particular trend/theme through digital banking access.

However, do note that such portfolios are generally high risk in nature and not suitable for conservative investors. However, for young investors looking to ride the long-term structural trends of certain themes such as Cloud Computing and the growth of the China economy, then this might be an interesting investing proposition for the long-term.

I will not be partaking in the low minimum investment portfolios made available by OCBC Roboinvests because of the dual fees involved which could raise annual recurring charges to approx. 1.6-1.7%. That to me is pretty sizable.

I will be giving its “high risk” Cloud Computing portfolio a shot (requires a minimum investment amount of US$6,000). This will require me to pay the recurring platform fees of 0.88%/annum.

However, it is also an easy way for me to partake in the 22 “cloud computing” companies that are vested in this portfolio, many of which I own on an individual basis as well, companies such as Fastly, Citrix, Crowdstrike, Twilio, etc. To be honest, many of these companies do not specialize in “cloud computing” in the narrowest of sense but a broad array of sub-sectors such as digital security, CDN, digital payments, etc.

At the end of the day, I believe the introduction of Robo-investing is a positive trend for investors here in Singapore. I hope that one day, our local Robo advisory services will evolve to a similar level to that of the fintech US Robo advisors, many of which provide an all-in-one platform that serves the personal finance needs of an individual.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- BEST ETFS IN SINGAPORE TO STRUCTURE YOUR PASSIVE PORTFOLIO

- LION-PHILLIP S-REIT ETF: SHOULD YOU BE BUYING THIS REIT ETF?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- THE IDEAL RETIREMENT PORTFOLIO STRUCTURE

- WHAT IS A REGULAR SAVINGS PLAN?

- CHEAPEST WAY TO INVEST THROUGH RSP. SHOW ME HOW.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.