Finding the best portfolio allocation strategies

Back in late 2020, I did a write-up on the Best Portfolio Allocation Strategies. For readers who are not familiar with portfolio allocation, it is the “ART” of investing in different asset classes to achieve proper diversification that fits an investor’s risk profile.

For example, investing 100% of your available capital into stocks can be considered “high risk” in nature vs. one that allocates 50:50 into stocks and bonds respectively. The latter’s portfolio can be classified as “moderate risk” with likely lower variability in terms of portfolio performances on a YoY basis.

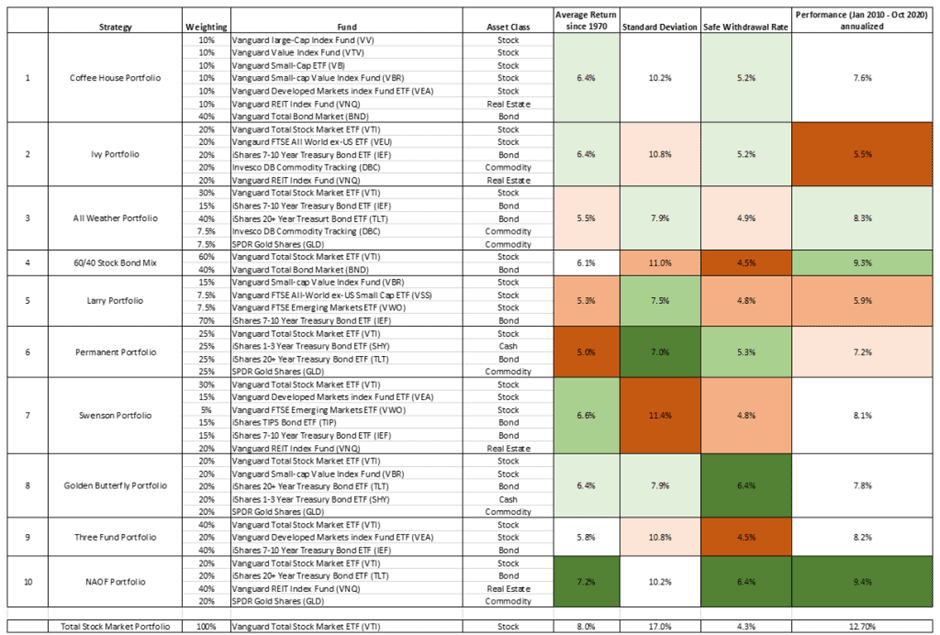

In that article, I highlighted 9 popular “widely adopted” portfolio allocation strategies and I included my very own NAOF Portfolio structure. The 10 portfolio allocation strategies are highlighted below.

- Coffeehouse portfolio

- Ivy Portfolio

- All Weather Portfolio

- 60:40 Stock bond mix Portfolio

- Larry Portfolio

- Permanent Portfolio

- Swenson Portfolio

- Golden Butterfly Portfolio

- Three Fund Portfolio

- NAOF Portfolio

A conclusion from that article was that the NAOF Portfolio managed to achieve not just one of the highest safe withdrawal rates at 6.4% (on par with Golden Butterfly Portfolio) but also managed to achieve the best-annualized performance from Jan 2010 to Oct 2020, clocking in at an annualized return of 9.4%.

On a long horizon basis based on returns stemming from 1970 to 2020, it achieved an average return of 7.2%, the strongest among all the portfolios in the list.

A summary table is shown below.

For those who are interested in how I derived the performances and the selection of the various ETFs that represent the corresponding asset class, you can refer back to the article in this link.

So how did the NAOF Portfolio perform in 2021 vs. the broader market as well as the rest of the portfolio?

Before I discuss the performances of the various portfolio allocation strategy, let me briefly highlight the various portfolio allocation strategies in this list.

For those who are already familiar with the above portfolio allocation strategies which are globally recognized as some of the best to achieve optimal portfolio diversification, you can skip the next segment and go straight to the 2021 performance reveal.

Portfolio Allocation Structure

Coffeehouse Portfolio

The Coffeehouse Portfolio was designed by Bill Schultheis, a financial adviser and co-founder of Soundmark Wealth Management. You can read more about it at his website The Coffeehouse Investor, and in his book by the same name.

The Coffeehouse Portfolio is hands-off investing; you make no changes to it apart from rebalancing once a year so the original portfolio allocation remains intact.

According to Bill Schultheis, there are three fundamental principles to successful investing:

Portfolio allocation: Having the right mix of securities in your portfolio.

Approximating the Stock Market Average: Not attempting to beat the market.

Saving: Choosing and maintaining a savings rate that matches your financial goals.

Portfolio allocation

10% Large Cap Blend

10% Large Cap Value

10% Small Cap Blend

10% Small Cap Value

10% International Stocks

40% Intermediate Bonds

10% REITs

Ivy Portfolio

The Ivy Portfolio attempts to diversify your money by dividing it into stocks, bonds, commodities, and real estate in a way that mirrors the Ivy League endowment funds.

It’s a way for individual investors to emulate the portfolio allocation strategies used by Ivy League Universities. The Ivy Portfolio doesn’t attempt to mirror every move the endowment fund makes.

That’s impossible. What is possible is to copy their portfolio allocation strategies.

Mebane T. Faber and Eric W. Richardson created the portfolio in the book, The Ivy Portfolio: How to Invest Like the Top Endowments and Avoid Bear Markets.

Meb Faber is the driving force behind this strategy.

Portfolio allocation

20% Total Stock Market

20% International Stocks

20% Intermediate Bonds

20% Commodities

20% REITs

All-Weather Portfolio

This portfolio is created by Ray Dalio, one of the most successful fund managers today. With such a catchy name, it is no wonder that the All-Weather Portfolio is one of the most popular portfolio structures today, with millions looking to structure this portfolio as a passive form of investing.

This portfolio’s single goal is to make money in all market conditions regardless of interest rates, deflation, what new pandemic is threatening our shores, or who the POTUS is. It does this by focusing on growth and inflation cycles.

According to Dalio, growth and inflation are all that matter. They are either up or down, and there are various combinations.

Growth is up; inflation is down. Growth is down, inflation is up, etc.

Portfolio allocation

30% Total Stock Market

40% Long Term Bonds

15% Intermediate Bonds

7.5% Commodities

7.5% Gold

Tony Robbins is a huge advocator of the All-Weather portfolio, highlighting this concept in his book: Money Master the game: 7 simple steps to financial freedom.

60:40 Stock Bond mix Portfolio

The Classic 60-40 portfolio is the ubiquitous portfolio allocation that serves as the benchmark in most portfolio discussions. Popularized by Jack Bogle — the founder of Vanguard who pioneered index investing — the Classic 60-40 portfolio has long been a staple of passive investors.

Other versions include varying the percentage by age, starting from 100. So if you are Age 20 today, your allocation to stocks should be 100-20 = 80%

Likewise, if you are 50 today, then you should have a portfolio structure that is 50% stock and 50% bonds.

A very popular strategy and understandably so, given its simplicity. However, in today’s low-interest-rate environment, there are concerns that the 40% bond composition will no longer be able to protect an investor from downside risks associated with a bearish market where the scope to further reduce interest rates to “stimulate the economy” is now greatly curtailed.

Portfolio allocation

60% Total Stock Market

40% Intermediate Bonds

Larry Portfolio

The Larry Portfolio is the name for a class of portfolios promoted by Larry Swedroe and Kevin Grogan in the book Reducing The Risk of Black Swans.

Mr. Swedroe suggests by tilting your portfolio to higher-risk asset classes that generate superior returns, you could hold less in stocks and more in safer investments (e.g., bonds).

Larry refers to it as a low-beta/high tilt portfolio.

Buy riskier stock funds, reduce your equity exposure, and decrease portfolio volatility. How?

Portfolio allocation

15% Small Cap Value

7.5% Int’l Small Cap Value

7.5% Emerging Markets¹

70% Intermediate Bonds

Take a look at the core components of the Larry Portfolio. How does a portfolio holding 70% bonds sound to you?

For some investors, 70% is the perfect mix, while others feel it’s too conservative.

This portfolio’s goal is to be both high performance and low volatility. It achieves its performance by tilting your portfolio to higher-risk stocks that are underpriced. Its low volatility is due to only holding 30% in stocks while 70% goes to bonds.

It’s a bit like a barbell strategy where you invest in two market extremes, both high and low-risk while avoiding the middle.

So how did such a portfolio perform? I will talk more about that later.

Permanent Portfolio

The Permanent Portfolio (PP) is a portfolio evenly split between stocks, bonds, gold, and cash. Harry Browne introduced the concept in his book, Inflation-Proofing Your Investments, in 1981.

Mr. Browne designed the portfolio to weather all economic conditions something like the All-Weather Portfolio.

So which is better? The Permanent Portfolio or the All-Weather Portfolio?

Just to give you guys a quick preview, the All-Weather Portfolio edges out the Permanent Portfolio based on average return since 1970 but the Permanent Portfolio has a lower standard deviation, ie less variability compared to the All-Weather

Portfolio allocation

25% Total Stock Market

25% Long Term Bonds

25% Cash

25% Gold

The even split between the above four categories makes it easy to model.

Gold, stocks, and bonds are volatile assets but can move independently of one another. The economic conditions will dictate their movements.

Browne suggests rebalancing annually to ensure your portfolio allocation doesn’t drift and maintains its efficiency.

Another quick preview: with 25% in cash, it is likely that this portfolio allocation structure underperforms the rest in the bull market of the last 10-years. We will find out more later.

Swenson Portfolio

David Swensen is the President and Chief Investment Officer of Yale’s endowment. Swensen, along with Dean Takahashi, invented The Yale Model.

He then wrote a book called Unconventional Success detailing how individual investors can mirror The Yale Model in their portfolios.

The final product is what’s known as the Swensen Portfolio.

He attempts to diversify it with a portfolio allocation combining the total stock market, international stocks, emerging markets, intermediate bonds, and real estate in the form of REITs.

Portfolio allocation

30% Total Stock Market

15% International Stocks

5% Emerging Markets

30% Intermediate Bonds¹

20% REITs

The Swensen Portfolio divides the bulk of its portfolio allocation between US stocks and Intermediate bonds.

Instead of investing directly in brick and mortar real estate, the Swensen Portfolio advises 20% to be put into REITs (Real Estate Investment Trusts).

International stocks make up a slightly smaller portfolio allocation at 15% of the total fund with emerging markets having a smaller slice at 5%.

While the long-term returns of the Swensen portfolio have been decent, it has the highest standard deviation across all the portfolios (except for the total market portfolio) and also one of the lowest safe withdrawal rates. More on that later.

Golden Butterfly Portfolio

Matching the high return of the Total Stock Market with the low volatility of the Permanent Portfolio, the Golden Butterfly is a home-grown Portfolio Charts sample portfolio that combines some of the best features of other portfolio allocations into a stable and efficient investment strategy for accumulation and retirement alike.

The Golden Butterfly is a small change to the All-Weather Portfolio. While Dalio is agnostic about the stock market, the Golden Butterfly skews toward prosperity. And for a good reason. Over time, there have been more times of economic growth than times of decline and recession.

Portfolio allocation

20% Total Stock Market

20% Small Cap Value

20% Long Term Bonds

20% Short Term Bonds

20% Gold

The portfolio allocation of the Golden Butterfly is not a popular one. Most of those in the world of personal finance don’t recommend gold as an investment although that investment thesis has now become more mainstream with the money printing press going out of control.

I have written about investing in gold as an inflation hedge.

Long-term treasuries are volatile for bonds and are at risk of losing significant value in the future. Small-cap value is controversial and value as a whole has been a big underperformer over the past decade.

So quite a number of unpopular assets comprise the Golden Butterfly Portfolio. Can its performance live up to its beautiful name in 2021? We shall find out later.

Three Fund Portfolio

The Three-Fund Portfolio by Taylor Larimore is an investing staple on the fantastic forums at Bogleheads.org. While the specific allocation percentages may vary by an individual investor, the one represented here is a good starting point.

Portfolio allocation

40% Total Stock Market

20% International Stocks

40% Intermediate Bonds

It’s a simple portfolio structure, something similar to that of the 60:40 equity to bond structure, with the key difference being that 20% has been allocated to international stocks. This provides a more diversified exposure.

One should however expect such a structure to generate pretty much similar returns to the 60:40 portfolio structure.

NAOF Portfolio

Last but not least, we have the NAOF structure which is introduced by me when I first wrote about it in this article.

The portfolio was created with retirement planning in mind and wasn’t meant to “outperform” the market.

It will however be ideal to have a portfolio structure that demonstrated the ability to consistently outperform the market in all market conditions while yet at the same time, “stable” enough to ensure that withdrawing x% each year to fund one’s retirement expenses will not disadvantage the retiree in terms of “selling at the low”.

The NAOF portfolio seems to fit that structure based on the conclusion then. It has a high safe withdrawal rate of 6.4% versus the 4% benchmark. Meaning that if you have got a $1m retirement portfolio at the start of your retirement journey, you can afford to withdraw out $64,000 per annum in your first year, and thereafter the annual withdrawal amount adjusted for inflation over a 30 years horizon and not risk running out of money.

$64k vs $40k. No brainer?

Portfolio allocation

20% Total Stock Market

20% Long Term Bonds

40% REITs

20% Gold

I previewed that the NAOF portfolio was the best portfolio allocation structure earlier. How did it perform in 2021 when the stock market performance has been nothing short of fantastic in a global economic environment cloud with uncertainties?

How did the various portfolio allocation strategies perform in 2021?

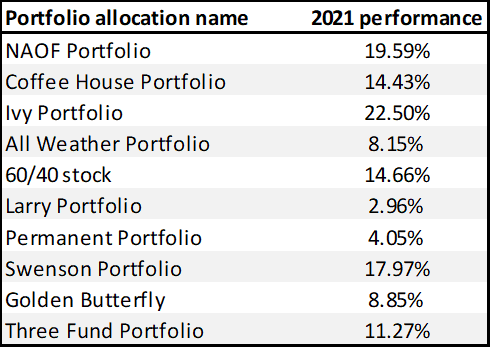

The honor of best portfolio allocation strategy in 2021 goes to Ivy portfolio, generating a return of 22.5% based on backtested data from portfoliovisualizer.

In second place is the NAOF portfolio with a 2021 return of 19.59% and in third place is Swenson Portfolio with a return of 17.97%.

The worst performing portfolio allocation structure is Larry Portfolio, understandably so given that 70% of the portfolio is allocated to bonds (and bonds did not fare well in 2021).

A very popular portfolio allocation structure, the All-Weather Portfolio only managed to generate a return of 8.15% in 2021, substantially underperforming the market as well as the other portfolio allocation strategies in this list.

The table below summarizes the performances of the 10 portfolio allocation strategies.

Why did the Ivy Portfolio and the NAOF portfolio did so well in 2021 whereas the Larry Portfolio and Permanent Portfolio lagged its peers and the general market so significantly?

Let’s do a quick analysis.

The Ivy Portfolio, as earlier mentioned, has a portfolio allocation as such:

20% Total Stock Market as represented by VTI ETF

20% International Stocks as represented by VEU ETF

20% Intermediate Bonds as represented by IEF ETF

20% Commodities as represented by DBC ETF

20% REITs as represented by VNQ ETF

Almost all components did well (stock and commodities heavy), with the exception of the intermediate bonds (IEF) which generated a return of -3.3% in 2021.

For the NAOF Portfolio, it has a portfolio allocation as such:

20% Total Stock Market as represented by VTI ETF

20% Long-Term Bonds as represented by TLT ETF

40% REITs as represented by VNQ ETF

20% Gold as represented by GLD ETF

The strong performance of the NAOF portfolio was predominantly due to its stock and REIT exposure while the long-term bonds and gold did not fair too well in 2021.

At the bottom of the pack, the Larry Portfolio has a portfolio allocation as such:

15% Small Cap Value as represented by VBR ETF

7.5% All-World ex-US Small-Cap as represented by VSS ETF

7.5% Emerging Market as represented by VWO ETF

70% Intermediate Bonds as represented by IEF ETF

Due to its heavy bond weightage (70%), the Larry Portfolio was the worst-performing portfolio allocation structure in 2021, a year where concerns over rising rates have generally depressed the performances of bonds.

The Permanent Portfolio has a portfolio allocation as such:

25% Total Stock Market as represented by VTI ETF

25% Short-term Bonds as represented by SHY ETF

25% Long-term Bonds as represented by TLT ETF

25% Gold as represented by GLD ETF

Given that 75% of its portfolio generally saw weak performances, it is understandable that the Permanent Portfolio allocation structure generated the 2nd lowest return in this list in 2021.

Conclusion

The NAOF Portfolio has done pretty well based on backtested results, both on a short-term (past 1-year), medium-term (2010-2020), and long term (since 1970).

While I have highlighted on numerous occasions the risk of rising inflation in 2022 negatively affecting stock returns, I believe the NAOF Portfolio, with its heavy concentration of REITs and Gold, both seen as inflationary hedges, will likely outperform the general market amid inflationary pressure (if that happens).

An investor looking to replicate the NAOF portfolio can purchase the highlighted ETFs (VTI, TLT, VNQ, and GLD) on a lump-sum basis using a low-cost brokerage firm such as Tiger Brokers or a no-cost brokerage firm such as TD Ameritrade.

The overall expense ratio of such a portfolio structure is just 0.16%.

Alternatively, they can look to dollar cost average into such a portfolio by manually purchasing individual counters on a monthly basis.

Syfe’s latest introduction “Syfe Trade” which allows fractional investing for investors with 5 free trades every month could mean that a beginner investor can possibly engage a DCA approach and purchase these 4 ETFs on a monthly basis with absolutely no commission costs. Do, however, note that platform fees charged by Syfe will still be incurred.

Syfe Robo Advisor

One of the more prominent Robo Advisors here in Singapore, Syfe Robo Advisor has been aggressively expanding its suite of products. Its latest Syfe Trade offering will see Syfe becoming the first neo-broker in Singapore

I will look to blog more about Dollar Cost Averaging using Syfe Trade when this function is made available to the public.

For investors who are interested to sign up for an account with Syfe, do check out the review I did on this popular Robo Advisor in Singapore as well as the various articles I have written on their product offerings.

Syfe Guide: Did Syfe’s ARI Algorithm outperform in today’s market volatility?

Syfe Select Review. Should you be investing in it?

Syfe Equity100 review: Does this portfolio make sense to you?

Syfe Review: Which of its portfolio offering will I select?

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only