Build an investment portfolio in 6-simple steps

Building an investment portfolio need not be a complicated affair. Neither is such an activity reserved for the wealthy.

In the first place, what exactly constitutes an investment portfolio, and how to build an investment portfolio that can withstand the test of time. We will be exploring more of that in this basic primer to get you acquainted with structuring an investment portfolio.

What is an investment portfolio?

An investment portfolio is a financial “jargon” in the investing world that refers to all of your invested assets. This can be broken down into the stocks, bonds, unit trusts, and cash (not exhaustive) that you own, etc.

While it might seem intimidating to build a portfolio, some steps can be taken to make this process painless. A simple solution nowadays is to engage the “service” of a Robo-advisor if you wish to have a “hands-off” approach (more on that later).

Whether you select a DIY approach or engage the service of a Robo-advisor, you can always follow these few simple steps to structure the investment portfolio that is uniquely you.

Steps to structuring your investment portfolio

Step 1: Understand your investment portfolio and risk tolerance

One of the most important things to consider when you build an investment portfolio for yourself is really to know yourself.

2 key things to take note of over here:

- What is your risk tolerance level

- How long is your investment horizon

These two factors go hand-in-hand.

Are you a risk-taker or someone who wishes to adopt a more conservative approach when it comes to investing? If you are a risk-taker, then theoretically you should not be overly concerned over the near-term volatility associated with the stock market. On the other hand, if the daily fluctuation of the market results in sleepless nights for you, then you should engage in a more conservative manner of investing.

As a young adult with a long investing horizon, you can also be more “aggressive” when it comes to your investing style. On the other hand, if you are someone approaching retirement, then it pays to be more conservative.

What would you do if your portfolio value declines by >20%? Are you able to still keep your cool or is that something that can never happen for your portfolio? Knowing how you would react to your portfolio drawdown is critical in structuring the right investment portfolio for yourself.

Step 2: Decide if you wish to Do-It-Yourself (DIY) or engage a more hands-free approach

After knowing about your risk profile, the next step is to decide if you wish to structure your portfolio or to leave the “heavy-lifting” to the professionals.

The easy way out is really to engage a low-cost Robo-Advisor to help you get started.

Robo-advisors are increasingly prevalent today and they are a low-cost, “all-in-one” solution to help you get started on your investing journey. They will take into account your risk tolerance and overall goals and help build and manage your investment portfolio, all in a single and easy-to-use platform.

When you select to invest using a Robo-Advisor, you would no longer be required to open your investment account or structure your investment portfolio based on asset allocation.

This will be done for you seamlessly through a Robo-advisor.

Additional Reading: Ultimate Guide to Robo-advisors in Singapore

Step 3: Open an investment/brokerage account

If you do wish to take the more “adventurous” route and DIY the creation of your investment portfolio, then you would need to first open an investment account or brokerage account that allows you to purchase the different investable assets (stocks, bonds, ETFs, commodities, unit trusts)

There are not that many brokerage platforms out there that allow one to purchase the different asset classes using one single platform, particularly when it comes to bond investing, which typically has a minimum investment criterion that is “out-of-reach” for the man-in-the-street.

However, a retail investor can now easily partake in bond investing through Bond ETFs, an investment product that trades just like a stock (more on that later).

With the advent of many low-cost or no-cost fintech brokerage firms such as Tiger Brokers, Moo-Moo, etc here in Singapore, investing is no longer an activity that is reserved for the wealthy.

The table below illustrates the commission costs for the various brokerages here in Singapore. For a more detailed write-up on the best stock brokerages here in Singapore, one can refer to the link below.

Additional Reading: Best Stock Brokerage in Singapore

Step 4: Know the type of investment assets and their associated risks

Different assets have different risks associated with them. For example, purchasing individual stocks typically entails the highest risk. One might “partially” mitigate the impact of individual stock purchase by buying a basket of stocks through an ETF.

Additional Reading: Stocks vs. Bonds vs. ETFs vs. Mutual Funds. A Beginner Primer

Bonds are an investment class that is typically less risky than stocks and has historically been a useful asset class to help hedge against a market sell-off. During a market sell-off, investors tend to switch their stock/equity holdings into the safety of bonds.

The decline in equity value in one’s investment portfolio will be partially mitigated by the increase in its bond value.

A more conservative investor will tend to have a higher percentage of their portfolio vested in bond holdings vs. stocks.

As previously mentioned, a retail investor can now easily invest in bonds through bond ETFs.

Other common investment asset classes include commodities which one can also easily partake through ETFs.

Step 5: Determine your “ideal” asset allocation

If you decide to engage in a hands-free approach through a Robo-advisor, then this step is usually “pre-fixed” for you based on your risk profile.

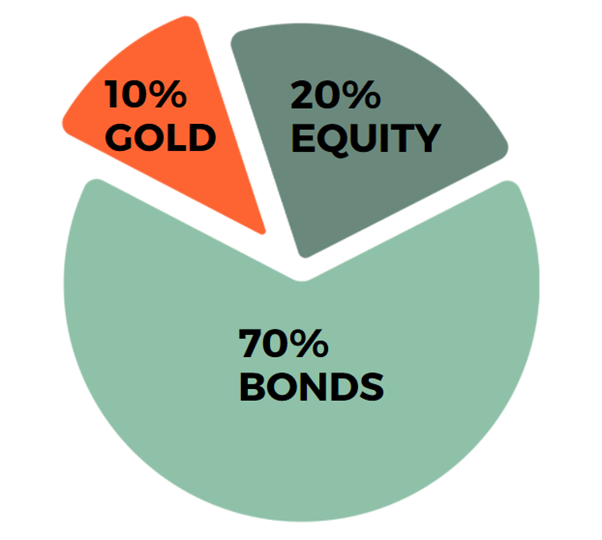

For example, if you are seen as a conservative investor, then you might be advised to structure your investment portfolio based on the below asset allocation:

Equity: 20%

Bonds: 70%

Commodity: 10%

On the other hand, if you are seen more as a risk-taker, then your ideal asset allocation might be as such:

Equity: 60%

Bonds: 20%

Commodity: 20%

Note that the asset allocation (with the Robo advisors) can always be altered as your risk profile changes along the way.

A DIY approach might entail more planning. First, decide how much you wish to allocate to your Equity, Bond, and Commodity pie. This again comes down to your risk and age profile.

A general rule of thumb when it comes to asset allocation is to subtract your age from 100 to determine what portion of your portfolio should be dedicated to stock investments.

For example, if you are 40, these rules suggest allocating 60% of your portfolio to stocks, leaving 40% to be allocated to your bond and/or commodity investments. If you are in your 60s, then your equity/bond mix should then be 40/60 instead.

Let say you have decided to allocate 60% of your portfolio to your equity pie and the remaining 40% of your portfolio to your bond/commodity pie.

For the equity portion (60%), decide how much should be done passively (through an index ETF perhaps) and how much should be done more actively through the selection of individual stocks.

For a new beginner, I would suggest not having more than 10% of your portfolio allocated to Active Investing.

The final breakdown of your investment portfolio could be as such:

Individual stock selection aka active investing (10%)

Index investing through ETFs aka passive investing (50%)

Bond investing through ETFs (30%)

Commodity investing through ETFs (10%)

At the end of the day, there is no hard and fast rule when it comes to your asset allocation profile. If you are starting from scratch, it can be helpful to look at model portfolios to give you a framework for how you might want to allocate your assets.

Additional Reading: Unveiling the best portfolio allocation structure

Step 6: Rebalance your investment portfolio as needed

If you are investing “passively” through a Robo-advisor, the rebalancing will typically be done automatically for you, usually on a bi-annual basis. The purpose of re-balancing is to keep your asset allocation in check.

For example, a strong equity market performance might result in your equity holdings now encompassing 70% of your portfolio vs. your original ideal asset allocation ratio of 60%. Re-balancing will mean selling your equity holdings and buying bonds to bring the asset allocation back to the original and ideal level of 60:40.

If you are engaging a DIY approach, then you might wish to rebalance your portfolio at set intervals, such as every 6 or 12 months, or when the allocation of one of your asset classes shifts by more than a predetermined percentage, say 10%.

Using the example above, if your equity holdings appreciate to account for 70% (from the original level of 60%) of your portfolio holdings in an equity bull market, you might wish to sell some stocks and reinvest them into other asset classes (bonds) until your portfolio is back to its original asset allocation ratio.

Conclusion

This is a simple 6 steps process to structure an investment portfolio that can withstand the test of time.

A new investor might choose to “outsource” the process to a Robo-advisor to do the “heavy-lifting” for them, engaging a disciplined dollar-cost averaging approach to building up one’s investment portfolio.

For the more adventurous folks who wish to DIY, it is not all that difficult to structure your portfolio based on the different asset classes. This can usually be achieved passively through index ETFs.

For Singaporean investors, I have previously written an article to highlight the Best ETFs in Singapore to structure your passive portfolio. One might wish to consider such an asset allocation setup. Alternatively, one might also wish to check out this article which highlights the best portfolio allocation structure.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Dollar Cost Averaging vs Lump Sum Investing. Which is more suitable for you?

- Stocks vs Bonds vs ETFs vs Mutual Funds: A Beginner Primer

- 4 Most Favoured Types Of Investment In Singapore For Inflation-beating Returns

- Cash Secured Put: Generating passive income the right way

- 4 Steps to understanding your Investment Time Horizon

- Beginners Guide to CryptoCurrencies and how to get started in 2021?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.