Investor Education Series: Short Squeeze

[Update Jan 2021] This is an updated post with the original post first written in November 2020, where I highlighted to NAOF readers some of the most shorted stocks in the universe and how to possibly profit from a powerful phenomenon known as a short squeeze. The list of short squeeze stocks has also been updated as of Jan 2021.

Some stocks such as Wynn Resorts (WYNN) spiked 28% in a single day, Live Nation, which owns Ticketmaster soared 15% higher, AMC Entertainment (AMC), the movie theatre chain, skyrocketing 51%. These aren’t your typical market leaders but are some of the worst performers of 2020 as their core businesses have been directly impacted by COVID-19.

So, it comes as no surprise that when Pfizer came out with positive vaccine news, these stocks were the first to rally. But the Pfizer vaccine is likely only half the story. The moves in these stocks wouldn’t have been so explosive if not for a powerful market force.

That powerful force is called a “short squeeze”. And that is a phenomenon unique to some of the most shorted stocks today.

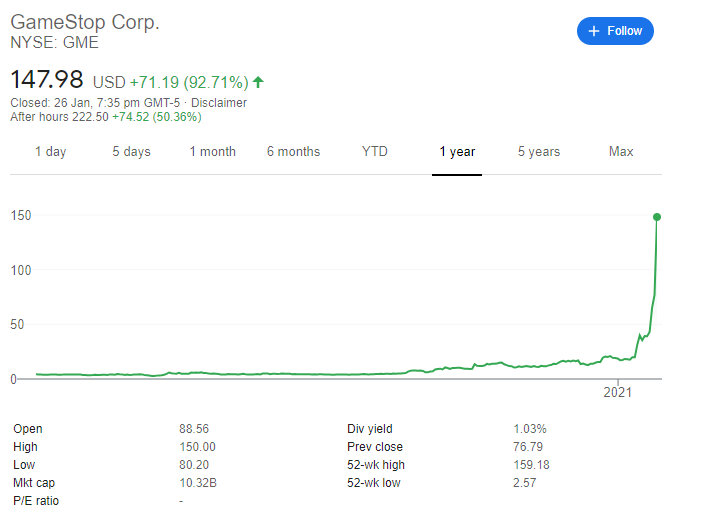

The most famous example in today’s context is the highly controversial stock called Gamestop (ticker: GME) which has been the target of short-sellers for years. Let me briefly detailed what exactly happened to the stock which triggered the strong share price appreciation since the start of 2021.

What happened to Gamestop?

If that is not a parabolic share price chart, then I don’t know what is! Gamestop has been a highly controversial stock for years, having its fair share of both bulls and bears. The most prominent supporter of the stock is Michael Burry, the man who is better known as “The Big Short” investor who gain prominence for shorting the US housing market back during the GFC crisis.

Gamestop’s share price has been slowly appreciating since 2H20 but it was only at the start of 2021 that the upward momentum gained traction.

On 11 Jan 2021, Gamestop noted that it has signed an agreement with Ryan Cohen’s RC Venture LLC, appointing the Chewy.com founder and two other e-commerce veterans to its board as the ailing videogame retailer doubles down on digital sales.

That started the whole momentum going, with the stock hitting a record high level of $30+ not seen since 2016. That positive momentum kept on going, likely bolstered by short covering (more on that later) but it was not until Jan 21/22 when its share price went “bonkers” as a result of a group of retail investors.

This group of retail investors stemmed from the Reddit community, particularly those from the community chat group called WallStreetbets. With much of wall street betting against the counter (highly shorted stock), they attempted to band together and force a rally by creating demand that did not exist in the past.

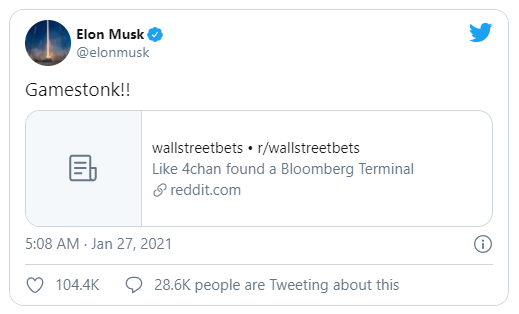

This kept going on for the past week, with Elon Musk and fame SPAC investor Chamath chipping in with twitter postings

That added oil to the fuel and as a result, Gamestop’s share price popped 93% yesterday on 26 Jan 2021 and looks to increase that by another 50% based on its pre-market price.

Talk about insanity! That is exactly what can happen when you combine highly shorted stocks + retail investors flushed with cash from stimulus efforts. This is likely the first time that retail investors are “in-control” vs the big boys.

Before I elaborate on how one can profit from the most shorted stocks (which are the stocks?) in today’s context, let’s talk a little about short selling.

What is short selling?

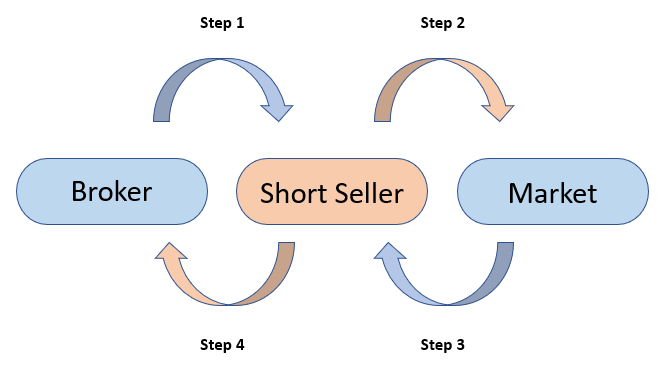

Short selling is simply selling a stock that you do not own, betting that the value of the stock will fall so that you can buy it back at a lower price.

Step 1: Short Seller borrows a stock from the broker

Step 2: Short-seller immediately sells the stock on the market

Step 3: Short-seller buys back the stock from the market

Step 4: Short-seller returns the borrowed stocks to the broker.

Such action will incur borrowing cost and that cost is what “incentivizes” actual shareholders of the stock to lend their shares out.

It is a little ironic that the shareholders of a particular stock counter might be their own “worst enemy” when they lend out their shares for a 6-7% annualized returns (could be much more) to short sellers.

The latter in turn sell those shares which they had borrowed in the market, creating a downward force and this downward momentum might become “self-sustaining” once technical traders and chartists pile into the “short” action upon the breaching of a key support level.

Without the availability of shares (to short), it will be much more difficult for a short seller to engage in short selling through the usual route.

At the end of the day, short selling is done to profit from a decline in the share price of a counter.

However, short-sellers would have to close off the trade at some point in time and when they do so, they must always buy the stock back.

That is where the opportunity comes in (as we have seen in the GME example)

What happens when a short trade goes wrong?

When a shorted stock spikes, short-sellers, many of which are opportunistic traders, often scramble en masse to buy back the stocks which they have sold earlier.

This forced buying can put intense pressure on a stock to rise. If the buying pressure is strong enough, it ignites what’s known as a “short squeeze” which can often lead to shares appreciating by 20%,30%,40%, or bigger gains in as little as a single day.

Historically, short squeezes have produced some of the most explosive moves in the stock market.

I mentioned a few just now, stocks such as AMC, whose core business has been substantially impacted due to the closure of movie theatres have been heavily shorted before the announcement of the vaccine by Pfizer. The same goes for Wynn and Live Nation (which organizes concerts)

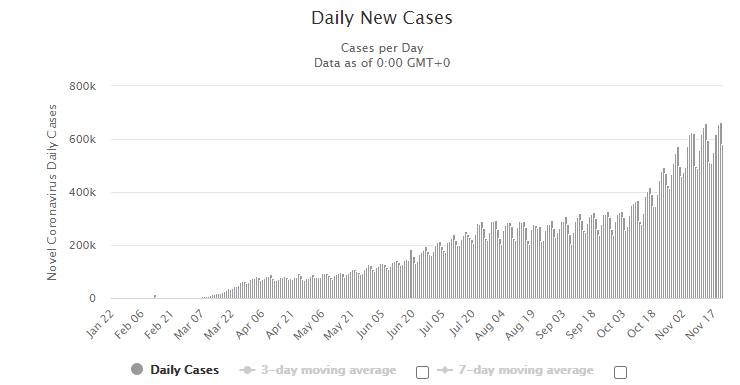

These stocks are “hated” by the market and rightfully so. Their core businesses have been decimated and there is no telling when their operations will be back to normal as the US now faces a “second wave” of COVID-19 spread.

News of the vaccine however gave the market “hope” that things will be back to normal soon enough and that caught the traders who were shorting these stocks off-guard.

The result: A tidal wave of forced buying which resulted in monstrous rallies in the blink of an eye.

So, should one be BUYING into some of the most hated stocks today in-lieu of a potential “short-squeeze” tomorrow? Let’s take a look.

Prime short squeeze candidates

Not all stocks are made for prime short squeeze candidates, or at least not in my view.

There might be multiple reasons why a stock is heavily shorted.

Two key reasons come to mind: 1. Weak Fundamentals and 2. Over-Valuation

Weak Fundamentals

Let’s take for example the above consumer-discretionary stocks I just mentioned. With the second wave of COVID-19 in play and infection rates at ALL TIME HIGH (seems to be the case every time I take a look at the infection stats, with the mortality rate creeping higher as well) it is hard to imagine how the fundamentals of these stocks might improve.

Should we be expecting clear skies anytime soon? Airline counters and airline-related stocks such as those here in Singapore (SIA, SATS) have essentially brushed off the “negativity” relating to the fact that air travel might not be back to normal anytime soon, with their share prices appreciating substantially over hopes that the announcement of a vaccine success will translate to a “back-to-normal” flying environment soon.

Wishful thinking perhaps? Many of these stocks might see a second wave of selling when the euphoria dies down. The delay of the SG-HK air travel bubble by 2-weeks, if further extended or canceled, might result in a sell-down of these air-travel related stocks.

Some might argue that these stocks “won’t die”. The government will come to their rescue because they are of national interest. Yes, a valid reason but these companies can also be “nationalized” at rock bottom prices when the going gets tough, essentially wiping out the share ownership of minorities.

I am not implying here that SIA or SATS are bad investments. They might be great long-term buy candidates at the right price.

When it comes down to being “short-squeeze” candidates, they are not my ideal trades. However, that is not to say that one cannot profit off short-term opportunistic short squeeze actions on these counters when executed at the right time.

I will further elaborate on this in the segment: How to screen for good short-squeeze candidates.

Over Valuation

Many stocks are being shorted because they are viewed as over-valued. Stock such as Zoom has been heavily shorted before COVID-19 due to its lofty valuation (before it became loftier as a result of COVID-19).

For example, in this Forbes article, it was highlighted that Zoom has 41% of its shares sold short back in Nov 2019. However, that article also highlighted 4 reasons as to why such a heavily shorted stock might also be a buying opportunity.

We all know what happened to Zoom shares since then.

As a result of COVID-19, Zoom’s growth prospect got a huge boost and consequently, the share price rallied “like crazy” as the counter benefitted from the short squeeze phenomenon.

Truth be told, Zoom still looks like an over-valued counter from traditional financial metrics but that seems to be the last thing on investors’ minds.

So, are “over-valued” stocks better short squeeze candidates? When we talked about overvalued stocks, counters such as Fastly, Cloudflare, The Trade Desk, Shopify, your typical SAAS plays, comes into mind. Counters which are priced “richly” despite zero/min profits. If combined with “heavy shorting”, will they become great short squeeze candidates?

I do think that in today’s context where growth seems to take precedence in investors’ minds, over-valuation has become rather “subjective” as long as the counter in question remains a strong sales/earnings grower.

Therefore, my ideal short squeeze plays are those which have a strong robust business model that can continue to prosper “come-what-may” concerning a second-wave of infection and whose business model is structured to ride certain themes with a long-growth runway. In this case, it is not just an opportunity for quick profits but an opportunity to get in on the ground floor of a rally that could last months or even years.

Valuation thus becomes a secondary issue.

However, identifying these overvalued, short squeeze stocks with a strong business model that has a long runway of growth is often not a simple task. It is more than just looking at a few financial ratios but also evaluating qualitative metrics such as the company’s leadership, presence of economic moats, such as network effect, etc.

Before I talk about how to potentially profit off short squeeze candidates, let me first disclose my preferred trading method here.

Using options to structure such trades

I do note the high-risk nature in trading these short squeeze candidates and that is why, IDEALLY, I prefer to limit my overall capital exposure by using options or call options specifically.

Purchasing call options will just require a fraction of the capital outlay (5-10% perhaps) vs. stocks and one’s losses will be well-defined.

There is some element of “gambling” here with the selection of long date-to-expiration (DTE) Out-of-the-money (OTM) options. On one hand, heavily shorted stocks can remain heavily shorted for a relatively long period, and thus I will need to structure a longer duration contract. While I pay more for time value, the low theta decay of the option works in my favor.

On the other hand, I also wish to limit my capital outlay, hence the selection of OTM call options which are “cheaper”, as long as I am comfortable with “losing it all”.

The combination of a long-DTE OTM call option will be my preferred trading platform to bet on a potential short-squeeze candidate that can see your returns increase multiple-folds.

However, a word of caution. Many of these short squeeze candidates do not have high liquidity in the options market and might not be the right candidates for using options for the additional leverage effect.

How to screen for good short squeeze candidates

There are many websites out there that provide one with information on stocks that are heavily shorted.

There are a couple of key metrics to look at:

- Shorts as a % of free float

This is the key metric to screen out for heavily shorted stocks. Typically, stocks that have more than 10% shorts as a % of free float is considered a heavily-shorted stock. The higher this percentage is, the more short-sellers there will be competing against each other to buy the stock back if its price starts to rise.

For example, the outstanding number of shorts on American Airlines Group (AAL) is approx. 49.3% (an extremely high number) of its outstanding share base. With total outstanding diluted shares of 509m, this means that there are c.240m shares that are being sold short on AAL.

- Short interest ratio

The second key metric to screen is the short-interest ratio. This ratio represents the number of days required to cover all short positions based on the average trading volume. The higher the ratio, the higher the likelihood short sellers will help drive the price up.

Again, using AAL as an example, the counter has a short interest ratio of 2.8 which means it takes slightly less than 3 days to close off all the outstanding short positions on AAL, based on the average daily traded volume on the counter.

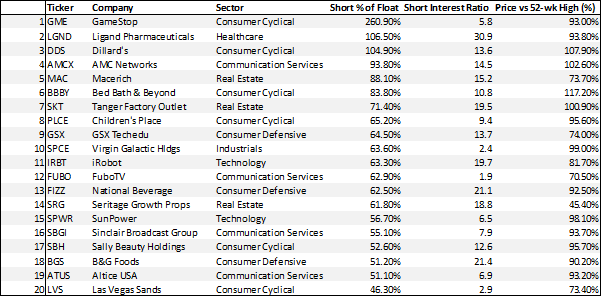

The table below shows some of the most shorted stocks, ranked based on shorts as a % of free float. No prizes for guessing who is No.1 on literally the “short” list.

Many of the most heavily shorted stocks are currently trading near their 52-weeks high, evident of a short squeeze in effect. if you ask me, it is quite ridiculous, with many of these stocks lacking the fundamentals to justify their current share price.

Well, one might say “to hell with fundamentals” to put it bluntly. Let the short squeeze party continue!

Stocks like Dillard’s, Bed Bath & Beyond, Tanger Factory Outlet are currently prime targets for a short squeeze, based on their high short % of float ratio.

Below I detail how to better screen for short-term opportunistic short squeeze stocks.

Short-term opportunistic short squeeze stocks

For a good short-term opportunistic short squeeze trade, I will like to select stocks where the shorts as a % of free float ratio is more than 20% and the short-interest ratio is typically more than 10.

I will also combine these metrics along with its current price vs. its 52-week high price. When a counter’s price is within 90% of its 52-week high price, there is a possibility that the short-sellers will start to panic and begin buying back their shorts in the market en-masse for fear that the moment the stock breaches its 52-week high mark, technical traders will start buying into the shares and pushing it up even higher.

While most public free websites that provide short interest in stocks will show you the two key financial metrics (1. Shorts as a % of free float and 2. Short interest ratio), it will not allow you to easily screen out for stocks that are trading within 10% of its 52-weeks high.

![Most Shorted Stocks: A smarter way to play the Short Squeeze game [Update Jan 2021] 1](https://newacademyoffinance.com/wp-content/uploads/2020/11/stock-rover-2-1-1024x570.png)

Stock Rover

An All-in-one Fundamental Stock Screener that EVERY serious investors should have in their investing arsenal.

This is my GO-TO Stock Screener for evaluating US stocks and ETFs

For that, I use the Stock Rover template which allows me to easily customize such information and screen out for stocks that meet my specific criteria:

- % of free float ratio > 20%

- Short Interest ratio > 10

- Within 90% of its 52-week high level

Based on the stock rover screener, there are currently 28 companies that meet these criteria and they are shown in the table below – ranked by short % of float (Updated as of 27 Jan 2021)

![Most Shorted Stocks: A smarter way to play the Short Squeeze game [Update Jan 2021] 2](https://newacademyoffinance.com/wp-content/uploads/2021/01/image-41.png)

These are stocks that have a higher probability of spiking even higher because of a short squeeze as the short-sellers rush for the exit when the price breaches the 52-week high level.

There are a few interesting candidates on my watchlist. They are Ligand Pharmaceuticals, National Beverage, B&G Foods, 1-800-Flowers.com, and Qualys.

An alternative method for short-term short squeeze trades

Another method which I use to identify short term opportunities is by combining the screening results of Stock Rover with that TradersGPS, a proprietary platform used in the Systematic Traders Program.

![Most Shorted Stocks: A smarter way to play the Short Squeeze game [Update Jan 2021] 3](https://newacademyoffinance.com/wp-content/uploads/2020/11/tgps-2-1.png)

The Systematic Traders Program

An investing course that is voted as the Best Investing Course by Seedly reviews, the Systematic Traders Program uses the proprietary platform, TradersGPS which tells you WHAT stock to buy, WHEN to buy and HOW much to buy.

First, I continue to screen for short squeeze candidates based on Short % of free float > 20% and Short Interest Ratio > 10. Once I get that list of stocks, I will import it into the Traders GPS platform to identify stocks that might be in the early stages of trending higher.

This might be a better “solution” compared to only buying these short squeeze candidates near their 52-week high level.

For example, DISCA is a stock that has been screened out by Stock Rover as a potential short-term short squeeze candidate. While not being anywhere near its 52-week high level at present, the TradersGPS system has identified it to be an early potential long candidate. The upward momentum of the counter might gather steam when a short-squeeze does take place down the road.

Long-term opportunistic short squeeze trades

These are my ideal short-squeeze trades and such trades, when successful, can last for many months or even years. However, it is a lot more difficult to identify these counters beyond the fact that they are also heavily “shorted” and ‘disliked”.

These are the ones that look over-valued on the surface based on traditional financial metrics but whose business model is prime to benefit from the long-term structural trend that is already set in motion.

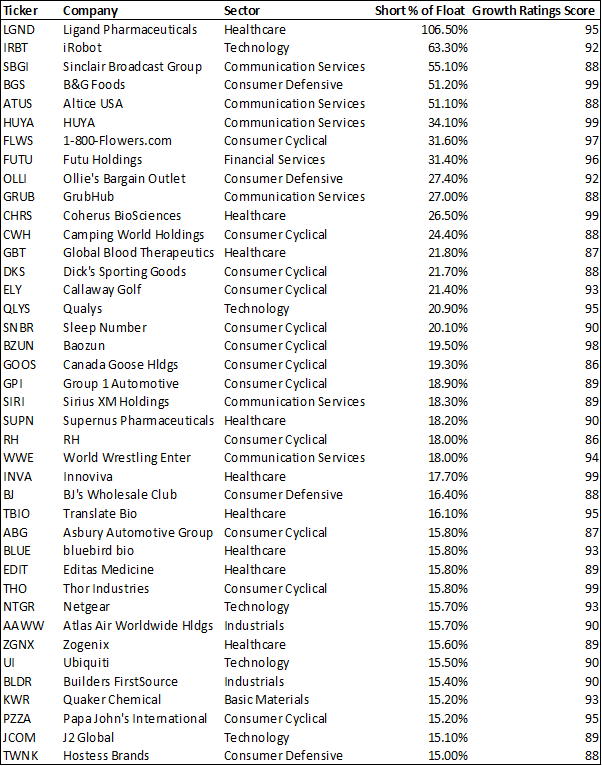

Compared to the short-term trades, I will lower the Short % of free float criteria to “just” > 15% which will broaden my list of stocks selection.

Next, I will look at identifying stocks that have strong earnings growth potential due to exposure to a certain theme that has a strong structural growth outlook.

For example, I use Stock Rover’s proprietary Stock Rover Growth metric. This proprietary algorithm compares a company to its peers and considers the consistency of key growth metrics as well as their direction of change.

Based on the selection criteria of Stock Rover Growth metric > 85, I screen for some of the most heavily short stocks with good growth prospects as identified by Stock Rover.

Consumer cyclical and technological stocks make up for the bulk of the selection list. (Updated on 27 Jan 2021)

Some interesting candidates in this list which I personally own includes iRobot (which recently saw a substantial jump in its share price as a result of good results), HUYA (the subject of merger arbitrage), Futu Holdings (a counter which I recently highlighted in this article), Qualys (a company in the cybersecurity business), Baozun (saw a huge pop yesterday on the back of a collaboration with iClick) and RH (luxury home furnishing company with good fundamentals).

Conclusion

I hope that I have provided some ideas as to how one might find good short and long-term short-squeeze candidates on some of the most shorted stocks in the market.

Short term candidates are typically easier to screen for and select and I have shown you how to do it using 3 screening criteria.

Longer-term short squeeze candidates will likely require more work, not so much in terms of the screening process but the due diligence needed to assess if a company’s qualitative metric is one that will position it to succeed in the long-term. Using a fundamental platform like Stock Rover eases the selection process through its proprietary Growth rating system which can easily screen out for stocks that exhibit high growth momentum.

Interestingly, while these longer-term short squeeze stocks are currently the most “hated” bunch, they have significantly outperformed the S&P 500 index recently (1,3 and 6 months) as well as over the longer-term horizon (1, 2, 5, and 10 years).

Do note that partaking in such trades is of a higher-risk nature and one should always be mindful that the potential losses could be significant if the short sellers are right after all.

I believe the methods I detailed above are smarter ways to play short squeeze trades vs. blindly following the reddit traders.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- 8Best Stock Brokerage in Singapore [Update July 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Most Shorted Stocks: A smarter way to play the Short Squeeze game [Update Jan 2021]”