Market Correction: Is the sky falling again in 2022?

The sky is falling “yet again” as the stock market experience its first significant market correction in 2022 with the S&P 500 declining by almost 2% and the Nasdaq tanking 3.3% last night (5th Jan) as meetings from the Fed spooked the market.

Minutes from the latest Fed meeting suggest that the US central bank might start increasing rates at an earlier and faster pace, in addition to a quicker start to normalizing the central bank’s balance sheet.

The Fed’s balance sheet is currently close to $9trn. They are not looking to just “taper” but to potentially “ween off the drug” that has been keeping it afloat since GFC. Easier said than done in my opinion.

The earlier guidance from its 15 Dec meeting was for 3 rate hikes in 2022, followed by another 3 rate hikes in 2023. After months of describing pricing pressures as “transitory”, the Fed dropped the term and spooked investors with new concerns just as a new variant of COVID-19 emerged.

Fed Chairman Jerome Powell shifted his tome to emphasize the ongoing pandemic’s risks to inflation, via ongoing supply-chain issues.

At the risk of sounding like a naysayer and the bearer of bad news, I have consistently written about inflationary issues being the stock market’s party pooper on numerous occasions. Just a couple of days back, I wrote about beating inflation in 2022 with some simple stock strategies.

Other articles/videos on the inflation topic which I have previously written include:

Inflation: Don’t ignore this silent retirement killer

Inflation at 5% in May 2021. Transitory or a structural problem?

Is inflation going to be transitory? What are some tools to hedge against inflation?

Best ETFs in Singapore to structure your Inflation-proof passive portfolio

Pricing Power: Stocks that can do well amid inflation concerns

Stagflation Investing: How to position your portfolio

The last article in this list which talks about stagflation is probably the worst-case scenario for the market.

This is a scenario where pricing is running wild (to the upside) while the economy is deflating. This is unlike the base case scenario at present calling for steady global economic growth in 2022.

While I am not implying that stagflation is DEFINITELY on the cards, it is better to be safe than sorry and be prepared for this “black swan” scenario. Check out that article if you wish to hear my thoughts on positioning your portfolio for such an event.

In light of yesterday’s drastic market sell-off triggered by the Fed’s hawkish speech, which are the industries that have remained “above water”?

“Defensive” stocks amid the market meltdown

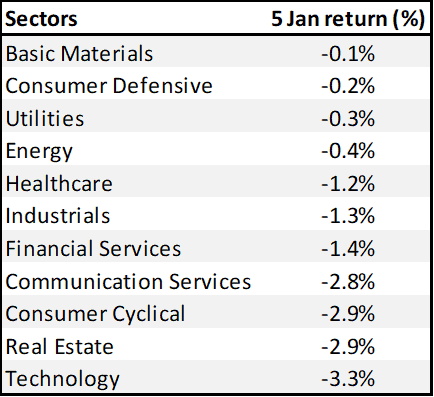

Using data from Stock Rover, all key sectors of the market were in the red last night when the DJIA declined by 1%, the S&P 500 by 2%, and the Nasdaq by 3.3%.

However, the best performing sectors were Basic Materials and Consumer Defensive, both sectors declining by just 0.1% and 0.2% respectively.

This should not be too surprising as consumer defensive counters typically hold up better when there is fear in the market, with investors/traders selling more “growth” and finding the safety of “value”, the latter found mainly in defensive stocks.

Basic materials aka commodity players are probably doing well as a result of inflationary fears.

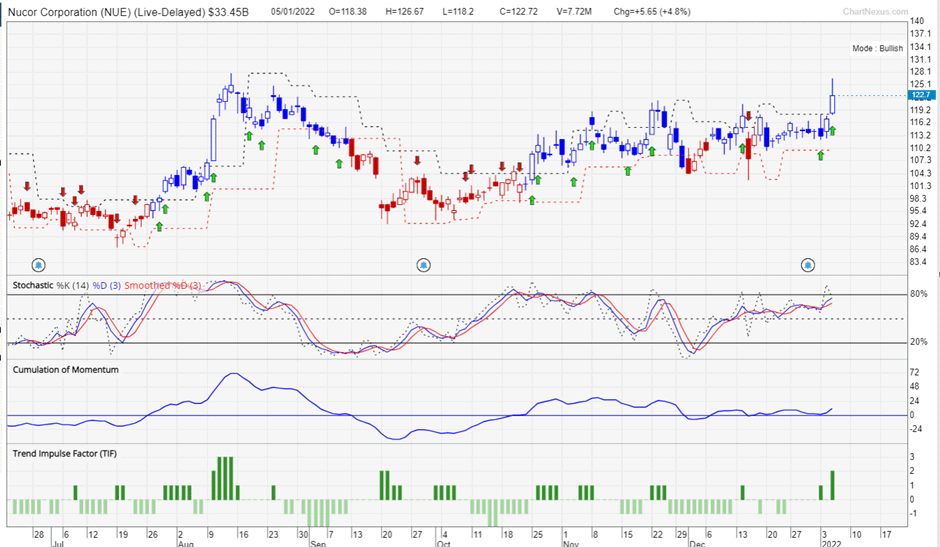

Again, using the Stock Rover platform, I can drill down deeper into the specific industries to check out which among the Basic materials and Consumer Defensive sectors are doing better than its peers.

Basic Materials

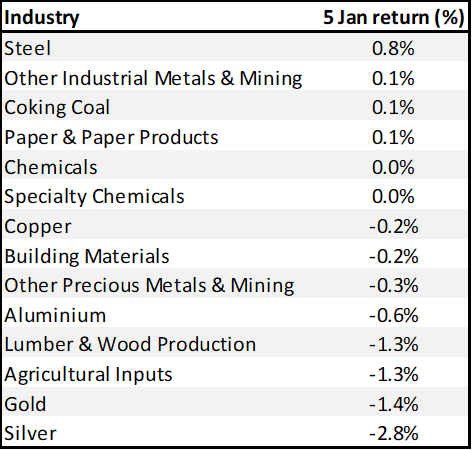

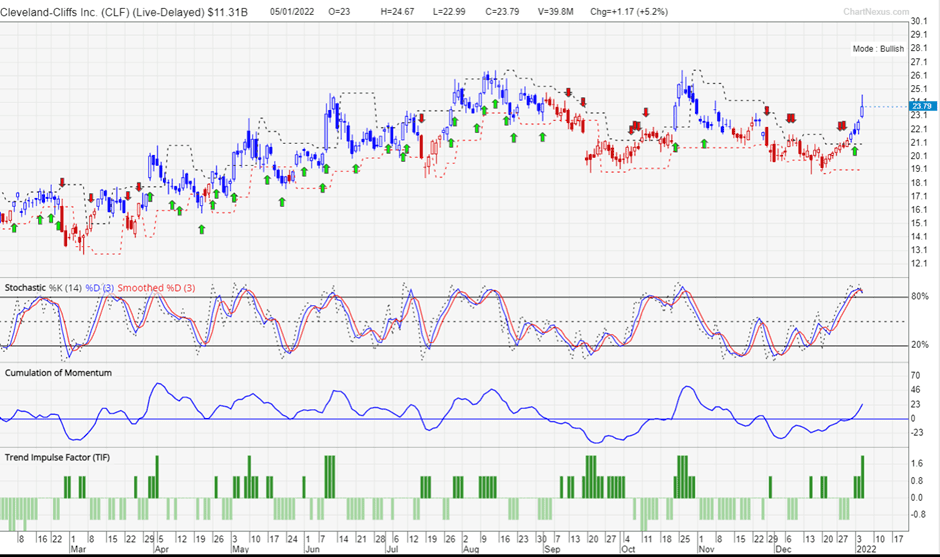

The Basic materials sector can be further broken down into 14 sub-industries and among these sub-industries, the best performing were Steel stocks and the worst performing being Silver. Gold stocks, in general, declined by 1.4% which is pretty surprising considering that Gold is typically seen as an inflation hedge and in such a scenario, the commodity should be well-supported.

Among the list of large-cap steel stocks, the better-performing ones are Nucor (NUE) and Cleveland-Cliffs (CLF). Both stocks have seen strong appreciation since the start of 2022 and that momentum could potentially continue into 2022.

Using another software, the TradersGPS which I used as a guide for short-term trading, both stocks do exhibit an increase in momentum, with positive entry signals for purchase.

Do note that a single day’s outperformance in a down market is never representative of the stock’s ability to continue doing well if the market collapses. Steel companies, with their fortunes often pegged to steel prices, might exhibit quite a bit of short-term volatility.

It is still too early to conclude that steel fundamentals are strong. A resurgent of COVID-19 globally as a result of Omicron could slow demand for steel products as infrastructure projects come to a halt.

For now, however, the momentum is strong and traders could look at these players exhibiting strong momentum for short-term trading opportunities.

The Systematic Trader

A course that teaches the use of the proprietary TradersGPS screener to identify the RIGHT stocks to buy at the RIGHT time, new traders can now engage a systematic approach to enhance their WIN probability

Consumer Defensive

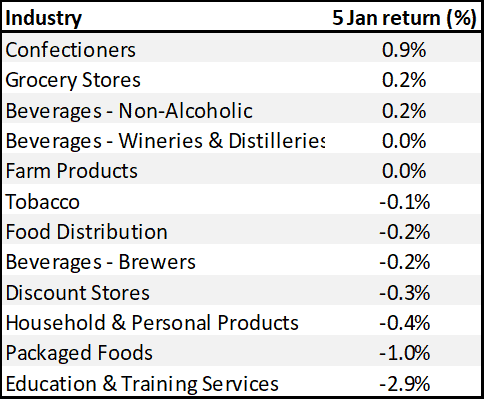

Within the consumer defensive sector, it is broken down into 12 sub-industries. The strongest industry last night was the Confectioners which generated a return of 0.9% while the weakest was Education and training services which declined by 2.9%.

There are not that many confectioners stocks, just a handful of them listed in the US, the largest being Mondelez International (MDLZ) and Hershey (HSY), with a market cap of $94bn and $40bn respectively.

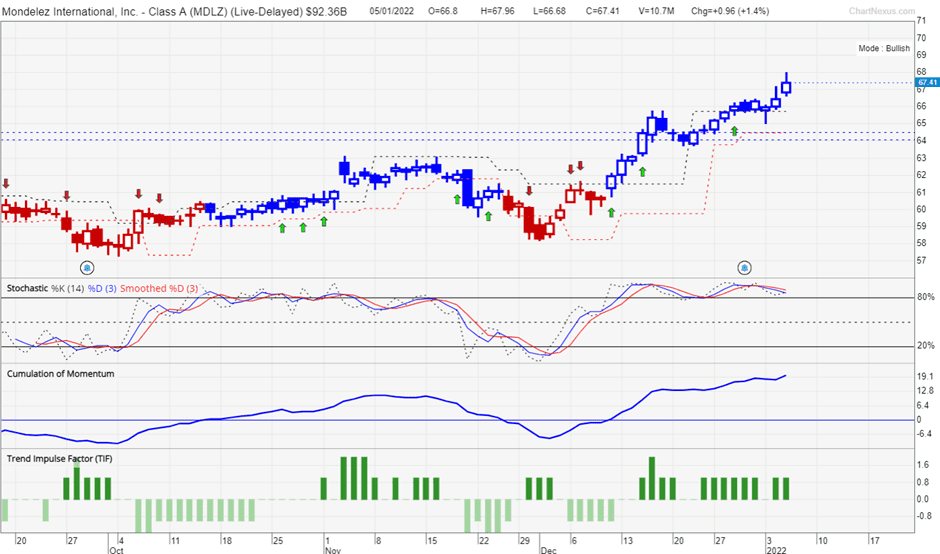

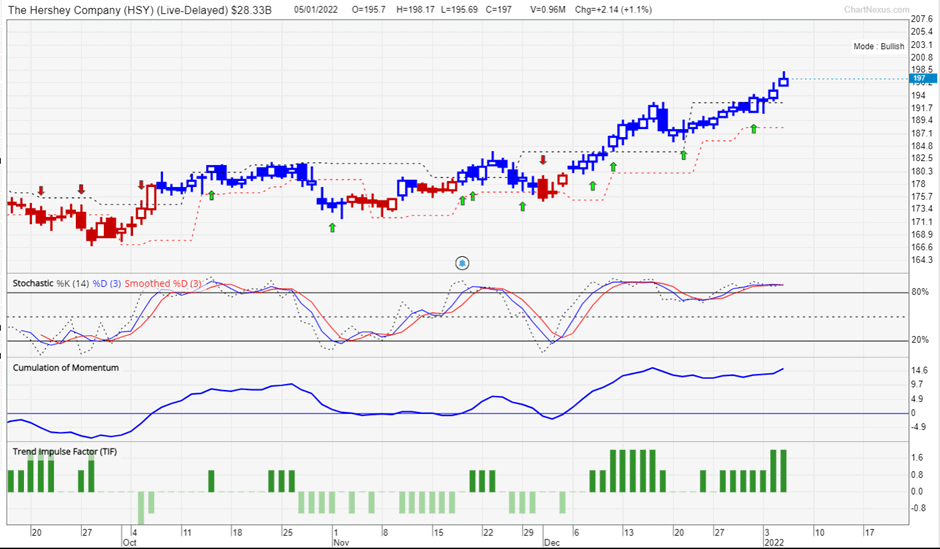

Both stocks generated positive returns last evening, with MDLZ appreciating by 1.4%, followed closely by HSY which appreciated by 1.1%.

While both stocks generated positive returns YTD 2022, the strength in their price appreciation is not as evident as those of the Steel players highlighted earlier. Both are currently up approx. 1.7-1.8% on a YTD basis.

The opportunity to trade these 2 stocks on a short-term basis also isn’t as “well-timed”, given that both these 2 counters have already appreciated substantially, according to the TGPS platform, and are currently sitting at All-time-highs.

It will be better to wait for a retracement before possible re-entries.

Do note that the above-highlighted stocks are meant as a sharing session and should not be seen as a recommendation or inducement to buy/sell.

Please do your due diligence when looking to trade stocks, which can be inherently risky.

Conclusion

This is a short article to just briefly highlight to NAOF readers which stocks might hold up much better if a bigger market correction is to take place.

Using the Stock Rover platform, which I have just written a pretty comprehensive review article on this stock screener platform that I believe to be the BEST fundamental stock screener available to retail investors, I can quickly discern the strongest sectors amid yesterday’s market sell-off.

Stock Rover Platform

The Stock Rover Screener is likely the BEST Fundamental stock screener for US stocks. If you are a serious fundamental investor, you will need to get your hands on this stock screener TODAY

Within those sectors, I can further drill down to the better performing sub-industries and subsequently the best-performing stocks in those respective industries.

Based on yesterday’s market sell-off, I have highlighted a handful of stocks that remain pretty resilient. Do however note that a single-day price performance isn’t truly representative of how the stock/s might react in the event of a further sell-off.

Nonetheless, these stocks continue to demonstrate strong momentum, and there could be an opportunity to trade these stocks to the upside, based on the TGPS platform, which is a proprietary trading platform developed by Collin Seow.

From a trading angle, I would place more emphasis on the Steel players highlighted in this article vs. the confectioners, given further upside potential from a successful breakout for the former.

For those who are interested in checking out the TGPS platform, do read the review that I have written on them and see if this investment/trading tool has a place in your arsenal. I believe it is a simple and easy-to-use platform that all retail traders will not have any issue mastering.

Once again, do note that the content in this article is solely for informational and educational purposes (it is your prerogative to disagree with me) and not meant to be seen as a recommendation or inducement to trade these stocks.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only