How to beat inflation and protect your investment portfolio

“Inflation is transitory”. That is no longer the buzzword used by the Fed, instead, the world’s largest central bank is acknowledging that price increases had exceeded its 2% target “for some time”.

Should we still hold the Fed’s words as the gospel truth? Well, not according to Allianz Chief Economic Advisor Mohamed El-Erian, who says that “transitory” was the “worst inflation call” in the history of the Fed.

I am not going to go into a debate of whether inflation is indeed going to become a “permanent” feature in 2022 and possibly the years ahead but to highlight to my readers what are the possible strategies to engage for your investment portfolio to prepare for a scenario where inflation is indeed running hotter than expected.

The Fed is already preparing the market for 3 rate hikes in 2022. A worst-than-expected inflationary scenario might force the Fed’s hands to raise rates at a much quicker pace. That could really spook the market and cause a sell-off, something which I have warned my readers of such a possibility as early as 2020 in this article.

The worst-case scenario I see could be one where we entered into a stagflation scenario, one where we combined economic slowdown with rising prices. Again, I wrote about this recently in this article entitled: Stagflation investing. How to position your portfolio.

I highlighted 3 asset classes that might do well in that scenario, namely commodities, short-term TIPS, and selected types of stocks. For those who are interested in getting more details, do check out the article.

Nonetheless, a stagflation scenario remains an “outside event”, with most economies still expected to grow their GDP “healthily” in 2022. Singapore, for example, is forecasted to grow its GDP by 3-5% in 2022, after a blistering 7.2% growth in 2021.

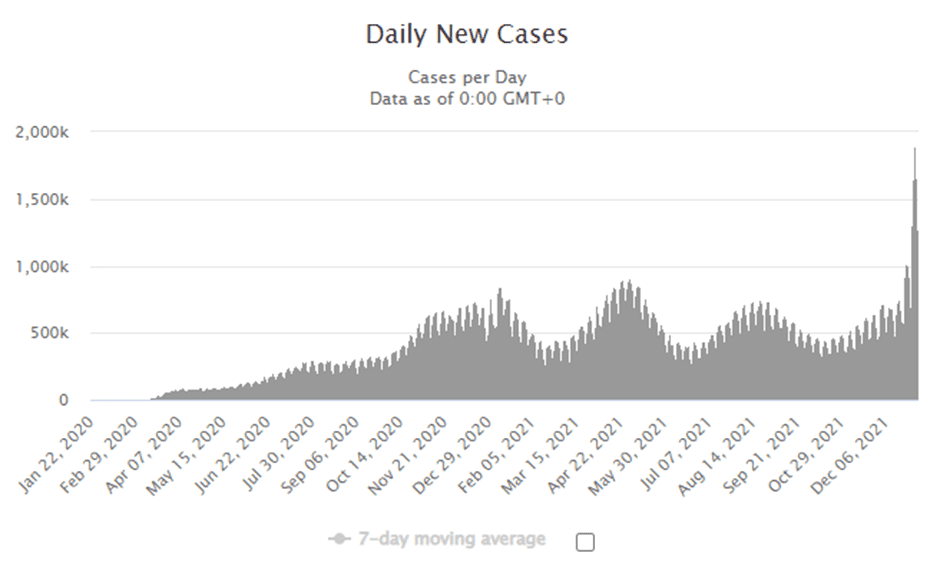

The rise in COVID-19 cases as a result of Omicron, could, however, derail the recovery efforts of major economies all over the world. We are already witnessing a sharp spike in daily new cases of late that have eclipsed the last high due to the Delta variant.

This has hampered re-opening efforts globally and it is still too early, in my humble opinion, to say that economic growth is all but certain in 2022 amid a drastic rise in COVID infections as seen over the past weeks.

While I do not wish to sound all doom and gloom, it is always wise to err on the side of caution and be prepared for an inflationary environment in 2022. Therefore, in this article, I will like to highlight 3 simple strategies that you can take for your stock portfolio to beat inflation in 2022.

Unlike my earlier article which highlighted a number of asset classes to possibly partake in, this article will have a “stock-centric” focus.

3 simple stock strategies to beat inflation

Strategy #1: Buy Stocks with Pricing Power

Consumer staple stocks are generally seen as defensive, one where their services or products are seen as a “daily requirement” whether the economy is growing or decelerating.

However, not all consumer staple stocks are the same. The weak ones operate in an extremely competitive environment which does not allow them to raise product/service prices easily. The better ones have strong pricing power that will allow them to offset any form of raw material/cost of goods increment with corresponding price hikes without affecting demand for their products/services.

Stocks with pricing power are typically those that demonstrate stronger margin performances aka, they generate operating margin improvements in an overall rising price environment.

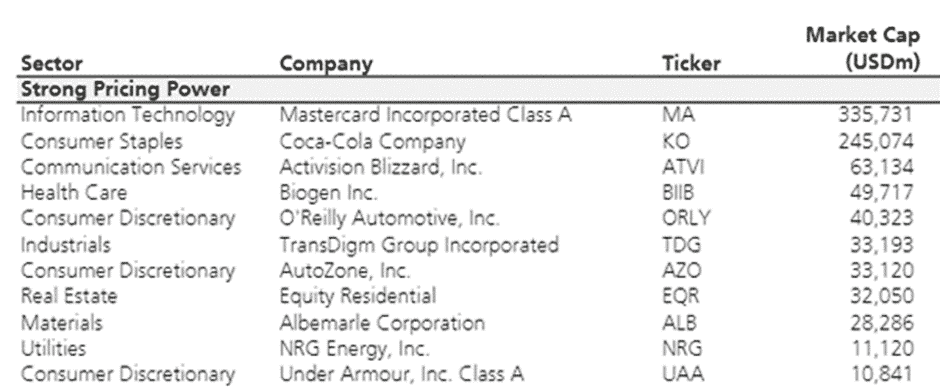

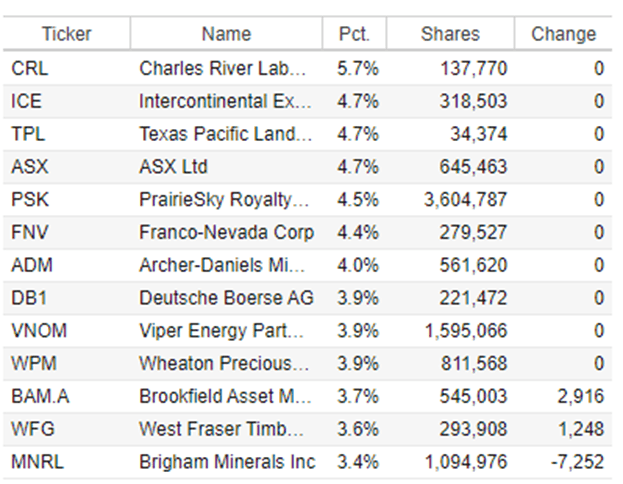

The table below shows some of the stocks with pricing power, according to UBS.

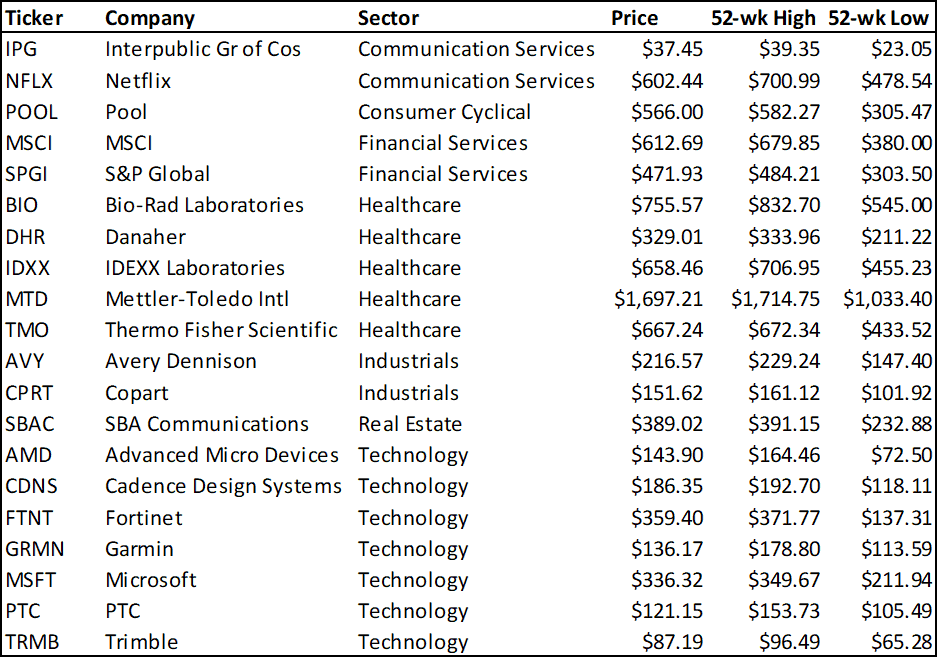

I have also compiled a list of 20 stocks that have generated operating margin improvement for 5 consecutive years, using data from the Stock Rover platform.

This is a good list to start in terms of evaluating stocks that have a consistent track record of generating operating margins improvement, likely due to their ability to consistently raise product/service prices without having a negative impact on demand.

Strategy #2: Avoid stocks with high workforce costs. Buy commodity-linked, asset-light companies instead.

In an inflationary environment with prices rising, companies with high workforce costs will find themselves at a huge disadvantage.

Workforce/labor cost is typically the largest component of a company’s operating expense and rising workforce cost will significantly “eat” into the company’s bottom line.

In the US, 26 US states will raise their minimum wage in 2022. A tight labor market resulted in many companies, ranging from banks to retailers to pizzerias, hiking wages for hourly workers to attract and retain staff.

Fed Chair Jerome Powell also cited wages as a key inflation signal to watch in 2022 and there are fears of what is known as a wage-price spiral, in which rising pay feeds rising prices.

The two industries most susceptible to higher labor costs are typically the 1) Retail and 2) Healthcare industries. These are people-centric fields in which labor is one of a company’s largest costs.

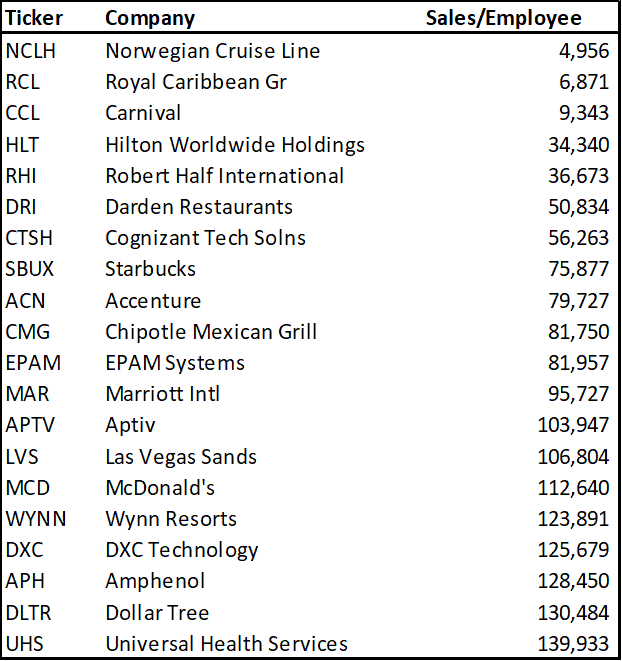

To avoid stocks that might be affected by higher labor costs as a result of inflationary pressures, one can screen for companies with a high proportion of employees relative to the sales which the company generates.

The table below shows the Top 20 companies in the S&P 500 with the lowest sales/employee ratio.

These companies could find themselves at a disadvantage as a result of rising labor costs if they are not able to pass on rising wage expenses through higher product/service prices.

However, for those who successfully pass on their higher wage costs to consumers (strong pricing power – Strategy #1), they might find favor with the market.

Take, for example, Chipotle Mexican Grill, despite having a high sales/employee ratio, has been able to pass on higher wage costs in the form of higher product prices. The company has strong pricing power which helps to offset the company’s dependency on labor.

Consequently, the company has been able to brush off wage inflationary fears in 2021, with its share price hitting a new high. Such strong price performance might again be replicated in 2022 if the company can demonstrate its strong pricing power yet again.

On the other hand, cruise liners and hotel operators might find themselves at the receiving end if a rebound in COVID-19 cases continues to limit their ability to generate higher sales from their operations to offset the rise in employee-related expenses.

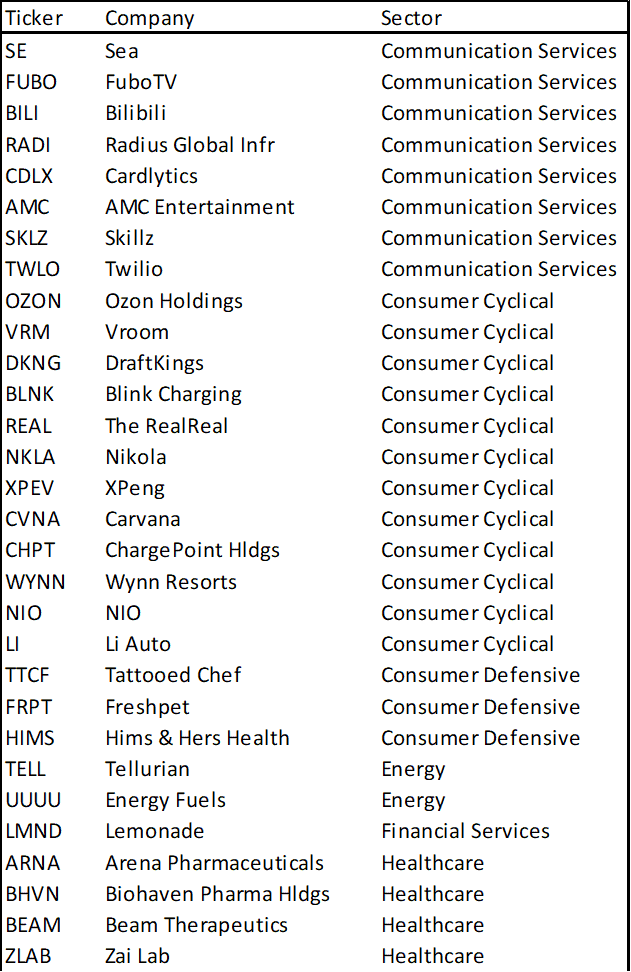

To avoid companies with rising workforce costs as a result of inflationary pressures, one might wish to further explore this ETF with the ticker INFL. This is the Horizon Kinetics Inflation Beneficiaries ETF which seeks to invest in companies that are expected to benefit, either directly or indirectly from rising prices.

These companies typically hold hard assets such as commodities/real estates and/or operate on an asset-light model which is not significantly impacted by rising wage costs.

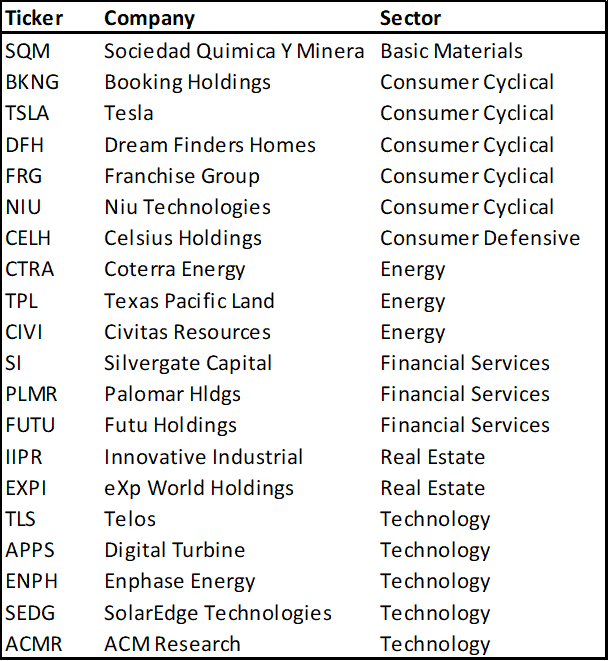

Some of the top holdings of the ETF are highlighted in the table above.

While this ETF failed to outperform the S&P500 in 2021, appreciating by 17+% in 2021 vs. the S&P500 20+% appreciation, its price resilience might be more evident when the market sell-off as a result of inflationary fears.

Strategy #3: Avoid growth stocks which are loss-making. Buy growth stocks that are profitable and exhibit operating leverage

The last strategy is to avoid growth stocks that are loss-making. There are many fast-growing stocks (many of which are in the tech sector) that are profitable. Those are ok and could in fact hold up well in a rising rate environment (due to inflation).

However, loss-making growth companies will be the ones most at risk from an interest rate rise.

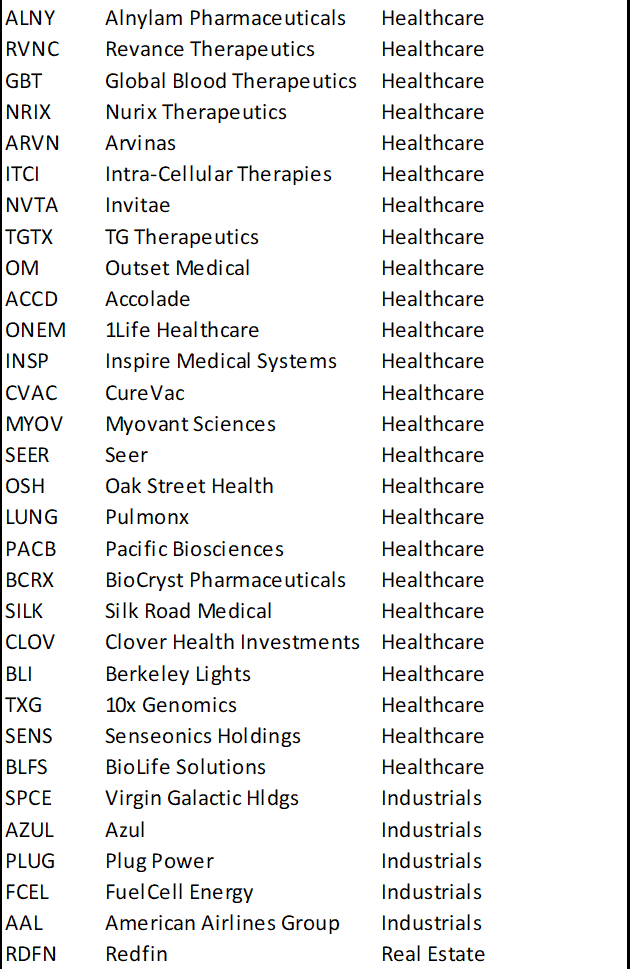

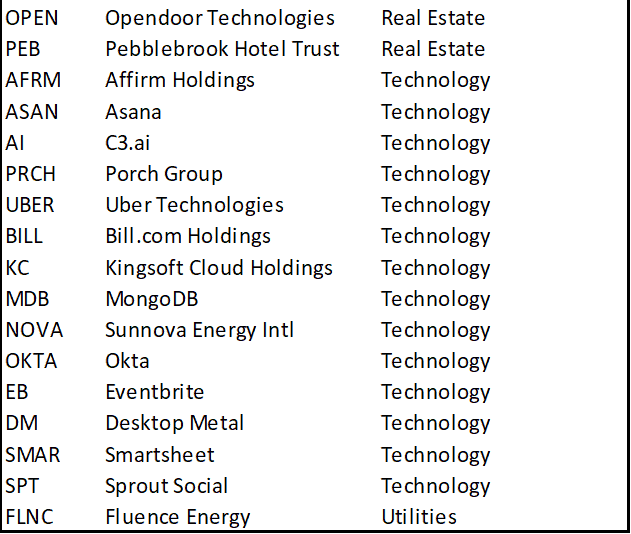

The table below illustrates some of the fastest-growing companies, many of which are looking to grow their top-line in excess of 30%/annum over the coming 2 years but are, however, loss-making in nature.

A rising rate environment could see many of these growth counters which are expected to remain loss-making in 2022, be hard hit.

Many of these stocks have already corrected significantly below their 52-week high. However, a rapidly-rising rate environment in 2022 could further pressure the stock prices of these stocks.

On the other hand, growth stocks that are increasingly more profitable through operating leverage might see stronger price resilience amid a rising rate environment.

Among major US growth stocks that are expected to increase their revenue by 30%/annum over the next 2 years, I screened out for stocks that are also expected to see an average of 20% annual growth in EPS over the same 2-year horizon according to the street estimates, using data from Stock Rover.

There are 20 stocks that meet this criterion.

While I am in no way implying that these stocks will continue to appreciate amid an inflationary environment, they might be better growth candidates to consider “bottom-fishing” when the opportunity arises.

Investors who have a stronger risk appetite might wish to consider these high growth counters that might reap significant dividends if their top and bottom-line growth surprise the street positively in 2022.

Conclusion

If inflation becomes a problem in 2022, you can expect rates to rise at a much faster rate than the market would expect. This is currently set at 3 rate rises in 2022.

A rising rate environment is typically positive for certain asset classes such as commodities. Stocks are typically seen as good inflation hedges as well.

There are certain categories of stocks that will likely outperform the market in a rising rate environment. In strategy #1, I have highlighted stocks with strong pricing power. These are stocks that are likely able to offset their higher operating expenses by raising their product/service prices without negatively impacting demand. Consequently, these companies can continue to achieve stronger operating margins even in an inflationary environment.

In strategy #2 which is to avoid companies with high labor costs, the flip side is to look at companies that operate on an asset-light model or commodity companies where their bottom-line is driven predominantly by hard assets such as commodity prices and less impacted by rising employee cost.

Lastly, while growth companies will typically “suffer” vs. their value counterpart in a rising rate environment, it will be best to avoid growth companies that are likely loss-making in the foreseeable future.

While many of these loss-making growth stocks do have fantastic long-term potential, one will need to be able to withstand their near-term price volatility amid a faster-than-expected rising rate environment.

Growth stocks that are already profitable and expected to generate operating leverage might be better stock candidates for such an environment.

For those who are interested to screen for stocks using unique financial metrics such as operating margin increment, sales/employee ratio, etc, where these financial data can be subsequently exported into Excel for further analysis, one should check out the Stock Rover platform. I have previously written a detailed write-up on the Stock Rover platform and its various functionalities.

In my opinion, the Stock Rover platform is hands down the best fundamental stock screener for US stocks available to retail investors and should be a quintessential investment tool for all serious fundamental investors out there.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only