Investment Tips for Beginners

Stocks, bonds, equities, dividends, leverage.

You’ve probably heard more investment jargon like these than you can count. If you do not fully understand them, don’t worry – investing as a beginner is not as complicated as it may seem. In fact, you can start investing in the stock market just by understanding these 4 simple investment tips for beginners

1. Know Your Personal Goal and Time Horizon

Before you start investing, ask yourself this: What is your motivation behind investing? Do you want to build wealth for retirement, take advantage of compound interest, or simply grow your money?

Depending on your answer, the way you invest should be different.

If your investment time horizon is more than 10 years, your portfolio can lean more heavily towards stocks; any less than that, you should have a mix of both stocks and bonds; and if less than 5 years, consider not having any stock exposure at all.

Jack Bogle, the founder of The Vanguard Group, proposed this simple rule of thumb: Subtract your age from 110. That’s how much, percentage-wise, you might want to keep in stocks. If you’re 20, that’s 90%; and if you’re 40, the number falls to 70%. However investing in stocks doesn’t directly have to be in stock, you can choose either Mutual Funds (or) Index Funds (or) Exchange Traded Funds (ETF’s) (or) combination of any.

If you ask me, that’s a pretty straight investment advice to start investing.

2. Don’t Put All Your Eggs Into One Basket

This one comes intuitively to most first-time investors. Diversification spreads out both your risks and returns, ensuring that a downturn in one sector or market won’t sink your whole portfolio.

Investing = selling fruits?

An analogy could be drawn to fruit stand vendors. As a vendor, you would likely offer a variety of fruits instead of just one, such that if a natural disaster cut off your supply of apples from the USA, you can still make an overall profit from selling bananas from Malaysia or mangoes from Thailand.

For similar reasons, an investor would want to hold a variety of assets. For example, when the economy is thriving, stocks tend to grow faster than bonds, but during a downturn, bonds often outshine stocks. By having a range of products, you are more insulated against the risks that threaten any single individual asset class.

Additional Reading: Best ETFs in Singapore to structure your passive portfolio

Ways of diversification

However, what may be overlooked by beginner investors is that there is more than one way to diversify your portfolio. Here are the three main ways:

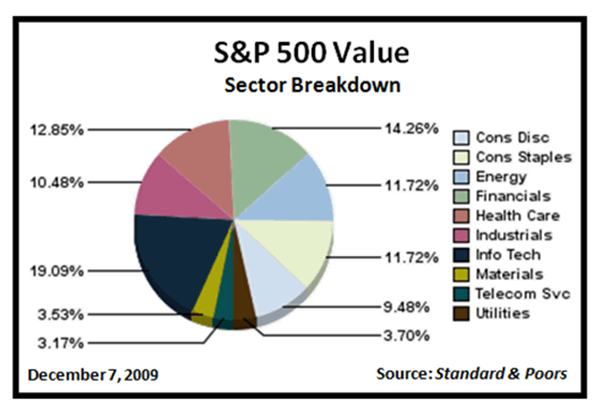

Sectors

Some may advise owning at least 12–18 stocks for enough diversification. However, a truly well-diversified portfolio will hold stocks across most, if not all, Global Industry Classification Standard (GICS) sectors.

Usually, different industries perform at varying levels, so holding a range of assets ensures less volatility in your overall portfolio. For instance, during a hurricane, insurance companies are often adversely affected, whereas stocks of home improvement companies such as Home Depot (HD) typically rise.

If you don’t believe in an individual stock and rather you wanna bet on an index, then index funds can be your option. Similarly a mutal fund can be your choice depending upon your priorities.

Assets

However, it is not enough to just own a diversity of stocks. You probably need to invest in other products such as bonds, ETFs, or options. This is because each asset class has its traits and perks, such as risk or return profiles, costs, and time horizons that can help balance your overall risk.

It is unlikely that a few assets like stocks, bonds, and precious metals would experience declines in the same direction at once. So if stocks fall by 20%, your bonds and gold would keep your portfolio from falling to the same extent. This is why diversification is important in your investments.

Markets

Thinking of playing safe by sticking to a local portfolio? Think again. If Singapore’s economy experiences a slowdown or even a recession (which has happened in the past and is re-occurring as of 2020), having a globally diversified portfolio of local, international, and emerging markets are one of the best ways for you to tide through it, and may even provide you with an uplift.

When most of the world’s fastest-growing, most profitable companies are listed in the NASDAQ Stock Market or the New York Stock Exchange (NYSE), why should we limit our investments to only companies on the SGX? Larger companies with a global outreach (think Apple, Amazon, Microsoft, Meta, Alphabet, Netflix, etc.) can give us more opportunities to reap greater returns in the future.

3. Don’t panic

This one is important – but easier said than done. Look market volatility is inevitable and as you hold on to your investment startegies, you’re bound to face challenges. For instance, if your stocks price falls drastically, for instance, it can be difficult to maintain a calm mentality.

Imagine if you see the news peppered with headlines like these – would you be able to keep a level head when much of your wealth is at stake? Barring an actual economic crisis, it is not uncommon for investors to overreact and sell because of short-term market volatility or sensationalist media headlines declaring a 70% stock market crash.

If you meet a financial advisor, the most common advice that he/she gives to new investors is to stay focused on the long term and refrain from maneuvering your stocks too much. Why? A very recent example of a stock market crash could testify to this statement.

The Great Coronavirus Crash

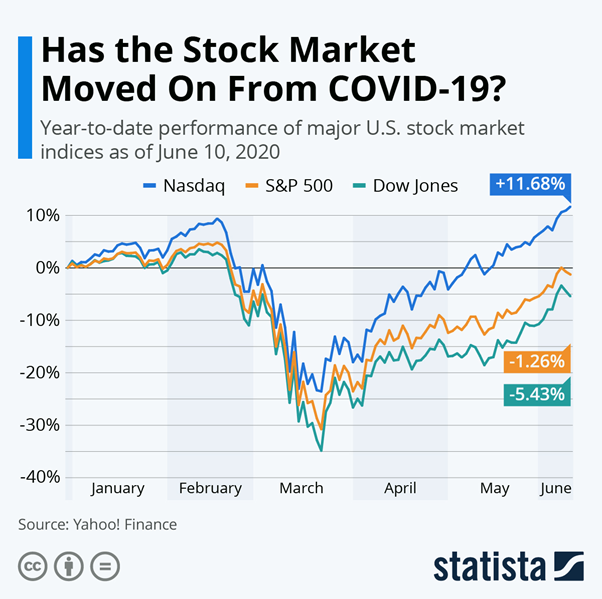

In March 2020, during the COVID-19 pandemic, the market plunged by almost 40% and subsequently rebounded to an all-time high in only the course of a few months.

The largest US stock market indices – NASDAQ, S&P 500, and the Dow Jones Industrial Average lost up to 37% of their value, with numerous investors losing a substantial portion of their wealth.

If you had been involved, the fear of the stock market crashing to further rates and your money dissolving in days could have pushed you to sell at a low point, just as many investors did. Yet in another few months, the market would have soared to an all-time high.

The truth is, investors below the age of 40 have a long time horizon ahead of you, and even if the market crashes tomorrow, there is plenty of time – decades – for your investments to bounce back. Don’t let the media scare you, and remember those market downturns are part of a normal, healthy market cycle. Hence don’t sell stocks from your investment account whenever you see a decline in the market.

Additional Reading: How to prepare for a bear market. A simple 3-steps process

4. Explore Your Options

After deciding on the proper mix of cash, bonds, and stocks based on your risk tolerance and time horizon, the final question facing beginning investors is what to invest in.

Fortunately, broad-based mutual or index funds and exchange-traded funds (ETFs), which combine the investments of many people to buy a variety of securities (including equity and debt), give you an easy way to begin.

Active vs passive funds

There are two kinds of broad-based funds: active and passive. Actively-managed funds seek to beat an index, but usually cost more than index/passive funds, which only intend to match the market’s performance. Of the two, index funds are more commonly invested in.

You may have heard of the SPY ETF, or more specifically, the SPDR S&P 500 ETF (NYSEMKT: SPY). This is the world’s largest ETF, widely acclaimed for its low cost and stable returns (9.9% a year on average). Besides SPDR, another investment management company known as Vanguard has its version of the S&P 500 fund, the Vanguard S&P 500 ETF (VOO).

The good news is that regardless of the company, the S&P 500 index fund is a good place to start for the average investor. Warren Buffett himself recommended it as the number 1 investment.

Additional Reading: What are my options when it comes to investing?

Robo-advisors

On the other hand, if you prefer a completely hands-off and stress-free approach to investing, there is the option of a Robo-advisor.

Robo-advisors are automated investment apps. Essentially, you provide information regarding your investment goals, age, and risk tolerance to the Robo-advisor, and it will recommend a suitable portfolio for you. In short, it can be your financial advisor for stocks. Thus using such platforms, you won’t be looking out for any advisory or brokerage services.

The upside is that the algorithms will automatically maximize your tax efficiency and invest at low-risk, typically by helping you purchase ETFs. This method is meant for you to invest passively in the longer-term, not to make short-term gains by buying and selling frequently.

Syfe

One of the Robo-advisors in Singapore, the Syfe Robo Advisor is an easy and low-cost way to get you started on your investing journey.

Invest in a basket of dividend-paying blue-chip REITs the easy way

Feel free to read my review on Syfe.

Individual stocks

Nevertheless, you can invest in individual stocks provided you are willing and able to do thorough research on the relevant companies. With proper diversification and the resolve to tide through economic ups and downs, you can beat the market over time.

Basic metrics for stock researching

Price-to-earnings (P/E) ratio, price-to-earnings-growth (PEG) ratio, and earnings per share (EPS). These metrics can help you conduct fundamental analysis, helping you find value stocks, and even analyze growth stocks.

Another strategy used to research companies is known as technical analysis. Technical analysts look at stock price charts to identify trends, with the ultimate aim of predicting future trends. While fundamental analysis usually tells you which stocks to buy, technical analysis can help you determine when to buy a stock.

The Systematic Trader

This is a top investing course that uses the proprietary TradersGPS platform that helps you identify the RIGHT stock to buy at the RIGHT top using a set of technical analysis tool

Conclusion

These are my Top 4 investment tips for beginners

The bottom line is that there’s no one-size-fits-all way to start investing in stocks, so it’s essential to thoroughly research your options and find the ones that are most suitable for you. Don’t worry if you take some time – everyone does. Just remember to not give up and above all, have fun!

NAOF Investing Series

A beginner video tutorial course to get you started on investing. The NAOF Investing Series is a simple step-by-step guide to help you maneuver the pitfalls of investing

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update Nov 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.